Professional Documents

Culture Documents

Activity - Estate Tax Computation

Uploaded by

Eki SunriseOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Activity - Estate Tax Computation

Uploaded by

Eki SunriseCopyright:

Available Formats

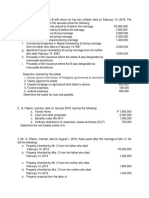

Juan, married to Maria, died on March 6, 2021 leaving the following properties and obligations:

Philippines Canada

Real Property in Bulacan inherited from his father on May 12, 2018 with a fair value at that time of P 7,800,000, for

which a mortgage of P 1,100,000 was assumed; the fair value of the property at the time of his death is

10,500,000.00

Family Home with a fair value of P 24,000,000 with the following breakdown:

Land -bought out of communal funds of the husband and wife 16,000,000.00

House - constructed using the exclusive money of Juan, fair value at the time of death 8,000,000.00

Receivable from Pedro, a close friend, who became insolvent and is capable only of paying 70% of the debt; the debt

was from the exclusive money of Juan 600,000.00

Various Cash Deposits 15,000,000.00 10,000,000.00

Jewelries for the personal use of the wife, some are kept safe abroad 3,000,000.00 6,000,000.00

Vacation House:

In Tagaytay, gifted to Juan by his mother 2 years ago prior to his death 4,300,000.00

In Ontario, Canada 8,000,000.00

Other personal properties, exclusive to Juan 1,500,000.00 2,500,000.00

Apartment for rent, used as family business 1,250,000.00

Rent accrued prior to his death but unpaid only 4 months after his demise 600,000.00

Unpaid mortgage on real property in Bulacan 600,000.00

Partial loss on the apartment due to fire, losses claimed as deduction on his income tax return 150,000.00

Unpaid and accrued income tax on the rent accrued above 50,000.00

Proceeds of Life Insurance

Sun Life of Canada - Philippines, his wife is designated as the irrevocable beneficiary 1,400,000.00

Manulife, he designated his estate as the irrevocable beneficiary 2,000,000.00

Unpaid obligations 5,500,000.00 2,000,000.00

Losses on vacation house due to acts of god

In Tagaytay - due to typhoon on January 8, 2021 750,000.00

In Ontario - due to fire on April 9, 2021, but with an insurance recovery of P 1,000,000 1,250,000.00

Estate tax paid in Canada 1,750,000.00

Requirements: 30 POINTS

1. Compute the Gross Estate:

a. Exclusive estate in the Philippines (1 point)

b. Communal estate in the Philippines (1 point)

c. Exclusive estate in Canada (1 point)

d. Communal Estate in Canada (1 point)

e. Total Gross Estate (1 point)

2. Compute the Ordinary Deductions (total of communal and exclusive):

a. Losses (1 point)

b. Indebtedness (1 point)

c. Taxes (1 point)

d. Vanishing Deduction (3 point)

3. Compute the Family Home as a deduction (1 point)

4. Share of the Surviving Spouse (5 point)

5. Net Taxable Estate (5 point)

6. Estate Tax Due (1 point)

7. Estate Tax Credit (5 point)

8. Estate Tax Due and Payable (2 point)

You might also like

- Texas Association of Realtors Residential Lease AgreementDocument14 pagesTexas Association of Realtors Residential Lease AgreementDallasDamien67% (6)

- SkipTheFlip Physical PDFDocument230 pagesSkipTheFlip Physical PDFSebi100% (4)

- Filipino Estate Tax Calculation for Married IndividualDocument3 pagesFilipino Estate Tax Calculation for Married IndividualSharjaaah100% (2)

- p2 - Guerrero Ch9Document49 pagesp2 - Guerrero Ch9JerichoPedragosa72% (36)

- GROSS INCOME SOURCESDocument45 pagesGROSS INCOME SOURCESannyeongchingu80% (5)

- Pe On Estate TaxDocument25 pagesPe On Estate TaxErica NicolasuraNo ratings yet

- HO4 Pre TestDocument4 pagesHO4 Pre TestJason Saberon Quiño0% (2)

- 1.2.1 MC - Exercises On Property RelationsDocument3 pages1.2.1 MC - Exercises On Property RelationsJem ValmonteNo ratings yet

- (Practice Test 2) : Task 1Document11 pages(Practice Test 2) : Task 1Eki SunriseNo ratings yet

- Syquia V. Lopez 84 PHIL 312Document2 pagesSyquia V. Lopez 84 PHIL 312Mervic AlNo ratings yet

- Exercise 7-7. Multiple Choice Problem: Items 1 and 2 Are Based On The Following InformationDocument14 pagesExercise 7-7. Multiple Choice Problem: Items 1 and 2 Are Based On The Following InformationSheie WiseNo ratings yet

- Estate Ni JonaDocument2 pagesEstate Ni Jonalov3m350% (2)

- 16Document11 pages16Sheie WiseNo ratings yet

- Estate Tax - Exercises On Allowable Deduction and Taxable Net EstateDocument5 pagesEstate Tax - Exercises On Allowable Deduction and Taxable Net EstateGileah ZuasolaNo ratings yet

- Estate Taxation - Discussions...............Document5 pagesEstate Taxation - Discussions...............jangjangNo ratings yet

- Illustration Deduction and Taxable EstateDocument8 pagesIllustration Deduction and Taxable EstateLadybellereyann A TeguihanonNo ratings yet

- 2.1bsa-Cy1 Angela R. Reveral Business Taxation Prelim TaskDocument4 pages2.1bsa-Cy1 Angela R. Reveral Business Taxation Prelim TaskAngela Ricaplaza ReveralNo ratings yet

- 4Document13 pages4mariyha PalangganaNo ratings yet

- Tandem Activity GE Allowable DeductionsDocument6 pagesTandem Activity GE Allowable DeductionsErin CruzNo ratings yet

- Test Bank 1 UpdatedDocument5 pagesTest Bank 1 UpdatedSumanting GarnethNo ratings yet

- Gross Estate Activity PDFDocument5 pagesGross Estate Activity PDFJaypee Verzo SaltaNo ratings yet

- Deductions From The Gross Estate Supplementary Pro 230712 100820Document8 pagesDeductions From The Gross Estate Supplementary Pro 230712 100820nichNo ratings yet

- Estate 1Document5 pagesEstate 1Israel MarquezNo ratings yet

- Tax Without ChoicesDocument6 pagesTax Without ChoicesEdwinJugadoNo ratings yet

- Estate Tax and Donor's Tax ComputationDocument8 pagesEstate Tax and Donor's Tax ComputationHeidi KaterineNo ratings yet

- Calculate Estate and Donor's Tax for Philippine EstateDocument8 pagesCalculate Estate and Donor's Tax for Philippine EstateMary Benedict AbraganNo ratings yet

- Answers To Assignment 1 and Problem Exercises Taxation2Document4 pagesAnswers To Assignment 1 and Problem Exercises Taxation2Dexanne BulanNo ratings yet

- Practice Set 1Document11 pagesPractice Set 1IVY JOY SIONOSANo ratings yet

- Taxn03b DrillDocument1 pageTaxn03b Drillsmosaldana.cvtNo ratings yet

- Business Taxation ReviewerDocument10 pagesBusiness Taxation ReviewerCyrelle AnnNo ratings yet

- Estate Tax Activities (Questions)Document4 pagesEstate Tax Activities (Questions)Christine Nathalie BalmesNo ratings yet

- Estate Tax Computation for Multiple ProblemsDocument3 pagesEstate Tax Computation for Multiple ProblemsElizabeth ApolonioNo ratings yet

- Transfer Tax Prelim ExamDocument4 pagesTransfer Tax Prelim ExamSalma AbdullahNo ratings yet

- Donor's Tax - 1Document3 pagesDonor's Tax - 1Crayon LloydNo ratings yet

- Acp and CPG QuizDocument6 pagesAcp and CPG QuizCarina Mae Valdez Valencia0% (1)

- Estate TaxDocument9 pagesEstate TaxHafi DisoNo ratings yet

- BusTax Chap 3Document16 pagesBusTax Chap 3Lisa ManobanNo ratings yet

- Chapter 4 - Discussion Questions / Problems: Conjugal Part. Abs. CommunityDocument4 pagesChapter 4 - Discussion Questions / Problems: Conjugal Part. Abs. CommunityCecille Agnes Criste AlmazanNo ratings yet

- Estate Tax Problems 2Document5 pagesEstate Tax Problems 2howaanNo ratings yet

- Finals Business TaxationDocument5 pagesFinals Business TaxationSherwin DueNo ratings yet

- Illustrations PDFDocument3 pagesIllustrations PDFCharrey Leigh FormaranNo ratings yet

- Estate Tax CalculationDocument4 pagesEstate Tax CalculationJohn Francis RosasNo ratings yet

- Exercise-2-Estate-Tax QDocument2 pagesExercise-2-Estate-Tax QJaypee Verzo SaltaNo ratings yet

- Estate Tax ProblemsDocument12 pagesEstate Tax ProblemsmikaelaNo ratings yet

- ESTATE AND DONOR'S TAX GUIDEDocument10 pagesESTATE AND DONOR'S TAX GUIDEJoseph MangahasNo ratings yet

- Princess Elaine Esperat - Tax 2 - Activity 2 FinalDocument3 pagesPrincess Elaine Esperat - Tax 2 - Activity 2 FinalPrincess Elaine EsperatNo ratings yet

- Orca Share Media1583984976335Document3 pagesOrca Share Media1583984976335Sherlock HolmesNo ratings yet

- Calculate Estate Tax PayableDocument12 pagesCalculate Estate Tax PayabletruthNo ratings yet

- Exercises On Estate Tax Additional ProblemsDocument8 pagesExercises On Estate Tax Additional ProblemsMidas Troy VictorNo ratings yet

- Donor's Tax (AutoRecovered)Document2 pagesDonor's Tax (AutoRecovered)Jan ernie MorillaNo ratings yet

- Transfer & Business TaxDocument5 pagesTransfer & Business TaxAlif FabianNo ratings yet

- 12Document12 pages12mariyha Palanggana0% (2)

- Ordinary DeductionsDocument10 pagesOrdinary DeductionsJULIUS BORDON100% (1)

- This Study Resource Was: Problem 1Document4 pagesThis Study Resource Was: Problem 1John Francis RosasNo ratings yet

- Problem 1: Net Taxable Estate 530,000 75,000 605,000Document3 pagesProblem 1: Net Taxable Estate 530,000 75,000 605,000camscamsNo ratings yet

- Cpa Reviewer in TaxationDocument34 pagesCpa Reviewer in TaxationMika MolinaNo ratings yet

- BALIMBIN TBLTpg83-94Document14 pagesBALIMBIN TBLTpg83-94mariyha Palanggana0% (1)

- Taxa2 Quiz3Document14 pagesTaxa2 Quiz3ishinoya keishiNo ratings yet

- Problem 1 Communal PropertiesDocument11 pagesProblem 1 Communal PropertiesJuanaNo ratings yet

- Exercise-2-Estate-Tax QDocument2 pagesExercise-2-Estate-Tax Qrick owensNo ratings yet

- Chapter 5Document6 pagesChapter 5Briggs Navarro BaguioNo ratings yet

- Composition of The Gross Estate of A DecedentDocument16 pagesComposition of The Gross Estate of A DecedentBill BreisNo ratings yet

- TaxfinDocument3 pagesTaxfinShr BnNo ratings yet

- Exercise No. 1-Estate TaxationDocument4 pagesExercise No. 1-Estate TaxationRed Velvet100% (1)

- Cash and Cash EquivalentDocument54 pagesCash and Cash EquivalentHello Kitty100% (1)

- JOURNAL ENTRIES WPS OfficeDocument3 pagesJOURNAL ENTRIES WPS OfficeEki SunriseNo ratings yet

- QUIZ 6 Joint ArrangementDocument2 pagesQUIZ 6 Joint ArrangementEki SunriseNo ratings yet

- To Reduce Trade andDocument2 pagesTo Reduce Trade andEki SunriseNo ratings yet

- To Reduce Trade andDocument2 pagesTo Reduce Trade andEki SunriseNo ratings yet

- QUIZ 6 Joint ArrangementDocument2 pagesQUIZ 6 Joint ArrangementEki SunriseNo ratings yet

- AST FinalsDocument6 pagesAST FinalsEki SunriseNo ratings yet

- Income Statement 1Document4 pagesIncome Statement 1Mhaye Aguinaldo0% (1)

- Val - ExamDocument11 pagesVal - ExamEki SunriseNo ratings yet

- Annual Profit Plan and Supporting Schedules Study Material 1Document4 pagesAnnual Profit Plan and Supporting Schedules Study Material 1Eki SunriseNo ratings yet

- Income Statement 1Document4 pagesIncome Statement 1Mhaye Aguinaldo0% (1)

- Question 1Document1 pageQuestion 1Eki SunriseNo ratings yet

- Property AssignmentDocument5 pagesProperty Assignmentdorene olinaresNo ratings yet

- Commercial Property Leasing AgreementDocument4 pagesCommercial Property Leasing AgreementRegi Ponferrada100% (4)

- BUSINESS ORGANIZATION I: PARTNERSHIPS, TRUSTS, & AGENCYDocument28 pagesBUSINESS ORGANIZATION I: PARTNERSHIPS, TRUSTS, & AGENCYChrisus Joseph SarchezNo ratings yet

- SPP Doc 201-202Document8 pagesSPP Doc 201-202gabNo ratings yet

- Module 2 - History and Trends in Socialized HousingDocument18 pagesModule 2 - History and Trends in Socialized HousingIPNo ratings yet

- Spinoso Real Estate Lawsuit Against American Eagle Over Leaving Northlake Mall in Charlotte, NCDocument7 pagesSpinoso Real Estate Lawsuit Against American Eagle Over Leaving Northlake Mall in Charlotte, NCWCNC DigitalNo ratings yet

- Finance Meeting 022316 Condominium ActDocument16 pagesFinance Meeting 022316 Condominium ActKaren Gina DupraNo ratings yet

- P2 PPT Acme StevenDocument87 pagesP2 PPT Acme StevenEsteven GaerlannNo ratings yet

- Draft Lease Agreement - 2Document3 pagesDraft Lease Agreement - 2Tinkita RathodNo ratings yet

- CIVIL LAW I (2022) : 1. Noel Is The Son of Spouses Marie and BenedictDocument19 pagesCIVIL LAW I (2022) : 1. Noel Is The Son of Spouses Marie and BenedictTannie Lyn Ebarle BasubasNo ratings yet

- REX Tunney Act Comment United States v. NAR 022021Document21 pagesREX Tunney Act Comment United States v. NAR 022021Robert HahnNo ratings yet

- Profile 2020 UPDATEDDocument15 pagesProfile 2020 UPDATEDXoghaye spsNo ratings yet

- Contract of LeaseDocument3 pagesContract of LeaseDannah Karoline RiveraNo ratings yet

- National Building Code - PD 1096 Summary - TOAZ - INFODocument6 pagesNational Building Code - PD 1096 Summary - TOAZ - INFOAlray GolisNo ratings yet

- Design + Construction Magazine (October To December 2019)Document86 pagesDesign + Construction Magazine (October To December 2019)Khuta JhayNo ratings yet

- Agris On-Line 2017 2 Drbohlav Svitalek Hejkrlik4Document15 pagesAgris On-Line 2017 2 Drbohlav Svitalek Hejkrlik4Marialee PlanNo ratings yet

- Omaxe Dwarka New DelhiDocument6 pagesOmaxe Dwarka New DelhiHimanshu KashyapNo ratings yet

- Real Estate Service Act REM1Document29 pagesReal Estate Service Act REM1Francis L100% (1)

- Tamil Nadu Buildings Lease and Rent Control Act 1960Document62 pagesTamil Nadu Buildings Lease and Rent Control Act 1960arunithiNo ratings yet

- Statcon Digest 4Document6 pagesStatcon Digest 4rheyneNo ratings yet

- Extra-Judicial-Settlement-Of-State-Bernardino FrondaDocument2 pagesExtra-Judicial-Settlement-Of-State-Bernardino Frondamichael lumboyNo ratings yet

- 2008 2009 2019 Bar QuestionsDocument10 pages2008 2009 2019 Bar QuestionsSachieCasimiroNo ratings yet

- CadastralDocument23 pagesCadastralጇን ጁንስNo ratings yet

- Norwalk Code Section 41.12 - FireworksDocument1 pageNorwalk Code Section 41.12 - FireworksLocal 5 News (WOI-TV)No ratings yet

- NOC From SocietyDocument7 pagesNOC From SocietyMahesh RampalliNo ratings yet

- Developing A London-Wide Private Sector Scheme (PSS) For Single Homeless PeopleDocument12 pagesDeveloping A London-Wide Private Sector Scheme (PSS) For Single Homeless PeopleEmpty HomesNo ratings yet