Professional Documents

Culture Documents

Control

Uploaded by

Tasha Marie0 ratings0% found this document useful (0 votes)

5 views3 pagesRisk and Control Assessment Auditing

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentRisk and Control Assessment Auditing

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views3 pagesControl

Uploaded by

Tasha MarieRisk and Control Assessment Auditing

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

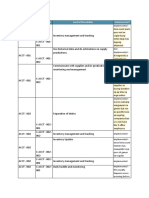

The purchasing department may fail to Inventory management and tracking

Failure to review the review the quantity of products which results

quantities of inventory. to overstatement or understatement of

inventory.

Continuously adjust the input data to

reflect actual conditions. (Start with

forecasts from estimates, historical data or

Inaccurate forecasting of supplies is when

Inaccurate forecasting of models and modify the sales forecast

the company underestimate or overestimate

supplies. figures when actual sales results become

the demand of stock.

available.);

or use historical data and do estimations

on supply productions.

Suppliers that happens to not meet the Communicate with supplier and/or

Delayed acceptance of delivery schedules can result in production Production monitoring and management

supplies. delays, inventory stockouts and customer

dissatisfaction. Supplier Contract*

The one who checks the Separation of duties

There might be a conflict on inventory

inventory is the same

control if the one who checks and delivers

person who provides

inventory were the same person.

supplies to the customer.

Inventory management and tracking

Delayed inventory count resulting to delay in

Delayed inventory count. Inventory Update

ordering new supplies and materials.

The incorrect inventory count may arise due Inventory management and tracking

Incorrect inventory count.

to merely counting the ending inventory.

Damaged inventory stock that cannot be Daily huddle and monitoring

Potential stock damages. used becomes waste and increases costs to

the business. *

Unauthorized access to Approval matrix

Google sheets which will Access control

Unauthorized access to Google sheets

affect the encoding of Access review control

which lead to unauthorized processing.

quantities and the

amount.

Misclassification or

Misclassification or failure to include

failure to identify all the

business expenses may result in the failure

expenses made during

to report a deductible expense.

the period.

Unauthorized access to google sheets may Approval matrix

Unauthorized access to

result to mismanagement for payment Access control

google sheets.

processing. Access review control

Unauthorized access to Unauthorized access to the company's Access control. Only the processor has

the company's mailbox mailbox by reason of unsecured access to company’s mailbox.

which causes spreadsheet software which causes Access review control

mismanagement. mismanagement.

Incorrect payment Review and approval

There are some instances that the company

processing as to amount, Bank File extracted uploaded to bank

may experience fraud caused by third

bank details and other portals

parties.

necessary information.

The one who processed The same person who processes and seeks Separation of duties

the payment of the approval for its payment may result to fraud.

invoice is the same

person who seek

approval for its payment.

Duplicate payment caused by flaws in a System detection of invoices

company's accounts payable processes that Review and approval

Duplicate payment

do not detect the presence of prior Bank reconciliation

payments.

Processer individually check invoices in AP

mailbox and match if it is uploaded in

Dataline. Once the invoice is processed,

the email is transferred to Subfolder –

Completed. Only those not yet uploaded

Not all invoices sent in Due to the demand of rejected invoice, some

and processed in Dataline and not yet will

mailbox will be of it cannot be processed on time which can

remain in the main Mailbox. But those

processed. result to the delay of claims.

partially processed has a flag for follow-up.

Hence, those item in main mailbox having

no red flag are not yet uploaded in

Dataline. (is this automated or manual, if

manual, is there other way to check)

Daily mailbox management and board

Late processing or Because of unregulated invoices that were

tracker

unprocessed invoices declined by the company, there instances

Weekly checking of and follow-up of

due to unmonitored that the progress of the invoice gets

rejected invoices

rejected invoices. interrupted and outdated.

QA audit

Invoice coding cheat sheet*

Inaccurate processing of The list of dismissed invoices may result to

TL review

rejected invoices. mistakes or errors in the overall processing.

QA audit

Erroneously deletion of invoices may occur Excalation matrix on over due invoices

Erroneously deletion of

when the management incorrectly deleted

invoices.

the rejected invoice.

Demographic information of customers such Checks and update customer master data

Not all invoices are as age, marital status, education may

updated about the change in the future compared by the time

customer's information the invoice was created. And because of

such as their these changes, the information in the invoice

demogaphic profile. becomes inaccurate if they are not updated

properly.

AP checklist of important info to check

Due to a significant amount of invoices Automated invoice coding cheat sheet

Inaccurate processing, received by a company, the invoice may not QA audit

coding` and allocation to be received by the proper approver and may The invoice undergoes approval matrix in

approver of invoices. cause errors in the codes during the Dataline

process.

Invalid invoices may result in prolonged and AP Checklist of valid invoices

Processing of invalid delayed payment processing which can QA audit

invoices. negatively impact the company's customer Approval matrix in Dataline

relationship.

Failure to read/receive The management might overlook the order

the order request. request received through e-mail.

Errors from incorrect input of amount such Generates commitment report

as transposition errors can cause

overstatement or understatement of an item.

Incorrect invoice amount.

If a deductible amount isn't claimed as a

result of the entry error, an error like this can

be costly.

Incorrect granting of payment terms to the

Incorrect granting of

customers will cause trouble the company's

credit terms/discount.

accounting book.

Unable to collect the payment due to

Failure to collect the

customers' inaccurate detailed information

claims on receivables.

input for bank transfer.

When it comes to bank transfers, there are

Incorrect input of amount instances where the customer may have

through collection from entered the wrong details in the invoice. This

bank transfer. will prolong the process because it requires

an assessment before continuing.

The company might get exposed to non-

Failure to encash the

encashment of checks paid by the customer

check.

due to cancellation or dishonored checks.

Inaccurate amount received may lead to Quality control

Inaccurate amount and

overstatement/understatement of cash Serko claims processing

currency claimed.

recording.

Delayed payment by the customer resulting

from timing of the transfer, where the

Late payment received

transfer is being made, the currencies

from bank transfer.

involved, security checks, bank holidays,

and the reasons for the transaction.

Incorrect input of the Incorrect input of information in the check

amount and other happens when the customer erroneously

necessary information in write the amount or recipient's name in the

the check. check.

Failure to collect the

Failure to collect the claim through bank

claim through bank

transfer because of the delayed payment.

transfer on time.

Late or non-payment of Team huddle reminder

Payment that are overdue from the due date

due invoices or out of Segregation of duties

of the invoice may disrupt the payment

cycle payment by the

processing.

customer.

Ghost employees are either employees on Quality control

Ghost employee that paper only, are dead but kept on the payroll, Checks and updates employees master

may exist in the list of or they are real people who do not even data

payrolls. work at the business that is sending out

paychecks to them.

You might also like

- Illustration 2.5.1 Working Paper EntriesDocument2 pagesIllustration 2.5.1 Working Paper EntriesTasha MarieNo ratings yet

- PDF Ch06docx DL PDFDocument23 pagesPDF Ch06docx DL PDFTasha MarieNo ratings yet

- Illustration 2.5.1 Consolidated FSDocument2 pagesIllustration 2.5.1 Consolidated FSTasha MarieNo ratings yet

- Graded Quiz 04Document2 pagesGraded Quiz 04Tasha MarieNo ratings yet

- Key Planning ActivitiesDocument3 pagesKey Planning ActivitiesTasha MarieNo ratings yet

- Engagement Process and PlanningDocument7 pagesEngagement Process and PlanningTasha MarieNo ratings yet

- Facts Case DigestDocument2 pagesFacts Case DigestTasha MarieNo ratings yet

- Module 6 - Assignment 5Document2 pagesModule 6 - Assignment 5Tasha MarieNo ratings yet

- Final ExamDocument18 pagesFinal ExamTasha MarieNo ratings yet

- Control Code Control Description Implemented?Document7 pagesControl Code Control Description Implemented?Tasha MarieNo ratings yet

- Chapter 1: An Unlucky YearDocument26 pagesChapter 1: An Unlucky YearTasha MarieNo ratings yet

- School of Accountancy & Management Accounting For Special Transaction Midterm ExaminationDocument11 pagesSchool of Accountancy & Management Accounting For Special Transaction Midterm ExaminationTasha MarieNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5796)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Simba: Program, Dan Ukuran Perusahaan TerhadapDocument17 pagesSimba: Program, Dan Ukuran Perusahaan TerhadapOktafianiwidi PangestiNo ratings yet

- Modelo de Contrato AlibabaDocument8 pagesModelo de Contrato AlibabaEduardo Franklin Vasquez HuamanNo ratings yet

- Marketing Assignment Chapter 5Document5 pagesMarketing Assignment Chapter 5zeeocracy86% (7)

- J 71 RSRR 2021 187Document11 pagesJ 71 RSRR 2021 187Smridhi sethiNo ratings yet

- Brics: Nikhil K Gowda Psir Notes Brics 2022Document10 pagesBrics: Nikhil K Gowda Psir Notes Brics 2022Avijith ChandramouliNo ratings yet

- Anemut Biadegelegn Final ThesisDocument113 pagesAnemut Biadegelegn Final Thesishundera eshetuNo ratings yet

- The Commerce Villa: Time: 3 Hours Mock Test (EC - 10) Marks: 80 Section A (Macro Economics)Document15 pagesThe Commerce Villa: Time: 3 Hours Mock Test (EC - 10) Marks: 80 Section A (Macro Economics)Shreyas PremiumNo ratings yet

- Applied of Commercial and Quality Principles in EngineeringDocument5 pagesApplied of Commercial and Quality Principles in EngineeringCIYA ELIZANo ratings yet

- Tutorial 1Document21 pagesTutorial 1Krrish BosamiaNo ratings yet

- Summer Internship ProjectDocument21 pagesSummer Internship ProjectSonam GuptaNo ratings yet

- Problem Statement 3-S SrividhyaDocument13 pagesProblem Statement 3-S SrividhyaAdish BhagwatNo ratings yet

- Tybaf Black Book TopicDocument7 pagesTybaf Black Book Topicmahekpurohit1800No ratings yet

- Abm W5Document14 pagesAbm W5Snider IpiliNo ratings yet

- E-Commerce Mid Term Project PresentationDocument35 pagesE-Commerce Mid Term Project Presentationmyn11No ratings yet

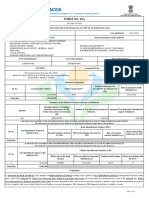

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToRichardNoelFernandesNo ratings yet

- 13 08 20 Final Capital Market ADDIS ABABA UNIVERSITYDocument2 pages13 08 20 Final Capital Market ADDIS ABABA UNIVERSITYchereNo ratings yet

- Topic 5 - ERP Component - The Fulfillment ProcessDocument48 pagesTopic 5 - ERP Component - The Fulfillment ProcessThái Bình PhanNo ratings yet

- Submitted By: Himanshu Rawat Submitted To:Dr. Pallavi DawraDocument16 pagesSubmitted By: Himanshu Rawat Submitted To:Dr. Pallavi DawraHIMANSHU RAWATNo ratings yet

- HTM C311 - 301 H Tourism and Hospitality Marketing: Group Work #1 (Formulation of PESTLE ANALYSIS)Document12 pagesHTM C311 - 301 H Tourism and Hospitality Marketing: Group Work #1 (Formulation of PESTLE ANALYSIS)aira mikaela ruazol100% (1)

- Free Cash Flow ValuationDocument46 pagesFree Cash Flow ValuationLayNo ratings yet

- Definition and Classification of Cooperative SocietiesDocument3 pagesDefinition and Classification of Cooperative Societiesmaasai phstswaiNo ratings yet

- Financial Statement Analysis of OSCBDocument55 pagesFinancial Statement Analysis of OSCBSunil ShekharNo ratings yet

- Tax in Voice Mi 1212210 A A 20100Document1 pageTax in Voice Mi 1212210 A A 20100Jibin S. KNo ratings yet

- Lesson 2-SSP 113Document8 pagesLesson 2-SSP 113Jan Lester DemaalaNo ratings yet

- MM 4 4th Edition Dawn Iacobucci Solutions Manual DownloadDocument13 pagesMM 4 4th Edition Dawn Iacobucci Solutions Manual DownloadJamie Guzman100% (22)

- Assignment Submission Cover Sheet: International Islamic University, IslamabadDocument5 pagesAssignment Submission Cover Sheet: International Islamic University, Islamabadruqayya muhammedNo ratings yet

- MGSC01 Lec 1 NotesDocument6 pagesMGSC01 Lec 1 Notesalex.c.mark66scribd2No ratings yet

- Topic 3 - International Monetary System and Balance of PaymentsDocument53 pagesTopic 3 - International Monetary System and Balance of PaymentsM.Hatta Dosen StiepanNo ratings yet

- Business Banking: You and Wells FargoDocument4 pagesBusiness Banking: You and Wells Fargobilly barker white50% (2)

- Addendum1 Acl Patrimonial Capital 3b FFDocument7 pagesAddendum1 Acl Patrimonial Capital 3b FFOriannys de CardenasNo ratings yet