Professional Documents

Culture Documents

2021 Tax Data Schedule v.3

Uploaded by

Brian SneeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2021 Tax Data Schedule v.3

Uploaded by

Brian SneeCopyright:

Available Formats

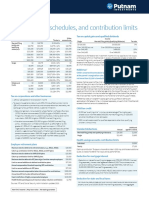

2021 Tax Data Schedules

2021 Federal 2021 California

Standard Deductions

Single $ 12,550 $4,803

Married Filing Jointly, Surviving Spouse 25,100 9,606

Married Filing Separately 12,550 4,803

Head of Household 18,800 9,606

Additional for Age 65 and Older or

Blind—Married 1,350

Additional for Age 65 and Older or

Blind—Unmarried 1,700

(per individual for each situation,

age or blind)

Taxpayer Claimed as a Dependent 1,100 1,100

Personal or Dependent Exemption Suspended for tax years

2018 - 2025

Maximum Child Tax Credit (qualifying child under age 17)

Single/Head of Household/Married Filing Separate $2,000

AGI Phaseout: $200,000 - 240,000

Married Filing Jointly 2,000

AGI Phaseout $400,000 - $440,000

Refundable Portion of Child Tax Credit $3,000

“Kiddie Tax” Unearned Income Exemption $1,100

California Exemption Credits

Single, Married Filing Separately, Head of Household $129

Married Filing Jointly, Surviving Spouse 258

Dependent 400

Blind or Age 65 and Older 129

Senior Head of Household Credit

2% of California taxable income, maximum credit of

California AGI threshold of $83,039 $1,565

Contact Us At taxalerts@windes.com www.windes.com 1

2021 Tax Data Schedules (continued)

2021 Federal 2021 California

California Joint Custody Head of Household

Credit and Dependent Parent Credit

30% of net tax with maximum credit of $ 513

California Young Child Tax Credit

For children younger than 6 years old on the last day of the tax year

AGI phaseout $25,000 - $30,000 with a max credit of $1,000

California Renter’s Credit

Married Filing Jointly, Head of Household,

Surviving Spouse if AGI is below $90,896 $ 120

Single or Married Filing Separately if

AGI is below $45,448 $ 60

IRC Section 179 Deduction $ 1,050,000 $ 25,000

Section 179 Purchase Phase-out 2,620,000 200,000

Beginning of Personal Exemption Phase-out

Range—Based on Federal AGI

Single N/A $ 212,288

Married Filing Jointly, Surviving Spouse N/A 424,581

Married Filing Separately N/A 212,288

Head of Household N/A 318,437

Beginning of Itemized Deduction Phase-out

Range—Based on Federal AGI

Single Limitation on $ 212,288

Married Filing Jointly, Surviving Spouse federal itemized 424,581

Married Filing Separately deductions is 212,288

Head of Household suspended for tax 318,437

Rate Reduced over federal AGI limits years 2018 - 2025 6%

Schedule A Medical Deduction

Based on federal AGI 7.5% 7.5%

Schedule A State & Local Tax Deduction Max

Married Filing Separately $ 5,000 N/A

All others $ 10,000 N/A

Schedule A Mortgage Interest Cap Only deductible on debt Only deductible on debt

up to $750,000* up to $1,000,000

*Loans entered into before December 15, 2017 are not subject to this limitation.

Contact Us At taxalerts@windes.com www.windes.com 2

2021 Tax Data Schedules (continued)

2021 Federal 2021 California

Schedule A Miscellaneous Deduction Suspended for tax

Based on federal AGI years 2018 - 2025 2%

Alternative Minimum Tax (AMT) Rate

AMTI Less Exemption up to $199,900 26%

AMTI Less Exemption over $199,900

($99,950 if Married Filing Separately) 28%

AMTI Less Exemption 6.65%

AMT Exemption Amounts

Married Filing Jointly, Surviving Spouse $ 114,600 $104,094

Single, Head of Household 73,600 78,070

Married Filing Separately 57,300 52,044

Estate or Trust 25,700 52,044

AMT Exemption Phase-out

Married Filing Jointly, Surviving Spouse $1,047,200 $390,351

Single, Head of Household 523,600 292,763

Married Filing Separately 523,600 195,172

Estate or Trust 85,650 195,172

199A Overview

Maximum Deduction 20% of Qualified Federal Only

Business Income*

*subject to wage and property limitations if AGI is above:

Married Filing Jointly $329,800

Married Filing Separately 164,925

All Others 164,900

Self-Employed Health Insurance Premiums

Adjustment for AGI, percentage of total

qualifying health insurance premiums 100% 100%

Contact Us At taxalerts@windes.com www.windes.com 3

2021 Tax Data Schedules (continued)

2021 Federal 2021 California

Auto Standard Mileage Allowances

Business .56 .56

Charity work - general .14 .14

Medical or moving .16 .16

U.S. Savings Bond Interest Exclusion Phase-out

Based on modified AGI

Joint Return, Surviving Spouse $124,800 - 154,800

All Others 83,200 - 98,200

California SDI

Federal tax deduction*

Annual wage limit $128,298

Rate 1.2%

Maximum Tax 1,539.58

*Amounts paid to a voluntary program in lieu of the state programs are not deductible, but may be a

credit on California return.

Contact Us At taxalerts@windes.com www.windes.com 4

2021 Federal Tax Rate Schedules

Taxable But Of The

Income Not Amount

Is Over Over Pay +% Over

Single

$0 $9,950 $0 10% $0

9,950 40,525 995.00 12% 9,950

40,525 86,375 4,664.00 22% 40,525

86,375 164,925 14,751.00 24% 86,375

164,925 209,425 33,603.00 32% 164,925

209,425 523,600 47,843.00 35% 209,425

523,600 and more 156,804.25 37% 523,600

Head of Household

$0 $14,200 $0 10% $0

14,200 54,200 1,420.00 12% 14,200

54,200 86,350 6,220.00 22% 54,200

86,350 164,900 13,293.00 24% 86,350

164,900 209,400 32,145.00 32% 164,900

209,400 523,600 46,385.00 35% 209,400

523,600 and more 156,355.00 37% 523,600

Married Filing Jointly or Surviving Spouse

$0 $19,900 $0 10% $0

19,900 81,050 1,990.00 12% 19,900

81,050 172,750 9,328.00 22% 81,050

172,750 329,850 29,502.00 24% 172,750

329,850 418,850 67,206.00 32% 329,850

418,850 628,300 95,686.00 35% 418,850

628,300 and more 168,993.50 37% 628,300

Contact Us At taxalerts@windes.com www.windes.com 5

2021 Federal Tax Data Schedules (continued)

Taxable But Of The

Income Not Amount

Is Over Over Pay +% Over

Married Filing Separately

$0 $9,950 $0 10% $0

9,950 40,525 995.00 12% 9,950

40,525 86,375 4,664.00 22% 40,525

86,375 164,925 14,751.00 24% 86,375

164,925 209,425 33,603.00 32% 164,925

209,425 314,150 47,843.00 35% 209,425

314,150 and more 84,496.75 37% 314,150

Estate or Nongrantor Trust

$0 $2,650 $0 10% $0

2,650 9,550 265.00 24% 2,650

9,550 13,050 1,921.00 35% 9,550

13,050 and more 3,146.00 37% 13,050

Contact Us At taxalerts@windes.com www.windes.com 6

2021 California Tax Rate Schedules

Taxable But Of The

Income Not Amount

Is Over Over Pay +% Over

Single, Married Filing Separately or Fiduciary Return

$0 $9,325 $0 1.00% $0

9,325 22,107 93.25 2.00% 9,325

22,107 34,892 348.89 4.00% 22,107

34,892 48,435 860.29 6.00% 34,892

48,435 61,214 1,672.87 8.00% 48,435

61,214 312,686 2,695.19 9.30% 61,214

312,686 375,221 26,082.09 10.30% 312,686

375,221 625,369 32,523.20 11.30% 375,221

625,369 and more 60,789.92 12.30% 625,369

An additional 1% surcharge applies to taxable income in excess of $1 million.

Married Filing Jointly or Surviving Spouse

$0 $18,650 $0 1.00% $0

18,650 44,214 186.50 2.00% 18,650

44,214 69,784 697.78 4.00% 44,214

69,784 96,870 1,720.58 6.00% 69,784

96,870 122,428 3,345.74 8.00% 96,870

122,428 625,372 5,390.38 9.30% 122,428

625,372 750,442 52,164.17 10.30% 625,372

750,442 1,250,738 65,046.38 11.30% 750,442

1,250,738 and more 121,579.83 12.30% 1,250,738

An additional 1% surcharge applies to taxable income in excess of $1 million.

Contact Us At taxalerts@windes.com www.windes.com 7

2021 California Tax Data Schedules (continued)

Taxable But Of The

Income Not Amount

Is Over Over Pay +% Over

Head of Household

$0 $18,663 $0 1.00% $0

18,663 44,217 186.63 2.00% 18,663

44,217 56,999 697.71 4.00% 44,217

56,999 70,542 1,208.99 6.00% 56,999

70,542 83,324 2,021.57 8.00% 70,542

83,324 425,251 3,044.13 9.30% 83,324

425,251 510,303 34,843.34 10.30% 425,251

510,303 850,503 43,603.70 11.30% 510,303

850,503 and more 82,046.30 12.30% 850,503

An additional 1% surcharge applies to taxable income in excess of $1 million.

LUXURY AUTO LIMIT

Depreciation limitations for automobiles acquired AFTER 2017 and first placed in service during the 2021

calendar year, for which the section 168(k) additional first year depreciation deduction applies.

Year First Second Third Thereafter

2021 $18,200 16,400 9,800 5,860

Depreciation limitations for automobiles first placed in service during the 2021 calendar year, for which

the section 168(k) additional first year depreciation deduction does NOT apply.

Year First Second Third Thereafter

2021 $10,200 16,400 9,800 5,860

Contact Us At taxalerts@windes.com www.windes.com 8

Social Security and Medicare Taxes

2020 2021

Social Security Tax

Maximum wage base $137,700 $142,800

Social Security rate - employee 6.2% 6.2%

Social Security rate - employer 6.2% 6.2%

Social Security rate - self-employed 12.4% 12.4%

Medicare Tax

Maximum wage base Unlimited Unlimited

Medicare rate - employee/employer 1.45% 1.45%

Medicare rate - self-employed 2.90% 2.90%

Monthly Medicare Part B Premium $144.60 $148.50

Additional Medicare Tax

An additional 0.9% Medicare tax is imposed on an employee's wages received in excess of

Married Filing Jointly $250,000 $250,000

Married Filing Separately $125,000 125,000

Qualifying Widower w/Dependent $200,000 200,000

Single/Head of Household 200,000 200,000

Net Investment Income Tax (NIIT) - also known as the Unearned Income

Medicare Contribution Tax

An additional 3.8% tax may be imposed on net investment income if modified AGI is in excess of

Married Filing Jointly $250,000 $250,000

Married Filing Separately $125,000 125,000

Qualifying Widower w/Dependent $250,000 250,000

Single/Head of Household 200,000 200,000

Earned Income Ceilings for Social Security Benefits

Under full retirement age $18,240 $18,960

At full retirement age Unlimited Unlimited

Contact Us At taxalerts@windes.com www.windes.com 9

Retirement Plan Limitations

2020 2021

Maximum 401(k) or 403(b) Deferral $19,500 $19,500

Maximum Defined Contribution Plan

or SEP Contribution 57,000 58,000

Maximum Annual Benefit for

Defined Benefit Plans 230,000 230,000

Annual Compensation Limit

for Computing Plan Benefits 285.000 290,000

Annual Compensation Limit for the

Definition of Highly Compensated

Employee IRC Section 414(q) 130,000 130,000

Compensation Minimum for SEP plan 600 650

Maximum Contribution for SIMPLE plan 13,500 13,500

Catch-up Contribution for 401(k) or 403(b)

for taxpayers age 50 and older 6,500 6,500

Catch-up Contribution for SIMPLE plan

for taxpayers age 50 and older 3,000 3,000

Key Employee for Top Heavy Purposes:

Officers Earning Over $185,000 $185,000

A more-than-5% Owner N/A N/A

A more-than-1% Owner Earning Over 150,000 150,000

Contact Us At taxalerts@windes.com www.windes.com 10

Traditional and Roth IRAs

2020 2021

Contribution Limit $6,000 $6,000

Catch-up Contribution age 50 and older 1,000 1,000

IRA Deduction Phase-out for Active Participants

Single or Head of Household $65,000 - 75,000 $66,000 - 76,000

Married Filing Jointly 104,000 - 124,000 105,000 - 125,000

Married Filing Separately 0 - 10,000 0 - 10,000

IRA Deduction Phase-out for Spousal Contributions

Married Filing Jointly $196,000 - 206,000 $198,000 - 208,000

Roth IRA Contribution Phase-out

Single or Head of Household $124,000 - 139,000 $125,000 - 140,000

Married Filing Jointly 196,000 - 206,000 198,000 - 208,000

Married Filing Separately 0 - 10,000 0 - 10,000

Roth IRA Conversion Phase-out

All Filing Statuses No AGI Limit No AGI Limit

Contact Us At taxalerts@windes.com www.windes.com 11

IRA and Pension Credit

Saver’s Credit Rate applied to maximum contribution of $2,000, based on AGI.

Joint Filers Heads of Household All Others Credit Rate

$0 - 39,500 $0 - 29,625 $0 - 19,750 50%

39,500 - 43,000 29,625 - 32,250 19,750 - 21,500 20%

43,000 - 66,000 32,250 - 49,500 21,500 - 33,000 10%

Over 66,000 Over 49,500 Over 33,000 0%

Estate and Gift Tax

Estate/GST Tax Highest Estate

Calendar Year Transfer Exemption and Gift Tax Rate

2020 $11,580,000 40%

2021 $11,700,000 40%

Gift tax:

Annual Gift Limitation of $15,000 for 2021

Contact Us At taxalerts@windes.com www.windes.com 12

Education-Related Tax Benefits

Coverdell Educational Savings Accounts

Annual Contribution Limit $2,000

Contribution phase-out based on modified AGI

Married Filing Jointly $190,000 - 220,000

All Others 95,000 - 110,000

Student Loan Interest Deduction

Maximum interest deduction $2,500

Deduction phase-out based on modified AGI

Married Filing Jointly $140,000 - 170,000

All Others 70,000 - 85,000

American Opportunity Tax Credit

Maximum Credit $2,500

Credit phase-out based on modified AGI

Married Filing Jointly $160,000 - 180,000

All Others 80,000 - 90,000

Lifetime Learning Credit

Maximum Credit $2,000

Credit phase-out based on modified AGI

Married Filing Jointly $160,000 - 180,000

All Others 80,000 - 90,000

Contact Us At taxalerts@windes.com www.windes.com 13

Important Phone Numbers

Tax Practitioner Hotlines

IRS Priority Service (866) 860-4259

FTB (916) 845-7057

FTB Fax (916) 845-9300

FTB e-file (916) 845-0353

EDD (888) 745-3886

CDTFA (800) 401-3661

Application for Taxpayer ID Number

Federal Form SS-4 Online: www.irs.gov/businesses *

Federal Form SS-4 Fax (855) 215-1627

EDD Form DE 1 Fax (916) 654-9211

EDD Form DE 1 Online: https://edd.ca.gov/payroll_taxes/save_time_and_register_online.htm

NOTE:

*For Federal Form SS-4 Phone: IRS no longer issues EINs by telephone for domestic taxpayers. Only

international applicants can receive an EIN by telephone.

For questions or more information, please contact our tax professionals at taxalerts@windes.com or

toll free at 844.4WINDES (844.494.6337).

Contact Us At taxalerts@windes.com www.windes.com 14

Windes is a recognized leader in the field of accounting, assurance, tax, and business consulting

services. Our goal is to exceed your expectations by providing timely, high-quality, and personalized

service that is directed at improving your bottom-line results. Quality and value-added solutions from

your accounting firm are essential steps toward success in today’s marketplace. You can depend

on Windes to deliver exceptional client service on each engagement. For 94 years, we have gone

beyond traditional services to provide proactive solutions and the highest level of expertise and

experience.

The Windes team approach allows you to benefit from a wealth of technical expertise and extensive

resources. We service a broad range of clients, from high-net-worth individuals and nonprofit

organizations to privately held businesses. We act as business advisors, working with you to set

strategies, maximize efficiencies, minimize taxes, and elevate your business to the next level.

Headquarters Orange County Offices Los Angeles Office

3780 Kilroy Airport Way 2050 Main Street 515 Flower Street

Suite 600 Suite 1300 Eighteenth Floor

Long Beach, CA 90806 Irvine, CA 92614 Los Angeles, CA 90071

562.435.1191 949.852.9433 213.239.9745

©2021 Windes, Inc. All rights reserved. www.windes.com

You might also like

- Surviving the New Tax Landscape: Smart Savings, Investment and Estate Planning StrategiesFrom EverandSurviving the New Tax Landscape: Smart Savings, Investment and Estate Planning StrategiesNo ratings yet

- US Master Tax Guide (PDFDrive)Document1,258 pagesUS Master Tax Guide (PDFDrive)sutan mNo ratings yet

- ZIM 2024 Tax Reference GuideDocument7 pagesZIM 2024 Tax Reference GuideAlex MilarNo ratings yet

- 2022 Oregon EITC NoticeDocument1 page2022 Oregon EITC NoticeMan Tue ThaiNo ratings yet

- 2019-2020 Tax GuideDocument2 pages2019-2020 Tax Guidecherry LiNo ratings yet

- Tax Cuts and Jobs Act of 2017: Reduced Individual Tax RatesDocument3 pagesTax Cuts and Jobs Act of 2017: Reduced Individual Tax RatesAlex SimonettiNo ratings yet

- Tax Foundation FF6241Document5 pagesTax Foundation FF6241muhammad mudassarNo ratings yet

- 2019 Tax GuideDocument20 pages2019 Tax GuidetaulantzeNo ratings yet

- Chapter 08 Test BankDocument158 pagesChapter 08 Test BankBrandon LeeNo ratings yet

- Ch4-Recordedlecture-Fall2023 17 5166787619170306Document38 pagesCh4-Recordedlecture-Fall2023 17 5166787619170306ronny nyagakaNo ratings yet

- 17vs18taxbracket FinalDocument2 pages17vs18taxbracket Finalapi-426611448No ratings yet

- HTTPSWWW - Irs.govpubirs Pdff1040es PDFDocument12 pagesHTTPSWWW - Irs.govpubirs Pdff1040es PDFmark beattyNo ratings yet

- Read This First:: Loan & General InfoDocument14 pagesRead This First:: Loan & General InfoJoannaNo ratings yet

- Windes 2021 Year End Year Round Tax Planning GuideDocument20 pagesWindes 2021 Year End Year Round Tax Planning GuideBrian SneeNo ratings yet

- Myrna Keith - Employer Package PDFDocument24 pagesMyrna Keith - Employer Package PDFJoey KeithNo ratings yet

- Tax Update 2009Document2 pagesTax Update 2009calebwoodsNo ratings yet

- Ma Tax ReturnDocument11 pagesMa Tax ReturnMark ThomasNo ratings yet

- Ac00unting 2Document45 pagesAc00unting 2Hazem El SayedNo ratings yet

- 529credit SS1Document1 page529credit SS1loristurdevantNo ratings yet

- Tax Cuts and Jobs Act Individuals 2018Document4 pagesTax Cuts and Jobs Act Individuals 2018godardsfanNo ratings yet

- Ey Tax Rates Alberta 2023 01 15 v1Document2 pagesEy Tax Rates Alberta 2023 01 15 v1AltafNo ratings yet

- Crosswalk CPA Review: Tax Inflation Adjustments 2021Document15 pagesCrosswalk CPA Review: Tax Inflation Adjustments 2021Adhira VenkatNo ratings yet

- Individual Taxation 2013 Pratt 7th Edition Test BankDocument19 pagesIndividual Taxation 2013 Pratt 7th Edition Test BankCharles Davis100% (34)

- Income Tax Fundamentals (Assignment 1 - FIN 4017 Questions Summer 2022) (11339)Document5 pagesIncome Tax Fundamentals (Assignment 1 - FIN 4017 Questions Summer 2022) (11339)Maria PatinoNo ratings yet

- Form 1040-ES: Purpose of This PackageDocument12 pagesForm 1040-ES: Purpose of This Packagetarles666No ratings yet

- Age Pension Age Set To Change 2023Document11 pagesAge Pension Age Set To Change 2023FrankNo ratings yet

- US Internal Revenue Service: F1040es - 2000Document7 pagesUS Internal Revenue Service: F1040es - 2000IRSNo ratings yet

- Ea Ea1 Su1 CCDocument2 pagesEa Ea1 Su1 CCAnkit chouhanNo ratings yet

- Individual Taxation 2013 Pratt 7th Edition Test BankDocument19 pagesIndividual Taxation 2013 Pratt 7th Edition Test Bankbrianbradyogztekbndm100% (42)

- US Internal Revenue Service: F1040es - 2001Document7 pagesUS Internal Revenue Service: F1040es - 2001IRSNo ratings yet

- Taxes by The NumbersDocument2 pagesTaxes by The NumbersBrad StevensNo ratings yet

- Alliance Tax Subsidies Levitt 2Document10 pagesAlliance Tax Subsidies Levitt 2llevittNo ratings yet

- F1040es 2020Document12 pagesF1040es 2020Job SchwartzNo ratings yet

- TABL 2751 Tax Rates 2022Document4 pagesTABL 2751 Tax Rates 2022Crystal CheahNo ratings yet

- Formula Sheet: Income Tax Rates 2012/13Document6 pagesFormula Sheet: Income Tax Rates 2012/13scribbyscribNo ratings yet

- High-Income Taxpayers 2021Document2 pagesHigh-Income Taxpayers 2021Finn KevinNo ratings yet

- PPT300Document28 pagesPPT300Ram RamNo ratings yet

- Caution - Guidance For Use of The 2009 Form 1040-ES, Estimated Tax For IndividualsDocument8 pagesCaution - Guidance For Use of The 2009 Form 1040-ES, Estimated Tax For Individualsezra242No ratings yet

- Sage 2009 Tax Table Changes 02/27/09Document3 pagesSage 2009 Tax Table Changes 02/27/09Wayne Schulz100% (2)

- Tax Compliance, The IRS, and Tax Authorities: 2020 EditionDocument44 pagesTax Compliance, The IRS, and Tax Authorities: 2020 EditionAhmed AdamjeeNo ratings yet

- Accuracy Checking - US TaxationTestDocument10 pagesAccuracy Checking - US TaxationTestAmit ManyalNo ratings yet

- Tax Penalty Fact SheetDocument2 pagesTax Penalty Fact SheetOutboundEngineNo ratings yet

- F 1040 EsDocument12 pagesF 1040 EsHyun SeonNo ratings yet

- California State Controller'S Office Paycheck Calculator - 2021 Tax RatesDocument1 pageCalifornia State Controller'S Office Paycheck Calculator - 2021 Tax RatesSamantha JahansouzshahiNo ratings yet

- ExtraTaxProblem-TY2020 Student - SUSANDocument6 pagesExtraTaxProblem-TY2020 Student - SUSANhhunter530No ratings yet

- Tax Rates Ontario 2019Document2 pagesTax Rates Ontario 2019Pratik BajajNo ratings yet

- US Internal Revenue Service: F1040esn - 2002Document5 pagesUS Internal Revenue Service: F1040esn - 2002IRSNo ratings yet

- 2023 ALICE Report County Snapshots MI FinalDocument166 pages2023 ALICE Report County Snapshots MI FinaldaneNo ratings yet

- F1040es 2018Document18 pagesF1040es 2018diversified1No ratings yet

- Senior Care An Essential Need 2021bruce FitchDocument8 pagesSenior Care An Essential Need 2021bruce Fitchapi-610034034No ratings yet

- Joint Explanatory StatementDocument570 pagesJoint Explanatory Statementacohnthehill50% (4)

- (SINGLE TEMPLATE) Federal Tax Analysis - Last Name, First Name (2021)Document6 pages(SINGLE TEMPLATE) Federal Tax Analysis - Last Name, First Name (2021)MD RAKIBNo ratings yet

- Chapter 14 PDFDocument14 pagesChapter 14 PDFJay BrockNo ratings yet

- SANDOVAL 8030228962 Loan EstimateDocument3 pagesSANDOVAL 8030228962 Loan EstimateRic PerezNo ratings yet

- Matteson 26 Million Bond IssueDocument293 pagesMatteson 26 Million Bond IssueBurton PhillipsNo ratings yet

- 333 LineDocument25 pages333 LineTiffany BrooksNo ratings yet

- 2020 MFJ Vs MFSDocument3 pages2020 MFJ Vs MFSenderjosNo ratings yet

- Stan Kate BarnettDocument15 pagesStan Kate BarnettFinancial SenseNo ratings yet

- UnknownDocument1 pageUnknownBSNL BBOVERWIFINo ratings yet

- L3, TVM Worksheet-SolDocument3 pagesL3, TVM Worksheet-SolYelzhan ShaikhiyevNo ratings yet

- Budget 2020 NewDocument5 pagesBudget 2020 NewecolumledlightNo ratings yet

- Assignment Beyene WG Assab Port ConstructionDocument1 pageAssignment Beyene WG Assab Port ConstructionAlemu RegasaNo ratings yet

- Mumbai Data CFODocument288 pagesMumbai Data CFOPreet Tiwari100% (1)

- The IKea ApproachDocument16 pagesThe IKea ApproachYashikaNo ratings yet

- Token Economics: What Is Braintrust?Document2 pagesToken Economics: What Is Braintrust?CaxonNo ratings yet

- Fund Formation Attracting Global Investors PDFDocument87 pagesFund Formation Attracting Global Investors PDFSushimNo ratings yet

- Annexure-I Terms & Conditions of AppointmentDocument6 pagesAnnexure-I Terms & Conditions of AppointmentManish MeenaNo ratings yet

- DJ Brothers FSMS ProceduresDocument112 pagesDJ Brothers FSMS ProceduresSunith DesaiNo ratings yet

- MM LLC - Ubs UsaDocument4 pagesMM LLC - Ubs UsaWilson Pena100% (1)

- Final Exam Review PPTDocument14 pagesFinal Exam Review PPTJackie JacquelineNo ratings yet

- Financial LiteracyDocument48 pagesFinancial LiteracyAni Vie Macero100% (1)

- Advance Logistics Management Course - Senior MGMTDocument2 pagesAdvance Logistics Management Course - Senior MGMTzulkarnainahmad_conanNo ratings yet

- Balance Sheet of Everest Kanto CylinderDocument2 pagesBalance Sheet of Everest Kanto Cylindersatya936No ratings yet

- Toyota Porter 5 ForcesDocument2 pagesToyota Porter 5 Forcestaraspence1997No ratings yet

- Case StudyDocument3 pagesCase StudyPapaiDip67% (3)

- 04-08-2021 Incident ReportDocument2 pages04-08-2021 Incident ReportnoahojitoNo ratings yet

- A Study On Sale and Distribution Management of Hindustan Unilever LimitedDocument35 pagesA Study On Sale and Distribution Management of Hindustan Unilever LimitedJakir HussainNo ratings yet

- PTW General Work - 2020, FilledDocument4 pagesPTW General Work - 2020, FilledPalaniappan SolaiyanNo ratings yet

- Group 1 - Cost Volume Profit AnalysisDocument21 pagesGroup 1 - Cost Volume Profit AnalysisPHILL BITUINNo ratings yet

- ICT751 Information Technology Management: Lecture 2: IT Systems Management byDocument33 pagesICT751 Information Technology Management: Lecture 2: IT Systems Management byLt Mohd Amiruddin Mohamad PSSTUDMNo ratings yet

- Global Management: Managing Across Borders: By: Estephany GeronaDocument18 pagesGlobal Management: Managing Across Borders: By: Estephany GeronaJamesAnthonyNo ratings yet

- Nike in ChinaDocument14 pagesNike in ChinaRahulKumarNo ratings yet

- 362 HW 1 SolDocument7 pages362 HW 1 SolKeshi AngelNo ratings yet

- Niveshmonthly: Indianivesh Securities Private LimitedDocument10 pagesNiveshmonthly: Indianivesh Securities Private LimitedynyyNo ratings yet

- Tourism Development in Zambia in 2017Document19 pagesTourism Development in Zambia in 2017Innocentih Bwalyah BonnaventurehNo ratings yet

- 18 A FYP Stakeholder ManagementDocument10 pages18 A FYP Stakeholder ManagementAsif HameedNo ratings yet

- Farm Manager's ReportDocument13 pagesFarm Manager's ReportHadrien FaryalaNo ratings yet

- Ordinance For Development Permit and Locational ClearanceDocument16 pagesOrdinance For Development Permit and Locational ClearanceAB Agosto100% (1)