Professional Documents

Culture Documents

Case Cereal Company

Case Cereal Company

Uploaded by

Samelyn SabadoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case Cereal Company

Case Cereal Company

Uploaded by

Samelyn SabadoCopyright:

Available Formats

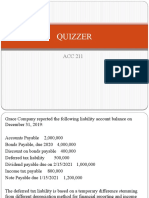

Problem 2-5 (AICPA Adapted)

Case Cereal Company distributed coupons to promote new products.

On October 1, 2019, the entity mailed 100,000 coupons for P45 off each box of cereal purchased.

The entity expected 12,000 of these coupons to be redeemed before the December 31, 2019 expiration

date.

It takes 30 days from the redemption date for the entity to receive the coupons from the retailers.

The entity reimbursed the retailers an additional P5 for each coupon redeemed.

On December 31, 2019, the entity had paid retailers P250,000 related to these coupons and had 5,000

coupons on hand that had not been processed for payment.

1. What amount should be reported as liability for coupons on December 31, 2019?

a. 350,000

b. 290,000

c. 250,000

d. 225,000

Solution 2-5

Answer a

Coupons expected to be redeemed 12,000

Multiply by payment for each coupon (45 + 5) 50

Total liability for coupons 600,000

Payments on December 31, 2019 (250,000)

Liability for coupons - December 31, 2019 350,000

The coupon liability on December 31, 2019 is not reduced by the 5,000 coupons on hand because the

coupons had not been processed for payment.

You might also like

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Current Liab ProblemsDocument6 pagesCurrent Liab ProblemsSharon LotinoNo ratings yet

- 1 Liabpdf PDF FreeDocument25 pages1 Liabpdf PDF FreekianamarieNo ratings yet

- Financial Accounting 2 - Liabilities (Solving) Multiple ChoiceDocument16 pagesFinancial Accounting 2 - Liabilities (Solving) Multiple ChoiceNicole Andrea TuazonNo ratings yet

- Chapter 41 - Reclassification of Financial Asset: PROBLEM 41 - 3 (IFRS - From The Amortized Cost To FVOCI)Document5 pagesChapter 41 - Reclassification of Financial Asset: PROBLEM 41 - 3 (IFRS - From The Amortized Cost To FVOCI)Reinalyn Mendoza75% (4)

- Cannon Ball Review Part 4Document20 pagesCannon Ball Review Part 4Jhopel Casagnap Eman100% (1)

- (TEST BANK and SOL) Current LiabilitiesDocument5 pages(TEST BANK and SOL) Current LiabilitiesJhazz DoNo ratings yet

- Quiz COST ACCOUNTING AND CONTROLDocument2 pagesQuiz COST ACCOUNTING AND CONTROLSamelyn SabadoNo ratings yet

- Current Liabilities Quiz No. 1 (September 10, 2020)Document5 pagesCurrent Liabilities Quiz No. 1 (September 10, 2020)Carlo De VeraNo ratings yet

- Employee Benefits Part 1Document12 pagesEmployee Benefits Part 1Khiks ObiasNo ratings yet

- Intermediate Accounting 2 Reviewer PDFDocument133 pagesIntermediate Accounting 2 Reviewer PDFCarl CagampzNo ratings yet

- Notes Receivable Test Bank PDFDocument7 pagesNotes Receivable Test Bank PDFAB CloydNo ratings yet

- Quiz Notes and Loans Receivable SY 2022 2023 SolutionDocument4 pagesQuiz Notes and Loans Receivable SY 2022 2023 Solutionreagan blaireNo ratings yet

- LIABILITIESDocument5 pagesLIABILITIESKate FernandezNo ratings yet

- ACC211 Review-Material PremiumDocument2 pagesACC211 Review-Material PremiumLexter Dave C EstoqueNo ratings yet

- AE 121 Prelim Quiz 1 THEORIES (10 Items X 2 Points 20 POINTS)Document10 pagesAE 121 Prelim Quiz 1 THEORIES (10 Items X 2 Points 20 POINTS)Eryn GabrielleNo ratings yet

- Premiums and WarrantyDocument8 pagesPremiums and WarrantyMarela Velasquez100% (2)

- Fair Value Adjustment 44,305: Unrealized Gain (Or Cummulative Amount of OCI) 8,730Document2 pagesFair Value Adjustment 44,305: Unrealized Gain (Or Cummulative Amount of OCI) 8,730Gray Javier100% (1)

- Practical Accounting 1Document22 pagesPractical Accounting 1Mica Gonzales63% (8)

- Homework On Current LiabilitiesDocument3 pagesHomework On Current LiabilitiesalyssaNo ratings yet

- Jollibee Foods-WPS OfficeDocument2 pagesJollibee Foods-WPS OfficeAramina Cabigting BocNo ratings yet

- FEU LQ1 Intermediate Acctg 2-1Document3 pagesFEU LQ1 Intermediate Acctg 2-1Andre G. LagamiaNo ratings yet

- Current LiabilitiesDocument3 pagesCurrent LiabilitiesAhlaya Lyrica Cadence SadoresNo ratings yet

- Q & A IntaccDocument9 pagesQ & A IntaccAramina Cabigting BocNo ratings yet

- Quiz - M1 M2Document12 pagesQuiz - M1 M2Jenz Crisha PazNo ratings yet

- Quiz On LiabilitiesDocument5 pagesQuiz On LiabilitiesDewdrop Mae RafananNo ratings yet

- Receivables QuizDocument3 pagesReceivables QuizAshianna KimNo ratings yet

- Assessment Task 2Document4 pagesAssessment Task 2Christian N MagsinoNo ratings yet

- Answer Key - M1L4 PDFDocument4 pagesAnswer Key - M1L4 PDFEricka Mher IsletaNo ratings yet

- IA2 Quiz 1 QuestionsDocument6 pagesIA2 Quiz 1 QuestionsJames Daniel SwintonNo ratings yet

- Reviewer For Mid Term ExamDocument12 pagesReviewer For Mid Term ExamJannelle SalacNo ratings yet

- Boslon Audit3 Quiz 2Document6 pagesBoslon Audit3 Quiz 2Ra Dela RamaNo ratings yet

- Fair Value of Bonds at December 31, 2019 5,250,000 Carrying Value of Bonds at December 31, 2019 4,600,000Document2 pagesFair Value of Bonds at December 31, 2019 5,250,000 Carrying Value of Bonds at December 31, 2019 4,600,000Gray JavierNo ratings yet

- First Activity, IntacDocument7 pagesFirst Activity, IntacLiwanag, NikkoNo ratings yet

- Solutions For Seatwork 2Document3 pagesSolutions For Seatwork 2Daisy Jane V. CamalingNo ratings yet

- CE - LiabilitiesDocument7 pagesCE - LiabilitiesJohn WIckNo ratings yet

- Audprob Answer 3 and 4Document2 pagesAudprob Answer 3 and 4venice cambryNo ratings yet

- Quiz 2 Current Liabilities and ProvisionsDocument2 pagesQuiz 2 Current Liabilities and ProvisionsJapon, Jenn RossNo ratings yet

- Financial Accounting & Reporting 2: Sec - 7 - Short Quiz 1 SolutionDocument4 pagesFinancial Accounting & Reporting 2: Sec - 7 - Short Quiz 1 SolutionDump DumpNo ratings yet

- Answer: Prepaid Insurance ($3,200 X 6/12) $1,600 Total Prepaid Expenses $3,600Document7 pagesAnswer: Prepaid Insurance ($3,200 X 6/12) $1,600 Total Prepaid Expenses $3,600blahblahblah100% (1)

- Fa4 Prelim Exercises 1 Fa4 Current - LiabilitiesDocument6 pagesFa4 Prelim Exercises 1 Fa4 Current - LiabilitiesatashajaylevelasquezNo ratings yet

- BANGAN ReceivablesDocument6 pagesBANGAN ReceivablesJenna BanganNo ratings yet

- Solutions - LiabilitiesDocument10 pagesSolutions - LiabilitiesjhobsNo ratings yet

- AP Long Test 3 - LiabilitiesDocument9 pagesAP Long Test 3 - LiabilitiesjasfNo ratings yet

- Audit of Liabilities - Set ADocument5 pagesAudit of Liabilities - Set AZyrah Mae SaezNo ratings yet

- Intermediate - Accounting - 2 - Quiz - 1.pdf Filename - UTF-8''InterDocument3 pagesIntermediate - Accounting - 2 - Quiz - 1.pdf Filename - UTF-8''InterClaire Magbunag AntidoNo ratings yet

- Homework 5 - Current Liabilities - RevisedDocument3 pagesHomework 5 - Current Liabilities - RevisedalvarezxpatriciaNo ratings yet

- Accounting 4 - Employee Benefits Computational - PDF - ... : End of PreviewDocument1 pageAccounting 4 - Employee Benefits Computational - PDF - ... : End of Previewfreymart18No ratings yet

- INTEG 2024 FARP Topic 10. LIABILITIESDocument6 pagesINTEG 2024 FARP Topic 10. LIABILITIESIchyy BoiNo ratings yet

- Impairment of ReceivablesDocument15 pagesImpairment of ReceivablesNicole Daphne FigueroaNo ratings yet

- Quiz - (Evening Class)Document4 pagesQuiz - (Evening Class)JeonNo ratings yet

- 6011ASSIGNMENTDocument8 pages6011ASSIGNMENTpathiranapremabanduNo ratings yet

- Chapter 20 - Effective Interest Method (Amortized Cost, FVOCI, FVPL)Document66 pagesChapter 20 - Effective Interest Method (Amortized Cost, FVOCI, FVPL)Never Letting GoNo ratings yet

- Far Review - Notes and Receivable AssessmentDocument6 pagesFar Review - Notes and Receivable AssessmentLuisa Janelle BoquirenNo ratings yet

- Ea 2 AcctgDocument8 pagesEa 2 AcctgKc SevillaNo ratings yet

- Quiz No. 4 Problems & SolutionsDocument5 pagesQuiz No. 4 Problems & SolutionsRiezel PepitoNo ratings yet

- ACAE 15 Activity - Investment in Bonds: Problem 1Document5 pagesACAE 15 Activity - Investment in Bonds: Problem 1Nick ivan AlvaresNo ratings yet

- RtgsDocument3 pagesRtgsFungaiNo ratings yet

- Quiz No. 4 Problems & SolutionsDocument5 pagesQuiz No. 4 Problems & SolutionsRiezel PepitoNo ratings yet

- ULCR Investment Consultants Investor’s Course “The Ultimate Investor’s Educational Learning Experience on Earth...”From EverandULCR Investment Consultants Investor’s Course “The Ultimate Investor’s Educational Learning Experience on Earth...”No ratings yet

- 135-Article Text-875-1-10-20220509Document14 pages135-Article Text-875-1-10-20220509Samelyn SabadoNo ratings yet

- Activity On AccountingDocument2 pagesActivity On AccountingSamelyn SabadoNo ratings yet

- Partnership Operation ActivityDocument2 pagesPartnership Operation ActivitySamelyn SabadoNo ratings yet

- ENGLISH + (First Lesson)Document13 pagesENGLISH + (First Lesson)Samelyn SabadoNo ratings yet

- Final Requirement - First EntryDocument2 pagesFinal Requirement - First EntrySamelyn SabadoNo ratings yet