Professional Documents

Culture Documents

Final Exam July 2021 QQ

Uploaded by

Lampard AimanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Final Exam July 2021 QQ

Uploaded by

Lampard AimanCopyright:

Available Formats

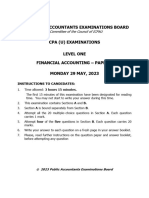

CONFIDENTIAL 1 AC/JUL 2021/FAR210

UNIVERSITI TEKNOLOGI MARA

FINAL EXAMINATION

COURSE : FINANCIAL ACCOUNTING 3

COURSE CODE : FAR210

EXAMINATION : JULY 2021

TIME : 3 HOURS

INSTRUCTIONS TO CANDIDATES

1. This question paper consists of five (5) questions.

2. Answer ALL questions. Start each answer on a new page.

3. Answer ALL questions in English.

4. Please submit the Answer online.

5. HONESTY DECLARATION: Please read, understand and tick (√) all boxes:

( ) I declare that I have observed and will adhere to the Faculty Online Assessment Regulations

or any of the Chief Invigilator / Invigilators’ instructions. If found otherwise, I can be barred

from taking the assessment or can be brought to the Student Disciplinary Action Board.

( ) I do understand that I can be penalised under Rules 48, Act 174 of the Educational Institutions

(Discipline) Act 1976 as at 1 November 2012 or other enforceable Acts, and can be charged

with a maximum penalty of dismissal from the University if I am found guilty of a disciplinary

offence.

( ) I declare that all answers on this assessment are based on my own work and effort that

depicted to the best level of my knowledge. I do not copy other student’s answer neither

collaborate nor communicate with anyone via any kind of medium communication.

DO NOT TURN THIS PAGE UNTIL YOU ARE TOLD TO DO SO

This examination paper consists of 8 pages

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 2 AC/JUL 2021/FAR210

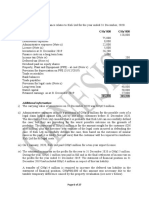

QUESTION 1

The following is the trial balance of Rinee Bhd as at 31 December 2020:

DR (RM) CR (RM)

Sales 9,800,900

Cost of sales 5,890,700

Administrative expenses 1,250,650

Distribution expenses 856,460

Directors' fees 758,000

Tax paid 89,000

Interim ordinary dividend 25,000

Bank 659,000

Accounts receivable and payable 76,300 45,870

Ordinary share capital 2,500,000

Retained profit as at 31 December 2019 1,339,840

Assets Revaluation Reserve as at 31 December 2019 65,000

10% Debentures 315,000

Income from investment 54,000

Other income 5,600

Fixed Deposit 40,000

Investment 650,000

Land 2,560,000

Building (cost) 890,000

Plant and machinery (cost) 650,000

Motor vehicle (cost) 415,000

Accumulated depreciation as at 31 December 2019:

Building 325,000

Plant and machinery 260,000

Motor vehicles 345,000

Allowance for impairment of trade receivables as at 31

December 2019 18,900

Inventories (at cost) as at 31 December 2020 265,000

15,075,110 15,075,110

Additional information:

1. Depreciation expenses for the property, plant and equipment are to be provided on

yearly basis as follows:

Building 2% on cost

Plant and machinery 20% on carrying amount

Motor vehicle 10% on cost

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 3 AC/JUL 2021/FAR210

Depreciation on building, plant and equipment are to be treated as administrative

expenses while depreciation on motor vehicle is to be treated as distribution expenses.

Land is not depreciated.

2. An independent valuer revalued the land at RM3,000,000. The directors decided to

incorporate the new value in the books of Rinee Bhd for the year ended 31 December

2020.

3. As at 31 December 2020, the net realisable value for the inventory was RM260,000.

4. The following transactions are to be recorded in the company’s books:

a. On 5 May 2020, the company decided to issue 1,000,000 units of ordinary shares

at RM2.00 per share to finance its new projects. All shares were fully subscribed.

b. Auditor’s fee outstanding amounted to RM35,000.

c. There is an outstanding of debenture interest for the year.

5. Allowance for impairment of trade receivables at the year-end was RM21,250.

6. Taxation expenses for the year was estimated at RM92,000.

Required:

a. Prepare the following financial statements in accordance with the requirement of

Companies Act 2016 and MFRS 101 Presentation of Financial Statement and other

relevant Malaysian Financial Reporting Standards:

i. Statement of Profit or Loss and Other Comprehensive Income for the year ended

31 December 2020.

(8 marks)

ii. Statement of Changes in Equity for the year ended 31 December 2020.

(5 marks)

iii. Statement of Financial Position as at 31 December 2020.

.

(8 marks)

b. Prepare a note on property, plant and equipment.

(6 marks)

(Total: 27 marks)

QUESTION 2

Enoki Bhd specialises in the production of high-quality medical tools and small appliances and

operates in Tasek Industrial Park. Due to the increasing demand for healthcare facilities and

appliances, the company receives high demand for the medical appliances. In order to meet

the increasing demand, the company purchased a specialised equipment on 21 May 2017.

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 4 AC/JUL 2021/FAR210

Details of the cost incurred are as follows:

RM

Purchase price 2,400,000

Import duty 25,200

Engineer fees 12,900

Pre – production testing 9,800

Shipping and transportation cost 11,900

Enoki Bhd received a trade discount of 5% from the purchase price. The specialised

equipment has an estimated useful life of ten years with no residual value and to be

depreciated on a straight-line method, monthly basis. The company closes its accounts on 31

December each year.

On 30 October 2020, due to cost ineffective of maintaining the specialised equipment the

company sold the specialised equipment at RM1,450,500.

Required:

a. Explain briefly whether the specialised equipment is an asset of Enoki Bhd in

accordance with the Malaysian Conceptual Framework for Financial Reporting.

(4 marks)

b. Explain briefly whether the specialised equipment satisfies the definition of property,

plant and equipment in accordance with the MFRS116 Property, Plant and Equipment.

(4 marks)

c. Compute the initial cost of the specialised equipment.

(5 marks)

d. Calculate depreciation on the specialised equipment for the year ended 31 December

2017.

(3 marks)

e. Assess whether the company can derecognise the specialised equipment in accordance

with MFRS116 Property, Plant and Equipment.

(5 marks)

f. Recommend the accounting treatment for the disposal of specialized equipment to the

management of Enoki Bhd.

(5 marks)

(Total: 26 marks)

QUESTION 3

Green Glove Bhd is a trading company located at Kota Bharu, Kelantan. The following

transactions were extracted from its book of accounts for the year ended 31 December 2020:

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 5 AC/JUL 2021/FAR210

Date Transactions

1 January 2020 The allowance for impairment of trade receivables amounted to

RM12,000.

10 January 2020 Issued invoice of RM200,000 for goods delivered to Rubber4U Bhd

on credit

15 May 2020 Sold goods worth RM60,000 to Unggul Pharmacy and accepted a 60-

day, 10% note in full payment upon delivery of goods on the same

day.

10 September 2020 Rubber4U Bhd is declared bankrupt. Only 80% of the amount owed

is collected. The company’s director decided to write off the remaining

amount as uncollectible.

31 December 2020 Amount of receivables at the end of the year amounted to

RM750,000.

Required:

a. Identify whether the transactions on 10 January 2020 and 15 May 2020 give rise

to financial assets.

(3 marks)

b. Discuss briefly the two (2) types of receivables that arise on 10 January 2020 and

15 May 2020.

(2 marks)

c. Determine the necessary journal entries to record the above transactions for the

financial year ended 31 December 2020.

(5 marks)

d. Green Glove Bhd produced the following ageing analysis of receivables as at 31

December 2020:

Past due days Amount Expected credit loss rate (%)

outstanding (RM)

Within maturity 350,000 0.5

1 – 30 days 200,000 1

31 – 90 days 80,000 2

91 - 180 days 70,000 10

181 – 365 days 50,000 20

750,000

Green Glove Bhd estimated its expected credit loss rate based on its historical credit

loss experience and adjusted for forward-looking estimates.

Determine the amount of impairment of trade receivables to be recognized in the

Statement of Profit or Loss AND the net realizable of receivables to be disclosed in

the Statement of Financial Position as at 31 December 2020.

(5 marks)

(Total: 15 marks)

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 6 AC/JUL 2021/FAR210

QUESTION 4

Fast & Furious Bhd is a leading company in trading imported cars. The company imported two

sport car models namely SZ and RZ.

On 29 December 2020, due to an increasing demand from the local market, Fast & Furious

Bhd purchased two (2) additional units of sport cars model SZ from the main supplier in

Germany. Fast & Furious Bhd were charged with the normal invoice price and incurred regular

import duties, storage cost, and freight insurance in relation to this purchase. In the sales and

purchase agreement, it included a clause of FOB Destination. The two (2) sport cars model

SZ arrived at Fast & Furious Bhd business premise on 11 January 2021.

Required:

a. Identify whether the purchased of 2 units of sport car models SZ were items of

inventories of Fast & Furious Bhd as at financial year end 31 December 2020 in

accordance with MFRS102 Inventories.

(3 marks)

As at financial year end 31 December 2020, below are the details for the two (2) existing units

of sport cars at Fast & Furious Bhd’s showroom:

SZ (RM) RZ (RM)

Quantity 1 unit 1 unit

Invoiced price 386,900 588,343

Import duties 10,000 25,000

Storage cost 10,000 15,000

Freight insurance 10,100 17,657

Estimated market price 500,000 680,000

Carriage cost to sell 20,000 50,000

Required:

b. State three (3) components of cost of inventories in accordance with MFRS102

Inventories.

(3 marks)

c. Determine the value of the inventory on item-by-item basis as at financial year end 31

December 2020 in accordance with MFRS102 Inventories.

(6 marks)

(Total: 12 marks)

QUESTION 5

The following are the Statement of Financial Position and Statement of Profit or Loss of

Keriangan Bhd:

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 7 AC/JUL 2021/FAR210

Keriangan Bhd

Statement of Financial Position as at 31 December 2020 and 2019

2020 2019

(RM ‘000) (RM ‘000)

Non-current Assets

Property, plant and equipment (carrying value) 683,258 761,472

Current Assets

Inventory 526,592 587,594

Accounts receivable 472,000 400,938

Prepayments 13,714 15,528

Marketable securities 3,044 14,572

Cash and bank 69,512 175,768

TOTAL ASSETS 1,768,120 1,955,872

Equity

Share capital 285,530 285,530

Retained earnings 408,414 349,728

Other reserves 40,000 40,000

Non-current Liabilities

Bank loan 320,000 620,000

Current Liablities

Accounts payable 536,600 464,344

Tax payable 149,024 153,440

Dividend payable 28,552 42,830

TOTAL EQUITY AND LIABILITIES 1,768,120 1,955,872

Keriangan Bhd

Statement of Profit or Loss for the year ended 31 December 2020

RM’000

Revenue 6,791,982

Cost of Sales (6,319,290)

Gross Profit 472,692

Administrative expenses (299,110)

Distribution cost (4,770)

Operating profit 168,812

Finance cost (59,474)

Investment income 6,978

Profit before Tax 116,316

Tax expense (29,078)

Profit after Tax 87,238

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 8 AC/JUL 2021/FAR210

Additional Information:

1. Depreciation charge for the year was RM88,214,000 and the amount was included in

the administrative expenses.

2. Dividend payable of last year was paid this year.

3. Marketable securities were qualified as cash equivalents.

4. Prepayments were related to administrative expenses.

Required:

a. Prepare the Statement of Cash Flows for the year ended 31 December 2020 for

Keriangan Bhd using the DIRECT METHOD in accorance with MFRS107 Statement of

Cash Flows.

(16 marks)

b. Analyse the differences in preparing the Cash Flow Statement using the Direct Method

in contrast to preparing the Cash Flow Statement using the Indirect Method.

(4 marks)

(Total: 20 marks)

END OF QUESTION

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

You might also like

- Final Assessment Far210 Feb2021Document8 pagesFinal Assessment Far210 Feb2021Lampard AimanNo ratings yet

- Faculty - Accountancy - 2022 - Session 1 - Diploma - Far210Document8 pagesFaculty - Accountancy - 2022 - Session 1 - Diploma - Far210Bil hutNo ratings yet

- Far270 July2022Document8 pagesFar270 July2022Nur Fatin AmirahNo ratings yet

- Far270 February 22 FaDocument8 pagesFar270 February 22 FarumaisyaNo ratings yet

- Pfa3163 Set G QPDocument5 pagesPfa3163 Set G QPNur hidayah putriNo ratings yet

- FAR460 - Feb 2021 - Q - Set 1Document7 pagesFAR460 - Feb 2021 - Q - Set 1Ahmad Adlan Bin RosliNo ratings yet

- June 2019 QDocument8 pagesJune 2019 Q2024786333No ratings yet

- Aug 2022 Final Exam Far 160Document9 pagesAug 2022 Final Exam Far 160adreanamarsyaNo ratings yet

- Far270 Q Feb2021 FaDocument9 pagesFar270 Q Feb2021 Fa2024786333No ratings yet

- Question - Test Acc106 Mac 2021 - 2july2021Document4 pagesQuestion - Test Acc106 Mac 2021 - 2july2021Fara husnaNo ratings yet

- Universiti Teknologi Mara Final Examination: Confidential 1 AC/FEB 2022/FAR320Document7 pagesUniversiti Teknologi Mara Final Examination: Confidential 1 AC/FEB 2022/FAR3202021202082No ratings yet

- MC 4 - Deferred Tax - A231Document4 pagesMC 4 - Deferred Tax - A231Patricia TangNo ratings yet

- Far-I Autumn 2021 TsaDocument3 pagesFar-I Autumn 2021 TsaUsman AhmedNo ratings yet

- Cuac208 Tests and AssignmentsDocument8 pagesCuac208 Tests and AssignmentsInnocent GwangwaraNo ratings yet

- 301 AFA II PL III Question CMA June 2021 Exam.Document4 pages301 AFA II PL III Question CMA June 2021 Exam.rumelrashid_seuNo ratings yet

- Universiti Teknologi Mara Final Examination: Confidential AC/JUL 2022/FAR320Document7 pagesUniversiti Teknologi Mara Final Examination: Confidential AC/JUL 2022/FAR3202021202082No ratings yet

- (EN) Problem Mojakoe AK1Document11 pages(EN) Problem Mojakoe AK1gebbyNo ratings yet

- Financial Accounting Exam QuestionsDocument9 pagesFinancial Accounting Exam QuestionsdayahNo ratings yet

- MAY 2023 PATHFINDER - SKILLS LEVELDocument176 pagesMAY 2023 PATHFINDER - SKILLS LEVELBrian DhliwayoNo ratings yet

- Cib GH 04-23 Financial Reporting, Planning & Analysis Level Iii Page 1Document8 pagesCib GH 04-23 Financial Reporting, Planning & Analysis Level Iii Page 1lilliananne5051No ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/32Document8 pagesCambridge International AS & A Level: ACCOUNTING 9706/32Saram Shykh PRODUCTIONSNo ratings yet

- Far210 Fe Feb23Document8 pagesFar210 Fe Feb23ediza adhaNo ratings yet

- FAR570 - Q - August 2021Document7 pagesFAR570 - Q - August 2021NURUL NAZAHANNIE MOHAMAD NAJIBNo ratings yet

- CPA Paper 1 Financial Accounting 2Document9 pagesCPA Paper 1 Financial Accounting 2philipisingomaNo ratings yet

- March 2020 Diploma in Accountancy Programme Question and AnswerDocument102 pagesMarch 2020 Diploma in Accountancy Programme Question and Answerethel100% (1)

- Question Far270 Feb2021Document9 pagesQuestion Far270 Feb2021Nur Fatin AmirahNo ratings yet

- BAC1614 - 2110 - Final ExaminationDocument9 pagesBAC1614 - 2110 - Final ExaminationNABILA HADIFAH BINTI MOHAMAD PATHANNo ratings yet

- Fin430 - Dec2019Document6 pagesFin430 - Dec2019nurinsabyhahNo ratings yet

- Mba ZC415 Ec-3r First Sem 2022-2023Document4 pagesMba ZC415 Ec-3r First Sem 2022-2023Ravi KaviNo ratings yet

- B7AF102 2021 OMD1 First Sitting Exam PaperDocument10 pagesB7AF102 2021 OMD1 First Sitting Exam PaperAZLEA BINTI SYED HUSSIN (BG)No ratings yet

- © The Institute of Chartered Accountants of IndiaDocument7 pages© The Institute of Chartered Accountants of IndiaSarvesh JoshiNo ratings yet

- Accounting P1 NSC Nov 2020 EngDocument11 pagesAccounting P1 NSC Nov 2020 EngSweetness MakaLuthando LeocardiaNo ratings yet

- Finance, Accounting and Risk Management: Code: AMIL38Document9 pagesFinance, Accounting and Risk Management: Code: AMIL38ilayanambiNo ratings yet

- April AssignmentDocument9 pagesApril AssignmentMehrunisaChNo ratings yet

- ACC 2101 CA1 with Template (1)Document8 pagesACC 2101 CA1 with Template (1)deboevaniaNo ratings yet

- Abfa1513 220518Document6 pagesAbfa1513 220518CRYSTAL NGNo ratings yet

- Based on the information provided, prepare the Statement of Cash Flows for SintokTech Bhd for the year ended 31 December 2021 using the indirect methodDocument6 pagesBased on the information provided, prepare the Statement of Cash Flows for SintokTech Bhd for the year ended 31 December 2021 using the indirect methodNajihah RazakNo ratings yet

- MAN1068 Exam Paper 2021-22Document16 pagesMAN1068 Exam Paper 2021-22Praveena RavishankerNo ratings yet

- Far160 (CT XXX 2022) QuestionDocument4 pagesFar160 (CT XXX 2022) QuestionFarah HusnaNo ratings yet

- Universiti Teknologi Mara Final Assessment: Confidential 1 AC/JUL 2022/MAF503Document10 pagesUniversiti Teknologi Mara Final Assessment: Confidential 1 AC/JUL 2022/MAF503Alyn AdnanNo ratings yet

- FAR270 - FEB 2022 SolutionDocument8 pagesFAR270 - FEB 2022 SolutionNur Fatin AmirahNo ratings yet

- Act3129 - Past Years Exercises On Employee Benefits - Insolvency - Capital Recons - 3may2020Document9 pagesAct3129 - Past Years Exercises On Employee Benefits - Insolvency - Capital Recons - 3may2020Muadz KamaruddinNo ratings yet

- MSA 1 Winter2022Document16 pagesMSA 1 Winter2022gohar azizNo ratings yet

- BBF 313 Financial Reporting, Analysis and Planning: Code of The Name of The Module Date of Exam Time of Exam SetDocument4 pagesBBF 313 Financial Reporting, Analysis and Planning: Code of The Name of The Module Date of Exam Time of Exam Setkp107416No ratings yet

- Far410 Dec 2019Document8 pagesFar410 Dec 2019NurulHuda Auni Binti Ab RahmanNo ratings yet

- SPREADSHEET APPLICATIONS - PEA 2021-2022 SESSION - Case StudiesDocument8 pagesSPREADSHEET APPLICATIONS - PEA 2021-2022 SESSION - Case StudiesOladapo Oluwakayode AbiodunNo ratings yet

- P1 Auditing August 2020Document26 pagesP1 Auditing August 2020paul sagudaNo ratings yet

- Accounting's AssignmentDocument4 pagesAccounting's AssignmentLinhzin LinhzinNo ratings yet

- Test Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: AccountingDocument8 pagesTest Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: Accountingsunil1287No ratings yet

- Accounting P1 NSC Nov 2020 EngDocument12 pagesAccounting P1 NSC Nov 2020 EngTlhago PitseNo ratings yet

- Advanced Financial Reporting Key HighlightsDocument8 pagesAdvanced Financial Reporting Key HighlightssmlingwaNo ratings yet

- 1 2 3 4 5 6 7 8 MergedDocument78 pages1 2 3 4 5 6 7 8 MergedKartik GuptaNo ratings yet

- Test Series: April 2023 Mock Test Paper - 2 Intermediate: Group - I Paper - 1: AccountingDocument7 pagesTest Series: April 2023 Mock Test Paper - 2 Intermediate: Group - I Paper - 1: AccountingKartik GuptaNo ratings yet

- f2 Financial Accounting August 2015Document18 pagesf2 Financial Accounting August 2015Saddam HusseinNo ratings yet

- QUESTION 6 Financial Reporting May 2021 KOLIDocument6 pagesQUESTION 6 Financial Reporting May 2021 KOLILaud ListowellNo ratings yet

- FAR 160 Group Project Semester Mar 2023 - Jul 2023: Prepared By: Name Student Id 1. 2. 3. 4Document6 pagesFAR 160 Group Project Semester Mar 2023 - Jul 2023: Prepared By: Name Student Id 1. 2. 3. 4NUR NAJWA MURSYIDAH NAZRINo ratings yet

- 73507bos59335 Inter p1qDocument7 pages73507bos59335 Inter p1qRaish QURESHINo ratings yet

- Final FAR-2 Mock Q. PaperDocument6 pagesFinal FAR-2 Mock Q. PaperAli OptimisticNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Confidential 1 AC/TEST MAY 2021/FAR270Document5 pagesConfidential 1 AC/TEST MAY 2021/FAR270Lampard AimanNo ratings yet

- Universiti Teknologi Mara Common Test: Confidential 1 AC/MAY 2021/FAR270Document4 pagesUniversiti Teknologi Mara Common Test: Confidential 1 AC/MAY 2021/FAR270Lampard AimanNo ratings yet

- Mohamad Aiman Azraai Bin Haja Mydin - 2019276458 - Ac1103dDocument11 pagesMohamad Aiman Azraai Bin Haja Mydin - 2019276458 - Ac1103dLampard AimanNo ratings yet

- SS Jun 2012 Cashflow StatementDocument3 pagesSS Jun 2012 Cashflow StatementLampard AimanNo ratings yet

- Chapter 13 Solutions AccountingDocument8 pagesChapter 13 Solutions AccountingLaura Carson0% (1)

- Dr. Reddys Laboratories LTD.: Company ProfileDocument18 pagesDr. Reddys Laboratories LTD.: Company ProfileNIHAL KUMARNo ratings yet

- BLGF SRE Manual 2015 PDFDocument120 pagesBLGF SRE Manual 2015 PDFBench Bayan100% (1)

- IBIG 04 03 Projecting 3 StatementsDocument75 pagesIBIG 04 03 Projecting 3 StatementsCarloNo ratings yet

- Leac206 PDFDocument50 pagesLeac206 PDFbhaiNo ratings yet

- Walmart Inc. - Operating Model and Valuation - Cover Page and NavigationDocument24 pagesWalmart Inc. - Operating Model and Valuation - Cover Page and Navigationmerag76668No ratings yet

- CFA Level I - Financial Reporting and Analysis - SMG PDFDocument38 pagesCFA Level I - Financial Reporting and Analysis - SMG PDFFinTree Education Pvt Ltd94% (17)

- SCA Takeover Practice NoteDocument39 pagesSCA Takeover Practice NoteWai Hoe KhooNo ratings yet

- Ch13-Cash Flow STMDocument44 pagesCh13-Cash Flow STMAnonymous zXWxWmgZENo ratings yet

- Fundamentals of Accountancy Business and Management II Module 4Document4 pagesFundamentals of Accountancy Business and Management II Module 4Rafael RetubisNo ratings yet

- Chapter 6 Mini Case: SituationDocument9 pagesChapter 6 Mini Case: SituationUsama RajaNo ratings yet

- Statement of Cash Flows: Question InformationDocument48 pagesStatement of Cash Flows: Question InformationOKTAVIANAHURINGNo ratings yet

- BUSINESS PLAN (Final)Document24 pagesBUSINESS PLAN (Final)Dessay BersabalNo ratings yet

- Advanced Financial Accounting 10th Edition Christensen Solutions Manual DownloadDocument50 pagesAdvanced Financial Accounting 10th Edition Christensen Solutions Manual DownloadCecil Lombardo100% (17)

- Report Requirements and Rubric Case 2Document4 pagesReport Requirements and Rubric Case 22ffdsh4g9wNo ratings yet

- MCQ Conceptual Frame Work - 1Document16 pagesMCQ Conceptual Frame Work - 1Koko LaineNo ratings yet

- Chapter 2 Financial Statements and Accounting Concepts/PrinciplesDocument12 pagesChapter 2 Financial Statements and Accounting Concepts/PrinciplesJue WernNo ratings yet

- Solutions Manual: Financial Accounting: Reporting, Analysis and Decision MakingDocument61 pagesSolutions Manual: Financial Accounting: Reporting, Analysis and Decision MakingJeffrey Sanchez Rojas100% (2)

- Revision Questions - CH 17 - QuestionsDocument3 pagesRevision Questions - CH 17 - QuestionsMinh ThưNo ratings yet

- Computerized AccountingDocument50 pagesComputerized AccountingRam VasuNo ratings yet

- Simple Nonprofit Financial StatementDocument62 pagesSimple Nonprofit Financial StatementThabiso MosokotsoNo ratings yet

- CFI Jeff Schmidt - Analysis of Financial StatementsDocument7 pagesCFI Jeff Schmidt - Analysis of Financial StatementsDR WONDERS PIBOWEINo ratings yet

- Chemalite Inc cash flows statement Jan-Jun 2003Document9 pagesChemalite Inc cash flows statement Jan-Jun 2003pankyagr75% (4)

- Corporate Finance Linking Theory To What Companies Do 3rd Edition Graham Test BankDocument33 pagesCorporate Finance Linking Theory To What Companies Do 3rd Edition Graham Test Bankdeborahmatayxojqtgzwr100% (8)

- Wiley Cash FlowDocument6 pagesWiley Cash FlowkimmynotNo ratings yet

- Comparable Companies TemplateDocument23 pagesComparable Companies Templatesandeep chaurasiaNo ratings yet

- Solutions To End of Chapter ProblemsDocument176 pagesSolutions To End of Chapter Problemsmitaleo23100% (1)

- Chapter 5 Test BankDocument12 pagesChapter 5 Test Bankmyngoc181233% (3)

- Fundamentals of Advanced Accounting 8th Edition Hoyle Test Bank 1Document30 pagesFundamentals of Advanced Accounting 8th Edition Hoyle Test Bank 1toddvaldezamzxfwnrtq100% (27)

- 2017 AFR GCs Volume I PDFDocument897 pages2017 AFR GCs Volume I PDFJessica Aldea100% (1)