Professional Documents

Culture Documents

To The of .: Exceptions Principle Indemnity

Uploaded by

NKOYOYO HANNINGTONOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

To The of .: Exceptions Principle Indemnity

Uploaded by

NKOYOYO HANNINGTONCopyright:

Available Formats

Page

Halsbury's Laws of England/Insurance (Volume 60 (2018))/1. Introduction/(1) Origin and Common

Principles/4. Exceptions to the principle of indemnity.

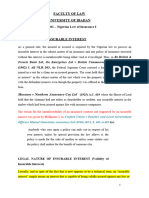

4. Exceptions to the principle of indemnity.

Brexit note

Contracts of life insurance, personal accident and sickness insurance and some forms of contingency insur-

ance are not strictly contracts of indemnity1. In contracts of this class there is normally no necessity to prove

a pecuniary loss2. If the insured chooses, for example, to value a leg or an arm at £50,000 or £500,000, and

to pay premiums accordingly, he is entitled to recover the stipulated sum in the event of his losing the mem-

ber in question. His estimate of his possible loss is, in effect, regarded as genuine and acceptable, even if

not agreed, because no one is likely deliberately to inflict such damage on himself, and no one can, in fact,

foresee, even at the date of loss of the member, what the full pecuniary loss is likely to be. Similarly, a pro-

poser can value his life at any figure that he can afford, particularly as he is unlikely to be able to foresee, at

the date when he takes out the policy, what at the date of his death his financial obligations to his depen-

dants may be. Indeed, it has been said that such an insurance is really a form of investment 3. The same

principle is equally applicable whether the life insured is that of the insured himself, or of some other person

in whose life he has an insurable interest4; the sum insured becomes payable in all cases merely by reason

of the happening of the event. Similarly, in some forms of contingency insurance the contract is merely to pay

a fixed sum or a sum arrived at by a stipulated calculation if the contingency matures 5.

1 See Dalby v India and London Life Assurance Co (1854) 15 CB 365, Ex Ch (life assurance); Theobald v Railway Passen-

gers Assurance Co (1854) 10 Exch 45 at 53 per Alderson B (personal accident and sickness insurance). A policy insuring a

third person against personal accident is, however, a contract of indemnity: Blascheck v Bussell (1916) 33 TLR 51 (affd 33

TLR 74, CA); Hebdon v West (1863) 3 B & S 579. As to contracts of indemnity see PARAS 2–3. As to contingency insurance

see PARA 717 et seq.

2 Dalby v India and London Life Assurance Co (1854) 15 CB 365, Ex Ch; Law v London Indisputable Life Policy Co (1855) 1

K & J 223; Gould v Curtis [1913] 3 KB 84 at 95, CA, per Buckley LJ.

3 Gould v Curtis [1912] 1 KB 635 at 640 per Hamilton J; affd [1913] 3 KB 84, CA.

4 See PARAS 463–472.

5 See PARA 718.

You might also like

- Gould V CurtisDocument13 pagesGould V CurtisKirk-patrick Taylor100% (1)

- Life InsuranceDocument12 pagesLife InsuranceSlim ShadyNo ratings yet

- Insurable Interest in The Context of Long Term InsuranceDocument18 pagesInsurable Interest in The Context of Long Term Insurancesaroj_parbhoo0% (1)

- Assignment 1 - Insurance LawDocument9 pagesAssignment 1 - Insurance LawLaurance NamukambaNo ratings yet

- Insurance ProjectDocument9 pagesInsurance ProjectVineeth ReddyNo ratings yet

- Aligarh Muslim University Malappuram Centre, Kerala: PROJECT Report On Topic LIFE INSURANCE Law of InsuranceDocument12 pagesAligarh Muslim University Malappuram Centre, Kerala: PROJECT Report On Topic LIFE INSURANCE Law of InsuranceSadhvi SinghNo ratings yet

- Insurance 1Document33 pagesInsurance 1Bimsara SomarathnaNo ratings yet

- Insurable Interest: Is There A Rule?Document9 pagesInsurable Interest: Is There A Rule?Donna WallaceNo ratings yet

- Lakshmi InsuranceDocument8 pagesLakshmi InsuranceVaalu MuthuNo ratings yet

- Article On Insurable InterestDocument9 pagesArticle On Insurable InterestPrashanth VaradarajanNo ratings yet

- Life Insurance:: Concept, Nature and ScopeDocument38 pagesLife Insurance:: Concept, Nature and ScopeAkshay BhasinNo ratings yet

- Insurance Law-Insurable InterestDocument18 pagesInsurance Law-Insurable InterestDavid Fong100% (1)

- IndemnityDocument10 pagesIndemnityAstik TripathiNo ratings yet

- Insurable Interests. Unit3Document20 pagesInsurable Interests. Unit3Tiffany NkhomaNo ratings yet

- Lli 202 Class 3Document13 pagesLli 202 Class 3Andziso CairoNo ratings yet

- Ins 418 - Life and Health Insurance Slide NotesDocument53 pagesIns 418 - Life and Health Insurance Slide Notesolaifa TomisinNo ratings yet

- Griffiths CaseDocument13 pagesGriffiths CaseMERCY LAWNo ratings yet

- IntroductionDocument15 pagesIntroductionlaxmi manasa60% (5)

- Contract Project - of - Indemnity - and - GuaranteeDocument20 pagesContract Project - of - Indemnity - and - GuaranteeAqib khanNo ratings yet

- Class 3Document73 pagesClass 3Geoffrey MwangiNo ratings yet

- Insurance LawDocument130 pagesInsurance LawJuliusNo ratings yet

- Law of InsuranceDocument7 pagesLaw of InsuranceJack Dowson100% (1)

- December2A - Gen Princiles of Insurance LawDocument51 pagesDecember2A - Gen Princiles of Insurance LawKirk-patrick TaylorNo ratings yet

- Class 4Document157 pagesClass 4Geoffrey MwangiNo ratings yet

- Insurance - Insurable Interest - Class Note-1Document11 pagesInsurance - Insurable Interest - Class Note-1Obafemi AdeoyeNo ratings yet

- Insurable InterestDocument6 pagesInsurable InterestShivani BishtNo ratings yet

- Chapter-1: Introduction To The Life Insurance Industry of IndiaDocument71 pagesChapter-1: Introduction To The Life Insurance Industry of IndiaJit SarkarNo ratings yet

- Life Insurance Is A Contract Between The Policy Owner and The InsurerDocument52 pagesLife Insurance Is A Contract Between The Policy Owner and The InsurerKartik VariyaNo ratings yet

- Recit 3 CasesDocument44 pagesRecit 3 CasesJenny Marie B. AlapanNo ratings yet

- Ultimate Guide To Life Insurance by Bryan VillarosaDocument28 pagesUltimate Guide To Life Insurance by Bryan VillarosaBryan VillarosaNo ratings yet

- Great Pacific Life Assurance Corp. vs. Court of Appeals and Medarda V. LeuterioDocument3 pagesGreat Pacific Life Assurance Corp. vs. Court of Appeals and Medarda V. LeuterioKristine Hipolito SerranoNo ratings yet

- Unit 2 GENERAL PRINCIPLES OF INSURANCE LAWDocument55 pagesUnit 2 GENERAL PRINCIPLES OF INSURANCE LAWAnchalNo ratings yet

- Role of Insurable Interest in Contingency Insurance and Indemnity InsuranceDocument3 pagesRole of Insurable Interest in Contingency Insurance and Indemnity InsuranceKenneth CJ KemeNo ratings yet

- Unit 3 Life InsuranceDocument196 pagesUnit 3 Life InsuranceAnchalNo ratings yet

- DigetDocument3 pagesDigetDon SumiogNo ratings yet

- Non Discloser PDFDocument8 pagesNon Discloser PDFBM Ariful IslamNo ratings yet

- A Promissory Warranty Is A Promissory Condition PrecedentDocument9 pagesA Promissory Warranty Is A Promissory Condition PrecedentjenniferNo ratings yet

- Indemnity and GuaranteeDocument20 pagesIndemnity and GuaranteeShrey ApoorvNo ratings yet

- Insurable Interest LifeDocument21 pagesInsurable Interest LifeDanmar ClarkeNo ratings yet

- Verifying References Talk Insurer Beneficiary Death Terminal Illness Critical IllnessDocument15 pagesVerifying References Talk Insurer Beneficiary Death Terminal Illness Critical Illnessjega78No ratings yet

- What Is Life Insurance?Document3 pagesWhat Is Life Insurance?Digvijay BhonsaleNo ratings yet

- Great Pacific LIfe Assurance Vs CA Oct 13, 1999Document2 pagesGreat Pacific LIfe Assurance Vs CA Oct 13, 1999Alvin-Evelyn GuloyNo ratings yet

- Unit-5 Banking and Insurance ManagementDocument25 pagesUnit-5 Banking and Insurance ManagementChandra sekhar VallepuNo ratings yet

- Insurance Law KenyaDocument6 pagesInsurance Law KenyaSenelwa Anaya100% (6)

- What Is Life Insurance?Document2 pagesWhat Is Life Insurance?RahatNo ratings yet

- Marine Insurance, Prof. GursesDocument154 pagesMarine Insurance, Prof. GursesSozia TanNo ratings yet

- What Laws Govern Insurance: Ruling: Since The Insurance Code Did Not Contain A Specific Provision ApplicableDocument8 pagesWhat Laws Govern Insurance: Ruling: Since The Insurance Code Did Not Contain A Specific Provision ApplicableChugsNo ratings yet

- Law 307 - Topic 2D - Subrogation and ContributionDocument20 pagesLaw 307 - Topic 2D - Subrogation and ContributionMoshiul TanjilNo ratings yet

- Case# 1: Lalican Vs Insular Life 597 SCRA 159 (2009) DOCTRINE: Mercantile Law Insurance Law Insurable Interest An Insurable Interest Is That InterestDocument20 pagesCase# 1: Lalican Vs Insular Life 597 SCRA 159 (2009) DOCTRINE: Mercantile Law Insurance Law Insurable Interest An Insurable Interest Is That InterestReyesJosellereyesNo ratings yet

- Project On Verticle AgreementDocument10 pagesProject On Verticle AgreementJ M RashmiNo ratings yet

- Insular Life Vs Ebrado 80 Scra 181Document2 pagesInsular Life Vs Ebrado 80 Scra 181roy rubaNo ratings yet

- Revised Pinciples and Life InsuranceDocument127 pagesRevised Pinciples and Life InsuranceparishaNo ratings yet

- Great Pacific Life Insurance v. CA - G.R. No. 113899 - Oct. 13, 1999Document2 pagesGreat Pacific Life Insurance v. CA - G.R. No. 113899 - Oct. 13, 1999Princess FaithNo ratings yet

- An Inchmaree Clause Is A Provision Common in Maritime Insurance Policies That Cover A Ship's Loss or Damage Due To Reasons Such AsDocument5 pagesAn Inchmaree Clause Is A Provision Common in Maritime Insurance Policies That Cover A Ship's Loss or Damage Due To Reasons Such AsSudhendra SoniNo ratings yet

- This Content Downloaded From 139.167.196.252 On Fri, 25 Mar 2022 11:23:46 UTCDocument19 pagesThis Content Downloaded From 139.167.196.252 On Fri, 25 Mar 2022 11:23:46 UTCTushar SikarwarNo ratings yet

- GREPALIFE v. LeuterioDocument2 pagesGREPALIFE v. LeuterioLourd MantaringNo ratings yet

- Insurance LawDocument15 pagesInsurance LawShruti KambleNo ratings yet

- Banking and InsuranceDocument7 pagesBanking and InsuranceVanshika GuptaNo ratings yet

- Cape Law: Texts and Cases - Contract Law, Tort Law, and Real PropertyFrom EverandCape Law: Texts and Cases - Contract Law, Tort Law, and Real PropertyNo ratings yet

- Civil ProcedureDocument17 pagesCivil ProcedureNKOYOYO HANNINGTONNo ratings yet

- Group C Draft Joint AssignmentDocument25 pagesGroup C Draft Joint AssignmentNKOYOYO HANNINGTONNo ratings yet

- LLB Insurance Reading List (Feb 2022)Document9 pagesLLB Insurance Reading List (Feb 2022)NKOYOYO HANNINGTONNo ratings yet

- PDF Law of Insurance - CompressDocument18 pagesPDF Law of Insurance - CompressNKOYOYO HANNINGTONNo ratings yet

- A Guide To Insurance ClaimsDocument6 pagesA Guide To Insurance ClaimsNKOYOYO HANNINGTONNo ratings yet

- Risk Margins and Solvency II: Peter England and Richard MillnsDocument38 pagesRisk Margins and Solvency II: Peter England and Richard MillnsWubneh AlemuNo ratings yet

- Rizal Commercial Banking Corporation vs. Court of Appeals: 292 Supreme Court Reports AnnotatedDocument18 pagesRizal Commercial Banking Corporation vs. Court of Appeals: 292 Supreme Court Reports AnnotatedAlexiss Mace JuradoNo ratings yet

- Mechanics Liens in Practice Contractor Rights NC W 015 8524Document7 pagesMechanics Liens in Practice Contractor Rights NC W 015 8524Brandace HopperNo ratings yet

- BMMF5103Document37 pagesBMMF5103Caballus90No ratings yet

- M2 Regular Income TaxDocument7 pagesM2 Regular Income TaxHERNANDO REYESNo ratings yet

- Retirement of A Partner: Special Transactions in Case of Death: Joint Life PolicyDocument7 pagesRetirement of A Partner: Special Transactions in Case of Death: Joint Life PolicykalyanikamineniNo ratings yet

- Banking Insurance and Financial Services: Unit 1: Introduction To BANKING (25%)Document13 pagesBanking Insurance and Financial Services: Unit 1: Introduction To BANKING (25%)sunगीत मजे्seNo ratings yet

- Solved Jessie Borrows 1 000 From Thomas and Agrees To Repay TheDocument1 pageSolved Jessie Borrows 1 000 From Thomas and Agrees To Repay TheAnbu jaromiaNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 754167410271120 Assessment Year: 2020-21Document8 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 754167410271120 Assessment Year: 2020-21Manish MishraNo ratings yet

- Guidelines For Investment Proof SubmissionDocument6 pagesGuidelines For Investment Proof Submissionzaheer KaziNo ratings yet

- HRv2 Single Sheeter 95LDocument2 pagesHRv2 Single Sheeter 95Lroxcox216No ratings yet

- Capital Surety & Insurance Co. Inc. vs. Ronquillo TradingDocument2 pagesCapital Surety & Insurance Co. Inc. vs. Ronquillo TradingwuplawschoolNo ratings yet

- Ampere Realty Acts As An Agent in Buying Selling RentingDocument2 pagesAmpere Realty Acts As An Agent in Buying Selling Rentingtrilocksp SinghNo ratings yet

- Forms of Compensation IncomeDocument6 pagesForms of Compensation IncomeMariaHannahKristenRamirezNo ratings yet

- Final Revision 2022 For First YearDocument21 pagesFinal Revision 2022 For First YearRabie HarounNo ratings yet

- Glosario de Ingles BancarioDocument53 pagesGlosario de Ingles BancarioGabriela SuárezNo ratings yet

- IDT Saar CA Final CH 8 Input Tax Credit by CA Mahesh Gour Handwritten NotesDocument27 pagesIDT Saar CA Final CH 8 Input Tax Credit by CA Mahesh Gour Handwritten NotesRonita DuttaNo ratings yet

- Budgeting Basics: Managing Your Money During The Lean YearsDocument2 pagesBudgeting Basics: Managing Your Money During The Lean YearsAlexaNo ratings yet

- Fire Insurance FindingsDocument11 pagesFire Insurance Findingssaroj aashmanfoundationNo ratings yet

- PP12201710731 HDFC Life ClassicAssure Plus Retail BrochureDocument6 pagesPP12201710731 HDFC Life ClassicAssure Plus Retail BrochureNatuskar pranitNo ratings yet

- An Introductory Guide To The English Law of Guarantees V1.1Document2 pagesAn Introductory Guide To The English Law of Guarantees V1.1greencott2001No ratings yet

- VOC Money Test 1Document1 pageVOC Money Test 1jaxes79020No ratings yet

- PhilHealth IssuesDocument11 pagesPhilHealth IssuesAmiel dionisioNo ratings yet

- Shipman 2009 Part I - IMWDocument16 pagesShipman 2009 Part I - IMWTong SepamNo ratings yet

- Yogi Apriyanto, Yuni Yulida, Aprida Siska Lestia: Asuransi Jiwa Berjangka Last SurvivorDocument11 pagesYogi Apriyanto, Yuni Yulida, Aprida Siska Lestia: Asuransi Jiwa Berjangka Last SurvivorSugeng KuswantoroNo ratings yet

- Asukkaan Ohje Retta ENGDocument4 pagesAsukkaan Ohje Retta ENGKshitij Deep GairheNo ratings yet

- We The PeopleDocument4 pagesWe The Peopleapi-702888406No ratings yet

- Ahip Module 2 (Solved%)Document2 pagesAhip Module 2 (Solved%)WizzardNo ratings yet

- Tara Sinha, SEWADocument10 pagesTara Sinha, SEWARaj Chauhan BhaveshkumarNo ratings yet

- Purdue FRSDocument79 pagesPurdue FRSMatt BrownNo ratings yet