Professional Documents

Culture Documents

2000 - Naspers CFS

Uploaded by

billroberts9810 ratings0% found this document useful (0 votes)

14 views1 pageCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views1 page2000 - Naspers CFS

Uploaded by

billroberts981Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

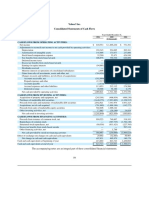

CASH FLOW STATEMENT

FOR THE YEAR ENDED 31 MARCH 2000

GROUP

2000 1999

Notes R’000 R’000

앥앥앥앥앥앥앥앥앥앥앥앥앥앥앥앥앥앥앥앥앥앥앥앥앥앥앥앥앥

CASH FLOW FROM OPERATING ACTIVITIES 285 676 (241 205)

Cash from activities 25.1 472 430 (100 357)

Investment income received 2 765 2 301

Dividends received from equity-accounted companies 29 558 29 233

ҀҀҀҀҀҀҀҀҀҀҀҀҀҀҀҀҀҀҀҀҀҀ

Cash generated from operating activities 504 753 (68 823)

Finance cost paid (154 113) (67 350)

Taxation paid (37 256) (80 643)

ҀҀҀҀҀҀҀҀҀҀҀҀҀҀҀҀҀҀҀҀҀҀ

313 384 (216 816)

Dividends paid (27 708) (24 389)

CASH FLOW FROM INVESTMENT ACTIVITIES (1 582 678) (493 816)

Property, plant and equipment acquired (670 080) (372 388)

2 0 0 0

Proceeds from sale of property, plant and equipment 26 260 66 745

Additional investment in existing subsidiaries (986 336) –

Acquisition of subsidiaries 25.2 (158 962) 992 997

R E P O R T

Proceeds from sale of subsidiaries – 6 039

Proceeds from sale of investments 882 811 –

Net investment in associated and other companies (537 887) (1 024 013)

Investment in intangible assets (138 484) (163 196)

A N N U A L

CASH FLOW FROM FINANCING ACTIVITIES 3 581 586 660 162

(Decrease)/increase in long-term liabilities (33 539) 63 149

Increase in short-term loans 14 121 216 435

Issue of shares: capital and premium 1 185 474 209 220

Contributions of minority shareholders 2 415 530 11 358

Issue of convertible debentures – 160 000

ҀҀҀҀҀҀҀҀҀҀҀҀҀҀҀҀҀҀҀҀҀҀ

Net increase/(decrease) in cash and cash equivalents 2 284 584 (74 859)

Forex translation adjustments on cash and cash equivalents (5 878) 174 930

Cash and cash equivalents at beginning of year 59 457 (40 614)

ҀҀҀҀҀҀҀҀҀҀҀҀҀҀҀҀҀҀҀҀҀҀ

Cash and cash equivalents at end of year 25.3 2 338 163 59 457

ҀҀҀҀҀҀҀҀҀҀҀҀҀҀҀҀҀҀҀҀҀҀ

32 H T T P : / / W W W . N A S P E R S . C O M

You might also like

- Dell Financial Data Mid Course Quiz 1668627324062Document10 pagesDell Financial Data Mid Course Quiz 1668627324062rohit goyalNo ratings yet

- 133399-A 2018 2018 Annual CFDocument1 page133399-A 2018 2018 Annual CFVijay KumarNo ratings yet

- 133399-AA 2018 2018 Annual CFDocument1 page133399-AA 2018 2018 Annual CFVijay KumarNo ratings yet

- Interim Consolidated Statements of Cash Flows: Samsung Electronics Co., Ltd. and Its SubsidiariesDocument2 pagesInterim Consolidated Statements of Cash Flows: Samsung Electronics Co., Ltd. and Its SubsidiariesDaniyal NawazNo ratings yet

- Financial Report 2017Document106 pagesFinancial Report 2017Le Phong100% (1)

- Ford 18Document6 pagesFord 18Bhavdeep singh sidhuNo ratings yet

- Cash Flow StatementDocument1 pageCash Flow StatementFurqan FakharNo ratings yet

- 2021 Full Year Cash Flow StatementDocument1 page2021 Full Year Cash Flow StatementROYAL ENFIELDNo ratings yet

- Cash Flow StatementDocument2 pagesCash Flow Statementsasanka1987No ratings yet

- (In Millions) : Consolidated Statements of Cash FlowsDocument1 page(In Millions) : Consolidated Statements of Cash FlowsrocíoNo ratings yet

- Teikoku Electric Mfg. Co., LTD.: Consolidated Statement of Cash Flows Year Ended March 31, 2016Document1 pageTeikoku Electric Mfg. Co., LTD.: Consolidated Statement of Cash Flows Year Ended March 31, 2016LymeParkNo ratings yet

- Standlone Cash Flow StatementDocument2 pagesStandlone Cash Flow StatementVaibhav SìňghNo ratings yet

- Cash Flow Statement 2016-2020Document8 pagesCash Flow Statement 2016-2020yip manNo ratings yet

- Microsoft Corporation: (In Millions) Year Ended June 30, 2010 2009 2008Document1 pageMicrosoft Corporation: (In Millions) Year Ended June 30, 2010 2009 2008Dylan MakroNo ratings yet

- Cash Flow For Apple Inc (AAPL) From MorningstarDocument2 pagesCash Flow For Apple Inc (AAPL) From MorningstarAswin P SubhashNo ratings yet

- First Quarter Financial Statement and Dividend AnnouncementDocument9 pagesFirst Quarter Financial Statement and Dividend Announcementkelvina_8No ratings yet

- Consolidated Cash Flow StatementDocument1 pageConsolidated Cash Flow Statementsurya553No ratings yet

- Page 17 - Cash FlowDocument1 pagePage 17 - Cash Flowapi-3701112No ratings yet

- DCF Model: Consolidated Balance Sheet Consolidated Statement of Profit & Loss Consolidated Statement of Cash FlowsDocument1 pageDCF Model: Consolidated Balance Sheet Consolidated Statement of Profit & Loss Consolidated Statement of Cash FlowsGolamMostafaNo ratings yet

- 2003 Annual Financial StatementDocument11 pages2003 Annual Financial Statementvenga1932No ratings yet

- The Boeing Company and Subsidiaries Consolidated Statements of Cash FlowsDocument1 pageThe Boeing Company and Subsidiaries Consolidated Statements of Cash Flowsdivineyang05No ratings yet

- 4019 XLS EngDocument13 pages4019 XLS EngAnonymous 1997No ratings yet

- HOME DEPOT FCF Template PracticeDocument17 pagesHOME DEPOT FCF Template PracticeAnihaNo ratings yet

- LSH Financial ReportDocument12 pagesLSH Financial ReportJohnny TehNo ratings yet

- AirtelDocument2 pagesAirtelShraddha RawatNo ratings yet

- Intermediate AccountingDocument5 pagesIntermediate AccountingWindelyn ButraNo ratings yet

- Akzonobel Report18 Cons Cash FlowsDocument1 pageAkzonobel Report18 Cons Cash FlowsS A M E E U L L A H S O O M R ONo ratings yet

- Annual: Etfx Uk Group LLCDocument70 pagesAnnual: Etfx Uk Group LLCeliasNo ratings yet

- Cashflow 2007Document1 pageCashflow 2007Zeeshan SiddiqueNo ratings yet

- Increase in Long Term Loans and AdvancesDocument2 pagesIncrease in Long Term Loans and Advancesusama siddiquiNo ratings yet

- Cash Flow Statement: For The Year Ended 31st March, 2019Document2 pagesCash Flow Statement: For The Year Ended 31st March, 2019Abhishek RajpootNo ratings yet

- Eds and Cerner CorporationDocument7 pagesEds and Cerner CorporationSwara SrivastavaNo ratings yet

- Financial MStatements Ceres MGardening MCompanyDocument11 pagesFinancial MStatements Ceres MGardening MCompanyRodnix MablungNo ratings yet

- AAGB Quarter1 Ended 31.03.2021Document26 pagesAAGB Quarter1 Ended 31.03.2021NUR RAHIMIE FAHMI B.NOOR ADZMAN NUR RAHIMIE FAHMI B.NOOR ADZMANNo ratings yet

- Un-Audited Financial Statements For The Six Months Ended June 30, 2021Document1 pageUn-Audited Financial Statements For The Six Months Ended June 30, 2021Fuaad DodooNo ratings yet

- UntitledDocument69 pagesUntitledJonathan OngNo ratings yet

- Bishop Group (IAS-21 + Cashflow) : Cfap 1: A A F RDocument1 pageBishop Group (IAS-21 + Cashflow) : Cfap 1: A A F R.No ratings yet

- 2016 Fullyear Cash Flow StatementDocument1 page2016 Fullyear Cash Flow StatementSilvana ElenaNo ratings yet

- Dandot Mar 09Document6 pagesDandot Mar 09studioad324No ratings yet

- Reliance Industries Limited Cash Flow Statement For The Year 20 13-14Document2 pagesReliance Industries Limited Cash Flow Statement For The Year 20 13-14Vaidehi VihariNo ratings yet

- Sedania Innovator Berhad - 2Q2022Document19 pagesSedania Innovator Berhad - 2Q2022zul hakifNo ratings yet

- Section B - Additional QuestionDocument124 pagesSection B - Additional QuestionGodie MaraNo ratings yet

- Consolidated Bank (Ghana) Limited: Unaudited Summary Financial StatementsDocument2 pagesConsolidated Bank (Ghana) Limited: Unaudited Summary Financial StatementsFuaad DodooNo ratings yet

- RBGH Financials 30 June 2021 Colour 15.07.2021 2 Full Pages EdtDocument2 pagesRBGH Financials 30 June 2021 Colour 15.07.2021 2 Full Pages EdtFuaad DodooNo ratings yet

- 2021 Con Quarter04 CFDocument2 pages2021 Con Quarter04 CFMohammadNo ratings yet

- Yahoo Annual Report 2006Document2 pagesYahoo Annual Report 2006domini809No ratings yet

- Atlas Honda Cash FlowDocument4 pagesAtlas Honda Cash FlowomairNo ratings yet

- Financial Statements Notes On The Financial StatementsDocument95 pagesFinancial Statements Notes On The Financial StatementsEvariste GaloisNo ratings yet

- UBA - June2021 FN StatementsDocument2 pagesUBA - June2021 FN StatementsFuaad DodooNo ratings yet

- Consolidated Statement of Cash Flows: For The Financial Year Ended 31 December 2017Document3 pagesConsolidated Statement of Cash Flows: For The Financial Year Ended 31 December 2017Vijay KumarNo ratings yet

- Standard Chartered Bank Ghana PLC: Unaudited Financial Statements For The Period Ended 30 September 2021Document1 pageStandard Chartered Bank Ghana PLC: Unaudited Financial Statements For The Period Ended 30 September 2021Fuaad DodooNo ratings yet

- Unconsolidated Statement of Cash Flows: For The Year Ended December 31, 2010Document1 pageUnconsolidated Statement of Cash Flows: For The Year Ended December 31, 2010maqsoom471No ratings yet

- Subject To Central Bank of Oman ApprovalDocument1 pageSubject To Central Bank of Oman ApprovalAttaNo ratings yet

- Vitrox q12015Document12 pagesVitrox q12015Dennis AngNo ratings yet

- RBGH Financials 31 December 2020 Colour 18.03.2021 3 Full PageseddDocument3 pagesRBGH Financials 31 December 2020 Colour 18.03.2021 3 Full PageseddFuaad DodooNo ratings yet

- Cash Flow Statement Lourdesllanes2022 FINALDocument5 pagesCash Flow Statement Lourdesllanes2022 FINALDv AccountingNo ratings yet

- Q1 2023 Puma Energy Results ReportDocument11 pagesQ1 2023 Puma Energy Results ReportKA-11 Єфіменко ІванNo ratings yet

- Tuto 6Document6 pagesTuto 6WEI QUAN LEENo ratings yet

- AF AR Annual-Report 2010 OHDocument68 pagesAF AR Annual-Report 2010 OHbillroberts981No ratings yet

- 2001 - Naspers InvestmentsDocument4 pages2001 - Naspers Investmentsbillroberts981No ratings yet

- 2000 - IS NaspersDocument1 page2000 - IS Naspersbillroberts981No ratings yet

- 2020 Annual Report (NICE Holdings)Document183 pages2020 Annual Report (NICE Holdings)billroberts981No ratings yet

- 2000 - Naspers InvestmentsDocument4 pages2000 - Naspers Investmentsbillroberts981No ratings yet

- 2005 Naspers ARDocument201 pages2005 Naspers ARbillroberts981No ratings yet

- 30 Years and Growing: $ at A TimeDocument112 pages30 Years and Growing: $ at A Timebillroberts981No ratings yet

- WD40 Ar2003Document25 pagesWD40 Ar2003Fiuman RiNo ratings yet

- 2006 WDDocument116 pages2006 WDbillroberts981No ratings yet

- 2006 DGDocument52 pages2006 DGbillroberts981No ratings yet

- 2004 WD40Document28 pages2004 WD40billroberts981No ratings yet

- 2002Document42 pages2002billroberts981No ratings yet

- 2005 WD PDFDocument98 pages2005 WD PDFbillroberts981No ratings yet

- How We Make Things Work: A Hands-On Approach To Learning in WD-40 CompanyDocument19 pagesHow We Make Things Work: A Hands-On Approach To Learning in WD-40 Companybillroberts981No ratings yet

- 2000 Annual ReportDocument16 pages2000 Annual Reportbillroberts981No ratings yet

- Silver Anniversary: Gold Medal ResultsDocument52 pagesSilver Anniversary: Gold Medal Resultsbillroberts981No ratings yet

- Can't Say It Enough: Value. Value. ValueDocument112 pagesCan't Say It Enough: Value. Value. Valuebillroberts981No ratings yet

- 30 Years and Growing: $ at A TimeDocument112 pages30 Years and Growing: $ at A Timebillroberts981No ratings yet

- 2013 DTDocument88 pages2013 DTbillroberts981No ratings yet

- 2014 DTDocument100 pages2014 DTbillroberts981No ratings yet

- Strong. Consistent. Growing.: Operating MarginDocument52 pagesStrong. Consistent. Growing.: Operating Marginbillroberts981No ratings yet

- The Art of The PossibleDocument54 pagesThe Art of The Possiblebillroberts981No ratings yet

- VALUE For All Seasons: Annual ReportDocument52 pagesVALUE For All Seasons: Annual Reportbillroberts981No ratings yet

- $4.24 BILLION... : and GrowingDocument52 pages$4.24 BILLION... : and Growingbillroberts981No ratings yet

- 2006 DGDocument52 pages2006 DGbillroberts981No ratings yet

- The Art of The PossibleDocument54 pagesThe Art of The Possiblebillroberts981No ratings yet

- 2006 DGDocument52 pages2006 DGbillroberts981No ratings yet

- 1625 B&G 4/12/00 12:43 PM Page B: Nnual EportDocument45 pages1625 B&G 4/12/00 12:43 PM Page B: Nnual Eportbillroberts981No ratings yet

- Just DialDocument392 pagesJust DialakhilbhedaNo ratings yet

- 4s-Logistics 2011-11 12Document8 pages4s-Logistics 2011-11 12rickreddiNo ratings yet

- Review Analisis Kinerja Keuangan Di PT Phapros. TBKDocument15 pagesReview Analisis Kinerja Keuangan Di PT Phapros. TBKMutia HidayatillahNo ratings yet

- Financial Market - A Study of Indian Capital Market by CA Hemraj KumawatDocument13 pagesFinancial Market - A Study of Indian Capital Market by CA Hemraj Kumawatijr_journalNo ratings yet

- Legal Aspects of Crowdfunding by Natalia Thurston, Social Venture LawDocument17 pagesLegal Aspects of Crowdfunding by Natalia Thurston, Social Venture Lawinnov8socialNo ratings yet

- Problem 8-31Document4 pagesProblem 8-31Majde QasemNo ratings yet

- Masonite International Corporation: Case Study of A Leveraged BuyoutDocument13 pagesMasonite International Corporation: Case Study of A Leveraged BuyoutpikaNo ratings yet

- EIC Torrent PharmaceuticalDocument22 pagesEIC Torrent PharmaceuticalRishi KanjaniNo ratings yet

- QUIZ1Document7 pagesQUIZ1Mikaela JeanNo ratings yet

- Beta Saham 20210101 enDocument14 pagesBeta Saham 20210101 enWawan A BehakiNo ratings yet

- Q Financial RatiosDocument5 pagesQ Financial RatiosUmmi KalthumNo ratings yet

- Finals Exercise 1 - WC Management Receivables and InventoryDocument4 pagesFinals Exercise 1 - WC Management Receivables and InventoryMarielle SidayonNo ratings yet

- CB Insights Insurance Tech Q1 2020Document42 pagesCB Insights Insurance Tech Q1 2020KumarNo ratings yet

- Case Study: How Carlyle Creates ValueDocument2 pagesCase Study: How Carlyle Creates Valueumang agrawalNo ratings yet

- Fundamental Analysis SeminarDocument18 pagesFundamental Analysis SeminarAndrew WangNo ratings yet

- Aditya Birla CertificateDocument1 pageAditya Birla CertificateSonu LovesforuNo ratings yet

- Mcdonal's Finanical RatiosDocument11 pagesMcdonal's Finanical RatiosFahad Khan TareenNo ratings yet

- Assignment-I (Interpretation of Financial Statements) On Global IME BankDocument8 pagesAssignment-I (Interpretation of Financial Statements) On Global IME BankPrena TmgNo ratings yet

- Financial Markets HMC CaseDocument7 pagesFinancial Markets HMC Casepradhu1No ratings yet

- Canada Goose - Final Long Form Prospectus (060820) (Quercus)Document261 pagesCanada Goose - Final Long Form Prospectus (060820) (Quercus)Daniel GaoNo ratings yet

- Methodology SP Vix Futures IndicesDocument40 pagesMethodology SP Vix Futures IndicesTaylor O'BrienNo ratings yet

- Serbia EBRDDocument2 pagesSerbia EBRDluciamg59No ratings yet

- CRVI Question PaperDocument5 pagesCRVI Question PaperCma SankaraiahNo ratings yet

- Factors Determining Optimal Capital StructureDocument8 pagesFactors Determining Optimal Capital StructureArindam Mitra100% (8)

- Bangladesh Power Sector An Appraisal From A Multi Dimensional PerspectiveDocument301 pagesBangladesh Power Sector An Appraisal From A Multi Dimensional PerspectiveShuvoNo ratings yet

- Ishares Msci Emerging Markets Etf: Fact Sheet As of 03/31/2021Document3 pagesIshares Msci Emerging Markets Etf: Fact Sheet As of 03/31/2021hkm_gmat4849No ratings yet

- Financial Management: Polytechnic University of The Philippines (Bs Accountancy 2-1) Ay 2020-2021Document13 pagesFinancial Management: Polytechnic University of The Philippines (Bs Accountancy 2-1) Ay 2020-2021Gabrielle Anne MagsanocNo ratings yet

- Challenges Facing Islamic BankingDocument92 pagesChallenges Facing Islamic BankingMohamed Elgazwi88% (8)

- Capital Structure MCQsDocument27 pagesCapital Structure MCQsTejas BhavsarNo ratings yet

- G Dividend PolicyDocument7 pagesG Dividend PolicySweeti JaiswalNo ratings yet