Professional Documents

Culture Documents

PRESENTATION Flow Organization of Banks

Uploaded by

TrudgeOnOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PRESENTATION Flow Organization of Banks

Uploaded by

TrudgeOnCopyright:

Available Formats

1. Organization of banks.

a. How do banks organize? Who supervises their organization? Okay, for this, let us

refer to Sec. 8 of R.A. 8791, GENERAL BANKING LAW OF 2000.

CHAPTER III

ORGANIZATION, MANAGEMENT AND ADMINISTRATION OF BANKS. QUASI-

BANKS AND TRUST ENTITIES

Section 8. Organization. - The Monetary Board may authorize the organization

of a bank or quasi-bank subject to the following conditions:

8.1 That the entity is a stock corporation (7);

8.2 That its funds are obtained from the public, which shall mean twenty (20) or more

persons (2-Da); and

8.3 That the minimum capital requirements prescribed by the Monetary Board for

each category of banks are satisfied. (n)

No new commercial bank shall be established within three (3) years from the

effectivity of this Act. In the exercise of the authority granted herein, the

Monetary Board shall take into consideration their capability in terms of their

financial resources and technical expertise and integrity. The bank licensing

process shall incorporate an assessment of the bank's ownership structure,

directors and senior management, its operating plan and internal controls as

well as its projected financial condition and capital base.

1. THE MONETARY BOARD

- Under the New Central Bank Act, the Monetary Board is not only empowered to

determine whether a person or entity is performing banking or quasi-banking

functions when exercised without the BSP’s authority, but the Board also has the

power to authorize entities or persons to engage in money service businesses.

- Next slide please

- Now there are other factors that the monetary board takes into

consideration.

- During a bank licensing process, the monetary board shall take into consideration

the capabilities of the applicant bank in terms of their financial resources and

technical expertise, and integrity. So during this time, the Monetary Board will

incorporate an assessment of:

a. The banks’s ownership structure

b. Directors and senior management

c. Its operating plans, and

d. Internal controls, as well as

e. Its projected financial condition and capital base

- Next slide please

- On determining an entity’s capability in integrity moreover, the entity’s

Incorporators/Subscribers, proposed directors and officers must:

(i) be persons of integrity and of good credit standing in the business

community. The subscribers must have adequate financial strength to pay

for their proposed subscriptions in the bank.

(ii) They must not have been convicted of any crime involving moral turpitude,

and unless otherwise allowed under the provisions of existing laws are not

officers and employees of a government agency, instrumentality, department

or office charged with the supervision of, or the granting of loans to banks.

- Okay, so those are the other factors the Monetary board considers during the

bank licensing process, let’s look again into those 3 conditions enumerated

under sec. 8.

- NEXT SLIDE PLEASE

1. It must be a stock corporation

- Under sec. 3 of the revised corporation code, a stock corporation is that

which has capital stock divided into shares, dividends, or allotments of the

surplus profits on the basis of the shares held. Banking institutions also are

only allowed to issue par value shares. Under sec. 10 of the RCCP moreover,

on the number and Qualifications of Incorporators. It states that Any person,

partnership, association or corporation, singly or jointly with others but not

more than fifteen (15) in number, 2 of whom must be independent directors,

may organize a corporation for any lawful purpose or purposes. sec. 116 of

the RCCP prohibits banks and quasi-banks from incorporating as a one-

person corporation or that corporation with a single stockholder.

- Since they are required to be stock corporations, they must submit those

requirements required by the RCCP to the SEC and one among those is an:

1. Name Verification Slip (through SEC’s website or at the Name

Verification Unit at SEC’s office building)

2. Articles of Incorporation and By-Laws

3. Treasurer’s Affidavit

4. Notarized Bank Certificate of Deposit (notarized in place where bank is

located)

5. Written Undertaking to Change Corporate Name by any Incorporator or

Director

6. Endorsement or Clearance from other government agencies (if

company will engage in a regulated industry)

NEXT SLIDE PLEASE

- This endorsement or Certificate of Authority to Register is issued by the

monetary board, and shall not be issued unless the monetary board is

satisfied from the evidence submitted to it. This requirement is evident

under sec. 14 of the GBL 2000 & sec. 16 of the RCCP, second

paragraph. For the GBL of 2000, it states that the Securities and

Exchange Commission shall not register the articles of incorporation of

any bank, or any amendment thereto, unless accompanied by a

certificate of authority issued by the Monetary Board, under it seal. Such

certificate shall not be issued unless the Monetary Board is

satisfied from the evidence submitted to it:

14.1 That all requirements of existing laws and regulations to engage in

the business for which the applicant is proposed to be incorporated have

been complied with;

14.2 That the public interest and economic conditions, both general and

local, justify the authorization; and

14.3 That the amount of capital, the financing, organization, direction

and administration, as well as the integrity and responsibility of the

organizers and administrators reasonably assure the safety of deposits

and the public interest. (9)

- From the RCCP on other hand, it states that no articles of

incorporation or any amendment thereto of banks, banking and

quasi-banking institutions, preneed, insurance and trust companies,

NSSLAS, pawnshops, and other financial intermediaries shall be

approved by the Commission unless accompanied by a favorable

recommendation of the appropriate government agency to the

effect that such articles or amendment is in accordance with law.

- What if the bank intends to branch its offices out?

E. Bank Branches

- (i) Universal or commercial banks may open branches or other offices

within or outside the Philippines upon prior approval of the Bangko

Sentral. Branching by all other banks shall be governed by pertinent

laws. A bank may, subject to prior approval of the Monetary Board, use any

or all of its branches as outlets for the presentation and/or sale of the financial

products of its allied undertaking or of its investment house units.

- (ii) A bank authorized to establish branches or other offices however

shall be responsible for all business conducted in such branches and

offices to the same extent and in the same manner as though such

business had all been conducted in the head office. A bank and its

branches and offices shall be treated as one unit.

- *Note: Cooperatives may organize a rural bank. Upon consultation with the

rural banks in the area, duly established cooperatives and corporations

primarily organize to hold equities in rural banks may organize a rural bank

and/or subscribe to the shares of stock of any rural bank: Provided, That a

cooperative or corporation owning or controlling the whole or majority of the

voting stock of the rural bank shall be subject to special examination and to

such rules and regulations as the Monetary Board may prescribe.

NEXT SLIDE PLEASE

2. The second condition under sec. 8 is that the funds must be obtained from

the public. Sec. 3 of the GBL of 2000 defines banks as.The second condition

under section 8 requires these banking or quasi-banking entities engaged in the

lending of funds to obtain the said funds in the form of deposits obtained from the

public, the public meaning twenty (20) or more persons (2-Da).

NEXT SLIDE PLEASE

3. And the third condition under sec. 8 is Capital requirements: That the minimum

capital requirements prescribed by the Monetary Board for each category of

banks are satisfied.

- According to sec. 121, part 1 of the 2018 Manual of Regulations for Banks

(MORB), The term capital shall be synonymous to unimpaired capital and

surplus, combined capital accounts and net worth and shall refer to the total

of the unimpaired paid-in capital, surplus and undivided profits

- NEXT SLIDE PLEASE

- Moreover, it is provided for by the New Central Bank Act (RA 11211,

amending RA 7653 or the New Central Bank Act) (sec. 41 which amended

sec. 108 of the GBL 2000) on Minimum Capital Ratios that the Monetary

Board may prescribe minimum risk-based capital adequacy ratios based on

internationally accepted standards and may alter said ratios whenever it

deems necessary. In the exercise of its authority under this section, the

Monetary Board may require banks to hold capital beyond the minimum

requirements commensurate to then risk profile."

NEXT SLIDE PLEASE

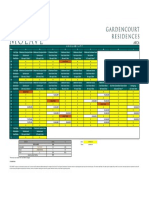

- Okay, so referred in this slide is the minimum capitalization required from

banks as provided by the 2018 MORB. These requirements shall also be the

required minimum capitalization upon (a) establishment of a new bank, (b)

conversion of an existing bank from a lower to a higher category bank and

vice versa, and (c) relocation of the head office of a TB/RB in an area of

higher classification.

Required

Bank Category Minimum Capitalization

Universal Banks

Head Office Only P3.00 billion

Up to 10 branches1 6.00 billion

11 to 100 branches2 15.00 billion

More than 100 branches3 20.00 billion

Commercial Banks

Head Office Only P2.00 billion

Up to 10 branches4 4.00 billion

11 to 100 branches5 10.00 billion

More than 100 branches6 15.00 billion

Thrift Banks

Head Office in National Capital Region (NCR)

Head Office Only P500 million

Up to 10 branches7 750 million

11 to 100 branches8 1.00 billion

More than 100 branches9 2.00 billion

Head Office in all Other Areas Outside NCR

Head Office Only P200 million

Up to 10 branches10 300 million

11 to 100 branches11 400 million

More than 100 branches12 800 million

Rural Banks and Cooperative Banks

Head Office in NCR

Head Office Only P50 million

Up to 10 branches13 75 million

11 to 100 branches14 100 million

More than 100 branches15 200 million

Head Office in All Other Areas Outside NCR

(All Cities up to 3rd class municipalities)

Head Office Only P20 million

Up to 10 branches16 30 million

11 to 100 branches17 40 million

More than 100 branches18 80 million

Head Office in All Other Areas Outside NCR

(4th class to 6th class municipalities)

Head Office Only P10 million

Up to 10 branches19 15 million

11 to 100 branches20 20 million

More than 100 branches21 40 million

- OKAY, So, upon submission of the RCCP requirements to the SEC,

accompanied with the Monetary Board’s certificate of authority to register, the

SEC will issue their certificate of incorporation. The bank is now A STOCK

CORPORATION AUTHORIZED TO ENGAGE IN MONEY SERVICE

BUSINESS. If the bank is a stock corporation, which law then must govern

them? WOULD it be the revised corporation code or the special laws

applicable to them like the general banking law of 2000?

NEXT SLIDE PLEASE

- The revised corporation code dictates that that corporations created by

special laws or charters shall be governed primarily by the provisions of the

special law or charter creating them or applicable to them, supplemented by

the provisions of the RCCP, insofar as they are applicable.

- The General Banking Law of 2000 (GBL) along with its amendments, is the

law that generally governs the regulation, organization and operation of

banks, quasi-banks, and other quasi-entities. It primarily governs Universal

Banks (UB) and Commercial Banks (CB), and has suppletory application to

other banks like Thrift Banks (which is primarily governed by RA 7906, the

Thrift Banks Act), Rural Banks (primarily governed by RA 7353, the Rural

Banks Act), and Cooperative Banks (primarily governed by RA 6938, the

Cooperative Code), The organization, ownership and capital

requirements, powers, supervision and general conduct of business of

Islamic banks shall be governed by special laws.

- Thank you. The next reporter will now be discussing the stockholdings

of banks.

- As mentioned by the previous group, Sec. 6 of GBL 2000 (Authority to

Engage in Banking and Quasi-Banking Functions) states that No person or

entity shall engage in banking operations or quasi-banking functions

without authority from the Bangko Sentral:. Provided, however, That an

entity authorized by the Bangko Sentral to perform universal or commercial

banking functions shall likewise have the authority to engage in quasi-

banking functions.

- Section 2. Section 3 of the same Act is hereby amended to read as follows:

- It is provided by the new Central Bank Act (R.A. No. 11211, July 23, 2018)

that it is the Bangko Sentral that will provide policy directions in the areas of

money, banking, and credit. It shall have supervision over the operations of

banks and exercise such regulatory and examination powers as provided in

this Act and other pertinent laws over the quasi-banking operations of non-

bank financial institutions.

- Relative to its exercise of supervisory powers moreover, the Monetary Board

was empowered to authorize entities or persons to engage in money service

business. As may be determined by the Monetary Board, it shall likewise

exercise regulatory and examination powers over money service businesses,

credit granting businesses, and payment system operators. The Monetary

Board is hereby empowered to authorize entities or persons to engage in

money service businesses.

- The determination of whether a person or entity is performing banking

or quasi-banking functions without Bangko Sentral authority shall be

decided by the Monetary Board. To resolve such issue, the Monetary

Board may; through the appropriate supervising and examining department of

the Bangko Sentral, examine, inspect or investigate the books and records of

such person or entity. Upon issuance of this authority, such person or entity

may commence to engage in banking operations or quasi-banking function

and shall continue to do so unless such authority is sooner surrendered,

revoked, suspended or annulled by the Bangko Sentral in accordance with

this Act or other special laws.

The department head and the examiners of the appropriate supervising and

examining department are hereby authorized to administer oaths to any such

person, employee, officer, or director of any such entity and to compel the

presentation or production of such books, documents, papers or records that

are reasonably necessary to ascertain the facts relative to the true functions

and operations of such person or entity. Failure or refusal to comply with the

required presentation or production of such books, documents, papers or

records within a reasonable time shall subject the persons responsible

therefore to the penal sanctions provided under the New Central Bank Act.

Persons or entities found to be performing banking or quasi-banking functions

without authority from the Bangko Sentral shall be subject to appropriate

sanctions under the New Central Bank Act and other applicable laws. (4a)

You might also like

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Rule of Signatures - 02Document2 pagesRule of Signatures - 02blcksource100% (16)

- Banking LawsDocument31 pagesBanking LawsJanMarkMontedeRamosWongNo ratings yet

- Republic Act No. 8791Document54 pagesRepublic Act No. 8791Vincent De VeraNo ratings yet

- Foreclosure of Real Estate MortgageDocument13 pagesForeclosure of Real Estate MortgageTrudgeOn100% (1)

- Banking LawDocument20 pagesBanking LawKenneth Rafols100% (2)

- Fake Talent Release FormDocument1 pageFake Talent Release FormValiant VNo ratings yet

- Banking Laws Zarah PDFDocument17 pagesBanking Laws Zarah PDFMarcelino CasilNo ratings yet

- Inter Vivos or Mortis Causa. Succession Inter Vivos Is Ordinary Donation. Succession MortisDocument23 pagesInter Vivos or Mortis Causa. Succession Inter Vivos Is Ordinary Donation. Succession MortisTrudgeOnNo ratings yet

- Banking Notes (With Digests From Kriz P) - Cha MendozaDocument570 pagesBanking Notes (With Digests From Kriz P) - Cha Mendozacmv mendozaNo ratings yet

- Dishonour of Cheques in India: A Guide along with Model Drafts of Notices and ComplaintFrom EverandDishonour of Cheques in India: A Guide along with Model Drafts of Notices and ComplaintRating: 4 out of 5 stars4/5 (1)

- Sarfaesi ActDocument10 pagesSarfaesi ActramyaNo ratings yet

- South China Sea Arbitration Case BriefDocument4 pagesSouth China Sea Arbitration Case BriefLexNo ratings yet

- Jorge Gonzales & Panel of Arbitrators vs. Climax Mining LTD., Climax-Arimco Mining Corp., & Australasian Philippines Mining IncDocument2 pagesJorge Gonzales & Panel of Arbitrators vs. Climax Mining LTD., Climax-Arimco Mining Corp., & Australasian Philippines Mining IncTrudgeOnNo ratings yet

- Banking Laws of 2000Document11 pagesBanking Laws of 2000Joy DalesNo ratings yet

- Ra 8791 General Banking Law: Maria Ginalyn CalderonDocument67 pagesRa 8791 General Banking Law: Maria Ginalyn CalderonVAT CLIENTS100% (1)

- Civpro Mods 1&2Document55 pagesCivpro Mods 1&2TrudgeOnNo ratings yet

- Banking and Allied Laws ReviewerDocument25 pagesBanking and Allied Laws Revieweramun dinNo ratings yet

- General Banking Laws of 2000 (RA 8791) : Banks Shall Be Classified IntoDocument9 pagesGeneral Banking Laws of 2000 (RA 8791) : Banks Shall Be Classified IntoJoy DalesNo ratings yet

- The General Banking Law of 2000Document28 pagesThe General Banking Law of 2000Joyce BelmonteNo ratings yet

- In Re Cunanan 94 PHIL. 534, MARCH 18, 1954Document1 pageIn Re Cunanan 94 PHIL. 534, MARCH 18, 1954Nick NicelNo ratings yet

- Translate Trade LicenseDocument2 pagesTranslate Trade LicenseMd Touhidul Islam100% (3)

- Spec Com PassDocument410 pagesSpec Com PassDwrd GBNo ratings yet

- Esguerra, Et Al. v. Trinidad, Et Al. (G.R. No. 169890, March 12, 2007)Document2 pagesEsguerra, Et Al. v. Trinidad, Et Al. (G.R. No. 169890, March 12, 2007)Lorie Jean UdarbeNo ratings yet

- Contract Labour R A Act 1970Document71 pagesContract Labour R A Act 1970Harshit ShrivastavaNo ratings yet

- PHILIPPINE AIRLINES INC. vs. HON. COURT OF APPEALS, JUDGE RICARDO D. GALANO (CFI OF MANILA), JAIME K. DEL ROSARIO (DEPUTY SHERIFF) & AMELIA TANDocument1 pagePHILIPPINE AIRLINES INC. vs. HON. COURT OF APPEALS, JUDGE RICARDO D. GALANO (CFI OF MANILA), JAIME K. DEL ROSARIO (DEPUTY SHERIFF) & AMELIA TANTrudgeOnNo ratings yet

- Rule 65 Certiorari, Prohibition and Mandamus JurisdictionDocument7 pagesRule 65 Certiorari, Prohibition and Mandamus JurisdictionTrudgeOnNo ratings yet

- Metropolitan Bank & Trust Company vs. Court of Appeals, Golden Savings & Loan Association, Inc., Lucia Castillo, Gloria CastilloDocument11 pagesMetropolitan Bank & Trust Company vs. Court of Appeals, Golden Savings & Loan Association, Inc., Lucia Castillo, Gloria CastilloTrudgeOnNo ratings yet

- CALTEX (PHILIPPINES), INC. vs. COURT OF APPEALS & SECURITY BANK & TRUST COMPANYDocument1 pageCALTEX (PHILIPPINES), INC. vs. COURT OF APPEALS & SECURITY BANK & TRUST COMPANYTrudgeOnNo ratings yet

- Philippine General Banking Act Ra 8791Document34 pagesPhilippine General Banking Act Ra 8791stylistahNo ratings yet

- Toyota Motor Philippines Corporation vs. CA, & Sun Valley Manufacturing & Development CorpDocument1 pageToyota Motor Philippines Corporation vs. CA, & Sun Valley Manufacturing & Development CorpTrudgeOnNo ratings yet

- DIGEST - Oria v. Mcmicking PDFDocument2 pagesDIGEST - Oria v. Mcmicking PDFAgatha ApolinarioNo ratings yet

- Consolidated Bank Vs NLRC DigestDocument2 pagesConsolidated Bank Vs NLRC DigestBurn-Cindy AbadNo ratings yet

- Barbasa V TuqueroDocument2 pagesBarbasa V TuqueroMarga LeraNo ratings yet

- RULE 64 Rev of Judgm of COMELEC & COADocument5 pagesRULE 64 Rev of Judgm of COMELEC & COATrudgeOnNo ratings yet

- Chapter 2 - Bank OrganizationDocument5 pagesChapter 2 - Bank OrganizationMhaiNo ratings yet

- FM 311 - Lesson 3Document13 pagesFM 311 - Lesson 3Rodrigo CabarrubiasNo ratings yet

- Ra 8791 - GBLDocument16 pagesRa 8791 - GBLJen AnchetaNo ratings yet

- Special Laws ProvisionsDocument103 pagesSpecial Laws ProvisionsGian Joshua DayritNo ratings yet

- RA 7906 Thrift Banks Act of 1995Document11 pagesRA 7906 Thrift Banks Act of 1995skylark74100% (1)

- GBLDocument14 pagesGBLMa Cristina Encisa-AltarejosNo ratings yet

- Republic Act No. 8791Document15 pagesRepublic Act No. 8791nn tyIINo ratings yet

- R.A. 8791Document18 pagesR.A. 8791Joyce AllenNo ratings yet

- General Banking Laws Republic Act No. 8791Document16 pagesGeneral Banking Laws Republic Act No. 8791jdelrosario97No ratings yet

- Republic Act No. 8791: Title and Classification of Banks Title Declaration of PolicyDocument27 pagesRepublic Act No. 8791: Title and Classification of Banks Title Declaration of PolicyKathleen del RosarioNo ratings yet

- Banking and Financial InstitutionDocument5 pagesBanking and Financial InstitutionMariel Crista Celda MaravillosaNo ratings yet

- Banking and Allied LawsDocument5 pagesBanking and Allied LawsFatima FatemehNo ratings yet

- FM2 NotesDocument11 pagesFM2 NotesEmily ResuentoNo ratings yet

- Gen Banking LawDocument21 pagesGen Banking LawolofuzyatotzNo ratings yet

- Republic Act No.: 8791 An Act Providing For TheDocument77 pagesRepublic Act No.: 8791 An Act Providing For TheRuel GuiangNo ratings yet

- AMLA Complete With R.A. No. 11521 Latest Amendment SPEC COM NotesDocument255 pagesAMLA Complete With R.A. No. 11521 Latest Amendment SPEC COM NotesAubrey CortezNo ratings yet

- Rules and Regulations For Cooperative BanksDocument11 pagesRules and Regulations For Cooperative Banksfrescy mosterNo ratings yet

- Republic Act No. 8791 - Chap 1-3Document5 pagesRepublic Act No. 8791 - Chap 1-3Joel Guasis AyonNo ratings yet

- Republic Act NoDocument49 pagesRepublic Act NoJo AngeliNo ratings yet

- Bank Report FinalDocument8 pagesBank Report FinalFariha AminNo ratings yet

- The Banko Sentral NG PilipinasDocument37 pagesThe Banko Sentral NG PilipinasJustice PajarilloNo ratings yet

- Decree Number 19-2002: The Congress of The Republic of GuatemalaDocument65 pagesDecree Number 19-2002: The Congress of The Republic of GuatemalaEstudiantes por DerechoNo ratings yet

- The Banking and Financial Institutions Act, 1989Document7 pagesThe Banking and Financial Institutions Act, 1989efekahNo ratings yet

- 28 - 2005 - ND - CP Microfinance InstitutionDocument10 pages28 - 2005 - ND - CP Microfinance InstitutionDzungNo ratings yet

- Thrift Bank ActDocument8 pagesThrift Bank ActCarina Amor ClaveriaNo ratings yet

- The General Banking Law of 2000Document24 pagesThe General Banking Law of 2000Jay Arnold PanganibanNo ratings yet

- About The Chamber of Thrift BanksDocument18 pagesAbout The Chamber of Thrift BanksRojusandino Acevedo YlaganNo ratings yet

- LIBRT: Online Lending Should Be Regulated by The Bangko Sentral NG Pilipinas Governing LawsDocument2 pagesLIBRT: Online Lending Should Be Regulated by The Bangko Sentral NG Pilipinas Governing LawsVanessa May GaNo ratings yet

- General Banking Law of 2000 (R.A. No.8791)Document7 pagesGeneral Banking Law of 2000 (R.A. No.8791)JABRIL MALTANo ratings yet

- 35 Bank Organization20221031232239Document59 pages35 Bank Organization20221031232239Alyssa Oreiro IgrosNo ratings yet

- Banking Laws: A. The New Central Bank Act (R.A. NO. 7653)Document14 pagesBanking Laws: A. The New Central Bank Act (R.A. NO. 7653)Ahl Ja MarNo ratings yet

- General Banking Law (RA 8971)Document26 pagesGeneral Banking Law (RA 8971)Carlito B. BancilNo ratings yet

- Commercial Law Review: Maria Zarah - Villanueva - CastroDocument20 pagesCommercial Law Review: Maria Zarah - Villanueva - CastroDan Perseus RubioNo ratings yet

- Custom Search: Today Is Tuesday, July 31, 2018Document17 pagesCustom Search: Today Is Tuesday, July 31, 2018NelNo ratings yet

- Unit - 1: Legal Framework of Regulation of BanksDocument71 pagesUnit - 1: Legal Framework of Regulation of BanksRajesh GuptaNo ratings yet

- RA 9576 April 29,2009: Section 1 State Policy and Objectives: Policy of The State To Generate, Preserve, Maintain FaithDocument4 pagesRA 9576 April 29,2009: Section 1 State Policy and Objectives: Policy of The State To Generate, Preserve, Maintain FaithDaryl Mae MansayNo ratings yet

- General Banking Law of 2000 (GBL) (Ra No. 8791)Document5 pagesGeneral Banking Law of 2000 (GBL) (Ra No. 8791)romeo n bartolomeNo ratings yet

- Notes of BanksDocument5 pagesNotes of Banksromeo n bartolomeNo ratings yet

- Notes of BanksDocument5 pagesNotes of Banksromeo n bartolomeNo ratings yet

- MORBDocument9 pagesMORBrhyz_13No ratings yet

- Thrift Banks LawDocument40 pagesThrift Banks Lawrona morteraNo ratings yet

- PRESIDENTIAL DECREE No. 129 February 15, 1973Document6 pagesPRESIDENTIAL DECREE No. 129 February 15, 1973chitru_chichruNo ratings yet

- Banking PresentationDocument8 pagesBanking PresentationTrudgeOnNo ratings yet

- TAXABLE INCOME ReportDocument6 pagesTAXABLE INCOME ReportTrudgeOnNo ratings yet

- Authority From The State.: OfficesDocument5 pagesAuthority From The State.: OfficesTrudgeOnNo ratings yet

- Korea Technologies Co., Ltd. (KOGIES) vs. Hon. Alberto Lerma & Pacific General Steel Manufacturing (PGSMC)Document3 pagesKorea Technologies Co., Ltd. (KOGIES) vs. Hon. Alberto Lerma & Pacific General Steel Manufacturing (PGSMC)TrudgeOnNo ratings yet

- Recall (Cases) : Garcia v. COMELEC (227 SCRA 100) FactsDocument9 pagesRecall (Cases) : Garcia v. COMELEC (227 SCRA 100) FactsTrudgeOnNo ratings yet

- Silverio Vs CaDocument2 pagesSilverio Vs CaTrudgeOnNo ratings yet

- Labrel CBA Counter Propo Part 1Document12 pagesLabrel CBA Counter Propo Part 1TrudgeOnNo ratings yet

- Rule 18 CivproDocument12 pagesRule 18 CivproTrudgeOnNo ratings yet

- Kinds of WillsDocument7 pagesKinds of WillsTrudgeOnNo ratings yet

- GOVERNMENT SERVICE INSURANCE SYSTEM vs. COURT OF APPEALS & MR. AND MRS. ISABELO R. RACHODocument2 pagesGOVERNMENT SERVICE INSURANCE SYSTEM vs. COURT OF APPEALS & MR. AND MRS. ISABELO R. RACHOTrudgeOnNo ratings yet

- Metropolitank Bank & Trust Company vs. Court of Appeals, Golden Savings & Loan Association Inc., Lucia Castillo & Gloria CastilloDocument2 pagesMetropolitank Bank & Trust Company vs. Court of Appeals, Golden Savings & Loan Association Inc., Lucia Castillo & Gloria CastilloTrudgeOnNo ratings yet

- THE HONGKONG & SHANGHAI BANKING CORPORATION LIMITED - PHILIPPINE BRANCHES vs. COMMISSIONER OF INTERNAL REVENUEDocument2 pagesTHE HONGKONG & SHANGHAI BANKING CORPORATION LIMITED - PHILIPPINE BRANCHES vs. COMMISSIONER OF INTERNAL REVENUETrudgeOnNo ratings yet

- FLORENTINA A. LOZANO vs. Hon. Antonio M. Martinez (Judge, RTC of Manila) & Hon. Jose B. Flaminiano (City Fiscal of Manila)Document2 pagesFLORENTINA A. LOZANO vs. Hon. Antonio M. Martinez (Judge, RTC of Manila) & Hon. Jose B. Flaminiano (City Fiscal of Manila)TrudgeOnNo ratings yet

- Citibank, N.A. Mastercard vs. Teodoro (150905) 411 SCRA 577 (2003)Document8 pagesCitibank, N.A. Mastercard vs. Teodoro (150905) 411 SCRA 577 (2003)Joe PoNo ratings yet

- POLGOVDocument17 pagesPOLGOVJohn Vincent daquioagNo ratings yet

- Floating Status Is Not Equivalent To DismissalDocument11 pagesFloating Status Is Not Equivalent To DismissaljaycoronelNo ratings yet

- Gardencourt Residences Molave Availability (July 19, 2022)Document1 pageGardencourt Residences Molave Availability (July 19, 2022)Nicolo MendozaNo ratings yet

- Ethics QuizDocument3 pagesEthics QuizathierahNo ratings yet

- Iii. Police PowerDocument120 pagesIii. Police PowerCornelio AlfonsoNo ratings yet

- Is 1387 1993Document10 pagesIs 1387 1993anilkumar18No ratings yet

- Jurnal Hukum - 2020 - 623-2244-2-pbDocument8 pagesJurnal Hukum - 2020 - 623-2244-2-pbKarimullah SaingNo ratings yet

- Lauro Santos Vs PeopleDocument5 pagesLauro Santos Vs PeopleCatherine MerillenoNo ratings yet

- Jss Law College: SyllabusDocument62 pagesJss Law College: SyllabusHome TuitionNo ratings yet

- P V LobitaniaDocument16 pagesP V LobitaniaJanelle Leano MarianoNo ratings yet

- CONTRACTSDocument11 pagesCONTRACTSJoshua dela CruzNo ratings yet

- Vocabulary (Crime)Document2 pagesVocabulary (Crime)Anna DubetsNo ratings yet

- 006 - Torts PDFDocument62 pages006 - Torts PDFkittie pacanaNo ratings yet

- 9 - People Vs AbalosDocument3 pages9 - People Vs AbalosMark Lester Lee AureNo ratings yet

- Il Foid Non Fillable 6 181Document2 pagesIl Foid Non Fillable 6 181levittjNo ratings yet

- Undertaking Pension OpenDocument3 pagesUndertaking Pension OpenMuhammad junaidNo ratings yet

- Argumentative Essay On Gun ControlDocument3 pagesArgumentative Essay On Gun ControlShaban ShabzNo ratings yet

- RefusalDocument4 pagesRefusalNadeem SheikhNo ratings yet

- Peralta vs. Abalon. GR No. 183448, June 30, 2014 PDFDocument24 pagesPeralta vs. Abalon. GR No. 183448, June 30, 2014 PDFSP ZeeNo ratings yet