Professional Documents

Culture Documents

MSCI Emerging Markets Index (USD)

Uploaded by

karim1104Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MSCI Emerging Markets Index (USD)

Uploaded by

karim1104Copyright:

Available Formats

MSCI Emerging Markets Index (USD)

The MSCI Emerging Markets Index captures large and mid cap representation across 26 Emerging Markets (EM) countries*.

With 1,401 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

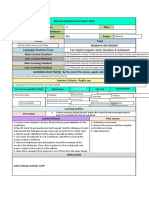

CUMULATIVE INDEX PERFORMANCE — NET RETURNS (USD) ANNUAL PERFORMANCE (%)

(FEB 2005 – FEB 2020) MSCI

Year Emerging MSCI ACWI MSCI World

Markets

MSCI Emerging Markets 2019 18.42 26.60 27.67

300 MSCI ACWI 2018 -14.57 -9.41 -8.71

MSCI World 2017 37.28 23.97 22.40

2016 11.19 7.86 7.51

246.30

2015 -14.92 -2.36 -0.87

244.52

2014 -2.19 4.16 4.94

242.79

200 2013 -2.60 22.80 26.68

2012 18.22 16.13 15.83

2011 -18.42 -7.35 -5.54

2010 18.88 12.67 11.76

2009 78.51 34.63 29.99

100

2008 -53.33 -42.19 -40.71

2007 39.42 11.66 9.04

50 2006 32.14 20.95 20.07

Feb 05 May 06 Aug 07 Nov 08 Feb 10 May 11 Aug 12 Nov 13 Feb 15 May 16 Aug 17 Nov 18 Feb 20

INDEX PERFORMANCE — NET RETURNS (%) ( FEB 28, 2020 ) FUNDAMENTALS ( FEB 28, 2020 )

ANNUALIZED

1 Mo 3 Mo 1 Yr YTD 3 Yr 5 Yr 10 Yr DecSince Div Yld (%) P/E P/E Fwd P/BV

29, 2000

MSCI Emerging Markets -5.27 -2.95 -1.88 -9.69 4.89 2.73 3.18 8.48 2.80 14.03 11.76 1.58

MSCI ACWI -8.08 -5.89 3.89 -9.09 6.96 5.55 8.10 5.04 2.60 17.55 14.90 2.21

MSCI World -8.45 -6.28 4.63 -9.01 7.24 5.88 8.75 4.95 2.58 18.18 15.47 2.34

INDEX RISK AND RETURN CHARACTERISTICS ( FEB 28, 2020 )

ANNUALIZED STD DEV (%) 2 SHARPE RATIO 2 , 3 MAXIMUM DRAWDOWN

Since

Turnover 3 Yr 5 Yr 10 Yr 3 Yr 5 Yr 10 Yr Dec 29, (%) Period YYYY-MM-DD

(%) 1 2000

MSCI Emerging Markets 11.62 14.81 16.12 17.22 0.27 0.17 0.22 0.41 65.25 2007-10-29—2008-10-27

MSCI ACWI 3.48 12.47 12.20 13.40 0.46 0.40 0.59 0.29 58.38 2007-10-31—2009-03-09

MSCI World 2.56 12.48 12.12 13.25 0.48 0.43 0.65 0.28 57.82 2007-10-31—2009-03-09

1 2 3

Last 12 months Based on monthly net returns data Based on ICE LIBOR 1M

* EM countries include: Argentina, Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Pakistan, Peru, Philippines,

Poland, Qatar, Russia, Saudi Arabia, South Africa, Taiwan, Thailand, Turkey and United Arab Emirates.

The MSCI Emerging Markets Index was launched on Jan 01, 2001. Data prior to the launch date is back-tested data (i.e. calculations of how the index might have performed

over that time period had the index existed). There are frequently material differences between back-tested performance and actual results. Past performance -- whether actual

or back-tested -- is no indication or guarantee of future performance.

MSCI Emerging Markets Index (USD) | msci.com

FEB 28, 2020

INDEX CHARACTERISTICS TOP 10 CONSTITUENTS

MSCI Emerging Markets Country Float Adj Mkt Index Sector

Number of 1,401 Cap Wt. (%)

( USD Billions)

Constituents ALIBABA GROUP HLDG ADR CN 352.00 6.26 Cons Discr

Mkt Cap ( USD Millions)

TENCENT HOLDINGS LI (CN) CN 283.97 5.05 Comm Srvcs

Index 5,620,817.93

TAIWAN SEMICONDUCTOR MFG TW 257.08 4.57 Info Tech

Largest 352,002.80 SAMSUNG ELECTRONICS CO KR 213.13 3.79 Info Tech

Smallest 83.21 CHINA CONSTRUCTION BK H CN 77.74 1.38 Financials

Average 4,012.00 NASPERS N ZA 66.39 1.18 Cons Discr

Median 1,490.89 PING AN INSURANCE H CN 62.11 1.10 Financials

RELIANCE INDUSTRIES IN 52.52 0.93 Energy

HOUSING DEV FINANCE CORP IN 49.42 0.88 Financials

CHINA MOBILE CN 48.32 0.86 Comm Srvcs

Total 1,462.69 26.02

FACTORS - KEY EXPOSURES THAT DRIVE RISK AND RETURN

MSCI FACTOR BOX MSCI FaCS

UNDERWEIGHT NEUTRAL OVERWEIGHT

VALUE

Relatively Inexpensive Stocks

LOW SIZE

Smaller Companies

MOMENTUM

Rising Stocks

QUALITY

Sound Balance Sheet Stocks

YIELD

Cash Flow Paid Out

LOW VOLATILITY

Lower Risk Stocks

MSCI FaCS provides absolute factor exposures

relative to a

<-1.5 0 +1.5< broad global index - MSCI ACWI IMI.

MSCI Emerging Markets MSCI ACWI

Neutral factor exposure (FaCS = 0) represents

MSCI ACWI IMI.

SECTOR WEIGHTS COUNTRY WEIGHTS

6.99% 6.65% 6.74%

6.29% 8.83% 24.51%

11.92%

5.16%

11.38%

3.07%

14.61% 2.95%

2.5% 12.11%

23.48%

16.39% 36.43%

Financials 23.48% Information Technology 16.39% Consumer Discretionary 14.61% China 36.43% Taiwan 12.11% South Korea 11.38% India 8.83%

Communication Services 11.92% Materials 6.99% Energy 6.65% Brazil 6.74% Other 24.51%

Consumer Staples 6.29% Industrials 5.16% Health Care 3.07%

Real Estate 2.95% Utilities 2.5%

MSCI Emerging Markets Index (USD) | msci.com

FEB 28, 2020

INDEX METHODOLOGY

The index is based on the MSCI Global Investable Market Indexes (GIMI) Methodology a comprehensive and consistent approach

to index construction that allows for meaningful global views and cross regional comparisons across all market capitalization size,

sector and style segments and combinations. This methodology aims to provide exhaustive coverage of the relevant investment

opportunity set with a strong emphasis on index liquidity, investability and replicability. The index is reviewed quarterly in February,

May, August and November with the objective of reflecting change in the underlying equity markets in a timely manner, while limiting

undue index turnover. During the May and November semi-annual index reviews, the index is rebalanced and the large and mid

capitalization cutoff points are recalculated.

FACTOR BOX AND FaCS METHODOLOGY

MSCI FaCS is a standard method (MSCI FaCS Methodology) for evaluating and reporting the Factor characteristics of equity

portfolios. MSCI FaCS consists of Factor Groups (e.g. Value, Size, Momentum, Quality, Yield, and Volatility) that have been

extensively documented in academic literature and validated by MSCI Research as key drivers of risk and return in equity

portfolios. These Factor Groups are constructed by aggregating 16 factors (e.g. Book-to-Price, Earnings/Dividend Yields, LT

Reversal, Leverage, Earnings Variability/Quality, Beta) from the latest Barra global equity factor risk model, GEMLT, designed to

make fund comparisons transparent and intuitive for use. The MSCI Factor Box, which is powered by MSCI FaCS, provides a

visualization designed to easily compare absolute exposures of funds/indexes and their benchmarks along 6 Factor Groups that

have historically demonstrated excess market returns over the long run.

ABOUT MSCI

MSCI is a leading provider of critical decision support tools and services for the global investment community. With over 45 years of expertise in research, data and technology, we power better investment

decisions by enabling clients to understand and analyze key drivers of risk and return and confidently build more effective portfolios. We create industry-leading research-enhanced solutions that clients use

to gain insight into and improve transparency across the investment process. To learn more, please visit www.msci.com.

The information contained herein (the "Information") may not be reproduced or redisseminated in whole or in part without prior written permission from MSCI. The Information may not be used to verify or

correct other data, to create indexes, risk models, or analytics, or in connection with issuing, offering, sponsoring, managing or marketing any securities, portfolios, financial products or other investment

vehicles. Historical data and analysis should not be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. None of the Information or MSCI index or other product

or service constitutes an offer to buy or sell, or a promotion or recommendation of, any security, financial instrument or product or trading strategy. Further, none of the Information or any MSCI index is

intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. The Information is provided "as is"

and the user of the Information assumes the entire risk of any use it may make or permit to be made of the Information. NONE OF MSCI INC. OR ANY OF ITS SUBSIDIARIES OR ITS OR THEIR DIRECT

OR INDIRECT SUPPLIERS OR ANY THIRD PARTY INVOLVED IN THE MAKING OR COMPILING OF THE INFORMATION (EACH, AN "MSCI PARTY") MAKES ANY WARRANTIES OR REPRESENTATIONS AND,

TO THE MAXIMUM EXTENT PERMITTED BY LAW, EACH MSCI PARTY HEREBY EXPRESSLY DISCLAIMS ALL IMPLIED WARRANTIES, INCLUDING WARRANTIES OF MERCHANTABILITY AND FITNESS FOR

A PARTICULAR PURPOSE. WITHOUT LIMITING ANY OF THE FOREGOING AND TO THE MAXIMUM EXTENT PERMITTED BY LAW, IN NO EVENT SHALL ANY OF THE MSCI PARTIES HAVE ANY LIABILITY

REGARDING ANY OF THE INFORMATION FOR ANY DIRECT, INDIRECT, SPECIAL, PUNITIVE, CONSEQUENTIAL (INCLUDING LOST PROFITS) OR ANY OTHER DAMAGES EVEN IF NOTIFIED OF THE POSSIBILITY

OF SUCH DAMAGES. The foregoing shall not exclude or limit any liability that may not by applicable law be excluded or limited.

© 2020 MSCI Inc. All rights reserved.

MSCI Emerging Markets Index (USD) | msci.com

You might also like

- Msci World Index Usd PriceDocument3 pagesMsci World Index Usd PriceMario FighetosteNo ratings yet

- THM07 Module 2 The Tourist Market and SegmentationDocument14 pagesTHM07 Module 2 The Tourist Market and Segmentationjennifer mirandaNo ratings yet

- MSCI Emerging Markets Index (USD)Document3 pagesMSCI Emerging Markets Index (USD)Dhanshyam LuckooNo ratings yet

- MSCI World Index (USD) : Cumulative Index Performance - Net Returns (Usd) (AUG 2006 - AUG 2021) Annual Performance (%)Document3 pagesMSCI World Index (USD) : Cumulative Index Performance - Net Returns (Usd) (AUG 2006 - AUG 2021) Annual Performance (%)Krishna MoorthiNo ratings yet

- Msci Indonesia Index NetDocument3 pagesMsci Indonesia Index NetJuju PoilNo ratings yet

- MSCI China Index (USD) : Cumulative Index Performance - Gross Returns (Usd) (FEB 2007 - FEB 2022) Annual Performance (%)Document3 pagesMSCI China Index (USD) : Cumulative Index Performance - Gross Returns (Usd) (FEB 2007 - FEB 2022) Annual Performance (%)testNo ratings yet

- Msci Emerging Markets Index (Usd) : Cumulative Index Performance - Net Returns Annual PerformanceDocument3 pagesMsci Emerging Markets Index (Usd) : Cumulative Index Performance - Net Returns Annual PerformanceRehan FarhatNo ratings yet

- Msci World IndexDocument3 pagesMsci World IndexEzrah PlaisanceNo ratings yet

- Msci Indonesia Index NetDocument3 pagesMsci Indonesia Index NetMOCH IRFANNo ratings yet

- Msci World Consumer Staples Index Usd NetDocument3 pagesMsci World Consumer Staples Index Usd Nettech.otakus.studioNo ratings yet

- Msci Indonesia Index NetDocument3 pagesMsci Indonesia Index Netendjoy_adjaNo ratings yet

- Msci Brazil Index NetDocument3 pagesMsci Brazil Index NetPavithraNo ratings yet

- MSCI World Index (USD) : Cumulative Index Performance - Gross Returns (Usd) (MAR 2008 - MAR 2023) Annual Performance (%)Document3 pagesMSCI World Index (USD) : Cumulative Index Performance - Gross Returns (Usd) (MAR 2008 - MAR 2023) Annual Performance (%)Cristhian MojarrangoNo ratings yet

- Msci World IndexDocument3 pagesMsci World IndexVpnNo ratings yet

- Untuk Kestabilan HayatiDocument3 pagesUntuk Kestabilan HayatiM Fahmi NNo ratings yet

- Msci Emerging Markets Index Usd NetDocument2 pagesMsci Emerging Markets Index Usd NetppNo ratings yet

- Msci Europe Real Estate Index Usd PriceDocument3 pagesMsci Europe Real Estate Index Usd Pricesoraya7560No ratings yet

- Msci World Small Cap IndexDocument3 pagesMsci World Small Cap IndexrichardsonNo ratings yet

- Msci Indonesia Index NetDocument3 pagesMsci Indonesia Index NetAndyHNo ratings yet

- Msci India Index NetDocument3 pagesMsci India Index NetHimanshu RaiNo ratings yet

- Msci Indonesia Index NetDocument3 pagesMsci Indonesia Index Netmajalahbatik idnNo ratings yet

- Msci Colombia Index NetDocument3 pagesMsci Colombia Index NetotmanjavierNo ratings yet

- Msci Philippines Index NetDocument3 pagesMsci Philippines Index Netjunnar jayNo ratings yet

- Msci Brazil IndexbnbDocument3 pagesMsci Brazil IndexbnbMatheus CarmoNo ratings yet

- Msci Acwi Growth Index Usd GrossDocument3 pagesMsci Acwi Growth Index Usd GrossAbudNo ratings yet

- Msci World IndexDocument3 pagesMsci World IndexjjpepNo ratings yet

- MSCI World Value Index (USD)Document3 pagesMSCI World Value Index (USD)CajikNo ratings yet

- Msci Acwi Imi Index (Usd)Document3 pagesMsci Acwi Imi Index (Usd)Benigno AvilaNo ratings yet

- Msci World Small Cap IndexDocument3 pagesMsci World Small Cap Indexodanodan84No ratings yet

- Msci Philippines Small Cap Index Usd NetDocument3 pagesMsci Philippines Small Cap Index Usd NetJose Dula IINo ratings yet

- Msci Indonesia Index NetDocument3 pagesMsci Indonesia Index NetAbudNo ratings yet

- Msci Japan IndexDocument3 pagesMsci Japan IndexCerio DuroNo ratings yet

- Msci India Index Inr GrossDocument3 pagesMsci India Index Inr Grosshakim shaikhNo ratings yet

- Msci India Index Inr GrossDocument3 pagesMsci India Index Inr GrossadityafantageNo ratings yet

- MSCI Vietnam Index (USD)Document3 pagesMSCI Vietnam Index (USD)AlezNgNo ratings yet

- Msci Ac Asia Islamic Index Usd GrossDocument3 pagesMsci Ac Asia Islamic Index Usd GrossAristo Elyan TambuwunNo ratings yet

- MSCI Indonesia Index (USD)Document3 pagesMSCI Indonesia Index (USD)Frankie TseNo ratings yet

- Msci Usa Index (Usd) : Cumulative Index Performance - Gross Returns (Usd) (DEC 2006 - DEC 2021) Annual Performance (%)Document3 pagesMsci Usa Index (Usd) : Cumulative Index Performance - Gross Returns (Usd) (DEC 2006 - DEC 2021) Annual Performance (%)Sahil GoyalNo ratings yet

- Msci India Index Inr GrossDocument3 pagesMsci India Index Inr Grossadcb704No ratings yet

- Msci Indonesia Small Cap Index NetDocument2 pagesMsci Indonesia Small Cap Index NetMuhammad Fathin JuzarNo ratings yet

- Msci Indonesia Small Cap Index NetDocument3 pagesMsci Indonesia Small Cap Index Netodanodan84No ratings yet

- 2016 - 0624 Msci-World-IndexDocument2 pages2016 - 0624 Msci-World-IndexMarlee123No ratings yet

- Msci India Index Inr GrossDocument3 pagesMsci India Index Inr Grosssantosh kumarNo ratings yet

- Msci Golden Dragon Index NetDocument3 pagesMsci Golden Dragon Index Netchandana kumarNo ratings yet

- Msci South East Asia Islamic Index Usd GrossDocument3 pagesMsci South East Asia Islamic Index Usd GrossAristo Elyan TambuwunNo ratings yet

- MSCI China All Shares Index (USD)Document3 pagesMSCI China All Shares Index (USD)J. BangjakNo ratings yet

- Msci India Momentum Index Inr PriceDocument3 pagesMsci India Momentum Index Inr Pricechitranjan JegadeesanNo ratings yet

- Msci Emerging Markets Large Cap Index Usd GrossDocument3 pagesMsci Emerging Markets Large Cap Index Usd Grossadcb704No ratings yet

- Msci India Index Inr GrossDocument3 pagesMsci India Index Inr Grosschitranjan JegadeesanNo ratings yet

- Msci BricDocument2 pagesMsci BricmentorvirtualNo ratings yet

- Msci Ac Asia Health Care Index Usd NetDocument2 pagesMsci Ac Asia Health Care Index Usd NetDanu Ariya NugrahaNo ratings yet

- Msci India Domestic Small Cap Index Inr GrossDocument3 pagesMsci India Domestic Small Cap Index Inr Grossadcb704No ratings yet

- MSCI Sri Lanka Index (USD)Document3 pagesMSCI Sri Lanka Index (USD)Chong Wai KenNo ratings yet

- Msci Ac Asia Pacific Imi IslamicDocument3 pagesMsci Ac Asia Pacific Imi IslamicAristo Elyan TambuwunNo ratings yet

- Msci India Value Index (Inr) : Cumulative Index Performance - Price Returns Annual PerformanceDocument3 pagesMsci India Value Index (Inr) : Cumulative Index Performance - Price Returns Annual Performancekishore13No ratings yet

- Msci India Domestic Large Cap Index Inr GrossDocument3 pagesMsci India Domestic Large Cap Index Inr Grossadcb704No ratings yet

- Msci Ac Asia Pacific Islamic Index Usd GrossDocument3 pagesMsci Ac Asia Pacific Islamic Index Usd GrossAristo Elyan TambuwunNo ratings yet

- Msci China Consumer Discretionary Index (CNY) : Cumulative Index Performance - Price Returns Annual PerformanceDocument2 pagesMsci China Consumer Discretionary Index (CNY) : Cumulative Index Performance - Price Returns Annual PerformanceHetanshNo ratings yet

- Msci India Domestic Mid Cap Index Inr GrossDocument3 pagesMsci India Domestic Mid Cap Index Inr Grossadcb704No ratings yet

- Msci Indonesia Growth IndexDocument3 pagesMsci Indonesia Growth IndexAbudNo ratings yet

- Government Publications: Key PapersFrom EverandGovernment Publications: Key PapersBernard M. FryNo ratings yet

- 1 MSCI Global Investable Market Indexes Methodology 20200212Document193 pages1 MSCI Global Investable Market Indexes Methodology 20200212karim1104No ratings yet

- 0 MSCI Fundamental Data Methodology 20190925Document70 pages0 MSCI Fundamental Data Methodology 20190925karim1104No ratings yet

- 0 MSCI Index Policies 20191029Document13 pages0 MSCI Index Policies 20191029karim1104No ratings yet

- 0 MSCI Index Glossary of Terms 20140620Document11 pages0 MSCI Index Glossary of Terms 20140620SwethaNo ratings yet

- MSCI Index Calculation Methodology - Jan 2020Document134 pagesMSCI Index Calculation Methodology - Jan 2020karim1104No ratings yet

- 0 INFORMATION DOCUMENT Description of Methodologies Set 20171113Document11 pages0 INFORMATION DOCUMENT Description of Methodologies Set 20171113SwethaNo ratings yet

- 0 MSCI Index Policies 20191029Document13 pages0 MSCI Index Policies 20191029karim1104No ratings yet

- MSCI Corporate Events Methodology Feb2020Document116 pagesMSCI Corporate Events Methodology Feb2020karim1104No ratings yet

- 0 MSCI Fundamental Data Methodology 20190925Document70 pages0 MSCI Fundamental Data Methodology 20190925karim1104No ratings yet

- MSCI Index Calculation Methodology - Jan 2020Document134 pagesMSCI Index Calculation Methodology - Jan 2020karim1104No ratings yet

- MSCI EM 50 Index Methodology 20190513Document14 pagesMSCI EM 50 Index Methodology 20190513karim1104No ratings yet

- MSCI Corporate Events Methodology Feb2020Document116 pagesMSCI Corporate Events Methodology Feb2020karim1104No ratings yet

- MSCI Index Calculation MethodologyDocument99 pagesMSCI Index Calculation MethodologyxaveoneNo ratings yet

- MSCI Index Calculation Methodology - Aug 2019Document130 pagesMSCI Index Calculation Methodology - Aug 2019karim1104No ratings yet

- MSCI Global Investable Market Indices Methodology Summary - May 2014Document13 pagesMSCI Global Investable Market Indices Methodology Summary - May 2014karim1104No ratings yet

- MSCI Corporate Events Methodology Feb2020Document116 pagesMSCI Corporate Events Methodology Feb2020karim1104No ratings yet

- MSCI Global Investable Market Indices Methodology - Feb 2015Document147 pagesMSCI Global Investable Market Indices Methodology - Feb 2015karim1104No ratings yet

- 0 INFORMATION DOCUMENT Description of Methodologies Set 20171113Document11 pages0 INFORMATION DOCUMENT Description of Methodologies Set 20171113SwethaNo ratings yet

- MSCI Global Investable Market Indices Methodology - May 2010Document114 pagesMSCI Global Investable Market Indices Methodology - May 2010karim1104No ratings yet

- 1 MSCI Global Investable Market Indexes Methodology 20200212Document193 pages1 MSCI Global Investable Market Indexes Methodology 20200212karim1104No ratings yet

- Predictability of Long-Term Spinoff Returns: John J. McconnellDocument19 pagesPredictability of Long-Term Spinoff Returns: John J. McconnellAdam KrajewskiNo ratings yet

- Vol26-2 Art2 PDFDocument16 pagesVol26-2 Art2 PDFGIRINo ratings yet

- Do Emerging Markets Benefit From Index InclusionDocument64 pagesDo Emerging Markets Benefit From Index Inclusionkarim1104No ratings yet

- The Cross-Section of Emerging Market Stock ReturnsDocument71 pagesThe Cross-Section of Emerging Market Stock Returnskarim1104No ratings yet

- Ips Rev 9.8 (Arabic)Document73 pagesIps Rev 9.8 (Arabic)ahmed morsyNo ratings yet

- PH Scale: Rules of PH ValueDocument6 pagesPH Scale: Rules of PH Valuemadhurirathi111No ratings yet

- Jamb Crk-Past QuestionDocument59 pagesJamb Crk-Past QuestionFadele1981No ratings yet

- Due Books List ECEDocument3 pagesDue Books List ECEMadhumithaNo ratings yet

- Coaching Manual RTC 8Document1 pageCoaching Manual RTC 8You fitNo ratings yet

- Machiavelli's Political Philosophy and Jamaican PoliticsDocument2 pagesMachiavelli's Political Philosophy and Jamaican PoliticsAndre RobinsonNo ratings yet

- Basic OmDocument242 pagesBasic OmRAMESH KUMARNo ratings yet

- History of Architecture VI: Unit 1Document20 pagesHistory of Architecture VI: Unit 1Srehari100% (1)

- Systems Analysis and Design 11th Edition Tilley Test BankDocument15 pagesSystems Analysis and Design 11th Edition Tilley Test Banksusanschroederoqdrkxtafn100% (15)

- 11 PJBUMI Digital Data Specialist DR NOOR AZLIZADocument7 pages11 PJBUMI Digital Data Specialist DR NOOR AZLIZAApexs GroupNo ratings yet

- Principles of Marketing: Quarter 1 - Module 6: Marketing ResearchDocument17 pagesPrinciples of Marketing: Quarter 1 - Module 6: Marketing ResearchAmber Dela Cruz100% (1)

- Historical Background of Land Ownership in The PhilippinesDocument2 pagesHistorical Background of Land Ownership in The Philippinesjohn100% (1)

- 173544avaya Aura AES 7-0 JTAPI Programmers GuideDocument88 pages173544avaya Aura AES 7-0 JTAPI Programmers GuideAhmed SakrNo ratings yet

- Bba 2ND Year Business Communication NotesDocument11 pagesBba 2ND Year Business Communication NotesDivya MishraNo ratings yet

- Chronology of Events:: Account: North Davao Mining Corp (NDMC)Document2 pagesChronology of Events:: Account: North Davao Mining Corp (NDMC)John Robert BautistaNo ratings yet

- Reflexive PronounsDocument2 pagesReflexive Pronounsquely8343% (7)

- Schopenhauer and KantDocument8 pagesSchopenhauer and KantshawnNo ratings yet

- Bed BathDocument6 pagesBed BathKristil ChavezNo ratings yet

- PFASDocument8 pagesPFAS王子瑜No ratings yet

- The Relationship Between Law and MoralityDocument12 pagesThe Relationship Between Law and MoralityAnthony JosephNo ratings yet

- Degree Program Cheongju UniversityDocument10 pagesDegree Program Cheongju University심AvanNo ratings yet

- Planning and Design of A Cricket StadiumDocument14 pagesPlanning and Design of A Cricket StadiumTenu Sara Thomas50% (6)

- 3RD Last RPHDocument5 pages3RD Last RPHAdil Mohamad KadriNo ratings yet

- UNIT VI. Gunpowder and ExplosivesDocument6 pagesUNIT VI. Gunpowder and ExplosivesMariz Althea Jem BrionesNo ratings yet

- D3Document2 pagesD3zyaNo ratings yet

- TRYOUT1Document8 pagesTRYOUT1Zaenul WafaNo ratings yet

- Jeoparty Fraud Week 2022 EditableDocument65 pagesJeoparty Fraud Week 2022 EditableRhea SimoneNo ratings yet

- SBMPTN 2016 Kode 333Document6 pagesSBMPTN 2016 Kode 333Allisa MasithaNo ratings yet

- Molly On The Shore by Percy Grainger Unit StudyDocument5 pagesMolly On The Shore by Percy Grainger Unit Studyapi-659613441No ratings yet