Professional Documents

Culture Documents

TXQDC I9 S9 e BUet 3 SZN La H8 Ne VDJQ BRW WNy SGC4 MB

Uploaded by

shanza FaheemOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TXQDC I9 S9 e BUet 3 SZN La H8 Ne VDJQ BRW WNy SGC4 MB

Uploaded by

shanza FaheemCopyright:

Available Formats

International Journal of Frontiers in Sociology

ISSN 2706-6827 Vol. 3, Issue 2: 13-20, DOI: 10.25236/IJFS.2021.030204

The Influence Mechanism of Compensation Incentive

in State-Owned Enterprises on the Realization of

Enterprise Strategic Goal:A Case Study of a

Petroleum Company in Guangzhou

Han Zhang1, Xingchi Lin1, Kaijian Li2 and Haojun Zhang1*

1

Sinochem Guangdong Co.Ltd, Guangdong, China

2

Guangzhou University, Guangzhou, China

*

Corresponding author

ABSTRACT. The report to the 19th National Congress of the Communist Party of China pointed out:

"Socialism with Chinese characteristics has entered a new era, which is a new historical juncture in

China's development.State-owned enterprises are the pillar of socialism with Chinese characteristics

and a powerful driving force for China to enter this new era of history. Meanwhile, Employee

compensation incentive is an indispensable part of state-owned enterprises to realize their strategic

goals and leapfrog development, and to attract and retain critical talent. In order to research the

influence mechanism of compensation incentive on the realization of strategic goals of state-owned

enterprises, this paper select a state-owned enterprise in the petroleum industry in Guangdong

Province as a case, and analyze its employee background, compensation structure, income change and

the comprehensive development of the enterprise from 2012 to 2020.The research shows that:If

state-owned enterprises want to keep their own compensation system competitive advantage in the

market competition and effectively help state-owned enterprises attract and retain talents, they need to

pay attention to the internal fairness and external competitiveness of the compensation system. At the

same time, this paper proposes to adhere to the policy of maintaining and increasing the value of

state-owned assets as the premise,and the next stage can continue to explore inefficient assets, loss

assets of a variety of innovative business models, such as managerial responsibility system of

contracting or entrusted management.

KEYWORDS: State-Owned Petroleum Enterprise, Enterprise Strategy, Compensation Incentive

1.Research Background

The report of the 19th CPC National Congress put forward a series of important expositions, such

as the new era, new ideas, new contradictions and new journey, which will inevitably bring great

influence and cause profound changes to the reform and development of state-owned enterprises. If the

state-owned enterprises are strong, the country will be strong. China's state-owned enterprises are the

pillar of socialism with Chinese characteristics and a strong driving force for China to enter this new

era of history. Only by adapting to the changes and development of the era can we better practice the

original intention and mission of making contributions to the Communist Party of China in the

economic field.

While the great responsibility of history falls on the shoulders of state-owned enterprises, there is

also a historical problem left for state-owned enterprises to solve. Since China joined the World Trade

Organization (WTO), it has been more deeply involved in economic globalization and integration.

Many foreign-funded enterprises enter China. They not only play a positive role in China's economic

development, but also have made considerable development and great success in the process of

globalization development. Similarly, there are some private enterprises in China, such as Alibaba,

Tencent, Baidu, NetEase, Didi and so on. They also contribute to China's economic development, but

also the enterprise itself has made great development. Obviously, they all have some similar reasons for

success, such as strong economic strength, advanced management level and methods, and the most

important is enterprise talent strategy. It is precisely because the above-mentioned foreign-funded

enterprises and private enterprises in emerging industries regard talent strategy as an important strategy

of enterprise development and human resources as the competitive advantage of enterprise organization

Published by Francis Academic Press, UK

-13-

International Journal of Frontiers in Sociology

ISSN 2706-6827 Vol. 3, Issue 2: 13-20, DOI: 10.25236/IJFS.2021.030204

that they can guarantee their competitive advantage over state-owned enterprises. However, due to

various historical reasons, the compensation system of most state-owned enterprises is not in line with

the market. Divorced from the reality of the market, the compensation setting is not reasonable, and

does not fully follow the principle of fair competition. At the same time, the compensation incentive

methods of state-owned enterprises are relatively single, with only a few forms such as basic salary,

cash welfare, royalties, year-end bonus, etc. These traditional incentive mechanisms may not well meet

the needs of employees, and fail to form a competitive advantage and competitiveness.Therefore, it is

of great practical significance and academic value to research the influence mechanism of

compensation incentive and the realization of strategic goals in state-owned enterprises.

2.Research Basis

This research takes a petroleum company in Guangzhou as a case.

2.1 Employee Characteristics and Company Performance

The dimensions of a company's performance evaluation and measurement can be diversified.

Company performance is the outward manifestation to measure whether a company succeeds or not

and whether its strategic objectives are realized. In this research, the pre-tax profit of the company

during 2012-2020 will be selected as the accounting index to measure the performance of the company,

and the ratio of the employee income, corporate tax and other welfare expenditure to the GDP of the

company will be used as the social index to measure the social contribution of the company.

(1)Employee age

The age distribution of employees, especially the age distribution of the management team, has a

significant impact on enterprise performance and is negatively correlated. When employees, especially

those in the management team, are younger on average, they are more willing to accept new things and

abandon the conformist practices and keep pace with the times, which is more conducive to the

company to seize the development opportunities.

(2)Tenure of the management team

Generally speaking, the tenure of management team has a significant impact on corporate

performance and is positively correlated. If the management team has a short term tenure, it is more

likely to make short-sighted decisions and pay attention to short-term gains and losses, which will

affect the long-term development and medium and long term performance of the company.

(3)Educational background and education level

Researches have shown that the degree of education of employees has a significant and positive

correlation with enterprise performance. In the face of difficulties and problems, highly educated teams

can screen and sort out effective information to assist operational decisions, so as to improve the

quality of the company's operation, and thus improve company performance and the ability to grasp the

strategic goals of the enterprise will be stronger. There are also empirical researches show that the

higher the education level and average education level of team members, the better the business growth

will be.

2.2 Incentive Theory

With the development of the western economics, many economists and researchers in the history

put forward many incentive theories, such as the American psychologist Abraham H. Maslow proposed

" Hierarchical theory of needs". It was divided into five kinds of human demand from low to high

respectively physiological need, safety need, esteem need, social need and self-actualization need.

Lazear and Rosen's Tournament theory suggests that the size of a salary increase associated with a

given promotion affects the motivatio of employees below that rank. As long as the outcome of a

promotion is not clear, employees are motivated to work hard for that promotion. Therefore, the theory

advocates that the company should have a clear position system and talent development path, so as to

motivate employees through promotion.

Published by Francis Academic Press, UK

-14-

International Journal of Frontiers in Sociology

ISSN 2706-6827 Vol. 3, Issue 2: 13-20, DOI: 10.25236/IJFS.2021.030204

2.3 Employee Compensation and Company Performance

(1)Post rank and base salary

Scholars at home and abroad have done a lot of research on fixed salary and corporate performance.

The research finds that the higher the employee's post salary, the more substantially the company's

performance will be improved, especially the salary of the management team and the general manager.

In addition, some researches have shown that the compensation level of corporate management team

has a positive correlation with company performance, which is positively moderated by long-term

incentives.

(2)Incentive mechanism

Many economists and researchers have shown that the more flexible the incentive mechanism is,

the more likely it is for the company to improve its performance. Among them, compensation incentive

and equity incentive are commonly used as incentive means in companies. Emotional need, value

identity and corporate vision building can also meet the high-level needs of employees, especially the

management team, to a certain extent.

2.4 Entrustment Management Theory

The theory of entrusted management, which was put forward by American economists Berle and

Means, is a basic theory of modern western economics. This theory points out that the owner and

operator of a company are separated, and its core is the "Hypothesis of economic man". Economic man

refers to the subject who carries out economic activities for the purpose of completely pursuing

material interests and his own enjoyment, hoping to obtain the maximum benefits at the least possible

cost. This mode can improve operators' sense of ownership, make business decisions from the

perspective of maximizing economic benefits, and improve the performance of the company.

3.Research Hypothesis and Model Design

Based on the strategic compensation management, this research puts forward the strategic

compensation management framework, including the strategic level: decomposition of corporate

strategic objectives, development strategy and corporate culture; institutional level: the evolution of

post and rank system, compensation and welfare system, salary management, etc ; technical level: post

analysis, post evaluation, salary research, etc. Then the theoretical analysis model of this study is put

forward.

A company's compensation management framework, strategic level, system level and technical

level are an inseparable, which is the framework and context of a company's compensation system.

Figure 1 Strategic compensation management framework for a petroleum company in Guangzhou

Published by Francis Academic Press, UK

-15-

International Journal of Frontiers in Sociology

ISSN 2706-6827 Vol. 3, Issue 2: 13-20, DOI: 10.25236/IJFS.2021.030204

As shown in Figure 2, this research selects the reform of the company's compensation and post rank

system, optimization of the incentive mechanism of terminal distribution business and optimization of

the retail incentive mechanism of gas station as independent variables, and takes the pre-tax profit of

the company from 2012 to 2020 as dependent variable. At the same time, the population characteristics

of the management team of the company are taken as the control variable to select three aspects: age,

tenure and education level.

Figure 2 Theoretical analysis model

4. The Empirical Analysis

4.1 Overall Descriptive Statistics

(1)Average age of the management team and corporate profits

Since 2012, the average age of the management team has fluctuated slightly between 36 and 38

years old, and the overall trend is positively correlated with the trend of company profits. The above

results further verify that the average age of the management team members is lower, open-minded and

advancing with the times, which is more conducive to the company to seize the opportunities in the

development process to create performance and gain benefits.

Figure 3 Average age of the management team and corporate profits

Figure 4 The education of management and corporate profits

(2)Tenure of the management team and corporate profits

The core of the company's management team (senior managers) changed once around 2015, while

the rest of the changes were mainly due to the normal transfer of the middle management team.

(3)The education of management team and corporate profits

Published by Francis Academic Press, UK

-16-

International Journal of Frontiers in Sociology

ISSN 2706-6827 Vol. 3, Issue 2: 13-20, DOI: 10.25236/IJFS.2021.030204

The proportion of members with master's degree or above in the management team is between 36%

and 39%, and it is steadily increasing year by year. The education level of the management team affects

the decision-making of the company, and the choices of these employees will have a significant effect

on the long-term development of the company.

4.2 Correlation Test

(1)Changes in the company's compensation and post rank system in recent years

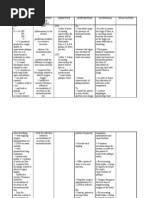

Table 1 Compensation and rank system

With the continuous development of the company, the needs of employees' personal development

are becoming more and more obvious, and the needs of promotion and spiritual motivation are also

more urgent. In order to solve the demands of employees' personal development and further achieve the

goal of collective and individual win-win, the company carries out innovation and reform in the

development of compensation and post rank system.

The compensation and rank system before 2019 was divided into "Post Classification" and " Post

Level", as shown below. In this system, the rank and compensation are matched, that is, the higher the

post level, the higher the compensation. Such a system design is conducive to encouraging employees

to pursue promotion so as to gain both fame and wealth, but at the same time, it also brings some

problems. For example, due to the limited management positions, it is impossible to meet the needs of

employees' promotion and salary adjustment without restrictions.

In order to solve the above problems, two dimensions of "post level" and "position level" are

introduced to set up the compensation and rank system, and the development need of employees are

refined into the need of post change, rank promotion and compensation adjustment.

(2)Terminal distribution business incentives and realization of strategic objectives

The company has established the strategic transformation plan of three programs: refined oil

distribution, terminal direct sales and gas station retail.

Since the rapid expansion of the company's terminal distribution business of petroleum product, the

company has timely formulated a salary incentive plan for sales personnel, adjusting the salary

structure into basic salary + quarterly commission bonus + cash benefits. Reward for sales staff every

Published by Francis Academic Press, UK

-17-

International Journal of Frontiers in Sociology

ISSN 2706-6827 Vol. 3, Issue 2: 13-20, DOI: 10.25236/IJFS.2021.030204

quarter reflect the timeliness of incentive cash, improve the sense of gain and work enthusiasm of sales

staff. In addition, the basic salary of sales staff is linked to the personal annual sales target.

The company's latest sales incentive plan divides sales customers into social end customers,

institutional customers, trading customers, bloc customers and strategic customers. The company's

customer classification is related to the sales commission coefficient.

Table 2 The petroleum company’s Incentive scheme

Incentive scheme (2017)

Royalty calculation Sales volume * Commission coefficient *Difficulty coefficient*Product

formula coefficient

Institutional Product

Bloc customers

Terminal customers coefficient

Name of the post / Strategic

gas station / Trading

customers 98# 95# 92#

customers

Business manager 2 0.9 0.5 8 4 2.4

Business supervisor 1.6 0.9 0.5 8 4 2.4

Business

1 0.5 0.3 8 4 2.4

commissioner

Effective incentive mechanism is an important guarantee for the realization of the company's

strategic goals. Since 2012, the company has realized the harmonious development of enterprise value

and employee value.

(3)Gas station retail business incentive and realization of strategic objective

At present, the company has 200 gas stations in Guangdong Province, forming the initial brand

influence. The company's gas station business development is closely related to the performance

assessment of the gas station management team and the attractive salary incentive mechanism.

Figure 5 The average salary of sales staff and the company's pfofits

Figure 6 The average salary of gas station management team and company's profits

Published by Francis Academic Press, UK

-18-

International Journal of Frontiers in Sociology

ISSN 2706-6827 Vol. 3, Issue 2: 13-20, DOI: 10.25236/IJFS.2021.030204

Table 3 Salary assessment standards for gas station

Performance bonus for oil sales:

Calculation Formula of Performance Bonus for Oil Sales :

In 2018, the company built a flexible and efficient innovation platform and a technology-driven

investment platform on the basis of consolidating the achievements of management innovation and

following the guidelines of "streamling administration,delegating more powers to lower-level

governments and society,improving regulation and optimizing services".

On the basis of established operating standards, the company implements "one development

strategy for each gas station", and gives contractors of gas stations partial autonomy in employment

recruitment, oil price management, marketing planning and cost control. The company encourages

contractors, commissioned managers and gas station staff to develop strategies according to market

demand, in order to achieve the purpose of "increasing sales volume, optimizing cost structure,

reducing cost burden and increasing benefits".

After the reform of the management mode, the profits of gas stations have been significantly

improved, and the average income of staff in gas stations has also increased by 33% year-on-year.

5.Research Conclusions and Recommendations

5.1 Research Conclusion

With the development of China's economy, the mobility of talents is becoming more frequent. For

state-owned enterprises, it is of great significance to attract talents and enhance enterprise

competitiveness through salary incentive. At present, there are not many studies on the influence of

compensation incentive on corporate strategic objectives by scholars. Through the study on the change

of compensation incentive mechanism and the growth of business performance of an petroleum

company in Guangzhou since its strategic transformation and development in 2012, the following

conclusions are drawn:

(1)The average age of the management team is negatively correlated with company profits

(2)Proper stability of the tenure of the management team is conducive to achieving the planned

goals in the development process.

(3)Employee's education level is positively correlated with company's profit.

Published by Francis Academic Press, UK

-19-

International Journal of Frontiers in Sociology

ISSN 2706-6827 Vol. 3, Issue 2: 13-20, DOI: 10.25236/IJFS.2021.030204

(4)Accurate incentive mechanism is conducive to the realization of the company's strategic

objectives

5.2 The Shortage of Research

(1) Due to the limitation of the length of the article, this paper only takes an oil company in

Guangzhou as a case, and the research conclusion cannot reflect the development situation of the whole

industry. In the follow-up, state-owned enterprises in different industries will be selected to study the

influence and change relationship between their compensation incentives and the realization of

corporate strategic goals.

(2) This paper mainly analyzes the impact of single factors, and does not explain or make in-depth

analysis of the superposition and cross-influence of factors. In the follow-up, cross-association tests of

multiple impact factors will be designed to analyze the correlation between compensation incentives

and the realization of corporate strategic goals.

5.3 Recommendation

(1) State-owned enterprises should pay attention to talents, who are the source and power of

company development and market competition. Through policy formulation and adjustment, we should

find and retain talents, establish a set of reasonable incentive mechanism to stimulate the enthusiasm of

employees, give play to the role of talents, rely on talents to revitalize state-owned enterprises, and

fulfill the original intention and mission of making greater contributions to the Communist Party of

China and the country in the economic field.

(2) The establishment of reasonable incentive mechanism is helpful to give full play to the effect of

incentive. Ensure that incentive methods are consistent with corporate strategic objectives and

corporate performance. Let the incentive mechanism become the action guide for everyone, and really

mobilize the enthusiasm of all the staff.

(3) The company should create a multi-channel and multi-form incentive mechanism. Innovative

business model and management model need to be supported by multi-channel and multi-form

incentive mechanism. The incentive plan should be tailored according to the needs of the company's

strategic promotion and reform, and the company should not only use a single incentive mechanism.

References

[1]Xi Wu(2020).Reflections on human resources and compensation incentive mechanism of

state-owned enterprises.Chinese & Foreign Corporate Culture,,no.11,p.191-192.

[2]Kang Geng(2019).Executive career background,compensation structure and company performance.

[3]Junde Tong(2020). Existing problems and optimization strategies of compensation management

system in state-owned enterprises. Enterprise Reform and Management,no.21,p.82-83.

[4]Chenjun Lin,Mengjiao Zhen(2020). Compensation incentive measures for state-owned

enterprises.Ren Cai Zi Yuan Kai Fa,no.21,P.93-94.

[5]Qinfeng Wen(2005). Research on Compensation Strategy of State-owned Enterprises.

[6]Jing Chen(2010). Research on the Compensation Strategy of Chinese Enterprises.Co-Operative

Economy & Science,no.24,P.71-72.

[7]Jianbing Shao,Jinhong Diao(2020) Does Compensation Regulation Discourage the Innovation of

State-owned Enterprises?Review of Economy and Management,no.5,p.42-55.

Published by Francis Academic Press, UK

-20-

You might also like

- UntitledDocument25 pagesUntitledADAMNo ratings yet

- Impact of Incentives On Employee PerformanceDocument9 pagesImpact of Incentives On Employee PerformanceJeorel Canillo QuiapoNo ratings yet

- Toward Creating Organizational Organization: Linking Organization: Vision, Mission, Values, Strategy, and Objectives with Performance ManagementFrom EverandToward Creating Organizational Organization: Linking Organization: Vision, Mission, Values, Strategy, and Objectives with Performance ManagementNo ratings yet

- Abt D StudyDocument9 pagesAbt D StudyShankar ChinnusamyNo ratings yet

- The ACE Advantage: How Smart Companies Unleash Talent for Optimal PerformanceFrom EverandThe ACE Advantage: How Smart Companies Unleash Talent for Optimal PerformanceNo ratings yet

- Table of Contents for HR ResearchDocument80 pagesTable of Contents for HR ResearchshobhitNo ratings yet

- Are Socially Responsible Companies Really Ethical? The Moderating Role of State-Owned Enterprises: Evidence From ChinaDocument19 pagesAre Socially Responsible Companies Really Ethical? The Moderating Role of State-Owned Enterprises: Evidence From Chinasita deliyana FirmialyNo ratings yet

- Reinventing Talent Management: Principles and Practics for the New World of WorkFrom EverandReinventing Talent Management: Principles and Practics for the New World of WorkNo ratings yet

- Pay Satisfaction of Employees at a State-Owned Science Institute in ChinaDocument14 pagesPay Satisfaction of Employees at a State-Owned Science Institute in ChinakamranNo ratings yet

- MB 0043 - Human Resource Management Assignment Set - 1Document18 pagesMB 0043 - Human Resource Management Assignment Set - 1jasarnejaNo ratings yet

- Assesing The Role of Employee Motivation On Organisation Performance. Acase of Alaf CompanyDocument6 pagesAssesing The Role of Employee Motivation On Organisation Performance. Acase of Alaf CompanySteven MarcusNo ratings yet

- Ajeba1239 44Document6 pagesAjeba1239 44Shahbaz AftabNo ratings yet

- Worker Satisfaction, Customer Satisfaction and Financial Health, The Three Pillars of Business SuccessFrom EverandWorker Satisfaction, Customer Satisfaction and Financial Health, The Three Pillars of Business SuccessNo ratings yet

- Internal Fission Strategies in Corporate Entrepreneurship: A Case Study in ChinaDocument20 pagesInternal Fission Strategies in Corporate Entrepreneurship: A Case Study in ChinaLahari DeviNo ratings yet

- IE Report 1.1Document58 pagesIE Report 1.1melgrace planaNo ratings yet

- The Impact of Management Incentive Policies On WorkerDocument11 pagesThe Impact of Management Incentive Policies On WorkergentlekenNo ratings yet

- Employee As Stakeholder Article RevieDocument3 pagesEmployee As Stakeholder Article RevieBir Betal MatketingNo ratings yet

- Challenges of Motivating Employees in Pakistan's Public SectorDocument26 pagesChallenges of Motivating Employees in Pakistan's Public SectorAsima IhsanNo ratings yet

- Effects of Compensation On Empoyee Performance (Incase of Commercial Bank of Ethiopia Yirgalem Branch)Document40 pagesEffects of Compensation On Empoyee Performance (Incase of Commercial Bank of Ethiopia Yirgalem Branch)Asfawosen Dingama100% (3)

- High-Impact Human Capital Strategy: Addressing the 12 Major Challenges Today's Organizations FaceFrom EverandHigh-Impact Human Capital Strategy: Addressing the 12 Major Challenges Today's Organizations FaceNo ratings yet

- Chapter 1Document11 pagesChapter 1Ahmad AriefNo ratings yet

- Formal vs informal training and employee performance in banking sectorDocument28 pagesFormal vs informal training and employee performance in banking sectorShahrez KhanNo ratings yet

- Factors Affecting The Rate of Growth of Startups in IndiaDocument23 pagesFactors Affecting The Rate of Growth of Startups in IndiaSAURABH KUMAR GUPTANo ratings yet

- The Impact of Incentives On The Performance of Employees in Public Sector: Case Study in Ministry of LaborDocument12 pagesThe Impact of Incentives On The Performance of Employees in Public Sector: Case Study in Ministry of LaborBaby SileshiNo ratings yet

- The Components of The Innovative Organization: Evidence From ThailandDocument9 pagesThe Components of The Innovative Organization: Evidence From ThailandcutadeNo ratings yet

- Corporate Governance What Is Corporate Governance?Document6 pagesCorporate Governance What Is Corporate Governance?Khadija JuttNo ratings yet

- ProposalDocument27 pagesProposalIbrahimNo ratings yet

- Strategic Human Resources AssignmentDocument10 pagesStrategic Human Resources Assignmentabanoub khalaf 22No ratings yet

- The Effectsof Human Capital Developmenton Organizational PerformanceDocument14 pagesThe Effectsof Human Capital Developmenton Organizational PerformanceBarka Tumba NgiddaNo ratings yet

- Research ProposalDocument17 pagesResearch ProposalJohn Bates BlanksonNo ratings yet

- Project Title 2019 War EagleDocument6 pagesProject Title 2019 War EagleVocpster OderoNo ratings yet

- ArticalDocument7 pagesArticalBushra KhanNo ratings yet

- Dynamics of Corporate America & Innovation: First EditionFrom EverandDynamics of Corporate America & Innovation: First EditionNo ratings yet

- Impact of ODIs on Employee Commitment, Motivation, Satisfaction & PerformanceDocument12 pagesImpact of ODIs on Employee Commitment, Motivation, Satisfaction & PerformanceRaiza RamirezNo ratings yet

- Promoting Quality Work LifeDocument13 pagesPromoting Quality Work LifevivekmikuNo ratings yet

- 233-Concept Note - Incentive SystemsDocument25 pages233-Concept Note - Incentive SystemstemekeNo ratings yet

- Strength and Tenacity: Research on Reputation Building of Chinese State-Owned Enterprises in the U.S.From EverandStrength and Tenacity: Research on Reputation Building of Chinese State-Owned Enterprises in the U.S.No ratings yet

- Research Report On Corporate Governance, Social Responsibility and Human Resources StrategiesDocument7 pagesResearch Report On Corporate Governance, Social Responsibility and Human Resources StrategiesScribd_abnNo ratings yet

- Effect of Reward on Employee MotivationDocument12 pagesEffect of Reward on Employee MotivationtesfaNo ratings yet

- Sustainability 11 00621 PDFDocument21 pagesSustainability 11 00621 PDFAhmed AliNo ratings yet

- How State-owned Enterprises Drag on Economic Growth: Theory and Evidence from ChinaFrom EverandHow State-owned Enterprises Drag on Economic Growth: Theory and Evidence from ChinaNo ratings yet

- Research compensationDocument32 pagesResearch compensationvirajpatel.inNo ratings yet

- Twelve Steps Business Executives Can Take to Survive the Next Recession in Terms of Organizational RestructuringFrom EverandTwelve Steps Business Executives Can Take to Survive the Next Recession in Terms of Organizational RestructuringNo ratings yet

- Entrepreneurship Skills for Growth-Orientated SMEsDocument23 pagesEntrepreneurship Skills for Growth-Orientated SMEsSurya PrasannaNo ratings yet

- Factors Affecting The Commitment To The Organization of Saigon Commercial Joint Stock Bank Staff in HCM CityDocument10 pagesFactors Affecting The Commitment To The Organization of Saigon Commercial Joint Stock Bank Staff in HCM CityaijbmNo ratings yet

- LHH Connecting The Dots Career DevelopmentDocument38 pagesLHH Connecting The Dots Career DevelopmentDevanshi MistryNo ratings yet

- Quality of Working Life in BangladeshDocument67 pagesQuality of Working Life in BangladeshZakaria Sakib0% (2)

- Research Paper On Human Capital DevelopmentDocument6 pagesResearch Paper On Human Capital Developmentvagipelez1z2100% (1)

- Literature Review On Msme in IndiaDocument4 pagesLiterature Review On Msme in Indiac5sq1b48100% (1)

- Qi Kotz 2019 The Impact of State Owned Enterprises On China S Economic GrowthDocument19 pagesQi Kotz 2019 The Impact of State Owned Enterprises On China S Economic GrowthsergiolefNo ratings yet

- Trends in Organizational DevelopmentDocument7 pagesTrends in Organizational DevelopmentMuhammad HarisNo ratings yet

- Innovation Case StudyDocument7 pagesInnovation Case Studybilhar keruboNo ratings yet

- Impact of Rewards and Recognition As Talent Retention Strategy in Indian CorporatesDocument5 pagesImpact of Rewards and Recognition As Talent Retention Strategy in Indian CorporatesRajni KumariNo ratings yet

- Compensation ArticleDocument10 pagesCompensation Articleshanza FaheemNo ratings yet

- Sir Bilal ReportDocument19 pagesSir Bilal Reportshanza FaheemNo ratings yet

- Change Management & Conflict Resolution: Ms Laraib AslamDocument14 pagesChange Management & Conflict Resolution: Ms Laraib Aslamshanza FaheemNo ratings yet

- C 2Document105 pagesC 2shanza FaheemNo ratings yet

- Bioenergetic AssignmentDocument16 pagesBioenergetic Assignmentshanza FaheemNo ratings yet

- Assignment: "Recruitment and Selection"Document4 pagesAssignment: "Recruitment and Selection"shanza FaheemNo ratings yet

- Assignment: "Recruitment and Selection"Document3 pagesAssignment: "Recruitment and Selection"shanza FaheemNo ratings yet

- 2009 Bar Exam Criminal Law QuestionsDocument25 pages2009 Bar Exam Criminal Law QuestionsJonny Duppses100% (2)

- Explosive Ordnance Disposal & Canine Group Regional Explosive Ordnance Disposal and Canine Unit 3Document1 pageExplosive Ordnance Disposal & Canine Group Regional Explosive Ordnance Disposal and Canine Unit 3regional eodk9 unit3No ratings yet

- Research On Evolution Equations Compendium Volume 1Document437 pagesResearch On Evolution Equations Compendium Volume 1Jean Paul Maidana GonzálezNo ratings yet

- Members From The Vietnam Food AssociationDocument19 pagesMembers From The Vietnam Food AssociationMaiquynh DoNo ratings yet

- NCP For Ineffective Airway ClearanceDocument3 pagesNCP For Ineffective Airway ClearanceJennelyn BayleNo ratings yet

- FABM 1 Module by L. DimataloDocument109 pagesFABM 1 Module by L. Dimataloseraphinegod267No ratings yet

- Question 1 - Adjusting EntriesDocument10 pagesQuestion 1 - Adjusting EntriesVyish VyishuNo ratings yet

- Individual Learning Monitoring PlanDocument2 pagesIndividual Learning Monitoring PlanJohnArgielLaurenteVictorNo ratings yet

- TULIP ChartDocument1 pageTULIP ChartMiguel DavillaNo ratings yet

- Document PDFDocument16 pagesDocument PDFnelson_herreraNo ratings yet

- Access 2013 Beginner Level 1 Adc PDFDocument99 pagesAccess 2013 Beginner Level 1 Adc PDFsanjanNo ratings yet

- BuellRetailCatalog en USDocument76 pagesBuellRetailCatalog en USErcüment Kayacık100% (2)

- Videoteca - Daniel Haddad (March 2019)Document8 pagesVideoteca - Daniel Haddad (March 2019)Daniel HaddadNo ratings yet

- Isoenzyme ClassifiedDocument33 pagesIsoenzyme Classifiedsayush754No ratings yet

- Operator'S Manual For Airprint: Multifunctional Digital Color Systems / Multifunctional Digital SystemsDocument30 pagesOperator'S Manual For Airprint: Multifunctional Digital Color Systems / Multifunctional Digital SystemsnamNo ratings yet

- 2.3 Stabilized MaterialDocument11 pages2.3 Stabilized MaterialMamush LetaNo ratings yet

- Summary and analysis of O. Henry's "The Ransom of Red ChiefDocument1 pageSummary and analysis of O. Henry's "The Ransom of Red ChiefRohan Mehta100% (1)

- The Paul Sellers Router PlaneDocument6 pagesThe Paul Sellers Router PlaneAjay Vishwanath100% (1)

- Cookery 10Document5 pagesCookery 10Angelica CunananNo ratings yet

- Case AnalysisDocument4 pagesCase AnalysisAirel Eve CanoyNo ratings yet

- Big Fix CommandsDocument80 pagesBig Fix CommandsRobbie ZitaNo ratings yet

- Song Activity by Christina AguileraDocument1 pageSong Activity by Christina AguileraRossita BasharovaNo ratings yet

- Christmas Elf NPCDocument4 pagesChristmas Elf NPCDrew CampbellNo ratings yet

- Lipid ChemistryDocument93 pagesLipid ChemistrySanreet RandhawaNo ratings yet

- Essay 2Document13 pagesEssay 2Monarch ParmarNo ratings yet

- Kinjal AttachedDocument1 pageKinjal AttachedNilay JethavaNo ratings yet

- Teacher Professional Reflections 2024 1Document2 pagesTeacher Professional Reflections 2024 1Roberto LaurenteNo ratings yet

- Read Me 22222222222222Document2 pagesRead Me 22222222222222sancakemreNo ratings yet

- CIMA Financial Accounting Fundamentals Past PapersDocument107 pagesCIMA Financial Accounting Fundamentals Past PapersAnonymous pwAkPZNo ratings yet

- Doctor Who - In-Vision 074 - Resurrection of The Daleks PDFDocument19 pagesDoctor Who - In-Vision 074 - Resurrection of The Daleks PDFTim JonesNo ratings yet