0% found this document useful (0 votes)

398 views7 pagesModified LESSON PLAN Mergers and Acquisitions 19 Final

This document provides a lesson plan for a 19-session course on Mergers and Acquisitions (M&A). The course aims to give students a comprehensive understanding of M&A from a corporate executive perspective, covering strategic approaches, valuation, due diligence, integration, and the legal/regulatory framework. Sessions will include lectures, exercises, cases, and student presentations. Students will be assessed via exams, assignments, and presenting their work in a workbook completed throughout the course. The lesson plan outlines the session topics, readings, and assessment guidelines in detail.

Uploaded by

sukeshCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOC, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

398 views7 pagesModified LESSON PLAN Mergers and Acquisitions 19 Final

This document provides a lesson plan for a 19-session course on Mergers and Acquisitions (M&A). The course aims to give students a comprehensive understanding of M&A from a corporate executive perspective, covering strategic approaches, valuation, due diligence, integration, and the legal/regulatory framework. Sessions will include lectures, exercises, cases, and student presentations. Students will be assessed via exams, assignments, and presenting their work in a workbook completed throughout the course. The lesson plan outlines the session topics, readings, and assessment guidelines in detail.

Uploaded by

sukeshCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOC, PDF, TXT or read online on Scribd

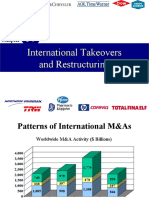

- Introduction to Mergers and Acquisitions

- Course Content and Outcomes

- Session Plan

- Prescribed Readings

- Student Assessment Guidelines

- Style and Conduct Guidelines