Professional Documents

Culture Documents

Aug 2022 Final Exam Far 160

Uploaded by

adreanamarsyaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Aug 2022 Final Exam Far 160

Uploaded by

adreanamarsyaCopyright:

Available Formats

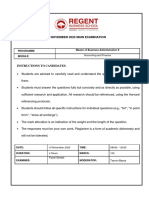

CONFIDENTIAL 1 AC/JULY 2022/FAR160

UNIVERSITI TEKNOLOGI MARA

FINAL EXAMINATION

COURSE : FINANCIAL ACCOUNTING 2

COURSE CODE : FAR160

EXAMINATION : JULY 2022

TIME : 3 HOURS

INSTRUCTIONS TO CANDIDATES

1. This question paper consists of five (5) questions.

2. Answer ALL questions by HANDWRITTEN in English. Start each answer on a new page.

3. Students are prohibited from any type of plagiarism, collusion and copying from others.

4. Students are required to submit the handwritten answers in ONE (1) pdf file.

DO NOT TURN THIS PAGE UNTIL YOU ARE TOLD TO DO SO

This examination paper consists of 9 printed pages

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 2 AC/JULY 2022/FAR160

QUESTION 1

A. A partnership could be dissolved either by compulsory dissolution, conditional

dissolution, or dissolution by agreement.

List FOUR (4) causes dissolution of partnership.

(4 marks)

B. Syaeeqa and Ulfa started a partnership on selling soft toys. The partnership agreement

contains the following provisions:

i) Syaeeqa is to receive a salary of RM1,200 per month.

ii) lnterest on opening capital is 10% per annum and interest on drawings is 8% per

annum.

iii) Profits sharing ratio between Syaeeqa and Ulfa is 2:1 respectively.

The following is the Statement of Financial Position of the partnership as at 31 December

2020:

Statement of Financial Position of the partnership as at 31 December 2020

RM RM

Non-current assets

Premises 170,000

Motor vehicles at carrying value 110,000

Shop equipment 65,000

345,000

Current assets

Inventories 30,000

Account receivables 15,000 45,000

390,000

Equity and Liabilities

Capital accounts

Syaeeqa 100,000

Ulfa 80,000 180,000

Current accounts

Syaeeqa 80,000

Ulfa 40,000 120,000

Non-Current Liability

15% Loan 50,000

Current Liabilities

Account payables 35,000

Bank overdraft 5,000 40,000

390,000

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 3 AC/JULY 2022/FAR160

Ulfa resigned from being a partner on 30 April 2021. Any amount due to her was paid

by cheque. Ulfa was replaced by Nur on the same day. Nur brought in RM50,000 into

the partnership, including RM12,000 which was her share of premium goodwill. Goodwill

was not to be maintained in the books.

The new partnership agreement is as follows:

i) Both Syaeeqa and Nur are to receive a salary of RM1,300 per month.

ii) No interest will be allowed on capital and interest on drawings is 5% per annum.

iii) The profit or loss is distributed equally among the partners.

Additional information:

1. Drawings made by the partners during the year are as follows:

Syaeeqa RM5,000 (1 March 2021)

Ulfa RM4,000 (1 February 2021)

Nur RM3,000 (30 June 2021)

2. Due to changes in the partnership, the assets of the partnership were revalued.

The value of premises was increased by RM60,000, while the value of motor

vehicles and inventories were reduced by RM25,000 and RM5,000 respectively.

3. Net profit for the year ended 31 December 2021 is RM120,000. This amount is

assumed to be accrued evenly throughout the year.

Show all your workings and round up your calculations to the nearest RM.

Required:

Prepare the following:

a. Goodwill account as at 30 April 2021.

(2 marks)

b. Revaluation account as at 30 April 2021.

(2 marks)

c. Appropriation statement showing the pre and post period for the year ended 31

December 2021.

(7 marks)

d. Current statement (Ulfa) for the year ended 31 December 2021.

(3 marks)

e. Capital statement (Ulfa) for the year ended 31 December 2021.

(2 marks)

(Total: 20 marks)

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 4 AC/JULY 2022/FAR160

QUESTION 2

A. Differentiate private company and public company in terms of their name and issuance

of shares.

(4 marks)

B. Rentas Negeri Bhd was incorporated as a trading company in 2018. The extract of the

Statement of Financial Position as at 31 December 2020 is as follows:

Issued and paid-up capital RM

40,000,000 ordinary shares 140,000,000

10,000,000 8% preference shares 18,000,000

Reserves

Retained earnings 200,000,000

Below are the transactions that have taken place for the year ended 31 December 2021:

1. In February 2021, the company decided to issue 30,000,000 ordinary shares to

the public at RM5.00 each and 25,000,000 8% preference shares at RM2.00 each.

2. Applications received for ordinary shares were oversubscribed by 10,000,000

units. The excess applications money was refunded to the unsuccessful

applicants. While for 8% preference shares were undersubscribed by 6,000,000

units.

3. A right issue of 1 to 40 shares was also made to the existing shareholders held at

the opening year balance at RM3.50 each.

4. On 1 July 2021, a company also issued RM5,000,000 9% debentures at 97 and

commission cost in respect for the issue amounting to RM50,000. The effective

interest rate was 12% and the interest was paid at the end of the financial year.

Required:

a. Prepare the journal entries to record the above transactions.

(10 marks)

b. Prepare the Statement of Financial Position (extract) as at 31 December 2021 for

the equity and liability section only.

(2 marks)

c. Explain briefly TWO (2) similarities of both Redeemable Preference shares and

Debentures.

(4 marks)

(Total: 20 marks)

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 5 AC/JULY 2022/FAR160

QUESTION 3

The Statement of Financial Position of Smoky Blue Bhd as at 31 December 2020 is given

below:

ASSETS RM

Investment 2,000,000

Other non-current assets (Carrying value) 6,500,000

Bank 2,548,000

11,048,000

EQUITY AND LIABILITIES

Issued and paid-up capital

2,000,000 Ordinary shares 5,500,000

Reserves

Retained earnings 2,520,000

Less: Treasury shares at cost (832,000)

Non-current liabilities

8% Redeemable preference shares 2,880,000

Current liabilities 980,000

11,048,000

During the year ended 31 December 2021, the following transactions took place:

1. A quarter of the 8% redeemable preference shares were redeemed. In order to finance

the redemption, ordinary shares were issued at RM1.50. The application received and

it was fully paid for 300,000 shares.

2. 150,000 ordinary shares were repurchased and cancelled at RM3.00 per share. The

share retirement method was used for this purpose.

3. Half of the treasury shares were sold at RM450,000.

Required:

Prepare the relevant journal entries to record the above transactions. (Narrations are not

required).

(Total: 15 marks)

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 6 AC/JULY 2022/FAR160

QUESTION 4

Andemik Bhd was incorporated two years ago. The principles activities are manufacturing and

marketing sports equipment. The company issued ordinary and preference shares to sustain

their business and remain as public listed. Some of the funds are also being financed by the

debentures. The following is the trial balance of Andemik Bhd as of 31 December 2021.

RM RM

2,500,000 Ordinary shares capital 5,000,000

700,000 7% Preference shares capital 700,000

Retained profit 2,450,000

General reserve 860,000

5% Debentures 450,000

250,000 Treasury shares 300,000

Sales 1,645,000

Other income 22,000

Investment income 50,000

Cost of sales 750,000

Administrative expenses 250,500

Selling and distribution expenses 120,000

Sales commission 10,000

Interest on debentures 13,500

Interim dividend - 7% Preference shares 10,500

Directors’ remuneration 64,500

Audit fee 12,000

Land and building at cost (Land is RM2,000,000) 3,700,000

Plant and equipment (cost) 5,840,000

Furniture and fittings (cost) 350,000

Accumulated depreciation as at 1 January 2021:

- Building 340,000

- Plant and equipment 770,000

- Furniture and fittings 140,000

Fixed deposit 400,000

Trademarks 160,000

Inventories 125,000

Bank 242,000

Trade receivables 150,000

Trade payables 101,000

Taxation paid 30,000

12,528,000 12,528,000

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 7 AC/JULY 2022/FAR160

The following information were taken place during the year ended 31 December 2021 and no

adjustment have been made during the year:

1. Provisions are to be made for electricity expenses of RM12,000 and accrued rent

received of RM6,500.

2. Part of interest on debentures was still unpaid. The Debentures was issued on 1 January

2020.

3. The current year depreciation charge as follow:

RM

Building 170,000

Plant and Equipment 150,000

Furniture and Fitting 60,000

4. On 1 November 2021, the company sold all its treasury shares in the market at RM1.50

per share.

5. During the current year, the company incurred RM24,500 for its taxation.

6. On 17 December 2021, the directors declared final dividend of 20 sen per Ordinary

shares and remaining dividend for the Preference shares.

Required:

Prepare the following statements in a form suitable for publication and in compliance with the

Companies Act 2016 (as amended) and related Malaysian Financial Reporting Standards

(MFRS):

a. Statement of Profit and Loss and Other Comprehensive Income for the year ended 31

December 2021.

(7 marks)

b. Statement of Changes in Equity for the year ended 31 December 2021.

(4 marks)

c. Statement of Financial Position as at 31 December 2021.

(8 marks)

d. Notes on property, plant and equipment to accompany the financial statements.

(6 marks)

(Total: 25 marks)

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 8 AC/JULY 2022/FAR160

QUESTION 5

Gen Why Sdn Bhd has involved in production of patchwork bedsheet since 2015. The

following list of balances was extracted from the books of Gen Why Sdn Bhd as at 31

December 2021.

RM

Purchases:

Raw materials 65,000

Finished goods 30,000

Inventory as at 1 January 2021:

Raw materials 5,500

Work in progress 2,500

Finished goods 9,600

Sales 958,000

Purchases return 5,850

Salary of production workers 50,000

Electricity and power 51,000

Royalty 8,570

Maintenance of machinery 570

Supervisor’s salary 21,600

Insurance on buildings 3,900

Office staff salary 40,000

Interest on loan 3,100

Allowance for unrealized profit as of 1 January 2021 4,900

Depreciation expenses 11,800

Additional information:

1. Inventories as of 31 December 2021 were as follows:

RM

Raw materials 4,300

Work in progress (at production cost) 2,700

Finished goods 7,980

2. Depreciation expenses for the year consists of following:

RM

Depreciation on machinery 8,100

Depreciation on office equipment 3,700

3. Purchases return is related to the purchase of raw materials only.

4. As of 31 December 2021, the following adjustments have not been recorded yet:

RM

Accrued electricity and power 2,500

Prepaid interest on loan 430

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 9 AC/JULY 2022/FAR160

5. The allocation of other expenses is as follows:

Factory Office

Electricity and power 65% 35%

Insurance on buildings 75% 25%

6. The manufactured goods are to be transferred to the Statement of Profit or Loss at a

mark-up of 30% on the production cost of finished goods.

Required:

a. Prepare Manufacturing account for the year ended 31 December 2021.

(10 marks)

b. Prepare Statement of Profit or Loss for the year ended 31 December 2021.

(6 marks)

c. Explain briefly TWO (2) differences between non-profit organizations and profitable

organizations in terms of their ownership and primary mission.

(4 marks)

(Total: 20 marks)

END OF QUESTION PAPER

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

You might also like

- FAR570 Test Questions AnswersDocument3 pagesFAR570 Test Questions AnswersAthira Adriana Bt RemlanNo ratings yet

- NYIF Accounting Module 10 Excercise With AnswersssDocument3 pagesNYIF Accounting Module 10 Excercise With AnswersssShahd OkashaNo ratings yet

- Acct 6065 Second Exam Spring 202104262021Document14 pagesAcct 6065 Second Exam Spring 202104262021Michael Pirone100% (1)

- Question - Test Acc106 Mac 2021 - 2july2021Document4 pagesQuestion - Test Acc106 Mac 2021 - 2july2021Fara husnaNo ratings yet

- This Paper Is Not To Be Removed From The Examination HallsDocument82 pagesThis Paper Is Not To Be Removed From The Examination HallsPutin PhyNo ratings yet

- Tutorial - Financial StatementDocument18 pagesTutorial - Financial StatementmellNo ratings yet

- Formula Sheet Mini Test FARDocument26 pagesFormula Sheet Mini Test FARcpacfa92% (13)

- Far160 (CT XXX 2022) QuestionDocument4 pagesFar160 (CT XXX 2022) QuestionFarah HusnaNo ratings yet

- Far160 - Jul 2021 - QDocument9 pagesFar160 - Jul 2021 - QNur ain Natasha ShaharudinNo ratings yet

- Final Exam July 2021 QQDocument8 pagesFinal Exam July 2021 QQLampard AimanNo ratings yet

- Far270 July2022Document8 pagesFar270 July2022Nur Fatin AmirahNo ratings yet

- BAC1614 - 2110 - Final ExaminationDocument9 pagesBAC1614 - 2110 - Final ExaminationNABILA HADIFAH BINTI MOHAMAD PATHANNo ratings yet

- Universiti Teknologi Mara Final Examination: Confidential 1 AC/FEB 2022/FAR320Document7 pagesUniversiti Teknologi Mara Final Examination: Confidential 1 AC/FEB 2022/FAR3202021202082No ratings yet

- FAR570 - Q - August 2021Document7 pagesFAR570 - Q - August 2021NURUL NAZAHANNIE MOHAMAD NAJIBNo ratings yet

- FAR160 PYQ FEB2023Document8 pagesFAR160 PYQ FEB2023nazzyusoffNo ratings yet

- Final Assessment Far210 Feb2021Document8 pagesFinal Assessment Far210 Feb2021Lampard AimanNo ratings yet

- Pfa3163 Set G QPDocument5 pagesPfa3163 Set G QPNur hidayah putriNo ratings yet

- Far670 - Q - Feb 2021Document5 pagesFar670 - Q - Feb 2021AMIRA BINTI AMRANNo ratings yet

- FAR160 PYQ JULY2023Document8 pagesFAR160 PYQ JULY2023nazzyusoffNo ratings yet

- CT Far160 Dec2022 QDocument4 pagesCT Far160 Dec2022 QSiti Nurul AtiqahNo ratings yet

- Financial AccountingDocument19 pagesFinancial AccountingObed AsamoahNo ratings yet

- QuestionsDocument7 pagesQuestionsFariha NazamNo ratings yet

- Far270 Q Feb2021 FaDocument9 pagesFar270 Q Feb2021 Fa2024786333No ratings yet

- Universiti Teknologi Mara Final Assessment: Confidential 1 AC/FEB 2022/FAR560Document7 pagesUniversiti Teknologi Mara Final Assessment: Confidential 1 AC/FEB 2022/FAR560NURUL IRA SHAFINAZ ARMENNo ratings yet

- Feb 2021Document4 pagesFeb 2021Muhammad ZulhisyamNo ratings yet

- Far270 February 22 FaDocument8 pagesFar270 February 22 FarumaisyaNo ratings yet

- Universiti Teknologi Mara Final Examination: Confidential AC/JUL 2022/FAR320Document7 pagesUniversiti Teknologi Mara Final Examination: Confidential AC/JUL 2022/FAR3202021202082No ratings yet

- Faculty - Accountancy - 2022 - Session 1 - Diploma - Far210Document8 pagesFaculty - Accountancy - 2022 - Session 1 - Diploma - Far210Bil hutNo ratings yet

- Abfa1513 220518Document6 pagesAbfa1513 220518CRYSTAL NGNo ratings yet

- Calculating impairment loss for machine J200Document4 pagesCalculating impairment loss for machine J200KAY PHINE NGNo ratings yet

- Advanced Financial Reporting Key HighlightsDocument8 pagesAdvanced Financial Reporting Key HighlightssmlingwaNo ratings yet

- f2 Financial Accounting August 2015Document18 pagesf2 Financial Accounting August 2015Saddam HusseinNo ratings yet

- Final Examination: Online Examination November 2020 SemesterDocument8 pagesFinal Examination: Online Examination November 2020 Semesternur sabrinaNo ratings yet

- MTP1 May2022 - Paper 5 Advanced AccountingDocument24 pagesMTP1 May2022 - Paper 5 Advanced AccountingYash YashwantNo ratings yet

- Test Series: March 2022 Mock Test Paper 1 Intermediate: Group - Ii Paper - 5: Advanced AccountingDocument7 pagesTest Series: March 2022 Mock Test Paper 1 Intermediate: Group - Ii Paper - 5: Advanced AccountingShrwan SinghNo ratings yet

- Far570 SoalanDocument7 pagesFar570 SoalanNURUL NAZAHANNIE MOHAMAD NAJIBNo ratings yet

- B7AF102 2021 OMD1 First Sitting Exam PaperDocument10 pagesB7AF102 2021 OMD1 First Sitting Exam PaperAZLEA BINTI SYED HUSSIN (BG)No ratings yet

- Fin430 - Dec2019Document6 pagesFin430 - Dec2019nurinsabyhahNo ratings yet

- Fa5 Nov20Document8 pagesFa5 Nov20Ridzuan SharifNo ratings yet

- Assignment/ TugasanDocument9 pagesAssignment/ TugasanmelNo ratings yet

- ACCT2014 Final Exam 2021-2022 - K.Ashman v2Document9 pagesACCT2014 Final Exam 2021-2022 - K.Ashman v2Christina StephensonNo ratings yet

- Financial Accounting Final Exam ReviewDocument9 pagesFinancial Accounting Final Exam ReviewDiana TuckerNo ratings yet

- RTP Dec 2020 QnsDocument13 pagesRTP Dec 2020 QnsbinuNo ratings yet

- Chartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalDocument81 pagesChartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalPrashant Sagar GautamNo ratings yet

- Test Series: April, 2022 Mock Test Paper 2 Intermediate: Group - I Paper - 1: AccountingDocument7 pagesTest Series: April, 2022 Mock Test Paper 2 Intermediate: Group - I Paper - 1: AccountingVishal MehraNo ratings yet

- (EN) Problem Mojakoe AK1Document11 pages(EN) Problem Mojakoe AK1gebbyNo ratings yet

- Micron Confidential FinancialsDocument13 pagesMicron Confidential FinancialsShalini DeviNo ratings yet

- 1 2 3 4 5 6 7 8 MergedDocument78 pages1 2 3 4 5 6 7 8 MergedKartik GuptaNo ratings yet

- June 2021Document82 pagesJune 2021刘宝英100% (1)

- Test Series: April 2023 Mock Test Paper - 2 Intermediate: Group - I Paper - 1: AccountingDocument7 pagesTest Series: April 2023 Mock Test Paper - 2 Intermediate: Group - I Paper - 1: AccountingKartik GuptaNo ratings yet

- Far570 Q Test December 2022Document4 pagesFar570 Q Test December 2022fareen faridNo ratings yet

- Far160 - Dec 2019 - QDocument8 pagesFar160 - Dec 2019 - QNur ain Natasha ShaharudinNo ratings yet

- Far-I Autumn 2021 TsaDocument3 pagesFar-I Autumn 2021 TsaUsman AhmedNo ratings yet

- Tutorial 1Document4 pagesTutorial 1rollinpeguyNo ratings yet

- June 2019 QDocument8 pagesJune 2019 Q2024786333No ratings yet

- 2020 Acc 410 Test 1Document8 pages2020 Acc 410 Test 1Kesa Metsi100% (1)

- Financial Accounting Exam QuestionsDocument9 pagesFinancial Accounting Exam QuestionsdayahNo ratings yet

- Cuac208 Tests and AssignmentsDocument8 pagesCuac208 Tests and AssignmentsInnocent GwangwaraNo ratings yet

- Bbfa1103 Assigment Question 2023Document13 pagesBbfa1103 Assigment Question 2023Bdq ArrogantNo ratings yet

- Accounting P1 NSC Nov 2020 EngDocument12 pagesAccounting P1 NSC Nov 2020 EngTlhago PitseNo ratings yet

- MBAP - AF101-Accounting and Finance - 10 Nov 23Document6 pagesMBAP - AF101-Accounting and Finance - 10 Nov 23aqueelahadam786No ratings yet

- AccountancyDocument32 pagesAccountancysunil kumarNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- CH 11Document4 pagesCH 11pablozhang1226No ratings yet

- Capital Gains Taxation RulesDocument15 pagesCapital Gains Taxation RulesShane Mark CabiasaNo ratings yet

- Stockholders' Equity - No.3Document40 pagesStockholders' Equity - No.3Carl Agape DavisNo ratings yet

- Midterm Exam Intermediate Accounting 2Document10 pagesMidterm Exam Intermediate Accounting 2Juan Dela cruzNo ratings yet

- Acct C.H.10Document6 pagesAcct C.H.10j8noelNo ratings yet

- MC With Answers Partnership Operation CorporationDocument19 pagesMC With Answers Partnership Operation CorporationASHLEY ROLAINE VICENTENo ratings yet

- Review 105 - Day 7 Theory of AccountsDocument11 pagesReview 105 - Day 7 Theory of AccountsKathleen PardoNo ratings yet

- Accounting 2 - Chapter 13 - Notes - MiuDocument5 pagesAccounting 2 - Chapter 13 - Notes - MiuAhmad Osama MashalyNo ratings yet

- Statement of Cash FlowsDocument35 pagesStatement of Cash Flowsonthelinealways100% (4)

- Exam True/False Questions for Shareholders' EquityDocument38 pagesExam True/False Questions for Shareholders' EquityJessie jorgeNo ratings yet

- CH 15Document15 pagesCH 15Yousef ShahwanNo ratings yet

- 6Document5 pages6Carlo ParasNo ratings yet

- Accounting Capital+Stock+TransactionsDocument17 pagesAccounting Capital+Stock+TransactionsOckouri BarnesNo ratings yet

- Beams AdvAcc11 ChapterDocument27 pagesBeams AdvAcc11 ChapterSt Teresa AvilaNo ratings yet

- 03 Ia Auditing Mock Board Exam QuestionsDocument16 pages03 Ia Auditing Mock Board Exam QuestionsKial PachecoNo ratings yet

- Two Approaches in Determining IncomeDocument14 pagesTwo Approaches in Determining IncomeAnDrea ChavEzNo ratings yet

- CBET financial records analysisDocument3 pagesCBET financial records analysisKristine Esplana ToraldeNo ratings yet

- Financial Accounting Sem 2 (2019-2020) Lecturer: Mr. Vu Tuan Anh, CMA, MSA Email: (Preferred) Tutor: Ms. Tran My HaDocument73 pagesFinancial Accounting Sem 2 (2019-2020) Lecturer: Mr. Vu Tuan Anh, CMA, MSA Email: (Preferred) Tutor: Ms. Tran My HaTrâm PhạmNo ratings yet

- Dividend Policy Chapter SummaryDocument30 pagesDividend Policy Chapter SummaryLyka Faye Aggabao100% (1)

- Advanced Financial Accounting Christensen 10th Edition Solutions ManualDocument42 pagesAdvanced Financial Accounting Christensen 10th Edition Solutions ManualMariaDaviesqrbg100% (40)

- CH 14 - MCQ PDFDocument11 pagesCH 14 - MCQ PDFYAHIA ADELNo ratings yet

- Commercial Law CommitteeDocument46 pagesCommercial Law Committeeangelouve100% (2)

- Crim2017 CampanillaDocument60 pagesCrim2017 CampanillaKing KingNo ratings yet

- #1 Shareholders' Equity & Retained Earnings PDFDocument8 pages#1 Shareholders' Equity & Retained Earnings PDFjanus lopezNo ratings yet

- Chapter 15Document10 pagesChapter 15Julia Angelica WijayaNo ratings yet

- Intermediate Accounting IIDocument10 pagesIntermediate Accounting IILexNo ratings yet

- Dilutive Dan EpsDocument18 pagesDilutive Dan EpsCepi Juniar PrayogaNo ratings yet