0% found this document useful (0 votes)

27 views3 pagesUnderstanding the Accounting Equation

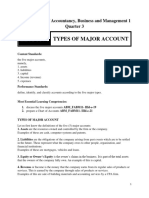

The document discusses key accounting concepts including assets, liabilities, capital, current and non-current assets and liabilities. Assets are economic resources owned by a company, while liabilities are obligations that must be paid. Current assets are related to the normal operating cycle and include cash, accounts receivable, inventory. Non-current assets include long-term receivables, land, equipment. Current liabilities must be paid within a year and include accounts payable, other short term obligations. Capital represents the owner's remaining interest after deducting liabilities.

Uploaded by

Jester BorresCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

27 views3 pagesUnderstanding the Accounting Equation

The document discusses key accounting concepts including assets, liabilities, capital, current and non-current assets and liabilities. Assets are economic resources owned by a company, while liabilities are obligations that must be paid. Current assets are related to the normal operating cycle and include cash, accounts receivable, inventory. Non-current assets include long-term receivables, land, equipment. Current liabilities must be paid within a year and include accounts payable, other short term obligations. Capital represents the owner's remaining interest after deducting liabilities.

Uploaded by

Jester BorresCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd