Professional Documents

Culture Documents

Azreaal: Eqe WD Raipur Chhattisgarh 492007 India

Uploaded by

Aditya Agrawal0 ratings0% found this document useful (0 votes)

9 views2 pagesOriginal Title

TDS_BrianLee_fwdw (2)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views2 pagesAzreaal: Eqe WD Raipur Chhattisgarh 492007 India

Uploaded by

Aditya AgrawalCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

Azreaal

eqe wd raipur Chhattisgarh 492007 India

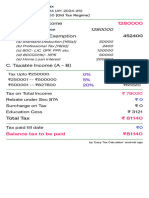

TDS WORK SHEET for the month of September 2021

EMPLOYEE NAME DESIGNATION TAX REGIME

Brian Lee, fwdw Executive Old Regime

Details of salary paid and any other income and tax deducted

Particulars Actual Projection Total

1) Gross Earnings

Basic ₹14,41,667.00 ₹0.00 ₹14,41,667.00

House Rent Allowance ₹7,20,833.00 ₹0.00 ₹7,20,833.00

Fixed Allowance ₹7,20,833.00 ₹0.00 ₹7,20,833.00

Leave Encashment ₹10,000.00 ₹0.00 ₹10,000.00

Total Income ₹28,93,333.00

2) Allowance to the extent exempt under Section 10

House Rent Allowance ₹0.00

Leave Encashment ₹10,000.00

Total of Allowance to the extent exempt under

₹10,000.00

Section 10

3) Total After Exemption (1-2) ₹28,83,333.00

4) Taxable Income under Previous employment

i) Income After Exemptions ₹0.00

ii) Less: Professional Tax ₹0.00

Total taxable income under Previous employment ₹0.00

5) Gross Total (3+4) ₹28,83,333.00

6) Under Section 16

a) Entertainment allowance ₹0.00

b) Tax on employment ₹0.00

c) Standard Deduction ₹50,000.00

Total Under Section 16 ₹50,000.00

7) Income Chargeable Under the Head Salaries (5-6) ₹28,33,333.00

8) Any other income reported by the employee

Total Income From Other Sources ₹0.00

9) Gross Total Income (7+8) ₹28,33,333.00

10) Section 6A Qualifying Deductible

80C ₹0.00 ₹0.00

80CCC ₹0.00 ₹0.00

80CCD(1) ₹0.00 ₹0.00

Total (80C+80CCC+80CCD) ₹0.00 ₹0.00

Total of Exemption under Section 6A ₹0.00

11) Total Income (Round By 10 Rupees) (9-10) ₹28,33,330.00

12) Tax Calculation

Exemption ₹2,50,000.00 and

₹25,83,330.00

the balance amount

i) For ₹2,50,000.00 : Tax - 5%

₹12,500.00

Tax Amount

ii) For ₹5,00,000.00 : Tax - 20%

₹1,00,000.00

Tax Amount

iii) For ₹18,33,330.00 : Tax -

₹5,49,999.00

30% Tax Amount

Tax on total Income ₹6,62,499.00

Less : Rebate Under Section 87A ₹0.00

Note: If taxable income is less than ₹5,00,000.00, tax rebate

of a maximum of ₹12,500.00 is provided under Section 87A.

13) Total Tax on Income ₹6,62,499.00

Surcharge Amount ₹0.00

Education Cess 4% of ₹6,62,499.00 ₹26,500.00

Less: Relief Under Section 89 ₹0.00

14) Tax Payable including Education Cess minus of

₹6,88,999.00

Relief Under Section 89

15) Tax Deducted at Source u/s 192(1)

i) TDS till last month ₹7,61,475.00

ii) TDS for September ₹0.00

iii) TDS by Previous Employer ₹0.00

A) Total Tax Deducted at Source (i+ii+iii) ₹7,61,475.00

Tax Payable / Refundable (14 - 15(A)) ₹-72,476.00

You might also like

- Info Sys Salary SlipDocument2 pagesInfo Sys Salary SlipGurpreetS Myvisa100% (1)

- Salary Sep 2019 PDFDocument1 pageSalary Sep 2019 PDFAnonymous eHnCyk7DYNo ratings yet

- MR Sharanabasappa Hosamani 01386452: Sap Labs India Pvt. LTDDocument1 pageMR Sharanabasappa Hosamani 01386452: Sap Labs India Pvt. LTDSharanu HosamaniNo ratings yet

- COUNCIL TAX BILL 2023/2024: The Valuation Office Agency Valued This Property As Band EDocument2 pagesCOUNCIL TAX BILL 2023/2024: The Valuation Office Agency Valued This Property As Band Erboadu71No ratings yet

- Assessment G - Budgets - V1-1Document5 pagesAssessment G - Budgets - V1-1timothy ohamsNo ratings yet

- Vicenzo Bernard Leandro Tioriman - 01011182025009Document6 pagesVicenzo Bernard Leandro Tioriman - 01011182025009ImVicNo ratings yet

- September 2022 TDS WorksheetDocument4 pagesSeptember 2022 TDS Worksheetsri sainathNo ratings yet

- It 2023 2024 7Document2 pagesIt 2023 2024 7luciferangellordNo ratings yet

- Ratios Analysis PDFDocument4 pagesRatios Analysis PDFSunil KNo ratings yet

- Provisional Taxsheet Mar 2020Document1 pageProvisional Taxsheet Mar 2020vivianNo ratings yet

- Income Tax CalculationDocument2 pagesIncome Tax CalculationMadhan Kumar BobbalaNo ratings yet

- May 2019 PDFDocument2 pagesMay 2019 PDFVinodhkumar ShanmugamNo ratings yet

- May 2019Document2 pagesMay 2019Vinodhkumar ShanmugamNo ratings yet

- PDF&Rendition 1Document2 pagesPDF&Rendition 1vijaybhaskar damireddyNo ratings yet

- Easy TaxDocument1 pageEasy TaxSiva GaneshNo ratings yet

- Provisional: Provisional Income Tax CalculationDocument1 pageProvisional: Provisional Income Tax CalculationM. A Hossain & Associates Tax ConsultantsNo ratings yet

- EMPH2800 TAXSHEET March 2021Document1 pageEMPH2800 TAXSHEET March 2021the anonymousNo ratings yet

- Income Tax Projection202206Document1 pageIncome Tax Projection202206Rakhi JadavNo ratings yet

- Master File of CalculationDocument4 pagesMaster File of Calculationjitendriyasahoo994No ratings yet

- Payslip India June - 2023Document2 pagesPayslip India June - 2023RAJESH DNo ratings yet

- YdryDocument2 pagesYdryVinodhkumar Shanmugam100% (1)

- Shubham Question 2Document17 pagesShubham Question 2Shubham DeyNo ratings yet

- Model Solution: Page 1 of 6Document6 pagesModel Solution: Page 1 of 6ShuvonathNo ratings yet

- HCL Technologies Ltd.Document76 pagesHCL Technologies Ltd.Hemendra GuptaNo ratings yet

- EntityDocument3 pagesEntityMayankNo ratings yet

- 22Document2 pages22TWCNo ratings yet

- Form 16Document3 pagesForm 16Apte SatishNo ratings yet

- Employee Details Payment & Leave Details: Arrears Current AmountDocument1 pageEmployee Details Payment & Leave Details: Arrears Current Amountindhar666No ratings yet

- FPQ1 - Answer KeyDocument6 pagesFPQ1 - Answer KeyJi YuNo ratings yet

- Tech Mahindra Business Services Limited: Tax Return E-Filing ServiceDocument5 pagesTech Mahindra Business Services Limited: Tax Return E-Filing ServiceDavidroy MunimNo ratings yet

- 372814-145 Jan 2024Document2 pages372814-145 Jan 2024dotcnnctNo ratings yet

- 2484 Jun2010 Sal MailDocument1 page2484 Jun2010 Sal MailShadab KhanNo ratings yet

- Financial Statement Analysis Live ProjectDocument6 pagesFinancial Statement Analysis Live ProjectAnand Shekhar MishraNo ratings yet

- Salary Slip EDIT-JULYDocument4 pagesSalary Slip EDIT-JULYpathyashisNo ratings yet

- 2023 11 qWIavwwVV0gWRmwVnoUpdgDocument1 page2023 11 qWIavwwVV0gWRmwVnoUpdgnsmankr1No ratings yet

- VRCM9179 Feb 2023Document1 pageVRCM9179 Feb 2023Alluzz AmiNo ratings yet

- Excel Payslip TemplateDocument2 pagesExcel Payslip TemplateGnana BetsyNo ratings yet

- Excel Payslip TemplateDocument2 pagesExcel Payslip TemplateRoxanne SolisNo ratings yet

- Excel Payslip TemplateDocument2 pagesExcel Payslip Templateawinash reddyNo ratings yet

- Excel Payslip TemplateDocument2 pagesExcel Payslip TemplateAhmad FarizNo ratings yet

- Contoh Slip PambayaranDocument2 pagesContoh Slip PambayaranAhmad FarizNo ratings yet

- Salary Slip EDIT-AUGDocument4 pagesSalary Slip EDIT-AUGpathyashisNo ratings yet

- Revised Financial Results For December 31, 2016 (Result)Document4 pagesRevised Financial Results For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Payslip IndiaApproved On30 Nov 2023 - UnlockedDocument3 pagesPayslip IndiaApproved On30 Nov 2023 - UnlockedrithulblockchainNo ratings yet

- Payslip India April - 2023Document3 pagesPayslip India April - 2023RAJESH DNo ratings yet

- Employee Details Payment & Leave Details: Arrears Current AmountDocument1 pageEmployee Details Payment & Leave Details: Arrears Current Amountabhilash eNo ratings yet

- Heads of Income Monthly Actual YTD Projected TotalDocument2 pagesHeads of Income Monthly Actual YTD Projected TotalDsr Santhosh KumarNo ratings yet

- Excel Payslip TemplateDocument2 pagesExcel Payslip TemplateJana ColadillaNo ratings yet

- AssignmentDocument5 pagesAssignmentSuyash PrakashNo ratings yet

- Rs in Million 1 Particulars Present 2020: Fixed Assets Net Working CapitalDocument19 pagesRs in Million 1 Particulars Present 2020: Fixed Assets Net Working CapitalKamakshi GuptaNo ratings yet

- Tax Computation ReportDocument12 pagesTax Computation ReportRajesh MNo ratings yet

- Shrey Payslip Apr 2023Document4 pagesShrey Payslip Apr 2023Shrey EducationNo ratings yet

- Payslip Sep-2022 NareshDocument3 pagesPayslip Sep-2022 NareshDharshan RajNo ratings yet

- Financial Aspect FinalDocument12 pagesFinancial Aspect Finalmelvanne tamboboyNo ratings yet

- Bhakti Yoga by Swami VivekanandaDocument1 pageBhakti Yoga by Swami Vivekanandaindhar666No ratings yet

- Employee Details Payment & Leave Details: Arrears Current AmountDocument1 pageEmployee Details Payment & Leave Details: Arrears Current AmountAmrit RajNo ratings yet

- Telangana State Power Generation Corporation LTD Kothagudem Thermal Power Station: PalonchaDocument1 pageTelangana State Power Generation Corporation LTD Kothagudem Thermal Power Station: PalonchaKANNE NITHINNo ratings yet

- PAYSLIP Nov-2022 - NareshDocument3 pagesPAYSLIP Nov-2022 - NareshDharshan RajNo ratings yet

- Tax CalculationDocument3 pagesTax Calculationreach2hardyNo ratings yet

- April 2023 - UnlockedDocument2 pagesApril 2023 - Unlockedajinkya jagtapNo ratings yet

- Pricewaterhousecoopers Service Delivery Center (Bangalore) PVT LTD Income Tax Computation StatementDocument15 pagesPricewaterhousecoopers Service Delivery Center (Bangalore) PVT LTD Income Tax Computation StatementRajat SinghNo ratings yet

- Income Tax 2015-2016Document4 pagesIncome Tax 2015-2016HanumanthNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Lembar Kerja Unit 3 - PT Prima ElektronikDocument12 pagesLembar Kerja Unit 3 - PT Prima ElektronikNi'matul Mukarromah100% (1)

- GST - Tax Invoice, Debit or Credit Notes, Returns, Payment of Tax PDFDocument78 pagesGST - Tax Invoice, Debit or Credit Notes, Returns, Payment of Tax PDFSapna MalikNo ratings yet

- Form 15 CA and 15 CBDocument6 pagesForm 15 CA and 15 CBscrana7480No ratings yet

- Solved Twelve Years Ago Marilyn Purchased Two Lots in An UndevelopedDocument1 pageSolved Twelve Years Ago Marilyn Purchased Two Lots in An UndevelopedAnbu jaromiaNo ratings yet

- Conneqt Business Solutions Limited: 286124 Siddhant Murari SharmaDocument1 pageConneqt Business Solutions Limited: 286124 Siddhant Murari SharmaRadha SharmaNo ratings yet

- Business MathDocument4 pagesBusiness MathShekinah HuertaNo ratings yet

- Error Analysis Lowell Corporation Has Used The Accrual Basis of PDFDocument1 pageError Analysis Lowell Corporation Has Used The Accrual Basis of PDFAnbu jaromiaNo ratings yet

- Indirect Tax Bootcamp Presentation PDFDocument120 pagesIndirect Tax Bootcamp Presentation PDFPeterson NderituNo ratings yet

- Lecture Notes Estates and TrustDocument3 pagesLecture Notes Estates and TrustNneka VillacortaNo ratings yet

- BAFS DepreciationDocument11 pagesBAFS DepreciationKwan Yin HoNo ratings yet

- Tax Law Project On: Capital Gain and Capital AssetsDocument15 pagesTax Law Project On: Capital Gain and Capital AssetsAazamNo ratings yet

- Bir60 EguideDocument12 pagesBir60 EguidekunalkhubaniNo ratings yet

- Incidence and Residence ProblemsDocument9 pagesIncidence and Residence ProblemsTarunvir KukrejaNo ratings yet

- EPayments Import TemplateDocument10 pagesEPayments Import TemplateGhulam MustafaNo ratings yet

- Classification of Individual TaxpayerDocument4 pagesClassification of Individual TaxpayerJj helterbrandNo ratings yet

- Nagaland WB Claim FormDocument2 pagesNagaland WB Claim FormnileshNo ratings yet

- 1 Basic SardaDocument12 pages1 Basic Sardaniko.tpNo ratings yet

- Case 2 - Acco 420Document7 pagesCase 2 - Acco 420Wasif SethNo ratings yet

- October PayslipDocument1 pageOctober PayslipDaniel CarpenterNo ratings yet

- 4 Heads - RemovedDocument59 pages4 Heads - Removedantiquehindustani0% (1)

- Arrear ClaimsDocument3 pagesArrear ClaimsNityananda PramanikNo ratings yet

- RMC No. 68-2021Document1 pageRMC No. 68-2021REX FABERNo ratings yet

- PT SEJAHTERA Buku BesarDocument15 pagesPT SEJAHTERA Buku BesarRiskiwe0% (1)

- Actual Income and Expenditure Past Year 2019Document3 pagesActual Income and Expenditure Past Year 2019Barangay CumadcadNo ratings yet

- Dynamics GP TAX Management Mexico - Data SheetDocument3 pagesDynamics GP TAX Management Mexico - Data SheetAriel SpallettiNo ratings yet

- Ferguson, James C. Mann, Dewey W O'Neill, Joseph T: Bonno A VDocument13 pagesFerguson, James C. Mann, Dewey W O'Neill, Joseph T: Bonno A VruqiaNo ratings yet

- Business Accounting and Taxation BrochureDocument4 pagesBusiness Accounting and Taxation BrochureRudrin DasNo ratings yet