Professional Documents

Culture Documents

Entry Types Continuation Part 1

Entry Types Continuation Part 1

Uploaded by

Crypto BitcoinOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Entry Types Continuation Part 1

Entry Types Continuation Part 1

Uploaded by

Crypto BitcoinCopyright:

Available Formats

Entry Types Continuation Part 1

Created @August 10, 2021 1:11 AM

Tags

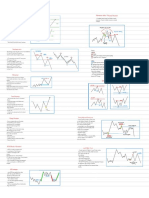

So when we are looking at the HTF, so it could be the daily, 4h, or 1h, now for me I

use 1h as my highest, which gives me a lot of opportunity and its just a great

timeframe to sort of base our trades around. Now for you can be the daily or the 4h,

it comes down to your own preference and could be the 4h or even a daily as your

highest timeframes.

But when we look at this diagram here, this is gonna be a HTF, so we are gonna call

this the 1h. So this diagram here.

Entry Types Continuation Part 1 1

So once we get a bullish OB (POI), as we can see here, so price came down but

then pushed up and bos, so we can see a clear shift in momentum and we know

potentially a clear shift and then bullish order flow from here.

Now once we get a bos this gives us a demand level or an OB within this. So when

price comes down to trade into this zone, for the very first time, this is in my opinion

not enough of a confluence for us to enter this trade and set a pending limit order.

So once price comes in, this is not enough of a confluence for me to be looking at

this to go long. I would rather wait for price to come in and see how price is delivered

and then look for our entry confirmations on a LTF.

Now a lot of smc traders would call that type of entry as a risk entry, but for me its

not something that I want to risk my money on, especially when we are trading on a

large sums of money.

What I would prefer to wait to see how price comes into that zone, and what I have

seen a lot more success with, is to wait to see how price comes into that zone, and

look for our entries on LTF.

So that why I will be not be looking at any sort of risk entries.

So if we get into the different types of entries, we can see once we bos here, we

have this as our first demand level. So we are looking for longs within this sort of

demand level here. Now this on a LTF would look something like this. So this is

gonna be our LTF, so for me I execute trades on a 1m, and sometimes I go down to

the 30s. But we are gonna stick to the 1m.

Entry Types Continuation Part 1 2

So once price comes down and trades into this zone, we will usually see, LLs and

LHs on a LTF.

So what we will be waiting for is for price to push in and then we wanna see intent

for bullish movement. So we wanna see a nice bos. Now this would then give us and

entry as it would create an OB down here.

Now this is entry type 1 which is a single bos which basically means a single bos

and a single confluence, which means we are trading the first bos on a HTF, as we

can see on 1h, is the first bos. Now this could have previously been a downtrend

with then bos showing intent tapped into a demand level, so its a single confluence

and its a single bos on the LTF.

Entry Types Continuation Part 1 3

Now entry type 2 would be waiting for the double bos, which basically means we

wanna see a bos it could pullback, it hasn´t got to mitigate this level here, it could

pullback and then bos again.

Thats still considered a double bos for me, so that is a double bos and its a single a

confluence, because we are still trading at this 1h demand level, but we have double

confirmation on a LTF.

So one thing I would say for anyone who struggles with entries or takes too many

losses, definitely try avoid this entry here (type 1), because when price bos now

obviously it depends how it breaks, but it could be just a fake out and then to head

lower.

Its not too much confirmation, but it all comes down to how it breaks as well, but

what I would say for like the newbies or beginners is definitely wait for a double bos

if you are struggling with entries, as we will get into some more better trades as we

are waiting for more confluence, and we are actually starting to see bullish order flow

on our LTF, and we can see that we are being respected from the 1h demand level.

Entry Types Continuation Part 1 4

So entry type 3 is we are gonna be looking at this second demand level on HTF. So

we can see bos, we pulled back, we bos again. So on the HTF we are clearly

showing bullish intent and bullish order flow.

Now we can see we put down here on caption intent for HTF prices. What this

basically means is prices trading above this lows, and once this was broken here this

structure, price then bos to the upside, we pulled back, we bos again and we can

see we are now showing intent has priced failed to trade below this level, so its

showing us intent for higher prices.

So back to this third entry, we have a bos, so a second bos on 1h, so this is our

double confluence because this is our second demand level.

So we are just seeing more confluence for price to continue.

Entry Types Continuation Part 1 5

Now this pullback to second demand level, this is what it will look like or this is what

we wanna see for the trade to meet our entry rules.

Entry Types Continuation Part 1 6

So now they will be trading inside the second demand level and the second bos.

Price again trading back down into it, and we will see LLs and LHs, we wanna wait

for a nice bos as we can see, and this would be our single bos, but with double

confluences, as we trade in the second demand.

Now entry type 4 we wanna wait for a double bos as we can see one bos, pullback,

second bos. Double bos and double confluence as we are trading at this second

demand.

This type 4 is taking to the extreme and waiting for a lot of confirmation, but if we are

waiting for this, then we are gonna get involved in some great trades, but we won´t

always get involved in the trade.

So for me, I do take trades with a single bos and a single

confluence as long as we are trading with the trend. But I do also

Entry Types Continuation Part 1 7

take a double bos as well, but again it comes down to how it

breaks, so we will need to do our testing on that. But like I say, if

we are struggling with entries, then the minimum that we should

be taking is a double bos and then entries type 3 and 4.

So now that we have gone through this continuation trades, its important to know

that this is just drawings and this is textbook setups. They are not always gonna be

as clean as this.

So its about using own initiative to asking ourself what is price actually doing?

How is price bos?

Where is price likely to react from?

And then look for our entries from there, but this is textbook continuation trades.

So once we start seeing HTF bullish or bearish order flow, just like this, we wanna

look for the bos.

Where are the demand levels or supply levels?

Where is the momentum come in before the bos?

So what where did price start that caused the bos?

This is where price is likely to come back to mitigate it before continuing, so its

important to understand where price broke from, where did the move initiate from.

Entry Types Continuation Part 1 8

Entry Types Continuation Part 1 9

You might also like

- Liquidity and ManipulationDocument20 pagesLiquidity and ManipulationAtharva Sawant82% (22)

- Liquidity and ManipulationDocument20 pagesLiquidity and ManipulationAtharva Sawant82% (22)

- Lower Timeframe Order Block RefinementDocument14 pagesLower Timeframe Order Block RefinementAtharva Sawant83% (12)

- Lower Timeframe Order Block RefinementDocument14 pagesLower Timeframe Order Block RefinementAtharva Sawant83% (12)

- Institutional Candle 1Document4 pagesInstitutional Candle 1Thabang100% (3)

- Market Structure Cheat SheetDocument55 pagesMarket Structure Cheat SheetMuralidaran Selvaraj100% (7)

- Supply and DemandDocument18 pagesSupply and DemandAtharva Sawant100% (5)

- Supply and DemandDocument18 pagesSupply and DemandAtharva Sawant100% (5)

- BOS CHoCHDocument6 pagesBOS CHoCHFelipe Silva100% (1)

- Mitigation of Orders and Cause For PriceDocument10 pagesMitigation of Orders and Cause For PriceAtharva Sawant100% (2)

- Mitigation of Orders and Cause For PriceDocument10 pagesMitigation of Orders and Cause For PriceAtharva Sawant100% (2)

- WWA Market StructureDocument1 pageWWA Market StructureMus'ab Abdullahi BulaleNo ratings yet

- Flipping Markets: Trading PlanDocument28 pagesFlipping Markets: Trading PlanDario Anchava88% (8)

- Market StructureDocument21 pagesMarket StructureAtharva Sawant100% (10)

- Types of LiquidityDocument12 pagesTypes of LiquidityAtharva Sawant100% (8)

- Price Action ImbalanceDocument22 pagesPrice Action ImbalanceAtharva Sawant100% (5)

- Price Action ImbalanceDocument22 pagesPrice Action ImbalanceAtharva Sawant100% (5)

- Types of LiquidityDocument12 pagesTypes of LiquidityAtharva Sawant100% (8)

- Market StructureDocument21 pagesMarket StructureAtharva Sawant100% (10)

- Trade PlanDocument10 pagesTrade Planquentin oliver67% (3)

- Liquidity Price VoidDocument12 pagesLiquidity Price VoidSIDOW ADENNo ratings yet

- Order Blocks: Supply & DemandDocument5 pagesOrder Blocks: Supply & DemandTradewith Dev100% (1)

- Trading Terminology and MeaningDocument2 pagesTrading Terminology and MeaningAtharva Sawant100% (1)

- Trading Terminology and MeaningDocument2 pagesTrading Terminology and MeaningAtharva Sawant100% (1)

- Entry Time: Entries 101Document5 pagesEntry Time: Entries 101quentin oliver100% (1)

- Multi Time Frame Structure Breakdown: Ivan KumburovicDocument6 pagesMulti Time Frame Structure Breakdown: Ivan KumburovicFX IINo ratings yet

- PazDocument18 pagesPazPoorya Bagherpoor93% (15)

- Proposal Majlis Berbuka PuasaDocument4 pagesProposal Majlis Berbuka PuasaheryizwanNo ratings yet

- Snowflake2 @FOREXSyllabusDocument27 pagesSnowflake2 @FOREXSyllabusHamzah Ahmed100% (3)

- Tradable Order BlocksDocument24 pagesTradable Order BlocksFelipe Silva93% (15)

- Lower - Timeframe - Bullish - Order - FlowDocument30 pagesLower - Timeframe - Bullish - Order - FlowAleepha Lelana100% (5)

- Flipping Markets: PDF Cheat SheetDocument59 pagesFlipping Markets: PDF Cheat SheetAsh Sam100% (9)

- Supply, Demand and Deceleration - Day Trading Forex, Metals, Index, Crypto, Etc.From EverandSupply, Demand and Deceleration - Day Trading Forex, Metals, Index, Crypto, Etc.No ratings yet

- How To Use Reclaimed Order BlocksDocument11 pagesHow To Use Reclaimed Order BlocksMarvrickEml100% (1)

- GU Live Example The Markets Need That Fuel To MoveDocument3 pagesGU Live Example The Markets Need That Fuel To MoveAtharva Sawant100% (1)

- GU Live Example The Markets Need That Fuel To MoveDocument3 pagesGU Live Example The Markets Need That Fuel To MoveAtharva Sawant100% (1)

- Market Structure ConfluenceDocument7 pagesMarket Structure ConfluenceSagar BhandariNo ratings yet

- Market StructureDocument12 pagesMarket StructureHODAALE MEDIANo ratings yet

- Structure GuideDocument7 pagesStructure Guidequentin oliverNo ratings yet

- 22template22 Backtest of Alex GU PDFDocument13 pages22template22 Backtest of Alex GU PDFjair100% (1)

- Liquidity: Quantum Stone CapitalDocument6 pagesLiquidity: Quantum Stone CapitalCapRa Xubo100% (5)

- Liquidity PrinciplesDocument21 pagesLiquidity PrinciplesAnurag Nauriyal93% (15)

- Sponsor - Candle - 2 37981Document5 pagesSponsor - Candle - 2 37981CapRa Xubo100% (1)

- Rule Based TradingDocument3 pagesRule Based TradingAlex Almeida100% (2)

- Bullish - Bearish - Order - BlocksDocument17 pagesBullish - Bearish - Order - BlocksAtharva Sawant100% (7)

- Entry Types Continuations Liquidity Part 2Document7 pagesEntry Types Continuations Liquidity Part 2Crypto Bitcoin100% (1)

- Entry Types Continuations & Liquidity Part 2: Created TagsDocument7 pagesEntry Types Continuations & Liquidity Part 2: Created TagsThero Raseasala100% (1)

- Entry Criteria, Targets and Market DirectionDocument16 pagesEntry Criteria, Targets and Market DirectionRui Almeida100% (2)

- What Is An Order BlockDocument16 pagesWhat Is An Order BlockLeonardo Caverzan100% (5)

- Price Action ImbalanceDocument22 pagesPrice Action ImbalanceVillaca KeneteNo ratings yet

- Week 1 Markup 4 NotesDocument3 pagesWeek 1 Markup 4 Notesabas100% (1)

- Safe - Target - and - LTF - Price - ActionDocument9 pagesSafe - Target - and - LTF - Price - ActionRui Almeida100% (1)

- Asia Session Range and Anticipation That Liquidity To Be SweptDocument6 pagesAsia Session Range and Anticipation That Liquidity To Be SweptAtharva Sawant100% (1)

- ResourcesDocument10 pagesResourcesAtharva Sawant50% (2)

- Entry Types: Quantum Stone CapitalDocument6 pagesEntry Types: Quantum Stone CapitalThabangNo ratings yet

- Order BlocksDocument8 pagesOrder Blocksdaniel75% (4)

- Choch Trading PlanDocument22 pagesChoch Trading PlanHarmanpreet Dhiman100% (4)

- Precision Based Trading King. D Boateng IG@ KingboatengofficialDocument24 pagesPrecision Based Trading King. D Boateng IG@ Kingboatengofficialdjkunal100% (1)

- BOS and Marking Last CandlesDocument13 pagesBOS and Marking Last Candlesvivaldi22100% (1)

- Tutti: Structure and Time Momentum Shifts / Reversal StructureDocument1 pageTutti: Structure and Time Momentum Shifts / Reversal StructureMus'ab Abdullahi BulaleNo ratings yet

- Obstacles, Predictions and Market DirectionDocument22 pagesObstacles, Predictions and Market DirectionRui AlmeidaNo ratings yet

- Tradingview Getting Started: Created TagsDocument8 pagesTradingview Getting Started: Created TagsAtharva Sawant100% (1)

- Bilal - Forex - What Is Mitigation BlocksDocument4 pagesBilal - Forex - What Is Mitigation Blocksrex anthony50% (2)

- FX Personal Trading Strategy ACLDocument29 pagesFX Personal Trading Strategy ACLAlberto Campos López100% (2)

- Market StructureDocument10 pagesMarket StructureliwiuszlipinskiNo ratings yet

- Risk Entries: 1st Pattern (Sell)Document17 pagesRisk Entries: 1st Pattern (Sell)Arya WibawaNo ratings yet

- Prediction - Understanding HTF DirectionDocument10 pagesPrediction - Understanding HTF DirectionRui AlmeidaNo ratings yet

- Asia Session Range and Anticipation That Liquidity To Be SweptDocument6 pagesAsia Session Range and Anticipation That Liquidity To Be SweptAtharva Sawant100% (1)

- Asia Session Range and Anticipation That Liquidity To Be SweptDocument6 pagesAsia Session Range and Anticipation That Liquidity To Be SweptAtharva Sawant100% (1)

- ResourcesDocument10 pagesResourcesAtharva Sawant50% (2)

- Tradingview Getting Started: Created TagsDocument8 pagesTradingview Getting Started: Created TagsAtharva Sawant100% (1)

- Bullish - Bearish - Order - BlocksDocument17 pagesBullish - Bearish - Order - BlocksAtharva Sawant100% (7)

- World Economic ForumDocument5 pagesWorld Economic ForumAtharva SawantNo ratings yet

- (Report Title) (2018) : (DATE)Document2 pages(Report Title) (2018) : (DATE)Atharva SawantNo ratings yet

- Adsp - Exp 5Document3 pagesAdsp - Exp 5Atharva SawantNo ratings yet

- Name of Experiment:: Study of Logic GatesDocument7 pagesName of Experiment:: Study of Logic GatesAtharva SawantNo ratings yet

- Document 7Document4 pagesDocument 7Atharva SawantNo ratings yet

- Name of Experiment:: Study of Logic GatesDocument6 pagesName of Experiment:: Study of Logic GatesAtharva SawantNo ratings yet

- Model Internship Guidelines ManualDocument44 pagesModel Internship Guidelines ManualAtharva SawantNo ratings yet

- Campus Schedule 16.8.2018Document2 pagesCampus Schedule 16.8.2018Atharva SawantNo ratings yet

- GTL FEE CHART 2021 Converted SDMCDocument3 pagesGTL FEE CHART 2021 Converted SDMCYUGAM VERMANo ratings yet

- Notice: Environmental Statements Availability, Etc.: Denali National Park and Preserve, AKDocument1 pageNotice: Environmental Statements Availability, Etc.: Denali National Park and Preserve, AKJustia.comNo ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological Universityvenkat naiduNo ratings yet

- Lines and Angles Worksheet-3Document4 pagesLines and Angles Worksheet-3umashankar_gNo ratings yet

- Fuchs Althusser Thompson Controversy 2019Document18 pagesFuchs Althusser Thompson Controversy 2019Miguel Ángel Cabrera AcostaNo ratings yet

- 002a REFRESHER PLUMBING CODE PDFDocument601 pages002a REFRESHER PLUMBING CODE PDFDoms DominguezNo ratings yet

- Chapter 4: Money Time Relationships and EquivalenceDocument12 pagesChapter 4: Money Time Relationships and EquivalenceAbed SolimanNo ratings yet

- Rajasthan Housing Board, Circle - Iii, JaipurDocument1 pageRajasthan Housing Board, Circle - Iii, JaipurAshish AshishNo ratings yet

- Fintech Barometer - Report by DLAI and CRIFDocument37 pagesFintech Barometer - Report by DLAI and CRIFsalgiashrenikNo ratings yet

- Form Three Mathematics Set 1 QSDocument9 pagesForm Three Mathematics Set 1 QSTiffanyNo ratings yet

- Iron Ore Industry Trends and AnalysisDocument21 pagesIron Ore Industry Trends and AnalysisZakir HossainNo ratings yet

- A Comparison of Hemodynamic Changes During Laryngoscopy and Endotracheal Intubation by Using Three Modalities of Anesthesia InductionDocument5 pagesA Comparison of Hemodynamic Changes During Laryngoscopy and Endotracheal Intubation by Using Three Modalities of Anesthesia Inductionammaa_No ratings yet

- Anchor Manual 2015Document172 pagesAnchor Manual 2015John100% (3)

- d-Copia300MF 400MF 500MFaien548702Document290 pagesd-Copia300MF 400MF 500MFaien548702rokebyschoolNo ratings yet

- Review AudDocument13 pagesReview AudMichelle AlvarezNo ratings yet

- Course Name: SCM100 Information SystemsDocument4 pagesCourse Name: SCM100 Information SystemsShivam AroraNo ratings yet

- Dynatron OscillatorDocument6 pagesDynatron OscillatorNikša StanojevićNo ratings yet

- Project Manager Business Analyst in ST Louis Resume Sharon DelPietroDocument2 pagesProject Manager Business Analyst in ST Louis Resume Sharon DelPietroSharonDelPietroNo ratings yet

- Internal Auditing PDFDocument68 pagesInternal Auditing PDFPirama RayanNo ratings yet

- The Importance of Emotional Intelligence in The WorkplaceDocument2 pagesThe Importance of Emotional Intelligence in The WorkplaceTMU ba15109015No ratings yet

- Busa 331 Chapter 14Document18 pagesBusa 331 Chapter 14Mais MarieNo ratings yet

- Ampco Machining RecommendationsDocument9 pagesAmpco Machining Recommendationsjunior_radaicNo ratings yet

- Electric Combi Oven 6GN1 - 1 - 217610-217620Document4 pagesElectric Combi Oven 6GN1 - 1 - 217610-217620Alan TanNo ratings yet

- 17W+17W Class D Speaker Amplifier For Digital Input: DatasheetDocument53 pages17W+17W Class D Speaker Amplifier For Digital Input: DatasheetmahfudNo ratings yet

- Spider Glass Curtain Walls-Glass OptionsDocument3 pagesSpider Glass Curtain Walls-Glass OptionsHAN HANNo ratings yet

- Ata 100Document10 pagesAta 100Wilian Silva Silva100% (2)

- ms880 Car Specific Cable Set - 53985Document11 pagesms880 Car Specific Cable Set - 53985SamuelNo ratings yet

- Packet Tracer 4.0 Skill Building Activity: Lab 1.1.4a Configuring NAT SolutionDocument3 pagesPacket Tracer 4.0 Skill Building Activity: Lab 1.1.4a Configuring NAT SolutionGlaiza LacsonNo ratings yet

- Climate Finance With CFA Institute and ACCADocument20 pagesClimate Finance With CFA Institute and ACCArushtwodrNo ratings yet