Professional Documents

Culture Documents

Homework: Goosehouse Coffee: Name: Session Time

Uploaded by

Abhilash Bollam0 ratings0% found this document useful (0 votes)

45 views2 pagesOriginal Title

optional6-new (2) (1) (2)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

45 views2 pagesHomework: Goosehouse Coffee: Name: Session Time

Uploaded by

Abhilash BollamCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

Name: Abhilash Bollam Session time: 4:30 PM

Q1 – Coffee house (Q2 on next page)

Homework: Goosehouse Coffee

• A specialty coffeehouse sells Colombian coffee at a fairly steady rate

of 280 pounds annually. The beans are purchased from a local

supplier for $2.40 per pound. The coffee house estimates that it

costs $45 in paperwork and labor to place an order for the coffee,

and holding costs are based on a 20 percent annual interest rate.

MGMT660

Introduction to Operations Management

• Use EOQ model

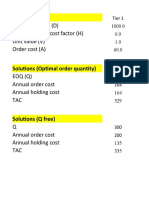

• The optimal order quantity isD= 280, S=45, H = 2.4*20%

Q= 229

• The time between placement of orders is

298.5 Days

• The annual cost of holding is

229/2*2.4*20% = 54.96

• The annual cost of ordering (not including the purchase cost) is

280/229*45 = 55.02

Homework: Goosehouse Coffee

• Suppose our estimate of R and H in the coffee house problem are correct

but the correct value of K is twice what we think it is. (It really is $90 per

order.)

• If we use Q = 229 our actual costs will be:

MGMT660

Introduction to Operations Management

Annual holding cost = 54.96

Annual ordering cost = 55.02*2= 110.04 (took k = 90)

Total = 165

• Using the correct K (= $90), we would adjust our EOQ value to:

Correct EOQ is 324

Annual holding cost is 77.76

Annual ordering cost is

77.77

Total = 155.55

Is the solution robust? Yes, the solution is robust

Q2 – Beer Distribution

Practice (Beer Distribution)

A beer distributor finds that it sells on average 100 cases a week of regular 12-

oz. Budweiser. For this problem assume that demand occurs at a constant rate

over a 50-week year. The distributor currently purchases beer at a cost of $8

per case. The inventory-related holding cost (capital, insurance, etc.) for the

distributor equals 25 percent of the dollar value of inventory per year. Each

MGMT660 Introduction to Operations

Management

order placed with the supplier costs the distributor $10. This cost includes

labor, forms, postage, and so forth.

a) What is the optimal order quantity? Q = Assuming per annum =707

if we consider per week = 223

b) What is the order cycle time? 7.07 weeks

if we consider per week = 2.23 weeks

c) How many orders does the distributor place every year? 7.07 orders

per week = 22.42 orders

d) What are the total inventory costs per week? Type your text

per week = 8.94

[Hint: for part a)-d), use EOQ model. Note that the holding cost rate is 20% per

year, you need to convert that to percentage per week.]

Total inventory cost = TC = PC + OC + HC, where TC is the Total Cost;

PC is Purchase Cost; OC is Ordering Cost; and

HC is Holding Cost.

all in per week = 100*10/707+707/2*0.04 = 15.55 per week

(dint consider purchasing cost

as mentioned in 1st question)

You might also like

- This Study Resource Was: Practice Questions and Answers Inventory Management: EOQ ModelDocument7 pagesThis Study Resource Was: Practice Questions and Answers Inventory Management: EOQ Modelwasif ahmedNo ratings yet

- Inventory ModelsDocument38 pagesInventory ModelsAngela MenesesNo ratings yet

- EOQ ModelDocument7 pagesEOQ ModelJoy EnglishNo ratings yet

- Deterministic InventoryDocument27 pagesDeterministic InventorySrijan ShettyNo ratings yet

- Chapter - 11a (Inventory Calculation)Document8 pagesChapter - 11a (Inventory Calculation)Kaneki Ken100% (1)

- Demonstration Problem: Chapter 13 - Exercise 7 Product Costing - Various IssuesDocument56 pagesDemonstration Problem: Chapter 13 - Exercise 7 Product Costing - Various IssuesNenouch JaegarNo ratings yet

- Qtkd-704015-Qtccu CH2Document78 pagesQtkd-704015-Qtccu CH2Na NguyễnNo ratings yet

- Chapter 11Document87 pagesChapter 11Sandeep PanNo ratings yet

- Soal AM Pertemuan 11-12 - Decision Making and PricingDocument4 pagesSoal AM Pertemuan 11-12 - Decision Making and PricingfauziyahNo ratings yet

- Credit and Inventory Management - NewDocument25 pagesCredit and Inventory Management - NewBidisha gogoiNo ratings yet

- Week 4 - GSI Discussion Section - 8 30 22Document24 pagesWeek 4 - GSI Discussion Section - 8 30 22Steven P. ChuaNo ratings yet

- EOQ ModelDocument6 pagesEOQ ModelmigomdoleyNo ratings yet

- Inventory ManagementDocument8 pagesInventory ManagementShameer FazeelNo ratings yet

- OPIM101 - Spring 2010 - R4 SolutionsDocument4 pagesOPIM101 - Spring 2010 - R4 Solutionsjoe91bmwNo ratings yet

- Basic EOQ Model: Trial and Error MethodDocument7 pagesBasic EOQ Model: Trial and Error MethodROCKYNo ratings yet

- EOQDocument11 pagesEOQAnonymous WtjVcZCgNo ratings yet

- Sol ch03Document12 pagesSol ch03Ahmed MousaNo ratings yet

- Inventory Management and Risk Pooling PDFDocument107 pagesInventory Management and Risk Pooling PDF笨小孩100% (2)

- Module 3 Management ScienceDocument10 pagesModule 3 Management ScienceGenesis RoldanNo ratings yet

- Inventory C3Document22 pagesInventory C3quynhtrang01.lscNo ratings yet

- L&SCM Review Final SolutionDocument9 pagesL&SCM Review Final SolutionmytinhszNo ratings yet

- Inventory Problems SolutionDocument8 pagesInventory Problems Solutionakash sam100% (1)

- ECO10004 - Week 5Document4 pagesECO10004 - Week 5Vuong Bao KhanhNo ratings yet

- Mathematics Grade 10 Weeks 1 - 4Document43 pagesMathematics Grade 10 Weeks 1 - 4Meng WanNo ratings yet

- Grade 10 Mathematics - 2021 - Term 2Document197 pagesGrade 10 Mathematics - 2021 - Term 2Naomi RodriguesNo ratings yet

- MBA IInd SEM POM Chapter 09 Inventorysimplified-Independent Demand Inventory SystemsDocument49 pagesMBA IInd SEM POM Chapter 09 Inventorysimplified-Independent Demand Inventory SystemsPravie100% (2)

- Production and CostsDocument110 pagesProduction and CostsramandeepkaurNo ratings yet

- Inventory ModelDocument63 pagesInventory ModelSRI RAMNo ratings yet

- Modelos de InventariosDocument63 pagesModelos de InventariosPaola CruzNo ratings yet

- Answer 2269 17Document10 pagesAnswer 2269 17Areej JehanNo ratings yet

- Problem: Inventory Management (Chapter 12) Problem-01Document23 pagesProblem: Inventory Management (Chapter 12) Problem-01tariNo ratings yet

- Exercises of Inventory ManagementDocument7 pagesExercises of Inventory ManagementĐức NguyễnNo ratings yet

- Silo - Tips Deterministic Inventory ModelsDocument20 pagesSilo - Tips Deterministic Inventory ModelsGwena AnneNo ratings yet

- Cost Analysis, How Little Things Add UpDocument3 pagesCost Analysis, How Little Things Add UpDomingo BernardoNo ratings yet

- Chapter 15: Inventory Models: OutlineDocument63 pagesChapter 15: Inventory Models: OutlinetwiceinawhileNo ratings yet

- ACCT3203 Week 6 Tutorial Questions Investment Management S2 2022Document7 pagesACCT3203 Week 6 Tutorial Questions Investment Management S2 2022Jingwen YangNo ratings yet

- CH 2Document28 pagesCH 2Badr AlghamdiNo ratings yet

- This Content Is Protected and May Not Be Shared, Uploaded To Any Website, Sold, or DistributedDocument7 pagesThis Content Is Protected and May Not Be Shared, Uploaded To Any Website, Sold, or DistributedHussain AliNo ratings yet

- Pertemuan 2 InventoryDocument33 pagesPertemuan 2 InventoryYulia Pratama Umbu DonguNo ratings yet

- II.3 Management of InventoriesDocument44 pagesII.3 Management of InventoriesKin SaysonNo ratings yet

- Solutions ExosDocument11 pagesSolutions ExosazratNo ratings yet

- Inventory Management: Operations Management Dr. Ron LembkeDocument61 pagesInventory Management: Operations Management Dr. Ron LembkeFredolanderNo ratings yet

- Economic Order Quantity QuestionsDocument11 pagesEconomic Order Quantity QuestionsAnkit Srivastava59% (17)

- Bus 359.Q2.2021.22 - Eoq Rop - HWDocument2 pagesBus 359.Q2.2021.22 - Eoq Rop - HWTrần Hữu ĐứcNo ratings yet

- Practice Problems 1Document5 pagesPractice Problems 1Murtaza PoonawalaNo ratings yet

- Unit5 Part I InventoryDocument100 pagesUnit5 Part I InventoryMounisha g bNo ratings yet

- Services Marketing2821Document21 pagesServices Marketing2821Anonymous GVWIlk3ZNo ratings yet

- Inventory Sample ProbsDocument5 pagesInventory Sample ProbsSreekanth Nagloor100% (3)

- Practice InventoryDocument9 pagesPractice InventoryDexter KhooNo ratings yet

- Inventory ModelDocument4 pagesInventory Modelmanan_09100% (1)

- Topic 9 Inventory and Credit ManagementDocument33 pagesTopic 9 Inventory and Credit Managementt6s1z7No ratings yet

- Q1) Dell Computers Purchases Integrated Chips at $350 Per Chip. The Holding Cost Is $35 Per UnitDocument3 pagesQ1) Dell Computers Purchases Integrated Chips at $350 Per Chip. The Holding Cost Is $35 Per UnitShaneen Angelique MoralesNo ratings yet

- Kojima, Yuji Expurma Midterm Exam Part 2Document4 pagesKojima, Yuji Expurma Midterm Exam Part 2Yuji KojimaNo ratings yet

- Powered by Koffee (EOQ + ROP)Document2 pagesPowered by Koffee (EOQ + ROP)Abeer SaadedineNo ratings yet

- Ass 8Document4 pagesAss 8Vũ Hoàng DiệuNo ratings yet

- OMT 8604 Logistics in Supply Chain Management: Master of Business AdministrationDocument42 pagesOMT 8604 Logistics in Supply Chain Management: Master of Business AdministrationMr. JahirNo ratings yet

- 73 220 Lecture21Document21 pages73 220 Lecture21api-26315128No ratings yet

- Making Your Home More Energy Efficient: A Practical Guide to Saving Your Money and Our PlanetFrom EverandMaking Your Home More Energy Efficient: A Practical Guide to Saving Your Money and Our PlanetNo ratings yet

- It's a HouseHeist® House Flip: Our Proven Steps for SuccessFrom EverandIt's a HouseHeist® House Flip: Our Proven Steps for SuccessNo ratings yet

- The Food Service Professional Guide to Controlling Liquor, Wine & Beverage CostsFrom EverandThe Food Service Professional Guide to Controlling Liquor, Wine & Beverage CostsNo ratings yet

- Assignment 4,............Document22 pagesAssignment 4,............Abhilash BollamNo ratings yet

- Assignment 5 Abhilash BollamDocument12 pagesAssignment 5 Abhilash BollamAbhilash BollamNo ratings yet

- Assignment 5 Abhilash BollamDocument7 pagesAssignment 5 Abhilash BollamAbhilash BollamNo ratings yet

- Post Session9Document33 pagesPost Session9Abhilash BollamNo ratings yet

- Intro Tweak According To JDDocument4 pagesIntro Tweak According To JDAbhilash BollamNo ratings yet

- Part (A) :: Product: Oil, Delivery Lead Time LT 1 Day Demand / DayDocument2 pagesPart (A) :: Product: Oil, Delivery Lead Time LT 1 Day Demand / DayAbhilash BollamNo ratings yet

- Chain Student Internship (Aug 2021 - Present) at MES, Inc. As Part of My Curriculum. at MES, I HadDocument1 pageChain Student Internship (Aug 2021 - Present) at MES, Inc. As Part of My Curriculum. at MES, I HadAbhilash BollamNo ratings yet

- Intern Candidate Questionnaire - 49504Document2 pagesIntern Candidate Questionnaire - 49504Abhilash BollamNo ratings yet

- Student Internship (Aug 2021 - Present) at MES, Inc. As Part of My Curriculum. at MES, We HaveDocument2 pagesStudent Internship (Aug 2021 - Present) at MES, Inc. As Part of My Curriculum. at MES, We HaveAbhilash BollamNo ratings yet

- Student Internship (Aug 2021 - Present) at MES, Inc. As Part of My Curriculum. at MES, We HaveDocument2 pagesStudent Internship (Aug 2021 - Present) at MES, Inc. As Part of My Curriculum. at MES, We HaveAbhilash BollamNo ratings yet

- Intro Tweak According To JDDocument4 pagesIntro Tweak According To JDAbhilash BollamNo ratings yet

- Keller Case AnalysisDocument3 pagesKeller Case AnalysisAbhilash Bollam100% (1)

- Case Study: Medisys Corp The Intense Care Product Development TeamDocument10 pagesCase Study: Medisys Corp The Intense Care Product Development TeamBig BNo ratings yet

- MT4400 STRG Flo Amp ValveDocument7 pagesMT4400 STRG Flo Amp ValveBrian Careel0% (1)

- Algebra1 Review PuzzleDocument3 pagesAlgebra1 Review PuzzleNicholas Yates100% (1)

- The Magical Number 5: Towards A Theory of Everything?Document27 pagesThe Magical Number 5: Towards A Theory of Everything?cesarfrancaNo ratings yet

- LogDocument67 pagesLogRudhi Al GhaisanNo ratings yet

- UnitPlan (P.E) Grade 6Document13 pagesUnitPlan (P.E) Grade 6Lou At CamellaNo ratings yet

- Wakit, Nico P.Document5 pagesWakit, Nico P.yeng botzNo ratings yet

- Staad 4Document37 pagesStaad 4saisssms9116100% (2)

- 1991 - Defect Chemistry of BaTiO3Document20 pages1991 - Defect Chemistry of BaTiO3Beh NaatNo ratings yet

- Fuses f150Document7 pagesFuses f150ORLANDONo ratings yet

- Chapter 6 SBLDocument4 pagesChapter 6 SBLbrave manNo ratings yet

- 01.introduction To Earth ScienceDocument29 pages01.introduction To Earth ScienceIshan Chua100% (1)

- 12.07.20. O&M Manual 41013 - New PLCDocument41 pages12.07.20. O&M Manual 41013 - New PLCFranco Sebastián GenreNo ratings yet

- 1802SupplementaryNotes FullDocument235 pages1802SupplementaryNotes FullCourtney WilliamsNo ratings yet

- Module 1 Inclusive Education Lecture 1 & Introduction - OnlineDocument32 pagesModule 1 Inclusive Education Lecture 1 & Introduction - OnlineSharon ShenNo ratings yet

- Service ManualDocument582 pagesService ManualBogdan Popescu100% (5)

- ENGLISH TOEFL Structure (3rd Exercise)Document5 pagesENGLISH TOEFL Structure (3rd Exercise)susannnnnnNo ratings yet

- 6000 Most Common Korean Words - For All TOPIK Levels PDFDocument232 pages6000 Most Common Korean Words - For All TOPIK Levels PDFZac67% (3)

- List of Tyre Pyrolysis Oil Companies in IndiaDocument2 pagesList of Tyre Pyrolysis Oil Companies in IndiaHaneesh ReddyNo ratings yet

- Pitch Analysis PaperDocument7 pagesPitch Analysis PaperMunib MunirNo ratings yet

- Yanmar Graafmachines SV17 PDFDocument10 pagesYanmar Graafmachines SV17 PDFAleksandar PetkovicNo ratings yet

- PUP 200 Quizzes 6Document47 pagesPUP 200 Quizzes 6Nam TranNo ratings yet

- Rule Based ClassificationsDocument14 pagesRule Based ClassificationsAmrusha NaallaNo ratings yet

- IES 2001 - I ScanDocument20 pagesIES 2001 - I ScanK.v.SinghNo ratings yet

- Law of DemandDocument16 pagesLaw of DemandARUN KUMARNo ratings yet

- Conquering College The Most Fun You Can Have Learning The Things You Need To Know NodrmDocument144 pagesConquering College The Most Fun You Can Have Learning The Things You Need To Know NodrmVithorNo ratings yet

- Literature Review On Parking SpaceDocument6 pagesLiterature Review On Parking Spacefvgy6fn3100% (1)

- Strategic Cost AnalysisDocument24 pagesStrategic Cost AnalysisBusiness Expert Press100% (10)

- Template 3 - MATH 3-REGULAR-DIAGNOSTICDocument2 pagesTemplate 3 - MATH 3-REGULAR-DIAGNOSTIClailanie CervantesNo ratings yet

- WideScreen Code For PS2 GamesDocument78 pagesWideScreen Code For PS2 Gamesmarcus viniciusNo ratings yet