Professional Documents

Culture Documents

Exercise # 1

Uploaded by

MA ValdezOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exercise # 1

Uploaded by

MA ValdezCopyright:

Available Formats

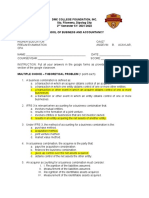

ALDERSGATE COLLEGE ADVANCED FINANCIAL ACCOUNTING AND REPORTING 2

(AACTG125.1)

SCHOOL OF BUSINESS MANAGEMENT AND ACCOUNTANCY

Exercise # 1 – Business Combination

Multiple Choice: THEORY

1. According to PFRS 3, it is a transaction or other event in which an acquirer obtains control of one

or more business.

a. Business combination c. business alliance

b. Business amalgamation d. all of these

2. This distinguish a business combination from other types of investment transactions.

a. Acquisition of assets c. obtaining of control

b. Acquisition of stocks d. all of these

3. A business combination can be affected through

a. Purchase of all of the assets and assumption of all of the liabilities of an acquiree by the acquirer.

b. Purchase of all or some of the voting shares of the acquiree, sufficient for the acquirer to obtain

control over the acquiree.

c. Acquisition of control without transfer of consideration

d. Any of these

4. After this type of business combination, the acquired entity ceases to exist as a separate legal or

accounting entity, The acquirer records in its accounting records the assets acquired and liabilities

assumed in the business combination.

a. Stock acquisition c. combination of mutual entities

b. Acquisition of control w/o transfer of consideration d. asset acquisition

5. It is a statutory type of combination which occurs when two or more companies merge into a single

entity which shall be one of the combining companies.

a. Merger b. consolidation c. stock acquisition d. mutual combination

6. It is a statutory type of combination which occurs when two or more companies consolidate into a

single entity which shall be the consolidated company.

b. Merger b. consolidation c. stock acquisition d. mutual combination

7. PFRS 3 requires a business combination to be accounted for using the?

a. Purchased method c. goodwill method

b. Acquisition method d. control method

8. The acquisition method requires which of the following?

PART TIME INSTRUCTOR – ALVIN JOHN C. PINTANG,CPA ADVANCED ACCOUNTING 2 Vol. 5

ALDERSGATE COLLEGE ADVANCED FINANCIAL ACCOUNTING AND REPORTING 2

(AACTG125.1)

SCHOOL OF BUSINESS MANAGEMENT AND ACCOUNTANCY

a. Identifying the acquirer

b. Determining the acquisition date

c. Recognizing and measuring the identifiable assets acquired, the liabilities assumed and any

non-controlling interest in the acquiree

d. . Recognizing and measuring goodwill or a gain from a bargain purchase

e. All of these

9. Its refers to the entity that obtains control after the business combination.

a. Acquired b. acquiree c. acquirer all of these

10. According to PFRS 3, this is the date on which the acquirer obtains control over the acquiree.

a. Control date c. date of purchase

b. Acquisition date d. valentine`s date

11. The identifiable assets acquired and liabilities assumed in a business combination are generally

measured at

a. Acquisition-date fair values c. fair value less cost to sell

b. Previous carrying amounts d. cost

12. Which of the following assets of an acquiree may not be included when computing for the goodwill

arising from a business combination?

a. Capitalized kitchen utensils and equipment

b. Intangible assets not previously recorded

c. Research and development cost charged as expense

d. Goodwill

13. For each business combination, the acquirer shall measure any non-controlling interest in the

acquiree

a. At fair value

b. At the non-controlling interest proportionate share of the acquiree`s identifiable net assets

c. Either a or b

d. Neither a nor b

14. How is goodwill or gain from bargain purchase computed?

PART TIME INSTRUCTOR – ALVIN JOHN C. PINTANG,CPA ADVANCED ACCOUNTING 2 Vol. 5

ALDERSGATE COLLEGE ADVANCED FINANCIAL ACCOUNTING AND REPORTING 2

(AACTG125.1)

SCHOOL OF BUSINESS MANAGEMENT AND ACCOUNTANCY

a. The difference the consideration transferred, including non-controlling interest in the acquiree, and

the acquisition date fair value of net identifiable assets acquired.

b. The difference between the sum of a) consideration transferred b)non-controlling interest in the

acquiree and c) acquisition date fair value of the acquirer`s previously held equity interest in the acquiree

and the acquisition date fair value of net identifiable assets acquired.

c. The difference between the purchase price and the acquisition date fair value of net identifiable

asset acquired.

d. The excess of the acquisition date fair value of net identifiable assets acquired and there carrying

amounts in the acquirees books.

15. Direct costs of a business combination are

a. Capitalized c. capitalized, except for cots of issuing equity and debt

instrument

b. Expense d. expense, except for cots of issuing equity and debt instrument

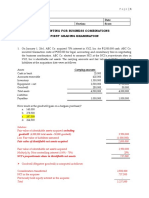

Multiple Choice: Computation

On January 1, 2019, Pikot Co. Acquired all of the assets and assumed all of the liabilities of Small,

inc. As of this date, the carrying amounts and fair values of the assets and liabilities of XYZ

acquired by ABC are shown below:

Assets Carrying amount Fair

Values

Cash in Bank 40,000 40,000

Receivables 800,000 480,000

Allowances for probable losses on receivables (120,000)

Inventory 2,080,000

1,400,000

Building-net 4,000,000

4,400,000

Goodwill 400,000 80,000

Total Assets 7,200,000

6,400,000

Liabilities

Payable 1,600,000

1,600,000

PART TIME INSTRUCTOR – ALVIN JOHN C. PINTANG,CPA ADVANCED ACCOUNTING 2 Vol. 5

ALDERSGATE COLLEGE ADVANCED FINANCIAL ACCOUNTING AND REPORTING 2

(AACTG125.1)

SCHOOL OF BUSINESS MANAGEMENT AND ACCOUNTANCY

On the negotiation for the business combination, PIKOT co. Incurred transaction cost amounting to

400,000 for legal, accounting, and consultancy fees.

1 Case # 1. If Pikot co. Paid P6,000,,000 cash as consideration for the assets and liabilities of

Small, inc. How much is the goodwill (gain on bargain purchase) on the business combination?

a. 1,200,000 b. 1,120,000 c. 1,280,000 d. 1,240,000

2) Case # 2. If Pikot co. Paid P4,000,,000 cash as consideration for the assets and liabilities of

Small, inc. How much is the goodwill (gain on bargain purchase) on the business combination?

a. 800,000 b. 720,000 c. 880,000 d. 1,200,000

On January 1,2019 Knave acquired 80% of the equity interest of RASCAL, inc. In exchange for

cash. Because the former owners of RASCAL needed to dispose of their investments in RASCAL

by a specified date, they did not have sufficient time to market RASCAL to multiple potential

buyers.

As January 1, 2019, RASCAL`s identifiable assets and liabilities have fair value of P4,800,000 and

P1,600,000, respectively.

3) KANVE co. Elects the option to measure non-controlling interests at fair value. An independent

consultant was engaged who determined that the fair value of the 20% non-controlling interest in

XYZ, inc. Is P620,000.

If KNAVE co. Paid P4,000,000 cash as consideration for the 80% interest in RASCAL, inc. How

much is the goodwill (gain on bargain purchase) on the business combination?

a. 800,000 b. 2,060,000 c. 1,440,000 d. 1,420,000

4) KANVE co. Elects the option to measure non-controlling interests at non-controlling interests

proportionate share of RASCAL inc, net identifiable assets

If KNAVE co. Paid P4,000,000 cash as consideration for the 80% interest in RASCAL, inc. How

much is the goodwill (gain on bargain purchase) on the business combination?

a. 1,440,000 b. 800,000 c. 1,400,000 d. 960,000

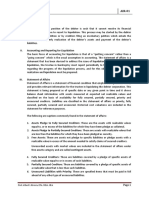

On January 1,2019 SMUTTY acquired all of the identifiable assets and assumed all of the liabilities

of OBSCENE, Inc. On this date, identifiable assets acquired and liabilities assumed have fair

values of P6,400,000 and P3,600,000, respectively.

PART TIME INSTRUCTOR – ALVIN JOHN C. PINTANG,CPA ADVANCED ACCOUNTING 2 Vol. 5

ALDERSGATE COLLEGE ADVANCED FINANCIAL ACCOUNTING AND REPORTING 2

(AACTG125.1)

SCHOOL OF BUSINESS MANAGEMENT AND ACCOUNTANCY

SMUTTY incurred the following acquisition related costs: legal fees P40,000, due diligence costs,

P400,000 and general administrative cost of maintaining an internal acquisitions department

P80,000.

5) Case #1: As consideration for the business combination, SMUTTY co. Transferred 8,000 of its

share own equity instruments with par value per share of P400 and fair value per share of P500 to

OBSCENE`s former owners. Costs of registering the share amounted to P160,000. how much is

the goodwill (gain on bargain purchase) on the business combination?

a. 716,000 b. 560,000 c. 600,000 d. 1200,000

6)Case #2: As consideration for the business combination, SMUTTY co. Issued bonds with face

amount and fair value of P4,000,000. Transaction costs incurred in issuing the bonds amounted to

P200,000. how much is the goodwill (gain on bargain purchase) on the business combination?

a. 716,000 b. 560,000 c. 600,000 d. 1200,000

On January 1,2017, FORTITUDE Co, acquired 15% ownership interest in ENDURANCE Inc for

P400,000. The investment was accounted for under PFRS 9. From 2016 to the end of 2019,

FORTITUDE recognized net fair value gains of P200,000.

On January 1, 2020 FORTITUDE acquired additional 60% ownership interest in ENDURANCE inc.

For P3,200,000. As of this date, FORTITUDE has identified the following:

a. The previously held 15% interest fair value of P720,000.

b. ENDURANCE net identifiable assets have a fair value of P4,000,000.

c. FORTITUDE elected to measure non-controlling interest at the non-controlling interest

proportionate share of ENDURANCE identifiable net assets.

7)How much is the goodwill or gain from bargain purchase?

a. 200,000 b. 420,000 c. 920,000 d. 540,000

On January 1, 2017 OBDURATE co. Acquired 30% ownership interest in STUBBORN, inc. For

P400,000. because the investment gave OBDURATE significant influence over STUBBORN, the

investment was accounted for under the equity method in accordance with PAS 28.

From 2017 to the end of 2019, OBDURATE recognized the P200,000 net share in the profits of the

associate and the P40,000 share in dividends. Therefore, the carrying amount of the investment in

associate account on January 1, 2020 is P560,000.

On January 1, 2020, OBDURATE acquired additional 60% ownership interest in STUBBORN inc.

For P3,200,000. As of this date, OBDURATE has identifiable the ff:

a. The previously held 30% interest has a fair value of P720,000.

b. STUBBORN net identifiable assets have fair value of P4,000,000.

PART TIME INSTRUCTOR – ALVIN JOHN C. PINTANG,CPA ADVANCED ACCOUNTING 2 Vol. 5

ALDERSGATE COLLEGE ADVANCED FINANCIAL ACCOUNTING AND REPORTING 2

(AACTG125.1)

SCHOOL OF BUSINESS MANAGEMENT AND ACCOUNTANCY

c. OBDURATE elected to measure non-controlling interest at the non-controlling interest

proportionate share of XYZ`s identifiable net assets.

8.)How much is the or gain from bargain purchase?

a. 320,000 b. 240,000 c. 280,000 d. 360,000

BUCOLIC Co. Owns 36,000 shares representing 40% ownership interest in RURAL inc. 90,000

outstanding shares. BUCOLIC accounts for the investment under the equity method.

On January 1, 2019, RYRAL reacquired 30,000 of its own shares from other investor so that

BUCOLIC shall obtain control over the RURAL. The following were determined as of acquisition

date:

A. The previously held 40% interest has a fair value of P720,000.

B. RURAL net identifiable assets have a fair value of P4,000,000.

C. BUCOLIC elected to measure non-controlling interest at the non-controlling interest`s proportionate

share of RURAL`s identifiable net assets.

9)How much is the or gain from bargain purchase?

a. (1,680,000) b. (1,320,000) c. (880,000) d. 0

PART TIME INSTRUCTOR – ALVIN JOHN C. PINTANG,CPA ADVANCED ACCOUNTING 2 Vol. 5

You might also like

- Internal Control of Fixed Assets: A Controller and Auditor's GuideFrom EverandInternal Control of Fixed Assets: A Controller and Auditor's GuideRating: 4 out of 5 stars4/5 (1)

- Exercise 1with AnswerDocument10 pagesExercise 1with AnswerMA ValdezNo ratings yet

- CDD Acctg. For Bus - Co Preliminary ExaminationDocument25 pagesCDD Acctg. For Bus - Co Preliminary ExaminationMaryjoy Sarzadilla JuanataNo ratings yet

- National College Business Combination ExamsDocument9 pagesNational College Business Combination ExamsheyNo ratings yet

- DMC College Foundation, Inc. Sta. Filomena, Dipolog City 2 Semester SY: 2021-2022 School of Business and AccountancyDocument9 pagesDMC College Foundation, Inc. Sta. Filomena, Dipolog City 2 Semester SY: 2021-2022 School of Business and AccountancyMitch RegenciaNo ratings yet

- Acctg.222 Exam - Questionnaire FINALDocument7 pagesAcctg.222 Exam - Questionnaire FINALAnonymous dbNSSxXPBNo ratings yet

- Business Combinations Accounting QuestionsDocument5 pagesBusiness Combinations Accounting QuestionsAndy LaluNo ratings yet

- CPA - Quizbowl 2008Document10 pagesCPA - Quizbowl 2008frankreedh100% (3)

- Accounting For Business Combinations: Adri N T. Nov LDocument30 pagesAccounting For Business Combinations: Adri N T. Nov Ltankofdoom 4100% (1)

- Midterm exam questions on business combinationsDocument6 pagesMidterm exam questions on business combinationsJustine FloresNo ratings yet

- Midterm Exam BuscomDocument8 pagesMidterm Exam BuscomJustine FloresNo ratings yet

- Separate Summary of Answers For Every ProblemDocument1 pageSeparate Summary of Answers For Every ProblemcpacpacpaNo ratings yet

- Quiz Chapter 1 Business Combinations Part 1Document6 pagesQuiz Chapter 1 Business Combinations Part 1Kaye L. Dela CruzNo ratings yet

- Business Combination Module 3Document8 pagesBusiness Combination Module 3TryonNo ratings yet

- PFRS 3 Business Combination Accounting RulesDocument13 pagesPFRS 3 Business Combination Accounting RulesRoselyn AmpoNo ratings yet

- IFRS 3 Business CombinationsDocument17 pagesIFRS 3 Business CombinationsGround ZeroNo ratings yet

- Business Combination MCQsDocument6 pagesBusiness Combination MCQsJustine FloresNo ratings yet

- AFAR QuestionsDocument6 pagesAFAR QuestionsTerence Jeff TamondongNo ratings yet

- Accounting For Business Combination - Practice ExamDocument6 pagesAccounting For Business Combination - Practice ExamZYRENE HERNANDEZNo ratings yet

- Advanced Accounting 4th Edition Jeter Test BankDocument20 pagesAdvanced Accounting 4th Edition Jeter Test Bankbryanharrismpqrsfbokn100% (15)

- Accounting For Business Combinations: Multiple ChoiceDocument19 pagesAccounting For Business Combinations: Multiple Choicehassan nassereddineNo ratings yet

- Lecture 1 Buscom at Acquisition DateDocument7 pagesLecture 1 Buscom at Acquisition DateKristine Joy SaavedraNo ratings yet

- Acctg 157 Midterm ExamDocument7 pagesAcctg 157 Midterm Examerica insiongNo ratings yet

- Test Bank Advanced Accounting 5th Edition Jeter PDFDocument17 pagesTest Bank Advanced Accounting 5th Edition Jeter PDFSyra SorianoNo ratings yet

- Quiz 1 Answers BUSICOMBIDocument14 pagesQuiz 1 Answers BUSICOMBIfoxtrotNo ratings yet

- Lebanese Association of Certified Public Accountants - IFRS August Exam 2017Document10 pagesLebanese Association of Certified Public Accountants - IFRS August Exam 2017jad NasserNo ratings yet

- Polytechnic University of The PhilippinesDocument12 pagesPolytechnic University of The PhilippinesKyla Dane P. Prado0% (1)

- Final Exam 10 PDF FreeDocument12 pagesFinal Exam 10 PDF FreeMariefel OrdanezNo ratings yet

- Business Combination - I: "Your Online Partner To Get Your Title"Document8 pagesBusiness Combination - I: "Your Online Partner To Get Your Title"Arlene Diane OrozcoNo ratings yet

- Afar-03: Corporate Liquidation: - T R S ADocument4 pagesAfar-03: Corporate Liquidation: - T R S AJenver BuenaventuraNo ratings yet

- Full Solution Manual Advance Accounting 5th Edition by Debra Jeter SLW1016Document18 pagesFull Solution Manual Advance Accounting 5th Edition by Debra Jeter SLW1016Sm Help75% (4)

- Accountancy DepartmentDocument13 pagesAccountancy DepartmentGRACELYN SOJORNo ratings yet

- Test Bank For Advanced Accounting 5th Edition Jeter, ChaneyDocument17 pagesTest Bank For Advanced Accounting 5th Edition Jeter, ChaneyEych Mendoza100% (2)

- Acctg for Business CombosDocument10 pagesAcctg for Business CombosFaye EnrileNo ratings yet

- Midterm or Pre Final Exam in Bus Com Trimex Pup CampusesDocument8 pagesMidterm or Pre Final Exam in Bus Com Trimex Pup CampusesmahilomferNo ratings yet

- Fischer - Fundamentals of Advanced Accounting 1eDocument27 pagesFischer - Fundamentals of Advanced Accounting 1eyechueNo ratings yet

- Business Combinations: Fees of Finders and Registration Fees Consultants For Equity Securities IssuedDocument5 pagesBusiness Combinations: Fees of Finders and Registration Fees Consultants For Equity Securities IssuedHanna Mendoza De Ocampo0% (3)

- Mixed Accounting QuestionsDocument10 pagesMixed Accounting QuestionsSVTKhsiaNo ratings yet

- AFAR 04 Business CombinationDocument9 pagesAFAR 04 Business CombinationPym-Kaytitinga St. Joseph ParishNo ratings yet

- Buss CombiDocument10 pagesBuss CombiIzzy BNo ratings yet

- Accounting for Business Combinations ExamDocument18 pagesAccounting for Business Combinations Examjoyce77% (13)

- ACC16 - HO 1 - Corporate LiquidationDocument5 pagesACC16 - HO 1 - Corporate LiquidationAubrey DacirNo ratings yet

- Chapter 2 3 4 15 16Document99 pagesChapter 2 3 4 15 16HayjackNo ratings yet

- 1st Quiz - Business ComDocument2 pages1st Quiz - Business ComPeter GonzagaNo ratings yet

- AFAR-03 (Corporate Liquidation)Document6 pagesAFAR-03 (Corporate Liquidation)Maricris AlilinNo ratings yet

- Advacc Midterm ExamDocument13 pagesAdvacc Midterm ExamJosh TanNo ratings yet

- ABC FX Summer 22 23Document16 pagesABC FX Summer 22 23Patricia EsplagoNo ratings yet

- Quiz 2 - Corp Liqui and Installment SalesDocument8 pagesQuiz 2 - Corp Liqui and Installment SalesKenneth Christian WilburNo ratings yet

- Topic 6 Tutorial SolutionsDocument6 pagesTopic 6 Tutorial SolutionsKitty666No ratings yet

- Pre-Quali - 2016 - Financial - Acctg. - Level - 1 - Answers - Docx Filename UTF-8''Pre-quali 2016 Financial Acctg. (Level 1) - AnswersDocument10 pagesPre-Quali - 2016 - Financial - Acctg. - Level - 1 - Answers - Docx Filename UTF-8''Pre-quali 2016 Financial Acctg. (Level 1) - AnswersReve Joy Eco IsagaNo ratings yet

- ACT15 Intermediate Accounting 1 Pre-Final Quiz ReviewDocument9 pagesACT15 Intermediate Accounting 1 Pre-Final Quiz ReviewJan MarcosNo ratings yet

- Finacct Mock Exam 1Document7 pagesFinacct Mock Exam 1Joseph Gerald M. ArcegaNo ratings yet

- Lebanese Association of Certified Public Accountants - IFRS July Exam 2018Document8 pagesLebanese Association of Certified Public Accountants - IFRS July Exam 2018jad NasserNo ratings yet

- Quiz - Chapter 2 - Business Combinations (Part 2)Document4 pagesQuiz - Chapter 2 - Business Combinations (Part 2)Pearly Jean ApuradorNo ratings yet

- Accounting For Business CombinationsDocument19 pagesAccounting For Business Combinationsvinanovia50% (2)

- Accounting For Business Combinations First Grading ExaminationDocument18 pagesAccounting For Business Combinations First Grading ExaminationNhel AlvaroNo ratings yet

- Group Accounts - ConsolidationDocument14 pagesGroup Accounts - ConsolidationWinnie GiveraNo ratings yet

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsFrom EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsNo ratings yet

- DOMINCEL - Output - SocMed - Engagement May 10Document1 pageDOMINCEL - Output - SocMed - Engagement May 10MA ValdezNo ratings yet

- DOMINCEL - Output - SocMed - Engagement (April 20,2022)Document1 pageDOMINCEL - Output - SocMed - Engagement (April 20,2022)MA ValdezNo ratings yet

- Instructional Module: AnswerDocument7 pagesInstructional Module: AnswerMA ValdezNo ratings yet

- DOMINCEL - Output - SocMed - Engagement May 12Document1 pageDOMINCEL - Output - SocMed - Engagement May 12MA ValdezNo ratings yet

- DOMINCEL - Output - SocMed - Engagement May 17Document1 pageDOMINCEL - Output - SocMed - Engagement May 17MA ValdezNo ratings yet

- Document (Narrative Report)Document1 pageDocument (Narrative Report)MA ValdezNo ratings yet

- Documentations: College of Business Management and AccountancyDocument1 pageDocumentations: College of Business Management and AccountancyMA ValdezNo ratings yet

- Questionnaires Feasibility StudyDocument6 pagesQuestionnaires Feasibility StudyMA ValdezNo ratings yet

- Share CHAPTER 4 ICT14 Mary Ann DomincelDocument4 pagesShare CHAPTER 4 ICT14 Mary Ann DomincelMA ValdezNo ratings yet

- Chapter 6Document3 pagesChapter 6MA ValdezNo ratings yet

- Share Mary Ann V 1ict 14 Chapter 2Document5 pagesShare Mary Ann V 1ict 14 Chapter 2MA ValdezNo ratings yet

- Problem 13 agricultural assetsDocument3 pagesProblem 13 agricultural assetsMA ValdezNo ratings yet

- NVSU COED module on exercise physiologyDocument2 pagesNVSU COED module on exercise physiologyMA ValdezNo ratings yet

- Sample QuestionsDocument6 pagesSample QuestionsMA ValdezNo ratings yet

- Share MARY ANN V. DOMINCEL CHAPTER 6Document3 pagesShare MARY ANN V. DOMINCEL CHAPTER 6MA ValdezNo ratings yet

- Share Mary Ann V Domincel Chapter 8Document3 pagesShare Mary Ann V Domincel Chapter 8MA ValdezNo ratings yet

- DocumentDocument1 pageDocumentMA ValdezNo ratings yet

- Checklist For Feasibility StudyDocument6 pagesChecklist For Feasibility StudyMA ValdezNo ratings yet

- Share Mary Ann V Domincel Chapter 5Document2 pagesShare Mary Ann V Domincel Chapter 5MA ValdezNo ratings yet

- Chapter 2Document12 pagesChapter 2MA ValdezNo ratings yet

- Aldersgate College Survey on Rapsa Inihaw RepublicDocument5 pagesAldersgate College Survey on Rapsa Inihaw RepublicMA ValdezNo ratings yet

- Curriculum VitaeDocument1 pageCurriculum VitaeMA ValdezNo ratings yet

- Rapsa Inihaw Republic financial analysisDocument7 pagesRapsa Inihaw Republic financial analysisMA ValdezNo ratings yet

- Checklist For Feasibility StudyDocument6 pagesChecklist For Feasibility StudyMA ValdezNo ratings yet

- Chapter 4Document7 pagesChapter 4MA ValdezNo ratings yet

- Preliminary PagesDocument24 pagesPreliminary PagesMA ValdezNo ratings yet

- Chapter 3Document13 pagesChapter 3MA ValdezNo ratings yet

- Chapter 27 - AnswerDocument23 pagesChapter 27 - AnswerMA ValdezNo ratings yet

- Muller PhippsDocument2 pagesMuller PhippsIqra SameerNo ratings yet

- Anarock - Annual - Report 2022 - Residential Real EstateDocument39 pagesAnarock - Annual - Report 2022 - Residential Real EstatekabithNo ratings yet

- Ethics in AccountsDocument7 pagesEthics in AccountsArun Kumar NairNo ratings yet

- To Prosperity: From DEBTDocument112 pagesTo Prosperity: From DEBTمحمد عبدﷲNo ratings yet

- 1.) The 4 Aspects of TradingDocument1 page1.) The 4 Aspects of Tradingrichie2885100% (1)

- NayanaDocument40 pagesNayanaNitish KumarNo ratings yet

- Gazette Sectoral Targets 19 57Document39 pagesGazette Sectoral Targets 19 57Lincoln de kockNo ratings yet

- Case 1 For PrintDocument8 pagesCase 1 For PrintRichardDinongPascualNo ratings yet

- 2023-03-20 Godin, Karen 310072 - Installment Schedule PDFDocument3 pages2023-03-20 Godin, Karen 310072 - Installment Schedule PDFKarenNo ratings yet

- JRD TataDocument17 pagesJRD TataDILIP VISHWAKARMANo ratings yet

- Principles of Costs and CostingDocument50 pagesPrinciples of Costs and CostingSOOMA OSMANNo ratings yet

- Q1. Cadila Co. Has Three Production Departments A, B and C and Two ServiceDocument5 pagesQ1. Cadila Co. Has Three Production Departments A, B and C and Two Servicemedha surNo ratings yet

- Goods & Services Tax (G.S.T.)Document15 pagesGoods & Services Tax (G.S.T.)EshanMishra100% (1)

- Which Risk Analysis Tool is Most Effective for Calculating Investment Risk: Variance, Standard Deviation, or VaRDocument1 pageWhich Risk Analysis Tool is Most Effective for Calculating Investment Risk: Variance, Standard Deviation, or VaRsajidschannelNo ratings yet

- Home Loan Rates Campaign Rates from 15.02.2023Document1 pageHome Loan Rates Campaign Rates from 15.02.2023WHITE DEVILNo ratings yet

- A Research Report Submitted in Partial Fulfillment of The Requirements of The Degree of Mba (Finance & Control)Document62 pagesA Research Report Submitted in Partial Fulfillment of The Requirements of The Degree of Mba (Finance & Control)Master PrintersNo ratings yet

- Villanueva v. CA, G.R. No. 114870Document2 pagesVillanueva v. CA, G.R. No. 114870xxxaaxxx100% (5)

- T3 2004 - Dec - QDocument8 pagesT3 2004 - Dec - QVinh Ngo NhuNo ratings yet

- BUSINESS PAPER 1 KCSE PAST PAPERSDocument46 pagesBUSINESS PAPER 1 KCSE PAST PAPERSrnyaboke90No ratings yet

- 08tax Forum BusecoDocument51 pages08tax Forum BusecoAemie JordanNo ratings yet

- Financial Management Tutorial QuestionDocument3 pagesFinancial Management Tutorial QuestionDâmDâmCôNươngNo ratings yet

- Deduction From Gross Income QuizzerDocument2 pagesDeduction From Gross Income QuizzerAcademeNo ratings yet

- Hackett C2C Receivables Solution Provider Evaluation REDACTED 2303Document22 pagesHackett C2C Receivables Solution Provider Evaluation REDACTED 2303Pravs AnsNo ratings yet

- Exercise 1: Supplier Cost Per Valve ($) Percent Large Percent Medium Percent SmallDocument4 pagesExercise 1: Supplier Cost Per Valve ($) Percent Large Percent Medium Percent SmallShital GuptaNo ratings yet

- Test Bank For Managerial Accounting Tools For Business Decision Making 8th Edition by Weygandt Full DownloadDocument59 pagesTest Bank For Managerial Accounting Tools For Business Decision Making 8th Edition by Weygandt Full DownloadcodysmithfknqpzosebNo ratings yet

- Form 16 - Vijaya Raja SelvanDocument4 pagesForm 16 - Vijaya Raja SelvansadhanaNo ratings yet

- Accounting Record Keeping Practices in Small and Medium Sized Enterprise's (SME's) in Sri LankaDocument6 pagesAccounting Record Keeping Practices in Small and Medium Sized Enterprise's (SME's) in Sri LankaNiyonzimaNo ratings yet

- Knaster, R., & Leffingwell, D. (2017) - SAFe 4.0 Distilled. Applying The Scaled Agile Framework For Lean Software and Systems EngineeringDocument429 pagesKnaster, R., & Leffingwell, D. (2017) - SAFe 4.0 Distilled. Applying The Scaled Agile Framework For Lean Software and Systems EngineeringMarco Antonio Jimenez Cervantes100% (1)

- Essence of Corporate GovernanceDocument5 pagesEssence of Corporate GovernanceNajmah Siddiqua NaazNo ratings yet

- Sl. No. Grade Cement Ggbfs Micro Filler CA FA Admixture Name of Lab Date Status RemarksDocument1 pageSl. No. Grade Cement Ggbfs Micro Filler CA FA Admixture Name of Lab Date Status Remarksmahesh naikNo ratings yet