Professional Documents

Culture Documents

Pension Contribution Note

Uploaded by

Dhruv RanaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pension Contribution Note

Uploaded by

Dhruv RanaCopyright:

Available Formats

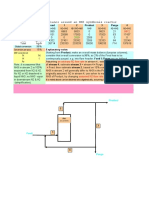

Employees' Pension Scheme (EPS)

EPS Contribution

The PF Contribution payable by employee as well as employer is @ 12% of the PF Salary

(Basic+D.A) and out of the contribution payable by the employer, a part of contribution @ 8.33% is

diverted to Employees' Pension Scheme subject to maximum of Rs.1250/- p.m (w.e.f 01.09.2014.

Prior to that i.e upto 31.08.2014 it was Rs.541/-p.m)

The maximum pensionable salary is limited to Rs. 15,000/-p.m w.e.f 01.09.2014. (prior to that it was

Rs.6500/-p.m)

Note: A] In case of an Indian Employee,

a) if the PF Salary is more than or equal to Rs.15,000/-, then Pension Contribution will be maximum

of Rs.1250 /- per month.

e.g: A having PF Salary Rs.16,000/- p.m.

His Employee PF Contribution = 12% of 16,000 = Rs.1920/-

Company Contribution= PF Contribution + Pension Contribution

a) Pension Contribution = 8.33% of 15,000 = Rs.1250/-

b) PF Contribution = 1920 – 1250 = Rs.670/-

b) if the PF Salary is less than 15000/-, then the Pension Contribution will be calculated @ 8.33% on

PF Salary per month.

e.g: B having PF Salary Rs.10,000/- p.m.

His Employee PF Contribution = 12% of 10,000 = Rs.1200/-

Company Contribution= PF Contribution + Pension Contribution

a) Pension Contribution = 8.33% of 10,000 = Rs.833/-

b) PF Contribution = 1200 - 833 = Rs.367/-

B] In case of an International Employee,

the Pension Contribution will be @ 8.33% on entire Monthly PF Salary.

e.g: IE having PF Salary Rs.1,00,000/- p.m.

His Employee PF Contribution = 12% of 1,00,000 = Rs.12000/-

Company Contribution= PF Contribution + Pension Contribution

a) Pension Contribution = 8.33% of 1,00,000 = Rs.8330/-

b) PF Contribution = 12000 - 8330 = Rs.3670/-

EPS Balance

EPS is a defined benefit scheme and not defined contribution scheme. Hence the EPS monthly

contribution or the accumulated balance has no relevance.

EPS contribution @ 8.33% is transferred to RPFC (Regional Provident Fund Commissioner) as the

compliance under EPS is being managed by EPFO (Employee's Provident Fund Organisation).

Therefore, the EPS contribution is not reflected in the Members Statement.

EPS Withdrawal Benefit

a) If an employee resigns before completing 10 years of pensionable service and / or before

attaining the age of 58 years, he is entitled for withdrawal benefit or may opt for Scheme Certificate

by submitting Form 10C.

b) If an employee resigns after completion of 10 years or more of pensionable service, he becomes

eligible for Monthly Member Pension on completion of 58 years of age. For obtaining pension,

member has to submit an application in Form 10D.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- ACCA F2 FormulasDocument1 pageACCA F2 Formulasabstract_art111740% (5)

- Compensation and Incentive PlansDocument48 pagesCompensation and Incentive Planssatyam7No ratings yet

- Cipla Limited Cipla House Lower Parel: Payslip For The Month of NOVEMBER 2021Document2 pagesCipla Limited Cipla House Lower Parel: Payslip For The Month of NOVEMBER 2021Dhruv RanaNo ratings yet

- Salary Slip - Oct 09Document1 pageSalary Slip - Oct 09Danielle Morris0% (1)

- Separation Pay ComputationDocument3 pagesSeparation Pay ComputationGerry MalgapoNo ratings yet

- History and Components of CompensationDocument42 pagesHistory and Components of CompensationNekoh Dela Cerna75% (4)

- ReportDocument1 pageReportDhruv RanaNo ratings yet

- CET-II Chapter 1 Vapour-Liquid Equilibrium - Part 1Document29 pagesCET-II Chapter 1 Vapour-Liquid Equilibrium - Part 1Dhruv RanaNo ratings yet

- ADVT 10 202122 TCM Rejected APP Due To Duplication ListDocument2,186 pagesADVT 10 202122 TCM Rejected APP Due To Duplication ListDhruv RanaNo ratings yet

- Uka Tarsadia University: Semester - IVDocument8 pagesUka Tarsadia University: Semester - IVDhruv RanaNo ratings yet

- Erucic Acid 112-86-7 Msds Us GhsDocument11 pagesErucic Acid 112-86-7 Msds Us GhsDhruv RanaNo ratings yet

- Gujarat Technological UniversityDocument2 pagesGujarat Technological UniversityDhruv RanaNo ratings yet

- CH 1 Introduction To Services ManagementDocument15 pagesCH 1 Introduction To Services ManagementDhruv RanaNo ratings yet

- Be Winter 2019Document2 pagesBe Winter 2019Dhruv RanaNo ratings yet

- Srno Course Name Enrollment No Student Name Gender Student CategoryDocument2 pagesSrno Course Name Enrollment No Student Name Gender Student CategoryDhruv RanaNo ratings yet

- Questionnaire BBA IIDocument63 pagesQuestionnaire BBA IIDhruv RanaNo ratings yet

- Questionnaire Semantic Differential Scale Template WordDocument12 pagesQuestionnaire Semantic Differential Scale Template WordDhruv RanaNo ratings yet

- Percpio - Learner GuideDocument12 pagesPercpio - Learner GuideDhruv RanaNo ratings yet

- Sum 19Document2 pagesSum 19Dhruv RanaNo ratings yet

- EJ1099575Document17 pagesEJ1099575Dhruv RanaNo ratings yet

- Syllabus: B.B.A. Iii Sem Subject - Business EnvironmentDocument37 pagesSyllabus: B.B.A. Iii Sem Subject - Business EnvironmentDhruv RanaNo ratings yet

- Measuring Attitudes: Current Practices in Health Professional EducationDocument28 pagesMeasuring Attitudes: Current Practices in Health Professional EducationDhruv RanaNo ratings yet

- ConclusionDocument2 pagesConclusionDhruv RanaNo ratings yet

- RM1 - Errors in Business ResearchDocument3 pagesRM1 - Errors in Business ResearchDhruv RanaNo ratings yet

- Ar2018e PDFDocument110 pagesAr2018e PDFDhruv RanaNo ratings yet

- Project PDFDocument147 pagesProject PDFDhruv RanaNo ratings yet

- Chapter - 7 Material Balance: Main ReactionDocument4 pagesChapter - 7 Material Balance: Main ReactionDhruv RanaNo ratings yet

- Ammonia Synthesis Material Balence CalulDocument1 pageAmmonia Synthesis Material Balence CalulDhruv RanaNo ratings yet

- Methanol: Ahmed Soliman Cairo University, Faculty of Engineering, Chemical Engineering DepartmentDocument21 pagesMethanol: Ahmed Soliman Cairo University, Faculty of Engineering, Chemical Engineering DepartmentDhruv RanaNo ratings yet

- Cepe PDFDocument9 pagesCepe PDFDhruv RanaNo ratings yet

- MianProject PDFDocument225 pagesMianProject PDFDhruv RanaNo ratings yet

- Ammonium ChlorideDocument1 pageAmmonium ChlorideDhruv RanaNo ratings yet

- Contract Labour Terms and ConditionsDocument2 pagesContract Labour Terms and ConditionsShravan KumarNo ratings yet

- Form R - Wages RegisterDocument1 pageForm R - Wages RegisterIngersol100% (1)

- Da Arrears-ApteachersDocument2 pagesDa Arrears-ApteachersSivaNo ratings yet

- Production: Specifies Yond SummerDocument1 pageProduction: Specifies Yond SummerKOLANUKONDA SAMPATHNo ratings yet

- Higher Pension - Joint Option-On Roll - Anx ADocument3 pagesHigher Pension - Joint Option-On Roll - Anx ASubramanyam K.V.RNo ratings yet

- Law of Minimum WageDocument7 pagesLaw of Minimum WageHoney DubeyNo ratings yet

- FORM - 9 (Revised) : Date of CoverageDocument4 pagesFORM - 9 (Revised) : Date of CoverageDS SystemsNo ratings yet

- Wage Board Structure Scope FunctionDocument22 pagesWage Board Structure Scope Functionsplit5244100% (2)

- Pay and BenefitsDocument2 pagesPay and BenefitsMonica ValentinaNo ratings yet

- Option Commutation PensionDocument3 pagesOption Commutation Pensionbs singhNo ratings yet

- Back Home: Wheel India SCM Solutions PVT LTD D-27, Okhla Phase-1 New Delhi-110020Document1 pageBack Home: Wheel India SCM Solutions PVT LTD D-27, Okhla Phase-1 New Delhi-110020Irfan ShaikhNo ratings yet

- HartantoDocument1 pageHartantohartantotantoNo ratings yet

- SflUsiExtract 2Document104 pagesSflUsiExtract 2Thomas McgilvrayNo ratings yet

- Summary of Current Regional Daily Minimum Wage RatesDocument2 pagesSummary of Current Regional Daily Minimum Wage RatesRenEleponioNo ratings yet

- OT Request FormDocument1 pageOT Request FormMacq Trampe-ParoanNo ratings yet

- 02 AC212 Lecture 2-Labour PDFDocument22 pages02 AC212 Lecture 2-Labour PDFsengpisalNo ratings yet

- July Sep2Document34 pagesJuly Sep2Carlo NuqueNo ratings yet

- Minimum Wages ACT 1948: - Abhilasha Dixit - Sos in Management, Jiwaji UniversityDocument14 pagesMinimum Wages ACT 1948: - Abhilasha Dixit - Sos in Management, Jiwaji UniversityAbhilasha ShuklaNo ratings yet

- Payslip-RS Sentosa-Jul-2022-Nur Intan-OktaviyaniDocument1 pagePayslip-RS Sentosa-Jul-2022-Nur Intan-OktaviyaniDPD NASDEM Kab. BogorNo ratings yet

- OvertimeDocument2 pagesOvertimeMarla BarbotNo ratings yet

- Employee Costs in Software IndustryDocument7 pagesEmployee Costs in Software Industryapi-3702531No ratings yet

- Overtime Pay Refers To The Additional Compensation For Work Performed Beyond Eight (8) Hours A DayDocument3 pagesOvertime Pay Refers To The Additional Compensation For Work Performed Beyond Eight (8) Hours A DayMeghan Kaye LiwenNo ratings yet

- Minimum Wages Act 1948Document11 pagesMinimum Wages Act 1948amulyaavadhaniNo ratings yet

- Atributos Empleados Data SourceDocument3 pagesAtributos Empleados Data SourceJulio Rafael Olivos PuenteNo ratings yet

- BAHR 222 Final SummaryDocument9 pagesBAHR 222 Final SummaryMAILYN BRIGOLENo ratings yet