Professional Documents

Culture Documents

Chapter - 13: Externalities

Uploaded by

shamawail hassanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter - 13: Externalities

Uploaded by

shamawail hassanCopyright:

Available Formats

Chapter - 13

EXTERNALITIES

AUNTORIP KARIM - CLASS VIII ECONOMICS - CHAPTER 13

Externalities are the spillover effects of consumption or

production. These are third party effects ignored by the price

mechanism.

AUNTORIP KARIM - CLASS VIII ECONOMICS - CHAPTER 13

• Negative Externalities (External cost) - Negative spillover effects of consumption or

production. For example, air pollution, noise pollution, traffic congestion, smoking and

alcohol abuse causing healthcare expenditure of the government to rise. Government

makes policies to reduce negative externalities.

• Positive Externalities (External benefit) - Positive spillover effects of consumption or

production. For example, healthcare, education and training, vaccine

AUNTORIP KARIM - CLASS VIII ECONOMICS - CHAPTER 13

• Public goods - Goods that have the characteristics of non-rivalry and non-excludability. For

example- street light, defense, law & order. Public goods are financed by taxation.

• Merit goods - Goods which are regarded as beneficial to the society and is expected to be

inadequately produced by the public sector. example- education and healthcare

• De-merit goods - Goods which are regarded as socially harmful and will be over-produced

and over-consumed if left to the private sector. For example- cigarettes and alcohol.

AUNTORIP KARIM - CLASS VIII ECONOMICS - CHAPTER 13

• Private cost - It is the cost of an economic activity to individuals and firms. For

example, cost of production, raw materials, price paid by consumers.

Social Cost = Private cost + External cost

AUNTORIP KARIM - CLASS VIII ECONOMICS - CHAPTER 13

• Private Benefit - It the reward of an economic activity to individuals and firms.

For example, revenue by firms.

Social Benefit = Private Benefit + External Benefit

AUNTORIP KARIM - CLASS VIII ECONOMICS - CHAPTER 13

Q.1 A new airport is being constructed in your city, Analyze the social cost and benefit of

such a construction?

Social Cost is the accumulation of private and external cost. Private cost is the cost of an economic

activity to individuals and firms. The private cost of this airport construction would be cost of

production, raw materials, wages paid to the labours. External costs are the spillover effects of

consumption or production. These are third party effects ignored by the price mechanism. The

external cost of this airport construction may be the increase in noise and sound pollution due to

this construction.

Social benefit is the accumulation of private and external benefit. Private benefit is the reward of an

economic activity to individuals and firms. In this case it would be the revenue of the construction

company. External benefit is the positive spillover effects of consumption or production. In this case

it would be infrastructure development of the city and the ease to air travel.

AUNTORIP KARIM - CLASS VIII ECONOMICS - CHAPTER 13

MARKET FALIURE

It is a situation where market leads to inefficiency, thus leading to a net welfare loss for society.

AUNTORIP KARIM - CLASS VIII ECONOMICS - CHAPTER 13

□Reason for Market Failure:

1) Externalities may not be taken into account while consumption and production of

goods and services. This can lead to over production in the market where negative

externalities exist.

2) The private sector is unlikely to provide public goods such as street lights due to the

free rider problem.

3) Imperfect information exists when people lack knowledge to make informed choices

and this leads to misallocation of resources.

4) Lack of competition may arise due to monopolies, which can exploit consumers with

higher prices.

AUNTORIP KARIM - CLASS VIII ECONOMICS - CHAPTER 13

□Government policies to reduce Market Failure:

1) Indirect Taxation

• Imposition of taxes will increase production cost and the price of the product will

rise. Higher prices will discourage production and consumption of a good with

negative externalities.

• Evaluation

i) It is difficult to quantify and attach a monetary value on the external cost.

ii) May not be effective if the magnitude of tax is low.

iii) If PED for the product is inelastic (tobacco, oil) then consumption will only fall less than

proportionately following an increase in price.

AUNTORIP KARIM - CLASS VIII ECONOMICS - CHAPTER 13

□Government policies to reduce Market Failure:

2) Government Regulation

• Government can pass rules and regulations to protect the environment and take

legal actions if anyone disobeys them. For example, banning smoking in public,

forcing firms to install pollution reducing equipment.

• Evaluation

i) It is difficult and expensive for government to monitor and enforce.

ii) Firms must be large enough to have some impact.

AUNTORIP KARIM - CLASS VIII ECONOMICS - CHAPTER 13

□Government policies to reduce Market Failure:

3) Subsidies

• It is a grant given by the government to reduce production cost. They may be

given to economic activities which reduce external cost such as firms that install

pollution reducing equipments, public transport, renewable energy, recycling and

waste management plans.

• Evaluation

i) It incurs opportunity cost for the government as the money could have been used in

other places instead of being spent on providing subsidies.

AUNTORIP KARIM - CLASS VIII ECONOMICS - CHAPTER 13

□Government policies to reduce Market Failure:

4) Tradable pollution permit

• It is an allowance on the amount of pollution firms may emit. Firms that emit below their limit

can sell surplus permits to other firms. Thus it acts as a profit incentive for firms to reduce

pollution.

• Evaluation

i) It is difficult to qualify external cost and therefore to set the right number of permit.

ii) It increases government expenditure of monitoring and enforcement.

iii) If many permits are issued, there will be little incentive for firms to invest into pollution

reducing technology.

AUNTORIP KARIM - CLASS VIII ECONOMICS - CHAPTER 13

□Government policies to reduce Market Failure:

5) Road Pricing

• It is a bundle of various direct charges levied for the usage of roads for

example, London congestion charge increases the cost of motoring during peak

hours and thus reduce the demand for road usage. It encourages motorists to

drive at off-peak hours.

Revenue raised from the charge can be spent on reducing congestion further by

developing transport infrastructure.

• Evaluation

i) The implementation of a road pricing scheme can be very expensive and depends

on the state technology available.

ii) It will not be successful if the magnitude of charge is low.

AUNTORIP KARIM - CLASS VIII ECONOMICS - CHAPTER 13

THE END

AUNTORIP KARIM - CLASS VIII ECONOMICS - CHAPTER 13

You might also like

- Quality Enhancement in Voluntary Carbon Markets: Opening up for MainstreamFrom EverandQuality Enhancement in Voluntary Carbon Markets: Opening up for MainstreamNo ratings yet

- Market FailureDocument26 pagesMarket Failurepratishdassani12No ratings yet

- 2010 'A' Level H1 Essay Q3 (Updated 25 June) (LT5)Document4 pages2010 'A' Level H1 Essay Q3 (Updated 25 June) (LT5)JohnNo ratings yet

- What Are Externalities?Document19 pagesWhat Are Externalities?elizabeth nyasakaNo ratings yet

- 2 8 (3) GovIntervExtMeritDemeritDocument11 pages2 8 (3) GovIntervExtMeritDemeritserge.hNo ratings yet

- Session-3-4-5 Public Goods and ExternalitiesDocument45 pagesSession-3-4-5 Public Goods and Externalitiessadiakhn03No ratings yet

- Essentials of Economics 8th Edition Mankiw Solutions ManualDocument15 pagesEssentials of Economics 8th Edition Mankiw Solutions Manualsamanthaadamsgofinbesmr100% (21)

- Essentials of Economics 8th Edition Mankiw Solutions ManualDocument38 pagesEssentials of Economics 8th Edition Mankiw Solutions Manualalfredosmithxttw100% (16)

- 017653086X - 405303-Chapter 10Document42 pages017653086X - 405303-Chapter 10Asadullah IoBMNo ratings yet

- Micro ExternalitiesDocument16 pagesMicro ExternalitiesClive LisambaNo ratings yet

- IAL Economics Market Failure, Part 1Document24 pagesIAL Economics Market Failure, Part 1Khalil AzrinNo ratings yet

- Week 12 Revision QuestionsDocument3 pagesWeek 12 Revision QuestionsAmber YangNo ratings yet

- Essentials of Economics 7th Edition Gregory Mankiw Solutions ManualDocument15 pagesEssentials of Economics 7th Edition Gregory Mankiw Solutions Manualsexton.garookuh6lsjr100% (23)

- Nguyễn Thị Huyền-24A7511485Document4 pagesNguyễn Thị Huyền-24A7511485Thị Huyền NguyễnNo ratings yet

- 2.10 Market FailureDocument16 pages2.10 Market FailureDaksh ChawlaNo ratings yet

- Theory of ExternalitiesDocument24 pagesTheory of ExternalitiesLester VillareteNo ratings yet

- Ex Tern Ali Ties N Public PolicyDocument30 pagesEx Tern Ali Ties N Public PolicySofyan CholidNo ratings yet

- Chapter 14 IGCSEDocument81 pagesChapter 14 IGCSEtaj qaiserNo ratings yet

- Market FailureDocument6 pagesMarket FailureZara0% (1)

- Chapter - 12: PrivatizationDocument9 pagesChapter - 12: Privatizationshamawail hassanNo ratings yet

- Market FailuresDocument4 pagesMarket FailuresErik F. Meinhardt100% (9)

- In-Class Assignment - 3: Positive ImpactDocument3 pagesIn-Class Assignment - 3: Positive Impactpreeti56526No ratings yet

- Government PoliciesDocument8 pagesGovernment Policieser_ankurpareekNo ratings yet

- Harsh Eco ProjectDocument7 pagesHarsh Eco ProjectUnknown patelNo ratings yet

- Solution Manual For Essentials of Economics 8th Edition N Gregory MankiwDocument15 pagesSolution Manual For Essentials of Economics 8th Edition N Gregory MankiwLisaVancekbntNo ratings yet

- A2-Unit-1 Basic Economic Ideas 2 of 3Document50 pagesA2-Unit-1 Basic Economic Ideas 2 of 3Wayne LOGIENo ratings yet

- Economics ReviewerDocument3 pagesEconomics ReviewerArnold MarcosNo ratings yet

- Public Finance (Prelim)Document22 pagesPublic Finance (Prelim)narterhealyn0No ratings yet

- Key Terms:: Market Failure Caused by The Over Supply of Demerit GoodsDocument7 pagesKey Terms:: Market Failure Caused by The Over Supply of Demerit GoodsSOURAV MONDALNo ratings yet

- Chapter 10-11Document12 pagesChapter 10-11FarNo ratings yet

- IGCSE Economics Self Assessment Chapter 14 AnswersDocument2 pagesIGCSE Economics Self Assessment Chapter 14 AnswersDesre100% (1)

- 320 33 Powerpoint Slides Chapter 15 Externalities Public GoodsDocument8 pages320 33 Powerpoint Slides Chapter 15 Externalities Public GoodsPrateek KhandelwalNo ratings yet

- Anti Dumping Regulations - RadhikaDocument22 pagesAnti Dumping Regulations - RadhikaRahul KamraNo ratings yet

- Discuss The UNIDO Approach of Social-Cost Benefit AnalysisDocument3 pagesDiscuss The UNIDO Approach of Social-Cost Benefit AnalysisAmi Tandon100% (1)

- CH 13 ExternalitiesDocument32 pagesCH 13 ExternalitiesSafawat GaniNo ratings yet

- CH 2 Cost and Benefit AnalysisDocument9 pagesCH 2 Cost and Benefit AnalysisHafeezurrahman ShayaanNo ratings yet

- Market Failure and The Role of GovernmentDocument39 pagesMarket Failure and The Role of GovernmentMariz RapadaNo ratings yet

- Module IDocument20 pagesModule Ivishal chaudharyNo ratings yet

- Landuse BarirerDocument64 pagesLanduse BarirerTony BuNo ratings yet

- Economics of IndiaDocument6 pagesEconomics of IndiaआlokNo ratings yet

- Allocative Efficiency, Market Failure and Government Measures To Address Market FailureDocument16 pagesAllocative Efficiency, Market Failure and Government Measures To Address Market Failurekim2hockinsNo ratings yet

- W1. U1+3 Reference ReadingDocument8 pagesW1. U1+3 Reference ReadingNgọc LinhNo ratings yet

- EXTERNALITIES (Positive & Negative) - Shreshth Mahto A70057920006Document6 pagesEXTERNALITIES (Positive & Negative) - Shreshth Mahto A70057920006rahul rathodNo ratings yet

- Principles of Economics Mankiw 7th Edition Solutions ManualDocument16 pagesPrinciples of Economics Mankiw 7th Edition Solutions ManualJacobTorresejcgaNo ratings yet

- Managerial EconomicsDocument27 pagesManagerial EconomicsJanna TubalinalNo ratings yet

- Agribusiness EconomicsDocument8 pagesAgribusiness EconomicsnoreenasyikinNo ratings yet

- Unit Ii: Porters Five Force ModelDocument5 pagesUnit Ii: Porters Five Force ModelAnonymous NZLpkOi0xwNo ratings yet

- Competition Law IndiaDocument51 pagesCompetition Law IndiaMegha JainNo ratings yet

- Solution Manual For Principles of Economics 9th Edition N Gregory MankiwDocument16 pagesSolution Manual For Principles of Economics 9th Edition N Gregory MankiwTonyDonaldsondfsoyNo ratings yet

- Market Success and Market FailureDocument32 pagesMarket Success and Market Failuremahajanmayur50% (2)

- Market Failure - FinalDocument32 pagesMarket Failure - FinalM Manjunath100% (1)

- Market Failure Model AnswerDocument7 pagesMarket Failure Model Answerkala1975No ratings yet

- Edexcel Economics AS-level Series Complete NotesDocument8 pagesEdexcel Economics AS-level Series Complete NotesShahab HasanNo ratings yet

- Markets in Action Essay QsDocument12 pagesMarkets in Action Essay Qsmkc306No ratings yet

- A2 European Union Competition PolicyDocument7 pagesA2 European Union Competition Policypunte77No ratings yet

- 12 Dmi Me 2016-18Document45 pages12 Dmi Me 2016-18viewpawanNo ratings yet

- Eco Cia 1.1Document5 pagesEco Cia 1.1Anonymous EzErYbJENo ratings yet

- Industrial Policy: Development and ImplicationsDocument47 pagesIndustrial Policy: Development and ImplicationsParul BajajNo ratings yet

- Topic 3-1Document20 pagesTopic 3-1Qasim AkramNo ratings yet

- Week4 Monopoly+&+Document40 pagesWeek4 Monopoly+&+Jack_Nguyen81No ratings yet

- Computer Computer System: Entral Processing Unit (CPU) - The CPU Is The Brains of TheDocument2 pagesComputer Computer System: Entral Processing Unit (CPU) - The CPU Is The Brains of Theshamawail hassanNo ratings yet

- Operating System: Examples of Operating SystemsDocument2 pagesOperating System: Examples of Operating Systemsshamawail hassanNo ratings yet

- Lecture 14Document1 pageLecture 14shamawail hassanNo ratings yet

- Lecture-12: Types of Networks: WAN, LAN. Networking Devices-Router, Modem, Switch WAN: A WAN (Wide Area Network) Is ADocument2 pagesLecture-12: Types of Networks: WAN, LAN. Networking Devices-Router, Modem, Switch WAN: A WAN (Wide Area Network) Is Ashamawail hassanNo ratings yet

- Outh Reeze Chool: Lesson Plan For IGCSE ICT (9-1)Document2 pagesOuth Reeze Chool: Lesson Plan For IGCSE ICT (9-1)shamawail hassanNo ratings yet

- Lecture 12 PhishingDocument2 pagesLecture 12 Phishingshamawail hassanNo ratings yet

- Sl. Day Date/Month Name of Holidays School - ReopensDocument1 pageSl. Day Date/Month Name of Holidays School - Reopensshamawail hassanNo ratings yet

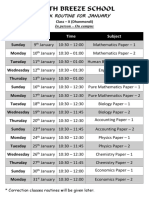

- Mock Routine - JanuaryDocument1 pageMock Routine - Januaryshamawail hassanNo ratings yet

- Class - X Second Mock Exam - 2021-22 Month - February/March: Date Subject Length Subject LengthDocument1 pageClass - X Second Mock Exam - 2021-22 Month - February/March: Date Subject Length Subject Lengthshamawail hassanNo ratings yet

- Bengali: Pearson Edexcel International GCSEDocument16 pagesBengali: Pearson Edexcel International GCSEshamawail hassanNo ratings yet

- Pearson Edexcel List of Fees June 2022 Exam SeriesDocument17 pagesPearson Edexcel List of Fees June 2022 Exam SeriesTahmid Jamil ChyNo ratings yet

- Instructions: Mock - 1Document18 pagesInstructions: Mock - 1shamawail hassanNo ratings yet

- What Makes A Good FriendshipDocument2 pagesWhat Makes A Good Friendshipshamawail hassanNo ratings yet

- Meeting Code: Xbsnbajnda: Class X RoutineDocument1 pageMeeting Code: Xbsnbajnda: Class X Routineshamawail hassanNo ratings yet

- 4AC0 01 Que 20180125Document20 pages4AC0 01 Que 20180125Ahmad RahjeNo ratings yet

- Roductivity Ivision of Labour: Auntorip Karim - Class Viii Economics - Chapter 15Document9 pagesRoductivity Ivision of Labour: Auntorip Karim - Class Viii Economics - Chapter 15shamawail hassanNo ratings yet

- Factors That May Hift THE Emand Curve: Auntorip Karim - Class Viii Economics - Chapter 4Document9 pagesFactors That May Hift THE Emand Curve: Auntorip Karim - Class Viii Economics - Chapter 4shamawail hassanNo ratings yet

- Chapter - 21: LigopolyDocument8 pagesChapter - 21: Ligopolyshamawail hassanNo ratings yet

- 2019 May MS 4ac0 2 PDFDocument8 pages2019 May MS 4ac0 2 PDFmahdiarahman10No ratings yet

- Chapter - 6: Shift in Supply CurveDocument4 pagesChapter - 6: Shift in Supply Curveshamawail hassanNo ratings yet

- Chapter - 1: He Economic ProblemDocument16 pagesChapter - 1: He Economic Problemshamawail hassanNo ratings yet

- Chapter - 20: MonopolyDocument5 pagesChapter - 20: Monopolyshamawail hassanNo ratings yet

- Chapter - 17: Conomies of CaleDocument12 pagesChapter - 17: Conomies of Caleshamawail hassanNo ratings yet

- Competitive Market: Auntorip Karim - Class Viii Economics - Chapter 18Document7 pagesCompetitive Market: Auntorip Karim - Class Viii Economics - Chapter 18shamawail hassanNo ratings yet

- Chapter - 19: Dvantages and Isadvantages of Large and Small FirmsDocument11 pagesChapter - 19: Dvantages and Isadvantages of Large and Small Firmsshamawail hassanNo ratings yet

- Chapter - 16: Usiness Costs Revenue RofitDocument6 pagesChapter - 16: Usiness Costs Revenue Rofitshamawail hassanNo ratings yet

- Chapter - 12: PrivatizationDocument9 pagesChapter - 12: Privatizationshamawail hassanNo ratings yet

- Chapter - 11: Mixed EconomyDocument7 pagesChapter - 11: Mixed Economyshamawail hassanNo ratings yet

- Chapter - 14: Ectors of The Economy Actors of ProductionDocument9 pagesChapter - 14: Ectors of The Economy Actors of Productionshamawail hassanNo ratings yet

- Chapter - 10: Income Elasticity of Demand YEDDocument10 pagesChapter - 10: Income Elasticity of Demand YEDshamawail hassanNo ratings yet

- Caraga Regional Science High School: San Juan, Surigao CityDocument3 pagesCaraga Regional Science High School: San Juan, Surigao CityMalote Elimanco Alaba100% (1)

- 2nd Part of XXCDocument21 pages2nd Part of XXCKarolina KosiorNo ratings yet

- Akash Company IntroductionDocument16 pagesAkash Company IntroductionPujitNo ratings yet

- NZEI Te Riu Roa - Social Infrastructure Discussion PaperDocument7 pagesNZEI Te Riu Roa - Social Infrastructure Discussion PaperLaura WaltersNo ratings yet

- Mobile No: Career Objective: Course Name of The Institution University / Board Period of Study PercentageDocument2 pagesMobile No: Career Objective: Course Name of The Institution University / Board Period of Study Percentagesuresh kumarNo ratings yet

- Control of AirDocument71 pagesControl of Airajay ahlawatNo ratings yet

- Environmental Conservation in Bhutan: Organization and PolicyDocument21 pagesEnvironmental Conservation in Bhutan: Organization and PolicyApriele Rose Gaudicos HermogenesNo ratings yet

- Collective Intelligence: Creating A Prosperous World at Peace - Complete Book Minus Jacket FlapsDocument648 pagesCollective Intelligence: Creating A Prosperous World at Peace - Complete Book Minus Jacket Flapsreconfigure100% (19)

- As W 18 ExhibitorsDocument72 pagesAs W 18 ExhibitorssvetlataNo ratings yet

- Name: Nikki Shann V. Casas Course&Year: Beed-Iii Date: February 17, 2021 Course Title: Educ 321Document4 pagesName: Nikki Shann V. Casas Course&Year: Beed-Iii Date: February 17, 2021 Course Title: Educ 321Nnahs Varcas-CasasNo ratings yet

- A Study On Impact of Motivation On LIC Agents .Document46 pagesA Study On Impact of Motivation On LIC Agents .Saswatika goudaNo ratings yet

- HubSpot - 16 Free Sales Voicemail TemplatesDocument14 pagesHubSpot - 16 Free Sales Voicemail Templatesameya kapreNo ratings yet

- Be Prepared! - Pass That Job InterviewDocument98 pagesBe Prepared! - Pass That Job InterviewvixosaNo ratings yet

- Zachary ResumeDocument1 pageZachary Resumeapi-480558345No ratings yet

- MYP - LA - Emergent - Unit - Planner - Example - Phase 1 Hy 2Document14 pagesMYP - LA - Emergent - Unit - Planner - Example - Phase 1 Hy 2solany perezNo ratings yet

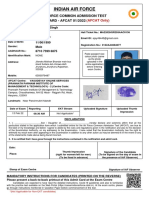

- Indian Air Force: Air Force Common Admission Test Admit Card - Afcat 01/2022Document6 pagesIndian Air Force: Air Force Common Admission Test Admit Card - Afcat 01/2022Ajay SinghNo ratings yet

- Kin 388-Student Assessment ReportDocument6 pagesKin 388-Student Assessment Reportapi-535394816No ratings yet

- 3314-06-03-Student AssignmentDocument4 pages3314-06-03-Student AssignmentSkye BeatsNo ratings yet

- Personal Characteristics of An Entrepreneur: Department of Management SciencesDocument32 pagesPersonal Characteristics of An Entrepreneur: Department of Management Sciencesshani27100% (1)

- SF Food Services Sector Info 20170714Document55 pagesSF Food Services Sector Info 20170714KhoaNguyenNo ratings yet

- Death Penalty in The Philippines, A Comparative Study - Research ProposalDocument24 pagesDeath Penalty in The Philippines, A Comparative Study - Research ProposalMJ69% (16)

- Rubric For Research PresentationDocument1 pageRubric For Research Presentationjoseph082281100% (3)

- Eaap ReviewerDocument3 pagesEaap ReviewerCamille SalvadoraNo ratings yet

- Zinkal ResumeDocument3 pagesZinkal Resumeexpert 60No ratings yet

- InterPals Compliance Guide For Law EnforcementDocument19 pagesInterPals Compliance Guide For Law Enforcementll6equj5No ratings yet

- Report in Oral CommDocument6 pagesReport in Oral CommellieNo ratings yet

- Bsbpmg511 Manage Project Scope: Assessment Part B Short Answer QuestionsDocument3 pagesBsbpmg511 Manage Project Scope: Assessment Part B Short Answer QuestionsAllana WardNo ratings yet

- Instruction of W.P. Exam-2018Document7 pagesInstruction of W.P. Exam-2018Sabyasachi KarNo ratings yet

- 21 HR Manual For Union Bank Officers Min PDFDocument217 pages21 HR Manual For Union Bank Officers Min PDFeswar414No ratings yet

- Listening Final Test Life 1 U 1-3Document1 pageListening Final Test Life 1 U 1-3Mariana GalvisNo ratings yet