Professional Documents

Culture Documents

Cambridge International AS & A Level: Accounting 9706/32

Uploaded by

Prethela ParvinOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cambridge International AS & A Level: Accounting 9706/32

Uploaded by

Prethela ParvinCopyright:

Available Formats

Cambridge International AS & A Level

ACCOUNTING 9706/32

Paper 3 Structured Questions October/November 2020

INSERT 3 hours

INFORMATION

*1322978784-I*

● This insert contains all of the required information and questions. The questions are provided in the

insert for reference only.

● You may annotate this insert and use the blank spaces for planning. Do not write your answers on the

insert.

This document has 12 pages. Blank pages are indicated.

DC (RCL (GO)) 188096/1

© UCLES 2020 [Turn over

2

Section A: Financial Accounting

Question 1

Source A1

FG Limited is a manufacturing business. The rate at which it accounts for factory profit has not changed

for some years. Inventory is valued at transfer price.

The company’s accountant produced draft financial statements for the year ended 31 December 2019

as follows.

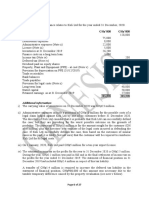

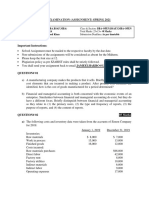

Draft manufacturing account for the year ended 31 December 2019

$

Cost of raw materials consumed 31 200

Direct labour 52 800

Prime cost 84 000

Overheads 54 900

Change in work in progress 1 100

Production cost of manufactured goods 140 000

Factory profit 28 000

Transfer price 168 000

Draft income statement for the year ended 31 December 2019

$ $

Revenue 320 800

Inventory 1 January 2019 36 000

Transfer price 168 000

204 000

Inventory 31 December 2019 30 000

Cost of sales 174 000

Gross profit 146 800

Factory profit 28 000

Change in provision for unrealised profit 1 000

Distribution costs 42 700

Administrative expenses 78 900 121 600

Draft profit for the year 54 200

© UCLES 2020 9706/32/INSERT/O/N/20

3

Answer the following questions in the question paper. Questions are printed here for

reference only.

(a) Explain two reasons why a factory profit is added in an income statement. [4]

Additional information

After the preparation of the draft financial statements the following errors were discovered.

1 The rent expense, $60 000, should have been split 70% factory, 10% distribution centre and

20% offices. In error it had been split 50% factory, 10% distribution centre and 40% offices.

2 An item of factory machinery, cost $50 000, had been bought on 1 January 2019. This had

been recorded in error as office equipment. Factory machinery is depreciated at the rate of

20% per annum and office equipment at 10% per annum.

3 An error had occurred in counting the inventory of finished goods at the year end. The value

in the draft financial statements was based on an inventory of 5000 units but in fact there

were only 4000 units.

(b) Calculate for the year ended 31 December 2019:

(i) the correct value for the production cost of manufactured goods [3]

(ii) the correct value of factory profit. [1]

(c) Prepare for the year ended 31 December 2019:

(i) the corrected provision for unrealised profit account [3]

(ii) the corrected income statement. [9]

Additional information

One of the directors has suggested that the company should stop accounting for factory profit.

(d) Advise the directors whether or not they should stop accounting for factory profit. Justify your

answer. [5]

[Total: 25]

© UCLES 2020 9706/32/INSERT/O/N/20 [Turn over

4

Question 2

Source A2

The books of account of RF plc for the year ended 31 December 2019 showed the following.

Plant and machinery Provision for depreciation of plant and

machinery

$000 $000 $000 $000

Balance b/d 100 Balance b/d 20

Bank 38 Balance c/d 138 Balance c/d 32 Income 12

138 138 statement

32 32

Motor vehicles Provision for depreciation of motor vehicles

$000 $000 $000 $000

Balance b/d 60 Disposal 16 Disposal 4 Balance b/d 25

Balance c/d 44 Balance c/d 31 Income 10

60 60 statement

35 35

Retained earnings Interest payable

$000 $000 $000 $000

Dividend 8 Balance b/d 33 Bank 5 Balance b/d 2

General 18 Profit for the 15 Balance c/d 1 Income 4

reserve year statement

Balance c/d 22 6 6

48 48

The following information is also available.

During the year ended 31 December 2019 the following had taken place.

1 Inventory had increased by $17 000.

2 Trade receivables had increased by $3000.

3 The bank balance had gone from an overdraft of $7000 to a positive balance.

4 The company had issued 72 000 ordinary shares of $0.50 each at par value.

5 A new bank loan of $5000 had been received.

6 Trade payables had decreased by $6000.

7 A motor vehicle had been sold for $15 000.

© UCLES 2020 9706/32/INSERT/O/N/20

5

Answer the following questions in the question paper. Questions are printed here for

reference only.

(a) Prepare the statement of cash flows for the year ended 31 December 2019. (Ignore taxation.)

[19]

(b) Explain how a premium on an issue of shares is dealt with differently in a statement of cash

flows as compared to the books of account of a company. [3]

(c) State three reasons why a company might prepare a statement of cash flows. [3]

[Total: 25]

© UCLES 2020 9706/32/INSERT/O/N/20 [Turn over

6

Question 3

Source A3

Alice and Babak had both been trading as sole traders for some years when they decided to merge

their businesses to form a partnership. The merger took place on 1 January 2020.

The book values of the assets and liabilities of the businesses immediately prior to the merger were as

follows.

Alice Babak

$ $

Premises 18 000 Nil

Equipment 7 400 8 900

Vehicle Nil 5 200

Intangible asset 200 Nil

Inventory 4 100 3 500

Trade receivables 2 600 1 800

Trade payables 1 400 700

Bank (300) 6 100

The terms of the merger were as follows.

1 The profit sharing ratio of the partnership would be Alice 2:Babak 1.

2 Alice’s premises would be revalued at $32 000.

3 Part of Alice’s inventory, valued at $400, would be written off.

4 An impairment loss of $800 on Babak’s vehicle would be accounted for.

5 Alice would transfer her personal vehicle to the business at a valuation of $2000.

6 The bank accounts would be merged and Alice would pay in enough cash that the

value of the capital accounts would be in the profit sharing ratio.

© UCLES 2020 9706/32/INSERT/O/N/20

7

Answer the following questions in the question paper. Questions are printed here for

reference only.

(a) Suggest two items, purchased by a business, which could be included in its intangible assets.

[2]

(b) Prepare, showing the adjustments made during the merger on 1 January 2020,

(i) the capital account of Babak [3]

(ii) the capital account of Alice. [6]

(c) Prepare the statement of financial position of the partnership immediately after the merger on

1 January 2020. [9]

Additional information

Whilst operating as sole traders both Alice and Babak maintained their books of account on a

manual basis. Babak has suggested that the partnership should use a computerised accounting

system.

(d) Advise Alice whether or not she should agree to using a computerised accounting system.

Justify your answer. [5]

[Total: 25]

© UCLES 2020 9706/32/INSERT/O/N/20 [Turn over

8

Question 4

Source A4

RP Limited provided the following information for the year ended 31 January 2020.

$000

Cash sales 1140

Credit sales 7260

Cash purchases 630

Credit purchases 4670

Inventory at 1 February 2019 1150

Inventory at 31 January 2020 1650

Trade receivables 1500

Trade payables 760

Answer the following questions in the question paper. Questions are printed here for

reference only.

(a) Calculate the working capital cycle ratio. Round up your answer to the next whole day. [8]

Additional information

The industry average for the working capital cycle ratio is 100 days.

(b) Compare your answer to (a) with the industry average. Suggest reasons for the difference.

[5]

(c) Explain why having cash sales and cash purchases might affect the usefulness of the working

capital cycle ratio to the directors. [2]

(d) Calculate the net working assets to revenue ratio. [4]

Additional information

The industry average for the net working assets to revenue ratio is 21%.

(e) Compare your answer to (d) with the industry average. Suggest reasons for the difference.

[3]

Additional information

One of the directors has suggested offering cash discount to credit customers.

(f) Advise the directors whether or not the company should start offering cash discount to credit

customers. Justify your answer. [3]

[Total: 25]

© UCLES 2020 9706/32/INSERT/O/N/20

9

Section B: Cost and Management Accounting

Question 5

Source B1

WJ plc uses a system of budgetary control. It prepares budgets for periods of four weeks each. Its

sales budget for the first four periods of the year shows the following.

period sales in units

1 6000

2 5600

3 6400

4 7200

The company spreads its sales and production evenly throughout the four weeks in each period.

Answer the following questions in the question paper. Questions are printed here for

reference only.

(a) State three factors which might affect the accuracy of a sales budget. [3]

Additional information

It is the policy of WJ plc to keep an inventory of finished goods sufficient to meet the budgeted

sales for the first week of the coming period.

(b) Prepare the production budget (in units) for each of the periods 1 to 3. [8]

Additional information

Each unit of production requires five kilos of raw material. It is the policy of the company to keep

an inventory of raw material sufficient for the production process for the first two weeks of the

coming period.

The raw material costs $10 per kilo.

(c) Prepare the purchases budget for both period 1 and period 2:

(i) in kilos [7]

(ii) in dollars. [2]

Additional information

One of the directors has made two suggestions to increase profits.

Suggestion 1 to continue to use the same supplier of raw materials but to buy a

lower quality of raw materials

Suggestion 2 to continue to buy the same quality of raw materials but to use a

cheaper supplier

(d) Advise the directors whether or not they should accept either of these suggestions. Justify

your answer. Ignore the effect on variances. [5]

[Total: 25]

© UCLES 2020 9706/32/INSERT/O/N/20 [Turn over

10

Question 6

Source B2

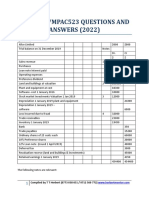

XP plc uses a system of standard costing. It manufactures and sells one product. The following per unit

information is available.

Direct material 2 kilos at $6 per kilo

Direct labour 4 hours at $10 per hour

Fixed overheads $3.50 per direct labour hour

The master budget for March was based on sales of 15 000 units at a selling price of $100 per unit.

Actual sales in March amounted to 14 000 units at a selling price of $104 each.

The materials usage variance for the month was $22 800 (Favourable) and the materials price variance

was $36 300 (Adverse).

Actual direct labour for the month was 53 200 hours at $10.40 per hour.

The fixed overhead expenditure variance for the month was $10 000 (Favourable) and the fixed

overhead volume variance was $14 000 (Adverse).

Answer the following questions in the question paper. Questions are printed here for

reference only.

(a) Calculate for the month of March:

(i) the amount of direct materials used (in kilos) [3]

(ii) the amount paid per kilo for the direct materials [3]

(iii) the labour rate variance [2]

(iv) the labour efficiency variance [2]

(v) the actual profit. [5]

(b) Prepare a statement reconciling the profit of $476 000 from the flexed budget with the actual

profit. [6]

(c) Name two other variances which the directors could calculate if they wished to do further

analysis of the change in the fixed overheads. [2]

(d) Suggest one reason for the company’s:

(i) materials price variance [1]

(ii) materials usage variance. [1]

[Total: 25]

© UCLES 2020 9706/32/INSERT/O/N/20

11

BLANK PAGE

© UCLES 2020 9706/32/INSERT/O/N/20

12

BLANK PAGE

Permission to reproduce items where third-party owned material protected by copyright is included has been sought and cleared where possible. Every

reasonable effort has been made by the publisher (UCLES) to trace copyright holders, but if any items requiring clearance have unwittingly been included, the

publisher will be pleased to make amends at the earliest possible opportunity.

To avoid the issue of disclosure of answer-related information to candidates, all copyright acknowledgements are reproduced online in the Cambridge

Assessment International Education Copyright Acknowledgements Booklet. This is produced for each series of examinations and is freely available to download

at www.cambridgeinternational.org after the live examination series.

Cambridge Assessment International Education is part of the Cambridge Assessment Group. Cambridge Assessment is the brand name of the University of

Cambridge Local Examinations Syndicate (UCLES), which itself is a department of the University of Cambridge.

© UCLES 2020 9706/32/INSERT/O/N/20

You might also like

- How To Bypass Google Verification On LG Device 2020 GuideDocument2 pagesHow To Bypass Google Verification On LG Device 2020 GuideericNo ratings yet

- Excel Safety Stock AbcSupplyChain enDocument16 pagesExcel Safety Stock AbcSupplyChain enSameh RadwanNo ratings yet

- CAPE Accounting 2017 U2 P2 PDFDocument8 pagesCAPE Accounting 2017 U2 P2 PDFHuey F. Kapri0% (1)

- Role of Auditors in Corporate GovernanceDocument9 pagesRole of Auditors in Corporate GovernanceDevansh SrivastavaNo ratings yet

- Non Conformance ProcedureDocument3 pagesNon Conformance ProcedureBharamu Patil33% (3)

- IBP Past PapersDocument13 pagesIBP Past Papersaakash ali AliNo ratings yet

- Using Economic Indicators to Improve Investment AnalysisFrom EverandUsing Economic Indicators to Improve Investment AnalysisRating: 3.5 out of 5 stars3.5/5 (1)

- CH 19Document12 pagesCH 19Felicia Carissa0% (1)

- PL Financial Accounting and Reporting IFRS Exam June 2019Document10 pagesPL Financial Accounting and Reporting IFRS Exam June 2019scottNo ratings yet

- Case Study - Financial Management - MBA Made EasyDocument13 pagesCase Study - Financial Management - MBA Made Easyr.n.pradeepNo ratings yet

- AQA Business 1-1-1-3 Workbook Answers 1Document38 pagesAQA Business 1-1-1-3 Workbook Answers 1Prethela ParvinNo ratings yet

- Economic Insights from Input–Output Tables for Asia and the PacificFrom EverandEconomic Insights from Input–Output Tables for Asia and the PacificNo ratings yet

- Process Failure Mode Effects AnalysisDocument20 pagesProcess Failure Mode Effects Analysissriramachandira100% (1)

- Ae It11 Test Oct Assessment CriteriaDocument5 pagesAe It11 Test Oct Assessment CriteriaAna Paula CristóvãoNo ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/31Document4 pagesCambridge International AS & A Level: ACCOUNTING 9706/31caiexpertcontactNo ratings yet

- Accounting and Management Exam - MancosaDocument11 pagesAccounting and Management Exam - MancosaFrancis Mtambo100% (1)

- Cambridge International AS & A Level: Accounting 9706/33Document12 pagesCambridge International AS & A Level: Accounting 9706/334ycvrzfjgfNo ratings yet

- November 2020 Insert Paper 31Document12 pagesNovember 2020 Insert Paper 31Shahmeer HasanNo ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/31Document16 pagesCambridge International AS & A Level: ACCOUNTING 9706/31waheeda17No ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/32Document12 pagesCambridge International AS & A Level: ACCOUNTING 9706/32Ruchira Sanket KaleNo ratings yet

- OSA Question - Cost AccountingDocument9 pagesOSA Question - Cost AccountingMohola Tebello GriffithNo ratings yet

- Paper 2.1 QQ N PDFDocument20 pagesPaper 2.1 QQ N PDFKAINo ratings yet

- This Paper Is Not To Be Removed From The Examination HallsDocument82 pagesThis Paper Is Not To Be Removed From The Examination HallsPutin PhyNo ratings yet

- 9706 31 Insert o N 20Document5 pages9706 31 Insert o N 20chirag mehtaNo ratings yet

- FYMMS Cost and MA AssignmentDocument2 pagesFYMMS Cost and MA AssignmentRahul Nishad100% (1)

- Cambridge International Advanced Subsidiary and Advanced LevelDocument12 pagesCambridge International Advanced Subsidiary and Advanced LevelKKNo ratings yet

- 2020 MayDocument15 pages2020 MaySenomi JayasingheNo ratings yet

- April AssignmentDocument9 pagesApril AssignmentMehrunisaChNo ratings yet

- Acct1101 Final Examination SEMESTER 2, 2020Document13 pagesAcct1101 Final Examination SEMESTER 2, 2020Yahya ZafarNo ratings yet

- 301 AFA II PL III Question CMA June 2021 Exam.Document4 pages301 AFA II PL III Question CMA June 2021 Exam.rumelrashid_seuNo ratings yet

- Module 3 - SW On MFTG Acctg & CfsDocument2 pagesModule 3 - SW On MFTG Acctg & CfsestebandgonoNo ratings yet

- Cambridge International Advanced Subsidiary and Advanced LevelDocument12 pagesCambridge International Advanced Subsidiary and Advanced LevelSSSNIPDNo ratings yet

- Sem - III CA II AtktDocument4 pagesSem - III CA II Atktabp1677No ratings yet

- University of Mauritius: Faculty of Law and ManagementDocument11 pagesUniversity of Mauritius: Faculty of Law and ManagementMîñåk Şhïï0% (1)

- MANAGEMENT ACCOUNTING PAPER 2.2 May 2019Document21 pagesMANAGEMENT ACCOUNTING PAPER 2.2 May 2019Nana DespiteNo ratings yet

- Financial Accounting AssignmentDocument23 pagesFinancial Accounting Assignmentyared0% (1)

- Bac 202 Second CatDocument2 pagesBac 202 Second CatBrian MutuaNo ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/32Document8 pagesCambridge International AS & A Level: ACCOUNTING 9706/32Saram Shykh PRODUCTIONSNo ratings yet

- QUESTION 6 Financial Reporting May 2021 KOLIDocument6 pagesQUESTION 6 Financial Reporting May 2021 KOLILaud ListowellNo ratings yet

- June 2019 QDocument8 pagesJune 2019 Q2024786333No ratings yet

- Accountancy Auditing 2021Document5 pagesAccountancy Auditing 2021Abdul basitNo ratings yet

- Accountancy & Auditing-I 2021Document2 pagesAccountancy & Auditing-I 2021Zeeshan Ashraf MalikNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument7 pages© The Institute of Chartered Accountants of IndiaSarvesh JoshiNo ratings yet

- MPACC512 Advanced Fin Reporting Answer Bank 2022Document44 pagesMPACC512 Advanced Fin Reporting Answer Bank 2022Tawanda Tatenda HerbertNo ratings yet

- Department of Commerce 1 Semester Exam 2020/2021 Grade 11 Accounting Page 1 of 9Document9 pagesDepartment of Commerce 1 Semester Exam 2020/2021 Grade 11 Accounting Page 1 of 9Eshal KhanNo ratings yet

- Financial Accounting and Reporting-I: Page 1 of 7Document7 pagesFinancial Accounting and Reporting-I: Page 1 of 7Hareem AbbasiNo ratings yet

- Test Series: March, 2022 Mock Test Paper - 1 Intermediate: Group - I Paper - 3: Cost and Management AccountingDocument7 pagesTest Series: March, 2022 Mock Test Paper - 1 Intermediate: Group - I Paper - 3: Cost and Management AccountingMusic WorldNo ratings yet

- Ca (Bsaf - Bba.mba)Document5 pagesCa (Bsaf - Bba.mba)kashif aliNo ratings yet

- ACC2002 Practice 2Document8 pagesACC2002 Practice 2Đan LêNo ratings yet

- ACC3201Document6 pagesACC3201natlyhNo ratings yet

- Af QP - CFSDocument4 pagesAf QP - CFSaman KumarNo ratings yet

- Financial Analysis 4Document10 pagesFinancial Analysis 4Alaitz GNo ratings yet

- Cambridge International Advanced Subsidiary and Advanced LevelDocument12 pagesCambridge International Advanced Subsidiary and Advanced LevelZaid NaveedNo ratings yet

- Cost AccountingDocument3 pagesCost AccountingXen XeonNo ratings yet

- Bangladesh Open University: BBA Program Semester: 192 (8 Level-AIS & Finance)Document11 pagesBangladesh Open University: BBA Program Semester: 192 (8 Level-AIS & Finance)monir mahmudNo ratings yet

- 8104 MbaexDocument3 pages8104 Mbaexgaurav jainNo ratings yet

- CPA 1 Financial Accounting-1Document8 pagesCPA 1 Financial Accounting-1LYNETTE NYAKAISIKINo ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/32Document16 pagesCambridge International AS & A Level: ACCOUNTING 9706/32Kristen NallanNo ratings yet

- Cash Flow Statement UDpdfDocument18 pagesCash Flow Statement UDpdfrizwan ul hassanNo ratings yet

- AFA IIP.L IIIQuestion June 2016Document4 pagesAFA IIP.L IIIQuestion June 2016HossainNo ratings yet

- Financial Reporting and Analysis (OUpm001111)Document10 pagesFinancial Reporting and Analysis (OUpm001111)SagarPirtheeNo ratings yet

- Paper 3.3 QQ NDocument12 pagesPaper 3.3 QQ NKAINo ratings yet

- Financial Analysis Test 2Document8 pagesFinancial Analysis Test 2Alaitz GNo ratings yet

- Ac2091 ZB - 2019Document15 pagesAc2091 ZB - 2019duong duongNo ratings yet

- B7AF102 Financial Accounting May 2020Document9 pagesB7AF102 Financial Accounting May 2020dayahNo ratings yet

- Practice Questions For Cuac217Document11 pagesPractice Questions For Cuac217Tino Makoni100% (1)

- Practice Questions For Cuac217Document11 pagesPractice Questions For Cuac217Tino MakoniNo ratings yet

- Exercise Topic 4Document7 pagesExercise Topic 4jr ylvsNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Economics Sample AnswerDocument11 pagesEconomics Sample AnswerPrethela ParvinNo ratings yet

- Eco O:n:2020Document12 pagesEco O:n:2020Prethela ParvinNo ratings yet

- Cambridge Assessment International Education: Economics 9708/42 October/November 2018Document10 pagesCambridge Assessment International Education: Economics 9708/42 October/November 2018Prethela ParvinNo ratings yet

- Cambridge International Examinations Cambridge International Advanced Subsidiary and Advanced LevelDocument10 pagesCambridge International Examinations Cambridge International Advanced Subsidiary and Advanced LevelPrethela ParvinNo ratings yet

- Aida Hadzibegovic 31499348 Proof of Payment - ThirdPartyDocument1 pageAida Hadzibegovic 31499348 Proof of Payment - ThirdPartyaida.skamo.rezervniNo ratings yet

- L2 - Plant Layout and Process Flow PatternsDocument41 pagesL2 - Plant Layout and Process Flow PatternsBeki Computerscience studNo ratings yet

- Ilide - Info Marketing Project On Itc Company PRDocument59 pagesIlide - Info Marketing Project On Itc Company PRSarvesh MishraNo ratings yet

- ABG FormatDocument4 pagesABG FormatIndranil RudraNo ratings yet

- CCI 07 (Opposite Party)Document30 pagesCCI 07 (Opposite Party)HrishikeshNo ratings yet

- Prescription Based Selling Skills (PBSS)Document66 pagesPrescription Based Selling Skills (PBSS)Anjum MushtaqNo ratings yet

- Wired 6.0 - Problem Statement - HRDocument3 pagesWired 6.0 - Problem Statement - HRKaram Singh Giani H21084No ratings yet

- Min Wage - 4Q 2018Document1 pageMin Wage - 4Q 2018Nico CiprianoNo ratings yet

- Partnership AgreementDocument6 pagesPartnership Agreementshyam052089No ratings yet

- Legal and Ethical Aspects OfstDocument4 pagesLegal and Ethical Aspects OfstЕлена ВасиленкоNo ratings yet

- 1QM S4hana1909 BPD en UsDocument51 pages1QM S4hana1909 BPD en UsBiji RoyNo ratings yet

- Abalos - 2019 - Presented at SIBR 2019 (Osaka) Conference On Interdisciplinary Business and Economics Research, 4th - 5th July 2019, Osa PDFDocument42 pagesAbalos - 2019 - Presented at SIBR 2019 (Osaka) Conference On Interdisciplinary Business and Economics Research, 4th - 5th July 2019, Osa PDFLydia KusumadewiNo ratings yet

- Hitungan Keuntungan AkasiaDocument13 pagesHitungan Keuntungan AkasiaPresa KautsarNo ratings yet

- Taller 2 Preicfes de Inglés.Document2 pagesTaller 2 Preicfes de Inglés.lizeth zamudio rojasNo ratings yet

- I. Programming. Draw A Complete FlowchartDocument4 pagesI. Programming. Draw A Complete FlowchartRey AdrianNo ratings yet

- Zaag Brochure Portfolio at A Glance en UsDocument2 pagesZaag Brochure Portfolio at A Glance en Usblogo3xNo ratings yet

- Finance (Salaries) Department: Loans and Advances by The State Government - Advances ToDocument2 pagesFinance (Salaries) Department: Loans and Advances by The State Government - Advances ToGowtham RajNo ratings yet

- Lampiran 1: Warehouse Managerpenerbitan Pelangi SDN BHDDocument7 pagesLampiran 1: Warehouse Managerpenerbitan Pelangi SDN BHDTJRismeNo ratings yet

- A Study On Customer Satisfaction Towards Yamaha: BikesDocument30 pagesA Study On Customer Satisfaction Towards Yamaha: BikesMani kandanNo ratings yet

- Zomato: Team MembersDocument14 pagesZomato: Team MembersBhavya ShahNo ratings yet

- Alejandro Fernandez 2Document2 pagesAlejandro Fernandez 2afdez100No ratings yet

- Inspiration For LawyersDocument4 pagesInspiration For LawyersNyakuni NobertNo ratings yet