Professional Documents

Culture Documents

Corporate Governance in Bangladesh Link Between Ownership and Financial Performance

Uploaded by

where is my mindOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Corporate Governance in Bangladesh Link Between Ownership and Financial Performance

Uploaded by

where is my mindCopyright:

Available Formats

CORPORATE GOVERNANCE IN BANGLADESH 1453

Corporate Governance in Bangladesh:

Link between Ownership and

Financial Performance

Omar Al Farooque,* Tony van Zijl, Keitha Dunstan

and AKM Waresul Karim

This paper investigates empirically the effect of board ownership on firm performance

in Bangladesh. By estimating single equation and simultaneous equation models on an

unbalanced pooled sample of listed firms, it offers some new insight into the ownership-

performance link in Bangladesh. Building on extant literature, it examines the ownership-

performance relationship in an emerging market economy considering ownership as

exogenous and as endogenous. The latter approach is favoured as recent empirical evidence

shows that ownership and performance are endogenously determined and there is either a

reverse-way or two-way causality relationship between the two. While OLS regression analy-

sis indicates a linear and non-linear relationship between board ownership and performance,

this disappears when 2-SLS estimation of a simultaneous equation model is carried out.

Instead, a reverse causality relationship emerges. Other governance and control variables

appear to have effects consistent with the literature. These results suggest a need to strengthen

the internal control mechanisms within listed firms in Bangladesh.

Keywords: Emerging markets, board ownership, financial performance, exogeneity, endoge-

neity, mono-directional non-monotonic causal relation, reverse-way causality

Introduction mechanisms differ between countries, par-

ticularly between developed and emerging

W ith closer integration of markets around

the world, the importance of corporate

governance practices in emerging economies is

economies. Emerging markets differ sub-

stantially from developed economies in their

institutional, regulatory and legal environ-

increasingly evident to domestic as well as ments (Prowse 1999). Bangladesh is an

international agencies. To attract a steady flow emerging market economy striving for eco-

of foreign financial resources towards these nomic growth. In recent years corporate gov-

economies, there is an increasing global market ernance has emerged as an important issue

pressure on them to reduce risks to investors for Bangladesh due to the ongoing effects of

and hold down the cost of capital (World Bank globalisation, as the domestic economy inte-

1999). Improved governance can go a long way grates with the global economy and firms

in meeting such investor expectations by con- strive to gain international competitiveness.

siderably reducing waste and misallocation of Economic liberalization carried out so far has

resources. opened the door for both foreign direct and

From the viewpoint of shareholders being portfolio investment as well as local institu- *Address for correspondence:

the residual claimants of the firm, corporate School of Business, Economics

tional investors. Therefore, it has become and Public Policy, Faculty of

governance refers to mechanisms by which essential to revisit the existing governance Professions, University of

the suppliers of finance control managers in system to examine its effectiveness and New England, Armidale, NSW

2351, Australia. Tel: +61 2 6773

order to ensure satisfactory return on their suggest ways to bring about changes if 3920; Fax: +61 2 6773 3148;

investment (Shleifer and Vishny 1997). These necessary. E-mail: ofarooqu@une.edu.au

© 2007 The Authors

Journal compilation © 2007 Blackwell Publishing Ltd, 9600 Garsington Road,

Oxford, OX4 2DQ, UK and 350 Main St, Malden, MA, 02148, USA Volume 15 Number 6 November 2007

1454 CORPORATE GOVERNANCE

This study examines the relationship began to flourish in Bangladesh during the

between ownership, as a governance mecha- period prior to independence and continued

nism, and corporate performance in Bang- in the post-independence period but with a

ladesh. In an earlier study (Farooque et al. 2007), 4-year interruption during 1972 to 1975. This

the authors have considered the ownership- period saw fundamental change in the coun-

performance relationship assuming endogene- try’s economic policy in the model of a social-

ity of the two and using data for 1995–2001 with ist framework. Following a reversal in the

performance measured as Tobin’s Q or Return policy of state ownership of the corporate

on Assets (ROA). The present study extends sector in 1975, a massive de-nationalization

this work by considering both ownership and strategy of public enterprises has been

performance variables as exogenous and carried out, with the exception of large-scale

endogenous in an enlarged data set for 1995– enterprises. Moves toward private sector-led

2002, and measuring performance instead by industrialization sharply turned the economic

the market to book value of equity (MBVE). wheel from a ‘socialist’ to a ‘mixed’ economy

Board ownership represents the shareholdings followed by a ‘market’ form of economy. At

of all members of the board of directors, execu- present, the corporate sector of Bangladesh

tive and non-executive, and financial perfor- comprises a few large-scale state owned

mance (i.e., shareholders value/firm value) enterprises (SOEs), a large number of priva-

is a function of production costs and other tised and privately owned firms, joint-

kinds of transaction costs caused by imper- ventures and multinational firms. Among the

fect managerial exchanges, institutions and different types of firms, SOEs are not listed

environmental/behavioral conditions as pre- on the stock exchange and have government-

scribed by the agency theorists. Given the controlled governance systems different from

noted differences between systems of gover- those of listed firms. The scope of this study

nance practiced in emerging and developed is limited to listed firms only, which includes

economies, the research interest is whether the both financial and non-financial firms and

observed relationship between ownership and firms with significant degrees of public, and

performance in developed countries holds in private or foreign ownerships.

a country like Bangladesh with a different

system of governance. The objective is to reveal Microstructure of Corporate Governance

whether existing corporate governance mecha-

nisms, in particular internal mechanisms,

Institutions in Bangladesh

improve financial performance in Bangladesh Institutions play a crucial role in shaping gov-

in a way consistent with those found in devel- ernance. It is argued that a sound institutional

oped economies. Having no comprehensive framework is a precondition for good gover-

prior empirical study on Bangladesh corporate nance. A strong institutional set up can foster

governance, an analysis of the effectiveness of accountability, transparency, equity and

corporate governance systems in Bangladesh is fairness. The institutional framework of the

considered meaningful in order to redress the country comprises both capital market and

gap in the relevant literature. It offers new regulatory institutions. In Bangladesh the

insights into corporate governance practices in capital market institutions are Dhaka Stock

Bangladesh and underlines the need for reform Exchange (DSE), Chittagong Stock Exchange

in this area. The remainder of the paper is orga- (CSE), Securities and Exchange Commission

nized as follows: Section 2 describes existing (SEC), central bank (Bangladesh Bank) and

corporate governance practices in Bangladesh. other financial institutions, Institute of Char-

Section 3 deals with existing literature and tered Accountants of Bangladesh (ICAB) and

Section 4 focuses on research method, models audit firms. The main components of the regu-

and data used. Section 5 describes empirical latory framework are the Companies Act 1994,

evidence while Section 6 concludes with the Securities and Exchange Commission Act

findings of the study. 1993, Bangladesh Bank Order 1972, Bank

Companies Act 1991, Financial Institutions

Act 1993, Insurance Act 1938, Income Tax

Scenario of Corporate Governance Ordinance 1984, DSE and CSE listing rules,

Practices in Bangladesh and the system of accounting and auditing

standards.

Bangladesh emerged as an independent

country on the 16th of December 1971. The Corporate Governance Practices

country is located in the South Asian region

and is neighboured by India and Myanmar

in Bangladesh

from all sides except for the Bay of Bengal The corporate governance system in Bang-

in the south. A capitalist form of economy ladesh is a hybrid of outsider-dominated

Volume 15 Number 6 November 2007 © 2007 The Authors

Journal compilation © Blackwell Publishing Ltd. 2007

CORPORATE GOVERNANCE IN BANGLADESH 1455

market-based systems (market or compliance- Bangladesh) is at best satisfactory (Karim and

based model of the US and the UK) and Ahmed 2005).

the insider-dominated bank-based systems The corporate sector in Bangladesh is pre-

(control or relationship-based model of dominantly owned and controlled by founder

Germany and Japan). Corporate firms are families or groups of families or foreign

characterized by the dominance of internal owners. The prevalence of family-owned busi-

governance mechanisms (direct measures) of nesses, together with state ownership, thus

control and weak and ineffective external plays a significant role. Listed companies are

governance mechanisms (indirect measures). not free from this prototype of governance,

Some of the institutional features of Bang- fittingly called ‘family capitalism’ or ‘crony

ladesh include a less developed capital capitalism’ (Asian Development Bank 2003).

market, an at least weak-form efficient stock Under the Companies Act 1994, a maximum of

market (Islam and Khaled 2005), absence of an 50 per cent of the total issued capital can be

active market for corporate control, generally retained by sponsor directors (i.e., the promot-

concentrated ownership, high reliance on bank ers of the company who also act as directors

financing, a passive managerial labour market, until the first directors are elected) while going

and poor incentive contracts for management. public. The remaining portion is distributed

The economic negligence experienced by the to general public, financial institutions, non-

country under the British colonial rule for resident Bangladeshis and employees of

nearly two centuries has been a significant issuing companies. Therefore, the ownership

contributor to the poor institutional and cor- structure has evolved as a dominant mecha-

porate base. As a result, the corporate environ- nism of governance. On average, the five

ment in Bangladesh lacks an effective market largest shareholders hold more than 50 per

based corporate governance system. Although cent of ordinary shares. In most cases they are

broadly categorised as a common-law country, family owners, major individual owners and

Bangladesh has a relatively unsophisticated domestic or foreign companies. Corporate

legal and regulatory framework. Problems of a governance practices are typically tailored to

weak regulatory regime are further aggravated suit the needs of these core owners. Families

by poor enforcement of whatever laws and therefore have extensive influence on the

statutes exist to secure satisfactory outcomes. decision-making process. Most of the compa-

Similarly, market incentives are poor due to nies have executive directors, the CEO and the

the presence of market anomalies and mal- Chairperson from controlling families. In most

practices. As a consequence, transparency and firms, an owner director also acts as the CEO

accountability at the corporate level remain (except for financial institutions).

inadequate. In the absence of market-based Corporate boards generally lack indepen-

monitoring and control measures, ownership- dence due to founder-family control, with

based monitoring and control have been estab- minimal representation of minority sharehold-

lished in Bangladesh as a core governance ers and institutional investors. Boards per se

mechanism. have never been central to corporate gover-

The financial reporting environment in nance in Bangladesh. Dominant shareholding

Bangladesh (i.e., general disclosure frame- families have treated boards as conduits for

work in accounting and auditing) is not in full implementing their agenda. It is said that

conformity with international standards. In important decisions involving company affairs

fact, financial disclosure is made primarily to are made at family meetings and such deci-

satisfy tax authorities rather than meet the sions are given a stamp of approval in board

needs of investors and markets do not neces- meetings merely to ensure that the legal

sarily reward more transparent firms. The requirements under the Companies Act are

Securities and Exchange Commission (SEC) met (Asian Development Bank 2003). The

in Bangladesh has made it mandatory for intertwining of management and the board

listed companies to comply with International reduces the opportunities for the board to

Accounting Standards (IASs/IFRSs) and Inter- prevent insider dealing and preferential treat-

national Standards on Auditing (ISAs) as ment. Minority shareholders’ rights are largely

applicable in Bangladesh (i.e., Bangladesh ignored or suppressed. Even non-executive

Accounting Standards [BASs] and Bangladesh directors fail to give independent judgement

Standards on Auditing [BSAs]). So far Bang- in enhancing corporate wealth for all share-

ladesh has adopted all but four IASs and two holders, as the nominees tend to have business

IFRSs and thirty five ISAs. With respect to the or social connections with the controlling

reliability and comparability of financial infor- shareholder group (Asian Development Bank

mation, it can be said that the general level of 2003). The above features of the corporate

compliance of Bangladesh firms to Interna- firms create the inevitable conflict between

tional Accounting Standards (as adopted in dominant shareholder(s) and minority share-

© 2007 The Authors Volume 15 Number 6 November 2007

Journal compilation © Blackwell Publishing Ltd. 2007

1456 CORPORATE GOVERNANCE

holders, as indicated by Williamson (1979), the relationship between ownership and per-

Grossman and Hart (1980), Fama and Jensen formance is not always a direct one. The rela-

(1983) and Shleifer and Vishny (1986). Oman tionship may be in fact being negative at

et al. (2003) contend that the key potential con- higher levels of ownership. This negative asso-

flict of interest in developing, transition and ciation is consistent with the entrenchment

emerging market countries (like Bangladesh) hypothesis (Fama and Jensen 1983; Morck et al.

tends to arise, not between managers and 1988). Stulz (1988) presents a formal model

shareholders like the US and the UK, but predicting a non-linear (i.e., bell or roof-

between controlling shareholders and other shaped) relation between managerial owner-

shareholders on the one hand, and other ship and financial performance. Performance

investors, on the other. There are plenty of is expected to improve as ownership increases

opportunities for controlling shareholders to from the lowest level possible (zero percent).

expropriate wealth from outside shareholders. However, it starts to decrease after a certain

This is central to the quality of corporate high level of ownership and reaches a

governance in Bangladesh impacting firm minimum when managers own 50 per cent or

performance as predicted by agency theory. more of the shares of the firm. Therefore, the

The above discussion of business owners’ contrasting approaches imply that increased

culture in Bangladesh highlights extensive managerial ownership either improves mana-

family control over corporate firms. This own- gerial incentives, thereby enhancing firm

ership structure is by no means similar to the value, or leads to entrenchment, and thereby

pyramidal structure found in Japan and some decreasing firm value. A number of studies

other East-Asian countries. Most of the fami- provide mixed results that support both

lies in Bangladesh hold shares independently the incentive-alignment and entrenchment

in a particular company or group of companies hypotheses. This suggests that the studies that

that they control. Except for one company predict only monotonic relationship may be

group, there is no existence of a ‘holding mis-specified as incentive-alignment, i.e., con-

company’ in other groups of companies. Even vergence of interest effect, does not seem to

the holding company of that particular group exist throughout all levels of ownership.

does not own majority shares in the sister Lichtenberg and Pushner (1994) find that

companies within the group. Although a few board ownership has a significant positive

cross shareholdings are found in some of the relationship with performance, while other

company groups, that is not a common feature types of ownership show mixed results.

of ownership of listed firms in Bangladesh. Mehran (1995) finds that firm performance is

positively related to the percentage of equity

Literature Review held by managers and the percentage of equity

and stock options held by CEOs. Also firms

Corporate governance literature on ownership- with more outside directors tend to offer more

performance relationship falls into two broad equity-based compensation than firms with

streams – one that ownership is an exogenous high percentages of inside shareholdings or

variable, and the other that ownership is an outside block-holdings. Xu and Wang (1999)

endogenous variable. Assuming ownership to provide similar evidence where ownership

be exogenous, the first stream of studies pro- concentration and ownership mix have signifi-

vides evidence of a ‘mono-directional’ or ‘one- cant positive performance effect. Randoy and

way causality’ relationship running from Goel (2001) also report that high levels of

ownership to performance. Using OLS estima- inside ownership have a positive impact on the

tion, these studies report a linear as well as a performance of founding family firms. Mitton

non-linear relationship between ownership (2002) reveals that largest block-holder and all

and performance. A monotomic increasing other shareholder concentration variables are

relationship between ownership and perfor- significantly positively associated with stock

mance suggests that firm performance is an return. On the other hand, Agrawal and Man-

increasing function of the extent of board delker (1990) provide evidence of a negative

shareholding, which is consistent with association between ownership and perfor-

incentive-alignment hypothesis (Berle and mance. Boyle et al. (1998) find evidence of

Means 1932; Jensen and Meckling 1976). insider entrenchment revealed in a negative

On the other hand, a non-monotonic rela- relation between insider ownership and anti-

tionship between the two variables suggests takeover provisions, at low levels of owner-

that firm performance initially increases up to ship but not at higher levels. Jensen and

a certain level of board shareholdings, then Murphy (1990) and Slovin and Sushka (1993)

decreases as ownership increases up to an- also report similar findings.

other level and finally increases with further In contrast to the above studies, Morck et al.

increases in board ownership. This means that (1988), for the first time, reported a non-linear

Volume 15 Number 6 November 2007 © 2007 The Authors

Journal compilation © Blackwell Publishing Ltd. 2007

CORPORATE GOVERNANCE IN BANGLADESH 1457

relationship between ownership and perfor- 12 per cent and above 41 per cent levels, but is

mance at different levels of ownership. They negatively related in 12 per cent–41 per cent

find that performance improves at 0 per cent–5 range. Fernandez and Gomez (2002) present

per cent management ownership levels. a non-linear relationship on an accounting-

However, it deteriorates at 5 per cent–25 per based performance measure. However, they

cent ownership levels before turning to cannot confirm the same relationship on a

improve again at 25 per cent and higher own- market-based performance measure. Mc-

ership levels. A number of studies find the Connell and Servaes (1990) provide evidence

same form of non-linear relation as found by of a curvilinear (reverse U-shaped) relation-

Morck et al. (1988). They include Wruck (1989), ship between ownership and performance at

Lichtenberg and Pushner (1994), Hubbard and different ranges of ownership with an inflec-

Palia (1995), Kole (1996), Cho (1998), Himmel- tion point between 40 per cent and 50 per cent.

berg et al. (1999), Holderness et al. (1999), Short The value of the firm initially increases at man-

and Keasey (1999), Xu and Wang (1999), Nagar agement ownership levels up to 40 per cent–50

et al. (2000), and Sarkar and Sarkar (2000). per cent but then decreases as ownership gets

Other studies find a different form of non- concentrated in the hands of insiders. A

linear relationship, not consistent with Morck number of studies confirm this curvilinear

et al. (1988). Belkaoui and Pavlik (1992) support relationship, including Keasey et al. (1994),

a non-monotonic relationship, but not the one Agrawal and Knoeber (1996), Steiner (1996)

found in Morck et al. (1988). Rather, they find a and Bohren and Odegaard (2001). Due to the

significant negative relationship between per- influence of convergence of interest and

formance and managerial ownership at a low entrenchment effects, it is not possible, a priori,

range (0 per cent–5 per cent) of ownership, a to predict the exact nature of the relationship at

positive relation at the middle range (5 per any level of managerial ownership. Thus,

cent–25 per cent) but negative relation at levels while maintaining the assumption that owner-

higher than 25 per cent. Hermalin and Weis- ship is exogenous, empirical evidence shows a

bach (1991) find a significantly positive rela- diverse range of non-linear relationships at

tionship between performance and CEO different levels of ownership across the world.

ownership at 0 per cent–1 per cent ownership None of the above-mentioned empirical

level but a significantly negative relationship research assumes that ownership is endog-

at levels greater than 20 per cent. Prevost et al. enous. Assuming instead that ownership is

(2002) also provide evidence of a significantly endogenous and thus using a simultaneous

negative relationship at a low range (0 per equations framework, the second stream of

cent–1 per cent), a positive one at the middle studies provides evidence of ‘no’, ‘reverse-

range (5 per cent–20 per cent) and a negative causality’, and ‘bi-directional’ or ‘two-way cau-

one again at levels higher than 20 per cent sality’ of the relationship between ownership

ownership levels. Neumann and Voetmann and performance. Demsetz (1983) argues that

(1999) show improving firm performance as there should be no systematic relationship

ownership increases from 0 per cent to 5 per between variations in ownership and firm per-

cent, but not thereafter. They report a constant formance as ownership levels depend on

level of firm performance as ownership the economic rationale of ‘natural selection’

increases from 5 per cent to 20 per cent and a or ‘mutual neutralization’. However, due to

decreasing trend in performance as ownership ‘imperfect market system’ and ‘incomplete

increases over 20 per cent. Mathiesen (2002) firm contract’, subsequent studies have argued

presents a significantly increasing trend of that there must be a relationship between

performance when managerial ownership is in ownership and performance, which is not nec-

0 per cent–0.5 per cent range, while no signifi- essarily a mono-directional one running from

cant effect can be observed at other ranges of ownership to performance. Their arguments

ownership. depend on the economic rationale of the

Chen et al. (1993) report a non-linear relation ‘reward’ and/or ‘insider reward’ and/or

where performance rises at ownership levels ‘insider investment’ argument (Kole 1996;

of 0 per cent to 5 per cent/7 per cent and falls Loderer and Martin 1997; Cho 1998). In either

between 10 per cent and 12 per cent range. situation, based on simultaneity of ownership

Beyond this range, performance continues to and performance, this stands against the

fall in one cross-sectional sample but starts to conventional theoretical predictions (agency

rise in two other cross-sectional samples. theory) of incentive-alignment and entrench-

Similarly, Short and Keasey (1999) show a ment hypotheses.

non-monotonic relationship between firm In terms of empirical evidence, Demsetz and

performance and managerial ownership. They Lehn (1985) show that there is no significant

suggest that performance is positively related relationship between concentrated ownership

to managerial ownership in 0 per cent– and performance. Agrawal and Knoeber (1996)

© 2007 The Authors Volume 15 Number 6 November 2007

Journal compilation © Blackwell Publishing Ltd. 2007

1458 CORPORATE GOVERNANCE

find no relationship between performance and in both directions. That is, both the ownership

inside ownership. Himmelberg et al. (1999) also and performance variables appear to mutually

find no meaningful relation between man- drive each other. More specifically, they find

agerial ownership and firm performance, that CEO equity ownership positively influ-

after controlling for a firm’s ‘fixed effects’ (i.e., ences firm performance measure and at the

unobserved firm heterogeneity) under OLS same time the former is determined by the

measures. Their results cast doubt on the latter. This study confirms a bi-directional rela-

assumption that managerial ownership is tionship between the two variables. Thus, the

exogenous in models that attempt to measure evidence presented in this section by the above

the impact of ownership on performance. On two groups of studies ranges from a signifi-

the other hand, recent studies mostly present cant ‘one-way’ (unidirectional) relationship to

evidence of a reverse-causality or a two-way ‘no’, ‘reverse-way’ and ‘two-way’ (bidirec-

causality between managerial equity owner- tional) relationship between ownership and

ship and performance, applying a simulta- performance. Taking into account the sound-

neous equations framework. Kole (1996) ness of methodology and sophistication of

reports a reverse-causality that performance is analytical tools used, the assumption owner-

a determinant of managerial ownership, not ship is endogenous appears to be more plau-

vice-versa. Loderer and Martin (1997) argue sible. Put differently, managerial ownership

that the notion derived from OLS regression and firm performance are likely to be interde-

results, that higher ownership fosters better pendent and jointly determined. The present

performance, is biased and subject to a ser- study relies more on the assumption that own-

ious identification problem. Considering both ership is endogenous than that it is exogenous,

performance and managerial ownership as although it tests both streams of research on

endogenous, they find no evidence that larger the sample firms.

managerial ownership boosts performance. In

contrast, performance appears to be a signifi-

cant negative predictor of management share- Hypothesis Development,

holding. They show that at high performance, Methodology, Data and the Models

management holds fewer shares or liquidates

part of their shareholding, particularly when For the first line of research, we develop a

their human capital is firm specific. This con- linear and cubic-form OLS regression model

firms the existence of a relationship whereby to estimate the effect of ownership on perfor-

firm performance is argued to drive manage- mance, as measured by market-to-book value

rial ownership. of equity ratio. The aim is to examine whether

Cho (1998) tests the hypothesis that insider a ‘linear’ or a ‘non-linear’ relationship exists

ownership affects investment, which, in turn, between board ownership and performance.

affects corporate value. However, after con- We thus test the following null hypothesis:

trolling for endogeneity, he finds that perfor-

mance is a positive predictor of ownership, H1: Firm performance is not a function of

but ownership cannot predict performance. board ownership.

Demsetz and Villalonga (2001) using a simul-

taneous equations model show no statistically

significant relationship between performance Model 1:

and managerial or Top 5 shareholders’ owner-

ship, but a significant negative influence of LOG-MBVE-Ratio i =

performance on managerial ownership. That β0 + β1 BD-SHAREi + β 2 ( BD-SHAREi )2

is, contrary to expectation, management seems

to hold fewer shares when the firm is doing + β 3 ( BD-SHAREi )3 + β 4 INST-SHAREi

well, as also found in Loderer and Martin + β 5 (INST-SHAREi )2

(1997). Bohren and Odegaard (2001) present

evidence that the insider ownership coefficient + β6 NON-EXE-DIR-Ratioi

is not significant in the performance equation, + β7 BD-SAL i (Spline-1) + β8 BD-SAL i (Spline-2)

while the performance coefficient is clearly

significant and positive in the insider owner- + β9 BD-SAL i (Spline-3 ) + β10 DPS i

ship equation. This implies that the causation + β11 CEO-DUM i + β12 CEO-CHAIR-DUAL-DUM i

seems to be reversed. + β13 CEO-TENUREi + β14 BIG-4 AUDIT-DUM i

Unlike the studies above-mentioned, Chung

and Pruitt (1996) find a two-way causality + β15 DEBT-Ratio i + β16 LOG-SALES i

between ownership and performance. Their + β17 INVEST-Ratioi + β18 ADVER-Ratioi

results show a strong positive association

+ β19 EARN-VOLATILEi + ε i

between executive ownership and firm value

Volume 15 Number 6 November 2007 © 2007 The Authors

Journal compilation © Blackwell Publishing Ltd. 2007

CORPORATE GOVERNANCE IN BANGLADESH 1459

And variables of interest of the model are ‘board

ownership percentage’ as a measure of owner-

29 26

ship and ‘market-to-book value of equity ratio’

∑ β IND-DUM

j i or ∑ β YEAR-DUM

j i

as a measure of performance. Log transforma-

j = 20 j = 20

23

tion of the performance measure is carried out

or ∑ β TYPE-DUM

j i

to ensure the variable is approximately normal

and to reduce the impact of outliers. Other

j=20

commonly used governance and control vari-

For the second line of research, a simultaneous ables are used in the models. The regression

equations model is developed, containing both model developed here has been tested for

performance and board ownership equations. ‘multi-collinearity’, ‘auto-correlation’, ‘het-

The aim is to examine whether a ‘reverse- eroskedasticity’, ‘stability’, ‘outliers’, ‘good-

causality’ exists between board ownership ness of fit’ and/or ‘normality’.

and performance, whereby performance de- The study is based on a sample of 723 firm-

termines board ownership rather than board years covering 8 years from 1995 to 2002. The

ownership determining performance. We thus sample is an unbalanced pooled sample of

test the following null hypothesis: Dhaka Stock Exchange listed firms produced

by a thorough screening of 1413 firm-years. It

H2: There is no relationship between own- covers all listed financial and non-financial

ership and firm performance in either firms, with 73 firms in 1995, 63 firms in 2002 and

direction. approximately 100 firms in the other years. All

Model 2: financial and non-financial data were manually

collected from the annual reports of the respec-

Performance Equation: tive firms for each year. Stock price data (year-

end) was obtained from the DataStream

LOG-MBVE-Ratio i = database. Stock price data for a number of firms

β0 + β1 BD-SHAREi + β 2 INST-SHAREi were not available in Data Stream, for which

data was collected from DSE Monthly Reviews,

+ β 3 (INST-SHAREi )2 a monthly bulletin published by Dhaka Stock

+ β 4 NON-EXE-DIR-Ratioi Exchange. For listed firms, annual reports are

+ β 5 BD-SAL i (Spline-1) + β6 BD-SAL i (Spline-2) largely audited by external audit firms and have

generally been approved by the Securities and

+ β7 BD-SAL i (Spline-3 ) + β8 DPS i Exchange Commission (SEC). Therefore, infor-

+ β9 CEO-DUM i mation produced in company annual reports

are taken as reliable and comparable. In case of

+ β10 CEO-CHAIR-DUAL-DUM i any doubts about the information presented in

+ β11 CEO-TENUREi + β12 BIG-4AUDIT-DUM i financial statements, the SEC is empowered to

+ β13 DEBT-Ratioi + β14 LOG-SALES i carry out special audits by its appointed audi-

tors. Only a few companies in Bangladesh have

+ β15 INVEST-Ratioi + β16 ADVER-Ratioi subsidiaries and preparation of consolidated

+ β17 EARN-VOLATILEi + ε i financial statement was not mandatory in Bang-

ladesh in the sample period of this study. In

Ownership Equation: those cases, parent company’s financial state-

ments have been used as the source of the

BD-SHAREi = necessary information. Therefore, subsidiary

β0 + β1LOG-MBVE-Ratioi + β 2 INST-SHAREi or consolidated financial statements have not

been used in this study.

+ β 3 PUB-SHAREi + β 4 GOV-SHAREi The descriptive statistics displayed in

+ β 5 BD-SIZEi + β6 FIRM-AGEi Table 2 show that the mean (median) MBVE

+ β7 CEO-TENUREi ratio is 5.395 (0.951) indicating that the market

values a firm’s share more than 5 times its

+ β8 CEO-CHAIR-DUAL DUM i book value on average, i.e., pays a premium

+ β9 BD-SAL-Ratio i + β10 DEBT-Ratioi over book value. The distribution of MBVE

ratio in the sample appears to be highly

+ β11LOG-ASSETS i + β12 INVEST-Ratioi

skewed as evident from the marked difference

+ β13 LIQUIDITY-Ratioi between the mean and the median. It appears

+ β14 PROFIT-VOLATILEi + ε i that a few firms command a very high MBVE

ratio while others have a generally low ratio.

With regard to the models and variables used The Log transformation neutralises the skew-

in this study, Table 1 explains variable labels, ness to a large extent. The mean (median)

definitions and expected signs. The main board shareholding is 0.388 (0.473), which

© 2007 The Authors Volume 15 Number 6 November 2007

Journal compilation © Blackwell Publishing Ltd. 2007

1460 CORPORATE GOVERNANCE

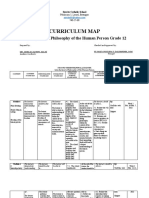

Table 1: Performance and ownership equation

Performance equation (MBVE as predicted variable)

Variable label Variable Variable definition Predicted sign

Endogenous variable

BD-SHARE Board ownership Board shareholding as a % of total outstanding shares +/-

(BD-SHARE)2 Board ownership squared +/-

(BD-SHARE)3 Board ownership cubed +/-

Explanatory variables

BD-SAL1 Board salary (Spline – 1) Tk 00–0.15 million +/-

BD-SAL2 Board salary (Spline – 2) Tk 0.15 million–0.75 million +/-

BD-SAL3 Board salary (Spline – 3) Above Tk 0.75 million +/-

INST-SHARE Financial institutional ownership Institutional shareholding as a % of total outstanding +/-

shares

(INST-SHARE)2 Institutions ownership squared +/-

NON-EXE-DIR-Ratio Non-executive directors’ ratio Ratio of non-executive directors ⫼ all directors +

CEO-DUM CEO dummy Owner or founder acts as CEO = 1 –

CEO-CHAIR-DUM CEO-Chair duality dummy CEO acts as Chairman = 1 –

CEO-TENURE CEO tenure No. of years served as CEO –

DPS Dividend per share Total dividend declared ⫼ total outstanding shares +

BIG-4 AUDIT-DUM BIG-4 affiliated dummy BIG-4 affiliated audit firm = 1 +

DEBT-Ratio Debt ratio Debt ⫼ total assets +/-

LOG-SALES Firm size Log total sales -

INVEST-Ratio Investment ratio Capital expenditure ⫼ total assets +

ADVER-Ratio Advertising ratio Advertising expenditure ⫼ total assets +

EARN-VOLATILE Firm-level risk SD of operating earnings ⫼ total sales -

and

IND-DUM Industry dummy 11-industry dummies ?

Or

YEAR-DUM Year dummy 8-year dummies ?

Or

TYPE-DUM Firm type dummy 5-firm-type dummies ?

Ownership Equation (BD-SHARE as predicted variable)

Variable label Variable Variable definition Predicted sign

Endogenous variable

MBVE-Ratio Market-to-book value of equity Market value of equity ⫼ book value of equity +/-

Explanatory variables

INST-SHARE Financial institutional ownership Institutional shareholding as a % of total outstanding –

shares

PUB-SHARE Public ownership Minority shareholding as a % of total outstanding shares –

GOV-SHARE Government ownership Government shareholding as a % of total outstanding -

shares

BD-SIZE Board size Number of directors on the board +/-

BD-SAL-Ratio Board salary ratio Directors’ salary ⫼ operating expense -

CEO-CHAIR-DUM CEO-Chair duality dummy CEO acts as Chairman = 1 +

CEO-TENURE CEO tenure No. of years served as CEO +

FIRM-AGE Firm age No. of years incorporated as a public limited company +/-

DEBT-Ratio Debt ratio Debt ⫼ total assets +/-

LOG-ASSETS Firm size Log total assets +/-

INVEST-Ratio Investment ratio Capital expenditure ⫼ total assets +

PROFIT-VOLATILE Firm-level risk SD of return on equity (ROE) +

LIQUIDITY-Ratio Liquidity ratio Cash flow ⫼ total assets +

Volume 15 Number 6 November 2007 © 2007 The Authors

Journal compilation © Blackwell Publishing Ltd. 2007

CORPORATE GOVERNANCE IN BANGLADESH 1461

Table 2: Summary of statistics on governance and financial characteristics

Variable Mean Median S.D. Minimum Maximum

MBVE 5.395 0.951 92.677 0.03 2,466.94

BD-SHARE 0.388 0.473 0.192 0.00 0.982

BD-SAL (Tk mill.) 0.947 0.440 1.554 0.00 13.53

BD-SAL-Ratio 0.042 0.021 0.059 0.00 0.33

BD-SIZE 8.3 6.00 6.249 3 37

NON-EXE-DIR-Ratio 0.672 0.80 0.294 0.00 0.97

INST-SHARE 0.197 0.176 0.133 0.001 0.96

PUB-SHARE 0.310 0.307 0.152 0.009 0.788

GOV-SHARE 0.029 0.00 0.112 0.00 0.66

CEO-DUM (no. of cases) 561

CEO-TENURE 10.4 9.00 7.257 1 32

CEO-CHAIR-DUM (no. of cases) 284

DPS (Tk) 8.9 4.9 11.49 0.00 100.34

FIRM-AGE 15.0 14 8.22 1 43

BIG-4 AUDIT-DUM (no. of cases) 240

DEBT (Tk mill.) 868.2 242.8 3,050.51 1.2 39,955.06

DEBT-Ratio 0.569 0.585 0.217 0.01 1.0

INVEST (Tk mill.) 38.0 6.81 143.64 0.00 2724.97

INVEST-Ratio 0.052 0.017 0.093 0.00 0.870

ADVER (Tk mill.) 3.3 0.39 14.32 0.00 199.58

ADVER-Ratio 0.005 0.001 0.020 0.00 0.28

CASH FLOW (Tk mill.) 49.8 24.13 87.93 -95.71 701.81

LIQUIDITY-Ratio 0.065 0.058 0.069 -0.41 0.65

Firm size – SALES (Tk mill.) 614.1 246.16 1,847.75 1.17 24,927.68

Firm size – ASSETS (Tk mill.) 1,172.6 399.7 3,211.62 9.00 41,895.87

Firm-level risk (EARN- VOLATILE) 0.472 0.096 2.356 0.00 43.63

Firm-level risk (PROFIT VOLATILE) 0.242 0.037 1.932 0.00 48.10

appears to be fairly high. Average institutional, On the contrary, owner CEOs can influence the

government and minority shareholdings are firm so that they serve as CEOs for a long

0.197, 0.029 and 0.310 respectively. Average period of time by virtue of their large share-

board size is 8 of which two-thirds are non- holdings in the firm. Only 33 per cent of firms

executive directors and average board salary is have Big-4 affiliated audit firms. Firms show a

close to Tk 1 million. In Bangladesh, compa- high level of earning and profit volatility. The

nies have to disclose board compensation, but average dividend per share is less than 10 per

a narrow definition of compensation is used, cent, debt ratio is 57 per cent, investment ratio

which includes only salary, bonuses, and fees is 5 per cent and the liquidity ratio is 7 per cent.

paid to the board members including the CEO

to attend board meetings. Any kind of perks or

profit sharing is not usually reported in annual Empirical Results

reports. Stock options or additional stock

awards are non-existent in Bangladesh. About Table 3 presents both linear and cubic-form

78 per cent of firms in the sample have owner regression (all firm effects) results for the first

CEOs and the remainder have non-owner line of research. The Linear-form regression

CEOs. The CEOs of 39 per cent of firms also act shows a significant negative effect of board

as chairperson of the board. While the average ownership on log MBVE, implying that higher

firm age is 15 years, average CEO tenure is levels of board shareholding lead to declining

about 10 years. In contrast to owner CEOs, firm performance and vice-versa. When board

non-owner CEOs are professionals who virtu- shareholding cubic-form variables are used, a

ally own no shares in the firm and do not act significant non-linear relationship between the

as chairperson of the board. Their tenure is two is discovered1. That is, performance

expected to be less than that of owner CEOs. initially decreases, then increases and again

© 2007 The Authors Volume 15 Number 6 November 2007

Journal compilation © Blackwell Publishing Ltd. 2007

1462 CORPORATE GOVERNANCE

Table 3: Determinants of financial performance

Variables Log MBVE Log MBVE

(Linear-form OLS) (Cubic-form OLS)

CONSTANT -0.184 -0.160

(-1.646)* (-1.485)

BD-SHARE -0.274 -3.221

(-3.141)*** (-7.250)***

(BD-SHARE)2 9.677

(7.639)***

(BD-SHARE)3 -7.739

(-8.132)***

INST-SHARE -0.848 -0.776

(-3.404)*** (-3.166)***

(INST-SHARE)2 0.668 0.594

(1.835)* (1.677)*

NON-EXE-DIR-Ratio 0.008 -0.035

(0.156) (-0.706)

BD-SAL1 1.761 1.840

(up to Tk 0.15 m) (5.101)*** (5.570)***

BD-SAL2 -0.356 -0.289

(Tk 0.15 m–0.75 m) (-4.193)*** (-3.526)***

BD-SAL3 0.036 0.027

(over Tk 0.75 m) (2.902)*** (2.229)**

CEO-DUM 0.177 0.233

(3.996)*** (5.246)***

CEO-CHAIR-DUM 0.067 0.021

(2.098)** (0.676)

CEO-TENURE -0.010 -0.009

(-4.800)*** (-4.195)***

DPS 0.006 0.005

(4.692)*** (4.582)***

DEBT-Ratio 0.540 0.539

(7.714)*** (8.051)***

BIG-4 AUDIT-DUM 0.111 0.145

(3.466)*** (4.630)***

LOG-SALES -0.076 -0.078

(-2.561)*** (-2.755)***

INVEST-Ratio 0.378 0.402

(2.569)*** (2.856)***

ADVER-Ratio 2.567 1.995

(3.531)*** (2.823)***

EARN-VOLATILE -0.006 -0.005

(-1.012) (-0.899)

N 723 723

Adjusted R2 0.195 0.263

F-statistic 11.266*** 14.590***

Turning points: Minimum 22.97%

Maximum 60.39%

***Significance at 1% confidence level using two-tailed test.

**Significance at 5% confidence level using two-tailed test.

*Significance at 10% confidence level using two-tailed test.

Volume 15 Number 6 November 2007 © 2007 The Authors

Journal compilation © Blackwell Publishing Ltd. 2007

CORPORATE GOVERNANCE IN BANGLADESH 1463

decreases as board shareholding increases. The a higher price for firms that pay regular divi-

turning points show that lower levels of board dends. Regulators, particularly the SEC, also

shareholding (up to 22.97 per cent) are nega- emphasize regular payment of dividends. Tax

tively related to performance, but the impact incentives are allowed for firms paying regular

turns positive for moderate levels of owner- dividends. In addition, the Dhaka Stock

ship (between 22.97 per cent–60.39 per cent) Exchange has categorized its securities (e.g., A,

and finally becomes negative as board owner- B and Z categories) on the basis of dividend

ship rises further (beyond 60.39 per cent). The payments and holding AGMs regularly, which

cubic regression model shows a significant appear to impact on the market price of shares.

relationship at the 1 per cent confidence level, The debt ratio has a significant positive rela-

having adjusted R2 of 0.263 and is stronger than tionship with performance, consistent with

for the linear form. Therefore, it appears that agency theory. The Big-4 audit firm dummy

low levels of board ownership do not provide presents a positive performance effect. This

sufficient incentive to enhance shareholder implies that the accounting and audit quality

wealth. Again, at extremely high levels of of the firm is one of the vital control-

board ownership, the ‘entrenchment’ effect can mechanisms to protect the interest of outside

be observed. At this level of shareholding, shareholders. For control variables, firm size

neither the ‘incentive effect’ nor the ‘outside and two discretionary expenditures show,

discipline’ (takeover) is effective in merging respectively, a significantly negative and posi-

the board members’ interest with that of tive relationship with performance, while firm

minority shareholders. Only the middle range risk appears to have no effect.

of board ownership (23 per cent–60 per cent) The above mentioned non-linear relation-

reveals an alignment of both groups’ interest. ship between board ownership and perfor-

For other governance variables, the 3 piece- mance supports the conclusions of Morck et al.

wise (or splines) variables for board salary (1988) that the relationship between manage-

show a non-linear relation with performance. rial or board ownership and firm performance

It has a positive effect when the salary range is may not be a simple linear one; rather it

up to Tk 0.15 million (US$2,500), then a nega- appears to be non-linear, dependent on the

tive effect between Tk 0.15 million and 0.75 level of board ownership and the institutional

million (US$2,500–$12,500) and again a posi- set-up in a particular country. It is also appar-

tive effect for board salary over Tk 0.75 million ent that the nature of non-linearity may be dif-

(US$12,500). Institutional shareholding ini- ferent in different countries or even across

tially has a strong negative impact on perfor- firms within the same country, depending

mance at 1 per cent significance level, but a upon the sample size, sample period, perfor-

positive effect thereafter at 10 per cent level. mance measure used, analytical tool used, etc.

This result suggests that institutions start The non-linear relationship between board

monitoring the firm once they reach substan- ownership and firm performance in the

tial stakes in it. The CEO dummy is significant present study is not exactly the same as found

and positive, against expectations. It was in most empirical research on developed

expected to have a negative impact on perfor- economies. The non-linear relation of the

mance considering the controlling dominance present study matches with those found by

of family or founder over the firm’s overall Belkaoui and Pavlik (1992) in the US and

activity. However the evidence is contrary to Prevost et al. (2002) in New Zealand with the

this, indicating that CEOs might have an exception of the range of board ownership and

owner-specific attribute (e.g., entrepreneurial the use of OLS regression – piecewise vs.

ability, talents, etc.) that contributes toward cubic. However, the cubic-form non-linearity

firm value. As for CEO tenure, the relationship of board ownership found in this study stands

with performance is significantly negative, as in contrast to that found in Chen et al. (1993)

expected. This means a longer CEO tenure is and Short and Keasey (1999), where the direc-

value destroying due to an entrenchment tion of non-linearity and the turning points are

effect or excessive reliance on CEO human the opposite from these found in this study.

capital. Both non-executive directors and A number of tests were undertaken to deter-

CEO-Chair dummy have no effect on perfor- mine the robustness of the above empirical

mance. Dividend per share shows a signifi- results. These tests (although not reported here)

cantly positive relationship with performance confirm the non-linear relationship2. Spline

as it serves as a signal of a high quality firm. board ownership variables are adopted from

This is because in Bangladesh dividend perfor- the ‘turning points’ observed in the cubic-form

mance is considered to be a strong indicator of regressions. The cubic-form ownership vari-

financial performance and sound operational ables are replaced by the three spline owner-

management of the firm. Shareholders appear ship variables (00–0.2286, 0.23–0.60, above

to prefer cash dividends and be willing to pay 0.60) keeping all other explanatory variables

© 2007 The Authors Volume 15 Number 6 November 2007

Journal compilation © Blackwell Publishing Ltd. 2007

1464 CORPORATE GOVERNANCE

unchanged. The piecewise regression confirms Chair dummy which turns positive at 10 per

the results of the cubic-form regression of cent significance level.

Table 3 with only minor differences. Regres-

sion analysis for the manufacturing firms only

(603 firm-years) also confirms the non-linear Conclusion

relationship of Table 3, with the exception of

financial institutional shareholding squared This study analyses the link between board

and CEO dummy variable. Furthermore, sepa- ownership and financial performance for listed

rate annual cross-sectional regressions show firms in Bangladesh, based on ownership

significant non-linearity of board ownership being viewed as exogenous and endogenous.

and MBVE ratio in the years 1996, 1998, 1999 It seeks to identify similarities or differences in

and 2001. In accordance with the empirical lit- relationships found in Bangladesh with those

erature, a number of ‘fixed-effects’ such as found in developed economies. While the evi-

industry effect, firm effect and specific firm- dence on the ownership-performance relation-

type effect if omitted could produce a spurious ship is mixed, it clarifies the role of corporate

correlation between ownership and perfor- governance in improving corporate perfor-

mance. Tests of all of these fixed-effects confirm mance. The empirical findings of the study in

the non-linearity of board ownership3. both streams of research are similar to those

Table 4 provides 2-SLS estimates for the found in developed economies.

simultaneous equations model. In the perfor- Regarding the first stream of research, the

mance equation, the main variable of interest – linear OLS estimates show a negative relation-

board ownership – has no explanatory power ship between board ownership and perfor-

to determine MBVE. This finding is contrary to mance, indicating that high board ownership

that of the OLS regression results discussed destroys firm value and vice-versa. The cubic-

above. That is, consistent with the established form OLS estimates support the existence of a

literature, the significant negative relationship non-linear relationship between board share-

between board ownership and MBVE in the holding and financial performance. This indi-

single equation model disappears when own- cates that board ownership destroys value up

ership is assumed to be endogenous. On the to 23 per cent level of ownership, enhances

other hand, the board shareholding equation value between 24 per cent and 60 per cent

reveals a significantly negative relation be- levels of ownership and again destroys value

tween MBVE and board ownership. This beyond the 60 per cent level. This mono-

supports the view that there is a ‘reverse- directional relationship indicates that the

causality’ relationship4, i.e., a firm’s financial incentives for monitoring change significantly

performance determines the level of board as ownership stakes rise beyond a particular

ownership but not vice-versa. As the relation- threshold. This means that initially the board

ship flows from performance to board owner- lacks incentives to increase firm performance

ship and is negative, it follows that a decrease and eventually they become entrenched and

in board ownership results from high financial perform poorly thereby negatively affecting

performance and vice-versa. Board members performance. Other governance and control

seem to hold fewer shares when a firm is variables are in the expected direction in their

doing well. This is due to selling shares on the relation with firm performance, with only few

part of the board members during good times, departures from the literature. Institutional

with the expectation that good performance shareholdings have a significantly negative

will be followed by poor performance; or due effect on performance at lower levels of own-

to liquidating a part of the stockholdings to ership due to lack of incentives, but later

generate capital gain so that their human become positive. This implies inadequate insti-

capital is less firm-specific; or due to the pres- tutional activism or a passive role until they

ence of a creditor’s monitoring. Such behav- gain sizable stockholding. Board salary

iour is consistent with the agency literature. appears to be a value provider up to the level

The ‘reverse-causality’ found in this study of US$2,500, then a value destroyer for the

with negative sign is consistent with the find- salary levels between US$2,500 and $12,500

ings of both Loderer and Martin (1997) and and finally, a value enhancer above US$12,500.

Demsetz and Villalonga (2001). This is cor- The sign of the board salary variables on per-

roborative of a relationship between board formance is opposite to that of the board own-

shareholding and performance existing, but ership variables suggesting that the negative

that performance appears to drive board performance effect of one variable might be

shareholding. With regard to the other compensated by the positive performance

explanatory variables in the MBVE equation, effect of the other. It seems that although non-

the 2-SLS estimates are mostly similar to those executive directors are irrelevant in improving

found in the OLS regression except for CEO- performance, owner-CEO and CEO-chairman

Volume 15 Number 6 November 2007 © 2007 The Authors

Journal compilation © Blackwell Publishing Ltd. 2007

CORPORATE GOVERNANCE IN BANGLADESH 1465

Table 4: Determinants of MBVE and board shareholding

Variables Log MBVE (2-SLS) Board Shareholding (2-SLS)

CONSTANT -0.217 0.663

(-1.791)* (15.247)***

BD-SHARE -0.194

(-1.362)

LOG-MBVE-Ratio -0.254

(-4.911)***

INST-SHARE -0.799 -0.351

(-3.087)*** (-7.304)***

(INST-SHARE)2 0.615

(1.652)*

PUB-SHARE -0.312

(-7.586)***

GOV-SHARE -0.457

(-7.685)***

BD-SIZE 0.003

(2.925)***

NON-EXE-DIR-Ratio 0.004

(0.084)

BD-SAL1 1.765

(up to Tk 0.15 m) (5.109)***

BD-SAL2 -0.347

(Tk 0.15 m–0.75 m) (-4.039)***

BD-SAL3 0.038

(over Tk 0.75 m) (2.978)***

BD-SAL-Ratio -0.261

(-2.316)**

CEO-DUM 0.170

(3.747)***

CEO-CHAIR-DUM 0.062 0.068

(1.897)* (5.186)***

CEO-TENURE -0.011 0.005

(-4.849)*** (3.779)***

FIRM-AGE -0.006

(-6.841)***

DPS 0.006

(4.580)***

BIG-4 AUDIT-DUM 0.116

(3.533)***

DEBT-Ratio 0.532 0.168

(7.488)*** (4.127)***

LOG-SALES -0.073

(-2.462)***

LOG-ASSETS -0.073

(-5.430)***

INVEST-Ratio 0.378 -0.035

(2.571)*** (-0.549)

ADVER-Ratio 2.653

(3.598)***

EARN-VOLATILE -0.006

(-0.960)

PROFIT-VOLATILE 0.020

(4.670)***

LIQUIDITY-Ratio 0.004

(0.033)

N 723 723

Adjusted R2 0.187 0.447

F-statistic 10.782*** 42.718***

***Significance at 1% confidence level using two-tailed test.

**Significance at 5% confidence level using two-tailed test.

*Significance at 10% confidence level using two-tailed test.

© 2007 The Authors Volume 15 Number 6 November 2007

Journal compilation © Blackwell Publishing Ltd. 2007

1466 CORPORATE GOVERNANCE

do improve performance. However, this Agrawal A. and Knoeber, C. R. (1996) Firm per-

erodes as CEO tenure gets longer. With respect formance and mechanisms to control agency

to other governance variables, dividend, debt problems between managers and shareholders.

and Big-4 affiliated audit appear to have posi- Journal of Financial and Quantitative Analysis, 31,

377–397.

tive performance effects. As for the control

Asian Development Bank (2003) ADB report on

variables, firm size and discretionary expendi- Bangladesh ‘capacity building of the Securities

tures have a negative and positive effect, and Exchange Commission and selected capital

respectively, on performance as expected, market institutions’, Dhaka, Bangladesh.

while earning volatility has no influence at all. Belkaoui A. and Pavlik, E. (1992) The effects of own-

In the second stream of research, the 2-SLS ership structure and diversification strategy on

results present a completely opposite conclu- performance, Management and Decision Economics,

sion for board ownership in the performance 13, 343–352.

equation – it shows no significant effect for Berle A. and Means, G. (1932) Modern corporation

board ownership on performance. This im- and private property. Macmillan, New York: World

INC.

plies that board ownership is irrelevant in

Bohren, O. and Odegaard, B. A. (2001) Corporate

explaining firm financial performance in governance and economic performance in Nor-

Bangladesh. The board ownership equation wegian listed firms, Research report 11, Norwe-

shows a significantly negative effect of perfor- gian School of Management.

mance on board ownership. That is, there is Boyle, G. W., Carter, R. B. and Stover, R. D. (1998)

a reverse-causality: performance determines Extraordinary antitakeover provisions and

board ownership rather than board ownership insider ownership structure: The case of convert-

determining performance. ing savings and loan, Journal of Financial and

With respect to other governance and Quantitative Analysis, 33, 291–304.

control variables, the 2-SLS results for all these Chen, H., Hexter, J. L. and Hu, M. Y. (1993) Man-

agement ownership and corporate value, Manage-

variables in the performance equation are

rial and Decision Economics, 14, 335–346.

similar to the OLS results with the exception of Cho, M. H. (1998) Ownership structure, investment

the CEO-Chair dummy variable. In the board and the corporate value: An empirical analysis,

ownership equation, the 2-SLS results indicate Journal of Financial Economics, 47, 103–121.

a negative effect for substitute ownership Chung, K. and Pruitt, S. (1996) Executive owner-

types, such as institutional, government, and ship, corporate value, and executive compensa-

public shareholdings on board ownership, as tion; A unifying framework, Journal of Banking

expected. Firm age, board salary ratio and firm and Finance, 20, 1135–1159.

size also have a negative impact on board own- Demsetz, H. (1983) The structure of ownership

ership while investment and liquidity ratios and the theory of the firm, Journal of Law and

Economics, XXVI, 375–390.

have no significant impact. Factors such as

Demsetz, H. and Lehn, K. (1985) The structure of

board size, CEO-chairman, CEO tenure, debt corporate ownership: Causes and consequences,

and profit volatility appear to have positive Journal of Political Economy, 93, 1155–1177.

influence on board ownership, as expected. Demsetz, H. and Villalonga, B. (2001) Ownership

These results imply that board ownership is structure and corporate performance, Journal of

determined by a number of alternative gover- Corporate Finance, 7, 209–233.

nance and control variables, in addition to Fama, E. F. and Jensen, M. (1983) Agency problems

financial performance. and residual claims, Journal of Law and Economics,

XXVI, 327–349.

Farooque, O. A., van Zijl T., Dunstan K. and Karim

Notes W. (2006) A Mono-Directional Perspective of

Board Ownership and Performance Relation in

1. Non-linearity is also found using Log Bangladesh, Conference Proceedings, the 29th

Tobin’s Q and ROA as performance Annual Congress of the European Accounting

measures (Farooque et al., 2006). Association, Dublin, Ireland, March 2006, and the

2 & 3. For brevity these results are not reported XVIII Asian Pacific Conference on International

here but are available from the authors upon Accounting Issues, Hawaii, October 2006.

request. Farooque, O. A., van Zijl T., Dunstan K. and Karim

4. Reverse-causality is also found in Farooque AKM W. (2007) Ownership Structure and Corpo-

et al. (2007) using Log Tobin’s Q and ROA as rate Performance: Evidence from Bangladesh,

the performance measures. Asia-Pacific Journal of Accounting & Economics, 14,

127–150.

References Fernandez, C. and Gomez, S. (2002) Does owner-

ship structure affect firm performance? Evidence

Agrawal, A. and Mandelker, G. N. (1990) Large from a continental-type governance system,

shareholders and the monitoring of managers: working paper.

The case of antitakeover charter amendments. Grossman S. and Hart, O. (1980) Takeover bids, the

Journal of Financial and Quantitative Analysis, 25, free-rider problem, and the theory of the corpo-

143–161. ration, Bell Journal of Economics, 11, 42–64.

Volume 15 Number 6 November 2007 © 2007 The Authors

Journal compilation © Blackwell Publishing Ltd. 2007

CORPORATE GOVERNANCE IN BANGLADESH 1467

Hermalin B. and Weisbach, M. (1991) The effect Neumann R. and Voetmann, T. (1999) Does owner-

of board composition and direct incentives on ship matter? Evidence from changes in institu-

firm performance, Financial Management, 20, 101– tional and strategic investors’ equity holdings,

112. working paper.

Himmelberg, C. P., Hubbard, R. G. and Palia, D. Oman, C., Fries S. and Buiter W. (2003) Corporate

(1999) Understanding the determinants of mana- Governance in Developing, Transition and

gerial ownership and the link between owner- Emerging-Market Economies. Development

ship and performance, Journal of Financial Centre Policy Brief No. 23, OECD, Paris.

Economics, 53, 353–384. Prowse, S. (1999) Corporate governance in East

Holderness, C., Kroszner, R. S. and Sheehan, D. Asia: A framework for analysis, Paper presented

(1999) Were the good old days that good? at high level Seminar on Managing Capital Flows,

Changes in managerial stock ownership since Bangkok, 15–16 June, 1998, Organized by ADB,

the great depression, Journal of Finance, LIV, 435– IMF, WB and United Nations Economic and

469. Social Commission for Asia and the Pacific.

Hubbard, R. and Palia, D. (1995) Benefits of control, Prevost, A. K., Rao, R. P. and Hossain, M. (2002)

managerial ownership and the stock returns of Determinants of board composition in New

acquiring firms, The Rand Journal of Economics, 26, Zealand: a simultaneous equations approach,

782–792. Journal of Empirical Finance, 9, 373–397.

Islam, A. and Khaled, M. (2005) Test of Weak-Form Randoy, T. and Goel, S. (2001) Ownership structure,

Efficiency of the Dhaka Stock Exchange, Journal of founding family leadership and performance in

Business Finance and Accounting, 32, 1613–1624. Norwegian SMEs, working paper.

Jensen, M. and Meckling, W. (1976) Theory of Sarkar, J. and Sarkar, S. (2000) Large shareholder

the firm: Managerial behaviour, agency costs activism in corporate governance in developing

and ownership structure, Journal of Financial countries: Evidence from India, International

Economics, 3, 305–360. Review of Finance, 1, 161–194.

Jensen, M. and Murphy, K. (1990) Performance Shleifer, A. and Vishny, R. W. (1986) Large share-

pay and top-management incentives, Journal of holders and corporate control, Journal of Political

Political Economy, 98, 225–264. Economy, 94, 461–488.

Karim, A. K. M. W. and Ahmed, J. U. (2005) Com- Shleifer, A. and Vishny, R. W. (1997) A survey of

pliance to international accounting standards corporate governance, Journal of Finance, LII, 737–

in Bangladesh: A survey of annual reports, The 783.

Bangladesh Accountant: Journal of the Institute of Short, H. and Keasey, K. (1999) Managerial owner-

Chartered Accountants in Bangladesh, 48, 23–41. ship and the performance of firms: Evidence from

Keasey, K., Short, H. and Watson, R. (1994) Direc- the UK, Journal of Corporate Finance, 5, 79–101.

tors’ ownership and the performance of small Slovin, M. B. and Sushka, M. E. (1993) Ownership

and medium sized firms in the UK, Small Business concentration, corporate control activity and firm

Economics, 6, 225–236. value: Evidence from the death of inside

Kole, S. R. (1996) Managerial ownership and firm blockholders, Journal of Finance, 48, 1293–1321.

performance: incentives or rewards? Advances in Steiner, T. L. (1996) A re-examination of the relation-

Financial Economics, 2, 119–149. ship between ownership structure, firm diversi-

Lichtenberg, F. and Pushner, G. M. (1994) Owner- fication and Tobin’s Q, Quarterly Journal of

ship structure and corporate performance in Business and Economics, 4, 39–48.

Japan, Japan and the World Economy, 6, 239–261. Stulz, R. (1988) Managerial control of voting rights:

Loderer, C. and Martin, K. (1997) Executive stock Financing policies and the market for corporate

ownership and performance: tracking faint control, Journal of Financial Economics, 20, 25–54.

traces, Journal of Financial Economics, 45, 223– Williamson, O. E. (1979) Transaction cost econom-

255. ics: The governance of transactional relations,

Mathiesen, H. (2002) Managerial ownership and Journal of Law and Economics, 22, 233–261.

financial performance. Ph.D. thesis, Department World Bank (1999) Corporate governance: A framework

of International Economics and Management, for implementation, Washington.

Copenhagen Business School, Denmark. Wruck K. H. (1989) Equity ownership concentra-

McConnell, J. J. and Servaes H. (1990) Additional tion and firm value – Evidence from private

evidence on equity ownership and corporate equity financings, Journal of Financial Economics,

value, Journal of Financial Economics, 27, 595–612. 23, 3–28.

Mehran, H. (1995) Executive compensation struc- Xu, X. and Wang, Y. (1999) Ownership structure and

ture, ownership and firm performance, Journal of corporate governance in Chinese stock compa-

Financial Economics, 38, 163–184. nies, China Economic Review, 10, 75–89.

Mitton, T. (2002) A cross-firm analysis of the impact

of corporate governance on the East Asian finan- Omar Al Farooque is a Lecturer in Accounting

cial crisis, Journal of Financial Economics, 64, 215– at the University of New England. He has pub-

241.

lished in different journals including the Asia

Morck, R., Shleifer, A., and Vishny, R. (1988) Man-

agement ownership and market valuation, Journal Pacific Journal of Accounting and Economics

of Financial Economics, 20, 293–315. (APJAE). Waiting for his PhD award, Mr.

Nagar, V., Petroni, K. and Wolfenzon, D. (2000) Farooque’s research interests are in corporate

Ownership structure and firm performance in governance, finance, financial disclosure and

closely-held corporations, working paper. reporting and entrepreneurship.

© 2007 The Authors Volume 15 Number 6 November 2007

Journal compilation © Blackwell Publishing Ltd. 2007

1468 CORPORATE GOVERNANCE

Tony van Zijl is Professor of Accounting & sion. Professor Dunstan’s research interests

Financial Management and Director of the are in the areas of corporate governance and

Centre for Accounting, Governance and Taxa- financial accounting.

tion Research at Victoria University of Well-

ington. His research interests are in valuation, AKM Waresul Karim is a Senior Lecturer in

cost of capital and financial reporting. He is a Accounting at Victoria University of Welling-

Director of the international expert services ton. Starting his career at the University of

firm LECG (NASDAQ: XPRT). Dhaka, Dr Karim earned a PhD from the

University of Leeds. He has published ex-

Keitha Dunstan is a Professor of Accounting tensively in academic and professional jour-

and Head of the School of Accounting and nals including the International Journal of

Commercial Law at Victoria University of Accounting, Asia Pacific Journal of Accounting

Wellington. She is also a member of New and Economics and Research in Banking and

Zealand Securities and Exchange Commis- Finance.

Volume 15 Number 6 November 2007 © 2007 The Authors

Journal compilation © Blackwell Publishing Ltd. 2007

You might also like

- Empirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveFrom EverandEmpirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveNo ratings yet

- Corporate Governance and Social Responsibility in Banking - Case Study Mogadishu SomaliaDocument13 pagesCorporate Governance and Social Responsibility in Banking - Case Study Mogadishu SomaliaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Ajsms 1 2 191 195Document5 pagesAjsms 1 2 191 195Atiq ur Rehman QamarNo ratings yet

- International Journal of Advanced Research in Management and Social Sciences (ISSN: 2278-6236)Document16 pagesInternational Journal of Advanced Research in Management and Social Sciences (ISSN: 2278-6236)ijgarph0% (1)

- Guven AlpayDocument20 pagesGuven Alpayfisayobabs11No ratings yet

- Government Ownership and Performance: An Analysis of Listed Companies in MalaysiaDocument9 pagesGovernment Ownership and Performance: An Analysis of Listed Companies in MalaysiaMuhammad FadelNo ratings yet

- Simpson - 2012 - Boards and Governance of State-OwnedDocument14 pagesSimpson - 2012 - Boards and Governance of State-OwnedtiraNo ratings yet

- Article 3Document18 pagesArticle 3kinza hameedNo ratings yet

- Corporate Governance and Firm Performance - A Study of Bse 100 CompaniesDocument11 pagesCorporate Governance and Firm Performance - A Study of Bse 100 CompaniesAbhishek GagnejaNo ratings yet

- Corporate Governance Failures in Bangladesh - A Study of Hall Mark and Basic BankDocument16 pagesCorporate Governance Failures in Bangladesh - A Study of Hall Mark and Basic BankMd Miraj AhmedNo ratings yet

- Corporate GovernanceDocument16 pagesCorporate GovernanceusvathNo ratings yet

- Corporate Governance and Performance of State-Owned Enterprises in GhanaDocument13 pagesCorporate Governance and Performance of State-Owned Enterprises in GhanaMuhammad SetiawanNo ratings yet

- Challenges and Concerns in The Progressive Regulatory Structure For Corporate Governance in IndiaDocument7 pagesChallenges and Concerns in The Progressive Regulatory Structure For Corporate Governance in IndiaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Role of Institutional Shareholders' Activism in Enhancing Firm Performance: The Case of PakistanDocument15 pagesRole of Institutional Shareholders' Activism in Enhancing Firm Performance: The Case of PakistanAjazzMushtaqNo ratings yet

- Jurnal Utama (Kelompok)Document24 pagesJurnal Utama (Kelompok)maharaniNo ratings yet

- Influence of Corporate Governance On Accounting Outcomes & Firms PerformanceDocument16 pagesInfluence of Corporate Governance On Accounting Outcomes & Firms PerformanceVarga AlinNo ratings yet

- Corporate Governance and Performance (A Case Study For Pakistani Communication Sector)Document8 pagesCorporate Governance and Performance (A Case Study For Pakistani Communication Sector)Nadeem AhmadNo ratings yet

- 10 1108 - IJCoMA 11 2011 0034 PDFDocument15 pages10 1108 - IJCoMA 11 2011 0034 PDFUmar Abdul AzizNo ratings yet

- An Overview of Corporate Governance Some EssentialDocument7 pagesAn Overview of Corporate Governance Some EssentialNaufal Surya MahardikaNo ratings yet

- Article 176767 PDFDocument6 pagesArticle 176767 PDFNaveed AhmadNo ratings yet

- Corporate Governance Mechanism and Firm Performance A Study of Listed Manufacturing Firms in Nigeri1Document59 pagesCorporate Governance Mechanism and Firm Performance A Study of Listed Manufacturing Firms in Nigeri1jamessabraham2No ratings yet

- Influence of Corporate Governance On Accounting Outcomes & Firms PerformanceDocument16 pagesInfluence of Corporate Governance On Accounting Outcomes & Firms PerformanceVarga AlinNo ratings yet

- 01 01-14 Mahboob UllahDocument14 pages01 01-14 Mahboob UllahB2MSudarman IfolalaNo ratings yet

- 757-Article Text-2779-1-10-20181030Document17 pages757-Article Text-2779-1-10-20181030Moiz RiazNo ratings yet

- Chap4 PDFDocument45 pagesChap4 PDFFathurNo ratings yet

- CGP in NGODocument5 pagesCGP in NGOHashir bariNo ratings yet

- Stakeholders and Sustainable Corporate Governance in NigeriaDocument154 pagesStakeholders and Sustainable Corporate Governance in NigeriabastuswitaNo ratings yet

- Corporate Governance Practices in SBI - A Case Study: Dr. Santanu Kumar DasDocument8 pagesCorporate Governance Practices in SBI - A Case Study: Dr. Santanu Kumar DasMd MajidNo ratings yet

- Effect of Corporate Directorship On Firm Performance: Cases of Companies Listed On The Uganda Securities Exchange (USE)Document15 pagesEffect of Corporate Directorship On Firm Performance: Cases of Companies Listed On The Uganda Securities Exchange (USE)International Journal of Innovative Science and Research TechnologyNo ratings yet

- For Plag CheckDocument259 pagesFor Plag CheckAftab TabasamNo ratings yet

- Thesis On Corporate Governance and Firm PerformanceDocument10 pagesThesis On Corporate Governance and Firm Performancegja8e2sv100% (2)

- Two Tier CG ModelDocument10 pagesTwo Tier CG Modelsafdar_tahir6548No ratings yet

- Ownership Structure and The Financial Performance-NigeriaDocument10 pagesOwnership Structure and The Financial Performance-Nigeriansrivastav1No ratings yet

- Corporate Governance and Firm PerformancDocument18 pagesCorporate Governance and Firm PerformancAfzalNo ratings yet

- Hsu (2005) SizeDocument15 pagesHsu (2005) Sizedara ibthiaNo ratings yet

- Abbreviations: Chief Executive OfficerDocument22 pagesAbbreviations: Chief Executive Officerعباس ناناNo ratings yet

- The Relationship Between Corporate Governance and Working Capital Management Efficiency of Firms Listed at The Nairobi Securities ExchangeDocument11 pagesThe Relationship Between Corporate Governance and Working Capital Management Efficiency of Firms Listed at The Nairobi Securities ExchangeSivabalan AchchuthanNo ratings yet

- Introduction of Corporate GovernanceDocument8 pagesIntroduction of Corporate GovernanceHasanur RaselNo ratings yet

- The Pricing of Discretionary Accruals - Evidence From PakistanDocument23 pagesThe Pricing of Discretionary Accruals - Evidence From PakistanFazaria RamadaniNo ratings yet

- Internal Corporate Governance and Financial Performance Nexus A Case of Banks of PakistanDocument7 pagesInternal Corporate Governance and Financial Performance Nexus A Case of Banks of PakistanCorolla SedanNo ratings yet

- Role of Corporate Governance in Firm Performance: A Comparative Study Between Chemical And..Document11 pagesRole of Corporate Governance in Firm Performance: A Comparative Study Between Chemical And..Asif SaleemNo ratings yet