Professional Documents

Culture Documents

Module 04 - Financial Instruments

Uploaded by

apostol ignacioOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Module 04 - Financial Instruments

Uploaded by

apostol ignacioCopyright:

Available Formats

FINANCIAL

INSTRUMENTS

Module No. 4

BATHEOAX

Conceptual Framework and Accounting Standards

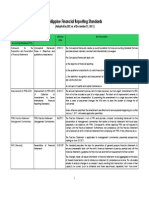

LEARNING OUTCOMES RELEVANT STANDARDS

At the end of this module, you are expected to: The following standards are essential for this

1. Understand and explain financial module.

instruments, what constitutes it, and the 1. Financial Instruments (PFRS 9)

types of financial instruments 2. Financial Instruments: Presentation (PAS 32)

2. Know, explain when to recognize the 3. Financial Instruments: Recognition and

financial assets and financial liabilities, its Measurement (PAS 39)

measurements, derecognition, and 4. Investments in Associates and Joint

reclassifying financial instruments. Ventures (PAS 28)

1

Pre-Activity

Try to answer the following questions.

1. Where do you usually invest your savings?

The objective is to establish principles for the financial reporting of financial assets and financial

liabilities that will present relevant and useful information to users of financial statements for their

assessment of the amounts, timing and uncertainty of an entity’s future cash flows.

DEFINITION

Financial Instruments

A financial instrument is any contract that gives rise to a financial asset of one entity and a

financial liability or equity instrument of another entity.

Financial Asset

A financial asset is any asset that is:

a. cash;

b. an equity instrument of another entity;

c. a contractual right:

i. to receive cash or another financial asset from another entity; or

ii. to exchange financial assets or financial liabilities with another entity under

conditions that are potentially favourable to the entity; or

d. a contract that will or may be settled in the entity’s own equity instruments and is:

i. a non‑derivative for which the entity is or may be obliged to receive a variable

number of the entity’s own equity instruments; or

ii. a derivative that will or may be settled other than by the exchange of a fixed

amount of cash or another financial asset for a fixed number of the entity’s own

equity instruments.

Financial Liability

A financial liability is any liability that is:

a. a contractual obligation:

i. to deliver cash or another financial asset to another entity; or

FINANCIAL INSTRUMENTS | Module No. 4

2

ii. to exchange financial assets or financial liabilities with another entity under

conditions that are potentially unfavourable to the entity; or

b. a contract that will or may be settled in the entity’s own equity instruments and is:

i. a non‑derivative for which the entity is or may be obliged to deliver a variable

number of the entity’s own equity instruments; or

ii. a derivative that will or may be settled other than by the exchange of a fixed

amount of cash or another financial asset for a fixed number of the entity’s own

equity instruments.

Equity Instrument

An equity instrument is any contract that evidences a residual interest in the assets of an entity

after deducting all of its liabilities.

RECOGNITION

An entity shall recognize a financial asset or a financial liability in its statement of financial

position when, and only when, the entity becomes party to the contractual provisions of the

instrument.

DERECOGNITION OF FINANCIAL ASSET

An entity shall derecognize a financial asset when, and only when:

a. the contractual rights to the cash flows from the financial asset expire, or

b. it transfers the financial asset and the transfer qualifies for derecognition rules.

Transfer of Financial Asset

An entity transfers a financial asset if, and only if, it either:

a. transfers the contractual rights to receive the cash flows of the financial asset, or

b. retains the contractual rights to receive the cash flows of the financial asset, but assumes

a contractual obligation to pay the cash flows to one or more recipient.

When an entity retains the contractual rights to receive the cash flows of a financial asset (the

‘original asset’), but assumes a contractual obligation to pay those cash flows to one or more

entities (the ‘eventual recipients’), the entity treats the transaction as a transfer of a financial

asset if, and only if, all of the following three conditions are met.

a. The entity has no obligation to pay amounts to the eventual recipients unless it collects

equivalent amounts from the original asset.

FINANCIAL INSTRUMENTS | Module No. 4

3

b. The entity is prohibited by the terms of the transfer contract from selling or pledging the

original asset other than as security to the eventual recipients for the obligation to pay

them cash flows.

c. The entity has an obligation to remit any cash flows it collects on behalf of the eventual

recipients without material delay.

When an entity transfers a financial asset, it shall evaluate the extent to which it retains the risks

and rewards of ownership of the financial asset. In this case:

a. if the entity transfers substantially all the risks and rewards of ownership of the financial

asset, the entity shall derecognize the financial asset and recognize separately as assets

or liabilities any rights and obligations created or retained in the transfer.

b. if the entity retains substantially all the risks and rewards of ownership of the financial

asset, the entity shall continue to recognize the financial asset.

c. if the entity neither transfers nor retains substantially all the risks and rewards of

ownership of the financial asset, the entity shall determine whether it has retained

control of the financial asset. In this case:

i. if the entity has not retained control, it shall derecognize the financial asset and

recognize separately as assets or liabilities any rights and obligations created or

retained in the transfer.

ii. if the entity has retained control, it shall continue to recognize the financial asset

to the extent of its continuing involvement in the financial asset.

DERECOGNITION OF FINANCIAL LIABILITY

An entity shall remove a financial liability (or a part of a financial liability) from its statement of

financial position when, and only when, it is extinguished—ie when the obligation specified in

the contract is discharged or cancelled or expires.

An exchange between an existing borrower and lender of debt instruments with substantially

different terms shall be accounted for as an extinguishment of the original financial liability and

the recognition of a new financial liability. Similarly, a substantial modification of the terms of

an existing financial liability or a part of it (whether or not attributable to the financial difficulty

of the debtor) shall be accounted for as an extinguishment of the original financial liability and

the recognition of a new financial liability.

The difference between the carrying amount of a financial liability (or part of a financial

liability) extinguished or transferred to another party and the consideration paid, including any

non‑cash assets transferred or liabilities assumed, shall be recognized in profit or loss.

FINANCIAL INSTRUMENTS | Module No. 4

4

CLASSIFICATION OF FINANCIAL ASSETS

An entity may, at initial recognition, irrevocably designate a financial asset as measured at fair

value through profit or loss if doing so eliminates or significantly reduces a measurement or

recognition inconsistency (sometimes referred to as an ‘accounting mismatch’) that would

otherwise arise from measuring assets or liabilities or recognizing the gains and losses on them

on different bases. Otherwise, it shall classify financial assets as subsequently measured at

amortized cost, fair value through other comprehensive income or fair value through profit or

loss on the basis of both:

a. the entity’s business model for managing the financial assets and

b. the contractual cash flow characteristics of the financial asset.

A financial asset shall be measured at amortized cost if both of the following conditions are met:

a. the financial asset is held within a business model whose objective is to hold financial

assets in order to collect contractual cash flows and

b. the contractual terms of the financial asset give rise on specified dates to cash flows that

are solely payments of principal and interest on the principal amount outstanding.

A financial asset shall be measured at fair value through other comprehensive income if both of

the following conditions are met:

a. the financial asset is held within a business model whose objective is achieved by both

collecting contractual cash flows and selling financial assets and

b. the contractual terms of the financial asset give rise on specified dates to cash flows that

are solely payments of principal and interest on the principal amount outstanding

Financial Asset at Financial Asset at

Financial Asset at

Business Model Fair Value through Fair Value through

Amortized Cost

Profit or Loss OCI

In the form of Equity

Held for Trading Default X X

Not Held for Trading Default By Irrevocable

X

Election

In the form of Debt

Held for Trading Default X X

Held for Collection of By Irrevocable

X Default

Contractual Cash Flows Election

FINANCIAL INSTRUMENTS | Module No. 4

5

Held for Collection of

By Irrevocable

Contractual Cash Flows Default X

Election

and Sale

CLASSIFICATION OF FINANCIAL LIABILITIES

An entity shall classify all financial liabilities as subsequently measured at amortized cost,

except for:

a. financial liabilities at fair value through profit or loss;

b. financial liabilities that arise when a transfer of a financial asset does not qualify for

derecognition ;

c. financial guarantee contracts;

d. commitments to provide a loan at a below‑market interest rate;

e. contingent consideration recognized by an acquirer in a business combination.

An entity may, at initial recognition, irrevocably designate a financial liability as measured at

fair value through profit or loss when permitted, or when doing so results in more relevant

information, because either:

a. it eliminates or significantly reduces a measurement or recognition inconsistency

(sometimes referred to as ‘an accounting mismatch’) that would otherwise arise from

measuring assets or liabilities or recognizing the gains and losses on them on

different bases; or

b. a group of financial liabilities or financial assets and financial liabilities is managed

and its performance is evaluated on a fair value basis.

RECLASSIFICATION

When, and only when, an entity changes its business model for managing financial assets it

shall reclassify all affected financial assets. An entity shall not reclassify any financial liability.

If an entity reclassifies financial assets, it shall apply the reclassification prospectively from the

reclassification date. The entity shall not restate any previously recognised gains, losses

(including impairment gains or losses) or interest.

FINANCIAL INSTRUMENTS | Module No. 4

6

Amortized Cost to Fair Value through Profit or Loss

The financial asset’s fair value is measured at the reclassification date. Any gain or loss arising

from a difference between the previous amortized cost of the financial asset and fair value is

recognized in profit or loss.

Fair Value through Profit or Loss to Amortized Cost

Its fair value at the reclassification date becomes its new gross carrying amount.

Amortized Cost to Fair Value through OCI

Its fair value is measured at the reclassification date. Any gain or loss arising from a difference

between the previous amortized cost of the financial asset and fair value is recognized in other

comprehensive income. The effective interest rate and the measurement of expected credit

losses are not adjusted as a result of the reclassification.

Fair Value through OCI to Amortized Cost

The financial asset is reclassified at its fair value at the reclassification date. However, the

cumulative gain or loss previously recognized in other comprehensive income is removed from

equity and adjusted against the fair value of the financial asset at the reclassification date. As a

result, the financial asset is measured at the reclassification date as if it had always been

measured at amortized cost. This adjustment affects other comprehensive income but does not

affect profit or loss and therefore is not a reclassification adjustment. The effective interest rate

and the measurement of expected credit losses are not adjusted as a result of the reclassification.

Fair Value through Profit or Loss to Fair Value through OCI

The financial asset continues to be measured at fair value.

Fair Value through OCI to Fair Value through Profit or Loss

The financial asset continues to be measured at fair value. The cumulative gain or loss

previously recognized in other comprehensive income is reclassified from equity to profit or

loss as a reclassification adjustment at the reclassification date.

INITIAL MEASUREMENT

Except for trade receivables, at initial recognition, an entity shall measure a financial asset or

financial liability at its fair value plus or minus, in the case of a financial asset or financial

liability not at fair value through profit or loss, transaction costs that are directly attributable to

the acquisition or issue of the financial asset or financial liability. However, if the fair value of

the financial asset or financial liability at initial recognition differs from the transaction price, an

entity shall recognize the asset initially at its fair value on the trade date. An entity shall

FINANCIAL INSTRUMENTS | Module No. 4

7

measure trade receivables at their transaction price if the trade receivables do not contain a

significant financing component.

SUBSEQUENT MEASUREMENT OF FINANCIAL ASSETS

After initial recognition, an entity shall measure a financial asset in accordance at:

a. amortized cost;

b. fair value through other comprehensive income; or

c. fair value through profit or loss.

An entity shall apply the impairment requirements to financial assets that are measured at

amortized cost and to financial assets that are measured at fair value through other

comprehensive income.

SUBSEQUENT MEASUREMENT OF FINANCIAL

LIABILITIES

After initial recognition, an entity shall measure a financial liability generally at amortized cost

and fair value for financial liabilities at fair value through profit or loss.

Modification of Contractual Cash Flows

When the contractual cash flows of a financial asset are renegotiated or otherwise modified and

the renegotiation or modification does not result in the derecognition of that financial asset in

accordance with this Standard, an entity shall recalculate the gross carrying amount of the

financial asset and shall recognize a modification gain or loss in profit or loss. The gross

carrying amount of the financial asset shall be recalculated as the present value of the

renegotiated or modified contractual cash flows that are discounted at the financial asset’s

original effective interest rate (or credit-adjusted effective interest rate for purchased or

originated credit-impaired financial assets) or, when applicable, the revised effective interest

rate calculated. Any costs or fees incurred adjust the carrying amount of the modified financial

asset and are amortized over the remaining term of the modified financial asset.

Write-Off

An entity shall directly reduce the gross carrying amount of a financial asset when the entity

has no reasonable expectations of recovering a financial asset in its entirety or a portion thereof.

A write-off constitutes a derecognition event.

FINANCIAL INSTRUMENTS | Module No. 4

8

EXPECTED CREDIT LOSSES

Recognition

At each reporting date, an entity shall assess whether the credit risk on a financial instrument

has increased significantly since initial recognition.

An entity shall recognize a loss allowance for expected credit losses on a financial assets at fair

value through OCI, financial assets at amortized cost, a lease receivable, a contract asset or a

loan commitment and a financial guarantee contract to which the impairment requirements

apply.

At each reporting date, an entity shall measure the loss allowance for a financial instrument at

an amount equal to the lifetime expected credit losses if the credit risk on that financial

instrument has increased significantly since initial recognition.

An entity may assume that the credit risk on a financial instrument has not increased

significantly since initial recognition if the financial instrument is determined to have low credit

risk at the reporting date. If, at the reporting date, the credit risk on a financial instrument has

not increased significantly since initial recognition, an entity shall measure the loss allowance

for that financial instrument at an amount equal to 12‑month expected credit losses.

An entity shall recognize in profit or loss, as an impairment gain or loss, the amount of expected

credit losses (or reversal) that is required to adjust the loss allowance at the reporting date to the

amount that is required to be recognized.

Measurement

An entity shall measure expected credit losses of a financial instrument in a way that reflects:

a. an unbiased and probability‑weighted amount that is determined by evaluating a range

of possible outcomes;

b. the time value of money; and

c. reasonable and supportable information that is available without undue cost or effort at

the reporting date about past events, current conditions and forecasts of future economic

conditions.

GAINS AND LOSSES

Arising from Financial Instruments Measured at Fair Value

A gain or loss on a financial asset or financial liability that is measured at fair value shall be

recognized in profit or loss unless:

FINANCIAL INSTRUMENTS | Module No. 4

9

a. it is part of a hedging relationship;

b. it is an investment in an equity instrument and the entity has elected to present gains

and losses on that investment in other comprehensive income;

c. it is a financial liability designated as at fair value through profit or loss and the entity is

required to present the effects of changes in the liability’s credit risk in other

comprehensive income; or

d. it is a financial asset measured at fair value through other comprehensive income and

the entity is required to recognize some changes in fair value in other comprehensive

income.

Dividends

Dividends are recognized in profit or loss only when:

a. the entity’s right to receive payment of the dividend is established;

b. it is probable that the economic benefits associated with the dividend will flow to the

entity; and

c. the amount of the dividend can be measured reliably.

Arising from Financial Instruments Measured at Amortized Cost

A gain or loss on a financial asset that is measured at amortized cost and is not part of a

hedging relationship shall be recognized in profit or loss when the financial asset is

derecognized, reclassified, through the amortization process or in order to recognize

impairment gains or losses.

A gain or loss on a financial liability that is measured at amortized cost and is not part of a

hedging relationship shall be recognized in profit or loss when the financial liability is

derecognized and through the amortization process.

Arising from Liabilities Designated as at Fair Value through Profit or Loss

An entity shall present a gain or loss on a financial liability that is designated as at fair value

through profit or loss as follows:

a. the amount of change in the fair value of the financial liability that is attributable to

changes in the credit risk of that liability shall be presented in other comprehensive

income; and

b. the remaining amount of change in the fair value of the liability shall be presented in

profit or loss

Arising from Assets Measured at Fair Value through OCI

A gain or loss on a financial asset measured at fair value through other comprehensive income

in accordance with paragraph 4.1.2A shall be recognized in other comprehensive income, except

FINANCIAL INSTRUMENTS | Module No. 4

10

for impairment gains or losses and foreign exchange gains and losses, until the financial asset is

derecognized or reclassified. When the financial asset is derecognized, the cumulative gain or

loss previously recognized in other comprehensive income is reclassified from equity to profit

or loss as a reclassification adjustment. Interest calculated using the effective interest method is

recognized in profit or loss. If a financial asset is measured at fair value through other

comprehensive income, the amounts that are recognized in profit or loss are the same as the

amounts that would have been recognized in profit or loss if the financial asset had been

measured at amortized cost.

PRESENTATION

Liabilities and Equity

The issuer of a financial instrument shall classify the instrument, or its component parts, on

initial recognition as a financial liability, a financial asset or an equity instrument in accordance

with the substance of the contractual arrangement and the definitions of a financial liability, a

financial asset and an equity instrument.

Compound Financial Instruments

The issuer of a non‑derivative financial instrument shall evaluate the terms of the financial

instrument to determine whether it contains both a liability and an equity component. Such

components shall be classified separately as financial liabilities, financial assets or equity

instruments.

Treasury Shares

If an entity reacquires its own equity instruments, those instruments (‘treasury shares’) shall be

deducted from equity. No gain or loss shall be recognized in profit or loss on the purchase, sale,

issue or cancellation of an entity’s own equity instruments. Such treasury shares may be

acquired and held by the entity or by other members of the consolidated group. Consideration

paid or received shall be recognized directly in equity.

Offsetting a Financial Asset and a Financial Liability

A financial asset and a financial liability shall be offset and the net amount presented in the

statement of financial position when, and only when, an entity:

a. currently has a legally enforceable right to set off the recognized amounts; and

b. intends either to settle on a net basis, or to realize the asset and settle the liability

simultaneously.

FINANCIAL INSTRUMENTS | Module No. 4

11

The objective of is to prescribe the accounting for investments in associates and to set out the

requirements for the application of the equity method when accounting for investments in associates.

INVESTMENTS IN ASSOCIATES

An associate is an entity over which the investor has significant influence.

SIGNIFICANT INFLUENCE

Significant influence is the power to participate in the financial and operating policy decisions

of the investee but is not control or joint control of those policies.

Prima Facie Threshold

If an entity holds, directly or indirectly (e.g. through subsidiaries), 20 percent or more of the

voting power of the investee, it is presumed that the entity has significant influence, unless it

can be clearly demonstrated that this is not the case. Conversely, if the entity holds, directly or

indirectly (e.g. through subsidiaries), less than 20 percent of the voting power of the investee, it

is presumed that the entity does not have significant influence, unless such influence can be

clearly demonstrated. A substantial or majority ownership by another investor does not

necessarily preclude an entity from having significant influence.

Evidences

The existence of significant influence by an entity is usually evidenced in one or more of the

following ways:

a. representation on the board of directors or equivalent governing body of the investee;

b. participation in policy-making processes, including participation in decisions about

dividends or other distributions;

c. material transactions between the entity and its investee;

d. interchange of managerial personnel; or

e. provision of essential technical information.

Potential Voting Rights

An entity may own share warrants, share call options, debt or equity instruments that are

convertible into ordinary shares, or other similar instruments that have the potential, if

exercised or converted, to give the entity additional voting power or to reduce another party’s

voting power over the financial and operating policies of another entity (i.e. potential voting

FINANCIAL INSTRUMENTS | Module No. 4

12

rights). The existence and effect of potential voting rights that are currently exercisable or

convertible, including potential voting rights held by other entities, are considered when

assessing whether an entity has significant influence.

In assessing whether potential voting rights contribute to significant influence, the entity

examines all facts and circumstances (including the terms of exercise of the potential voting

rights and any other contractual arrangements whether considered individually or in

combination) that affect potential rights, except the intentions of management and the financial

ability to exercise or convert those potential rights.

Loss of Significant Influence

An entity loses significant influence over an investee when it loses the power to participate in

the financial and operating policy decisions of that investee. The loss of significant influence can

occur with or without a change in absolute or relative ownership levels. It could occur, for

example, when an associate becomes subject to the control of a government, court,

administrator or regulator. It could also occur as a result of a contractual arrangement.

EQUITY METHOD

Features

Under the equity method, on initial recognition the investment in an associate venture is

recognized at cost, and the carrying amount is increased or decreased to recognize the

investor’s share of the profit or loss of the investee after the date of acquisition. The investor’s

share of the investee’s profit or loss is recognized in the investor’s profit or loss. Distributions

received from an investee reduce the carrying amount of the investment. Adjustments to the

carrying amount may also be necessary for changes in the investor’s proportionate interest in

the investee arising from changes in the investee’s other comprehensive income. Such changes

include those arising from the revaluation of property, plant and equipment and from foreign

exchange translation differences. The investor’s share of those changes is recognized in the

investor’s other comprehensive income.

Application

An entity with significant influence over an investee shall account for its investment in an

associate using the equity method except when that investment qualifies for exemption.

Exemption

An entity need not apply the equity method to its investment in an associate if the entity is a

parent that is exempt from preparing consolidated financial statements by the scope exception

in paragraph 4(a) of PFRS 10 or if all the following apply:

FINANCIAL INSTRUMENTS | Module No. 4

13

a. The entity is a wholly-owned subsidiary, or is a partially-owned subsidiary of another

entity and its other owners, including those not otherwise entitled to vote, have been

informed about, and do not object to, the entity not applying the equity method.

b. The entity’s debt or equity instruments are not traded in a public market (a domestic or

foreign stock exchange or an over-the-counter market, including local and regional

markets).

c. The entity did not file, nor is it in the process of filing, its financial statements with a

securities commission or other regulatory organization, for the purpose of issuing any

class of instruments in a public market.

d. The ultimate or any intermediate parent of the entity produces financial statements

available for public use that comply with PFRSs, in which subsidiaries are consolidated

or are measured at fair value through profit or loss in accordance with PFRS 10.

Discontinuance of Use

An entity shall discontinue the use of the equity method from the date when its investment

ceases to be an associate or a joint venture as follows:

a. If the investment becomes a subsidiary, the entity shall account for its investment in

accordance with PFRS 3 Business Combinations and PFRS 10.

b. If the retained interest in the former associate is a financial asset, the entity shall measure

the retained interest at fair value. The fair value of the retained interest shall be regarded

as its fair value on initial recognition as a financial asset in accordance with PFRS 9. The

entity shall recognize in profit or loss any difference between:

i. the fair value of any retained interest and any proceeds from disposing of a part

interest in the associate or joint venture; and

ii. the carrying amount of the investment at the date the equity method was

discontinued.

c. When an entity discontinues the use of the equity method, the entity shall account for all

amounts previously recognized in other comprehensive income in relation to that

investment on the same basis as would have been required if the investee had directly

disposed of the related assets or liabilities.

Changes in Ownership Interest

If an entity’s ownership interest in an associate or a joint venture is reduced, but the investment

continues to be classified either as an associate or a joint venture respectively, the entity shall

reclassify to profit or loss the proportion of the gain or loss that had previously been recognized

in other comprehensive income relating to that reduction in ownership interest if that gain or

loss would be required to be reclassified to profit or loss on the disposal of the related assets or

liabilities.

FINANCIAL INSTRUMENTS | Module No. 4

14

Intercompany Transactions

Gains and losses resulting from ‘upstream’ and ‘downstream’ transactions between an entity

(including its consolidated subsidiaries) and its associate are recognized in the entity’s financial

statements only to the extent of unrelated investors’ interests in the associate. The investor’s

share in the associate’s or joint venture’s gains or losses resulting from these transactions is

eliminated.

‘Upstream’ transactions are, for example, sale of assets from an associate or a joint venture to

the investor. ‘Downstream’ transactions are, for example, sales or contributions of assets from

the investor to its associate or its joint venture.

When downstream transactions provide evidence of a reduction in the net realizable value of

the assets to be sold or contributed, or of an impairment loss of those assets, those losses shall be

recognized in full by the investor. When upstream transactions provide evidence of a reduction

in the net realizable value of the assets to be purchased or of an impairment loss of those assets,

the investor shall recognize its share in those losses.

Statement Dates

The most recent available financial statements of the associate are used by the entity in applying

the equity method. When the end of the reporting period of the entity is different from that of

the associate, the associate prepares, for the use of the entity, financial statements as of the same

date as the financial statements of the entity unless it is impracticable to do so.

When the financial statements of an associate used in applying the equity method are prepared

as of a date different from that used by the entity, adjustments shall be made for the effects of

significant transactions or events that occur between that date and the date of the entity’s

financial statements. In any case, the difference between the end of the reporting period of the

associate or joint venture and that of the entity shall be no more than three months. The length

of the reporting periods and any difference between the ends of the reporting periods shall be

the same from period to period.

The entity’s financial statements shall be prepared using uniform accounting policies for like

transactions and events in similar circumstances.

Investee’s Preference Shares

If an associate has outstanding cumulative preference shares that are held by parties other than

the entity and are classified as equity, the entity computes its share of profit or loss after

adjusting for the dividends on such shares, whether or not the dividends have been declared.

FINANCIAL INSTRUMENTS | Module No. 4

15

Excessive Losses

If an entity’s share of losses of an associate equals or exceeds its interest in the associate, the

entity discontinues recognizing its share of further losses. The interest in an associate is the

carrying amount of the investment in the associate determined using the equity method

together with any long-term interests that, in substance, form part of the entity’s net investment

in the associate.

After the entity’s interest is reduced to zero, additional losses are provided for, and a liability is

recognized, only to the extent that the entity has incurred legal or constructive obligations or

made payments on behalf of the associate. If the associate subsequently reports profits, the

entity resumes recognizing its share of those profits only after its share of the profits equals the

share of losses not recognized.

Excess of Fair Value over Cost

In case the fair value of the net assets acquired over the investee exceeds the cost of the

investment, the excess shall be recorded as an investment income at the date of purchase.

IMPAIRMENT LOSSES

After application of the equity method, including recognizing the associate’s losses, the entity

determines whether there is any objective evidence that its net investment in the associate is

impaired. The net investment in an associate is impaired and impairment losses are incurred if,

and only if, there is objective evidence of impairment as a result of one or more events that

occurred after the initial recognition of the net investment (a ‘loss event’) and that loss event (or

events) has an impact on the estimated future cash flows from the net investment that can be

reliably estimated.

Objective evidence that the net investment is impaired includes observable data that comes to

the attention of the entity about the following loss events:

a. significant financial difficulty of the associate;

b. a breach of contract, such as a default or delinquency in payments by the associate;

c. the entity, for economic or legal reasons relating to its associate’s financial difficulty,

granting to the associate a concession that the entity would not otherwise consider;

d. it becoming probable that the associate or joint venture will enter bankruptcy or other

financial reorganization; or

e. the disappearance of an active market for the net investment because of financial

difficulties of the associate.

FINANCIAL INSTRUMENTS | Module No. 4

16

The disappearance of an active market because the associate’s or joint venture’s equity or

financial instruments are no longer publicly traded is not evidence of impairment. A

downgrade of an associate’s or joint venture’s credit rating or a decline in the fair value of the

associate or joint venture, is not of itself, evidence of impairment, although it may be evidence

of impairment when considered with other available information.

The recoverable amount of an investment in an associate shall be assessed for each associate,

unless the associate does not generate cash inflows from continuing use that are largely

independent of those from other assets of the entity.

FINANCIAL INSTRUMENTS | Module No. 4

17

Self-Check

Basing on your readings, answer the following questions.

1. What are the conditions that shall be met for a financial asset to be measured at

amortized cost?

2. What is a financial liability?

3. What are the different classification of financial assets?

4. When shall dividends be recognized in profit or loss?

5. Cite at least 3 scenarios that indicate the existence of significant influence.

Exercise 1.1 TRUE OR FALSE

Determine whether the following statements are true or false.

___________1. An entity may, at initial recognition, irrevocably designate a financial liability

as measured at fair value through profit or loss when permitted, or when

doing so results in more relevant information.

___________2. An entity shall directly reduce the gross carrying amount of a financial asset

when the entity has reasonable expectations of recovering a financial asset in

its entirety or a portion thereof.

___________3. Financial liabilities at fair value through profit or loss shall be subsequently

measured at amortized cost.

___________4. An entity shall not apply the impairment requirements to financial assets that

are measured at fair value through profit or loss.

___________5. Dividends received from an investee reduce the carrying amount of the

investment.

___________6. Held for trading financial assets shall be initially classified at fair value

through profit or loss unless irrevocably designated at fair value through OCI.

___________7. The loss of significant influence can occur with or without a change in

absolute or relative ownership levels.

___________8. The investor’s share in the associate’s or joint venture’s gains or losses

resulting from intercompany transactions shall be totally eliminated.

___________9. If an entity’s share of losses of an associate equals or exceeds its interest in the

associate, the entity discontinues recognizing its share of further losses.

___________10. If the investment becomes a subsidiary, the entity shall discontinue the use of

equity method.

___________11. Investment is equity securities cannot be designated as financial assets at

amortized cost because cash flows resulting from said securities cannot pass

the contractual cash flow test.

FINANCIAL INSTRUMENTS | Module No. 4

18

Exercise 1.2 IDENTIFICATION

Identify the terminologies best described by the following statements.

___________1. This refers to own equity instruments acquired by the entity.

___________2. The power to participate in the financial and operating policy decisions of the

investee but is not control or joint control of those policies.

___________3. This shall be assessed by the entity on a financial instrument at each reporting

date whether it has increased significantly since initial recognition.

___________4. This shall be recorded when the fair value of the net assets acquired over the

investee exceeds the cost of investment.

___________5. Sales or contributions of assets to associate or join venture from its investors is

an example of?

FINANCIAL INSTRUMENTS | Module No. 4

You might also like

- IFRS Chapter 14 Financial Assets and LiabilitiesDocument32 pagesIFRS Chapter 14 Financial Assets and LiabilitiesDeLa Vianty AZ-ZahraNo ratings yet

- Ias 7 Statement of Cash Flows: PurposeDocument14 pagesIas 7 Statement of Cash Flows: Purposemusic niNo ratings yet

- Cpa Review School of The Philippines Manila Financial Accounting and Reporting 6725 Accounting ProcessDocument5 pagesCpa Review School of The Philippines Manila Financial Accounting and Reporting 6725 Accounting ProcessJane ValenciaNo ratings yet

- Module 06 - PPE, Government Grants and Borrowing CostsDocument24 pagesModule 06 - PPE, Government Grants and Borrowing Costspaula manaloNo ratings yet

- Pas 40 Investment PropertyDocument4 pagesPas 40 Investment PropertykristineNo ratings yet

- FAR and IAs Quali Exams With AnswersDocument17 pagesFAR and IAs Quali Exams With AnswersReghis AtienzaNo ratings yet

- IFRS 2 Share Based Payment Final Revision ChecklistDocument17 pagesIFRS 2 Share Based Payment Final Revision ChecklistEmezi Francis ObisikeNo ratings yet

- Ifrs 9 - Financial Instruments Review QuestionsDocument9 pagesIfrs 9 - Financial Instruments Review QuestionsHamad Sadiq100% (1)

- IFRS 16 Leases: You Might Want To Check That Out HereDocument10 pagesIFRS 16 Leases: You Might Want To Check That Out HerekoshkoshaNo ratings yet

- TOA Summary NotesDocument11 pagesTOA Summary NotesKaren Balidio100% (1)

- Module No. 2 Week 2 Acctg. For Business CombinationDocument3 pagesModule No. 2 Week 2 Acctg. For Business CombinationJayaAntolinAyusteNo ratings yet

- Philippine Financial Reporting Standards: (Adopted by SEC As of December 31, 2011)Document27 pagesPhilippine Financial Reporting Standards: (Adopted by SEC As of December 31, 2011)Ana Liza MendozaNo ratings yet

- Financial Accounting and Reporting - Volume 1A PDFDocument61 pagesFinancial Accounting and Reporting - Volume 1A PDFKharen Valdez100% (1)

- Conceptual Framework and Accounting StandardDocument16 pagesConceptual Framework and Accounting StandardAya AlayonNo ratings yet

- Review Questions Financial Accounting and Reporting PART 1Document3 pagesReview Questions Financial Accounting and Reporting PART 1Claire BarbaNo ratings yet

- Lecture NotesDocument32 pagesLecture NotesRavinesh PrasadNo ratings yet

- Acca - Chapter 1-9 SummaryDocument5 pagesAcca - Chapter 1-9 SummaryBianca Alexa SacabonNo ratings yet

- Module 1C - ACCCOB2 - Conceptual Framework For Financial Reporting - FHVDocument56 pagesModule 1C - ACCCOB2 - Conceptual Framework For Financial Reporting - FHVCale Robert RascoNo ratings yet

- Module 3 - Events After The Reporting Period PDFDocument7 pagesModule 3 - Events After The Reporting Period PDFCaroline Bagsik100% (1)

- IAS 16 Property Plant EquipmentDocument4 pagesIAS 16 Property Plant EquipmentMD Hafizul Islam HafizNo ratings yet

- ACCA 1 DIPAC Framework - Presentation - Revenue - Change in Acc Policies - Income TaxDocument178 pagesACCA 1 DIPAC Framework - Presentation - Revenue - Change in Acc Policies - Income Taxgavin henningNo ratings yet

- IAS 40 Investment Property (2021)Document7 pagesIAS 40 Investment Property (2021)Tawanda Tatenda HerbertNo ratings yet

- Ifrs 1 First-Time Adoption On International Financial Reporting StandardDocument9 pagesIfrs 1 First-Time Adoption On International Financial Reporting StandardAsad MehmoodNo ratings yet

- IAS 7: Statement of Cash Flows NotesDocument4 pagesIAS 7: Statement of Cash Flows NotesNepo SerokaNo ratings yet

- Ias 37 Provisions, Contingent Liabilities & Contingent AssetsDocument12 pagesIas 37 Provisions, Contingent Liabilities & Contingent AssetsTawanda Tatenda HerbertNo ratings yet

- Lecture 10 - Prospective Analysis - ForecastingDocument15 pagesLecture 10 - Prospective Analysis - ForecastingTrang Bùi Hà100% (1)

- Events After The Reporting Period Final 6 KiloDocument13 pagesEvents After The Reporting Period Final 6 Kilonati100% (1)

- Financial Forecasting Shan ReportDocument6 pagesFinancial Forecasting Shan ReportJMerrill CaldaNo ratings yet

- Ias 12 - Income Taxes DefinitionsDocument4 pagesIas 12 - Income Taxes DefinitionsFurqan ButtNo ratings yet

- Summary of IFRS 3Document11 pagesSummary of IFRS 3Sheila Mae Guerta LaceronaNo ratings yet

- CFAS Easy To Learn (Conceptual Framework)Document61 pagesCFAS Easy To Learn (Conceptual Framework)Borg Camlan100% (1)

- Ias 40 Ias 40investment PropertyDocument16 pagesIas 40 Ias 40investment PropertyPhebieon MukwenhaNo ratings yet

- Deferred Tax Lecture SlidesDocument38 pagesDeferred Tax Lecture Slidesmd salehinNo ratings yet

- Accounting For Provisions and Contingent LiabilitiesDocument8 pagesAccounting For Provisions and Contingent LiabilitiesHenry Lister100% (1)

- IAS 19 SummaryDocument6 pagesIAS 19 SummaryMuchaa VlogNo ratings yet

- Financial Instruments by Sir AB JanjuaDocument14 pagesFinancial Instruments by Sir AB JanjuaMian Sajjad100% (1)

- Financial Reporting Act 2015 - English - Unofficial VersionDocument29 pagesFinancial Reporting Act 2015 - English - Unofficial VersionReefat HasanNo ratings yet

- 04 RevenueDocument95 pages04 RevenueShehrozSTNo ratings yet

- CONCEPTUAL - FRAMEWORK - FOR - FINANCIAL - REPORDocument30 pagesCONCEPTUAL - FRAMEWORK - FOR - FINANCIAL - REPORKwenzie Fortaleza100% (1)

- Accounting For Government GrantsDocument4 pagesAccounting For Government GrantsSandia EspejoNo ratings yet

- Conceptual Framework Lecture Notes: The Framework at A GlanceDocument11 pagesConceptual Framework Lecture Notes: The Framework at A Glancenicole bancoro100% (1)

- Conceptual Framework - Chapter 2Document42 pagesConceptual Framework - Chapter 2Wijdan Saleem Edwan100% (1)

- Presentation in Accounting & Financial AnalysisDocument55 pagesPresentation in Accounting & Financial AnalysisNamrata Gupta100% (1)

- Chapter 27 Leases (Student)Document29 pagesChapter 27 Leases (Student)Kelvin Chu JYNo ratings yet

- Principles of Accounting ExercisesDocument3 pagesPrinciples of Accounting ExercisesAB D'oriaNo ratings yet

- MODULE 3-Financial Accounting and ReportingDocument7 pagesMODULE 3-Financial Accounting and ReportingAira AbigailNo ratings yet

- Accounting For Public Sector and Civil Society 2022 LatestDocument170 pagesAccounting For Public Sector and Civil Society 2022 LatestZerai Hagos HailemariamNo ratings yet

- SUBJECT: Accounting 15 DESCIPTIVE TITLE: Accounting For Business Combination Instructor: Alfredo R. CabisoDocument4 pagesSUBJECT: Accounting 15 DESCIPTIVE TITLE: Accounting For Business Combination Instructor: Alfredo R. CabisoPrince CalicaNo ratings yet

- Chapter 18 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document10 pagesChapter 18 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- c6 Question BankDocument25 pagesc6 Question BankWaseem Ahmad QurashiNo ratings yet

- IAS 37 Provision NotesDocument26 pagesIAS 37 Provision Notessteven lino2No ratings yet

- Accounting Policies, Changes in Accounting Estimates and ErrorsDocument32 pagesAccounting Policies, Changes in Accounting Estimates and ErrorsAmrita TamangNo ratings yet

- Partnership FormationDocument28 pagesPartnership FormationDe Gala ShailynNo ratings yet

- Revision Question BankDocument134 pagesRevision Question Bankgohasap_303011511No ratings yet

- Investment Property: DefinitionsDocument17 pagesInvestment Property: Definitionssamit shresthaNo ratings yet

- Accounting For Biological Asset Tutorial IVDocument5 pagesAccounting For Biological Asset Tutorial IVJohn TomNo ratings yet

- IAS 12 GuideDocument52 pagesIAS 12 Guidezubair_zNo ratings yet

- Audit TheoryDocument6 pagesAudit TheoryVon Lloyd Ledesma LorenNo ratings yet

- Chap. 7-9 Summary For Written ReportDocument22 pagesChap. 7-9 Summary For Written ReportMJNo ratings yet

- Aliangan Payment Art1242 1243Document1 pageAliangan Payment Art1242 1243apostol ignacioNo ratings yet

- ManufacturingDocument5 pagesManufacturingapostol ignacioNo ratings yet

- Automobile Industry AnalysisDocument28 pagesAutomobile Industry Analysisapostol ignacioNo ratings yet

- Draft 5 9Document3 pagesDraft 5 9apostol ignacioNo ratings yet

- Accounting For Merchandising Business With VAT & Special JournalsDocument24 pagesAccounting For Merchandising Business With VAT & Special Journalsapostol ignacioNo ratings yet

- 01 The Accounting Environment and Accounting FrameworkDocument39 pages01 The Accounting Environment and Accounting Frameworkapostol ignacio100% (1)

- Problem I: Account Title Debit CreditDocument15 pagesProblem I: Account Title Debit Creditapostol ignacioNo ratings yet

- Case Statement: Executive SummaryDocument3 pagesCase Statement: Executive Summaryapi-532604124No ratings yet

- Dempster Mills Manufacturing Case Study BPLsDocument15 pagesDempster Mills Manufacturing Case Study BPLstycoonshan24No ratings yet

- Neacsu George-Cristian: Purchasing SpecialistDocument3 pagesNeacsu George-Cristian: Purchasing SpecialistCristi NeacsuNo ratings yet

- D1309-93 (2015) Standard Test Method For Settling ProperDocument2 pagesD1309-93 (2015) Standard Test Method For Settling ProperCamilo GuardadoNo ratings yet

- Action Plan in Filipino Values Month FundDocument2 pagesAction Plan in Filipino Values Month FundHamdan Alversado100% (2)

- Resume - Mr. Sagar SharmaDocument2 pagesResume - Mr. Sagar SharmasagarNo ratings yet

- INTERNSHIP ProjectDocument65 pagesINTERNSHIP ProjectTarun SainiNo ratings yet

- Price Controls and Quotas: Meddling With MarketsDocument53 pagesPrice Controls and Quotas: Meddling With MarketsMarie-Anne RabetafikaNo ratings yet

- The Graph Showing Net Working CapitalDocument31 pagesThe Graph Showing Net Working CapitalPRATIK PALKHENo ratings yet

- ENTREPRENEURIAL MANAGEMENT ReviewerDocument3 pagesENTREPRENEURIAL MANAGEMENT ReviewerlapNo ratings yet

- SAS17 ACC 100 2nd Periodical ExamDocument8 pagesSAS17 ACC 100 2nd Periodical ExamElizabeth diane NOVENONo ratings yet

- UNVR Forecasting and Valuation 091121-TemplateDocument31 pagesUNVR Forecasting and Valuation 091121-TemplateSyskiaNo ratings yet

- Entreprenurship Subject NotesDocument42 pagesEntreprenurship Subject NotesM.Vaishnavi 19-452No ratings yet

- Day 1 (Sole Trader Final Account)Document7 pagesDay 1 (Sole Trader Final Account)Han Thi Win KoNo ratings yet

- Entrepreneurship: Quarter 3 - Week 2Document7 pagesEntrepreneurship: Quarter 3 - Week 2Mhar Ryan LoboNo ratings yet

- Fundamentals of Accounting 1Document70 pagesFundamentals of Accounting 1Xia AlliaNo ratings yet

- Sem - VI FR 0 FSA (Ratio 0 Intro.) Sample TestDocument1 pageSem - VI FR 0 FSA (Ratio 0 Intro.) Sample TestAmit SinghNo ratings yet

- Parle GDocument73 pagesParle GKondu Krishna Vamsi ChowdaryNo ratings yet

- Resultats LicencesProf IUTFV 2020 2021 PDFDocument5 pagesResultats LicencesProf IUTFV 2020 2021 PDFNgenwo RogerNo ratings yet

- Bhagawati Hydropower Development Co. Ltd.Document54 pagesBhagawati Hydropower Development Co. Ltd.ombahadur KumhalNo ratings yet

- BSBSTR801 Assessment Task 3Document7 pagesBSBSTR801 Assessment Task 3Jon AdidNo ratings yet

- Ex-99. (C) (3) 3 D699526Dex99C3.Htm Discussion Materials Prepared by Morgan Stanley Asia LimitedDocument48 pagesEx-99. (C) (3) 3 D699526Dex99C3.Htm Discussion Materials Prepared by Morgan Stanley Asia LimitedpriyanshuNo ratings yet

- Mini Case: Shrewsbury Herbal Products, LTDDocument7 pagesMini Case: Shrewsbury Herbal Products, LTDSriSaraswathy100% (1)

- Microeconomics Chapter 5-6Document4 pagesMicroeconomics Chapter 5-6YzappleNo ratings yet

- City Marketing: Pengelolaan Kota Dan WilayahDocument21 pagesCity Marketing: Pengelolaan Kota Dan WilayahDwi RahmawatiNo ratings yet

- Acknowledgement Sample 06Document3 pagesAcknowledgement Sample 06Kylene Andrea AlimNo ratings yet

- Business Card: Business Cards Are Cards Bearing Business Information About A Company or IndividualDocument8 pagesBusiness Card: Business Cards Are Cards Bearing Business Information About A Company or Individualangel8sanchez-7No ratings yet

- Research On Attitude of Consumers Towards Online Shopping in GuwahatiDocument14 pagesResearch On Attitude of Consumers Towards Online Shopping in Guwahatitamanna bavishiNo ratings yet

- Mergers and Acquisitions - Colgate Takes Over Toms of MaineDocument11 pagesMergers and Acquisitions - Colgate Takes Over Toms of MaineBhooshan ParikhNo ratings yet

- Chapter 5 The Business PlanDocument27 pagesChapter 5 The Business PlanLawrence MosizaNo ratings yet