Professional Documents

Culture Documents

Cashflow 2017-2016

Uploaded by

malihaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cashflow 2017-2016

Uploaded by

malihaCopyright:

Available Formats

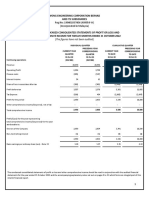

consolidated statement of changes in equity

consolidated statement of cash flows

for the year ended december 31, 2017 for the year ended december 31, 2017

(Amounts in thousand) Reserve (Amounts in thousand)

Capital Revenue Note 2017 2016

Share Share Exchange Hedging Remeasurement Unappropriated Total -----------------Rupees-----------------

capital premium revaluation reserve of post profit

reserve employment

benefits

Cash flows from operating activities

--------------------------------------------------------------------------- Rupees -------------------------------------------------------------------------

Cash generated from operations 34 29,532,348 7,979,703

Balance as at January 1, 2017 13,309,323 3,132,181 10,802 - (26,646) 25,222,724 41,648,384

Retirement and other service benefits paid (45,888) (43,617)

Finance cost paid (2,651,371) (3,430,269)

Transactions with owners Taxes paid (3,994,219) (3,498,254)

Long term loans and advances - net (13,898) 39,716

Shares issued upon exercise of conversion

option (note 15.4) 43,670 252,723 - - - - 296,393

Net cash generated from operating activities 22,826,972 1,047,279

Dividends: Cash flows from investing activities

- Final 2016: Rs. 2.50 per share - - - - - (3,338,251) (3,338,251)

- 1st interim 2017: Rs. 2.50 per share - - - - - (3,338,251) (3,338,251) Purchases of property, plant and equipment and intangibles (3,900,123) (3,010,417)

- 2nd interim 2017: Rs. 3.00 per share - - - - - (4,005,898) (4,005,898) Proceeds from disposal of :

- - - - - (10,682,400) (10,682,400) - property, plant & equipment 704,092 11,983

- investments - net - 1,104,129

Total comprehensive income for Income on deposits / other financial assets 64,779 217,833

the year ended December 31, 2017

Net cash utilised in investing activities (3,131,252) (1,676,472)

Profit for the year - - - - - 11,155,622 11,155,622

Other comprehensive income: Cash flows from financing activities

- exchange revaluation - - 72,381 - - - 72,381

- remeasurements, net of tax - - - - (20,669) - (20,669) Proceeds from:

- - 72,381 - (20,669) 11,155,622 11,207,334

- long term borrowings 1,500,000 25,132,253

- short term borrowings - 724,700

Balance as at December 31, 2017 13,352,993 3,384,904 83,183 - (47,315) 25,695,946 42,469,711

Repayments of :

Balance as at January 1, 2016 13,309,323 3,132,181 13,805 (4,536) (40,310) 25,921,266 42,331,729

- long term borrowings (5,085,439) (26,711,653)

- short term borrowings (800,000) -

Transactions with owners Dividends paid (10,677,051) (9,968,554)

Net cash utilised in financing activities (15,062,490) (10,823,254)

Dividends:

- Final 2015: Rs. 3.00 per share - - - - - (3,992,797) (3,992,797) Net increase / (decrease) in cash and cash equivalents 4,633,230 (11,452,447)

- 1st interim 2016: Rs. 2.00 per share - - - - - (2,661,865) (2,661,865)

- 2nd interim 2016: Rs. 2.50 per share - - - - - (3,327,333) (3,327,333) Cash and cash equivalents at beginning of the year 14,365 11,469,815

- - - - - (9,981,995) (9,981,995)

Total comprehensive income for Exchange gain translation 72,381 (3,003)

the year ended December 31, 2016

Cash and cash equivalents at end of the year 35 4,719,976 14,365

Profit for the year - - - - - 9,283,453 9,283,453

Other comprehensive income:

- exchange revaluation - - (3,003) - - - (3,003)

The annexed notes from 1 to 47 form an integral part of these consolidated financial statements.

- cash flow hedges, net of tax - - - 4,536 - - 4,536

- remeasurements, net of tax - - - - 13,664 - 13,664

- - (3,003) 4,536 13,664 9,283,453 9,298,650

Balance as at December 31, 2016 13,309,323 3,132,181 10,802 - (26,646) 25,222,724 41,648,384

The annexed notes from 1 to 47 form an integral part of these consolidated financial statements.

Atif Kaludi Ruhail Mohammed Ghias Khan Atif Kaludi Ruhail Mohammed Ghias Khan

Chief Financial Officer Chief Executive Chairman Chief Financial Officer Chief Executive Chairman

89 engro fertilizers Annual Report 2017 90

You might also like

- Information MemorandumDocument38 pagesInformation Memorandumsun6raj18100% (1)

- Ecobank FinancialsDocument2 pagesEcobank FinancialsFuaad Dodoo0% (1)

- UBL Annual Report 2018-78Document1 pageUBL Annual Report 2018-78IFRS LabNo ratings yet

- Cash Flow StatementDocument1 pageCash Flow StatementFurqan FakharNo ratings yet

- Equity Group Holdings PLC Condensed Financial Statements For The Period Ended 31 ST December 2020Document1 pageEquity Group Holdings PLC Condensed Financial Statements For The Period Ended 31 ST December 2020MajugoNo ratings yet

- Microsoft Corporation: (In Millions) Year Ended June 30, 2010 2009 2008Document1 pageMicrosoft Corporation: (In Millions) Year Ended June 30, 2010 2009 2008Dylan MakroNo ratings yet

- Vitrox q12021Document15 pagesVitrox q12021Dennis AngNo ratings yet

- Cashflow 2007Document1 pageCashflow 2007Zeeshan SiddiqueNo ratings yet

- Sharjah Cement 2016Document35 pagesSharjah Cement 2016NotesfreeBookNo ratings yet

- Vitrox q12018Document13 pagesVitrox q12018Dennis AngNo ratings yet

- AlMeezan AnnualReport2023 MIIFDocument9 pagesAlMeezan AnnualReport2023 MIIFmrordinaryNo ratings yet

- Vitrox q12015Document12 pagesVitrox q12015Dennis AngNo ratings yet

- Finance Report 2018 enDocument1 pageFinance Report 2018 enPhương Linh VũNo ratings yet

- Techna-X Berhad: Incorporated in MalaysiaDocument17 pagesTechna-X Berhad: Incorporated in MalaysiaChoon Wei WongNo ratings yet

- Standlone Cash Flow StatementDocument2 pagesStandlone Cash Flow StatementVaibhav SìňghNo ratings yet

- Aali - LK Tw-I - 2016Document72 pagesAali - LK Tw-I - 2016Moza PangestuNo ratings yet

- Vitrox q22013Document12 pagesVitrox q22013Dennis AngNo ratings yet

- Vitrox q22018Document14 pagesVitrox q22018Dennis AngNo ratings yet

- Statement of Changes in EquityDocument1 pageStatement of Changes in EquityRommel VinluanNo ratings yet

- Finance Report enDocument1 pageFinance Report enPhương Linh VũNo ratings yet

- Vitrox q32017Document14 pagesVitrox q32017Dennis AngNo ratings yet

- Finance Report 2016 enDocument1 pageFinance Report 2016 enPhương Linh VũNo ratings yet

- UBL Annual Report 2018-120Document1 pageUBL Annual Report 2018-120IFRS LabNo ratings yet

- UBL Annual Report 2018-105Document1 pageUBL Annual Report 2018-105IFRS LabNo ratings yet

- UBA - June2021 FN StatementsDocument2 pagesUBA - June2021 FN StatementsFuaad DodooNo ratings yet

- 2021 Full Year FinancialsDocument2 pages2021 Full Year FinancialsFuaad DodooNo ratings yet

- UBL Annual Report 2018-79Document1 pageUBL Annual Report 2018-79IFRS LabNo ratings yet

- UBL Annual Report 2018-107Document1 pageUBL Annual Report 2018-107IFRS LabNo ratings yet

- Zenith Bank 2020Document2 pagesZenith Bank 2020Fuaad DodooNo ratings yet

- JHM 1Qtr21 Financial Report (Amendment)Document13 pagesJHM 1Qtr21 Financial Report (Amendment)Ooi Gim SengNo ratings yet

- Vitrox q22007Document11 pagesVitrox q22007Dennis AngNo ratings yet

- Untitled 1Document7 pagesUntitled 1Shafeeq GigyaniNo ratings yet

- Cscstel 202209 Q3Document12 pagesCscstel 202209 Q3Al TanNo ratings yet

- Access BankDocument1 pageAccess BankFuaad DodooNo ratings yet

- Financial Statements Notes On The Financial StatementsDocument95 pagesFinancial Statements Notes On The Financial StatementsEvariste GaloisNo ratings yet

- Vitrox q12019Document15 pagesVitrox q12019Dennis AngNo ratings yet

- Vitrox q32021Document16 pagesVitrox q32021Dennis AngNo ratings yet

- Un-Audited Financial Statements For The Six Months Ended June 30, 2021Document1 pageUn-Audited Financial Statements For The Six Months Ended June 30, 2021Fuaad DodooNo ratings yet

- + UpdatedDocument22 pages+ UpdatedRobert ManjoNo ratings yet

- Annual-Report-FML-30-June-2020-23 Vol 2Document1 pageAnnual-Report-FML-30-June-2020-23 Vol 2Bluish FlameNo ratings yet

- 7050 Wong QR 2022-10-31 Wecfrq4fy2022 - 2122247081Document13 pages7050 Wong QR 2022-10-31 Wecfrq4fy2022 - 2122247081Quint WongNo ratings yet

- PETRONAS IR20 Financial Review and Other InformationDocument8 pagesPETRONAS IR20 Financial Review and Other InformationFendi SamsudinNo ratings yet

- Q1 Financials 2018 (IFRS) FinalDocument44 pagesQ1 Financials 2018 (IFRS) FinalMicaNo ratings yet

- Superlon Holdings Berhad (Incorporated in Malaysia)Document12 pagesSuperlon Holdings Berhad (Incorporated in Malaysia)Gan ZhiHanNo ratings yet

- KFC Holdings (Malaysia) BHD: Individual Quarter Cumulative QuartersDocument4 pagesKFC Holdings (Malaysia) BHD: Individual Quarter Cumulative QuarterskriliaNo ratings yet

- Q4 FY2007 Financial ReconciliationDocument4 pagesQ4 FY2007 Financial ReconciliationЂорђе МалешевићNo ratings yet

- Vitrox q42014Document10 pagesVitrox q42014Dennis AngNo ratings yet

- Sun Limited Abridged Financial Statements: The Group's Audited Results For The Year Ended 30 June 2017 Are As FollowsDocument1 pageSun Limited Abridged Financial Statements: The Group's Audited Results For The Year Ended 30 June 2017 Are As FollowsYash HardowarNo ratings yet

- 06 Pirelli Separate Financial Statements PDFDocument44 pages06 Pirelli Separate Financial Statements PDFCarlos PespNo ratings yet

- 2021 Summarised Financial Statement 1 Pager Final SignedDocument1 page2021 Summarised Financial Statement 1 Pager Final SignedFuaad DodooNo ratings yet

- Financial Report Q1 2021Document21 pagesFinancial Report Q1 2021FiestaNo ratings yet

- Document Incorporated by Reference EBI F Cial Statements 2007 2009-08-17Document80 pagesDocument Incorporated by Reference EBI F Cial Statements 2007 2009-08-17Megan KosNo ratings yet

- MAGML Q3 Accounts For The Period 31.03.2022Document2 pagesMAGML Q3 Accounts For The Period 31.03.2022shoyeb rakibNo ratings yet

- Annual Report 2019 Financial Statements and Notes PDFDocument124 pagesAnnual Report 2019 Financial Statements and Notes PDFArti AtkaleNo ratings yet

- 2000 - Naspers CFSDocument1 page2000 - Naspers CFSbillroberts981No ratings yet

- Vitrox q12017Document12 pagesVitrox q12017Dennis AngNo ratings yet

- Ai CF 14-15Document1 pageAi CF 14-15subhash dalviNo ratings yet

- 10 11Q1StandaloneDocument1 page10 11Q1Standalonemahaveer_singh75No ratings yet

- Vitrox q42019Document17 pagesVitrox q42019Dennis AngNo ratings yet

- Fajarbaru Builder Group BHDDocument5 pagesFajarbaru Builder Group BHDShungchau WongNo ratings yet

- The Cost-Cutting Case For Banks: The ROI of Using Ripple and XRP For Global Interbank SettlementsDocument14 pagesThe Cost-Cutting Case For Banks: The ROI of Using Ripple and XRP For Global Interbank SettlementsVasileGheorghiuNo ratings yet

- LeasingDocument19 pagesLeasingJHONNo ratings yet

- Business Plan Investors BankersDocument199 pagesBusiness Plan Investors BankersDJ-Raihan RatulNo ratings yet

- Indiainc'Sbiggest Merger:Hdfcbank& Hdfcltdwillbeone: Kashmiri Pandit, 2 Migrants Shot At, CRPF Man Killed in ValleyDocument18 pagesIndiainc'Sbiggest Merger:Hdfcbank& Hdfcltdwillbeone: Kashmiri Pandit, 2 Migrants Shot At, CRPF Man Killed in ValleygoochinaatuNo ratings yet

- Talk About ImbalancesDocument1 pageTalk About ImbalancesforbesadminNo ratings yet

- Financial Regulatory Bodies of IndiaDocument6 pagesFinancial Regulatory Bodies of IndiaShivangi PandeyNo ratings yet

- Carmela Jia Ming A. Wong Section 20Document2 pagesCarmela Jia Ming A. Wong Section 20Carmela WongNo ratings yet

- CIR Vs PhilamlifeDocument2 pagesCIR Vs PhilamlifeBreAmberNo ratings yet

- Appendix 1.1 (Cir1124 - 2021)Document2 pagesAppendix 1.1 (Cir1124 - 2021)Vemula PraveenNo ratings yet

- Health Insurance and Risk ManagementDocument7 pagesHealth Insurance and Risk ManagementPritam BhowmickNo ratings yet

- International Financial Management: Jeff Madura 7 EditionDocument38 pagesInternational Financial Management: Jeff Madura 7 EditionBilal sattiNo ratings yet

- Imp S - 4 HANA - New Asset Accounting - Considering Key Aspects - SAP BlogsDocument39 pagesImp S - 4 HANA - New Asset Accounting - Considering Key Aspects - SAP BlogsAnonymous X17EU0lFdNo ratings yet

- DEPB SchemeDocument4 pagesDEPB SchemeHarshada PawarNo ratings yet

- TCS Result Analysis 2023Document4 pagesTCS Result Analysis 2023vinay_814585077No ratings yet

- Illustration For Your HDFC Life Click 2 Protect PlusDocument1 pageIllustration For Your HDFC Life Click 2 Protect Plussatish vermaNo ratings yet

- Complete List of Banking TermsDocument33 pagesComplete List of Banking TermsTanya Hughes100% (1)

- International Journals Call For Paper HTTP://WWW - Iiste.org/journalsDocument12 pagesInternational Journals Call For Paper HTTP://WWW - Iiste.org/journalsAlexander DeckerNo ratings yet

- Standard, The Conceptual Framework Overrides That StandardDocument6 pagesStandard, The Conceptual Framework Overrides That StandardwivadaNo ratings yet

- Retail Costing-F&tDocument31 pagesRetail Costing-F&tKaushal YadavNo ratings yet

- NOVATECH, LTD - Account Overview Relatório 2005Document2 pagesNOVATECH, LTD - Account Overview Relatório 2005RONI SANTOSNo ratings yet

- Risk and Return Analysis of Equity Mutual FundDocument90 pagesRisk and Return Analysis of Equity Mutual Fundmajid_khan_4No ratings yet

- Statement of Profit or Loss and Other Comprehensive IncomeDocument3 pagesStatement of Profit or Loss and Other Comprehensive IncomePatricia San Pablo100% (1)

- Transaction StatementDocument2 pagesTransaction StatementSatya GopalNo ratings yet

- List PDFDocument4 pagesList PDFPam Welch HeuleNo ratings yet

- PC-16 MCQ Rahi CPWA AllChaptersDocument150 pagesPC-16 MCQ Rahi CPWA AllChaptersVirendra Ramteke100% (1)

- Trading Account (Factorey) : Trading and Profit & Loss A/c With Different Groups & LedgerDocument2 pagesTrading Account (Factorey) : Trading and Profit & Loss A/c With Different Groups & Ledgersameer maddubaigariNo ratings yet

- Kaplan Sensoy Strömberg 2009 Should Investors Bet On The Jockey or The HorseDocument41 pagesKaplan Sensoy Strömberg 2009 Should Investors Bet On The Jockey or The HorseThắng VũNo ratings yet

- Income Tax Case List Exam Related PurposeDocument9 pagesIncome Tax Case List Exam Related PurposeShubham PhophaliaNo ratings yet

- Part 2 Working Capital Management Qs PDFDocument15 pagesPart 2 Working Capital Management Qs PDFAnuar LoboNo ratings yet