Professional Documents

Culture Documents

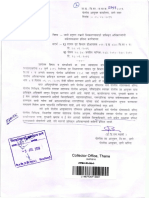

शासकीय कार्यालयात प्रतिज्ञापत्रासाठी स्टॅप पेपरची मागणी न करणे बाबत

शासकीय कार्यालयात प्रतिज्ञापत्रासाठी स्टॅप पेपरची मागणी न करणे बाबत

Uploaded by

Abhimanyu Yashwant Altekar0 ratings0% found this document useful (0 votes)

8 views14 pagesOriginal Title

शासकीय कार्यालयात प्रतिज्ञापत्रासाठी स्टॅप पेपरची मागणी न करणे बाबत

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views14 pagesशासकीय कार्यालयात प्रतिज्ञापत्रासाठी स्टॅप पेपरची मागणी न करणे बाबत

शासकीय कार्यालयात प्रतिज्ञापत्रासाठी स्टॅप पेपरची मागणी न करणे बाबत

Uploaded by

Abhimanyu Yashwant AltekarCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 14

fer .-zrreraste aerator fara ten reed erro = ascot,

ot a saa, CALM pare fener safer aheeefet oa we P2072

BAM 3/3. HPCE. P9IVE 30.20%

sarees foward defite cared aasfawarer at Pe, ae aievit amfafere

cen agte osfrere oqo) aot. areewfset aa ae aerator. 4g /2020 22

Fexsnyeent saa erie a ataa aisett ane. ae caren arti wre tora

Seaert aa meneta saad a aan ae rat ea do ad wT

crane ett a pate ordeneten secret pase Be TET a arta.

ot seer oa

va,

aaa, carer sear fererey Ferrite srreqer aerators afore foram afar ata

saifecttera are,

ama stfirardt, cere ara, Premfirentt rater, sufern

YU mega define sara sage aut afer RO dawite ferret sft aaranet aera

eee a al

Scanned with CamScanner

SS

ogeneral.sa3@gmait.com

BRP 2oAVATT.Y BWM. 933.09

wit,

ALRRene aie, YS, VEG, AER, SET

sa -aresta Sealers wivENTATETST FET jad are a eters

Sci - ae Fah FERS TET TRIS afters, eae) AN aaSSS

a FAT tT 4C/2OPVHO/ ag/AA/BO

eartea dafia vardt ua ofa orlardiere at Stea Stech sm. FEE TAT

ager oer corarte ataret ore ara ere a TE SAE TS

——— oar

mora ina WE voren stan Rie Ye we Bes TESTER SE

caira ordoarn Tatra ae ode wie wean tod way Ree Bears AT

ema Rr ach Soars rh ker edb TET, SH TER TT BH ,

——

Scanned with CamScanner

alooh arrfertiens a agias fries, meee Toe, got why arate,

et adler wert garter aaseroren, Puretaraameaite, gor.

areaett armies - 020 26123826

W.T-S/MSTMATT-5B/2021/5 10/24 , 16/11/2021

wa,

ar, Risch args pt, ante,

Aetlo5 igro@ignnaharashira.gov.An

fewer :- erate areterenet wittsrearerst eee deed ATA

ahaa.

Fat 1. HT, sor marae scare uss wit waite

unfean srarias ac/aoe after earerartie seer,

2. FERTSE oa, HEY aT ar lamers ala

W. FRI 2004/1663/s.m.436/-1 FE. 01/07/2004.

feraiftier we det wm. 1 car amterent safta afer

58/2021 Ai Seq wararaa, stems wists ait arctavat yuar

‘eaear aka.

o state that, the exercise shall be done by

jOughout the State of bringing it to the notice of

iments and the ai

and declaration not to insist upon the stamp duty

3 SoM Farare, arene isthe ater tier aneerepae ene

artiorare vfetares erat aRaiet ating age rear ao are

wa, ari agi arent: arnt ae a. tat wai 2 car ener

\

Scanned with CamScanner

ies accepting affidavits

ee

= qaareat

weve sen aftaes, Braheorat FeReIeTs SS i ee oe

dota wee Pea duane tas areas Peg RET *

ait mA Rad we A.

‘wraa- 1 wr yeu scrersu sicarare ar Pit NO 58

OF 2021 Atha sarafactardt 9.

2. AERIEe UTee. EGR oan Perret HOTT

w. Agi 2004/1663. 436-1 01107/2004

Scanned with CamScanner

af

S7.PNL SA-20Z1 eet

IMBAY

COURT OF JUDICATURE AT BO!

Rae a NCH AT AURANGABAD

PUBLIC INTEREST LITIGATION NO. 58 OF 2021

Rhuchan fehwat Mahajan

Versus

The State of Maharashtra and others » Respondents

Ms. PS. Talekar, Advocate h/f M/s, Talekar and Associates, for the

Petitioner.

Mr. A. R. Kale, AGP for Respondent Nos. 1 to 4.

CORAM: —S. V GANGAPURWALA &

R.N. LADDHA, JJ.

DATED: 11” October, 2021.

PER COURT:

The present public interest litigation is filed seeking following

reliefs :

A) To direct the respondents, their subordinates, officers,

agents to strictly implement the notification dated 01.07.2004

issued by the Revenue and Forest Department, Mantralaya,

Mumbai, wherein it is held by the State Government that the

stamp duty chargeable under Article 4 of Schedule 1 of the

Maharashtra Stamp Act, 1958 for the purposes of Affidavits to

: ‘be used for any purposes has been remitted under Section 9 of

tthe said Act, by issuing a weit of mandamus, of any other

Sppenpriate writ, order of direction as the case may be:

1) Yo direct the respondents their subordinates, officers,

agents to display in theis officer/public offices at conspicuous

place that ‘as per satiation dated 01.07.2004 the stamp duty

Lota

= teat «ner © Downtentnd an = 2008OR HDAC

Scanned with CamScanner

2 97-PIL $8-2021.08t

chargeable under the ‘Maharashtra

purposes of Affidavits 10 be used for any purposes .

remitted by issuing a writ o} or any other

der or direction as the case may be;

f mandamus,

appropriate writ, 0

©) To direct the respondents to give wide publicity to the

notification dated 01.07.2004 issued by the Revenue and Forest

Department, Mantralaya, Mumbai, pending hearing and final

disposal of this petition.

D) To direct the respondents, their subordinates, officers,

agents not to insist any person to pay stamp duty under the

Maharashtra Stamp Act, 1958 for the purposes of Affidavits to

be used for any purposes, pending hearing and final disposal of

this petition;

F) To grant any other relief to which the petitioner is

entitled to.

2. Ms. Talekar, learned counsel for the petitioner submits that in

spite of the fact that notification has been issued on 01.07.2004 by the

state Government under Section 9 of the Maharashtra Stamp Act, 1958

(hereinafter referred to as Act of 1958") remitting the stamp duty

chargeable under Article 4 of Schedule I of the Act of 1958 for the

purpose of affidavit, the departments of the State Government are

insisting for affidavits either on Rs. 100/- stamp paper or on Rs. 500/-

stamp paper consistently. The same is in flagrant violation of the

remission granted by the State Government. The departments of the

State cannot insist for affidavit on a stamp paper

20f9

Scanned with CamScanner

4 97-PIL $8-2021.008

the affidavits. The learned A.G.B further submits that the notification

granting remission of stamp duty for affidavit is also published on the

‘Website.

5, The Act of 1958 is enacted to consolidate and amend the Jaw

relating to stamps and stamp duties in the State of Maharashtra. The

same is adopted and modified by the Maharashtra Adaptation of Laws

(State and Concurrent Subjects) Order, 1960. Article 4 of Schedule I of

the Act of 1958 provides that affidavit that is to say, a statement in

writing purporting to be a statement of facts, signed by the person

making it and confirmed by him on oath or in the case of persons by

law allowed to affirm or declare instead of swearing, by affirmation is

required to be on a stamp paper of Rs. 100/-. Article 4 grants

exemption to certain specific affidavits.

6. Section 9 of the Act of 1958 empowers the State Government to

reduce or remit, whether prospectively or retrospectively, in the whole

or any part of the State the duties with which any instruments or any

particular class of instruments or any of the instruments belonging to

such class, or any instruments when executed by or in favour of any

particular class of persons, or by or in favour of any members of such

class, are chargeable.

40f9

Scanned with CamScanner

3 TPL SSRMLOR

3. The learned counsel for the petitioner to buttress her ‘submissions

relies on the tender documents of the Public Works Department to

contend that now the Public Works Department is insisting for affidavit

‘on Rs. 500/- stamp paper. The leamed counsel also has referred to

other illustrations to submit that in all Government departments, the

affidavits are insisted on stamp papers.

4. Mr. Kale, learned AGP submits that the State Government

invoking its powers under Section 9 of the Act of 1958 has granted

remission from payment of stamp duty on affidavits as envisaged under

Article 4 of the Act of 1958. The State machinery has already instructed

to all the Deputy Commissioners, District Collectors as well as all the

authorities concerned informing issuance of resolution and instructed

them for non insistence of the stamp papers. The authorities have also

taken care to give wide publicity through posters as well as through

news items. The steps are taken for public awareness of the issuance of

notification granting remission of stamp duties for affidavits. The

copies of news items and the relevant posters are also annexed with the

affidavit in reply. The learned AGB further submits that the Joint

District Registrar, Aurangabad has filed affidavit that the authorities

have also taken care to give wide publicity through poster as well as

through news items and further granting remission of stamp duties for

30f9

1 Downbbededon = 20407021 103519 2

Scanned with CamScanner

5 ‘97-PIL $8-2021.0dt

7. Invoking Section 9 of the Act of 1958, the State Government

under notification” dated 01.07.2004 remitted the stamp duty

chargeable under Article 4 of schedule 1 appended to the said Act, on

the instruments of affidavit or the declaration made for obtaining caste

certificate/income certificate/domicile certificate/nationality certificate

or for any other purpose of being filed or used before any Government

authority or in any Court or before the officer of any Court.

8. The notification dated 01.07.2004 thereby remits the stamp duty

on the instruments of affidavit or declaration for being used before any

Government authority or in any Court or before the officer of any

Court.

9. The notification is explicitly clear. No Government authority can

insist for affidavit on a stamp paper. The Government, it appears was

aware that its authorities are not abiding by the notification dated

01.07.2004 as such, issued a circular on 12.05.2015 directing not to

insist for affidavits on stamp paper. It appears from the information

provided under the Right to Information Act that Rs. 100/- stamps are

used for non judicial purposes on a large scale.

10. It appears that Suo Moto Public Interest Litigation No. 121 of

2014 was registered at the Principal Seat of this Court on the basis of

Sof9

+2 Uploaded on - 0/s07024 Downloaded on - 20710021 10:35:19

Scanned with CamScanner

S)

o7-PIL$8-2021.0dt

mbai Mirror 07 10.07.2014, “Mystery

yublished in ‘Mur

In the said Public Interest

the news item P

Rs. 100/- Stamp

by the Additio ;

produced by the Court in

shortage of Papers

nthe affidavit was file

paragraph No, 4 and 6 of the affidavit a6 re

terest Litigation N

28.03.2016 in Public Int

nal Controller of Stamps.

Litigatior

jo. 121 of

its judgment dated

2014, The same reads thus :

4) in the aforesaid affidavit, ‘Additional Controller of

Stamps has denied that there was any shortage of stamp papers

of the denomination of Rs. 100 in the month of July 2014, or

he has pointed out that the

for that matter at present. Further,

d upon it by clause (a) of

State in exercise of powers conferre

section 9 of the Maharashtra Stamp Act, 1958 has issued

notification dated 1 July 2014 remitting the stamp duty

chargeable under section 4 of schedule I appended to the said

‘Act, on the instruments of affidavit or declaration made for

obtaining caste certificates, income certificates, domicile

certificates and nationality certificates. As such, he has

submitted that there is no necessity for purchase of any stamp

paper for the aforessid purpose. Mr G. W Mattos, the

Government Pleader has submitted that in view of such

notification, there are hardly any purposes, for which, the

students seeking admission to educational institutions are

required to purchase stamp papers.

5] That apart, the Additional Controller of Stamps at

paragraphs 6, 7 and 8 of his affidavit has made the following

statements :

“I say that the Government in the Revenue and Forest

6 of

1 Upload on. tenet it Downloaded on -20v1a02t 10:35:19 23

Scanned with CamScanner

—/

7 97-PIL 58-2021.0dt

Department vide a Circular dated 14” October, 2014

granted Stamp Vending licenses to Bar Associations for sale

of Stamp Papers and Court Fee Labels in Court premises. I

say that my office has issued Stamp Vending Licenses to the

Dadar Bar Association, the Bombay Advocates Bar

Association at the Small Causes Court, Mumbai, The Motor

Accident Claim Tribunal Bar Association, The Borivali

Advocates Bar Associations, the Advocates Associates of

Western India, The Mazagaon Court Bar Association at

Esplanade Court, Mumbai, However che Advocates

Association of Western India has not yet commenced the

sale of Stamp Papers and Court Fee Labels inter alia on

account of some administrative difficulties. I say that my

office has also issued a Stamp Vending License to The

Indian Advocates Multi State Multi Purpose Co-operative

Society Ltd. situate in the High Court premises as per the

permission granted by the Government in the Revenue and

Forest Department vide its letter dated 26% November,

2014,

7. I say that it is made compulsory to fill the form in

Annexure 1 for obtaining Stamp Papers for executing

Affidavits and the form in Annexure 2 for executing

documents other than Affidavits as per the Circular dated

14" August, 2014 issued by Inspector General of

Registration, Maharashtra State, Pune. The specimen copies

of the said Annexures are hereto annexed and marked as

EXHIBITS 2" and % respectively. I say that for completing

these formalities it takes some time, which some times

results into long queues of people at the Stamp Vending

Centres.

70f9

Scanned with CamScanner

i

6 97-P1L 58-202.08t

; suburban District

8. I say that in Mumbai and Mumbai Subu1 District

there are 24 Government approved license Stamp Vendors. I

say that as per the demand of the said Stamp Vendors,

being

supply of stamp papers and Court Fee labels is

arranged by my office regularly: Hence, there is no scarcity

of stamp papers. I say that with a view to keep a check inter

alia on the sale of stamp papers by Stamp Vendors,

instructions are issued to all Collectors of Stamps in

Mumbai and Mumbai Suburban District by my office to

carry out periodic inspections of the licensed Stamp Vendors

premises so as to inter alia ensure that the persons

intending to purchase Stamp Papers are not overcharged.”

11. The said affidavit also clarified the stand of the State that

remission on stamp paper for the affidavit is provided for.

12, The officers of the Government are required to be imparted with

the necessary knowledge of the notification published by the State

Government remitting the stamp duty, Though it is submitted that time

to time news items are published, on the website also the same is

published, still the fact remains that the affidavit on stamp papers are

insisted upon by the Government Departments and also on the

documents to be used before the Court.

13. The Government may take further steps such as holding

‘workshops for the officers and the authorities and/or such steps so as

to bring it to the notice of all concerned that they shall not insist for

809

Uploaded on - 1/10/2021 Downloaded on - 20/2021 10:35:19

Sten . is eae

Scanned with CamScanner

; ®

9 ‘97-PIL.$8-2021.08t

affidavits on stamp paper. The notification has to be brought in effect in

reality and the same shall not remain only on papers. The order dated

08.01.2015 issued by the State Election Commission also it seems is

flouted. The State Election Commission on 08.01.2015 had issued an

order that the affidavit and declaration shall not be insisted on the

samp paper, but stil the same is accepted on stamp paper during the

process of elections. All the Government authorities have to take

effective steps to implement the notification and to make the

authorities and the public aware. It is also the duty of the authorities to

implement the notification in its true letter and spirit, so that

itizens would be avoided. Needless to state

unnecessary burden on the

that, the exercise shall be done by the State Government throughout

the State of bringing it to the notice of all the Government departments

and the authorities accepting affidavits and declaration not to insist

upon the stamp duty.

14. Public interest litigation is disposed of. No costs.

(R.N. LADDHA ) (SV. GANGAPURWALA )

JUDGE JUDGE

PS.B. .

90f9

Ag # Uploaded on s6narz024 :

it Downlonded on = 20/5072021 10:25:10

Scanned with CamScanner

igo eh a vale SC

odie

OFTEN

sufi set

am UR-4

Brg ener} eres neater rare Te

cafe tg ah Pet nie enfAam) Far er

aaa fara

sismera, ypof yoo 032 Pomme 9 aR #96

(ome gan, aH onfin a-mt

aren

ed yates Fre, a4

BTN ETE oow/ a |K/ A. H, waLIA-S =H eS aAFTIA segs Soy HT IMS

fo) area warm gem as (ot) ETE mea eva onere roreren Sree THe

Btottarera aa aad sierra on anh orl Geena mer ma TET?

‘ara aoronraaeUsT wmroRrayereen TOTpeTtaReT Taro Arvicenanch oe

corr ats a omer ura res CATED er Te ONT

cvan aFRwATAN sep 4 er ORPTR y SPATE eR serie Here

1

iw ata an

amrargr® qoagrs wren seem ¢ Aa

ang: mee

a er

’

| fae

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Bluechip Investments Weekly Issue No. (32) 10 To 16 June 2019Document16 pagesBluechip Investments Weekly Issue No. (32) 10 To 16 June 2019Abhimanyu Yashwant Altekar70% (10)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Zerodha PMLA PolicyDocument8 pagesZerodha PMLA PolicyAbhimanyu Yashwant AltekarNo ratings yet

- Clause 4 (1) (B) (Ii) Format - (B)Document1 pageClause 4 (1) (B) (Ii) Format - (B)Abhimanyu Yashwant AltekarNo ratings yet

- WinextensionsDocument142 pagesWinextensionsAbhimanyu Yashwant AltekarNo ratings yet

- ,'A Ew Ffiq,: Q ( (:-PR S D Qaqffi FT 3tim (Y P T Q 4I Ilia / Ffi QFL Ffil QRQLDocument9 pages,'A Ew Ffiq,: Q ( (:-PR S D Qaqffi FT 3tim (Y P T Q 4I Ilia / Ffi QFL Ffil QRQLAbhimanyu Yashwant AltekarNo ratings yet

- Wisemoney 748Document20 pagesWisemoney 748Abhimanyu Yashwant AltekarNo ratings yet

- RMS Works On The Following ConceptsDocument2 pagesRMS Works On The Following ConceptsAbhimanyu Yashwant AltekarNo ratings yet

- Neo Wave Patterns1Document22 pagesNeo Wave Patterns1Abhimanyu Yashwant Altekar100% (1)

- Policy For Dormant AccountsDocument2 pagesPolicy For Dormant AccountsAbhimanyu Yashwant AltekarNo ratings yet

- Commodities Digest PDFDocument30 pagesCommodities Digest PDFAbhimanyu Yashwant AltekarNo ratings yet