Professional Documents

Culture Documents

Bond Issued at A Premium - Straight Line Method

Bond Issued at A Premium - Straight Line Method

Uploaded by

jack petersOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bond Issued at A Premium - Straight Line Method

Bond Issued at A Premium - Straight Line Method

Uploaded by

jack petersCopyright:

Available Formats

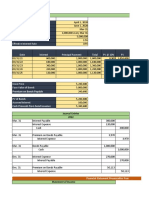

BOND ISSUED AT A PREMIUM - STRAIGHT LINE METHOD

The amount of premium in this case, is evenly distributed among the semi-annual periods.

Amount to be debited to Premium on Bonds Payable Account is obtained by dividing the

premium by the number of semi-annual periods in the bond agreement. The amount of interest

expense would be equal throughout the semi-annual period on the bond agreement.

Venture Company bond issued;

The stated rate of the bond = 10%

10 %

The interest is payable semi-annually hence periodic interest of the bond is = = 5%

2

The amount of interest payable semi-annually is = 5% × 600,000 = 30000

600000

The par value of the bond is = 100, hence the no. of bonds = = 6000

100

The market value of the bond = 103, hence the bond proceeds is = 6000 × 103 = 618000

The Face value of the bond = 600000

Therefore, the amount of premium on the bond = 618000 – 600000 = 18000

18000

Premium amortization over 20 years semi-annually on straight line basis = = 450

40

Hence, interest expense paid semi-annually for 20 years = interest (30000) – semi-annual

premium amortized (450) = 29550

a)

Journal Entries for a Bond Sold at a Premium – Straight Line Method

Date Account name Debit Credit

1-Jan-2017 Cash 618,000

Premium on Bond payable 18000

Bond payable 600000

(To record issuance of bond at a premium)

b)

Date Account name Debit Credit

30-Jun-2017 Interest Expense 29550

Premium on Bonds Payable 450

Cash 30000

(To record payment of the first interest and the amortization of bond premium)

c)

Date Account name Debit Credit

31-Dec-2037 Interest Expense 29550

Premium on Bonds Payable 450

Cash 30000

(To record payment of the last interest and the amortization of bond premium)

d)

Date Account name Debit Credit

31-Dec-2037 Bonds Payable 600000

Cash 600000

(To record retirement of the bonds at maturity)

You might also like

- Final Grading Exam - Key AnswersDocument35 pagesFinal Grading Exam - Key AnswersJEFFERSON CUTE97% (32)

- LQ 1 - Set A SolutionDocument14 pagesLQ 1 - Set A SolutionChristina Jazareno64% (11)

- Intermediate Accounting 2Document27 pagesIntermediate Accounting 2CARMINA SANCHEZNo ratings yet

- Fa 2 1Document8 pagesFa 2 1Quỳnh Anh NguyễnNo ratings yet

- Ch08 Harrison 8e GE SM (Revised)Document102 pagesCh08 Harrison 8e GE SM (Revised)Muh BilalNo ratings yet

- Harrison FA IFRS 11e CH09 SMDocument106 pagesHarrison FA IFRS 11e CH09 SMShako GrdzelidzeNo ratings yet

- Audit of Long Term Liabilities 2Document5 pagesAudit of Long Term Liabilities 2Cesar EsguerraNo ratings yet

- Loans Receivable ReviewerDocument3 pagesLoans Receivable ReviewerWilliam TabuenaNo ratings yet

- Module - IA Chapter 6Document10 pagesModule - IA Chapter 6Kathleen EbuenNo ratings yet

- Ia2 Final Exam A Test Bank - CompressDocument32 pagesIa2 Final Exam A Test Bank - CompressFiona MiralpesNo ratings yet

- 2020 Black Dwarf Company: Problem 7 Bonds Payable - Straight Line Method Journal Entries Date Account Title & ExplanationDocument7 pages2020 Black Dwarf Company: Problem 7 Bonds Payable - Straight Line Method Journal Entries Date Account Title & ExplanationLovely Anne Dela CruzNo ratings yet

- Accounting 1Document10 pagesAccounting 1Jay EbuenNo ratings yet

- Financial Liabilities ProblemsDocument20 pagesFinancial Liabilities ProblemsEvelyn LabhananNo ratings yet

- Financial Instruments: Scope and DefinitionsDocument168 pagesFinancial Instruments: Scope and Definitionskiran gNo ratings yet

- Ia PPT 6Document20 pagesIa PPT 6lorriejaneNo ratings yet

- Bonds PayableDocument13 pagesBonds PayablePrincess Grace M. BaricuatroNo ratings yet

- Answers Part2Document1 pageAnswers Part2Jamaica DavidNo ratings yet

- BAT Unit 5 AssignmentDocument14 pagesBAT Unit 5 AssignmentTalhah WaleedNo ratings yet

- Chapter 6 - Notes ReceivableDocument5 pagesChapter 6 - Notes ReceivableTurks100% (1)

- Notes PayablesDocument9 pagesNotes Payablesdarlenesolayao3301No ratings yet

- Chapter 9 - Discounting of Note ReceivableDocument5 pagesChapter 9 - Discounting of Note ReceivableLorence IbañezNo ratings yet

- Date of Bonds Date of Issue Interest Payment Dates Marurity Face Value Nominal Rate Effective Interest RateDocument5 pagesDate of Bonds Date of Issue Interest Payment Dates Marurity Face Value Nominal Rate Effective Interest RateJa RedNo ratings yet

- 7 Loan ReceivableDocument10 pages7 Loan ReceivableAYEZZA SAMSONNo ratings yet

- Notes ReceivableDocument47 pagesNotes ReceivableAlexandria Ann FloresNo ratings yet

- Paranoid Company Journal Entries: Date Account Title and ExplanationDocument8 pagesParanoid Company Journal Entries: Date Account Title and ExplanationKristel FieldsNo ratings yet

- AE 16 Solutions To Chapter 5 2 1Document10 pagesAE 16 Solutions To Chapter 5 2 1Miles CastilloNo ratings yet

- IA - Receivables Addtl ConceptsDocument3 pagesIA - Receivables Addtl ConceptsDiana AcostaNo ratings yet

- Me AnswersDocument9 pagesMe Answersgabprems11No ratings yet

- Chapter 4 Investments in Debt Securities and Other Long-Term InvestmentDocument11 pagesChapter 4 Investments in Debt Securities and Other Long-Term Investmentpapajesus papaNo ratings yet

- FAR 1 Chapter - 6Document13 pagesFAR 1 Chapter - 6Klaus DoNo ratings yet

- Loan ImpairmentDocument8 pagesLoan ImpairmentPaolo Immanuel OlanoNo ratings yet

- Chapter8 Note PayableDocument24 pagesChapter8 Note PayableKristine Joy Peñaredondo BazarNo ratings yet

- Current Liabilities - PROBLEMSDocument11 pagesCurrent Liabilities - PROBLEMSIra Grace De Castro100% (2)

- IA2 Worksheet-BONDS PAYABLE - 101010Document11 pagesIA2 Worksheet-BONDS PAYABLE - 101010aehy lznuscrfbjNo ratings yet

- FAR-07 Trade & Other PayableDocument3 pagesFAR-07 Trade & Other PayableKim Cristian MaañoNo ratings yet

- Problem 5-3 Requirement 1 2020Document7 pagesProblem 5-3 Requirement 1 2020Adyagila Ecarg NelehNo ratings yet

- Fin Acc 2 Chap 7Document10 pagesFin Acc 2 Chap 7MkaeDizonNo ratings yet

- Tutor UasDocument13 pagesTutor UasHENDY YUDHA PRAMANANo ratings yet

- Bond Retirement Prior To Maturity A. Illustration 1 - Straight LineDocument27 pagesBond Retirement Prior To Maturity A. Illustration 1 - Straight Linephoebelyn acdogNo ratings yet

- Harrison Fa Ifrs 11e Ch09 SMDocument107 pagesHarrison Fa Ifrs 11e Ch09 SMAshleyNo ratings yet

- LQ 1 Sec C Solution PDFDocument14 pagesLQ 1 Sec C Solution PDFmaria evangelistaNo ratings yet

- 5 27 LoansDocument9 pages5 27 LoansRengeline LucasNo ratings yet

- LQ 1 - Set A Solution PDF Bonds (Finance) ADocument2 pagesLQ 1 - Set A Solution PDF Bonds (Finance) AeaeNo ratings yet

- Ans: A) Journal Entry On Date of Issue Date Account DR CRDocument4 pagesAns: A) Journal Entry On Date of Issue Date Account DR CRHumera AkbarNo ratings yet

- Problem 5 On Loan ReceivableDocument6 pagesProblem 5 On Loan Receivablebm1ma.allysaamorNo ratings yet

- Intacc2-Quiz ExamDocument10 pagesIntacc2-Quiz ExamCmNo ratings yet

- L.T. LiabilitiesDocument18 pagesL.T. LiabilitiesMustafa Bin ShakeelNo ratings yet

- L.T. LiabilitiesDocument18 pagesL.T. LiabilitiesNaeemullah baigNo ratings yet

- Chapter 14 QuizDocument7 pagesChapter 14 QuizSherri BonquinNo ratings yet

- 13 Acctg Ed 1 - Loan ReceivableDocument17 pages13 Acctg Ed 1 - Loan ReceivableNath BongalonNo ratings yet

- Liabilities - ManuDocument7 pagesLiabilities - ManuClara MacallingNo ratings yet

- Module 5-NOTE PAYABLE AND DEBT RESTRUCTUREDocument13 pagesModule 5-NOTE PAYABLE AND DEBT RESTRUCTUREJeanivyle Carmona100% (1)

- BONEO Pup Receivables3 SRC 2 1Document13 pagesBONEO Pup Receivables3 SRC 2 1hellokittysaranghaeNo ratings yet

- Notes Payable and Debt Restructuring (Ruma, Jamaica)Document14 pagesNotes Payable and Debt Restructuring (Ruma, Jamaica)Jamaica RumaNo ratings yet

- Adv Accounting 100 Imp Questions 1642420796 PDFDocument179 pagesAdv Accounting 100 Imp Questions 1642420796 PDFsigeshNo ratings yet

- Hand Out 1 Practice SetDocument6 pagesHand Out 1 Practice SetLayka ResorezNo ratings yet

- Audit of LiabilitiesDocument6 pagesAudit of LiabilitiesandreamrieNo ratings yet

- Personal Money Management Made Simple with MS Excel: How to save, invest and borrow wiselyFrom EverandPersonal Money Management Made Simple with MS Excel: How to save, invest and borrow wiselyNo ratings yet

- Upto Baumol ModelDocument18 pagesUpto Baumol ModelShaikh Saifullah KhalidNo ratings yet

- Do Current CMBS Pricing Conventions Make Sense?Document3 pagesDo Current CMBS Pricing Conventions Make Sense?ii_xi6481100% (1)

- Pak Country en Excel v2Document579 pagesPak Country en Excel v2Diana RoseyNo ratings yet

- Business Plan - KitaKit's Food ProductsDocument24 pagesBusiness Plan - KitaKit's Food ProductsRocky Lee MoscosoNo ratings yet

- Taxation Review Final Income TaxDocument4 pagesTaxation Review Final Income TaxGendyBocoNo ratings yet

- Portfolio Management'Document99 pagesPortfolio Management'sumesh894No ratings yet

- ESENECO 2 Interest Money Time Relationship Rev1Document49 pagesESENECO 2 Interest Money Time Relationship Rev1Irah BonifacioNo ratings yet

- SCHV AnnDocument757 pagesSCHV AnnsajithcsNo ratings yet

- P4 Chapter 04 Risk Adjusted WACC and Adjusted Present Value PDFDocument45 pagesP4 Chapter 04 Risk Adjusted WACC and Adjusted Present Value PDFasim tariqNo ratings yet

- Chapter 1 Introduction To Engineering EconomyDocument55 pagesChapter 1 Introduction To Engineering EconomySha IraNo ratings yet

- Bareng Vs CADocument2 pagesBareng Vs CAReth GuevarraNo ratings yet

- Given: J 9.84 % Anually I Required: Solution: I Let I J N I J NDocument3 pagesGiven: J 9.84 % Anually I Required: Solution: I Let I J N I J NHarabas BlackNo ratings yet

- A Macroeconomic Analysis of IndiaDocument21 pagesA Macroeconomic Analysis of IndiaJehangir KhambataNo ratings yet

- 1308 - Mutuality of ContractsDocument3 pages1308 - Mutuality of ContractsSarah Jane UsopNo ratings yet

- Foreign Exchange Hedging HCL TechDocument61 pagesForeign Exchange Hedging HCL TechNilesh Mandlik100% (1)

- Memorandum of Agreement Amongst: (Nabard)Document19 pagesMemorandum of Agreement Amongst: (Nabard)reldly sammiNo ratings yet

- Analysis of Financial StatementsDocument12 pagesAnalysis of Financial StatementsMulia PutriNo ratings yet

- 9 CMA Rev. Cash Flow StatementDocument15 pages9 CMA Rev. Cash Flow StatementSakshiNo ratings yet

- Financial Markets and Institutions 8th Edition Mishkin Solutions ManualDocument8 pagesFinancial Markets and Institutions 8th Edition Mishkin Solutions Manualmichaelkrause22011998gdj100% (33)

- LIC Housing Finance LimitedDocument5 pagesLIC Housing Finance LimitedVijay SinghNo ratings yet

- University of Mauritius: Faculty of Law and ManagementDocument10 pagesUniversity of Mauritius: Faculty of Law and ManagementMîñåk ŞhïïNo ratings yet

- Income-Tax-Calculator 2023-24Document8 pagesIncome-Tax-Calculator 2023-24AlokNo ratings yet

- Fsa 2012 16Document190 pagesFsa 2012 16Muhammad Shahzad IjazNo ratings yet

- Chapter 7 Unemployment, Inflation, and Long-Run GrowthDocument21 pagesChapter 7 Unemployment, Inflation, and Long-Run GrowthNataly FarahNo ratings yet

- Chapter 4Document7 pagesChapter 4Gilang PurwoNo ratings yet

- Project Report For Pgdba FinanceDocument74 pagesProject Report For Pgdba FinanceAmit DwivediNo ratings yet

- Chapter 1 - Accounting For PartnershipDocument13 pagesChapter 1 - Accounting For PartnershipKim EllaNo ratings yet

- SLF066 CalamityLoanApplicationForm V03 PDFDocument2 pagesSLF066 CalamityLoanApplicationForm V03 PDFKram Tende AwanucavNo ratings yet

- Page 18 To 19Document2 pagesPage 18 To 19Judith CastroNo ratings yet

- Welcome To The Presentation On: Solving Case StudyDocument25 pagesWelcome To The Presentation On: Solving Case Studyমেহের আব তমালNo ratings yet