Professional Documents

Culture Documents

Appendix 2: Economic and Financial Analysis For Adding Meat Goats To A Wool Growing Activity

Uploaded by

AzmiManNorOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Appendix 2: Economic and Financial Analysis For Adding Meat Goats To A Wool Growing Activity

Uploaded by

AzmiManNorCopyright:

Available Formats

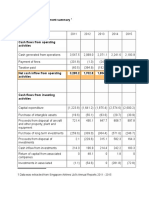

Appendix 2: Economic and financial analysis for adding meat goats to a wool growing activity.

Item Units Year

1 2 3 4 5 6 7 8 9 10

Economic Analysis

Benefits:

Income from goat sales $ 25,333 25,619 29,742 30,229 31,107 32,623 33,925 35,280 36,690 38,157

Value of labour freed up from 429 446 464 483 502 522 543 565 587 611

change in activitivies 20,768

Salvage value of goats 15,796

Disposal of merino sheep

Costs:

Variable costs-goat activity $ 3,972 4,131 4,296 4,468 4,646 4,832 5,025 5,226 5,435 5,653

Replacements of goats 0 0 1,941 8,621 9,511 9,937 10,186 10,753 11,018 11,630

Acquisition of goats 30,493

Net income no longer received 10,069 10,472 10,890 11,326 11,779 12,250 12,740 13,250 13,780 14,331

from merino sheep

Annual extra net cash flow before tax $ -2,976 11,463 13,078 6,298 5,673 6,126 6,516 6,616 7,044 27,921

Tax payable $ 947 734 641 2,560 1,267 1,447 1,581 1,662 1,813 2,020

Annual extra net cash after tax $ -3,923 10,729 12,437 3,737 4,405 4,678 4,935 4,954 5,230 25,901

Net Present Value at nominal discount rates after tax of 15% = $30,592

After tax Internal Rate of Return >30% 3

Financial Analysis

Item Year

1 2 3 4 5 6 7 8 9 10

$ $ $ $ $ $ $ $ $ $

Cumulative net cash flow after tax -3,923 6,610 18,576 23,003 28,511 34,339 40,868 47,718 55,174 83,655

Interest on cumulative deficit or surplus -196 -471 690 1,102 1,150 1,594 1,896 2,225 2,580 3,527

Cumulative net cash flow after -4,119 6,139 19,266 24,105 29,661 35,933 42,764 49,943 57,753 87,181

interest and tax

You might also like

- Public Healthcare-Global Equity Fund (Phgef) : Responsibility StatementDocument5 pagesPublic Healthcare-Global Equity Fund (Phgef) : Responsibility StatementAzmiManNorNo ratings yet

- Public Greater China Fund (PGCF) : Responsibility StatementDocument6 pagesPublic Greater China Fund (PGCF) : Responsibility StatementAzmiManNorNo ratings yet

- User Manual: AKASO Brave 4 Action CameraDocument31 pagesUser Manual: AKASO Brave 4 Action CameraAzmiManNorNo ratings yet

- User Manual: AKASO Brave 4 Action CameraDocument31 pagesUser Manual: AKASO Brave 4 Action CameraAzmiManNorNo ratings yet

- Authorization Letter - Vehicle Owner - RFID PDFDocument1 pageAuthorization Letter - Vehicle Owner - RFID PDFAzmiManNorNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5796)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Additional Tutorial Questions For Bad Debts AccountingDocument2 pagesAdditional Tutorial Questions For Bad Debts AccountingHenRy Pig Cyj0% (1)

- Chapter 1 Problems and Solutions EnglishDocument6 pagesChapter 1 Problems and Solutions EnglishyandaveNo ratings yet

- Memorandum of LawDocument13 pagesMemorandum of LawTheNoWhereMan100% (7)

- How To Start A Clothing Line PDFDocument6 pagesHow To Start A Clothing Line PDFSANDEEP KUMARNo ratings yet

- Dobbs - The NEWNEY Approach To Unscrambling The EuroDocument70 pagesDobbs - The NEWNEY Approach To Unscrambling The Euroonat85No ratings yet

- Philippine Christian University: Understanding Culture, Society, and Politics (G 12) W 9 MAY 4-8, 2020Document7 pagesPhilippine Christian University: Understanding Culture, Society, and Politics (G 12) W 9 MAY 4-8, 2020Adrian DoblasNo ratings yet

- 2nd Term Bus Study jss1Document1 page2nd Term Bus Study jss1Ayobami onifadeNo ratings yet

- McDonalds' Money Problems in ArgentinaDocument4 pagesMcDonalds' Money Problems in ArgentinaSuhas KiniNo ratings yet

- Model Question Paper RVO-IBBIDocument20 pagesModel Question Paper RVO-IBBIBhaskar Jain100% (1)

- New Income Slab Rates CalculationsDocument6 pagesNew Income Slab Rates Calculationsphani raja kumarNo ratings yet

- Debt WorksheetDocument5 pagesDebt Worksheetapi-340380090No ratings yet

- Real Options and Other Topics in Capital BudgetingDocument24 pagesReal Options and Other Topics in Capital BudgetingAJ100% (1)

- 5 Year Cash FlowDocument5 pages5 Year Cash FlowRith TryNo ratings yet

- Laurus LabsDocument32 pagesLaurus LabsAkash GowdaNo ratings yet

- 03 Application For Purchase of Premium Prize Bonds Registered IndiDocument1 page03 Application For Purchase of Premium Prize Bonds Registered IndiMuneeb AhmedNo ratings yet

- Kajaria PDFDocument20 pagesKajaria PDFvaibhav surekaNo ratings yet

- Swedbank: A Corporate PresentationDocument32 pagesSwedbank: A Corporate PresentationmeluojuNo ratings yet

- The Trial Balance of Norr LTD at 31 December 20x2Document1 pageThe Trial Balance of Norr LTD at 31 December 20x2Bube KachevskaNo ratings yet

- Equicapita Signs Agreement With ATB Corporate Financial Services For Acquisition FacilityDocument2 pagesEquicapita Signs Agreement With ATB Corporate Financial Services For Acquisition FacilityEquicapita Income TrustNo ratings yet

- English Essay NotesDocument3 pagesEnglish Essay NotesleaNo ratings yet

- 3 MonthDocument25 pages3 MonthUpendra SamadhiyaNo ratings yet

- Screen Euroclear (Grupo Comercial Noinu S.C) 10-02-2018Document24 pagesScreen Euroclear (Grupo Comercial Noinu S.C) 10-02-2018Alberto SarabiaNo ratings yet

- Kanrich PDFDocument20 pagesKanrich PDFRandora LkNo ratings yet

- Chapter 2 Financial Derivatives Use: A Literature ReviewDocument68 pagesChapter 2 Financial Derivatives Use: A Literature ReviewAyushi SiriyaNo ratings yet

- HuDocument13 pagesHujt626No ratings yet

- National Income: Three and Four Sector ModelDocument13 pagesNational Income: Three and Four Sector ModelKratika PandeyNo ratings yet

- Lockheed Tristar ProjectDocument1 pageLockheed Tristar ProjectDurgaprasad VelamalaNo ratings yet

- 7B Form GRA Original - Part499 PDFDocument1 page7B Form GRA Original - Part499 PDFRicardo SinghNo ratings yet

- EntriesDocument6 pagesEntriesThato theo mackenzieNo ratings yet

- Introduction To Primary Markets 010218Document4 pagesIntroduction To Primary Markets 010218chee pin wongNo ratings yet