Professional Documents

Culture Documents

1,,BFI 327 Course Outline

Uploaded by

Kelvin mwaiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1,,BFI 327 Course Outline

Uploaded by

Kelvin mwaiCopyright:

Available Formats

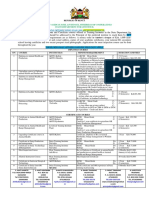

University of Embu

Department of Business and Economics

Course code: BFI 327 Academic year: 2021/22

Course Title: MONETARY THEORY AND PRACTICE

COURSE OUTLINE FORM

INSTRUCTOR: Dr. Karambu Kiende Gatimbu, PhD, CPA-K

EMAIL: kiende.gatimbu@embuni.ac.ke

PURPOSE: to introduce the learner to both the monetary and fiscal policies employed by the government

and their economic implication.

Expected learning outcomes

evaluate the role of money in the economy’

apply the Keynesian theory of money demand in the economy

understand the theories of money supply and demand

understand how monetary policy works

Week/ Date Lecture Topic Remarks

Role of money in the macro-economy

1: Expected

Money and banking

Barter system

Functions and importance of money

Qualities of good money material

Value of money

Money supply: simple deposit multiplier, the multi-

2, 3,4&5: Expected

deposit multiplier; Determinants of money supply;

Changes in the monetary base;

Money demand: theories of money demand - classical

theories, Keynesian theory, the modern quantity theory,

the general equilibrium approach, the monetarist theory,

the new classical theory, the new Keynesian theory.

Banking system

6&7: Expected

Commercial banks- functions, advantages

Central bank of Kenya- functions

Method of credit control

8: CAT 1 Expected

Monetary policy

9&10: Expected

Limitations of monetary policy

Monetary policy objectives

Instruments of monetary policy

Expansionary and contractionary monetary effects

11: CAT 2 Expected

Money and Inflation

12: Expected

Types, causes, effects of inflation

Anti- inflationary measures-monetary, fiscal and

non-monetary measures

13: Revision. Expected

14 & 15 Examination

Course Delivery Methodology

A combination of lectures, discussions and Library research

Course Evaluation

Assignments 10%

CATs 20%

Exam 70%

Total 100%

Reference Texts

1. Carl E Walsh (1998) Monetary Theory and Policy, MIT Press

2. Harris L (2004) Monetary Theory McGrawhill

3. Mankiw N.G & Mark P.T(2006) Economics Thomsons Learning UK

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- International Trade (Multiple Choice Questions)Document8 pagesInternational Trade (Multiple Choice Questions)Nick100% (2)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Securities Analysis and Portfolio Management PDFDocument64 pagesSecurities Analysis and Portfolio Management PDFShreya s shetty100% (1)

- Portfolio ManagementDocument71 pagesPortfolio ManagementAnantha Nag100% (1)

- Alex Frey, Ivy Bytes-A Beginner's Guide To Investing How To Grow Your Money The Smart and Easy Way - Ivy Bytes (2011)Document53 pagesAlex Frey, Ivy Bytes-A Beginner's Guide To Investing How To Grow Your Money The Smart and Easy Way - Ivy Bytes (2011)miche345100% (1)

- International Business Environment PDFDocument298 pagesInternational Business Environment PDFHarmeet AnandNo ratings yet

- Correlating The Chemical Engineering Plant Cost Index With Macro-Economic IndicatorsDocument10 pagesCorrelating The Chemical Engineering Plant Cost Index With Macro-Economic IndicatorsCraftychemist100% (1)

- CIPS L4-Business Needs in Procurement and SupplyDocument131 pagesCIPS L4-Business Needs in Procurement and SupplyAsheque Iqbal100% (3)

- 2015 ACI Airport Economics Report - Preview - FINAL - WEBDocument12 pages2015 ACI Airport Economics Report - Preview - FINAL - WEBEloy Mora VargasNo ratings yet

- Group Assignment Eco211 - Mac 2021 - EditDocument3 pagesGroup Assignment Eco211 - Mac 2021 - EditwnathirahNo ratings yet

- Theories of Bureucracy According To Max WemberDocument3 pagesTheories of Bureucracy According To Max WemberKelvin mwaiNo ratings yet

- Bba 301-Module-Lesson 2Document17 pagesBba 301-Module-Lesson 2Kelvin mwaiNo ratings yet

- Topic Eight Risk ManagementDocument24 pagesTopic Eight Risk ManagementKelvin mwaiNo ratings yet

- 2,,ethical TheoriesDocument45 pages2,,ethical TheoriesKelvin mwaiNo ratings yet

- 2,,working Capital ManagementDocument19 pages2,,working Capital ManagementKelvin mwaiNo ratings yet

- Bba 301-Module-LessonDocument25 pagesBba 301-Module-LessonKelvin mwaiNo ratings yet

- 2,,lesson Two-International Business EnvironmentDocument34 pages2,,lesson Two-International Business EnvironmentKelvin mwaiNo ratings yet

- Bac 205 Aeb 403 M.A Course OutlineDocument2 pagesBac 205 Aeb 403 M.A Course OutlineKelvin mwaiNo ratings yet

- Bac 209 Course OutlineDocument3 pagesBac 209 Course OutlineKelvin mwaiNo ratings yet

- 1,,WEEK 1-2 - Introduction To Capital BudgetingDocument31 pages1,,WEEK 1-2 - Introduction To Capital BudgetingKelvin mwaiNo ratings yet

- 0,,BBA 305, Business Values and EthicsDocument2 pages0,,BBA 305, Business Values and EthicsKelvin mwaiNo ratings yet

- Accounting For PartnetshipDocument36 pagesAccounting For PartnetshipKelvin mwaiNo ratings yet

- Notes - Quantitative MethodsDocument4 pagesNotes - Quantitative MethodsKelvin mwaiNo ratings yet

- Plant or Facility LayoutDocument9 pagesPlant or Facility LayoutKelvin mwaiNo ratings yet

- Topic One: Introduction General OverviewDocument27 pagesTopic One: Introduction General OverviewKelvin mwaiNo ratings yet

- Financial Inclusion in Rwanda An Analysis of Role Played IJMSBADocument8 pagesFinancial Inclusion in Rwanda An Analysis of Role Played IJMSBAKelvin mwaiNo ratings yet

- Introduction To EntreprenuershipDocument106 pagesIntroduction To EntreprenuershipKelvin mwaiNo ratings yet

- Recruitment Adverts 2020Document3 pagesRecruitment Adverts 2020Kelvin mwaiNo ratings yet

- NOVEMBER 2020. Application Requirements Are As Follows: A Money OrderDocument1 pageNOVEMBER 2020. Application Requirements Are As Follows: A Money OrderKelvin mwaiNo ratings yet

- Notes - QT 3rd LessonDocument7 pagesNotes - QT 3rd LessonKelvin mwaiNo ratings yet

- Chap 011 NotesDocument10 pagesChap 011 Notesfree50No ratings yet

- Qdoc - Tips Hoc Anh Van Cung Thay Developing Skills For The ToDocument40 pagesQdoc - Tips Hoc Anh Van Cung Thay Developing Skills For The ToKiên Đỗ TrungNo ratings yet

- Assignment 7 Econ 343Document9 pagesAssignment 7 Econ 343Jack BNo ratings yet

- 20181112111447443373Document62 pages20181112111447443373Stiven OlivarNo ratings yet

- Engineering Economic AnalysisDocument8 pagesEngineering Economic Analysischhetribharat08No ratings yet

- Zone1 FMS Delhi HavellsDocument31 pagesZone1 FMS Delhi HavellsSharad MundharaNo ratings yet

- In Gold We Trust Report 2014Document94 pagesIn Gold We Trust Report 2014ZerohedgeNo ratings yet

- The Wall Street Journal - 16.06.2021Document32 pagesThe Wall Street Journal - 16.06.2021Adolfo PerezNo ratings yet

- PRM1 - Assignment 2Document16 pagesPRM1 - Assignment 2Dawn SimNo ratings yet

- Pacific-Basin Finance Journal: Dinh Hoang Bach Phan, Paresh Kumar Narayan, R. Eki Rahman, Akhis R. Hutabarat TDocument13 pagesPacific-Basin Finance Journal: Dinh Hoang Bach Phan, Paresh Kumar Narayan, R. Eki Rahman, Akhis R. Hutabarat TZella Qaulan QarimahNo ratings yet

- Swot Analysis of Revlon IncDocument5 pagesSwot Analysis of Revlon IncSubhana AsimNo ratings yet

- WEF Global Risks Report 2023 (1) (01-25)Document25 pagesWEF Global Risks Report 2023 (1) (01-25)Juan Esteban Rodriguez EspitiaNo ratings yet

- COVID-19 Economic Impact - Malaysia - 080420 PDFDocument25 pagesCOVID-19 Economic Impact - Malaysia - 080420 PDFmuhamadrafie1975100% (1)

- Economics: Number Key Number Key Number KeyDocument11 pagesEconomics: Number Key Number Key Number KeySilenceNo ratings yet

- Global Impact of Russia-Ukraine Conflict PDFDocument7 pagesGlobal Impact of Russia-Ukraine Conflict PDFBipul RahulNo ratings yet

- Mcs 035Document256 pagesMcs 035Urvashi Roy100% (1)

- Forest Voice Summer 2003Document16 pagesForest Voice Summer 2003SolomonidouKostasNo ratings yet

- The Mirage of ModinomicsDocument18 pagesThe Mirage of ModinomicsparamjitNo ratings yet

- CROWN CementDocument23 pagesCROWN CementRahim RahiNo ratings yet

- Analyzing The Effects of Contemporary Issues Affecting The Filipino Entrepreneur Practice Task 1Document2 pagesAnalyzing The Effects of Contemporary Issues Affecting The Filipino Entrepreneur Practice Task 1Chachie ChieNo ratings yet

- Challenges of Urbanization BangladeshDocument22 pagesChallenges of Urbanization BangladeshSyed R Monjur86% (7)