Professional Documents

Culture Documents

Total Comprehensive Income For The Year 139,400.00

Uploaded by

Siti rahmahOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Total Comprehensive Income For The Year 139,400.00

Uploaded by

Siti rahmahCopyright:

Available Formats

Nama : Siti Rahmah Fitriani

NPM : 2020220009

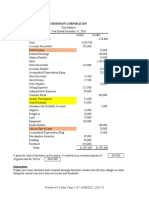

a. Combined Statement Approach

Wheaterspoon Shoe

Statement of Comprehensive Income

For the year Ended December 31 2022

Net Sales £ 980,000.00

Cost of Goods Sold -£ 516,000.00

Gross Profit £ 464,000.00

Operating Expenses:

Administrative Expenses £ 181,000.00

Selling Expenses £ 140,000.00

Interest Expense £ 18,000.00 £ 339,000.00

Income from Continuing Operations Before income tax £ 125,000.00

Income Tax -£ 30,600.00

Income from Continuing Operations £ 94,400.00

Discontinuing Operations -

Net Income £ 94,400.00

Other Comprehensive Income:

Rent Revenue £ 29,000.00

Unrealized gain on non-trading equity securities, net of tax £ 31,000.00

Loss on sale of plant assets -£ 15,000.00

Other Comprehensive Income £ 45,000.00

Total Comprehensive Income for the Year £ 139,400.00

b. Two Statement Approach

Weatherspoon Shoe

Income Statement

For the Year Ended December 31, 2022

Net Sales £ 980,000.00

Cost of Goods Sold -£ 516,000.00

Gross Profit £ 464,000.00

Operating Expenses:

Administrative Expenses £ 181,000.00

Selling Expenses £ 140,000.00

Interest Expense £ 18,000.00 £ 339,000.00

Income from Continuing Operations Before income tax £ 125,000.00

Income Tax -£ 30,600.00

Income from Continuing Operations £ 94,400.00

Discontinuing Operations -

Net Income £ 94,400.00

Weatherspoon Shoe

Comprehensive Income Statement

For the Year Ended December 31, 2022

Net Income £ 94,400.00

Other Comprehensive Income:

Rent Revenue £ 29,000.00

Unrealized gain on non-trading equity securities, net of tax £ 31,000.00

Loss on sale of plant assets -£ 15,000.00

Other Comprehensive Income £ 45,000.00

Total Comprehensive Income for the Year £ 139,400.00

c. Which format do you prefer? Discuss.

I prefer to prefer to use the two statement approach format. because this format separates the income

statement from the comprehensive income statement, so in my opinion it is easier to read by readers who only

want to see net income.

Lopez Inc.

Statement of Cash Flow

For the Year Ended December 31, 2022

Cash flow from operating activities

Net Income $ 34,000.00

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation Expense $ 6,000.00

Increase in accounts receivable $ (3,000.00)

Increase in accounts payable $ 5,000.00 $ 8,000.00

Net cash provided by operating activities $ 42,000.00

Cash flow from investing activities

Purchase of equipment $ (17,000.00)

Net cash used by investment activities $ (17,000.00)

Issuance of common stock $ 20,000.00

Payment of cash dividends $ (13,000.00)

Net cash provided by financing activities $ 7,000.00

Net increase in cash $ 32,000.00

Cash at beggining of year $ 13,000.00

Cash at end of year $ 45,000.00

You might also like

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Tugas 6 - Aulia KhairaniDocument3 pagesTugas 6 - Aulia KhairaniadvokesmahmmbNo ratings yet

- Income statement and financial position documents solutionsDocument59 pagesIncome statement and financial position documents solutionsNam PhươngNo ratings yet

- Final Exam - FA PDFDocument7 pagesFinal Exam - FA PDFNga NguyễnNo ratings yet

- Accounting Assignments Financial StatementsDocument5 pagesAccounting Assignments Financial StatementsTendai MakosaNo ratings yet

- Sample Functional Form of Statement of Comprehensive IncomeDocument2 pagesSample Functional Form of Statement of Comprehensive IncomeHazel Joy DemaganteNo ratings yet

- Latihann Arus Kas & Jawaban (Indirect)Document3 pagesLatihann Arus Kas & Jawaban (Indirect)Mona FitriaNo ratings yet

- 2023 11 13 08 00 22 A021231048 William Mangumban A021231048 Tugas AkuntansiDocument1 page2023 11 13 08 00 22 A021231048 William Mangumban A021231048 Tugas AkuntansiWilliam MangumbanNo ratings yet

- Ia Assignment 2Document2 pagesIa Assignment 2Shekinah SesbrenoNo ratings yet

- Cases Chapter 4 - Syndicate 8Document4 pagesCases Chapter 4 - Syndicate 8Ahike HukatenNo ratings yet

- Tugas Personal 1 - Diaz Hesron Deo Simorangkir - 2602202526Document6 pagesTugas Personal 1 - Diaz Hesron Deo Simorangkir - 2602202526Diaz Hesron Deo SimorangkirNo ratings yet

- E5-9 Multiple-Step Income StatementDocument2 pagesE5-9 Multiple-Step Income StatementNg. Minh ThảoNo ratings yet

- Sample Problem IncomeDocument4 pagesSample Problem IncomeJoyce Ann Agdippa Barcelona100% (1)

- 2E Intermediate (Sat - 16-3-2024) - Final Ch.2 (A)Document20 pages2E Intermediate (Sat - 16-3-2024) - Final Ch.2 (A)ahmedNo ratings yet

- Sample Income Statement ManufacturingDocument1 pageSample Income Statement ManufacturingIrish Kit SarmientoNo ratings yet

- Pr. 4-146-Income StatementDocument13 pagesPr. 4-146-Income StatementElene SamnidzeNo ratings yet

- Asdos Pert 2Document2 pagesAsdos Pert 2mutiaoooNo ratings yet

- ForumDocument5 pagesForumMariana Hb0% (1)

- Prefinal Exam - SolutionDocument7 pagesPrefinal Exam - SolutionKarlo PalerNo ratings yet

- Cash Flow Statement for Passaic CompanyDocument7 pagesCash Flow Statement for Passaic CompanyShane TabunggaoNo ratings yet

- PRACTICEDocument4 pagesPRACTICEGleeson Jay NiedoNo ratings yet

- Balance Sheet As of November 2020: Company No.456789 123 Lopez ST., Jaro, Iloilo CityDocument1 pageBalance Sheet As of November 2020: Company No.456789 123 Lopez ST., Jaro, Iloilo CityAljenika Moncada GupiteoNo ratings yet

- Assignment 2Document6 pagesAssignment 2TAWHID ARMANNo ratings yet

- Teaching Note - Cash FlowDocument21 pagesTeaching Note - Cash Flowmohit rajputNo ratings yet

- Thompson Corporation: InstructionsDocument7 pagesThompson Corporation: InstructionsrahmawNo ratings yet

- Cash FlowDocument6 pagesCash Flowsilvia indahsariNo ratings yet

- This Study Resource Was: Solutions To Assigned Problems & ExercisesDocument3 pagesThis Study Resource Was: Solutions To Assigned Problems & ExercisesMikaela Amigan EvangelistaNo ratings yet

- Income Statement TemplateDocument2 pagesIncome Statement TemplatemonsurNo ratings yet

- Hardhat Case - Rajesh Kumar NayakDocument12 pagesHardhat Case - Rajesh Kumar NayakSandeep RawatNo ratings yet

- 72 - Pertemuan 4 DocumentDocument7 pages72 - Pertemuan 4 DocumentWahyu JanokoNo ratings yet

- Patrice R. Barquilla 12 Gandionco Business Finance CHAPTER 2 ASSIGNMENTDocument12 pagesPatrice R. Barquilla 12 Gandionco Business Finance CHAPTER 2 ASSIGNMENTJohnrick RabaraNo ratings yet

- PT Cagak financial statement 2020Document9 pagesPT Cagak financial statement 2020Laras sukma nurani tirtawidjajaNo ratings yet

- Entah ApaDocument2 pagesEntah ApaYESSICA CHANDRANo ratings yet

- National College of Business and Arts: Fairview, Quezon CityDocument4 pagesNational College of Business and Arts: Fairview, Quezon CityLouise MchaleNo ratings yet

- Nok Siti Nur Hasanah - 202047005 - Tugas 3.1 3.2 3.3 3.4Document4 pagesNok Siti Nur Hasanah - 202047005 - Tugas 3.1 3.2 3.3 3.4Risma AmeliaNo ratings yet

- Gawagawa Din Company COGS StatementDocument5 pagesGawagawa Din Company COGS StatementJosh AlvarezNo ratings yet

- Assignment1_Profit and loss exercise E financeDocument8 pagesAssignment1_Profit and loss exercise E financees.eldeebNo ratings yet

- Account AssignmentDocument4 pagesAccount AssignmentNavjeet SandhuNo ratings yet

- Hardhat LTD Projected Income Statement 2000/2001Document12 pagesHardhat LTD Projected Income Statement 2000/2001Rajeshkumar NayakNo ratings yet

- Financial Accounting - Tugas 4 - 23 Oktober 2019Document3 pagesFinancial Accounting - Tugas 4 - 23 Oktober 2019AlfiyanNo ratings yet

- ABC Company financial statement for 2020Document2 pagesABC Company financial statement for 2020Vinella SantosNo ratings yet

- ACC401-Basic Conso SPLDocument4 pagesACC401-Basic Conso SPLOhene Asare PogastyNo ratings yet

- Solutions To ProblemsDocument22 pagesSolutions To ProblemsSyeed AhmedNo ratings yet

- Multiple StepDocument1 pageMultiple StepMerza DyanNo ratings yet

- Income Statement PreparationDocument11 pagesIncome Statement PreparationIbi Ifti100% (1)

- FM-Cash Budget)Document9 pagesFM-Cash Budget)Aviona GregorioNo ratings yet

- DiscussionDocument1 pageDiscussionstella avrilNo ratings yet

- Week 6 Exercise SolutionsDocument6 pagesWeek 6 Exercise SolutionsrahmawNo ratings yet

- Answer W8 - As5 CashflowDocument2 pagesAnswer W8 - As5 CashflowJere Mae MarananNo ratings yet

- Absorption and Marginal Costing TemplateDocument13 pagesAbsorption and Marginal Costing TemplateGeorge PNo ratings yet

- CH 4 Brief Exercises 16th PDFDocument18 pagesCH 4 Brief Exercises 16th PDFNiken PurwantyNo ratings yet

- Profit Planning and Pro-Forma FS ExerciseDocument1 pageProfit Planning and Pro-Forma FS ExerciseVixen Aaron EnriquezNo ratings yet

- Financial Ratios Formulas ExplainedDocument5 pagesFinancial Ratios Formulas ExplainedRegina De LeónNo ratings yet

- Roudaina Abushufa HomeworkDocument1 pageRoudaina Abushufa HomeworkMoad NasserNo ratings yet

- Profit or LossDocument1 pageProfit or LossKryss Clyde TabliganNo ratings yet

- Soal Tugas Akm Is - ST o FP - CFDocument6 pagesSoal Tugas Akm Is - ST o FP - CFElyssa Fiqri Fauziah0% (1)

- Muad Taboun - CH5 HWDocument1 pageMuad Taboun - CH5 HWMoad Nasser0% (1)

- FSA-Tutorial 3-Fall 2023 With SolutionsDocument4 pagesFSA-Tutorial 3-Fall 2023 With SolutionschtiouirayyenNo ratings yet

- PT Atlantik Financial Report Earnings Loss ComprehensiveDocument2 pagesPT Atlantik Financial Report Earnings Loss ComprehensiveMuhammad IrvanNo ratings yet

- Assign. Acct 101Document16 pagesAssign. Acct 101Carlos Vicente E. Torralba100% (1)

- Traphaco Reviews Distribution Restructuring and 2019 Business PlanDocument4 pagesTraphaco Reviews Distribution Restructuring and 2019 Business PlanHai YenNo ratings yet

- Government Accounting ManualDocument9 pagesGovernment Accounting ManualGabriel PonceNo ratings yet

- Cultivating The Affluent ClientDocument12 pagesCultivating The Affluent ClientSummer K. LeeNo ratings yet

- Chap 6 ProblemsDocument5 pagesChap 6 ProblemsCecilia Ooi Shu QingNo ratings yet

- GRC PWC IntegritydrivenperformanceDocument52 pagesGRC PWC IntegritydrivenperformanceDeepak YakkundiNo ratings yet

- Quote 023Document1 pageQuote 023Matthew LeeNo ratings yet

- GST Question Bank Nov 22Document750 pagesGST Question Bank Nov 22mercydavizNo ratings yet

- DLF - Building India: Achintya PR Ankit Uttam Arun Ks Manish Watharkar Nishigandha Pankaj Kumar Prashant PatroDocument143 pagesDLF - Building India: Achintya PR Ankit Uttam Arun Ks Manish Watharkar Nishigandha Pankaj Kumar Prashant PatroAshish AggarwalNo ratings yet

- C1 Introduction To AuditDocument24 pagesC1 Introduction To AuditTan Yong Feng MSUC PenangNo ratings yet

- Module Guide: Module BM3309 International Business Semester: October 2015Document40 pagesModule Guide: Module BM3309 International Business Semester: October 2015Nor Ashikin IsmailNo ratings yet

- An Introduction To Marxism - Its Origins, Key Ideas, and Contemporary RelevanceDocument2 pagesAn Introduction To Marxism - Its Origins, Key Ideas, and Contemporary RelevancemikeNo ratings yet

- Barcelona PDFDocument165 pagesBarcelona PDFHector Alberto Garcia LopezNo ratings yet

- June 2017Document599 pagesJune 2017Asif sheikhNo ratings yet

- 20211018-Chapter 4 - PPT MarxismDocument25 pages20211018-Chapter 4 - PPT Marxismuzair hyderNo ratings yet

- The Graduates of Bachelor of Science in Criminology of Collegio de Amore SY 2010 To 2018 A Tracer StudyDocument11 pagesThe Graduates of Bachelor of Science in Criminology of Collegio de Amore SY 2010 To 2018 A Tracer Studyjetlee estacionNo ratings yet

- Capstone Research Paper - Ferrari 2015 Initial Public OfferingDocument9 pagesCapstone Research Paper - Ferrari 2015 Initial Public OfferingJames A. Whitten0% (1)

- Profile of The Aerospace Industry in Greater MontrealDocument48 pagesProfile of The Aerospace Industry in Greater Montrealvigneshkumar rajanNo ratings yet

- Logistics SsDocument18 pagesLogistics SsCarla Flor LosiñadaNo ratings yet

- Marketing Vocabulary: Term MeaningDocument3 pagesMarketing Vocabulary: Term MeaningSudarmika KomangNo ratings yet

- PDF To WordDocument17 pagesPDF To WordMehulsonariaNo ratings yet

- SUF ESG Score Methodology 2022-06Document15 pagesSUF ESG Score Methodology 2022-06R N ShuklaNo ratings yet

- Introduction of Planning System and Urban Regeneration in TaiwanDocument70 pagesIntroduction of Planning System and Urban Regeneration in TaiwanRCE August ResidencesNo ratings yet

- Child Labor: A Global View: Cathryne L. Schmitz Elizabeth Kimjin Traver Desi Larson EditorsDocument230 pagesChild Labor: A Global View: Cathryne L. Schmitz Elizabeth Kimjin Traver Desi Larson EditorsRamiroNo ratings yet

- FincourseDocument6 pagesFincoursebrandonxstarkNo ratings yet

- Project Management Process OverviewDocument49 pagesProject Management Process OverviewIlyaas OsmanNo ratings yet

- FranchisingDocument39 pagesFranchisingWilsonNo ratings yet

- The Management of Employee Benefits and ServicesDocument37 pagesThe Management of Employee Benefits and ServicesImy AbrenillaNo ratings yet

- PWC Talent Mobility 2020Document36 pagesPWC Talent Mobility 2020amulya_malleshNo ratings yet

- DS112 Development Perspectives I Course OverviewDocument68 pagesDS112 Development Perspectives I Course OverviewDanford DanfordNo ratings yet