Professional Documents

Culture Documents

1

Uploaded by

mariyha PalangganaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1

Uploaded by

mariyha PalangganaCopyright:

Available Formats

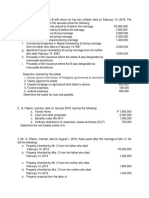

Proceeds of life insurance in the life of Jose with Sarah as the

Irrevocable beneficiary

300,000

Land in Dagupan City, donated by Jose to his son when he

learned that he was dying, exclusive property

450,000

Building in Sta Mesa Manila inherited from his father in 2005

(mortgage up on inheritance, P300,000 all of which were paid by

Jose)

1,320,000

Accounts receivable, the debtor went abroad on a one-year job

contract

50,000

Coconut land received as donation from a friend on February 28,

2017 (valued the at P120 000 and mortgaged for P27,750

which was paid by Jose)

150,000

Citrus plantation in Pangasinan, exclusive property of Sarah

950,000

Deductions claimed on the estate are the following:

Funeral expenses

190,000

Judicial expenses

85,000

Medical expenses incurred 2 months before death

18,000

Losses from gambling

140,000

Debts contracted by Sarah (the proceeds benefited her

exclusive property)

60,000

Debts contracted by Jose (the proceeds rebounded to the

benefit of the conjugal property

40,000

Unpaid mortgage on me lot contracted before marriage

125,000

Unpaid engage on as plantation

150,000

Support to his illegitimate child

150,000

Donations to the parish of St. Dominic de Guzman

15,000

REQUIRED Compute the net taxable estate and estate tax due.

Exclusive Conjugal Total

Family home – house P4,500,000

Family home- lot P4,000,000

Furniture and appliances 320,000

You might also like

- 4Document13 pages4mariyha PalangganaNo ratings yet

- EncodedDocument8 pagesEncodedMary Benedict AbraganNo ratings yet

- Tandem Activity GE Allowable DeductionsDocument6 pagesTandem Activity GE Allowable DeductionsErin CruzNo ratings yet

- BALIMBIN TBLTpg83-94Document14 pagesBALIMBIN TBLTpg83-94mariyha Palanggana0% (1)

- Estate Ni JonaDocument2 pagesEstate Ni Jonalov3m350% (2)

- ProblemsDocument12 pagesProblemsJohn Carlo J. DominoNo ratings yet

- Practice Set 1Document11 pagesPractice Set 1IVY JOY SIONOSANo ratings yet

- Transfer Tax Prelim ExamDocument4 pagesTransfer Tax Prelim ExamSalma AbdullahNo ratings yet

- Estate Tax - Exercises On Allowable Deduction and Taxable Net EstateDocument5 pagesEstate Tax - Exercises On Allowable Deduction and Taxable Net EstateGileah ZuasolaNo ratings yet

- Exercises On Estate Tax Additional ProblemsDocument8 pagesExercises On Estate Tax Additional ProblemsMidas Troy VictorNo ratings yet

- Donor's Tax - 1Document3 pagesDonor's Tax - 1Crayon LloydNo ratings yet

- 2.1bsa-Cy1 Angela R. Reveral Business Taxation Prelim TaskDocument4 pages2.1bsa-Cy1 Angela R. Reveral Business Taxation Prelim TaskAngela Ricaplaza ReveralNo ratings yet

- Copy 3 ACC 321 Sample Problems For Estate Taxation of Married Individuals and Computation of Tax CreditDocument2 pagesCopy 3 ACC 321 Sample Problems For Estate Taxation of Married Individuals and Computation of Tax CreditMitsuke MitsukeNo ratings yet

- De La Salle University-Dasmarinas College of Business Administration and Accountancy Accountancy DepartmentDocument2 pagesDe La Salle University-Dasmarinas College of Business Administration and Accountancy Accountancy DepartmentGurong MNo ratings yet

- Estate TaxDocument1 pageEstate TaxMelisa Joy MalenabNo ratings yet

- TaxfinDocument3 pagesTaxfinShr BnNo ratings yet

- AEC 215 Reviewer ComputationsDocument6 pagesAEC 215 Reviewer ComputationsHazel Seguerra BicadaNo ratings yet

- Exercise-2-Estate-Tax QDocument2 pagesExercise-2-Estate-Tax QJaypee Verzo SaltaNo ratings yet

- Princess Elaine Esperat - Tax 2 - Activity 2 FinalDocument3 pagesPrincess Elaine Esperat - Tax 2 - Activity 2 FinalPrincess Elaine EsperatNo ratings yet

- Integrative Course For Taxation Ateneo de Zamboanga University Accountancy Department Estate TaxDocument3 pagesIntegrative Course For Taxation Ateneo de Zamboanga University Accountancy Department Estate TaxElizabeth ApolonioNo ratings yet

- Practice Exam AE 217Document1 pagePractice Exam AE 217Loida Santos AgapitoNo ratings yet

- Acp and CPG QuizDocument6 pagesAcp and CPG QuizCarina Mae Valdez Valencia0% (1)

- Semi Quiz 1Document2 pagesSemi Quiz 1jp careNo ratings yet

- Pe On Estate TaxDocument25 pagesPe On Estate TaxErica NicolasuraNo ratings yet

- Answers To ActivityDocument19 pagesAnswers To ActivityjayNo ratings yet

- MR A, Filipino, Married To B With Whom He Has Two Children Died On February 14, 2018. TheDocument3 pagesMR A, Filipino, Married To B With Whom He Has Two Children Died On February 14, 2018. TheSharjaaah100% (2)

- Problem 8 & 9 Estate Tax: Married Decedents: Caraig Dela Cruz TanDocument12 pagesProblem 8 & 9 Estate Tax: Married Decedents: Caraig Dela Cruz TanmikaelaNo ratings yet

- Estate Taxation - Discussions...............Document5 pagesEstate Taxation - Discussions...............jangjangNo ratings yet

- Problem 1: Net Taxable Estate 530,000 75,000 605,000Document3 pagesProblem 1: Net Taxable Estate 530,000 75,000 605,000camscamsNo ratings yet

- Illustrations PDFDocument3 pagesIllustrations PDFCharrey Leigh FormaranNo ratings yet

- Property Regime For Married IndividualsDocument35 pagesProperty Regime For Married IndividualsbetariceNo ratings yet

- Estate TaxDocument9 pagesEstate TaxHafi DisoNo ratings yet

- Orca Share Media1583984976335Document3 pagesOrca Share Media1583984976335Sherlock HolmesNo ratings yet

- HO4 Pre TestDocument4 pagesHO4 Pre TestJason Saberon Quiño0% (2)

- 16Document11 pages16Sheie WiseNo ratings yet

- Chapter 3 - Deductions From The Gross EstateDocument22 pagesChapter 3 - Deductions From The Gross EstateAngelika BalmeoNo ratings yet

- Gross Estate Activity PDFDocument5 pagesGross Estate Activity PDFJaypee Verzo SaltaNo ratings yet

- Deductions From The Gross Estate Supplementary Pro 230712 100820Document8 pagesDeductions From The Gross Estate Supplementary Pro 230712 100820nichNo ratings yet

- Prelim TaskDocument8 pagesPrelim TaskHeidi KaterineNo ratings yet

- Chapter 7&8 ProblemsDocument5 pagesChapter 7&8 ProblemsAngeline Aquino LaroaNo ratings yet

- Gross Estate Board WorkDocument5 pagesGross Estate Board Worksharon5lotinoNo ratings yet

- TAXATION 2 Chapter 5 Estate Tax Payable PDFDocument5 pagesTAXATION 2 Chapter 5 Estate Tax Payable PDFKim Cristian MaañoNo ratings yet

- Estate 1Document5 pagesEstate 1Israel MarquezNo ratings yet

- Solutions To Problems: Pe On Estate TaxDocument11 pagesSolutions To Problems: Pe On Estate TaxErica NicolasuraNo ratings yet

- Estate Tax Problems 2Document5 pagesEstate Tax Problems 2howaanNo ratings yet

- Exercise 7-7. Multiple Choice Problem: Items 1 and 2 Are Based On The Following InformationDocument14 pagesExercise 7-7. Multiple Choice Problem: Items 1 and 2 Are Based On The Following InformationSheie WiseNo ratings yet

- Activity - Estate Tax ComputationDocument2 pagesActivity - Estate Tax ComputationEki SunriseNo ratings yet

- Transfer Taxes Multiple Choice ProblemsDocument14 pagesTransfer Taxes Multiple Choice Problemsnbragas0% (1)

- Estate Tax Problems Quizzer 1104Document10 pagesEstate Tax Problems Quizzer 1104Fate Serrano100% (1)

- BusTax Chap 3Document16 pagesBusTax Chap 3Lisa ManobanNo ratings yet

- Quiz On Estate TaxDocument4 pagesQuiz On Estate TaxRenz CastroNo ratings yet

- Answers To Assignment 1 and Problem Exercises Taxation2Document4 pagesAnswers To Assignment 1 and Problem Exercises Taxation2Dexanne BulanNo ratings yet

- Test Bank 1 UpdatedDocument5 pagesTest Bank 1 UpdatedSumanting GarnethNo ratings yet

- Applicable Property Regime in Default of An AgreementDocument3 pagesApplicable Property Regime in Default of An AgreementMarie Tes LocsinNo ratings yet

- Arturo Died Leaving The Following PropertiesDocument1 pageArturo Died Leaving The Following PropertiesCristine Salvacion PamatianNo ratings yet

- Midterm - Taxation2 - Module - Estate TaxDocument18 pagesMidterm - Taxation2 - Module - Estate TaxEJ HipolitoNo ratings yet

- This Study Resource Was: Problem 1Document4 pagesThis Study Resource Was: Problem 1John Francis RosasNo ratings yet

- Coca ColaDocument50 pagesCoca Colamariyha PalangganaNo ratings yet

- Process Flow of The Banking IndustryDocument2 pagesProcess Flow of The Banking Industrymariyha PalangganaNo ratings yet

- Samsung Electronics: S StrengthDocument34 pagesSamsung Electronics: S Strengthmariyha PalangganaNo ratings yet

- Audit Tenure and Investor's Perception On Audit Quality Before and After Implementation of The SA 240Document11 pagesAudit Tenure and Investor's Perception On Audit Quality Before and After Implementation of The SA 240mariyha PalangganaNo ratings yet

- Understanding Audit Quality: Insights From Audit Partners and InvestorsDocument59 pagesUnderstanding Audit Quality: Insights From Audit Partners and Investorsmariyha PalangganaNo ratings yet

- Audit Quality DisclosureDocument48 pagesAudit Quality Disclosuremariyha PalangganaNo ratings yet

- Work 843Document27 pagesWork 843mariyha PalangganaNo ratings yet

- Term: (1998-2001) : He Used His Popularity As An Actor To Make Gains in PoliticsDocument7 pagesTerm: (1998-2001) : He Used His Popularity As An Actor To Make Gains in Politicsmariyha PalangganaNo ratings yet

- Laboratory Experiment No. 1: Kinematics: (Average vs. Instantaneous Velocities)Document2 pagesLaboratory Experiment No. 1: Kinematics: (Average vs. Instantaneous Velocities)mariyha PalangganaNo ratings yet

- Module 1 - Wrap Up QuesDocument4 pagesModule 1 - Wrap Up Quesmariyha PalangganaNo ratings yet

- B7801: Operations Management 27 March 1998 - AgendaDocument55 pagesB7801: Operations Management 27 March 1998 - Agendamariyha PalangganaNo ratings yet

- Module 2 Hist 1 (BSA)Document4 pagesModule 2 Hist 1 (BSA)mariyha PalangganaNo ratings yet

- Module 5amp6 Cheerdance PDF FreeDocument27 pagesModule 5amp6 Cheerdance PDF FreeKatNo ratings yet

- Seminars - 09-12-2022 - Vanessa AQUINO CHAVESDocument3 pagesSeminars - 09-12-2022 - Vanessa AQUINO CHAVESVanessa AquinoNo ratings yet

- Bus Organization of 8085 MicroprocessorDocument6 pagesBus Organization of 8085 MicroprocessorsrikrishnathotaNo ratings yet

- Hoc Volume1Document46 pagesHoc Volume1nordurljosNo ratings yet

- Lyndhurst OPRA Request FormDocument4 pagesLyndhurst OPRA Request FormThe Citizens CampaignNo ratings yet

- Agitha Diva Winampi - Childhood MemoriesDocument2 pagesAgitha Diva Winampi - Childhood MemoriesAgitha Diva WinampiNo ratings yet

- Grade 10 Science - 2Document5 pagesGrade 10 Science - 2Nenia Claire Mondarte CruzNo ratings yet

- Masmud Vs NLRC and Atty Go DigestDocument2 pagesMasmud Vs NLRC and Atty Go DigestMichael Parreño Villagracia100% (1)

- Project CharterDocument10 pagesProject CharterAdnan AhmedNo ratings yet

- A Comparison of Practitioner and Student WritingDocument28 pagesA Comparison of Practitioner and Student WritingMichael Sniper WuNo ratings yet

- IsaiahDocument7 pagesIsaiahJett Rovee Navarro100% (1)

- List of Notified Bodies Under Directive - 93-42 EEC Medical DevicesDocument332 pagesList of Notified Bodies Under Directive - 93-42 EEC Medical DevicesJamal MohamedNo ratings yet

- Snowflake Core Certification Guide Dec 2022Document204 pagesSnowflake Core Certification Guide Dec 2022LalitNo ratings yet

- Cooking Oils and Smoke Points - What To Know and How To Choose The Right Cooking Oil - 2020 - MasterClassDocument7 pagesCooking Oils and Smoke Points - What To Know and How To Choose The Right Cooking Oil - 2020 - MasterClasschumbefredNo ratings yet

- 06 Ankit Jain - Current Scenario of Venture CapitalDocument38 pages06 Ankit Jain - Current Scenario of Venture CapitalSanjay KashyapNo ratings yet

- Earnings Statement: Hilton Management Lane TN 38117 Lane TN 38117 LLC 755 Crossover MemphisDocument2 pagesEarnings Statement: Hilton Management Lane TN 38117 Lane TN 38117 LLC 755 Crossover MemphisSelina González HerreraNo ratings yet

- Anglicisms in TranslationDocument63 pagesAnglicisms in TranslationZhuka GumbaridzeNo ratings yet

- Referensi PUR - Urethane Surface coating-BlockedISO (Baxenden) - 20160802 PDFDocument6 pagesReferensi PUR - Urethane Surface coating-BlockedISO (Baxenden) - 20160802 PDFFahmi Januar AnugrahNo ratings yet

- God Made Your BodyDocument8 pagesGod Made Your BodyBethany House Publishers56% (9)

- Chap6 Part1Document15 pagesChap6 Part1Francis Renjade Oafallas VinuyaNo ratings yet

- Send Me An AngelDocument3 pagesSend Me An AngeldeezersamNo ratings yet

- Construction Agreement SimpleDocument3 pagesConstruction Agreement Simpleben_23100% (4)

- ZultaniteDocument4 pagesZultaniteAcharya BalwantNo ratings yet

- Syllabus For Final Examination, Class 9Document5 pagesSyllabus For Final Examination, Class 9shubham guptaNo ratings yet

- SPE-199498-MS Reuse of Produced Water in The Oil and Gas IndustryDocument10 pagesSPE-199498-MS Reuse of Produced Water in The Oil and Gas Industry叶芊No ratings yet

- Rata-Blanca-La Danza Del FuegoDocument14 pagesRata-Blanca-La Danza Del FuegoWalter AcevedoNo ratings yet

- Adrenal Cortical TumorsDocument8 pagesAdrenal Cortical TumorsSabrina whtNo ratings yet

- PH Water On Stability PesticidesDocument6 pagesPH Water On Stability PesticidesMontoya AlidNo ratings yet

- Peptic UlcerDocument48 pagesPeptic Ulcerscribd225No ratings yet

- E F Eng l1 l2 Si 011Document2 pagesE F Eng l1 l2 Si 011Simona ButeNo ratings yet