Professional Documents

Culture Documents

Application For MRI - Sri Claim

Application For MRI - Sri Claim

Uploaded by

Jon SnowOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Application For MRI - Sri Claim

Application For MRI - Sri Claim

Uploaded by

Jon SnowCopyright:

Available Formats

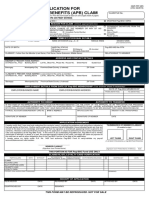

APPLICATION FOR MRI/SRI CLAIM

_________________________

(Branch)

(PRINT ALL ENTRIES IN BLOCK OR CAPITAL LETTERS)

REASON FOR CLAIM (Check appropriate box)

DEATH PERMANENT TOTAL DISABILITY TERMINAL ILLNESS

Date of Death: _____________________ Date of Injury/Sickness Sustained: ________________________

(MM/DD/YYYY) (MM/DD/YYYY)

BORROWER/CO-BORROWER DETAILS

MARITAL STATUS

LAST NAME FIRST NAME NAME EXTENSION (e.g., Jr., II) MIDDLE NAME MAIDEN NAME

(for married women) Single/Unmarried

Married

Widow/er

DATE OF BIRTH (MM/DD/YYYY) AGE PRINCIPAL BORROWER HOUSING ACCOUNT NO. Legally Separated

CO-BORROWER Annulled

NAME OF OTHER BORROWER/S, IF APPLICABLE

HOUSING NAME EXTENSION PRINCIPAL/

LAST NAME FIRST NAME MIDDLE NAME

ACCOUNT NO. (e.g., Jr., II) CO-BORROWER

CLAIMANT/BENEFICIARY/HEIR DETAILS

LAST NAME FIRST NAME NAME EXTENSION (e.g., Jr., II) MIDDLE NAME RELATIONSHIP TO THE

BORROWER/CO-BORROWER

PRESENT ADDRESS CONTACT DETAILS

Unit/Room No., Floor Building Name Lot No., Block No., Phase No. House No. Street Name Subdivision Home

Cell Phone

Barangay Municipality/City Province/State/Country (if abroad) ZIP Code

Email Address

CERTIFICATION

I hereby certify, under pain of perjury that my signature appearing herein is genuine and authentic and the submitted

documents are true reproduction of the original documents.

_________________________________________ ___________________________

Signature of Borrower/Claimant/Beneficiary/ Date

Heir Over Printed Name

THIS FORM MAY BE REPRODUCED. NOT FOR SALE

GUIDELINES AND INSTRUCTIONS

A. WHO MAY FILE

A Pag-IBIG Fund housing loan borrower, his heir/s or beneficiary/ies may file the insurance claims with complete

requirements upon the occurrence of any of the following grounds on or after November 1, 2014.

1. Permanent Total Disability

1.1. The housing loan borrower or his beneficiary/ies may file for MRI/SRI claim due to PTD; provided, the

following conditions are present:

a. Totally disabled by bodily injury or disease;

b. Prevented from engaging in any occupation for compensation or profit, from performing the normal

activities of life; and

c. Disabled for a continuous period of at least six (6) months;

1.2. Borrowers who are at least eighteen (18) years old but have not attained their 65th birthday shall be

allowed to file MRI/SRI claim due to PTD.

2. Terminal Illness Living Benefit

2.1. A Pag-IBIG housing loan borrower, who has been diagnosed with Terminal Illness, or his

beneficiary/ies may file MRI/SRI claim with complete requirements; provided said illness is expected

to result in the insured's death within twelve (12) months from the date of the diagnosis of such illness

by an acceptable licensed physician. Said date when such illness or injury was diagnosed must be on

or after November 1, 2014

2.2. Borrowers who are at least eighteen (18) years old but have not attained their 70th birthday shall be

allowed to file MRI/SRI claim due to Terminal Illness.

2.3. In case of claim that can be both filed against Permanent Total Disability and Terminal Illness, only

one benefit can be utilized by the insured.

3. Death

3.1. The heirs/beneficiaries of deceased borrowers shall be allowed to file MRI/SRI claim, provided the

deceased borrower is at least eighteen (18) years old and has not attained his 70th birthday at the

time of death.

B. HOW TO FILE

The housing loan borrower or heir/s or beneficiary/ies shall submits duly accomplished application form and

documentary requirements indicated in the Checklist of Requirements for Application of Mortgage/Sales

Redemption Insurance Claims (HQP-HLF-715) to any Pag-IBIG Branch or through e-mail. Processing of

application shall commence only upon submission of complete documents.

C. APPLICATION OF INSURANCE PROCEEDS

1. In case of PTD/Death of the borrower, Pag-IBIG Fund shall apply the MRI/SRI proceeds to the entire

outstanding obligation as of date of PTD/Death of the said borrower. The excess MRI/SRI proceeds after

application to the outstanding obligation as of date of PTD/Death, if any, shall be released to the borrower

or his beneficiary/ies.

In case of tacked loans and the MRI/SRI proceeds is not enough to fully settle the entire outstanding

obligation, the remaining borrower/s or heir/s or beneficiary/ies must still settle the outstanding obligation

through any of the following modes:

a. Full payment

b. Re-documenting the housing loan application

c. Dacion En Pago

d. Revised Amortization Scheme

2. The MRI/SRI proceeds due to Terminal Illness shall be considered as regular amortization payments.

You might also like

- Application For MRI - SRI ClaimDocument2 pagesApplication For MRI - SRI ClaimivyNo ratings yet

- PAGIBIG Application For Provident Benefits ClaimDocument2 pagesPAGIBIG Application For Provident Benefits ClaimMeal StubNo ratings yet

- Application For Provident Benefits (Apb) ClaimDocument2 pagesApplication For Provident Benefits (Apb) ClaimLIERANo ratings yet

- PFF285 ApplicationProvidentBenefitsClaim V03Document2 pagesPFF285 ApplicationProvidentBenefitsClaim V03Carlo Beltran Valerio0% (2)

- Application For Provident Benefits Claim (HQP-PFF-040, V02.1) PDFDocument2 pagesApplication For Provident Benefits Claim (HQP-PFF-040, V02.1) PDFPhilip Floro0% (1)

- Application For Provident Benefits (Apb) Claim: Type or Print EntriesDocument2 pagesApplication For Provident Benefits (Apb) Claim: Type or Print Entriesglenn padernal67% (3)

- HDMF Provident ClaimDocument4 pagesHDMF Provident ClaimCitiham MarketingNo ratings yet

- Application For Provident Benefits (Apb) ClaimDocument2 pagesApplication For Provident Benefits (Apb) ClaimJoey Singson100% (1)

- HTTPS:::WWW - Pagibigfund.gov - ph:document:pdf:dlforms:providentrelated:PFF285 ApplicationProvidentBenefitsClaim V07Document2 pagesHTTPS:::WWW - Pagibigfund.gov - ph:document:pdf:dlforms:providentrelated:PFF285 ApplicationProvidentBenefitsClaim V07Zyreen Kate CataquisNo ratings yet

- PFF285 ApplicationProvidentBenefitsClaim V08Document5 pagesPFF285 ApplicationProvidentBenefitsClaim V08Trisha ApalisNo ratings yet

- Death, Disability and Retirement Claim: Social Security SystemDocument2 pagesDeath, Disability and Retirement Claim: Social Security SystemJo-Anne LegaspiNo ratings yet

- Philippine Government Forms SssDocument2 pagesPhilippine Government Forms SssRosemarie GajetelaNo ratings yet

- SLF066 CalamityLoanApplicationForm V07Document2 pagesSLF066 CalamityLoanApplicationForm V07Mervin BauyaNo ratings yet

- SLF066 CalamityLoanApplicationForm V08Document2 pagesSLF066 CalamityLoanApplicationForm V08Crispolo BernardinoNo ratings yet

- SLF066 CalamityLoanApplicationForm V05 PDFDocument2 pagesSLF066 CalamityLoanApplicationForm V05 PDFHakdog Longgadog100% (1)

- Calamity Loan Application Form - FillableDocument2 pagesCalamity Loan Application Form - FillableReddy RentarNo ratings yet

- SSSForm Early Withdrawal FlexiFund PDFDocument2 pagesSSSForm Early Withdrawal FlexiFund PDFAlvin EspirituNo ratings yet

- Calamity Loan Application Form: Filipino FilipinoDocument2 pagesCalamity Loan Application Form: Filipino Filipinoaljhondelacruz22No ratings yet

- Application For Provident Benefits (Apb) Claim: Type or Print EntriesDocument2 pagesApplication For Provident Benefits (Apb) Claim: Type or Print EntriesShantal CervantesNo ratings yet

- SLF066 CalamityLoanApplicationForm V05 Fillable Final PDFDocument2 pagesSLF066 CalamityLoanApplicationForm V05 Fillable Final PDFSherwin Mandalones67% (3)

- Https2Fwww Pagibigfund Gov Ph2Fdocument2Fpdf2Fdlforms2Fprovidentrelated2FDocument4 pagesHttps2Fwww Pagibigfund Gov Ph2Fdocument2Fpdf2Fdlforms2Fprovidentrelated2FKingNo ratings yet

- PAGIBIG CalamityLoanApplicationForm - V06Document3 pagesPAGIBIG CalamityLoanApplicationForm - V06michelleqborbeNo ratings yet

- SLF065 MultiPurposeLoanApplicationForm V03Document2 pagesSLF065 MultiPurposeLoanApplicationForm V03Belle Adante100% (1)

- Multi-Purpose Loan (MPL) Application Form: Crown Hotel Management CorpDocument2 pagesMulti-Purpose Loan (MPL) Application Form: Crown Hotel Management CorpMA BethNo ratings yet

- Gsli MS AyreneDocument3 pagesGsli MS AyreneDaniel ColladoNo ratings yet

- (In Years) : Application Form Application Form Application Form Application FormDocument4 pages(In Years) : Application Form Application Form Application Form Application Formgina dela cruzNo ratings yet

- PAGIBIG SALARY MultiPurposeLoanApplicationForm - V05Document3 pagesPAGIBIG SALARY MultiPurposeLoanApplicationForm - V05michelleqborbeNo ratings yet

- InformationForm V09Document2 pagesInformationForm V09Rein manzanoNo ratings yet

- SLF065 MultiPurposeLoanApplicationForm V04Document3 pagesSLF065 MultiPurposeLoanApplicationForm V04Catherine Quijano100% (1)

- MemberChangeInformation V06Document2 pagesMemberChangeInformation V06joy barrameda50% (2)

- BI Form 2014-00-002 Rev 0 CGAF For Non-Immigrant Visa Special Work Permit and Provisional Work Permit Jan 2014 (Fillable)Document2 pagesBI Form 2014-00-002 Rev 0 CGAF For Non-Immigrant Visa Special Work Permit and Provisional Work Permit Jan 2014 (Fillable)Eli John CaluyaNo ratings yet

- UB Form - DJSDocument3 pagesUB Form - DJSD Delos SalNo ratings yet

- Member'S Data Form (MDF) (Sss/Pag-Ibig) : Membership Category Personal DetailsDocument2 pagesMember'S Data Form (MDF) (Sss/Pag-Ibig) : Membership Category Personal DetailsRonel SibayNo ratings yet

- (For IISP Branch Only) : Application AgreementDocument2 pages(For IISP Branch Only) : Application AgreementRachel CabanlitNo ratings yet

- FM GSIS OPS CPR 01 Pensioners Request Form FillableDocument1 pageFM GSIS OPS CPR 01 Pensioners Request Form Fillablebrida athenaNo ratings yet

- Member'S Change of Information Form (Mcif) : Magbanua Renzvin RosalesDocument2 pagesMember'S Change of Information Form (Mcif) : Magbanua Renzvin RosalesFrancis AngNo ratings yet

- SSSForm Death ClaimDocument3 pagesSSSForm Death ClaimJohnlesther PabellonNo ratings yet

- MPL Loan Pag-IbigDocument2 pagesMPL Loan Pag-Ibigchristopher ighotNo ratings yet

- SLF065 MultiPurposeLoanApplicationForm V05Document3 pagesSLF065 MultiPurposeLoanApplicationForm V05JOSPEH ONTORIANo ratings yet

- Multi-Purpose Loan (MPL) Application Form: (E.g., JR., II) (For Married Women) (Check If Applicable Only)Document2 pagesMulti-Purpose Loan (MPL) Application Form: (E.g., JR., II) (For Married Women) (Check If Applicable Only)Erold John Salvador BuenaflorNo ratings yet

- SSSForm Retirement ClaimDocument3 pagesSSSForm Retirement ClaimMark JosephNo ratings yet

- PFF049 MembersChangeInformation V05Document2 pagesPFF049 MembersChangeInformation V05Bernie L. DaytecNo ratings yet

- SLF066 CalamityLoanApplicationForm V03 PDFDocument2 pagesSLF066 CalamityLoanApplicationForm V03 PDFKram Tende AwanucavNo ratings yet

- SLF065 MultiPurposeLoanApplicationForm V03Document2 pagesSLF065 MultiPurposeLoanApplicationForm V03Cheery Fernandez SumargoNo ratings yet

- SLF066 CalamityLoanApplicationForm V04 PDFDocument2 pagesSLF066 CalamityLoanApplicationForm V04 PDFLevyCastillo100% (3)

- SLF066 CalamityLoanApplicationForm V04Document2 pagesSLF066 CalamityLoanApplicationForm V04marta100% (4)

- HLF069 HousingLoanApplicationCoBorrower V06Document2 pagesHLF069 HousingLoanApplicationCoBorrower V06Rouselle RaraNo ratings yet

- Member'S Change of Information Form (Mcif) : Presented For AuthenticationDocument2 pagesMember'S Change of Information Form (Mcif) : Presented For AuthenticationJonna Marie Ibuna100% (2)

- HMDFDocument2 pagesHMDFmaricar0% (1)

- AAF212 OTPNegotiatedSaleIndividual V02Document2 pagesAAF212 OTPNegotiatedSaleIndividual V02Joferjay JosonNo ratings yet

- AAF004 OfferPurchaseNegotiatedRetailSale V03 PDFDocument2 pagesAAF004 OfferPurchaseNegotiatedRetailSale V03 PDFJerson Obo67% (3)

- SLF066 CalamityLoanApplicationForm V05 Fillable FinalDocument2 pagesSLF066 CalamityLoanApplicationForm V05 Fillable FinalFrancis Raymond MachadoNo ratings yet

- Multi-Purpose Loan (MPL) Application FormDocument2 pagesMulti-Purpose Loan (MPL) Application FormBecca BelenNo ratings yet

- Calamity Loan Application FormDocument2 pagesCalamity Loan Application FormAyan VicoNo ratings yet

- E1-E-6 FormDocument2 pagesE1-E-6 Formmanigoanne22No ratings yet

- Introducing : Microsoft Dynamics 365Document32 pagesIntroducing : Microsoft Dynamics 365arunchennai1No ratings yet

- NOAH Peppertree Presentation 9-20-2022Document13 pagesNOAH Peppertree Presentation 9-20-2022WCNC DigitalNo ratings yet

- QT Complaint NO Exhibits 62nd AveDocument14 pagesQT Complaint NO Exhibits 62nd AveCheryl WhelestNo ratings yet

- Important Case Laws (2 Marks) - 2020Document3 pagesImportant Case Laws (2 Marks) - 2020Rubina HannureNo ratings yet

- Form No. 137 Petition For Corporate RehabilitationDocument4 pagesForm No. 137 Petition For Corporate RehabilitationKristianne Sipin100% (1)

- Test Bank Chap 008Document16 pagesTest Bank Chap 008Minh TríNo ratings yet

- Adigrat University College of Business and Economics Department of Accounting and FinanceDocument55 pagesAdigrat University College of Business and Economics Department of Accounting and Financemubarek oumerNo ratings yet

- Exercicios Chapter2e3 IPM BKMDocument8 pagesExercicios Chapter2e3 IPM BKMLuis CarneiroNo ratings yet

- Leave and License Agreement: Particulars Amount Paid GRN/Transaction Id DateDocument5 pagesLeave and License Agreement: Particulars Amount Paid GRN/Transaction Id DateDeepak AryaNo ratings yet

- Questions and Problems: BasicDocument2 pagesQuestions and Problems: BasicTas MimaNo ratings yet

- Islamic Banking in PakistanDocument72 pagesIslamic Banking in PakistanRida ZehraNo ratings yet

- Two Mark Questions & Answers - Ba 1722 - Security Analysis and Portfolio ManagementDocument9 pagesTwo Mark Questions & Answers - Ba 1722 - Security Analysis and Portfolio ManagementSabha PathyNo ratings yet

- FinmanDocument3 pagesFinmanGurra ArmanNo ratings yet

- Gift Deed For An Immovable PropertyDocument3 pagesGift Deed For An Immovable Propertyhimanshu khandelwalNo ratings yet

- 23 Mutual Fund OperationsDocument49 pages23 Mutual Fund OperationsPaula Ella BatasNo ratings yet

- Property Law 2 ProjectDocument20 pagesProperty Law 2 ProjectAakash ChauhanNo ratings yet

- Medel v. Court of Appeals, G.R. No. 131622, November 27, 1998Document4 pagesMedel v. Court of Appeals, G.R. No. 131622, November 27, 1998Charmila SiplonNo ratings yet

- Test Bank For Accounting 28th Edition Carl Warren Christine Jonick Jennifer Schneider 2 DownloadDocument42 pagesTest Bank For Accounting 28th Edition Carl Warren Christine Jonick Jennifer Schneider 2 Downloadmrshaileyjordanwtmbcafnkd100% (34)

- SalesLaw - Midterms - Rabena, Aubrey Rose Millean ADocument5 pagesSalesLaw - Midterms - Rabena, Aubrey Rose Millean AAubrey Rose RabenaNo ratings yet

- Office Building Case Study - Part One (MS Word)Document1 pageOffice Building Case Study - Part One (MS Word)minani marcNo ratings yet

- MDP Scheme Document 6122022 Final-1Document63 pagesMDP Scheme Document 6122022 Final-1ManmohanNo ratings yet

- Chapter-2 IAPMDocument11 pagesChapter-2 IAPMBantamkak FikaduNo ratings yet

- SIDBI MSME Application FormDocument4 pagesSIDBI MSME Application FormPalaniswamy K100% (1)

- In 2001 Enron Corporation Filed For Chapter 11 Bankruptcy ProtectionDocument2 pagesIn 2001 Enron Corporation Filed For Chapter 11 Bankruptcy ProtectionMuhammad ShahidNo ratings yet

- Jestra Development and Management Corporation vs. PacificoDocument12 pagesJestra Development and Management Corporation vs. PacificoGnairah AmoraNo ratings yet

- Dinesh Kumar: Account StatementDocument5 pagesDinesh Kumar: Account Statementdineshjangir310No ratings yet

- NSB Lpan Application FormDocument1 pageNSB Lpan Application FormManjula Jeewan KumaraNo ratings yet

- Managerial Economics 2nd Assignment Bratu Carina-Maria BA WORDDocument4 pagesManagerial Economics 2nd Assignment Bratu Carina-Maria BA WORDCarina BratuNo ratings yet

- Financing Options in The Oil and Gas Industry: MaintainedDocument31 pagesFinancing Options in The Oil and Gas Industry: MaintainedmayorladNo ratings yet

- SBR Current Development S22 TO J23Document53 pagesSBR Current Development S22 TO J23Akshay SadhuNo ratings yet