Professional Documents

Culture Documents

Summary of The Conceptual Framework

Uploaded by

school worksOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Summary of The Conceptual Framework

Uploaded by

school worksCopyright:

Available Formats

CHAMIE YVONNE T.

CARIÑO

CONCEPTUAL FRAMEWORK AND ACCOUNTING STANDARDS

SUMMARY OF CONCEPTUAL FRAMEWORK

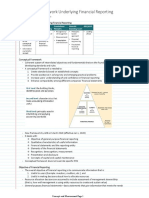

CONCEPTUAL FRAMEWORK

A conceptual framework can be defined as a system of ideas and goals that leads to the creation

of a consistent set of rules and standards. Specifically, in accounting, the rules and standards

define the nature, function, and boundaries of financial accounting and financial reporting.

1. THE OBJECTIVE OF FINANCIAL REPORTING

• To provide financial information that is useful to users in making decisions

relating to providing resources to entity.

2. QUALITATIVE CHARACTERISTICS OF USEFUL FINANCIAL

INFORMATION

• The fundamental qualitative characteristics contained in the Conceptual

Framework there are two types these are the relevant and faithful representation.

• RELEVANCE- is capable of making a different decisions if it’s a predictive

value or confirmatory value.

❖ PREDICTIVE VALUE- Information has a predictive value if it can

help users to make predictions about future outcomes.

❖ CONFIRMATORY VALUE- it refers to feedback about past/previous

evaluations.

❖ MATERIALITY- is an entity specific aspect of the relevance.

• FAITHFUL REPRESENTATION- This information is faithfully represented if

it is factual.

❖ COMPLETENESS- all information for user’s to have a complete

understanding of the financial statements that is provided.

❖ NEUTRALITY- avoid bias.

❖ FREE FROM ERROR- no errors or omissions.

• ENHANCING QUALITATIVE CHARACTERISTICS – These four

qualitative characteristics make the information more useful. But they can't make

useless information useful.

❖ COMPARABILITY – refers to the user’s ability to distinguish the

similarities and differences.

❖ VERIFIABILITY- It refers to the user's ability to ensure that the

information accurately represents what was intended and that the

measurement method selected was used without bias.

❖ TIMELINESS – Information should received at the right time.

❖ UNDERSTANDABILITY- The information must classified and clearly

stated to. sometimes, the information is hard to understand.

3. FINANCIAL STATEMENTS AND THE REPORTING ENTITY

• Provide the information about an entity assets, liabilities, equity, income and

expenses useful to users of financial statements.

✓ REPORTING PERIOD- financial statements are prepared for general purpose

financial reporting

✓ REPORTING ENITY- is an entity that is required to prepare a financial

statements.

✓ GOING CONCERN- under this concept, the business is assumed to continue to

exist for an indefinite period of time

✓ OBLIGATION- means a duty or responsibility.

4. THE ELEMENTS OF FINANCIAL STATEMENTS

• To provide the information about the assets, liabilities, equity, income, and

expense.

❖ ASSETS- are the economic resources you control that have resulted from

past events.

❖ LIABILITIES- present obligations that have resulted from past events

and can require you to give up resources when setting them.

❖ EQUITY- residual interest in the assets of the entity after deducting all of

the liabilities.

❖ INCOME- increases in economic benefits during the period in the form of

increase in assets or decrease in liabilities, that result in increases in equity

, excluding those relating to investments by the owner.

❖ EXPENSE- arise in the course of the ordinary activities of a business

5. RECOGNITION AND DERECOGNITION

❖ RECOGNITION- The amount of an asset, a liability or equity is recognized in

the statement of financial position is reported as carrying amount.

❖ DERECOGNITION- is defined as the removal of all or part of a recognized

asset or liability from the statement of financial position. Is an asset occurs when

the entity loses control of all or part of the assets.

6. MEASUREMENT

❖ Is defined as quantifying in monetary terms the elements in the financial

statements.

❖ Historical Cost- Assets are initially recorded at their acquisition cost.

• CURRENT VALUE-current value provides information updated to reflect conditions at

the measurement date.

❖ FAIR VALUE- Reflects the current expectations of market participants regarding

the amount, timing, and uncertainty of future cash flows.

❖ VALUE IN USE- reflect the current expectations of the particular entity

regarding quantity, timing, and uncertainty of future cash flows.

❖ FULLFILLMENT VALUE FOR LIABILITY- reflect the current expectations

of the particular entity regarding quantity, timing, and uncertainty of future cash

flows.

❖ CURRENT COST - Paid to collect an equal asset. To obtained to tackle an equal

liability.

7. PRESENTATION AND DISCLOSURE

❖ The presentation and disclosure can be an effective communication tool about the

information in financial statements.

❖ CLASSIFICATION- is the sorting of assets liabilities ,income, equity, and

expense in the basis of shared.

8. CONCEPTS OF CAPITAL AND CAPITAL MAINTENANCE

❖ The financial concept of equity is used by most organizations when preparing

financial statements. In the financial concept of capital, such as money invested or

purchasing power invested, capital is synonymous with a company's net worth or

equity. According to the physical concept of capital, such as operating capacity,

capital is considered to be the capacity of an enterprise, for example, in terms of

output per day.

You might also like

- Chapter 4 Accounting Concepts and PrinciplesDocument14 pagesChapter 4 Accounting Concepts and PrinciplesAngellouiza MatampacNo ratings yet

- Chapter 4 2019 0 NewDocument61 pagesChapter 4 2019 0 Newnomthandazomtshweni574No ratings yet

- Conceptual Framework: Theoretical FoundationDocument13 pagesConceptual Framework: Theoretical FoundationAnne Jeaneth SevillaNo ratings yet

- Accounting Concepts and PrinciplesDocument43 pagesAccounting Concepts and PrinciplesOliver RomeroNo ratings yet

- Revised Conceptual FrameworkDocument18 pagesRevised Conceptual FrameworkRodielAlejandroNo ratings yet

- Lesson 2 - Accounting Concepts and PrinciplesDocument5 pagesLesson 2 - Accounting Concepts and PrinciplesJeyem AscueNo ratings yet

- Cfas Exercise 2 EssayDocument2 pagesCfas Exercise 2 EssayDaisy Ann Cariaga SaccuanNo ratings yet

- 6 Qualitative CharacteristicsDocument27 pages6 Qualitative CharacteristicsAlhaider LagiNo ratings yet

- Handout 2 Concepts and Principles of AccountingDocument5 pagesHandout 2 Concepts and Principles of AccountingRyzha JoyNo ratings yet

- IFRS Conceptual Framework SummaryDocument2 pagesIFRS Conceptual Framework SummaryJohn lordrie HerreraNo ratings yet

- IFRS Conceptual Framework OverviewDocument16 pagesIFRS Conceptual Framework OverviewSheikh Sahil MobinNo ratings yet

- Basic Concepts and Principles of AccountingDocument12 pagesBasic Concepts and Principles of AccountingArchieliz Espinosa AsesorNo ratings yet

- Confras Module 2Document12 pagesConfras Module 2Lovely Anne LeyesaNo ratings yet

- Summary Notes - Conceptual Framework - Objective of Financial ReportingDocument5 pagesSummary Notes - Conceptual Framework - Objective of Financial ReportingEDMARK LUSPENo ratings yet

- Financial Reporting FrameworkDocument15 pagesFinancial Reporting FrameworkPang SiulienNo ratings yet

- CFAS NOTES SALISID Chapter 02 Conceptual FrameworkDocument5 pagesCFAS NOTES SALISID Chapter 02 Conceptual FrameworkBerdel PascoNo ratings yet

- Far AssignmentDocument5 pagesFar AssignmentMy everyday LifeeeNo ratings yet

- ACC 203 Module 2 Conceptual FrameworkDocument26 pagesACC 203 Module 2 Conceptual FrameworkMitch Giezcel DrizNo ratings yet

- MODULE 2 Accounting Concepts and PrinciplesDocument4 pagesMODULE 2 Accounting Concepts and PrinciplesKatherine MagpantayNo ratings yet

- Accounting Concepts and PrinciplesDocument41 pagesAccounting Concepts and PrinciplesDon Jack Caalim100% (1)

- Conceptual FrameworkDocument9 pagesConceptual FrameworkheeeyjanengNo ratings yet

- Conceptual Framework For Financial ReportingDocument5 pagesConceptual Framework For Financial ReportingRaina OsorioNo ratings yet

- Orms of Usiness Rganization: Sole ProprietorshipDocument25 pagesOrms of Usiness Rganization: Sole ProprietorshipRosanna AlbanoNo ratings yet

- confras 2Document8 pagesconfras 2Dwight Gabriel C. GarciaNo ratings yet

- Chapter 2 - Conceptual Framework For Financial ReportingDocument18 pagesChapter 2 - Conceptual Framework For Financial Reportingdame ʕ·ᴥ·ʔNo ratings yet

- Copyofcopy3ofapresentation 150501110626 Conversion Gate01Document11 pagesCopyofcopy3ofapresentation 150501110626 Conversion Gate01Gian LawrenceNo ratings yet

- Basic Financial Statements: Conceptual FrameworkDocument11 pagesBasic Financial Statements: Conceptual FrameworkNhel AlvaroNo ratings yet

- Module 3 - Conceptual Framework (Chapter3)Document47 pagesModule 3 - Conceptual Framework (Chapter3)No NotreallyNo ratings yet

- Chapter 3 Starting Up A BusinessDocument3 pagesChapter 3 Starting Up A BusinessNyah MallariNo ratings yet

- FIN600 Module 1 Topic 2Document29 pagesFIN600 Module 1 Topic 2Inés Tetuá TralleroNo ratings yet

- CFAS - Chapter 1-8Document10 pagesCFAS - Chapter 1-8John Rafael Reyes PeloNo ratings yet

- Module 2 Conceptual Framework For Financial ReportingDocument9 pagesModule 2 Conceptual Framework For Financial ReportingVivo V27No ratings yet

- Revised Conceptual Framework: O Q F E R M P CDocument8 pagesRevised Conceptual Framework: O Q F E R M P CFrancis Angelo RosalesNo ratings yet

- Chapter 2 - Acctg Concepts & PrinciplesDocument20 pagesChapter 2 - Acctg Concepts & PrinciplesEowyn DianaNo ratings yet

- Framework For FRDocument11 pagesFramework For FRDeep JoshiNo ratings yet

- Accounting Concepts and PrinciplesDocument4 pagesAccounting Concepts and PrinciplesKathrine Nicole FernanNo ratings yet

- ACCOUNTINGDocument6 pagesACCOUNTINGFe VhieNo ratings yet

- Conceptual FrameworkDocument5 pagesConceptual FrameworkBeverly UrbaseNo ratings yet

- Conceptual Framework and Accounting Standards ExplainedDocument5 pagesConceptual Framework and Accounting Standards ExplainedJOMAR FERRERNo ratings yet

- Conceptual FrameworkDocument14 pagesConceptual FrameworkJefferson ManingdingNo ratings yet

- Fundamentals of AccountingDocument9 pagesFundamentals of AccountingKairo ZeviusNo ratings yet

- CH 1 FrameworksDocument6 pagesCH 1 FrameworksShaily SetiaNo ratings yet

- Module 2 Conceptual FrameworkDocument49 pagesModule 2 Conceptual FrameworkNicole ConcepcionNo ratings yet

- Conceptual Framework (Part 1)Document3 pagesConceptual Framework (Part 1)Eui KimNo ratings yet

- Conceptual Framework Underlying Financial Reporting: Thursday, January 9, 2020 9:45 PMDocument10 pagesConceptual Framework Underlying Financial Reporting: Thursday, January 9, 2020 9:45 PMClyde Ian Brett PeñaNo ratings yet

- CFAS Chap2-7Document40 pagesCFAS Chap2-7Patrick Jayson VillademosaNo ratings yet

- 5 Conceptual FrameworkDocument17 pages5 Conceptual FrameworkAlhaider LagiNo ratings yet

- Rev. CH2Document3 pagesRev. CH2Mark RanekNo ratings yet

- Module 1C - ACCCOB2 - Conceptual Framework For Financial Reporting - FHVDocument56 pagesModule 1C - ACCCOB2 - Conceptual Framework For Financial Reporting - FHVCale Robert RascoNo ratings yet

- Qualitative Characteristics of Useful Financial InformationDocument8 pagesQualitative Characteristics of Useful Financial InformationAngel DIMACULANGANNo ratings yet

- Conceptual Framework - Qualitative CharacteristicsDocument57 pagesConceptual Framework - Qualitative CharacteristicsRey ArellanoNo ratings yet

- Ch.2b Accounting QCs and AssumptionsDocument13 pagesCh.2b Accounting QCs and Assumptionsyfzhizhi0214No ratings yet

- Chapter 2 - Actg Framework & ConceptsDocument16 pagesChapter 2 - Actg Framework & ConceptsHana YusriNo ratings yet

- 8th Week Qualitative CharacteristicsDocument13 pages8th Week Qualitative CharacteristicsMikaela CatimbangNo ratings yet

- Conceptual FrameworkDocument5 pagesConceptual Frameworkchaleen23No ratings yet

- Understand Key Accounting Concepts in 40 CharactersDocument4 pagesUnderstand Key Accounting Concepts in 40 Charactersana angelesNo ratings yet

- Intermediate Accounting: Eleventh Canadian EditionDocument41 pagesIntermediate Accounting: Eleventh Canadian EditionthisisfakedNo ratings yet

- CORPORATE REPORTING NotesDocument30 pagesCORPORATE REPORTING Notesvinnieparmar100% (1)

- The Finace Master: What you Need to Know to Achieve Lasting Financial FreedomFrom EverandThe Finace Master: What you Need to Know to Achieve Lasting Financial FreedomNo ratings yet

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNo ratings yet

- Understanding Obligation and RightsDocument7 pagesUnderstanding Obligation and Rightsschool worksNo ratings yet

- Rancor CompanyDocument1 pageRancor Companyschool worksNo ratings yet

- Rancor CompanyDocument1 pageRancor Companyschool worksNo ratings yet

- Problem 2-3 Xanthous CompanyDocument1 pageProblem 2-3 Xanthous Companyschool worksNo ratings yet

- Carinño, Chamie - True or False and Multiple Choice - Obligation and ContractsDocument1 pageCarinño, Chamie - True or False and Multiple Choice - Obligation and Contractsschool worksNo ratings yet

- Carino-Problem 1-9 and Multiple ChoicesDocument2 pagesCarino-Problem 1-9 and Multiple Choicesschool worksNo ratings yet

- Problem 1-3 and Problem 1-4 CarinoDocument2 pagesProblem 1-3 and Problem 1-4 Carinoschool worksNo ratings yet

- PHILO - Extra Credit Paper - Jeepney StrikeDocument3 pagesPHILO - Extra Credit Paper - Jeepney StrikeFaith DytianNo ratings yet

- DS112 Development Perspectives I Course OverviewDocument68 pagesDS112 Development Perspectives I Course OverviewDanford DanfordNo ratings yet

- A Geographical Analysis of Bell - Metal Industry in Sarthebar PDFDocument255 pagesA Geographical Analysis of Bell - Metal Industry in Sarthebar PDFDhiraj DaimaryNo ratings yet

- Accounting For Managers: Module - 1Document31 pagesAccounting For Managers: Module - 1Madhu RakshaNo ratings yet

- Thanos Industries Case StudyDocument48 pagesThanos Industries Case StudyWJ TanoNo ratings yet

- Pei201509 DLDocument46 pagesPei201509 DLanjangandak2932No ratings yet

- Cathay PacificDocument3 pagesCathay PacificSachin SuryavanshiNo ratings yet

- A PROJECT REPORT of SlicDocument51 pagesA PROJECT REPORT of SlicShreya KatreNo ratings yet

- Class XI QPDocument100 pagesClass XI QPDevansh DwivediNo ratings yet

- Advanced Accounting RTP N21Document39 pagesAdvanced Accounting RTP N21Harshwardhan PatilNo ratings yet

- Currency Convertor: 1.abstractDocument6 pagesCurrency Convertor: 1.abstractUSHASI BANERJEE100% (1)

- 5138 5604 Chapter 04 Forward ContractsDocument33 pages5138 5604 Chapter 04 Forward ContractsShomodip DeyNo ratings yet

- Zero Base BudgetingDocument15 pagesZero Base BudgetingSumitasNo ratings yet

- LE-TRA - Config Guide For Shipment & Shipment Cost Document - Part IIIDocument20 pagesLE-TRA - Config Guide For Shipment & Shipment Cost Document - Part IIIАвишек СенNo ratings yet

- Report of Accountability For Accountable FormsDocument2 pagesReport of Accountability For Accountable FormsDilg-car Baguio75% (4)

- Advanced Financial MGMT Notes 1 To 30Document87 pagesAdvanced Financial MGMT Notes 1 To 30Sangeetha K SNo ratings yet

- IntroductionDocument13 pagesIntroductionNadiaaNo ratings yet

- Jepi 03.23.22Document3 pagesJepi 03.23.22physicallen1791No ratings yet

- Case Studies For Acc2Document2 pagesCase Studies For Acc2jtNo ratings yet

- Sample Test Paper Sample Test Paper Sample Test Paper: Part-ADocument8 pagesSample Test Paper Sample Test Paper Sample Test Paper: Part-AMUHAMMED SHAMMASNo ratings yet

- TUGAS 1 (Shoshana Grossbard) Jacob Mincer A Pioneer of Mo (BookFi - Org) UTS S3-Halaman-111-128Document18 pagesTUGAS 1 (Shoshana Grossbard) Jacob Mincer A Pioneer of Mo (BookFi - Org) UTS S3-Halaman-111-128Fakhrul RoziNo ratings yet

- Managerial Economics in A Global Economy Ninth Edition: by Dominick SalvatoreDocument35 pagesManagerial Economics in A Global Economy Ninth Edition: by Dominick SalvatoreRAHUL SINGHNo ratings yet

- BCG MatrixDocument22 pagesBCG Matrixnomanfaisal1No ratings yet

- H2 Economics Textbook (Choo Yan Min) PDFDocument92 pagesH2 Economics Textbook (Choo Yan Min) PDFWinston0% (1)

- Enterpreneurship Lec 10Document10 pagesEnterpreneurship Lec 10SaMee KHanNo ratings yet

- Term Paper (Business Mathematics)Document34 pagesTerm Paper (Business Mathematics)Omar Faruk100% (1)

- MoU - 2023 - 24 - LBAS - MADocument5 pagesMoU - 2023 - 24 - LBAS - MAMetilda AcademyNo ratings yet

- PPG Asian Paints PVT LTD: Indian Institute of Management Tiruchirappalli Post Graduate Programme in Business ManagementDocument15 pagesPPG Asian Paints PVT LTD: Indian Institute of Management Tiruchirappalli Post Graduate Programme in Business ManagementMohanapriya JayakumarNo ratings yet

- Virtual Construction LTD: Purchases Order Form (POF)Document31 pagesVirtual Construction LTD: Purchases Order Form (POF)Shoyeeb AhmedNo ratings yet

- Experiemental Marketing Notes by Ankit and AshneeDocument3 pagesExperiemental Marketing Notes by Ankit and AshneeDeepakshi GargNo ratings yet