Professional Documents

Culture Documents

Msci India Index Inr Gross

Uploaded by

chitranjan JegadeesanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Msci India Index Inr Gross

Uploaded by

chitranjan JegadeesanCopyright:

Available Formats

MSCI India Index (INR)

The MSCI India Index is designed to measure the performance of the large and mid cap segments of the Indian market. With 101

constituents, the index covers approximately 85% of the Indian equity universe.

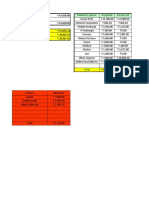

CUMULATIVE INDEX PERFORMANCE — GROSS RETURNS (INR) ANNUAL PERFORMANCE (%)

(OCT 2006 – OCT 2021) MSCI

Year MSCI India Emerging MSCI BRIC

Markets

MSCI India 2020 18.64 21.50 20.68

MSCI Emerging Markets 479.45 2019 9.98 21.54 25.84

MSCI BRIC 2018 1.39 -6.19 -5.09

400 2017 30.49 29.55 33.58

386.01

2016 1.12 14.50 15.29

370.34

2015 -1.61 -10.49 -9.08

2014 26.41 0.20 -0.56

2013 8.57 10.34 9.22

2012 29.96 22.39 18.53

200 2011 -25.38 -2.82 -8.16

2010 16.22 14.53 5.49

2009 93.71 70.99 84.84

2008 -56.28 -42.13 -49.74

50 2007 54.16 24.52 41.65

Oct 06 Jan 08 Apr 09 Jul 10 Oct 11 Jan 13 Apr 14 Jul 15 Oct 16 Jan 18 Apr 19 Jul 20 Oct 21

INDEX PERFORMANCE — GROSS RETURNS (%) (OCT 29, 2021) FUNDAMENTALS (OCT 29, 2021)

ANNUALIZED

1 Mo 3 Mo 1 Yr YTD 3 Yr 5 Yr 10 Yr DecSince Div Yld (%) P/E P/E Fwd P/BV

30, 1994

MSCI India 0.11 11.49 52.29 29.00 20.55 15.92 13.03 12.03 1.01 30.27 22.74 3.89

MSCI Emerging Markets 1.89 0.22 18.56 2.48 13.17 12.33 9.88 9.76 2.24 15.08 12.67 1.93

MSCI BRIC 2.28 0.30 6.93 -2.77 12.20 12.62 9.51 11.42 2.10 14.52 12.70 1.99

INDEX RISK AND RETURN CHARACTERISTICS (OCT 29, 2021)

ANNUALIZED STD DEV (%) 2 MAXIMUM DRAWDOWN

Turnover 3 Yr 5 Yr 10 Yr (%) Period YYYY-MM-DD

(%) 1

MSCI India 15.40 20.41 18.21 16.58 37.28 2020-01-17—2020-03-23

MSCI Emerging Markets 7.99 16.69 14.52 13.34 29.33 2020-01-17—2020-03-19

MSCI BRIC 10.28 16.85 15.13 15.22 63.74 2008-05-19—2008-10-27

1 2

Last 12 months Based on monthly gross returns data

The MSCI India Index was launched on Apr 30, 1993. Data prior to the launch date is back-tested data (i.e. calculations of how the index might have performed over that time

period had the index existed). There are frequently material differences between back-tested performance and actual results. Past performance -- whether actual or back-tested

-- is no indication or guarantee of future performance.

MSCI India Index (INR) | msci.com

OCT 29, 2021

INDEX CHARACTERISTICS TOP 10 CONSTITUENTS

MSCI India Float Adj Mkt Index Sector

Number of 101 Cap Wt. (%)

( INR Billions)

Constituents RELIANCE INDUSTRIES 7,235.29 10.16 Energy

Mkt Cap ( INR Millions)

INFOSYS 5,685.20 7.98 Info Tech

Index 71,218,120.62

HOUSING DEV FINANCE CORP 4,875.58 6.85 Financials

Largest 7,235,285.68 ICICI BANK 4,107.85 5.77 Financials

Smallest 132,107.20 TATA CONSULTANCY 3,142.11 4.41 Info Tech

Average 705,129.91 BAJAJ FINANCE 2,010.02 2.82 Financials

Median 352,706.72 HINDUSTAN UNILEVER 1,968.02 2.76 Cons Staples

BHARTI AIRTEL 1,693.78 2.38 Comm Srvcs

AXIS BANK 1,682.67 2.36 Financials

HCL TECHNOLOGIES 1,241.50 1.74 Info Tech

Total 33,642.03 47.24

FACTORS - KEY EXPOSURES THAT DRIVE RISK AND RETURN

MSCI FACTOR BOX MSCI FaCS

UNDERWEIGHT NEUTRAL OVERWEIGHT

VALUE

Relatively Inexpensive Stocks

LOW SIZE

Smaller Companies

MOMENTUM

Rising Stocks

QUALITY

Sound Balance Sheet Stocks

YIELD

Cash Flow Paid Out

LOW VOLATILITY

Lower Risk Stocks

MSCI FaCS provides absolute factor exposures

relative to a

<-1.5 0 +1.5< broad global index - MSCI ACWI IMI.

MSCI India MSCI Emerging Markets

Neutral factor exposure (FaCS = 0) represents

MSCI ACWI IMI.

SECTOR WEIGHTS

8.94% 8.23%

9.7% 5.07%

4.29%

4.1%

12.41%

3.29%

0.35%

17.18% 26.44%

Financials 26.44% Information Technology 17.18% Energy 12.41%

Materials 9.7% Consumer Staples 8.94% Consumer Discretionary 8.23%

Health Care 5.07% Industrials 4.29% Utilities 4.1%

Communication Services 3.29% Real Estate 0.35%

MSCI India Index (INR) | msci.com

OCT 29, 2021

INDEX METHODOLOGY

The index is based on the MSCI Global Investable Indexes (GIMI) Methodology—a comprehensive and consistent approach to

index construction that allows for meaningful global views and cross regional comparisons across all market capitalization size,

sector and style segments and combinations. This methodology aims to provide exhaustive coverage of the relevant investment

opportunity set with a strong emphasis on index liquidity, investability and replicability. The index is reviewed quarterly—in February,

May, August and November—with the objective of reflecting change in the underlying equity markets in a timely manner, while

limiting undue index turnover. During the May and November semi-annual index reviews, the index is rebalanced and the large and

mid capitalization cutoff points are recalculated.

FACTOR BOX AND FaCS METHODOLOGY

MSCI FaCS is a standard method (MSCI FaCS Methodology) for evaluating and reporting the Factor characteristics of equity

portfolios. MSCI FaCS consists of Factor Groups (e.g. Value, Size, Momentum, Quality, Yield, and Volatility) that have been

extensively documented in academic literature and validated by MSCI Research as key drivers of risk and return in equity

portfolios. These Factor Groups are constructed by aggregating 16 factors (e.g. Book-to-Price, Earnings/Dividend Yields, LT

Reversal, Leverage, Earnings Variability/Quality, Beta) from the latest Barra global equity factor risk model, GEMLT, designed to

make fund comparisons transparent and intuitive for use. The MSCI Factor Box, which is powered by MSCI FaCS, provides a

visualization designed to easily compare absolute exposures of funds/indexes and their benchmarks along 6 Factor Groups that

have historically demonstrated excess market returns over the long run.

ABOUT MSCI

MSCI is a leading provider of critical decision support tools and services for the global investment community. With over 45 years of expertise in research, data and technology, we power better investment

decisions by enabling clients to understand and analyze key drivers of risk and return and confidently build more effective portfolios. We create industry-leading research-enhanced solutions that clients use

to gain insight into and improve transparency across the investment process. To learn more, please visit www.msci.com.

The information contained herein (the "Information") may not be reproduced or redisseminated in whole or in part without prior written permission from MSCI. The Information may not be used to verify or

correct other data, to create indexes, risk models, or analytics, or in connection with issuing, offering, sponsoring, managing or marketing any securities, portfolios, financial products or other investment

vehicles. Historical data and analysis should not be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. None of the Information or MSCI index or other product

or service constitutes an offer to buy or sell, or a promotion or recommendation of, any security, financial instrument or product or trading strategy. Further, none of the Information or any MSCI index is

intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. The Information is provided "as is"

and the user of the Information assumes the entire risk of any use it may make or permit to be made of the Information. NONE OF MSCI INC. OR ANY OF ITS SUBSIDIARIES OR ITS OR THEIR DIRECT

OR INDIRECT SUPPLIERS OR ANY THIRD PARTY INVOLVED IN THE MAKING OR COMPILING OF THE INFORMATION (EACH, AN "MSCI PARTY") MAKES ANY WARRANTIES OR REPRESENTATIONS AND,

TO THE MAXIMUM EXTENT PERMITTED BY LAW, EACH MSCI PARTY HEREBY EXPRESSLY DISCLAIMS ALL IMPLIED WARRANTIES, INCLUDING WARRANTIES OF MERCHANTABILITY AND FITNESS FOR

A PARTICULAR PURPOSE. WITHOUT LIMITING ANY OF THE FOREGOING AND TO THE MAXIMUM EXTENT PERMITTED BY LAW, IN NO EVENT SHALL ANY OF THE MSCI PARTIES HAVE ANY LIABILITY

REGARDING ANY OF THE INFORMATION FOR ANY DIRECT, INDIRECT, SPECIAL, PUNITIVE, CONSEQUENTIAL (INCLUDING LOST PROFITS) OR ANY OTHER DAMAGES EVEN IF NOTIFIED OF THE POSSIBILITY

OF SUCH DAMAGES. The foregoing shall not exclude or limit any liability that may not by applicable law be excluded or limited.

© 2021 MSCI Inc. All rights reserved.

MSCI India Index (INR) | msci.com

You might also like

- How To Earn Money Blogging? (Top 10 Ways To Easily Earn $1k+ Per Month)Document34 pagesHow To Earn Money Blogging? (Top 10 Ways To Easily Earn $1k+ Per Month)Raginee Summoogum100% (1)

- Vertical Pumps Repairs Standards VPRSDocument44 pagesVertical Pumps Repairs Standards VPRSAlvialvarez100% (1)

- Barbrik Project Limited: Salary Slip For The Month: Jun-2019Document1 pageBarbrik Project Limited: Salary Slip For The Month: Jun-2019Sanjay Kumar PandeyNo ratings yet

- Math Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesFrom EverandMath Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesRating: 5 out of 5 stars5/5 (3)

- Cosmoprof North America 2012Document316 pagesCosmoprof North America 2012probeautyassociationNo ratings yet

- 1DSAP CHEAT SHEET Order To Cash (OTC) Process For SAP Functional Consultants Summary TabletDocument12 pages1DSAP CHEAT SHEET Order To Cash (OTC) Process For SAP Functional Consultants Summary TabletKunjunni MashNo ratings yet

- Mobileye - The Future of Driverless CarsDocument3 pagesMobileye - The Future of Driverless CarsMonica PandeyNo ratings yet

- Brand Awareness of Presto Lite BatteryDocument62 pagesBrand Awareness of Presto Lite Batteryravi_shah333No ratings yet

- Ecommerce Website Project ReportDocument11 pagesEcommerce Website Project ReportSaurav SumanNo ratings yet

- Q2, Module 2, Lesson 2Document9 pagesQ2, Module 2, Lesson 2Jerome A. Gomez67% (3)

- I. True or False: Pre TestDocument18 pagesI. True or False: Pre TestErina SmithNo ratings yet

- GANN MidPoint CalculatorDocument4 pagesGANN MidPoint Calculatorprasch100% (1)

- WhatsApp Payment Kumar Simplilearn CBAP PROJECT PDFDocument18 pagesWhatsApp Payment Kumar Simplilearn CBAP PROJECT PDFPriyanka Shrivastava100% (1)

- Msci India Index Inr GrossDocument3 pagesMsci India Index Inr Grosshakim shaikhNo ratings yet

- Msci India Index Inr GrossDocument3 pagesMsci India Index Inr Grosssantosh kumarNo ratings yet

- Msci India Index Inr GrossDocument3 pagesMsci India Index Inr Grossadcb704No ratings yet

- Msci India Index Inr GrossDocument3 pagesMsci India Index Inr GrossadityafantageNo ratings yet

- Msci India Domestic Small Cap Index Inr GrossDocument3 pagesMsci India Domestic Small Cap Index Inr Grossadcb704No ratings yet

- Msci World Index Usd PriceDocument3 pagesMsci World Index Usd PriceMario FighetosteNo ratings yet

- Msci Europe Real Estate Index Usd PriceDocument3 pagesMsci Europe Real Estate Index Usd Pricesoraya7560No ratings yet

- Msci World IndexDocument3 pagesMsci World IndexEzrah PlaisanceNo ratings yet

- Msci Japan IndexDocument3 pagesMsci Japan IndexCerio DuroNo ratings yet

- Msci Acwi Imi Index (Usd)Document3 pagesMsci Acwi Imi Index (Usd)Benigno AvilaNo ratings yet

- Msci Usa Index (Usd) : Cumulative Index Performance - Gross Returns (Usd) (DEC 2006 - DEC 2021) Annual Performance (%)Document3 pagesMsci Usa Index (Usd) : Cumulative Index Performance - Gross Returns (Usd) (DEC 2006 - DEC 2021) Annual Performance (%)Sahil GoyalNo ratings yet

- Msci India Domestic Mid Cap Index Inr GrossDocument3 pagesMsci India Domestic Mid Cap Index Inr Grossadcb704No ratings yet

- MSCI World Index (USD) : Cumulative Index Performance - Net Returns (Usd) (AUG 2006 - AUG 2021) Annual Performance (%)Document3 pagesMSCI World Index (USD) : Cumulative Index Performance - Net Returns (Usd) (AUG 2006 - AUG 2021) Annual Performance (%)Krishna MoorthiNo ratings yet

- Msci Indonesia Index NetDocument3 pagesMsci Indonesia Index NetMOCH IRFANNo ratings yet

- Msci World IndexDocument3 pagesMsci World IndexjjpepNo ratings yet

- Msci World IndexDocument3 pagesMsci World IndexVpnNo ratings yet

- Msci Acwi Growth Index Usd GrossDocument3 pagesMsci Acwi Growth Index Usd GrossAbudNo ratings yet

- MSCI World Value Index (USD)Document3 pagesMSCI World Value Index (USD)CajikNo ratings yet

- Msci Indonesia Index NetDocument3 pagesMsci Indonesia Index NetJuju PoilNo ratings yet

- Msci Ac Asia Islamic Index Usd GrossDocument3 pagesMsci Ac Asia Islamic Index Usd GrossAristo Elyan TambuwunNo ratings yet

- Msci India Momentum Index Inr PriceDocument3 pagesMsci India Momentum Index Inr Pricechitranjan JegadeesanNo ratings yet

- MSCI Emerging Markets Index (USD)Document3 pagesMSCI Emerging Markets Index (USD)karim1104No ratings yet

- Msci Indonesia Index NetDocument3 pagesMsci Indonesia Index NetAndyHNo ratings yet

- Msci Philippines Small Cap Index Usd NetDocument3 pagesMsci Philippines Small Cap Index Usd NetJose Dula IINo ratings yet

- Msci India Domestic Large Cap Index Inr GrossDocument3 pagesMsci India Domestic Large Cap Index Inr Grossadcb704No ratings yet

- Msci World Small Cap IndexDocument3 pagesMsci World Small Cap IndexrichardsonNo ratings yet

- MSCI Sri Lanka Index (USD)Document3 pagesMSCI Sri Lanka Index (USD)Chong Wai KenNo ratings yet

- MSCI World Index (USD) : Cumulative Index Performance - Gross Returns (Usd) (MAR 2008 - MAR 2023) Annual Performance (%)Document3 pagesMSCI World Index (USD) : Cumulative Index Performance - Gross Returns (Usd) (MAR 2008 - MAR 2023) Annual Performance (%)Cristhian MojarrangoNo ratings yet

- Msci Ac Asia Pacific Imi IslamicDocument3 pagesMsci Ac Asia Pacific Imi IslamicAristo Elyan TambuwunNo ratings yet

- Msci Indonesia Small Cap Index NetDocument2 pagesMsci Indonesia Small Cap Index NetMuhammad Fathin JuzarNo ratings yet

- MSCI Emerging Markets Index (USD)Document3 pagesMSCI Emerging Markets Index (USD)Dhanshyam LuckooNo ratings yet

- Msci Emerging Markets Index (Usd) : Cumulative Index Performance - Net Returns Annual PerformanceDocument3 pagesMsci Emerging Markets Index (Usd) : Cumulative Index Performance - Net Returns Annual PerformanceRehan FarhatNo ratings yet

- Msci Brazil Index NetDocument3 pagesMsci Brazil Index NetPavithraNo ratings yet

- Msci Indonesia Index NetDocument3 pagesMsci Indonesia Index Netmajalahbatik idnNo ratings yet

- MSCI Vietnam Index (USD)Document3 pagesMSCI Vietnam Index (USD)AlezNgNo ratings yet

- Msci Indonesia Index NetDocument3 pagesMsci Indonesia Index Netendjoy_adjaNo ratings yet

- MSCI Indonesia Index (USD)Document3 pagesMSCI Indonesia Index (USD)Frankie TseNo ratings yet

- Msci India Value Index (Inr) : Cumulative Index Performance - Price Returns Annual PerformanceDocument3 pagesMsci India Value Index (Inr) : Cumulative Index Performance - Price Returns Annual Performancekishore13No ratings yet

- Msci World Small Cap IndexDocument3 pagesMsci World Small Cap Indexodanodan84No ratings yet

- MSCI China All Shares Index (USD)Document3 pagesMSCI China All Shares Index (USD)J. BangjakNo ratings yet

- MSCI China Index (USD) : Cumulative Index Performance - Gross Returns (Usd) (FEB 2007 - FEB 2022) Annual Performance (%)Document3 pagesMSCI China Index (USD) : Cumulative Index Performance - Gross Returns (Usd) (FEB 2007 - FEB 2022) Annual Performance (%)testNo ratings yet

- Msci South East Asia Islamic Index Usd GrossDocument3 pagesMsci South East Asia Islamic Index Usd GrossAristo Elyan TambuwunNo ratings yet

- Msci Emerging Markets Index Usd NetDocument2 pagesMsci Emerging Markets Index Usd NetppNo ratings yet

- Msci Golden Dragon Index NetDocument3 pagesMsci Golden Dragon Index Netchandana kumarNo ratings yet

- Msci World Consumer Staples Index Usd NetDocument3 pagesMsci World Consumer Staples Index Usd Nettech.otakus.studioNo ratings yet

- Msci Indonesia Small Cap Index NetDocument3 pagesMsci Indonesia Small Cap Index Netodanodan84No ratings yet

- Untuk Kestabilan HayatiDocument3 pagesUntuk Kestabilan HayatiM Fahmi NNo ratings yet

- Msci BricDocument2 pagesMsci BricmentorvirtualNo ratings yet

- Msci Indonesia Index NetDocument3 pagesMsci Indonesia Index NetAbudNo ratings yet

- Msci Colombia Index NetDocument3 pagesMsci Colombia Index NetotmanjavierNo ratings yet

- Msci China Consumer Discretionary Index (CNY) : Cumulative Index Performance - Price Returns Annual PerformanceDocument2 pagesMsci China Consumer Discretionary Index (CNY) : Cumulative Index Performance - Price Returns Annual PerformanceHetanshNo ratings yet

- 2016 - 0624 Msci-World-IndexDocument2 pages2016 - 0624 Msci-World-IndexMarlee123No ratings yet

- Msci Indonesia Growth IndexDocument3 pagesMsci Indonesia Growth IndexAbudNo ratings yet

- Msci Ac Asia Pacific Islamic Index Usd GrossDocument3 pagesMsci Ac Asia Pacific Islamic Index Usd GrossAristo Elyan TambuwunNo ratings yet

- Msci India Index NetDocument3 pagesMsci India Index NetHimanshu RaiNo ratings yet

- Msci Philippines Index NetDocument3 pagesMsci Philippines Index Netjunnar jayNo ratings yet

- Msci Us Broad Market Index (Usd) : Cumulative Index Performance - Net Returns Annual PerformanceDocument2 pagesMsci Us Broad Market Index (Usd) : Cumulative Index Performance - Net Returns Annual PerformancePrayogoNo ratings yet

- Msci Emerging Markets Large Cap Index Usd GrossDocument3 pagesMsci Emerging Markets Large Cap Index Usd Grossadcb704No ratings yet

- Msci Ac Asia Health Care Index Usd NetDocument2 pagesMsci Ac Asia Health Care Index Usd NetDanu Ariya NugrahaNo ratings yet

- Personal Details: First Name Middle Name Last Name PAN Date of Birth Mobile Email Address Residential StatusDocument1 pagePersonal Details: First Name Middle Name Last Name PAN Date of Birth Mobile Email Address Residential Statuschitranjan JegadeesanNo ratings yet

- Usa Blank DS 160 Form C1DDocument9 pagesUsa Blank DS 160 Form C1Dchitranjan JegadeesanNo ratings yet

- Tradewise Tax PNL ReportDocument71 pagesTradewise Tax PNL Reportchitranjan JegadeesanNo ratings yet

- Return Amount: Monthly Salary Income Monthly Expense Projected Actual Cost Other IncomeDocument14 pagesReturn Amount: Monthly Salary Income Monthly Expense Projected Actual Cost Other Incomechitranjan JegadeesanNo ratings yet

- Momentum Strategies Based On Reward-Risk Stock Selection CriteriaDocument49 pagesMomentum Strategies Based On Reward-Risk Stock Selection Criteriachitranjan JegadeesanNo ratings yet

- 3354-Warwick 2021 Final RollDocument4,026 pages3354-Warwick 2021 Final Rollchitranjan JegadeesanNo ratings yet

- 2021 - School Tax Collectors - 202109231430507374Document1 page2021 - School Tax Collectors - 202109231430507374chitranjan JegadeesanNo ratings yet

- Qdoc - Tips Gann Calculator Excel BaseDocument3 pagesQdoc - Tips Gann Calculator Excel Basechitranjan JegadeesanNo ratings yet

- RPA Simp TieDocument2 pagesRPA Simp TieArshiya BegumNo ratings yet

- Roll 3 - 269128 Class Class 9 - N Name Hamza Abdul RehmanDocument1 pageRoll 3 - 269128 Class Class 9 - N Name Hamza Abdul Rehmanfloppaedits752No ratings yet

- Case Analysis: A Simple Strategy at Costco: Informative Background InformationDocument15 pagesCase Analysis: A Simple Strategy at Costco: Informative Background InformationFred Nazareno CerezoNo ratings yet

- LAI Insurance RequirementsDocument3 pagesLAI Insurance RequirementsMatthew EveringhamNo ratings yet

- Leac202 DebenturesDocument75 pagesLeac202 DebenturesMidhunidharNo ratings yet

- Analysis of Supply Chain in Siddhi Engineers: Interim Report ONDocument6 pagesAnalysis of Supply Chain in Siddhi Engineers: Interim Report ONantrikshaagrawalNo ratings yet

- Dharavi Redevelopment ProjectDocument1 pageDharavi Redevelopment ProjectDanish MallickNo ratings yet

- Company Secretarial Practice in BangladeshDocument7 pagesCompany Secretarial Practice in BangladeshMohammadOmarFaruq0% (1)

- Russia Global Economic Implications of The Russia-Ukraine War - Economist Intelligence UnitDocument3 pagesRussia Global Economic Implications of The Russia-Ukraine War - Economist Intelligence UnitAsdfgh Jklbhu100% (1)

- FOR Office USE Only: HDFC Life Sb/Ca/Cc/Sb-Nre/Sb-Nro/OtherDocument2 pagesFOR Office USE Only: HDFC Life Sb/Ca/Cc/Sb-Nre/Sb-Nro/OtherAnithaNo ratings yet

- Summary Strategic Management 2Document12 pagesSummary Strategic Management 2Mariët KrebsNo ratings yet

- Ys%, XLD M Dka S%L Iudcjd Ckrcfha .Eiü M %H: The Gazette of The Democratic Socialist Republic of Sri LankaDocument53 pagesYs%, XLD M Dka S%L Iudcjd Ckrcfha .Eiü M %H: The Gazette of The Democratic Socialist Republic of Sri LankaSanaka LogesNo ratings yet

- Statistics in The Crem As of October 2020Document11 pagesStatistics in The Crem As of October 2020kamijou08No ratings yet

- 1 s2.0 S0306457318306794 Main PDFDocument26 pages1 s2.0 S0306457318306794 Main PDFCharlène HebertNo ratings yet

- Unit-3: Project SelectionDocument101 pagesUnit-3: Project SelectionMandeep Singh BhatiaNo ratings yet

- BusplanDocument38 pagesBusplanCrissa MorescaNo ratings yet

- The Rise of The Inclusive ConsumerDocument6 pagesThe Rise of The Inclusive ConsumerpenstyloNo ratings yet

- Dunkin' Donuts: The History of The Phenomenal BrandDocument9 pagesDunkin' Donuts: The History of The Phenomenal BrandMacMac DañasNo ratings yet

- Emergency Management and Recovery Plan TemplateDocument28 pagesEmergency Management and Recovery Plan TemplateRay MeeNo ratings yet