Professional Documents

Culture Documents

Income Effects of Alternative Cost Accumulation Systems

Uploaded by

sserwaddaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income Effects of Alternative Cost Accumulation Systems

Uploaded by

sserwaddaCopyright:

Available Formats

INCOME EFFECTS OF ALTERNATIVE COST ACCUMULATION SYSTEMS

LEARNING OBJECTIVES

After studying this chapter, you should be able to:

explain the differences between an absorption costing and a variable costing

system;

prepare profit statements based on a variable costing and absorption costing

system;

explain the difference in profits between variable and absorption costing profit

calculations;

explain the arguments for and against variable and absorption costing;

SUMMARY

The following items relate to the learning objectives listed at the beginning of the

chapter.

Explain the differences between an absorption costing and a variable costing

system.

With an absorption costing system, fixed manufacturing overheads are allocated to

the products and these are included in the inventory valuations.

With a variable costing system, only variable manufacturing costs are assigned to

the product; fixed manufacturing costs are regarded as period costs and written

off as a lump sum to the profit and loss account.

Both variable and absorption costing systems treat non-manufacturing overheads

as period costs.

Prepare profit statements based on a variable costing and absorption costing

system.

With a variable costing system, manufacturing fixed costs are added to the

variable manufacturing cost of sales to determine total manufacturing costs to be

deducted from sales revenues.

Prepared By Senior Hannington - 0789538704

CPA Paper 7 – Cost & Management Accounting – March 2021 Sitting

Manufacturing fixed costs are assigned to products with an absorption costing

system. Therefore, manufacturing cost of sales is valued at full cost

(manufacturing variable costs plus manufacturing fixed costs).

With an absorption costing system, fixed manufacturing costs are unitized by

dividing the total manufacturing costs by estimated output.

If actual output differs from estimated output an under- or over-recovery of

overheads arises. This is recorded as a period cost adjustment in the current

accounting period.

Explain the difference in profits between variable and absorption costing profit

calculations.

When production exceeds sales, absorption costing systems report higher profits.

Variable costing systems yield higher profits when sales exceed production.

Nevertheless, total profits over the life of the business will be the same for both

systems. Differences arise merely in the profits attributed to each accounting

period.

The arguments that have been made supporting absorption costing include:

absorption costing does not understate the importance of fixed costs;

absorption costing avoids the possibility of fictitious losses being reported;

fixed manufacturing overheads are essential to production and therefore should be

incorporated in the product costs; and

internal profit measurement should be consistent with absorption costing profit

measurement that is used for external reporting requirements.

Prepared By Senior Hannington - 0789538704

CPA Paper 7 – Cost & Management Accounting – March 2021 Sitting

MARGINAL COSTING OR ABSORPTION COSTING?

Strength of Marginal costing in costing

Simple to operate.

No apportionments which are frequently on arbitrary basis, of fixed costs to

products or departments. Many fixed costs are indivisible by their nature, e.g.

managing director’s salary.

Under or over absorption of overheads is almost entirely avoided. The usual reason

for under/over absorption is the inclusion of fixed costs into overhead absorption

rates and the level of activity being different to that planned.

The technique provides useful data for managerial decision making.

The technique is flexible in the sense that it can be used along with other

techniques such as budgetary control and standard costing.

Weaknesses of Marginal costing

If used for setting prices of products the resulting profit may not cover the fixed

costs of the company.

It is not always easy to separate fixed costs from variable costs.

It is not acceptable for external reporting due to the fact that it understates

closing stock of work in progress and finished goods values.

The information provided by the system can be used in the short run.

It is not appropriate to exclude fixed manufacturing costs from production costs.

The variable cost per unit remains constant only in the short run but not in the

long run.

Strengths of Total Absorption costing

The technique is supported by tax authorities because it gives the true and correct

profits of the company.

IAS 2 Inventory requires that costs must be matched against revenues that are

derived from a particular period.

Fixed costs are incurred so that production takes place therefore should be taken

into consideration when valuing the cost of a production and stock.

The calculation of marginal cost and the concentration upon contribution may lead

to the firm setting prices which are below the total cost although producing some

contribution. etc.

Arguments of Absorption Costing

Absorption costing depends on a number of estimates and assumptions while

calculating full cost of a product or a service.

Prepared By Senior Hannington - 0789538704

CPA Paper 7 – Cost & Management Accounting – March 2021 Sitting

The treatment of under or over absorption of fixed costs can at times give a

misleading picture of the profit.

Absorption costing is not favourable for decision making since it does not make a

distinction between fixed and variable costs. Fixed costs do not influence the

decision but variable costs influence because they do change.

It increases the company’s tax liability due to the fact that it uses full costs; the

value of closing stock is at times higher than that of marginal costing. This results

into an increase in the company’s profits therefore higher taxes.

Prepared By Senior Hannington - 0789538704

CPA Paper 7 – Cost & Management Accounting – March 2021 Sitting

You might also like

- Vendmart - TheDocument6 pagesVendmart - TheSagarrajaNo ratings yet

- Cost Accounting Questions and Their AnswersDocument5 pagesCost Accounting Questions and Their Answerszulqarnainhaider450_No ratings yet

- Assignment On The Application of Full Costing and Variable Costing in The Manufacturing Industry of BangladeshDocument8 pagesAssignment On The Application of Full Costing and Variable Costing in The Manufacturing Industry of BangladeshManuelNo ratings yet

- MAS Variable and Absorption CostingDocument11 pagesMAS Variable and Absorption CostingGwyneth TorrefloresNo ratings yet

- Costing Marginal Final Sem 2Document37 pagesCosting Marginal Final Sem 2Abdul Qadir EzzyNo ratings yet

- Marginal and Absorption CostingDocument5 pagesMarginal and Absorption CostingHrutik DeshmukhNo ratings yet

- Absorption CostingDocument3 pagesAbsorption CostingThirayuth BeeNo ratings yet

- Absorption Costing and Varibale CostingDocument6 pagesAbsorption Costing and Varibale Costinghoney beeNo ratings yet

- Break Even Analysis: Costing Systems and Techniques For Engineering CompaniesDocument6 pagesBreak Even Analysis: Costing Systems and Techniques For Engineering Companiesasimrafiq12No ratings yet

- Chapter 13 Variable CostingDocument3 pagesChapter 13 Variable CostingJJ JaumNo ratings yet

- Mid Term Assignment On: The Superior University LahoreDocument9 pagesMid Term Assignment On: The Superior University LahoreFaizan ChNo ratings yet

- Overview of absorption and variable costing methodsDocument3 pagesOverview of absorption and variable costing methodsAreeb Baqai100% (1)

- Marginal costing definition and principlesDocument15 pagesMarginal costing definition and principlesShivani JainNo ratings yet

- UGB253 Management Accounting Business FinalDocument15 pagesUGB253 Management Accounting Business FinalMohamed AzmalNo ratings yet

- Ch8 Absorption Variable Costing Income ReportingDocument19 pagesCh8 Absorption Variable Costing Income ReportingIsra' I. SweilehNo ratings yet

- Chapter 10Document5 pagesChapter 10Ailene QuintoNo ratings yet

- Landau CompanyDocument4 pagesLandau Companysherwinrs100% (2)

- Marginal and Absorption CostingDocument3 pagesMarginal and Absorption CostingsyedzulqarnainhaiderNo ratings yet

- UNIT 3 Absorption Variable CostingDocument19 pagesUNIT 3 Absorption Variable Costingannabelle albaoNo ratings yet

- Meaning of Marginal Costing:: AdvertisementsDocument8 pagesMeaning of Marginal Costing:: AdvertisementsUnni KuttanNo ratings yet

- Marginal Costing: Understanding Key Concepts and ApplicationsDocument9 pagesMarginal Costing: Understanding Key Concepts and ApplicationsPratyush Pratim SahariaNo ratings yet

- MAS Absorption Costing/Variable Costing Study ObjectivesDocument6 pagesMAS Absorption Costing/Variable Costing Study ObjectivesMarjorie ManuelNo ratings yet

- Cost Accounting ProjectDocument2 pagesCost Accounting Projectaloksemail2011No ratings yet

- Absorption Costing Vs Variable CostingDocument2 pagesAbsorption Costing Vs Variable Costingneway gobachew100% (1)

- Marginal vs absorption costing: Understanding key differencesDocument5 pagesMarginal vs absorption costing: Understanding key differencesosama haseebNo ratings yet

- Marginal Costing 300 Level-1Document23 pagesMarginal Costing 300 Level-1simon danielNo ratings yet

- Analyzing Costs, Profits, and Risks for Business PlanningDocument28 pagesAnalyzing Costs, Profits, and Risks for Business Planningmanas_samantaray28No ratings yet

- Chapter 8 Absorption and Variable Costing and Inventory ManagementDocument49 pagesChapter 8 Absorption and Variable Costing and Inventory ManagementNatanael PakpahanNo ratings yet

- ACCA F5 - Part A - Specialist Cost and Management Accounting TechniquesDocument5 pagesACCA F5 - Part A - Specialist Cost and Management Accounting TechniquesMuneera Al Hassan100% (2)

- Marginal and Absorption CostingDocument4 pagesMarginal and Absorption CostingNabeel Ismail/GDT/BCR/SG4No ratings yet

- Absorption Costing Technique Is Also Termed As Traditional or Full Cost MethodDocument2 pagesAbsorption Costing Technique Is Also Termed As Traditional or Full Cost MethodPankaj2cNo ratings yet

- Pages From MCOM-Ac - Paper - II PDFDocument64 pagesPages From MCOM-Ac - Paper - II PDFPravesh Kumar SinghNo ratings yet

- ADVANCED COST ACCOUNTING ACC 310 Marginal Absoption Lecture 12Document30 pagesADVANCED COST ACCOUNTING ACC 310 Marginal Absoption Lecture 12okeowoNo ratings yet

- Absorption (Variable) Costing and Cost-Volume-Profit AnalysisDocument41 pagesAbsorption (Variable) Costing and Cost-Volume-Profit AnalysisPapsie PopsieNo ratings yet

- HR Accounting Unit 2Document12 pagesHR Accounting Unit 2Cassidy DonahueNo ratings yet

- Marginal Costing Vs Absorption CostingDocument3 pagesMarginal Costing Vs Absorption CostingAntrickscoolNo ratings yet

- Variable and Absorption CostingDocument2 pagesVariable and Absorption CostingAppraiser PhilippinesNo ratings yet

- Accounting and FinanceDocument4 pagesAccounting and FinanceMuhammad WaqasNo ratings yet

- Ch3 Raiborn SMDocument34 pagesCh3 Raiborn SMOwdray Cia100% (1)

- Marginal Costing: Definition: (CIMA London)Document4 pagesMarginal Costing: Definition: (CIMA London)Pankaj2cNo ratings yet

- Advantages and Disadvantages of Marginal CostingDocument4 pagesAdvantages and Disadvantages of Marginal CostingnileshmsawantNo ratings yet

- Predetermined Overhead Rates, Flexible Budgets, and Absorption/Variable Costing QuestionsDocument4 pagesPredetermined Overhead Rates, Flexible Budgets, and Absorption/Variable Costing QuestionsSomething ChicNo ratings yet

- Chapter 15 - Alternative Inventory Valuation MethodsDocument5 pagesChapter 15 - Alternative Inventory Valuation MethodsLemon VeinNo ratings yet

- Learning ObjectivesDocument10 pagesLearning ObjectivesShraddha MalandkarNo ratings yet

- Costing and Profit PlanningDocument27 pagesCosting and Profit PlanningSIDDHANT CHUGHNo ratings yet

- Dominic assignmentDocument2 pagesDominic assignmentmarkzugg9No ratings yet

- CMA-II-Chapter 1Document20 pagesCMA-II-Chapter 1Yared BitewNo ratings yet

- Marginal Costing PDFDocument26 pagesMarginal Costing PDFMasumiNo ratings yet

- Marginal Costing With Decision MakingDocument38 pagesMarginal Costing With Decision MakingHaresh Sahitya0% (1)

- Review Management Advisory Services Part 1Document6 pagesReview Management Advisory Services Part 1Francis Ryan PorquezNo ratings yet

- Strategic Cost Management: Absorption vs Variable CostingDocument3 pagesStrategic Cost Management: Absorption vs Variable CostingMarites AmorsoloNo ratings yet

- Marginal CostingDocument37 pagesMarginal Costingbhavinpoldiya100% (1)

- Ca 1 Costing TechniquesDocument6 pagesCa 1 Costing TechniquesORIYOMI KASALINo ratings yet

- Variable and Absorption Costing ComparisonDocument8 pagesVariable and Absorption Costing ComparisonKarthi SkNo ratings yet

- Allocation Forcosts of JointProducts ByproductsDocument4 pagesAllocation Forcosts of JointProducts ByproductsMd. Ridoy HossainNo ratings yet

- Assignment - Management AccountingDocument16 pagesAssignment - Management AccountingPriyaNo ratings yet

- Ma Unit 4Document12 pagesMa Unit 4Prashant GuptaNo ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Textbook of Urgent Care Management: Chapter 12, Pro Forma Financial StatementsFrom EverandTextbook of Urgent Care Management: Chapter 12, Pro Forma Financial StatementsNo ratings yet

- Field inspection plan for structural steel erectionDocument1 pageField inspection plan for structural steel erectionDelta akathehusky100% (1)

- Arco GulDocument65 pagesArco Gulharsh1100.hNo ratings yet

- CalPERS Sep2022Document7 pagesCalPERS Sep2022Manish SinghNo ratings yet

- Chapter 3 The Project Management Process GroupsDocument13 pagesChapter 3 The Project Management Process GroupsKristel Joy Eledia NietesNo ratings yet

- Economics of Strategy (Rješenja)Document227 pagesEconomics of Strategy (Rješenja)Antonio Hrvoje ŽupićNo ratings yet

- Monopolistically CompetitiveDocument26 pagesMonopolistically Competitivebeth el100% (1)

- Ramandeep Kaur: Sub: Submission of Press ReleaseDocument3 pagesRamandeep Kaur: Sub: Submission of Press Releasekashyappathak01No ratings yet

- Ch03 - The Environment and Corporate CultureDocument28 pagesCh03 - The Environment and Corporate CultureRISRIS RISMAYANINo ratings yet

- Ufone ReportDocument16 pagesUfone ReportZeeshan Maqbool NZNo ratings yet

- Consolidation techniques and proceduresDocument25 pagesConsolidation techniques and proceduresArisBachtiarNo ratings yet

- Colorado Corporate Income Tax GuideDocument42 pagesColorado Corporate Income Tax Guideneo kNo ratings yet

- Service & Support: Lightnin and Plenty MixersDocument8 pagesService & Support: Lightnin and Plenty MixersDima ArfNo ratings yet

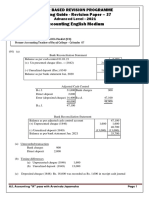

- Accounting English Medium: Paper Based Revision Programme Marking Guide - Revision Paper - 37Document6 pagesAccounting English Medium: Paper Based Revision Programme Marking Guide - Revision Paper - 37Malar SrirengarajahNo ratings yet

- Activity-2 Accounting EquationDocument3 pagesActivity-2 Accounting EquationAwais ur RehmanNo ratings yet

- Civil Society Participation in Urban Sanitation and Solid Waste Management in UgandaDocument15 pagesCivil Society Participation in Urban Sanitation and Solid Waste Management in UgandaVictoria Sepúlveda CastañedaNo ratings yet

- Cuaderno Técnico Schneider Electric N 145 Estudio Térmico de Cuadros EléctricosDocument1 pageCuaderno Técnico Schneider Electric N 145 Estudio Térmico de Cuadros EléctricosisaacingNo ratings yet

- Business CommunicationDocument144 pagesBusiness CommunicationtauhidNo ratings yet

- Worksheet 4Document4 pagesWorksheet 4JabarrioMykaelHolligan0% (2)

- Alpha Beta - Beta RoleDocument3 pagesAlpha Beta - Beta RoleHaung TuanNo ratings yet

- A Project Report ON Production Process AT Katraj Dairy IndustryDocument43 pagesA Project Report ON Production Process AT Katraj Dairy IndustryHařsh Thakkar HťNo ratings yet

- OligopolyDocument2 pagesOligopolyOptimistic RiditNo ratings yet

- Stars Produces Stars For Elementary Teachers To Reward Their StudentsDocument14 pagesStars Produces Stars For Elementary Teachers To Reward Their StudentsJalaj GuptaNo ratings yet

- Marketing The New Venture: OutlineDocument41 pagesMarketing The New Venture: OutlineAnkit SinghNo ratings yet

- 2020-07-23 St. Mary's County TimesDocument32 pages2020-07-23 St. Mary's County TimesSouthern Maryland OnlineNo ratings yet

- Business Essentials: Ebert, Griffin, Starke, DracopoulosDocument38 pagesBusiness Essentials: Ebert, Griffin, Starke, DracopoulosGurleen CheemaNo ratings yet

- AVIATION IN INDIA - Mega Max PDFDocument11 pagesAVIATION IN INDIA - Mega Max PDFRishikesh MishraNo ratings yet

- Chapter 1Document11 pagesChapter 1Yassin ALIUSODANNo ratings yet

- ICH Q13 Business PlanDocument3 pagesICH Q13 Business PlanbioNo ratings yet

- Udemy Business Executive SummaryDocument8 pagesUdemy Business Executive SummaryAshish RanjanNo ratings yet

- Agrinurture, Inc.: Philippine Stock ExchangeDocument2 pagesAgrinurture, Inc.: Philippine Stock ExchangeJohn AzellebNo ratings yet