Professional Documents

Culture Documents

Partnership 41

Uploaded by

dasha limOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Partnership 41

Uploaded by

dasha limCopyright:

Available Formats

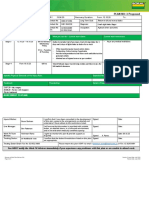

A and B entered into a partnership as of March 1,2009 by investing P125,000 and P75,000,

respectively, they agreed that A, as the managing partner, was to receive a salary; P30,000 per year

and a bonus computed at 10% of the net profit after adjustment for the salary; the balance of the profit

was to be distributed in the ratio of their original capital balances.On December 31,2009 account

balances were as follows:

Cash 70,000 Accounts Payable P60,000

Accounts receivable 67,000 A,capital 125,000

Furnitures and fixture 45,000 B,capital 75,000

Sales returns 5,000 A,drawing -20,000

Purchases 196,000 B,drawing -30,000

Operating expenses 60,000 Sales 233,000

Inventories on December 31, 2009 were as follows: supplies, P2,500, merchandise, P73,000, Prepaid

insurance was P950 while while accrued expenses were P1,550. Depreciation rate was 20% per year.

The partners' capital balances on December 31, 2009, after closing the net profit and drawing accounts,

were:

A B A B

a. P135,940 P47,960 c. P139,680 P48,680

b. P139,540 P49,860 d. P142,350 P47,670

ANSWER

Schedule 1- Computation and Distribution of Net Profit

Net Sales (P233,000-5,000) P228,000

Cost of Sales (P196,000-73,000) P123,000

Expenses:

Operating expense P60,000

Supplies -2,500

Prepaid insurance -950

Accrued expense 1,550

Depreciation (45,000 x 20% x 10 7,500 65,600 -188,600

Net profit P39,400

Distribution of Net Profit Total A B

Salary: (P30,000 x 10/12) P25,000 P25,000 P-

Bonus: (P39,400-P25,000) x 10 1,440 1,440 -

Remainder, at 5:3 12,960 8,100 4,860

Total P39,400 P34,540 P4,860

Partner's Capital balances, Dec. 31,2009: A B

Initial investments P125,000 P75,000

Share in Profit (Schedule 1) 34,540 4,860

Drawing -20,000 -30,000

Dec. 31,2005 capital balances P139,540 P49,860

You might also like

- Practical Accounting TwoDocument25 pagesPractical Accounting TwoJoseph SalidoNo ratings yet

- Pre-Quali Examination - Level III - Cluster C, PDF FSUU AccountingDocument13 pagesPre-Quali Examination - Level III - Cluster C, PDF FSUU AccountingRobert CastilloNo ratings yet

- Practical Accounting TwoDocument48 pagesPractical Accounting TwoFerdinand FernandoNo ratings yet

- (Ast) Iysb Quicknotes Afar Preweek 2021Document32 pages(Ast) Iysb Quicknotes Afar Preweek 2021Sandra DandingNo ratings yet

- FAR 2&3 Test BankDocument63 pagesFAR 2&3 Test BankRachelle Isuan TusiNo ratings yet

- Drill Problems - ConsolidationDocument6 pagesDrill Problems - Consolidationgun attaphanNo ratings yet

- Cpa Review School of The Philippines ManilaDocument4 pagesCpa Review School of The Philippines Manilaxara mizpahNo ratings yet

- Chapters-1-10-Exam-Problem (2) Answer JessaDocument6 pagesChapters-1-10-Exam-Problem (2) Answer JessaLynssej BarbonNo ratings yet

- BADNEWS!Document4 pagesBADNEWS!Janella CastroNo ratings yet

- Cash To Accrual ProblemsDocument10 pagesCash To Accrual ProblemsAmethystNo ratings yet

- Practice Problems: C. The Consolidated Total Assets After The Combination Is P6,116,250Document5 pagesPractice Problems: C. The Consolidated Total Assets After The Combination Is P6,116,250Will Emmanuel A PinoyNo ratings yet

- OperationDocument6 pagesOperationKenncy50% (2)

- #Test Bank - Finc - L Acctg. 2 - 3 (V)Document34 pages#Test Bank - Finc - L Acctg. 2 - 3 (V)Nhaj100% (1)

- RESA 1st PBDocument9 pagesRESA 1st PBRay Mond0% (1)

- AttDocument8 pagesAttKath LeynesNo ratings yet

- Fin ExamDocument6 pagesFin ExamKissesNo ratings yet

- SM07 4thExamReview 054702Document4 pagesSM07 4thExamReview 054702Hilarie JeanNo ratings yet

- IR 2 - Mod 6 Bus Combi FinalDocument4 pagesIR 2 - Mod 6 Bus Combi FinalLight Desire0% (1)

- 1 1 2-Partnership-OperationDocument14 pages1 1 2-Partnership-OperationCundangan, Denzel Erick S.No ratings yet

- DocxDocument16 pagesDocxJustin NoladaNo ratings yet

- Partnership OperationDocument3 pagesPartnership OperationBianca Iyiyi0% (1)

- Toaz - Info Joint Venture Quizzers PRDocument4 pagesToaz - Info Joint Venture Quizzers PRMark Anthony BabaoNo ratings yet

- Installment SalesDocument12 pagesInstallment SalesJocel Ann GuerraNo ratings yet

- Test Bank Advanced Acctg. I Antonio Dayag: D. A, P65,000 B, P81,000Document45 pagesTest Bank Advanced Acctg. I Antonio Dayag: D. A, P65,000 B, P81,000We WNo ratings yet

- Acc7 q1Document2 pagesAcc7 q1Jao FloresNo ratings yet

- AFAR-01A (Supplemental Material To Partnership Accounting)Document2 pagesAFAR-01A (Supplemental Material To Partnership Accounting)Maricris AlilinNo ratings yet

- Teamprtc Mock Board Oct 2020 Afar PDFDocument16 pagesTeamprtc Mock Board Oct 2020 Afar PDFBryle EscosaNo ratings yet

- AFAR 1st PB PDFDocument11 pagesAFAR 1st PB PDFrav dano100% (1)

- Minglana, Mitch T. (Quiz 1)Document6 pagesMinglana, Mitch T. (Quiz 1)Mitch Tokong MinglanaNo ratings yet

- P1 2ND Preboard PDFDocument9 pagesP1 2ND Preboard PDFmaria evangelistaNo ratings yet

- Ansay, Allyson Charissa T - Activity 4Document14 pagesAnsay, Allyson Charissa T - Activity 4Allyson Charissa AnsayNo ratings yet

- Review MCQDocument2 pagesReview MCQKrista FloresNo ratings yet

- Resa p1 First PB 1015Document21 pagesResa p1 First PB 1015Din Rose GonzalesNo ratings yet

- Corporate Liquidation & Joint Venture2Document5 pagesCorporate Liquidation & Joint Venture2jjjjjjjjjjjjjjjNo ratings yet

- BusCom SubsequentDocument7 pagesBusCom SubsequentDianeL.ChuaNo ratings yet

- Pamantasan NG Cabuyao: Katapatan Subd., Banay Banay, City of CabuyaoDocument5 pagesPamantasan NG Cabuyao: Katapatan Subd., Banay Banay, City of CabuyaoLyca SorianoNo ratings yet

- Practical Accounting 2Document4 pagesPractical Accounting 2RajkumariNo ratings yet

- Cebu CPAR Center: C.C.P.A.R. Practical Accounting Problems 1 - PreweekDocument23 pagesCebu CPAR Center: C.C.P.A.R. Practical Accounting Problems 1 - PreweekIzzy BNo ratings yet

- NFJPIA Mockboard 2011 P2Document6 pagesNFJPIA Mockboard 2011 P2ELAIZA BASHNo ratings yet

- Special TransactionsDocument5 pagesSpecial TransactionsJehannahBarat100% (1)

- ABC FinalsDocument10 pagesABC Finalsnena cabañesNo ratings yet

- Pre-Test 4Document3 pagesPre-Test 4BLACKPINKLisaRoseJisooJennieNo ratings yet

- Examination About Investment 4Document3 pagesExamination About Investment 4BLACKPINKLisaRoseJisooJennieNo ratings yet

- Ia2 QuestionsDocument6 pagesIa2 QuestionsSharjaaahNo ratings yet

- Questions Problems Pre BQTAP 2018 2019Document12 pagesQuestions Problems Pre BQTAP 2018 2019GuinevereNo ratings yet

- PartnershipDocument4 pagesPartnershipComan Nocat Eam83% (6)

- Review On AfarDocument4 pagesReview On AfarKenneth Christian WilburNo ratings yet

- IA2 Finals ReviewerDocument6 pagesIA2 Finals ReviewerJoana MarieNo ratings yet

- 2601 PartnershipsDocument57 pages2601 PartnershipsMerdzNo ratings yet

- Acp 101 MexamDocument5 pagesAcp 101 MexamLyca SorianoNo ratings yet

- AC15 Quiz 2Document6 pagesAC15 Quiz 2Kristine Esplana Toralde100% (1)

- Afar Short Quiz Business Combination 01Document3 pagesAfar Short Quiz Business Combination 01Sharmaine Clemencio0No ratings yet

- Review Problems With AnswersDocument5 pagesReview Problems With AnswersGelai BatadNo ratings yet

- Test Bank For Managerial Accounting 7thDocument7 pagesTest Bank For Managerial Accounting 7thKarlo D. ReclaNo ratings yet

- Audit of Financial Statement PresentationDocument7 pagesAudit of Financial Statement PresentationHasmin Saripada Ampatua100% (1)

- AuditingDocument106 pagesAuditingdasha limNo ratings yet

- Types of ProbabilityDocument17 pagesTypes of Probabilitydasha limNo ratings yet

- (2 Points) : True FalseDocument11 pages(2 Points) : True Falsedasha limNo ratings yet

- December 2014: FOB Term Date Shipped Date Received Invoice Number AmountDocument8 pagesDecember 2014: FOB Term Date Shipped Date Received Invoice Number Amountdasha limNo ratings yet

- Prelim ExamDocument5 pagesPrelim Examdasha limNo ratings yet

- ADV ACCTG Theories1946Document4 pagesADV ACCTG Theories1946dasha limNo ratings yet

- Partnership 42Document1 pagePartnership 42dasha limNo ratings yet

- La Liga Filipina Discourse Analysis WorkshopDocument3 pagesLa Liga Filipina Discourse Analysis Workshopdasha limNo ratings yet

- NonesDocument15 pagesNonesMary Rose Nones100% (3)

- This Study Resource Was: Pas 41 - AgricultureDocument3 pagesThis Study Resource Was: Pas 41 - Agriculturedasha limNo ratings yet

- This Study Resource Was Shared Via: Discourse Analysis WorkshopDocument2 pagesThis Study Resource Was Shared Via: Discourse Analysis Workshopdasha limNo ratings yet

- E20 Derivatives PDFDocument4 pagesE20 Derivatives PDFdasha limNo ratings yet

- FUYP+RZP CieloDocument19 pagesFUYP+RZP CieloCarlos ManriquezNo ratings yet

- Survey of Processes For High Temperature-High Pressure Gas Purification - OCR PDFDocument241 pagesSurvey of Processes For High Temperature-High Pressure Gas Purification - OCR PDFChristopher BrownNo ratings yet

- Valid Arguments For Tariffs or Export SubsidiDocument1 pageValid Arguments For Tariffs or Export SubsidiTrang Chử ThuNo ratings yet

- Integral Representations For Jacobi Polynomials and Some ApplicationsDocument27 pagesIntegral Representations For Jacobi Polynomials and Some ApplicationsRaja SNo ratings yet

- General: Preferred Jobs To Work (Position(s) You Want To Apply For)Document4 pagesGeneral: Preferred Jobs To Work (Position(s) You Want To Apply For)voodoonsNo ratings yet

- Schubert String Trio in BB D471Document4 pagesSchubert String Trio in BB D471Ethan BalakrishnanNo ratings yet

- Formative Assessment Impact of IrDocument3 pagesFormative Assessment Impact of Irapi-738511179No ratings yet

- Caterpillar 750Document5 pagesCaterpillar 750esilva2021No ratings yet

- General Deductions (Under Section 80) : Basic Rules Governing Deductions Under Sections 80C To 80UDocument67 pagesGeneral Deductions (Under Section 80) : Basic Rules Governing Deductions Under Sections 80C To 80UVENKATESAN DNo ratings yet

- COMPUTER ETHICS - An Introduction - 2Document14 pagesCOMPUTER ETHICS - An Introduction - 2Zheb Herb WebNo ratings yet

- 10th Grade Mural City Text - QuestionsDocument2 pages10th Grade Mural City Text - QuestionsMohammed YahyaNo ratings yet

- Ocean Climate Change EssayDocument2 pagesOcean Climate Change EssayRahmad RivaldiNo ratings yet

- D7250D7250M 30432Document7 pagesD7250D7250M 30432darebusi1No ratings yet

- Electronics For IT Ch2 20212 P3Document39 pagesElectronics For IT Ch2 20212 P3Thành Bùi VănNo ratings yet

- IOS Configuration HSRPDocument7 pagesIOS Configuration HSRPaossereNo ratings yet

- 2020-Biochem-Activity-17 Clinical ChemDocument24 pages2020-Biochem-Activity-17 Clinical ChemGabrielle John HernaezNo ratings yet

- Chapter 8 - Profit MaximizationDocument93 pagesChapter 8 - Profit MaximizationRoshan BhattaNo ratings yet

- Radical Change in Installing Floating WindfarmsDocument17 pagesRadical Change in Installing Floating WindfarmsBenoit BriereNo ratings yet

- Microwave Decontamination of ConcreteDocument8 pagesMicrowave Decontamination of ConcreteAndres ForeroNo ratings yet

- France - Airbus : A Web Based Case StudyDocument13 pagesFrance - Airbus : A Web Based Case Studyvijaysingh_83No ratings yet

- Subledger Accounting Cost Management DetailsDocument15 pagesSubledger Accounting Cost Management Detailszeeshan780% (1)

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument2 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceLoan LoanNo ratings yet

- ch-7 Gravitation PDFDocument15 pagesch-7 Gravitation PDFSuraj BiswalNo ratings yet

- Section-14 Durability r1Document8 pagesSection-14 Durability r1EENo ratings yet

- Route Venue FinalDocument52 pagesRoute Venue FinalYocobSamandrewsNo ratings yet

- Factors Affecting Online Buying BehaviorDocument17 pagesFactors Affecting Online Buying BehaviorJohn DoeNo ratings yet

- Recover at Work Plan 5 ProposedDocument2 pagesRecover at Work Plan 5 ProposedSiosiana DenhamNo ratings yet

- 10251company Profile PDFDocument3 pages10251company Profile PDFkavenindiaNo ratings yet

- Apple, Google, and Facebook Battle For Your Internet ExperienceDocument4 pagesApple, Google, and Facebook Battle For Your Internet ExperienceMariana AngeLia100% (1)

- ! Free Discord Nitro Codes Generator 2021 - Latest WORKING 100%Document2 pages! Free Discord Nitro Codes Generator 2021 - Latest WORKING 100%nonohaxkingNo ratings yet