Professional Documents

Culture Documents

Silid Act 6 - BALDERAS

Uploaded by

Justine Marie BalderasOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Silid Act 6 - BALDERAS

Uploaded by

Justine Marie BalderasCopyright:

Available Formats

JUSTINE MARIE A.

BALDERAS

BSA 1

Chapter 6: Business Transactions and their Analysis

ACTIVITY 1: JOURNAL ENTRIES

Instruction: Provide the journal entries to record the transactions described below. You do not need

to provide a short description for the journal entries.

1. Owner contributes ₱600,000 to the business.

2. The business obtains a loan of ₱400,000.

3. Purchase of inventory worth ₱200,000 on cash basis.

4. Purchase of inventory worth ₱500,000 on account.

5. Sale of goods for ₱900,000, on account. The cost of the goods sold is ₱400,000.

6. Payment of ₱400,000 as settlement of accounts payable.

7. Collection of ₱500,000 on accounts receivable.

8. Purchase of equipment worth ₱480,000.

9. Drawings of owner amounting to ₱10,000.

10. Payment for interest expense of ₱5,000.

1. CASH 600,000

OWNER’S EQUITY 600,000

2.CASH 400,000

NOTES PAYABLE 400,000

3. INVENTORY 200,000

CASH 200,000

4. INVENTORY 500,000

ACCOUNTS PAYABLE 500,000

5. ACCOUNTS RECEIVABLE 900,000

SALES 900,000

COST OF SALES 400,000

INVENTORY 400,000

6. ACCOUNTS PAYABLE 400,000

CASH 400,000

7. CASH 500,000

ACCOUNTS RECEIVABLE 500,000

8. EQUIPMENT 480,000

CASH 480,000

9. OWNER’S DRAWING 10,000

CASH 10,000

10. INTEREST EXPENSE 5,000

CASH 5,000

ACTIVITY 2: MULTIPLE CHOICE

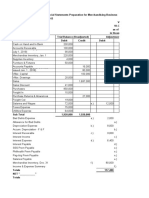

Instruction: Record the transactions in the journal provided below. Indicate the dates and provide a

brief description for each journal entry.

Dates Transactions

Nov. 1, 20x1 A business owner provides ₱2,000,000 cash as investment to the business.

Nov. 5, 20x1 The business obtains a ₱500,000 loan and issues a promissory note.

Nov. 8, 20x1 The business acquires equipment costing ₱1,000,000 on cash basis.

Nov. 16, 20x1 The business purchases inventory costing ₱200,000 on cash basis.

Nov. 30, 20x1 The business sells goods costing ₱135,000 for ₱300,000 on cash basis.

Dec. 1, 20x1 The business sells goods costing ₱180,000 for ₱400,000 on account.

Dec. 4, 20x1 The business purchases inventory costing ₱600,000 on account.

Dec. 9, 20x1 The business collects ₱100,000 accounts receivable.

Dec. 17, 20x1 The business pays ₱200,000 accounts payable.

Dec. 28, 20x1 The business owner made temporary withdrawal of ₱120,000 cash from the Business

JOURNAL

DATES ACCOUNT TITLES DEBIT CREDIT

NOV. 1 20x1 CASH 2,000,000

OWNER’S CAPITAL 2,000,000

to record the contribution by the owner

NOV. 5 20x1 CASH 500,000

NOTES PAYABLE 500,000

To record the loan obtained

NOV. 8 20x1 EQUIPMENT 1,000,000

CASH 1,000,000

To record the acquisition of equipment

NOV. 16 20x1 INVENTORY 200,000

CASH 200,000

To record the purchase of inventory

NOV. 30 20x1 CASH 300,000

SALES 300,000

To record sale of goods

COST OF SALES 135,000

INVENTORY 135,000

To charge the cost of goods sold as expense

DEC. 1 20x1 ACCOUNT RECEIVABLE 400,000

SALES 400,000

To record the sale of goods

COST OF SALES 180,000

INVENTORY 180,000

To charge the cost of goods sold as expense

DEC. 4 20x1 INVENTORY 600,000

ACCOUNTS PAYABLE 600,000

DEC. 9 20x1 CASH 100,000

ACCOUNTS RECEIVABLE 100,000

To record the collection of accounts receivable

Dec. 17 20x1 ACCOUNTS PAYABLE 200,000

CASH 200,000

To record the payment of accounts payable

DEC. 28 20x1 OWNER’S DRAWING 120,000

CASH 120,000

To record the drawings of the owner

You might also like

- Quizzes - Chapter 6 - Business Transactions & Their AnalysisDocument6 pagesQuizzes - Chapter 6 - Business Transactions & Their AnalysisClint Abenoja100% (1)

- Quizzes - Chapter 6 - Business Transactions & Their AnalysisDocument6 pagesQuizzes - Chapter 6 - Business Transactions & Their AnalysisAmie Jane MirandaNo ratings yet

- Quizzes - Chapter 6 - Business Transactions & Their AnalysisDocument6 pagesQuizzes - Chapter 6 - Business Transactions & Their AnalysisAmie Jane MirandaNo ratings yet

- Quizzes - Chapter 6 - Business Transactions & Their AnalysisDocument6 pagesQuizzes - Chapter 6 - Business Transactions & Their AnalysisAmie Jane Miranda67% (3)

- Part Ia Journal Entries - FarDocument5 pagesPart Ia Journal Entries - Farshe kioraNo ratings yet

- Jan Mark Castillo - BSA 1 Chapter-6-Business-Transactions-And-Their-AnalysisDocument8 pagesJan Mark Castillo - BSA 1 Chapter-6-Business-Transactions-And-Their-AnalysisJan Mark CastilloNo ratings yet

- AccountingDocument4 pagesAccountingAnne AlagNo ratings yet

- Business Transactions Their Analysis With Answers by AlagangwencyDocument4 pagesBusiness Transactions Their Analysis With Answers by AlagangwencyHello KittyNo ratings yet

- Formula ZDocument21 pagesFormula ZCleofe Mae Piñero AseñasNo ratings yet

- Accounting EquationDocument2 pagesAccounting Equationunknown PersonNo ratings yet

- M Enterprises: Financial Statements/ReportsDocument30 pagesM Enterprises: Financial Statements/ReportsAishah Mae M. AtomarNo ratings yet

- Rico - Assignment IaDocument18 pagesRico - Assignment IaGwen TimoteoNo ratings yet

- Perpetual Answer KeyDocument11 pagesPerpetual Answer KeyRichelle Janine Dela CruzNo ratings yet

- Assignment - J&RDocument6 pagesAssignment - J&RJie SapornaNo ratings yet

- Financial Statement HandoutDocument3 pagesFinancial Statement Handoutrafeeq50% (2)

- ACC203 - AssignmentDocument2 pagesACC203 - AssignmentHailsey WinterNo ratings yet

- Answer: Problem 10-4: Requirement ADocument17 pagesAnswer: Problem 10-4: Requirement APatricia Nicole BarriosNo ratings yet

- Assignment POSTING TO THE LEDGERDocument7 pagesAssignment POSTING TO THE LEDGERJie SapornaNo ratings yet

- Inventories and Related Expenses: Multiple Choice - TheoryDocument14 pagesInventories and Related Expenses: Multiple Choice - TheoryMadielyn Santarin MirandaNo ratings yet

- Accounting ActivityDocument3 pagesAccounting ActivityKae Abegail GarciaNo ratings yet

- Problem #1: Adjusting EntriesDocument5 pagesProblem #1: Adjusting EntriesShahzad AsifNo ratings yet

- CHAPTER 6 - Joint VentureDocument10 pagesCHAPTER 6 - Joint VentureminmenmNo ratings yet

- Financial Statement HandoutDocument5 pagesFinancial Statement Handoutmuzamilarshad31No ratings yet

- MODULE 2 JOINT ARRANGEMENTS ASSIGNMENT AAC2 Mar 2023 - Copy-1Document3 pagesMODULE 2 JOINT ARRANGEMENTS ASSIGNMENT AAC2 Mar 2023 - Copy-1Lorifel Antonette Laoreno TejeroNo ratings yet

- DB6 - Worksheet & FS Prep For Merchandising BusinessDocument4 pagesDB6 - Worksheet & FS Prep For Merchandising BusinessArrianeNo ratings yet

- Basic Accounting Midterm ExamDocument11 pagesBasic Accounting Midterm ExamC J A SNo ratings yet

- Institute of Aeronautical Engineering: (Autonomous) Financial Accounting and Analysis (Master of Business Administration)Document5 pagesInstitute of Aeronautical Engineering: (Autonomous) Financial Accounting and Analysis (Master of Business Administration)Mr V. Phaninder ReddyNo ratings yet

- Questions12-18 SolvedDocument9 pagesQuestions12-18 SolvedDaxhing RajaNo ratings yet

- Acc 1 - Financial Accounting and Reporting QUIZ NO. 15 - Accounting Cycle of A Merchandising Business (Application)Document1 pageAcc 1 - Financial Accounting and Reporting QUIZ NO. 15 - Accounting Cycle of A Merchandising Business (Application)nicole bancoroNo ratings yet

- Impairment Loss 1,200,000Document8 pagesImpairment Loss 1,200,000Clint RoblesNo ratings yet

- 16 UNIT III LiquidationDocument20 pages16 UNIT III LiquidationLeslie Mae Vargas ZafeNo ratings yet

- PartnershipDocument7 pagesPartnershipShane Nayah100% (2)

- FABM 2 HANDOUTS 1st QRTRDocument17 pagesFABM 2 HANDOUTS 1st QRTRDanise PorrasNo ratings yet

- Myco Paque InventoriesDocument5 pagesMyco Paque InventoriesMYCO PONCE PAQUENo ratings yet

- Final Accounts Example - MBA WPDocument6 pagesFinal Accounts Example - MBA WPJIJONo ratings yet

- December 31, 20x1 January 2, 20x1: 1. A. Fob Shipping Point, Freight CollectDocument8 pagesDecember 31, 20x1 January 2, 20x1: 1. A. Fob Shipping Point, Freight CollectIvy MaximoNo ratings yet

- Financial PositionDocument4 pagesFinancial PositionBeth Diaz Laurente100% (2)

- ULOa Let's Analyze Week 8 9Document4 pagesULOa Let's Analyze Week 8 9emem resuentoNo ratings yet

- Problem 4Document11 pagesProblem 4Caila Nicole ReyesNo ratings yet

- Transactions: Balance Sheet Income StatementDocument5 pagesTransactions: Balance Sheet Income StatementKothari InvestmentsNo ratings yet

- And Profit and Loss Account and Balance Sheet On 31st December, 2019Document2 pagesAnd Profit and Loss Account and Balance Sheet On 31st December, 2019Prabhleen KaurNo ratings yet

- Acctg Problem 7Document4 pagesAcctg Problem 7Salvie Perez Utana57% (14)

- Problem 1Document13 pagesProblem 1Caila Nicole ReyesNo ratings yet

- Accounting 02182021Document4 pagesAccounting 02182021badNo ratings yet

- Particulars Rs. Particulars RsDocument2 pagesParticulars Rs. Particulars RsAman RajNo ratings yet

- A. The Following Account Balances Were Presented On December 31, 2017Document3 pagesA. The Following Account Balances Were Presented On December 31, 2017Shiela Mae Pon AnNo ratings yet

- Audit of Cash and Cash Equivalents QuizDocument16 pagesAudit of Cash and Cash Equivalents QuizBienvenido JmNo ratings yet

- Samson's Journal EntryDocument2 pagesSamson's Journal EntryShayne PagwaganNo ratings yet

- MULTIPLE CHOICES-answer KeyDocument7 pagesMULTIPLE CHOICES-answer KeyLiaNo ratings yet

- Acc2 CH11Document6 pagesAcc2 CH11Leah CalataNo ratings yet

- AE13 Final ActivityDocument5 pagesAE13 Final ActivityWenjunNo ratings yet

- Module 3 Main TaskDocument10 pagesModule 3 Main TaskBC qpLAN CrOwNo ratings yet

- Christine Sousa BagsDocument8 pagesChristine Sousa BagsKaila Clarisse Cortez100% (5)

- Partnership ActivityDocument12 pagesPartnership ActivityTeresa Pantallano DivinagraciaNo ratings yet

- Chapter 11 17Document62 pagesChapter 11 17Melissa Cabigat Abdul KarimNo ratings yet

- Assignment#1 ADRIANOCAÑADADocument4 pagesAssignment#1 ADRIANOCAÑADAADRIANO, Glecy C.78% (9)

- Initial InvestmentDocument18 pagesInitial InvestmentLyca Mae Cubangbang100% (3)

- Quiz 1 SFM AnswerDocument4 pagesQuiz 1 SFM Answerangelicacas063No ratings yet

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Okou3pvj0 - Activity 1 (Nuguid, Angel) Contemporary (1) - WPS OfficeDocument1 pageOkou3pvj0 - Activity 1 (Nuguid, Angel) Contemporary (1) - WPS OfficeJustine Marie BalderasNo ratings yet

- dl09cfb0p - Assignment 1 (Agojo, Kayla)Document1 pagedl09cfb0p - Assignment 1 (Agojo, Kayla)Justine Marie BalderasNo ratings yet

- Feasibility Study Group 2. AbmDocument62 pagesFeasibility Study Group 2. AbmJustine Marie BalderasNo ratings yet

- 1 - EarthquakeDocument39 pages1 - EarthquakeJustine Marie BalderasNo ratings yet

- ICF HymnDocument1 pageICF HymnJustine Marie BalderasNo ratings yet

- How To Register and Log in To SilidLMS For StudentsDocument16 pagesHow To Register and Log in To SilidLMS For StudentsJustine Marie BalderasNo ratings yet

- 6un44rh0q - Cost Accounting and ControlDocument75 pages6un44rh0q - Cost Accounting and ControlJustine Marie BalderasNo ratings yet

- Balderas, Justine Marie A. (Contem Act 1)Document1 pageBalderas, Justine Marie A. (Contem Act 1)Justine Marie BalderasNo ratings yet

- 375rc34qs - Understanding The Self Module 1BDocument15 pages375rc34qs - Understanding The Self Module 1BJustine Marie BalderasNo ratings yet

- Pcswevk1w - Activity1 ContemporaryDocument1 pagePcswevk1w - Activity1 ContemporaryJustine Marie BalderasNo ratings yet

- Balderas, Justine Marie (Assignment 1)Document1 pageBalderas, Justine Marie (Assignment 1)Justine Marie BalderasNo ratings yet

- Chapter 2 TQMDocument9 pagesChapter 2 TQMJustine Marie BalderasNo ratings yet

- Ikny4ls0k - Last Activity of Cost AccountingDocument1 pageIkny4ls0k - Last Activity of Cost AccountingJustine Marie BalderasNo ratings yet

- Balderas Chapter2.FarDocument4 pagesBalderas Chapter2.FarJustine Marie Balderas100% (1)

- Balderas-Chapter 1.farDocument5 pagesBalderas-Chapter 1.farJustine Marie BalderasNo ratings yet

- Lesson 5. Military CourtesyDocument45 pagesLesson 5. Military CourtesyJustine Marie BalderasNo ratings yet

- Rjnth64oq - ACTIVITY - CHAPTER 16 - ACCOUNTING FOR DIVIDENDSDocument2 pagesRjnth64oq - ACTIVITY - CHAPTER 16 - ACCOUNTING FOR DIVIDENDSJustine Marie BalderasNo ratings yet

- Lux IndustriesDocument10 pagesLux Industriesmanish jakharNo ratings yet

- Opgavesæt 1Document3 pagesOpgavesæt 1derreck VlogsNo ratings yet

- Kyc Form - Individual Jan 24 EditableDocument4 pagesKyc Form - Individual Jan 24 EditableYogesh PoteNo ratings yet

- Credit and Collection ANSWERDocument2 pagesCredit and Collection ANSWERLlyod Daniel PauloNo ratings yet

- Domino's Case SolutionDocument2 pagesDomino's Case SolutionPrachi Rajan100% (1)

- Tut Test 3 SolDocument2 pagesTut Test 3 SolRanjeet SinghNo ratings yet

- K. NASKAH PUBLIKASI ANDRE YAHYA 20130420246Document25 pagesK. NASKAH PUBLIKASI ANDRE YAHYA 20130420246Mariaa IvannaNo ratings yet

- The Accountant of Minerva LTD A Small Company Manufacturing OnlyDocument2 pagesThe Accountant of Minerva LTD A Small Company Manufacturing OnlyAmit PandeyNo ratings yet

- Frasier Case Analysis Harvard Case Solution & AnalysisDocument6 pagesFrasier Case Analysis Harvard Case Solution & Analysisaishwarya sahaiNo ratings yet

- Terms & Conditions: Citi Rewards Credit CardDocument3 pagesTerms & Conditions: Citi Rewards Credit CardMOHAMMAD ZAIFNo ratings yet

- Delivery Order: KMTCSHAH571339ADocument2 pagesDelivery Order: KMTCSHAH571339AGusti IchsanNo ratings yet

- The Business Case For Managing Cultural DiversityDocument15 pagesThe Business Case For Managing Cultural DiversityJoymarie Rodrigo100% (1)

- BBA Course Allocation Summer 2020Document2 pagesBBA Course Allocation Summer 2020Murgi kun :3No ratings yet

- India Consumer Electricals - Sector Report - 29-04-2022 - SystematixDocument185 pagesIndia Consumer Electricals - Sector Report - 29-04-2022 - SystematixSiddhartha RoyNo ratings yet

- Group 7-Mindful MarketingDocument5 pagesGroup 7-Mindful MarketingBritney BissambharNo ratings yet

- Fme Project PrinciplesDocument44 pagesFme Project PrinciplesAbu NadiaNo ratings yet

- E-Tendering ProcedureDocument6 pagesE-Tendering ProcedureSHANAVAS ENo ratings yet

- Supply Chain Management MCQ Questions and Answers PDFDocument4 pagesSupply Chain Management MCQ Questions and Answers PDFMijanur RahmanNo ratings yet

- Giving Outsourcing A Bad NameDocument2 pagesGiving Outsourcing A Bad NameRolando ValenciaNo ratings yet

- Budget EstimateDocument5 pagesBudget EstimateJoraine RobinsonNo ratings yet

- EFASDocument3 pagesEFASIvan LewNo ratings yet

- QUIZ: Graded: Q.1. Explain Customer Perceived Value (CPV) - Q2.How Is Net Promoter Score' Calculated?Document39 pagesQUIZ: Graded: Q.1. Explain Customer Perceived Value (CPV) - Q2.How Is Net Promoter Score' Calculated?Hiba KhanNo ratings yet

- Adele's Laughing SongDocument9 pagesAdele's Laughing SongSiúnNo ratings yet

- Enter P. Full Note 19Document83 pagesEnter P. Full Note 19Hussen MohammedNo ratings yet

- Constant Increasing and Decreasing - Cost IndustryDocument3 pagesConstant Increasing and Decreasing - Cost IndustrySiti Suhaili Zainal AbidinNo ratings yet

- Primary Related Standard: 1110 - Organizational IndependenceDocument1 pagePrimary Related Standard: 1110 - Organizational IndependenceHammadNo ratings yet

- Faisal Momin Faisal Momin: Accounts Receivable - Yatha Trading DMCC - Dubai, UAE - (2018 - Present)Document2 pagesFaisal Momin Faisal Momin: Accounts Receivable - Yatha Trading DMCC - Dubai, UAE - (2018 - Present)joansennaNo ratings yet

- Module 3 - BreakevenDocument2 pagesModule 3 - BreakevenBern Austin EsguerraNo ratings yet

- CVDocument6 pagesCVMaroun DeebNo ratings yet

- The Project Life Cycle (Phases)Document3 pagesThe Project Life Cycle (Phases)nuraina aqilahNo ratings yet