Professional Documents

Culture Documents

THE CONCEPT OF CORPORATE GOVERNANCE Lesson 1

Uploaded by

LEONARDO CRISTALLIOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

THE CONCEPT OF CORPORATE GOVERNANCE Lesson 1

Uploaded by

LEONARDO CRISTALLICopyright:

Available Formats

Revista Científica "Visión de Futuro"

ISSN: 1669-7634

ISSN: 1668-8708

revistacientifica@fce.unam.edu.ar

Universidad Nacional de Misiones

Argentina

THE CONCEPT OF CORPORATE

GOVERNANCE

Garzón Castrillón, Manuel Alfonso

THE CONCEPT OF CORPORATE GOVERNANCE

Revista Científica "Visión de Futuro", vol. 25, núm. 2, 2021

Universidad Nacional de Misiones, Argentina

Disponible en: https://www.redalyc.org/articulo.oa?id=357966632010

DOI: https://doi.org/10.36995/j.visiondefuturo.2021.25.02R.005.en

© 2021 Revista Cientifica "Visión de Futuro" - Facultad de Ciencias Económicas - UNaM

Esta obra está bajo una Licencia Creative Commons Atribución-NoComercial 3.0 Internacional.

PDF generado a partir de XML-JATS4R por Redalyc

Proyecto académico sin fines de lucro, desarrollado bajo la iniciativa de acceso abierto

Revista Científica "Visión de Futuro", 2021, vol. 25, núm. 2, Julio-Diciembre, ISSN: 1669-7634 1668...

THE CONCEPT OF CORPORATE GOVERNANCE

Manuel Alfonso Garzón Castrillón DOI: https://doi.org/10.36995/

Fundación para la Investigación y el Desarrollo Educativo j.visiondefuturo.2021.25.02R.005.en

Empresarial, Colombia Redalyc: https://www.redalyc.org/articulo.oa?

manuelalfonsogarzon@fidee.org id=357966632010

Recepción: 18 Diciembre 2020

Aprobación: 04 Marzo 2021

Abstract:

is article aimed to identify the different concepts of corporate governance, in this sense, the first section presents a review of

the literature based on the Methodi Ordinatio in relation to the concept of corporate governance (CG), followed by the revision

of the theories from which it is studied: eory of the agency; the shareholder or stockholder theory; the resource dependency

theory; Stakeholder theory; the theory of Stewardship or Management eory, the approach based on knowledge and corporate

governance and the performance of the company, finally, the conclusion of the study in which it stands out that the objective of

CG theories is not to study how managers govern - that would lead us to confuse the term governance with administration - but

rather how it is

Keywords: Corporate governance, eory.

INTRODUCTION

e practice of corporate governance (CG) in organizations has developed rapidly in recent times, and its

importance has been highlighted around the world. It has even been adopted by countries that have not

yet regulated the adoption of CG in their organizations. e reason for the global interest in GC is that

it underpins a company's operating framework. erefore, the adoption and implementation of the QA

practice is expected to benefit the owners, since they are committed to using the principles and mechanisms,

which in the broadest sense amounts to an effective monitoring of the activities of a company, particularly

when the principles of disclosure and transparency are adopted. (Grantham, (2020).

Consequently, when adopting and implementing CG in companies, this decision can have a positive

impact on decisions related to current investors, on the one hand, and potential investors on the other

(Hebble and Ramaswamy, 2005). e bankruptcy and collapse of large US corporations such as Worldcom,

Enron and Adolphia, and public awareness of these financial disasters has led investors to become increasingly

aware of organizations that are known for having good QA practices to achieve and maintain a good

reputation, since there is guidance for investors to prefer to invest in companies that adopt best QA practices

In addition, as the information is available, shareholders and owners can access and evaluate decisions on

a daily basis , in addition to the evaluation carried out by the analysts (Alabdullah, Yahya and urasamy

2014).

In this way, the clear and important role of the CG is highlighted with respect to the effect of these

mechanisms on the performance of companies (Alabdullah, 2016). Several studies prove the relationship

between CG and company performance, but the results are inconsistent; some report positive results, and

others are mixed: negative and positive from company performance (Alabdullah et al., 2016).

is article fills a gap in relation to the concept of corporate governance, in this sense, the first section

presents a review of the literature in relation to the concept of corporate governance (CG), followed by

a review of the theories from which It is studied: eory of the agency; eory of the shareholder or

stockholder; e resource dependency theory; the Stakeholder eory; Stewardship eory or Management

eory, an approach based on knowledge and corporate governance and the performance of the company

and finally, the conclusion of the study.

PDF generado a partir de XML-JATS4R por Redalyc

Proyecto académico sin fines de lucro, desarrollado bajo la iniciativa de acceso abierto 178

Manuel Alfonso Garzón Castrillón. THE CONCEPT OF CORPORATE GOVERNANCE

DEVELOPMENT

Methodology

In the present investigation, the methodology called Methodi Ordinatio de Pagani was used; Kovaleski;

and Resende, (2015); based on which the stages proposed by the authors were developed, which

include conducting a preliminary exploratory research with keywords in databases, the combination

of keywords used were: Corporate governance; practice of corporate governance; Impact of Corporate

Governance; Characteristics on Corporate; Corporate Governance and control, Corporate governance

theory, fundamental theories in corporate governance and the databases consulted Scopus, WoS, and Scielo;

the final search in the databases, the filtering procedure, was carried out taking into account the identification

of the impact factor, year of publication and number of citations.

e classification of the works using the formula of the InOrdinatio de Paganiet.al. (2015);

InOrditnatio = (IF / 1000) α * [10- (Research year -year of publication)] + (ΣCi), where: (Pagani et.al

(2015)

• IF is the impact factor, a is a weighting factor ranging from 1 to 10, which must be attributed by

the researcher;

• ResearchYear is the year in which the research was developed;

• PublishYear is the year the article was published; and

• Summation Ci (ΣCi) is the number of times the article was cited.

Based on the results obtained, the articles were classified, the complete documents were searched, and the

final reading and systematic analysis of the papers were read.

Definitions of Corporate Governance

Definitions of corporate governance vary considerably (Claessens, 2003). ese definitions correspond to

approximations made since 1992 focused on establishing guidelines for the management and control of

companies, directing their actions to guarantee investors that their invested resources are investors that the

resources they provide are managed to achieve profitability and efficiency.

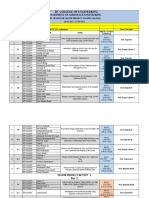

Based on the authors consulted, Table 1 was prepared:

PDF generado a partir de XML-JATS4R por Redalyc

Proyecto académico sin fines de lucro, desarrollado bajo la iniciativa de acceso abierto 179

Revista Científica "Visión de Futuro", 2021, vol. 25, núm. 2, Julio-Diciembre, ISSN: 1669-7634 1668...

TABLE 1.

Emphasis on corporate governance models

Prepared based on the authors cited in this table

From table 1 it can be deduced that the emphasis of the analyzed authors in relation to CG is on

the following components: a government financial model; that of a model of governance of contracts

between participants (normative); a cognitive model of government; or focused on decision-making through

good practices that for Andrés-Alonso and Santamaría-Mariscal (2010) should be focused on governance

mechanisms that discipline managers and resolve agency conflicts, or on governance mechanisms that

induce learning and, for example, that stimulate managers to imagine, perceive and generate new investment

opportunities.

But the proposal made by Paz-Ares (2004) makes a distinction of corporate governance depending on

whether it is imposed on the company or voluntarily assumed. It calls external or institutional corporate

governance (imposed from outside by the legal system and the network of institutions of a given country)

and internal or contractual corporate governance (voluntarily assumed from within by each company).

Allayannis, Lel, and Miller (2012) make a similar distinction in a study on the reasons for holding foreign

exchange derivatives, referring to corporate governance at the country level and corporate governance at the

company level.

Based on the revised definitions, it is concluded that the ultimate purpose of the good governance of

the company is to add value to it, and to ensure that those who contribute directly or indirectly to its

generation can participate in the increase in value. For this reason, good practices establish conditions to

protect and equitably reward shareholders for the capital contributed; to reward workers for their work

and intellectual contribution; to offer customers higher quality products and services and better prices; to

adequately remunerate suppliers for the delivery of products or the provision of services and to offer them

guarantees or the confidence that they will be paid in a timely manner; to offer creditors that the resources

they have lent to the company will be restored and that they will be well compensated; it also includes

responsibility towards society in general, thus including compliance with tax obligations.

In this regard, it is necessary to establish that there is no distinctive definition that specifically describes

the meaning of CG when taking into account the integral characteristics of the CG system, therefore, there

is some controversy and confusion regarding the definition of CG (Windsor, 2009). However, in general,

the traditional definition of CG is the one proposed by the Organization for Economic Cooperation and

Development (OECD, April 1999) which provided the following: Corporate governance is the system by

which business corporations are directed and controlled. (OECD, 2016)

PDF generado a partir de XML-JATS4R por Redalyc

Proyecto académico sin fines de lucro, desarrollado bajo la iniciativa de acceso abierto 180

Manuel Alfonso Garzón Castrillón. THE CONCEPT OF CORPORATE GOVERNANCE

Depending on the point of view with which the definition of corporate governance of companies is

faced, they can have different meanings. From an economic perspective, corporate governance is generally

understood as defending the interests of shareholders (García, 2014)

Finally, the concept of corporate governance is explained by the authors, and not expressly defined because

it encompasses different areas of interaction, such as management, ethical, legal, regulatory, structural, and

behavioral aspects. e approach adopted, whether of the shareholder or the stakeholder, will determine

the type of corporate governance that will be developed in a company, or in a country and the mechanisms

through which its compliance will be verified. Corporate governance is a process, not a state. e field is

continually evolving (Claessens, 2003).

Good governance codes

It is also important to bear in mind that the concept of corporate governance is framed within business ethics.

Business ethics is the ethics applied to the organizational field, which refers to human quality, the excellence

of people and their actions, within the framework of their work in them. Good business conduct practices

are embodied in codes of ethics, which contemplate the set of values that are established in the same system

or code in order to benefit the company as a whole. us, corporate governance framed within the area of

business ethics is defined as the system by which companies are directed and controlled, Cadbury (1992) and

embodied in the so-called codes of good governance.

In this way, the objective of all good governance codes is to protect shareholders from the power of

managers, as well as to ensure that there is good control of the former towards the latter, avoiding the agency

problems existing between them. In this context, it is agency theory that studies the relationships between

shareholders and managers and the underlying conflicts of interest between the two. Currently, there are

various control mechanisms, both externally (goods and services market, capital market, job market for

managers and corporate control market) and internal (board of directors, design of compensation contracts,

general meeting of shareholders and financial structure). All of them aim to reduce existing agency problems,

such as opportunistic and self-interested profit-making by managers.

In order to reconcile the common objectives between the shareholders (principal) and the managers

(agents), the figure of the board of directors appears. It is a key entity within the internal mechanisms used by

companies to control their executives (Dalton, Daily, Ellstrand and Johnson, 1998). e directors belonging

to the boards of directors will have a level of information about the composition and characteristics of said

boards in matters of corporate governance.

Depending on a series of characteristics of the board, a level of corporate governance culture is determined,

in which, at a higher level of corporate culture, fewer agency problems between shareholders and company

executives. In fact, existing agency problems in a company can be minimized. On the one hand, through

the control of internal mechanisms such as those related to the composition of the board of directors

(Baek, 2009) and, on the other, favoring the transparency of organizations, through the issuance of more

adequate financial-accounting information to reality (Fernández-Rodríguez, Gómez-Ansón and Cuervo-

García, 2008).

e issuance of good governance codes by different countries improves the level of corporate governance

culture by companies (Zattoni and Coumo, 2008), which favors obtaining better business results (Alix

Valenti, Luce and Mayfield , 2011). is is achieved through comply or explain recommendations, which

dictate procedures that favor the disclosure of more and better information for all the agents involved (Van

den Berghe, 2002; Monks and Minow, 2004). By obtaining better results, on the one hand, and information

more appropriate to the reality of the company on the other, the ultimate goal of value creation companies

is achieved.

PDF generado a partir de XML-JATS4R por Redalyc

Proyecto académico sin fines de lucro, desarrollado bajo la iniciativa de acceso abierto 181

You might also like

- TIMO Final 2020-2021 P3Document5 pagesTIMO Final 2020-2021 P3An Nguyen100% (2)

- RTDM Admin Guide PDFDocument498 pagesRTDM Admin Guide PDFtemp100% (2)

- Checklist & Guideline ISO 22000Document14 pagesChecklist & Guideline ISO 22000Documentos Tecnicos75% (4)

- Grade 7 ExamDocument3 pagesGrade 7 ExamMikko GomezNo ratings yet

- Corporate GovernanceDocument14 pagesCorporate GovernancekgfbsbfmhfklnhuvmaNo ratings yet

- THE CONCEPT OF CORPORATE GOVERNANCE - Lesson 5Document3 pagesTHE CONCEPT OF CORPORATE GOVERNANCE - Lesson 5LEONARDO CRISTALLINo ratings yet

- Contribution of The Supervisory Board As Corporate Governance Body in The Development of The Company Strategy of State-Owned Enterprises in Bosnia and HerzegovinaDocument17 pagesContribution of The Supervisory Board As Corporate Governance Body in The Development of The Company Strategy of State-Owned Enterprises in Bosnia and HerzegovinashackeristNo ratings yet

- Sustainability 12 02153 v2 PDFDocument36 pagesSustainability 12 02153 v2 PDFSatish PatilNo ratings yet

- Coursework Submission Coversheet College of Business, Arts and Social SciencesDocument9 pagesCoursework Submission Coversheet College of Business, Arts and Social Scienceskrisna2211No ratings yet

- LegitimacyTheoryinManagementAccountingResearch PDFDocument10 pagesLegitimacyTheoryinManagementAccountingResearch PDFMaia NovitasariNo ratings yet

- Business Research Proposal: Name of The Student: Name of The University: Author's NoteDocument15 pagesBusiness Research Proposal: Name of The Student: Name of The University: Author's Noteexpert 61No ratings yet

- Sustainability 12 06398Document20 pagesSustainability 12 06398Hien Quoc VuNo ratings yet

- Broader and DeeperDocument11 pagesBroader and DeeperViswa Chandra ReddyNo ratings yet

- Ce Es ErDocument15 pagesCe Es ErMenik SunartoNo ratings yet

- Ce Es ErDocument15 pagesCe Es ErMenik SunartoNo ratings yet

- Will Design Thinking Save UsDocument7 pagesWill Design Thinking Save UsClaire NouvelNo ratings yet

- 2022 KhanDocument19 pages2022 KhanKiều Lê Nhật ĐôngNo ratings yet

- Ingles FinanzaDocument6 pagesIngles FinanzaLILI JHOVANITA SALDAÑA MANOSALVANo ratings yet

- 177 Dobrowolska, SliżDocument20 pages177 Dobrowolska, SliżRadek PolonusNo ratings yet

- Disclosure on sustainable development, CSR environmental disclosure and greater value recognized to the company by usersFrom EverandDisclosure on sustainable development, CSR environmental disclosure and greater value recognized to the company by usersNo ratings yet

- Independent Directors' Background and CSR Disclosure: Roberto Fernández Gago Laura Cabeza García Mariano NietoDocument11 pagesIndependent Directors' Background and CSR Disclosure: Roberto Fernández Gago Laura Cabeza García Mariano NietoshaharyarkhanNo ratings yet

- Sustainability 10 04206 v2Document30 pagesSustainability 10 04206 v2moamen BNo ratings yet

- Organizational Performance by The Process of Knowledge CreationDocument14 pagesOrganizational Performance by The Process of Knowledge CreationFilip AndreiNo ratings yet

- Knowledge Transfer and Organizational PerformanceDocument9 pagesKnowledge Transfer and Organizational PerformanceBinu JacobNo ratings yet

- Public Research Organizations' Interactions With Firms: Factors Driving The Perceived BenefitsDocument32 pagesPublic Research Organizations' Interactions With Firms: Factors Driving The Perceived BenefitsJaider VegaNo ratings yet

- 2.2. Theoretical FrameworkDocument5 pages2.2. Theoretical FrameworkKim FloresNo ratings yet

- Corporate Social Responsibility in Multinational Companies: Management Initiatives or Negotiated Agreements?Document26 pagesCorporate Social Responsibility in Multinational Companies: Management Initiatives or Negotiated Agreements?Masudur RahmanNo ratings yet

- Corporate Social Responsibility MeasuremDocument29 pagesCorporate Social Responsibility MeasuremNik EmilNo ratings yet

- The Relationship Between Non-Financial Reporting, Environmental Strategies and Financial Performance. Empirical Evidence From Milano Stock ExchangeDocument9 pagesThe Relationship Between Non-Financial Reporting, Environmental Strategies and Financial Performance. Empirical Evidence From Milano Stock ExchangeRima LaaouinaNo ratings yet

- 1 s2.0 S1042443120300913 MainDocument23 pages1 s2.0 S1042443120300913 MainDaniel MahnNo ratings yet

- VCNG 3011Document33 pagesVCNG 3011vitcng2k4No ratings yet

- pesieja,+IER 08 02 02 pp025 2073 Rosinska BukowskaDocument12 pagespesieja,+IER 08 02 02 pp025 2073 Rosinska BukowskaannaNo ratings yet

- The Relation Between Network of CollaborDocument8 pagesThe Relation Between Network of CollaborAna Paula SantosNo ratings yet

- Corporate Social Responsibility and Smes A Literature Review and Agenda For Future ResearchDocument5 pagesCorporate Social Responsibility and Smes A Literature Review and Agenda For Future Researchfut0mipujeg3No ratings yet

- Sustainability 10 04265Document22 pagesSustainability 10 04265Manar HossamNo ratings yet

- Signalling Responsibility? Applying Signalling Theory To The ISO 26000 Standard For Social ResponsibilityDocument20 pagesSignalling Responsibility? Applying Signalling Theory To The ISO 26000 Standard For Social Responsibilitydummy GoodluckNo ratings yet

- Technological Forecasting & Social Change: A B A B ADocument11 pagesTechnological Forecasting & Social Change: A B A B ALaura Juliana DuitamaNo ratings yet

- Personal Values As Predictors of Entrepreneurial Intentions of University StudentsDocument29 pagesPersonal Values As Predictors of Entrepreneurial Intentions of University StudentsHugoBenzaquenHinopeNo ratings yet

- 39903-Texto Do Artigo-140868-1-10-20200417..Document19 pages39903-Texto Do Artigo-140868-1-10-20200417..Raise Your WordsNo ratings yet

- Which Country Characteristics Support Corporate SocialperformanceDocument15 pagesWhich Country Characteristics Support Corporate SocialperformancedessyNo ratings yet

- Literature Review On CSR ActivitiesDocument4 pagesLiterature Review On CSR Activitiesafmzuiffugjdff100% (1)

- Balanced Scorecard: Key Tool For Strategic Learning and Strengthening in Business OrganizationsDocument11 pagesBalanced Scorecard: Key Tool For Strategic Learning and Strengthening in Business OrganizationsderlingkepplerNo ratings yet

- ESG Performance and Ownership Structure On Cost of Capital and Research & Development InvestmentDocument18 pagesESG Performance and Ownership Structure On Cost of Capital and Research & Development Investmentasri_lutfianiNo ratings yet

- Pengaruh Financial Dan Non-Financial Disclosure Terhadap Biaya Modal Ekuitas Dengan Pengungkapan Lingkungan Sebagai Variabel ModeratingDocument20 pagesPengaruh Financial Dan Non-Financial Disclosure Terhadap Biaya Modal Ekuitas Dengan Pengungkapan Lingkungan Sebagai Variabel ModeratingFreyashela Merida Sanchia RosaNo ratings yet

- WORK The Good The Bad and The Successful How Corporate Social Responsibility Leads To Competitive Advantage and Organizational TransformationDocument21 pagesWORK The Good The Bad and The Successful How Corporate Social Responsibility Leads To Competitive Advantage and Organizational TransformationsaintdongroupNo ratings yet

- Corporate Social Responsibility in PrivaDocument15 pagesCorporate Social Responsibility in PrivaElianaNo ratings yet

- Finance Dissertation DownloadDocument4 pagesFinance Dissertation DownloadWriteMyPaperFastCanada100% (1)

- Research PaperDocument15 pagesResearch PaperAliNo ratings yet

- Dissertation On Access To FinanceDocument6 pagesDissertation On Access To FinancePayToDoPaperCanada100% (1)

- Corporate Disclosure, Materiality, and Integrated Report: An Event Study AnalysisDocument15 pagesCorporate Disclosure, Materiality, and Integrated Report: An Event Study AnalysisAdriana CristinaNo ratings yet

- Social Audit Article 4Document19 pagesSocial Audit Article 4DHANRAJ KAUSHIKNo ratings yet

- JOIE Volume 14 Special Issue Pages 71-78Document8 pagesJOIE Volume 14 Special Issue Pages 71-78hayumandani28No ratings yet

- 1 s2.0 S2444569X16000032 MainDocument8 pages1 s2.0 S2444569X16000032 MainLisa van EssenNo ratings yet

- ArticileDocument7 pagesArticileBekele GetachewNo ratings yet

- Literature Review of CSR Case StudyDocument7 pagesLiterature Review of CSR Case Studyea59a2k5100% (1)

- Knowledge Management Dissertation TopicsDocument8 pagesKnowledge Management Dissertation TopicsPaperWritingHelpOnlineSingapore100% (1)

- Social Innovation Drivers in Social Enterprises: Systematic ReviewDocument22 pagesSocial Innovation Drivers in Social Enterprises: Systematic ReviewFajar1978No ratings yet

- Some Insights On The Worlds Most Innovative CompaDocument17 pagesSome Insights On The Worlds Most Innovative CompaSharjana Alam ShailyNo ratings yet

- Thesis CSR PDFDocument7 pagesThesis CSR PDFaflogmseugojga100% (2)

- The Balanced Scorecard in The Public Sector OrganizationDocument14 pagesThe Balanced Scorecard in The Public Sector OrganizationCosmin RoscanNo ratings yet

- Research Paper On CSR PDFDocument5 pagesResearch Paper On CSR PDFwxvhtrgkf100% (1)

- CORPORATE GOVERNANCE MECHANISMS AND INTELLECTUAL CAPITAL DISCLOSURE IN MALAYSIAN GLCsDocument32 pagesCORPORATE GOVERNANCE MECHANISMS AND INTELLECTUAL CAPITAL DISCLOSURE IN MALAYSIAN GLCsAbeerAlgebaliNo ratings yet

- Eco-Knowledge Management: A Case Study of Itc Limited: Journal of Shanghai Jiaotong University (Science) April 2022Document13 pagesEco-Knowledge Management: A Case Study of Itc Limited: Journal of Shanghai Jiaotong University (Science) April 2022jesNo ratings yet

- Corporate Governance-Issues and Challenges in Pakistan: Beenish AmeerDocument18 pagesCorporate Governance-Issues and Challenges in Pakistan: Beenish Ameersaad aliNo ratings yet

- Arnold Ventures Letter To Congressional Social Determinants of Health CaucusDocument7 pagesArnold Ventures Letter To Congressional Social Determinants of Health CaucusArnold VenturesNo ratings yet

- Week 7 Sex Limited InfluencedDocument19 pagesWeek 7 Sex Limited InfluencedLorelyn VillamorNo ratings yet

- Acute Coronary SyndromeDocument30 pagesAcute Coronary SyndromeEndar EszterNo ratings yet

- Analizador de Combustion Kigaz 310 Manual EngDocument60 pagesAnalizador de Combustion Kigaz 310 Manual EngJully Milagros Rodriguez LaicheNo ratings yet

- A Case Study of Coustomer Satisfaction in Demat Account At: A Summer Training ReportDocument110 pagesA Case Study of Coustomer Satisfaction in Demat Account At: A Summer Training ReportDeepak SinghalNo ratings yet

- E Flight Journal Aero Special 2018 Small PDFDocument44 pagesE Flight Journal Aero Special 2018 Small PDFMalburg100% (1)

- AlpaGasus: How To Train LLMs With Less Data and More AccuracyDocument6 pagesAlpaGasus: How To Train LLMs With Less Data and More AccuracyMy SocialNo ratings yet

- Review1 ScheduleDocument3 pagesReview1 Schedulejayasuryam.ae18No ratings yet

- An Exploration of The Ethno-Medicinal Practices Among Traditional Healers in Southwest Cebu, PhilippinesDocument7 pagesAn Exploration of The Ethno-Medicinal Practices Among Traditional Healers in Southwest Cebu, PhilippinesleecubongNo ratings yet

- Fss Presentation Slide GoDocument13 pagesFss Presentation Slide GoReinoso GreiskaNo ratings yet

- Emea 119948060Document31 pagesEmea 119948060ASHUTOSH MISHRANo ratings yet

- Skills Redux (10929123)Document23 pagesSkills Redux (10929123)AndrewCollas100% (1)

- The Mantel Colonized Nation Somalia 10 PDFDocument5 pagesThe Mantel Colonized Nation Somalia 10 PDFAhmad AbrahamNo ratings yet

- Floating Oil Skimmer Design Using Rotary Disc MethDocument9 pagesFloating Oil Skimmer Design Using Rotary Disc MethAhmad YaniNo ratings yet

- Opc PPT FinalDocument22 pagesOpc PPT FinalnischalaNo ratings yet

- The Use of Air Cooled Heat Exchangers in Mechanical Seal Piping Plans - SnyderDocument7 pagesThe Use of Air Cooled Heat Exchangers in Mechanical Seal Piping Plans - SnyderJaime Ocampo SalgadoNo ratings yet

- Space Hulk - WDDocument262 pagesSpace Hulk - WDIgor Baranenko100% (1)

- Hima OPC Server ManualDocument36 pagesHima OPC Server ManualAshkan Khajouie100% (3)

- V737 OverheadDocument50 pagesV737 OverheadnewahNo ratings yet

- Wilcoxon Matched Pairs Signed Rank TestDocument3 pagesWilcoxon Matched Pairs Signed Rank TestDawn Ilish Nicole DiezNo ratings yet

- IEC ShipsDocument6 pagesIEC ShipsdimitaringNo ratings yet

- Hdfs Default XML ParametersDocument14 pagesHdfs Default XML ParametersVinod BihalNo ratings yet

- Manual s10 PDFDocument402 pagesManual s10 PDFLibros18No ratings yet

- MASONRYDocument8 pagesMASONRYJowelyn MaderalNo ratings yet

- Tribal Banditry in Ottoman Ayntab (1690-1730)Document191 pagesTribal Banditry in Ottoman Ayntab (1690-1730)Mahir DemirNo ratings yet

- Chapter 2 ProblemsDocument6 pagesChapter 2 ProblemsYour MaterialsNo ratings yet