Professional Documents

Culture Documents

Students Edition On Cashbook: Capital 15,300 8,200

Uploaded by

Geoffrey ObongoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Students Edition On Cashbook: Capital 15,300 8,200

Uploaded by

Geoffrey ObongoCopyright:

Available Formats

STUDENTS EDITION ON CASHBOOK

1. Started a business with Ksh. 15,300 in cash and 8, 200 in bank.

DATE DETAILS F CASH BANK DATE DETAILS F CASH BANK

Capital 15,300 8,200

2. Dagoreti Enterprises had the following balances, cash in hand Ksh. 15,300 and

Ksh. 8, 200 in bank.

DATE DETAILS F CASH BANK DATE DETAILS F CASH BANK

Bal b/d 15,300 8,200

3. Started a business with Ksh. 15,300 in cash and a bank overdraft of Ksh 8, 200.

DATE DETAILS F CASH BANK DATE DETAILS F CASH BANK

Capital 15,300 Capital 8,200

4. Harrison, a debtor settled his account of Ksh. 18,000 by issuing a cheque of Ksh.

13,400 and the rest by cheque.

DATE DETAILS F CASH BANK DATE DETAILS F CASH BANK

Harrison 4,600 13,400

5. Paid Wangila, a creditor Ksh. 94,000 by cheque in full settlement of his account

after deducting 6% cash discount.

Interpretation: ALL monies owed to Wangila was paid. (In full settlement). But this payment was

received after the discount. So Ksh. 94,000 is the amount in the face of the cheque and equals to

94%. So one is required to calculate discount received.

PREPARED BY: TOBIAS YOGO

GENDIA HIGH SCHOOL

DATE DETAILS F DISC. CASH BANK DATE DETAILS F DISC. CASH BANK

ALL. RCVD

Wangila 6000 94,000

6. Received a cheque for Ksh. 58,800 from Wetu after allowing her a cash discount

of Ksh. 1,200.

Interpretation: what was received? Cheque of Ksh.58, 800…was the discount awarded already?

Yes…of Ksh. 1,200

DATE DETAILS F DISC. CASH BANK DATE DETAILS F DISC. CASH BANK

ALL. RCVD

Wetu 1,200 58,800

7. Anyango, a debtor paid her account of Ksh. 75,000 by cheque less 10% cash

discount.

Interpretation: what Anyango needs to pay, Ksh. 75,000/=. Did she pay all amount? No. she paid

less 10% cash discount. So 75,000 is 100% but Anyango paid 90%.

DATE DETAILS F DISC. CASH BANK DATE DETAILS F DISC. CASH BANK

ALL. RCVD

Anyango 7,500 67,500

8. Paid Furaha traders Ksh.29, 100 in cash in full settlement of their account less

3% cash discount.

Interpretation: in full settlement of their account less…means all has been paid, but amount paid is

less than the required, showing discount was awarded.

Amount owing to Furaha was X, amount paid is 29,100, but after paying 29,100(in full settlement),

No amount is now owed to Furaha. So 29,100 is 97%.

Discount is = X-29,100 = 3%

DATE DETAILS F DISC. CASH BANK DATE DETAILS F DISC. CASH BANK

ALL. RCVD

Furaha 900 29,100

9. Koko a debtor settled her account of Ksh 40,000 by cheque less 2.5% cash

discount.

Interpretation: ‘ settled’ means ‘fully paid’… account of means… amount to be paid, but not paid

as indicated .so, 40,000 ought to be paid in full but not paid as a discount was allowed.

DATE DETAILS F DISC. CASH BANK DATE DETAILS F DISC. CASH BANK

ALL. RCVD

Koko 1000 39,000

PREPARED BY: TOBIAS YOGO

GENDIA HIGH SCHOOL

10. Dishonoured cheque.

If a cheque previously received as cash payment turns out to be dishonoured, then you need to

realise that the debtor still owes the money as at before the issue of the dishonoured cheque.

Consequently, the entries that were made on the receipt of the cheques ( i.e Dr.Cash book) need to

be nullified in order to get back to the position before the presentation of the dishonoured cheque.

This is done by:

Cr. Cash book (bank a/c) to remove the false cash receipt.

Jan 4: received a cheque of Ksh 20,000 from Muema.

Jan 20: Cheque received on 4th Jan, was dishonoured. The bank charged him Ksh. 2,500.

DATE DETAILS F CASH BANK DATE DETAILS F CASH BANK

4/1/…. Muema 20,000 20/1/… Dishonoured 20,000

cheque /

Muema

Bank charges 2,500

In the ledger:

Dr. Debtor’s a/c

Cr. Bank a/c to remove the false cash receipts.

11. Drawings

Withdrew Ksh 8,900 from the bank for personal use.

Interpretation: this is recorded as drawings on the credit side of the cash book…personal use refers

to Drawings.

DATE DETAILS F DISC. CASH BANK DATE DETAILS F DISC. CASH BANK

ALL. RCVD

Drawings 8,900

12. CONTRA-ENTRY (C)

This refers to transaction affecting both sides of a 2 or 3 column cash book simultaneously. Mainly

involve cash and bank accounts. It’s indicated by letter ‘c’ in the folio column.

a. Withdrew From bank for office use

Withdrew Kshs. 15,000 from the bank for business use.

Interpretation: money was taken from business bank account to the cash till. The amount in bank

reduced while amount in cash increased by the same amount. So it’s a contra-entry.

DATE DETAILS F DISC. CASH BANK DATE DETAILS F DISC. CASH BANK

ALL. RCVD

Bank 15,000 Cash 15,000

PREPARED BY: TOBIAS YOGO

GENDIA HIGH SCHOOL

b. Deposited all the cash / banked all the cash.

Steps.

1. Add all the cash on the Dr. side, say 70,000

2. Add all the cash on the Cr. Side, say 50,000

3. Get the difference 70,000 – 50,000 = 20,000

4. Credit the difference, 20,000 in the cash. Write Bank on the details column and post the

amount on cash column. Cr. side

5. Debit the difference, 20,000 in the bank. Write Cash on the details and post the amount on

bank column. Dr side

6. Write letter ‘C’ on folio columns for both transactions.

DATE DETAILS F DISC. CASH BANK DATE DETAILS F DISC. CASH BANK

ALL. RCVD

Cash 20,000 Bank 20,000

c. Deposited all the cash except. / banked all cash except.

1. Add all the cash on the Dr. Side, say 70,000

2. Add all the cash on the Cr. Side, say 50,000

3. Get the difference 70,000 – 50,000 = 20,000

4. Get the difference with cash at hand and the ‘except’ amount, say the except was 1,300, it

will be 20,000 – 1,300 =18,700

5. Credit the difference, 18,700 in the cash. Write Bank on the details column and post the

amount on cash column. Cr. side

6. Debit the difference, 18,700 in the bank. Write Cash on the details and post the amount on

bank column. Dr Side

7. Write letter ‘C’ on folio columns for both transactions.

8. Post the ‘except’ amount, 1,300 on the credit side of the cash book on the cash column,

writing ‘balance c/d’ on the details.

Deposited all the cash into bank except Ksh 13,700

DATE DETAILS F DISC. CASH BANK DATE DETAILS F DISC. CASH BANK

ALL. RCVD

Cash 18,700 Bank 18,700

Bal c/d 1,300

70,000 70,000

POINTS TO NOTE

WORD ON THE TRANSACTION WORD TO POST ON DETAILS

Sold ……. Sales (Dr.)

Bought….. Purchases (Cr)

Withdrew….. for personal use Drawings (Cr)

PREPARED BY: TOBIAS YOGO

GENDIA HIGH SCHOOL

1. The format must be correct. No interchange of columns.

2. Details / particulars must be correct.

3. Dates must be written.

4. Totals on discount columns must be shown.

5. No interchange of discount columns.

6. Balance must be specified whether b/d or c/d.

Reasons for maintaining a cash book.

a) To reduce the number of entries made to the general ledger.

b) To easily avail cash balances / show cash balances at a glance

c) Enhance specialization in book – keeping by allocating different ledgers to

different workers.

d) To easily monitor the cash inflows (receipt)

e) To easily monitor the cash outflows (payments)

f) To show discount allowed to debtors

g) To show discount received from creditors.

Why a three column cash book is used both as a journal and a ledger.

Cash and bank column in the cash book acts as a ledger and total balances are used to prepare

trial balance like other ledger accounts.

Both discount allowed and discount received columns acts as journal and their totals are

transferred to the ledger.

Cash transactions are entered in a three column cash book directly as they occur. It is a

journal because cash transactions are recorded as they occur.

PREPARED BY: TOBIAS YOGO

GENDIA HIGH SCHOOL

You might also like

- Cash Book Summary: Capital 15,300 8,200Document7 pagesCash Book Summary: Capital 15,300 8,200KOECH VINCENTNo ratings yet

- Two Column Cash BookDocument24 pagesTwo Column Cash BookDarshans dadNo ratings yet

- Manage Cash Flow with a Two-Column Cash BookDocument5 pagesManage Cash Flow with a Two-Column Cash BookAdika Denish0% (1)

- Cash Books To StudentsDocument8 pagesCash Books To StudentsIRUNGU BRENDA MURUGINo ratings yet

- ACCTG 102 Practice Sets Quizzes ExamsDocument25 pagesACCTG 102 Practice Sets Quizzes ExamsheythereitsclaireNo ratings yet

- Two Column Cash BookDocument4 pagesTwo Column Cash Booktarrant HighNo ratings yet

- BRS Tax and InstDocument25 pagesBRS Tax and InstNivedhitha BalajiNo ratings yet

- Types of Cash Books Single - Column Cash Book Two Column Cash Book Three Column Cash Book Past KCSE Questions On The TopicDocument10 pagesTypes of Cash Books Single - Column Cash Book Two Column Cash Book Three Column Cash Book Past KCSE Questions On The TopicHENRY MURIGINo ratings yet

- Cash Book and Bank Reconciliation Lecture IDocument10 pagesCash Book and Bank Reconciliation Lecture IDavidNo ratings yet

- 03 Bank Reconcilation Answer KeyDocument6 pages03 Bank Reconcilation Answer Keywheein aegiNo ratings yet

- Book KeepingDocument10 pagesBook KeepingOnyiNo ratings yet

- BRS (Bank Reconciliation Statement)Document23 pagesBRS (Bank Reconciliation Statement)Shruti KapoorNo ratings yet

- Bank-Reconciliation-and-Proof-of-Cash-Problems-01-04_043916Document2 pagesBank-Reconciliation-and-Proof-of-Cash-Problems-01-04_043916azazelrallosNo ratings yet

- Intermediate 1-Lopez, Michelle D. Bsa-4 Answer With SolutionDocument11 pagesIntermediate 1-Lopez, Michelle D. Bsa-4 Answer With SolutionMichelle LopezNo ratings yet

- Principles of Financial Accounting: Chapter 7 - Fraud, Internal Controls, & CashDocument12 pagesPrinciples of Financial Accounting: Chapter 7 - Fraud, Internal Controls, & CashAli Zain Parhar100% (2)

- Lecture 07Document13 pagesLecture 07Khaleel AbdoNo ratings yet

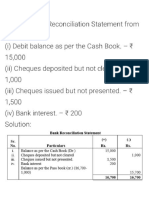

- Prepare Bank Reconciliation Statement From The Following: (I) Debit Balance As Per The Cash BookDocument10 pagesPrepare Bank Reconciliation Statement From The Following: (I) Debit Balance As Per The Cash BookPragya ShuklaNo ratings yet

- CCP102Document24 pagesCCP102api-3849444No ratings yet

- Analyzing Bank Reconciliation ItemsDocument19 pagesAnalyzing Bank Reconciliation ItemsMarvelous Julia StamariaNo ratings yet

- Module 7.2Document23 pagesModule 7.2Yen AllejeNo ratings yet

- Cash Cash Equivalent Bank ReconDocument4 pagesCash Cash Equivalent Bank Reconmavie arellanoNo ratings yet

- Financial Accounting ProblemsDocument5 pagesFinancial Accounting ProblemsLedesma Ken Rembrandt83% (6)

- Fabm2 Quarter2 Week 3-4Document10 pagesFabm2 Quarter2 Week 3-4studentemailNo ratings yet

- Cash and CE Problems ExercisesDocument3 pagesCash and CE Problems ExercisesMa. Erika Charisse DacerNo ratings yet

- Bank Reconciliation and Cash BalancesDocument5 pagesBank Reconciliation and Cash BalancesCruxzelle BajoNo ratings yet

- CCP102Document15 pagesCCP102api-3849444No ratings yet

- Bank Reconciliation (IA)Document7 pagesBank Reconciliation (IA)rufamaegarcia07No ratings yet

- Revsion Final 2023-6Document20 pagesRevsion Final 2023-6Verena FaredNo ratings yet

- Bank Reconciliation: QuizDocument4 pagesBank Reconciliation: QuizBrgy Baloling50% (2)

- Debit and credit rules for asset, liability, equity, revenue and expense accountsDocument3 pagesDebit and credit rules for asset, liability, equity, revenue and expense accountsDanica del RosarioNo ratings yet

- Bank Reconciliation Statement ExamplesDocument8 pagesBank Reconciliation Statement ExamplesGulneer LambaNo ratings yet

- CCP102Document16 pagesCCP102api-3849444No ratings yet

- Annex 8-SK CHAIRPERSON'S CERTIFICATIONDocument3 pagesAnnex 8-SK CHAIRPERSON'S CERTIFICATIONVermon JayNo ratings yet

- Ap-5907 CashDocument11 pagesAp-5907 CashSaoxalo ONo ratings yet

- MC- Bank Reconciliation and Proof of CashDocument4 pagesMC- Bank Reconciliation and Proof of CashGwen Ashley Dela PenaNo ratings yet

- A. Bank To Book MethodDocument5 pagesA. Bank To Book MethodDiane MagnayeNo ratings yet

- CCP102Document39 pagesCCP102api-3849444No ratings yet

- Individual AssignmentDocument6 pagesIndividual AssignmentSalim MohamedNo ratings yet

- Bank ReconciliationDocument64 pagesBank ReconciliationmarkjohnmagcalengNo ratings yet

- Bank ReconciliationDocument6 pagesBank ReconciliationXienaNo ratings yet

- Financial Accounting and Reporting: Cash and Cash EquivalentsDocument17 pagesFinancial Accounting and Reporting: Cash and Cash EquivalentsGabriel JacaNo ratings yet

- Aud ProbDocument21 pagesAud ProbCarmellae OrbitaNo ratings yet

- FAR2 BANK RECONCILIATION StudentDocument7 pagesFAR2 BANK RECONCILIATION StudentCHRISTIAN BETIANo ratings yet

- Module 2Document41 pagesModule 2Sujata SarkarNo ratings yet

- CCP102Document22 pagesCCP102api-3849444No ratings yet

- Bank Reconciliation Statement NumericalDocument6 pagesBank Reconciliation Statement NumericalTejas RajNo ratings yet

- Review - Practical Accounting 1Document2 pagesReview - Practical Accounting 1yes yesnoNo ratings yet

- Nudjpia Far and Afar Solutions - CashDocument5 pagesNudjpia Far and Afar Solutions - CashKyla Artuz Dela CruzNo ratings yet

- Audit of CashDocument9 pagesAudit of CashEmma Mariz Garcia25% (8)

- Cash AssignmentDocument2 pagesCash Assignmentyjkq4byrj6No ratings yet

- CASH AND CASH EQUIVALENTS BALANCESDocument8 pagesCASH AND CASH EQUIVALENTS BALANCESRonel CaagbayNo ratings yet

- Chapter 4-Cash & Cash EquivalentDocument14 pagesChapter 4-Cash & Cash EquivalentEmma Mariz Garcia75% (4)

- Bank Reconciliation StatementDocument32 pagesBank Reconciliation StatementMuhammad Arslan100% (2)

- CVCITC Quiz 1: Calculating Cash and Cash EquivalentsDocument10 pagesCVCITC Quiz 1: Calculating Cash and Cash EquivalentsTyrelle Dela CruzNo ratings yet

- Makeup Test Reviewer PDFDocument43 pagesMakeup Test Reviewer PDFandrea arapocNo ratings yet

- Quiz - CashDocument4 pagesQuiz - CashJustin ManaogNo ratings yet

- BankingDocument11 pagesBankingSg ShaNo ratings yet

- Kairavi Accounting PPT 9thDocument10 pagesKairavi Accounting PPT 9thKairavi GargNo ratings yet

- QUIZ 1 CASH With Answer KeyDocument8 pagesQUIZ 1 CASH With Answer KeyPrincess Vheil SagumNo ratings yet

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Business Quick Revision-1Document306 pagesBusiness Quick Revision-1Geoffrey ObongoNo ratings yet

- Bust Top Schools Trial ExamsDocument54 pagesBust Top Schools Trial ExamsGeoffrey ObongoNo ratings yet

- Business Studies F4 NotesDocument61 pagesBusiness Studies F4 NotesGeoffrey ObongoNo ratings yet

- BS Book 4 Lesson Notes-1Document89 pagesBS Book 4 Lesson Notes-1Geoffrey ObongoNo ratings yet

- BS 1 Lesson NotesDocument87 pagesBS 1 Lesson NotesGeoffrey ObongoNo ratings yet

- The Price List of The Indoor Playground Accessories From BettaplayDocument8 pagesThe Price List of The Indoor Playground Accessories From BettaplayЯрослав ЗолотовNo ratings yet

- Function of World Trade Organization (WTO)Document2 pagesFunction of World Trade Organization (WTO)MAHENDRA SHIVAJI DHENAK100% (1)

- PorscheCroatia 2017 0109Document5,256 pagesPorscheCroatia 2017 0109Mihael CigićNo ratings yet

- Payment Voucher Fnf23Document1 pagePayment Voucher Fnf23D E W A N ANo ratings yet

- Rent Reciepts 2022-2023Document6 pagesRent Reciepts 2022-2023durga selvaNo ratings yet

- Archive Copy: Booking ConfirmationDocument2 pagesArchive Copy: Booking ConfirmationegemenNo ratings yet

- Sales 2020 SmiiDocument182 pagesSales 2020 SmiiRicardo DelacruzNo ratings yet

- General RegsDocument108 pagesGeneral RegsTendai MwatumaNo ratings yet

- Nigeria's Structural Adjustment Program: Goals, Mechanisms and OutcomesDocument9 pagesNigeria's Structural Adjustment Program: Goals, Mechanisms and OutcomeskymhanNo ratings yet

- 1INDEA2022001Document90 pages1INDEA2022001Renata SilvaNo ratings yet

- Fashion E-Commerce in The United StatesDocument87 pagesFashion E-Commerce in The United StatesPratyush BaruaNo ratings yet

- Institutional Framework FOR International Business: Business R. M. JoshiDocument45 pagesInstitutional Framework FOR International Business: Business R. M. JoshiIshrat SonuNo ratings yet

- đường nhân gian đầy ải thương đauDocument4 pagesđường nhân gian đầy ải thương đauNguyễn Ngọc Phương LinhNo ratings yet

- Ch30 Money Growth and InflationDocument16 pagesCh30 Money Growth and InflationMộc TràNo ratings yet

- Teemage Builders Invoice 1Document3 pagesTeemage Builders Invoice 1ManikandanNo ratings yet

- India International Trade - ppt-SYLDocument12 pagesIndia International Trade - ppt-SYLsinghgajendra654100% (1)

- EFT Payments and Receipts Ex. 21 - 30Document14 pagesEFT Payments and Receipts Ex. 21 - 30Derick du ToitNo ratings yet

- European Yearbook of International Economic LawDocument292 pagesEuropean Yearbook of International Economic LawAAANo ratings yet

- Arthur Lewis and Industrial Development in The Caribbean: An AssessmentDocument32 pagesArthur Lewis and Industrial Development in The Caribbean: An AssessmentRichardson HolderNo ratings yet

- Prima Official Game GuideDocument120 pagesPrima Official Game GuidezotyoNo ratings yet

- International Trade TheoryDocument35 pagesInternational Trade TheorySachin MalhotraNo ratings yet

- The Future of The Monetary System 1674238557Document44 pagesThe Future of The Monetary System 1674238557juan ignacio tarullaNo ratings yet

- Market MasteryDocument79 pagesMarket MasteryFrancis Ejike100% (3)

- Bahamas Company Cash Items ReportDocument26 pagesBahamas Company Cash Items ReportMarie MagallanesNo ratings yet

- 12 Major Currency PairsDocument3 pages12 Major Currency PairsNeo AzrinNo ratings yet

- Germany BranchDocument2 pagesGermany BranchparuNo ratings yet

- Bangladesh Economic Review - Chapter 5Document20 pagesBangladesh Economic Review - Chapter 5Md. Abdur RakibNo ratings yet

- Problem Solving questions-IFTDocument18 pagesProblem Solving questions-IFTPiyush KothariNo ratings yet

- Postal Manual Volume VI Part IDocument564 pagesPostal Manual Volume VI Part Iatifmuhammad051988No ratings yet

- InvoiceDocument1 pageInvoiceSümît DãsNo ratings yet