Professional Documents

Culture Documents

Cordova Catholic Cooperative School (Formerly Cordova Academy) Poblacion, Cordova Cebu

Uploaded by

NJ TanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cordova Catholic Cooperative School (Formerly Cordova Academy) Poblacion, Cordova Cebu

Uploaded by

NJ TanCopyright:

Available Formats

CORDOVA CATHOLIC COOPERATIVE SCHOOL

(formerly Cordova Academy)

Poblacion, Cordova Cebu

LEARNING PACKAGE WEEK NUMBER 24 – February 14 – 19, 2022

Flow of Funds and Financial Reporting!

Name: Date Received:

Grade and Section: Date Submitted:

Subject: Business Finance Teacher’s Name: Mr. Andrew L. Bomediano Teacher’s Signature:

Standards: The learner...

Content: demonstrates an understanding of the definition of finance, the activities of the financial manager, and financial

institutions and markets.

Performance: *defines Finance;

*describes who are responsible for financial management within an organization; and

*describes the primary activities of the financial manager.

Formation: instills the value of thrift and savings by recognizing the major role of financial management and appreciating

varied financial institutions and their corresponding services.

Learning Outcome/Objectives:

explains the flow of funds within an organization – through and from the enterprise—and the role of the financial manager MELC;

distinguishes between stockholders and stakeholders;

describes the different stakeholders who would be interested in reviewing the financial statements prepared by a business

organization (MELC);

shows an understanding of ethical issues in finance (MELC); and

V: makes a tabular presentation on the institution and its services rendered.

PVMGOV: Teamwork, Relationship, Service, Respect, Commitment, Hard Work

21st Century Skills: Critical Thinking, Communication, Social Skills, Technology Literacy

Pretend that you are working as a finance manager for a manufacturing firm. The story is going well until your boss asks you to show

him a summary of results on how the company has fared in terms of financial performance in the past six months. You can almost hear

the boss shouting: “I want to know everything! I want to know sales, expenses, cash on hand, cash on the bank...everything! Before

you could say anything else, the scene gets more exciting. “I would like to see reports no later than tomorrow afternoon.”

For a real finance manager, the scene described above would neither be bad nor exciting. Finance managers are ready for this kind of

situation. Preparation with daily prayer is essential in order to effectively exercise your role as a future finance manager.

Day 1-2: Core Content: The Flow of Funds in Business Organizations

The flow of funds is essentially a financial report or account that illustrates fund inflow and outflow in an economy across different

sectors operating within it on a whom-to-whom basis.

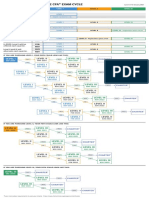

Figure 21.2 - The Flow of Funds with Financial Institutions

Suppliers of Funds Financial Institutions or Demanders of Funds

(those who have surplus money) Intermediaries (in the form of loans and/or investments

● Individuals/Households ● Commercial Banks from the suppliers)

● Organizations (profit and ● Savings Banks ● Individuals/Households

nonprofit) ● Investment Banks ● Organizations (profit and nonprofit)

● Government ● Insurance Companies ● Government

Explore: Activity number 1 – Smooth Flow! Study figure 21.2 above on the flow of funds with financial institutions and describe the

role of financial intermediaries in the flow of funds through and from the business.

Firm-Up: Activity number 2 – Figure It Out! Study figure 21.3 on how financial institutions provide financing for firms and answer

the question:

1..How do the key financial

institutions serve as intermediaries

for suppliers and users of funds?

2..Which type of financial institution

do you think is most critical for

firms?

Transfer: Activity number 3 –

Community of Savers! What are

some of the financial institutions in

your community? Have you dealt

with any of them? Can you describe

the experience?

Closure: Happiness is a positive

cash flow.

Day 3-4: Core Content: Standards

in Financial Reporting

Financial statements provide a

snapshot of a firm’s financial

1

performance within a specified period of time. Before you proceed to learn about the preparation of financial statements, you’ll have a

quick review first on some essential theories and principles that you learned on your previous accounting subjects.

Explore: Activity number 4 – Quick Review! Match the letter with the definition that corresponds to the following terms:

1. Accounting System ___ A. Exchanges of goods or services between/among two or more entities or some other event having an

2. Debit ___ economic impact on a business enterprise.

3. Credit ___ B. An accounting record used to list a particular type of frequently recurring transaction.

4. Transactions ___ C. A record used to classify and summarize the effects of transactions.

5.Double-Entry Accounting D. An entry on the right side of an account.

___ E. A record used as the basis for analyzing and recording transactions. Examples include invoices,

6. Journal Entry ___ check stubs and receipts.

7. Journals ___ F. A collection of accounts maintained by a business.

8. Accounting Process (or G. Procedures used for analyzing, recording, classifying, and summarizing the information to be

cycle) ___ presented in accounting reports.

9. Special Journals ___ H. An entry on the left side of an account.

10. General Journal ___ I. Procedures and methods used, including data processing equipment, to collect and report accounting

11. Account ___ data.

12. Ledger ___ J. An accounting record used to record all business activities for which a special journal is not

13. Posting ___ maintained.

14. General Ledger ___ K. The process of summarizing transactions by transferring amounts from the journals to the ledger

15. Subsidiary Ledgers ___ accounts.

L. The grouping of supporting accounts that in total equal the balance of a control account in the

general ledger.

M. The general ledger account that summarizes the detailed information in a subsidiary ledger.

N. A collection of all the accounts used by a business that could appear on the financial statements.

O. A system of recording transactions in a way that maintains the equality of the accounting equation.

P. Records in which transactions are first entered, providing a chronological record of business

activity.

Q. The recording of a transaction in which debits equal credits. It usually includes a date and an

explanation of the transaction.

LET’S LEARN! - A financial statement is a record which gives the users a picture or description of how an individual, a business, or

an organization is in terms of financial health.

STOCKHOLDERS VS. STAKEHOLDERS - Finance managers are not only accountable to stockholders. They also have to almost

always consider the perspective of stakeholders. Both stockholders and stakeholders are all users of financial statements. A

stockholder is a person who bought shares of stocks of a publicly traded corporation. On the other hand, a stakeholder is a person

who is not necessarily the owner of the business, but has an interest or a stake on how the business is performing or how it iis

managed.

An internal stakeholder is someone who is directly involved in the business. The stakeholders are as follows:

(Employees; Stockholders; Top Management; Department Managers; Board of Directors; Labor Unions)

An external stakeholder is someone who is not directly involved in the business but in one way or another has a stake in how the

business is managed or how it is performing. The following are external stakeholders:

(Customers; Suppliers; Government; Competitors; Financial Institutions; Potential Investors)

Firm-Up: Activity number 5 – Compare and Contrast! Compare and contrast stockholders and stakeholders

COMPARISON DIFFERENCE

STOCKHOLDERS

STAKEHOLDERS

PVMGOV Integration: Activity number 6 – The Right Choice!

As a stakeholder, what specific values will you look for a company that you want to do business with?

Learning Outcomes/Objectives Check: Activity number 7 – Reflect Upon!

Do you agree that customers are the most important stakeholders? Justify your answer.

Closure: A customer is the most important visitor on our premises. He is not dependent on us. We are dependent on him. He is not an

interruption in our work. He is the purpose of it. He is not an outsider in our business. He is part of it. We are not doing him a favor by

serving him. He is doing us a favor by giving us an opportunity to do so. - Mahatma Gandhi

Day 5: Study Day Pointers: Study about the basics of accounting, journal entry, elements of financial position and financial

performance and the four main categories of financial ratios: Liquidity, Profitability, Efficiency, Leverage (Solvency) you may refer to

Diwa - Business Finance book pages 70 to 78 in the library.

Day 6: Monthly Examination

.

Note: If you have any concerns or questions with regards to the activities and instructions of this learning package you can reach me through

my messenger chat box with the profile name Andrew Bomediano or call/text me at 09553707244.

You could also contact me through the school’s telephone number 496-8456.

Resources/Materials: Business Finance Books (Rex Book Store / DIWA); Teaching Guide for Senior High School BUSINESS FINANCE

You might also like

- NCERT Solutions For Class 11th: CH 1 Introduction To Accounting AccountancyDocument36 pagesNCERT Solutions For Class 11th: CH 1 Introduction To Accounting Accountancydinesh100% (1)

- CSEC Principles of Accounts NotesDocument66 pagesCSEC Principles of Accounts NotesAbdullah Ali94% (32)

- Financial InformationDocument12 pagesFinancial InformationVeronica BaileyNo ratings yet

- Bookkeeping LessonDocument81 pagesBookkeeping LessonKriziel ReyesNo ratings yet

- CBSE Class 11 Accountancy Study Material PDFDocument148 pagesCBSE Class 11 Accountancy Study Material PDFKaushik SenguptaNo ratings yet

- Entrep m-11 Bookkeeping NEWDocument16 pagesEntrep m-11 Bookkeeping NEWFe JanduganNo ratings yet

- Basics of Accounting and Book KeepingDocument16 pagesBasics of Accounting and Book KeepingPuneet DhuparNo ratings yet

- Financial Accounting MD 1Document87 pagesFinancial Accounting MD 1Robert KabweNo ratings yet

- E For Finance and Accountingfinal TestDocument6 pagesE For Finance and Accountingfinal TestNguyễn Ngọc Thanh TrangNo ratings yet

- Fundamentals of Accounting Questions With AnswersDocument13 pagesFundamentals of Accounting Questions With Answersdhabekarsharvari07No ratings yet

- Learn Financial ReportsDocument6 pagesLearn Financial ReportsMai RuizNo ratings yet

- Introduction To Accounting Class 11 Notes Accountancy Chapter 1Document6 pagesIntroduction To Accounting Class 11 Notes Accountancy Chapter 1SSDLHO sevenseasNo ratings yet

- Fundamentals of Accountancy, Business and Management 1Document16 pagesFundamentals of Accountancy, Business and Management 1Gladzangel Loricabv83% (6)

- Giao Trinh Tacn Ke Toan Tai ChinhDocument76 pagesGiao Trinh Tacn Ke Toan Tai ChinhMinh Lý TrịnhNo ratings yet

- Financial Accounting 1 document overviewDocument21 pagesFinancial Accounting 1 document overviewVignesh CNo ratings yet

- Week 10 (Learning Materials)Document8 pagesWeek 10 (Learning Materials)CHOI HunterNo ratings yet

- Chapter 7 Accounting and Financial ConsiderationsDocument32 pagesChapter 7 Accounting and Financial ConsiderationsErwin MatunanNo ratings yet

- Chapter 1 and 2Document40 pagesChapter 1 and 2kirbydegay1028No ratings yet

- Concept of Accounting: The Language of BusinessDocument13 pagesConcept of Accounting: The Language of BusinessSanthu bm97No ratings yet

- POA Book NotesDocument72 pagesPOA Book NotesChelsea MortleyNo ratings yet

- Chapter 1 - Student - Introduction of International Accounting - 2012Document108 pagesChapter 1 - Student - Introduction of International Accounting - 2012Kieu TrangNo ratings yet

- Fundamentals of Accountancy, Business and Management 1Document22 pagesFundamentals of Accountancy, Business and Management 1Gladzangel Loricabv100% (6)

- Chapter 1-Directed Reading WorksheetDocument9 pagesChapter 1-Directed Reading WorksheetfeyzaNo ratings yet

- 413 Block1Document208 pages413 Block1Subramanyam Devarakonda100% (1)

- Basic Accounting NotesDocument83 pagesBasic Accounting NotesUmutoni ornellaNo ratings yet

- BUSINESS FINANCE Week 5Document8 pagesBUSINESS FINANCE Week 5Ace San GabrielNo ratings yet

- Chapter 1 (Acc)Document7 pagesChapter 1 (Acc)Navya jainNo ratings yet

- 1 Sem Bcom - Financial AccountingDocument50 pages1 Sem Bcom - Financial AccountingMahantesh Mahantesh100% (2)

- Finance For Managers NotesDocument114 pagesFinance For Managers NotesDavid Luko Chifwalo100% (1)

- Chapter-1 Introduction To Accounting and BusinessDocument17 pagesChapter-1 Introduction To Accounting and BusinessTsegaye Belay100% (1)

- Module 2Document18 pagesModule 2ashley.cyang1988No ratings yet

- Study Material Accountingcomclass XiDocument143 pagesStudy Material Accountingcomclass XiKushal DeyNo ratings yet

- Principles of Accounting SummaryDocument9 pagesPrinciples of Accounting SummaryMichael BrandonNo ratings yet

- Lecture 1 Introduction To AccountingDocument72 pagesLecture 1 Introduction To AccountingLinnea KulunduNo ratings yet

- Conceptual Foundation of Company AccountingDocument6 pagesConceptual Foundation of Company AccountingBibhush MaharjanNo ratings yet

- G 12 Fabm 2 Q1 G. BruanDocument33 pagesG 12 Fabm 2 Q1 G. BruanDark SideNo ratings yet

- Project Work in Accountancy: Analysis of JK Tyres Financial StatementsDocument14 pagesProject Work in Accountancy: Analysis of JK Tyres Financial StatementsAdityaNo ratings yet

- Question Answer EMBA505Document9 pagesQuestion Answer EMBA505Md. AsaduzzamanNo ratings yet

- Entrep12 Q2 Mod10 Bookkeeping v2Document84 pagesEntrep12 Q2 Mod10 Bookkeeping v2Regina Minguez Sabanal93% (14)

- UNIT IV BEFADocument20 pagesUNIT IV BEFApramod rockzNo ratings yet

- Financial Accounting ReportDocument11 pagesFinancial Accounting Reportthu thienNo ratings yet

- FABM Q3 L2. SLeM - 2S - Q3 - W2 Accounting Concept & PrinciplesDocument16 pagesFABM Q3 L2. SLeM - 2S - Q3 - W2 Accounting Concept & PrinciplesSophia MagdaraogNo ratings yet

- C1 ACCOUNTING AND BOOKKEEPING FUNDAMENTALSDocument5 pagesC1 ACCOUNTING AND BOOKKEEPING FUNDAMENTALSIleana SendreaNo ratings yet

- Introduction To Accounting Question BankDocument7 pagesIntroduction To Accounting Question Bankjeevan varmaNo ratings yet

- Ncert AccountancyDocument9 pagesNcert AccountancyArif ShaikhNo ratings yet

- Accounts 1Document14 pagesAccounts 1Piyush PatelNo ratings yet

- Topic 5Document5 pagesTopic 5Kary EscobarNo ratings yet

- minor project on financial performace analysis on the basis of annual reprotsDocument31 pagesminor project on financial performace analysis on the basis of annual reprotsatishay jainNo ratings yet

- Accounting Principles Module 1 OverviewDocument14 pagesAccounting Principles Module 1 OverviewPatricia BaluyoNo ratings yet

- LM Business Finance Q3 WK 3 4 Module 6Document24 pagesLM Business Finance Q3 WK 3 4 Module 6Minimi LovelyNo ratings yet

- Prelim ModuleDocument5 pagesPrelim ModuleJenefer GwmpesawNo ratings yet

- FCA Notes 01Document8 pagesFCA Notes 01US10No ratings yet

- Analysis Strategy Elective Courses: 5 Reasons Why You Should Do An MbaDocument22 pagesAnalysis Strategy Elective Courses: 5 Reasons Why You Should Do An Mbathella deva prasadNo ratings yet

- Class 11 Accountancy Part 1 Chapter 1Document9 pagesClass 11 Accountancy Part 1 Chapter 1Ioanna Maria MonopoliNo ratings yet

- Chapter 1: Session 1 Introduction To Financial AccountingDocument161 pagesChapter 1: Session 1 Introduction To Financial AccountingHarshini Akilandan100% (1)

- Accounting For Financial Services: Questions Selected byDocument25 pagesAccounting For Financial Services: Questions Selected byGhulam MurtazaNo ratings yet

- Part 1 - Acc - 2016Document10 pagesPart 1 - Acc - 2016Sheikh Mass JahNo ratings yet

- Accounting and Finance For Managers - Course Material PDFDocument94 pagesAccounting and Finance For Managers - Course Material PDFbil gossayw100% (1)

- Balance Sheet: What Do You Mean by Corporate Financial Statements?Document3 pagesBalance Sheet: What Do You Mean by Corporate Financial Statements?maabachaNo ratings yet

- Implementing entrepreneurship education to reduce graduate unemploymentDocument13 pagesImplementing entrepreneurship education to reduce graduate unemploymentCEO DimejiNo ratings yet

- A SUMMER INTERNSHIP PROJECT REPORT (1) PoojaDocument41 pagesA SUMMER INTERNSHIP PROJECT REPORT (1) PoojaRubina MansooriNo ratings yet

- Statement of Purpose PDFDocument2 pagesStatement of Purpose PDFSree HarshiniNo ratings yet

- Understanding Business EnvironmentsDocument20 pagesUnderstanding Business EnvironmentsTrần Nữ Ngọc Nhi100% (1)

- Customer Service ResumeDocument3 pagesCustomer Service ResumeNADExOoGGYNo ratings yet

- Lp-Fabm1 - Feb 28Document7 pagesLp-Fabm1 - Feb 28Roselyn GabonNo ratings yet

- Icp Sustainability Report PDFDocument40 pagesIcp Sustainability Report PDFLuke SkywalkerNo ratings yet

- Expert Consulting Proposal <40Document4 pagesExpert Consulting Proposal <40Bryan Citrasena100% (1)

- Entrepreneur ReportDocument20 pagesEntrepreneur ReportJamie AyalaNo ratings yet

- Tria Aulia Rosty - CV.Document1 pageTria Aulia Rosty - CV.Tria Aulia RostyNo ratings yet

- Bhu Assistant Registrar ApplicationDocument2 pagesBhu Assistant Registrar ApplicationGauri MittalNo ratings yet

- Anexo 1 - QuestionsDocument3 pagesAnexo 1 - QuestionsAlbert Antonio Villada HerreraNo ratings yet

- Stratman Second Assignment (For Release)Document5 pagesStratman Second Assignment (For Release)mumbiNo ratings yet

- Strategies For Analyzing and Entering Foreign Markets: Lecture Outline OPENING CASE: The Business of LuxuryDocument20 pagesStrategies For Analyzing and Entering Foreign Markets: Lecture Outline OPENING CASE: The Business of LuxuryYomi BrainNo ratings yet

- CIMA PulseDocument10 pagesCIMA PulseTarun KumarNo ratings yet

- Work Immersion Student Portfolio at Dolores National High SchoolDocument28 pagesWork Immersion Student Portfolio at Dolores National High SchoolMernalyn BacurNo ratings yet

- MHRM BrochureDocument22 pagesMHRM Brochureadiranjan1112No ratings yet

- Philippine Christian University: Module in Entrepreneurship (Grade 12)Document6 pagesPhilippine Christian University: Module in Entrepreneurship (Grade 12)Jude Michael G. PondalesNo ratings yet

- Ashlyn OsborneDocument1 pageAshlyn Osborneapi-662917421No ratings yet

- Strategy and Strategic-ConvertiDocument28 pagesStrategy and Strategic-Convertifarouk federerNo ratings yet

- Youth Leaders of Agribusiness Congress 2023Document6 pagesYouth Leaders of Agribusiness Congress 2023Annabelle AriolaNo ratings yet

- Case Study 02 - Centum WorkSkills India - Large-Scale Vocational Training For YouthDocument20 pagesCase Study 02 - Centum WorkSkills India - Large-Scale Vocational Training For YouthNeha RohillaNo ratings yet

- Vietnam Edtech Elearning Report 2022 1Document31 pagesVietnam Edtech Elearning Report 2022 1Ha PhanNo ratings yet

- Marketing 6th Edition Grewal Levy Solution ManualDocument61 pagesMarketing 6th Edition Grewal Levy Solution Manualwillie100% (27)

- CBS Student Investing Ideas in Graham & Doddsville NewsletterDocument35 pagesCBS Student Investing Ideas in Graham & Doddsville NewsletterMarco MessinaNo ratings yet

- CBT Candidate Pathing InfographicDocument1 pageCBT Candidate Pathing InfographicNishant SenapatiNo ratings yet

- Prepare Annual Budget for Education UnitDocument25 pagesPrepare Annual Budget for Education UnitCyrus Joaquin ArcaynaNo ratings yet

- Assignment 3: Rebecca RoutliffeDocument8 pagesAssignment 3: Rebecca RoutliffeMe MeNo ratings yet

- Topic 2: Entrepreneurial ManagementDocument9 pagesTopic 2: Entrepreneurial ManagementAmrezaa IskandarNo ratings yet

- Security & Business Valuation AnalysisDocument12 pagesSecurity & Business Valuation AnalysisThu Hiền KhươngNo ratings yet