Professional Documents

Culture Documents

Cambridge International AS & A Level: Accounting 9706/33

Uploaded by

4ycvrzfjgfOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cambridge International AS & A Level: Accounting 9706/33

Uploaded by

4ycvrzfjgfCopyright:

Available Formats

Cambridge International AS & A Level

ACCOUNTING 9706/33

Paper 3 Structured Questions October/November 2020

INSERT 3 hours

INFORMATION

*2023985371-I*

● This insert contains all of the required information and questions. The questions are provided in the

insert for reference only.

● You may annotate this insert and use the blank spaces for planning. Do not write your answers on the

insert.

This document has 12 pages. Blank pages are indicated.

DC (RCL (GO)) 187380/6

© UCLES 2020 [Turn over

2

Section A: Financial Accounting

Question 1

Source A1

GH plc prepared draft financial statements for the year ended 30 June 2020. These included the

following.

GH plc

Draft income statement for the year ended 30 June 2020

$

Revenue 1 980 000

Cost of sales 1 324 000

Gross profit 656 000

Distribution costs 186 500

Administrative expenses 391 000

Profit from operations 78 500

Finance costs 49 000

Draft profit for the year 29 500

The following information was also available.

1 The draft cost of sales value comprised opening inventory of $85 000, purchases of $1 317 000

and closing inventory of $78 000.

2 Included in sales were goods which had been invoiced to a customer on a sale or return basis at

the end of June 2020. These goods had an original cost of $8000 and a selling price of $20 000.

The customer had not yet decided to make a purchase.

3 Included in closing inventory were goods which had originally cost $27 000 and had a normal

selling price of $63 000. These had been damaged and could now only be sold for $18 200 after

repairs costing $4100 had taken place.

4 Import duties of $30 000 on goods purchased for resale had been included in distribution costs. Of

these $3500 related to goods in inventory at the year end.

5 Export duties of $7200 had been included in administrative expenses in the draft income statement.

6 The value of trade receivables in the draft statement of financial position was $194 000, which was

shown after deducting a provision for doubtful debts of $6000. This was the provision for the start

of the financial year which needed to be updated to 5% of the closing trade receivables.

7 Other income of $6300 had been netted off against administrative expenses in the draft income

statement.

8 During the year ended 30 June 2020 a customer had started legal action against GH plc. At the

year end, it was considered that there was a 75% possibility that GH plc would lose the case and

have to pay $31 000.

9 An impairment loss of $4000 relating to a delivery vehicle was yet to be accounted for.

© UCLES 2020 9706/33/INSERT/O/N/20

3

Answer the following questions in the question paper. Questions are printed here for reference

only.

(a) Calculate the correct values of:

(i) inventory at 30 June 2020 [4]

(ii) cost of sales for the year ended 30 June 2020. [2]

(b) Prepare a corrected income statement for the year ended 30 June 2020. [15]

(c) Explain how your treatment of item 8 would be different if there was a 25% possibility of the

company losing the case. [4]

[Total: 25]

© UCLES 2020 9706/33/INSERT/O/N/20 [Turn over

4

Question 2

Source A2

RX Sports is a sports club which provides sporting facilities and also sells running machines to its

members.

The treasurer prepared the financial statements for the club for the year ended 31 December 2019.

These included the following.

RX Sports

Trading account for the year ended 31 December 2019

$ $

Sales 14 800

Inventory 1 January 2019 700

Purchases 9 950

10 650

Inventory 31 December 2019 1 250

Cost of sales 9 400

Profit for the year 5 400

Income and expenditure account for the year ended 31 December 2019

$ $

Subscriptions 14 200

Profit on disposal of club equipment 600

Profit from trading account 5 400

20 200

Depreciation – computers 1 900

– club equipment 4 010

Staff costs 9 800

Rent 6 000

Other costs 1 320 23 030

Deficit for the year 2 830

The treasurer accidentally deleted the receipts and payments account from the computer before it

could be printed off. However, the following information was available.

1

at 1 January 2019 at 31 December 2019

$ $

Subscriptions paid in advance 200 600

Subscriptions in arrears 400 300

Trade receivables 5200 3740

Trade payables 1560 2910

Cash and cash equivalents 1420 ?

Net book value of computers 4800 ?

2 The club equipment which was disposed of during the year had an original cost of $7200.

Accumulated depreciation was $3100.

3 The club depreciates its computers at the rate of 25% per annum using the reducing balance

method.

© UCLES 2020 9706/33/INSERT/O/N/20

5

4 No club equipment was purchased during the year. A new computer was bought and was paid for

by cheque.

5 One month’s rent was unpaid at the year end.

6 Staff costs in the income and expenditure account included a provision for holiday pay of $160.

7 All sales and purchases of running machines were made on a credit basis.

Answer the following questions in the question paper. Questions are printed here for reference

only.

(a) Prepare the receipts and payments account for the year ended 31 December 2019. [16]

(b) State three reasons why the difference between the total receipts and total payments in

a receipts and payments account may not equal the surplus or deficit in an income and

expenditure account. [3]

Additional information

The credit sales of running machines to members involved the members repaying their debt in

instalments. The managing committee of the club is considering making future sales only on a

cash basis.

(c) Name the financial statement in which the write-off of an irrecoverable debt arising from the

sale of a running machine to a club member would be recorded. [1]

(d) Advise the committee whether or not future sales should only be made on a cash basis.

Justify your answer, making reference to the effect of this change on the club’s cash flow and

its surplus/deficit for the year. [5]

[Total: 25]

© UCLES 2020 9706/33/INSERT/O/N/20 [Turn over

6

Question 3

Source A3

Arthur and Belinda had run a successful partnership for some years. They had shared profits and

losses equally. They decided to retire and VC plc agreed to buy the business on 1 January 2020 for a

purchase consideration of $300 000.

Answer the following questions in the question paper. Questions are printed here for reference

only.

(a) State three reasons why VC plc might want to buy the partnership. [3]

(b) State three ways in which the purchase consideration might be settled. [3]

Additional information

Arthur says that as there were only two partners, he is entitled to receive half of the purchase

consideration.

(c) Advise Belinda whether or not she should agree to Arthur receiving half of the purchase

consideration. Justify your answer. [5]

Additional information

VC plc took over all the assets and liabilities of the partnership except for the bank account. The

assets were revalued for the purposes of the sale.

The book value of the assets and liabilities of the partnership on 1 January 2020, along with the

revalued amounts, were as follows.

Book Revalued

values amounts

$ $

Premises 98 000 168 000

Equipment 61 000 45 000

Vehicles 14 800 14 950

Inventory 31 270 30 000

Trade receivables 19 440 18 500

Trade payables 15 100 15 100

(d) Suggest two reasons for the difference in the values for the equipment. [2]

(e) Calculate:

(i) the value of goodwill recorded in the books of VC plc [3]

(ii) the total profit on realisation made by the partnership. [3]

(f) Explain the treatment of the total profit on realisation made by the partnership in (e)(ii). [2]

(g) Explain why a revaluation reserve may appear in the financial statements of a limited company

but not in the financial statements of a partnership. [4]

[Total: 25]

© UCLES 2020 9706/33/INSERT/O/N/20

7

PLEASE TURN OVER

© UCLES 2020 9706/33/INSERT/O/N/20 [Turn over

8

Question 4

Source A4

The books of account of PM Limited contained the following summarised ledger accounts for the year

ended 31 March 2020.

Premises Provision for depreciation of premises

$000 $000 $000 $000

Balance b/d 900 Balance c/d 900 Balance b/d 72

900 900 Balance c/d 90 Income 18

statement

90 90

Plant and machinery Provision for depreciation of plant and

machinery

$000 $000 $000 $000

Balance b/d 405 Disposal 92 Disposal 46 Balance b/d 184

Bank 117 Balance c/d 430 Balance c/d 245 Income 107

522 522 statement

291 291

Motor vehicles Provision for depreciation of motor vehicles

$000 $000 $000 $000

Balance b/d 198 Disposal 44 Disposal 35 Balance b/d 103

Bank 76 Balance c/d 230 Balance c/d 114 Income 46

274 274 statement

149 149

Disposal of plant and machinery Disposal of motor vehicle

$000 $000 $000 $000

Plant and 92 Provision for 46 Motor 44 Provision for 35

machinery depreciation vehicles depreciation

of plant and Income 10 of motor

machinery statement vehicles

Bank 17 Bank 19

Income 29 54 54

statement

92 92

© UCLES 2020 9706/33/INSERT/O/N/20

9

Answer the following questions in the question paper. Questions are printed here for reference

only.

(a) Prepare a schedule of non-current assets for the year ended 31 March 2020 in accordance

with the provisions of IAS16, suitable for inclusion in the notes to the accounts. [9]

(b) Identify the total figures from the summarised ledger accounts which would appear in the

statement of cash flows for the year ended 31 March 2020. State the section of the statement

of cash flows in which each figure would be recorded. [10]

(c) Explain how your answer to (a) would be different if the premises had been revalued upwards

at the end of the year. [2]

(d) Explain how your answer to (b) would be different if the premises had been revalued upwards

at the end of the year. [2]

(e) State two items (other than the initial purchase price) which can be included in the total cost

of a non-current asset when following IAS16. [2]

[Total: 25]

© UCLES 2020 9706/33/INSERT/O/N/20 [Turn over

10

Section B: Cost and Management Accounting

Question 5

Source B1

At present PL plc manufactures only one product. It manufactures and sells 2000 units a year. The

following information is available.

Direct material $20 per unit

Direct labour $12 per unit

Total production overheads $36 000 per year

Total selling and distribution overheads (all variable, $20 000 per year

relating to number of units)

Mark-up 33.33%

The production overheads are as follows.

$

Machine set-up costs 22 000 (for 440 set-ups)

Quality inspection costs 6 000 (for 500 inspections)

Order processing costs 8 000 (for 800 orders)

36 000

Answer the following questions in the question paper. Questions are printed here for reference

only.

(a) Calculate the selling price of one unit. [6]

Additional information

The directors are considering starting the manufacture of a deluxe version of the product. The plan

is to manufacture and sell 1000 units of the deluxe version per year in addition to the standard

version already being made. The percentage of mark-up would be unchanged.

Data relating to the deluxe version are as follows.

Direct material $30 per unit

Direct labour $20 per unit

Machine set-ups 350 per year

Quality inspections 400 per year

Orders processed 770 per year

The production overhead costs would be the same for each occurrence of an activity for the

deluxe version as for the standard version. The per-unit selling and distribution costs would be

unchanged.

(b) Calculate the selling price of one unit of the deluxe version. [12]

(c) State two concerns the directors might have in setting the selling price of the deluxe version.

[2]

© UCLES 2020 9706/33/INSERT/O/N/20

11

Additional information

One of the directors is suggesting halving the number of quality inspections.

(d) Advise the directors whether or not they should halve the number of quality inspections taking

place. Justify your answer. [3]

(e) State what is meant by the following terms.

(i) Cost driver [1]

(ii) Cost pool [1]

[Total: 25]

© UCLES 2020 9706/33/INSERT/O/N/20 [Turn over

12

Question 6

Source B2

OT plc makes one product and uses a standard costing system. Its standard costs and revenues for

one month are based on the following information.

Sales

12 000 units at $15 each

Per-unit costs

Direct materials 0.25 kilos at $8 per kilo

Direct labour 30 minutes at $6 per hour

Variable overhead $10 per direct labour hour

Total fixed overhead

$20 000 per month

In March 2020 actual sales amounted to 12 500 units.

Answer the following questions in the question paper. Questions are printed here for reference

only.

(a) State, with regard to standard costing, two advantages and two disadvantages. [4]

(b) Prepare a budgeted income statement in respect of the master budget and the flexed budget

for March 2020. [6]

Additional information

The increase in sales units in March 2020 was the result of a special promotion where the selling

price was reduced to $14.50.

(c) Prepare a statement reconciling the budgeted sales revenue from the master budget with the

total actual sales revenue for March 2020, using relevant variances. [4]

Additional information

After the success of the promotion in March 2020, the company is considering reducing the selling

price still further, to $13. At this price, the company expects to sell 14 000 units a month.

(d) Name the variances which would be affected if the selling price was reduced to $13 per unit.

Show the revised amounts of these variances. [4]

(e) Advise the directors whether or not they should proceed with the suggested reduction in

selling price to $13 a unit. Support your answer with calculations. [7]

[Total: 25]

Permission to reproduce items where third-party owned material protected by copyright is included has been sought and cleared where possible. Every

reasonable effort has been made by the publisher (UCLES) to trace copyright holders, but if any items requiring clearance have unwittingly been included, the

publisher will be pleased to make amends at the earliest possible opportunity.

To avoid the issue of disclosure of answer-related information to candidates, all copyright acknowledgements are reproduced online in the Cambridge

Assessment International Education Copyright Acknowledgements Booklet. This is produced for each series of examinations and is freely available to download

at www.cambridgeinternational.org after the live examination series.

Cambridge Assessment International Education is part of the Cambridge Assessment Group. Cambridge Assessment is the brand name of the University of

Cambridge Local Examinations Syndicate (UCLES), which itself is a department of the University of Cambridge.

© UCLES 2020 9706/33/INSERT/O/N/20

You might also like

- Healthy Chicken Pasta Recipes From EatingWell MagazineDocument10 pagesHealthy Chicken Pasta Recipes From EatingWell MagazineAlice GiffordNo ratings yet

- Grade 9: International Junior Math OlympiadDocument13 pagesGrade 9: International Junior Math OlympiadLong Văn Trần100% (1)

- The Complete Motown CatalogueDocument10 pagesThe Complete Motown Cataloguehermeto0% (1)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Supercritical CO2 Extraction: A Clean Extraction MethodDocument6 pagesSupercritical CO2 Extraction: A Clean Extraction MethodPrincess Janine CatralNo ratings yet

- O Level Accounts Important QuestionsDocument55 pagesO Level Accounts Important QuestionsibrahoNo ratings yet

- B&A Performance AnalysisDocument16 pagesB&A Performance AnalysisNathalia Caroline100% (1)

- Can or Can't Esl Worksheet With Animals Vocabulary For Kids PDFDocument2 pagesCan or Can't Esl Worksheet With Animals Vocabulary For Kids PDFופאאכאלד50% (4)

- PL Financial Accounting and Reporting IFRS Exam June 2019Document10 pagesPL Financial Accounting and Reporting IFRS Exam June 2019scottNo ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/31Document16 pagesCambridge International AS & A Level: ACCOUNTING 9706/31waheeda17No ratings yet

- Cambridge International Advanced Subsidiary and Advanced LevelDocument20 pagesCambridge International Advanced Subsidiary and Advanced LevelAimen AhmedNo ratings yet

- Cambridge International AS & A Level: Accounting 9706/32Document12 pagesCambridge International AS & A Level: Accounting 9706/32Prethela ParvinNo ratings yet

- Paper 2.1 QQ N PDFDocument20 pagesPaper 2.1 QQ N PDFKAINo ratings yet

- November 2020 Insert Paper 31Document12 pagesNovember 2020 Insert Paper 31Shahmeer HasanNo ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/32Document16 pagesCambridge International AS & A Level: ACCOUNTING 9706/32Kristen NallanNo ratings yet

- ACC2002 Practice 2Document8 pagesACC2002 Practice 2Đan LêNo ratings yet

- FR 2021 Paper PrelimDocument10 pagesFR 2021 Paper PrelimshashalalaxiangNo ratings yet

- ACT 205 Assignment - Spring 2019-20Document5 pagesACT 205 Assignment - Spring 2019-20Muhammad AhamdNo ratings yet

- 2020-12 ICMAB FL 001 PAC Year Question December 2020Document3 pages2020-12 ICMAB FL 001 PAC Year Question December 2020Mohammad ShahidNo ratings yet

- 9706 w19 QP 31Document13 pages9706 w19 QP 31PontuChowdhuryNo ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/32Document8 pagesCambridge International AS & A Level: ACCOUNTING 9706/32Saram Shykh PRODUCTIONSNo ratings yet

- Accounting 2020 P1 Info BookDocument9 pagesAccounting 2020 P1 Info BookodiantumbaNo ratings yet

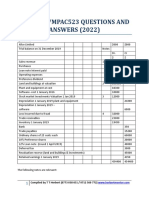

- MPAC523 WIP A 2020Document8 pagesMPAC523 WIP A 2020Tawanda Tatenda HerbertNo ratings yet

- 9706 31 Insert M J 20Document8 pages9706 31 Insert M J 20chirag mehtaNo ratings yet

- This Paper Is Not To Be Removed From The Examination HallsDocument82 pagesThis Paper Is Not To Be Removed From The Examination HallsPutin PhyNo ratings yet

- 301 AFA II PL III Question CMA June 2021 Exam.Document4 pages301 AFA II PL III Question CMA June 2021 Exam.rumelrashid_seuNo ratings yet

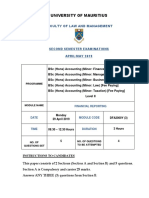

- University of Mauritius: Faculty of Law and ManagementDocument11 pagesUniversity of Mauritius: Faculty of Law and ManagementMîñåk Şhïï0% (1)

- Name: Dao Mai Linh Class: F13B ID NUMBER: F13-127Document30 pagesName: Dao Mai Linh Class: F13B ID NUMBER: F13-127Linhzin LinhzinNo ratings yet

- Fin430 - Dec2019Document6 pagesFin430 - Dec2019nurinsabyhahNo ratings yet

- Athlete Wear Co Case StudyDocument12 pagesAthlete Wear Co Case StudyZouh BharatNo ratings yet

- FA Dec 2020Document9 pagesFA Dec 2020Shawn LiewNo ratings yet

- Audit of Expenditure and Disbursements Cycle BA 123 ProblemsDocument4 pagesAudit of Expenditure and Disbursements Cycle BA 123 ProblemsBecky GonzagaNo ratings yet

- A Level QP3 Acc PB2022Document12 pagesA Level QP3 Acc PB2022Kalash JainNo ratings yet

- Accounting's AssignmentDocument4 pagesAccounting's AssignmentLinhzin LinhzinNo ratings yet

- AP Module 01 - Accounting Changes and ErrorsDocument10 pagesAP Module 01 - Accounting Changes and ErrorsjasfNo ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/31Document4 pagesCambridge International AS & A Level: ACCOUNTING 9706/31caiexpertcontactNo ratings yet

- MAY 2020 EXAM CHIEF EXAMINER'S REPORTDocument18 pagesMAY 2020 EXAM CHIEF EXAMINER'S REPORTMahediNo ratings yet

- ALICE LIMITED FINANCIAL STATEMENTSDocument44 pagesALICE LIMITED FINANCIAL STATEMENTSTawanda Tatenda HerbertNo ratings yet

- 1819 IB124 Summer Exam PaperDocument6 pages1819 IB124 Summer Exam PaperHarry TaylorNo ratings yet

- Cambridge International Advanced Subsidiary and Advanced LevelDocument12 pagesCambridge International Advanced Subsidiary and Advanced LevelSSSNIPDNo ratings yet

- Paper 2.2 QQ NDocument20 pagesPaper 2.2 QQ NKAINo ratings yet

- Cambridge International Advanced Subsidiary and Advanced LevelDocument20 pagesCambridge International Advanced Subsidiary and Advanced LevelRay DoughNo ratings yet

- June 2019 QDocument8 pagesJune 2019 Q2024786333No ratings yet

- April AssignmentDocument9 pagesApril AssignmentMehrunisaChNo ratings yet

- ACCOUNTING P1 GR12 QP JUNE 2023 - EnglishDocument11 pagesACCOUNTING P1 GR12 QP JUNE 2023 - Englishfanelenzima03No ratings yet

- Ac208 2019 11Document6 pagesAc208 2019 11brian mgabi100% (1)

- LCC-L2 Saturday Class-1b Incomplete Record-Sole Trader (S) (151022)Document2 pagesLCC-L2 Saturday Class-1b Incomplete Record-Sole Trader (S) (151022)wu alanNo ratings yet

- Sample Midterm Exam With SolutionDocument17 pagesSample Midterm Exam With Solutionq mNo ratings yet

- Cib GH 04-23 Financial Reporting, Planning & Analysis Level Iii Page 1Document8 pagesCib GH 04-23 Financial Reporting, Planning & Analysis Level Iii Page 1lilliananne5051No ratings yet

- Cambridge International Advanced Subsidiary and Advanced LevelDocument12 pagesCambridge International Advanced Subsidiary and Advanced LevelKKNo ratings yet

- Chapter-2 Homework MisstatementsDocument4 pagesChapter-2 Homework MisstatementsKenneth Christian WilburNo ratings yet

- Icag Nov 2020-Group Discuss...Document6 pagesIcag Nov 2020-Group Discuss...Papa Ekow ArmahNo ratings yet

- March 2020 Diploma in Accountancy Programme Question and AnswerDocument102 pagesMarch 2020 Diploma in Accountancy Programme Question and Answerethel100% (1)

- Far410 Dec 2019Document8 pagesFar410 Dec 2019NurulHuda Auni Binti Ab RahmanNo ratings yet

- Dea Aul - QuizDocument5 pagesDea Aul - QuizDea Aulia AmanahNo ratings yet

- Pfa3163 Set G QPDocument5 pagesPfa3163 Set G QPNur hidayah putriNo ratings yet

- 18.01.2022 11 ACCOUNTS POST MID TERM 2021-22 CC Post Mid Acc 11Document3 pages18.01.2022 11 ACCOUNTS POST MID TERM 2021-22 CC Post Mid Acc 11Jr.No ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/22Document16 pagesCambridge International AS & A Level: ACCOUNTING 9706/22Aimen AhmedNo ratings yet

- Financial Accounting and Reporting-I Suggested AnswersDocument7 pagesFinancial Accounting and Reporting-I Suggested AnswersHareem AbbasiNo ratings yet

- Nov 19 Q PDFDocument9 pagesNov 19 Q PDFTenywa SalimNo ratings yet

- Acp - Acc417 Case Study 1Document6 pagesAcp - Acc417 Case Study 1Faker MejiaNo ratings yet

- November 2020 Professional Exams Financial Accounting ReportDocument20 pagesNovember 2020 Professional Exams Financial Accounting ReportMahediNo ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/32Document12 pagesCambridge International AS & A Level: ACCOUNTING 9706/32shanti teckchandaniNo ratings yet

- This Question Paper Is Printed On BOTH SIDES. This Question Paper Contains 5 Questions and 9 PagesDocument9 pagesThis Question Paper Is Printed On BOTH SIDES. This Question Paper Contains 5 Questions and 9 PagesDjameel ZubairNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Hitachi - AssignmentDocument6 pagesHitachi - AssignmentPraveena IvanaNo ratings yet

- Calculating parameters for a basic modern transistor amplifierDocument189 pagesCalculating parameters for a basic modern transistor amplifierionioni2000No ratings yet

- Activity Sheets in Science VIDocument24 pagesActivity Sheets in Science VIFrauddiggerNo ratings yet

- Chapter 2 - DynamicsDocument8 pagesChapter 2 - DynamicsTHIÊN LÊ TRẦN THUẬNNo ratings yet

- Case - History WPC 3790-2013Document2 pagesCase - History WPC 3790-2013Sachin solomonNo ratings yet

- Quiz Microeconomics BECO201 Date 30/10/2017 Name: IDDocument5 pagesQuiz Microeconomics BECO201 Date 30/10/2017 Name: IDAA BB MMNo ratings yet

- Philips NTRX505Document28 pagesPhilips NTRX505EulerMartinsDeMelloNo ratings yet

- Marantz sr4200 Service PDFDocument29 pagesMarantz sr4200 Service PDFAnonymous KSedwANo ratings yet

- Simulation of Spring: Date: Martes, 25 de Agosto de 2020 Designer: Solidworks Study Name: Resorte 1 Analysis TypeDocument10 pagesSimulation of Spring: Date: Martes, 25 de Agosto de 2020 Designer: Solidworks Study Name: Resorte 1 Analysis TypeIván D. ArdilaNo ratings yet

- The Paul Sellers Router PlaneDocument6 pagesThe Paul Sellers Router PlaneAjay Vishwanath100% (1)

- Pecet 2016 Colleges ListDocument7 pagesPecet 2016 Colleges Listandhramirchi50% (2)

- Wireless Local LoopDocument8 pagesWireless Local Loopapi-3827000100% (1)

- Question 1 - Adjusting EntriesDocument10 pagesQuestion 1 - Adjusting EntriesVyish VyishuNo ratings yet

- Letter To Editor NDocument5 pagesLetter To Editor NNavya AgarwalNo ratings yet

- BBL CVDocument13 pagesBBL CVkuashask2No ratings yet

- MalayoDocument39 pagesMalayoRoxanne Datuin UsonNo ratings yet

- Seam 3 - Lesson 8 & 9 - Week 9Document12 pagesSeam 3 - Lesson 8 & 9 - Week 9Jeffrey SacramentoNo ratings yet

- Human Rights EducationDocument149 pagesHuman Rights EducationLeonard MamergaNo ratings yet

- CIMA Financial Accounting Fundamentals Past PapersDocument107 pagesCIMA Financial Accounting Fundamentals Past PapersAnonymous pwAkPZNo ratings yet

- Bacterial Recombination MCQsDocument3 pagesBacterial Recombination MCQsJon HosmerNo ratings yet

- Grade 1 Mother Tongue SyllabusDocument3 pagesGrade 1 Mother Tongue SyllabusDorz EDNo ratings yet

- Mental Health and Mental Disorder ReportDocument6 pagesMental Health and Mental Disorder ReportBonJovi Mojica ArtistaNo ratings yet

- FisikaDocument46 pagesFisikaNurol Hifzi Putri RizkiNo ratings yet

- BS 07579-1992 (1999) Iso 2194-1991Document10 pagesBS 07579-1992 (1999) Iso 2194-1991matteo_1234No ratings yet