Professional Documents

Culture Documents

Earning Outcomes: LSPU Self-Paced Learning Module (SLM)

Uploaded by

Nicole BartolomeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Earning Outcomes: LSPU Self-Paced Learning Module (SLM)

Uploaded by

Nicole BartolomeCopyright:

Available Formats

Republic of the Philippines

Laguna State Polytechnic University

ISO 9001:2015 Certified

Province of Laguna

Level I Institutionally Accredited

LSPU Self-paced Learning Module (SLM)

Course Fundamentals of Accounting 1 & 2

Sem/AY First Semester/2021-2022

Module No. 1

Lesson Title DEFINITION OF ACCOUNTING, FUNDAMENTAL CONCEPTS AND BASIC PRINCIPLES,

ELEMENTS OF FINANCIAL STATEMENTS

Week

4

Duration

Date March 14 to April 08, 2022

This lesson introduces Accounting to BSOA students who do not have any background

Description in accounting and a review for those BSOA students who graduated from Senior HS

of the with academic track in ABM. This lesson will discuss the definition of Accounting,

Lesson importance of accounting in a business entity. This will identify and describe the

fundamental concepts and principles of Accounting. This will also discuss the elements

of the financial statements, those that pertains to the financial position of a business

which are assets, liabilities and equity, and those that pertains it’s financial

performance which are income and expenses.

This lesson will also discuss what is an account, the simplest form of account which is

the “T” account, and the accounting equation or the basic accounting model. This

lesson will also discuss the double-entry system and how it follows the rule of the

accounting equation. The rule of debits and credits will also be discussed in this lesson

Learning Outcomes

Intended Students should be able to meet the following intended learning outcomes:

Learning Define accounting.

Outcomes Explain the fundamental accounting concepts and principles

To identify and define the elements of the financial statements

To describe the account, “T” account, and the accounting equation

To explain how the double-entry system follows the rules of the accounting

equation.

Targets/ At the end of the lesson, students should be able to:

Objectives Identify the functions of accounting.

Enumerate the fundamental concepts and basic principles of accounting.

Identify the elements of the statement of financial position.

Identify the elements of the statement of financial performance.

Define assets, liability, equity, income and expense.

Classify account titles under each element.

To analyse the effect of transactions in the elements of the financial statements

LSPU SELF-PACED LEARNING MODULE: FUNDAMENTALS OF ACCOUNTING 1 & 2

Prepared by: MA. ALYN S. KARAGDAG, CPA

Republic of the Philippines

Laguna State Polytechnic University

ISO 9001:2015 Certified

Province of Laguna

Level I Institutionally Accredited

using the basic accounting model.

To state the rules of debit and credits.

To identify the normal balance of each account.

Student Learning Strategies

Online Activities A. Online Discussion via Google Meet/FB Group Page

(Synchronous/

(For further instructions, refer to your Google Classroom and see the

Asynchronous) schedule of activities for this module)

B. Learning Guide Questions:

1. Give at least three definitions of accounting.

2. Why is accounting often referred to as the language of business?

3. What are some of the fundamental concepts that underlie the

accounting process?

4. What are some of the accounting principles that guide the accounting

practice?

5. What are the two basic financial statements?

6. What are the elements that can be found in each financial statement?

7. What is the basic summary device of accounting? What does it contain?

8. What is the basic accounting model?

9. How the double-entry system follows the rules accounting equation?

Note: The insight that you will post on online discussion forum using Learning Management

System (LMS) will receive additional scores in class participation.

Offline Activities

(e-Learning/Self- Lecture Guide

(Refer to the textbook: Chapter 1- Accounting and Its Environment

Paced) 2 – Accounting Principles and Reporting Standards

Definitions of Accounting

1. Is a service activity. Its function is to provide quantitative information, primarily

financial in nature, about the economic entities that is intended to be useful in making

economic decisions.

2. Is an information system that measures, process and communicates financial

information about an economic entity.

3. Is the art of recording, classifying and summarizing in a significant manner and in

terms of money, transactions and events which are, in part at least, of a financial

character, and interpreting the results thereof.

Phases of Accounting

1. Recording business transactions

Business transactions are the economic activities of a business. Recording these

LSPU SELF-PACED LEARNING MODULE: FUNDAMENTALS OF ACCOUNTING 1 & 2

Prepared by: MA. ALYN S. KARAGDAG, CPA

Republic of the Philippines

Laguna State Polytechnic University

ISO 9001:2015 Certified

Province of Laguna

Level I Institutionally Accredited

historical events is a significant function of accounting.

Before the effects of the transactions can be recorded, they must be measured in

terms of money.

To measure a business transaction, the accountant must decide on three(3) issues:

a. Recognition issue – when the transaction occurred

b. Valuation issue – what value to place on the transaction

c. Classification issue – how the components of the transaction should be

classified

2. Classification

Classification of recorded data reduces the effects of numerous transactions into

useful group or categories

3. Summarization

Summarization of financial data is achieved through the preparation of financial

statements.

4. Interpretation

The financial statements are analyzed to evaluate the liquidity, profitability and

solvency of the business organization.

Fundamental Concepts

1. Entity Concept. This is the most basic concept in accounting. It’s simply the

accounting of business transactions of different entities should be accounted for

separately.

2. Periodicity Concept. The life of an entity is divided into a time periods usually

one year for financial reporting purposes. This is called the accounting period.

3. Stable Monetary Unit Concept. Since the information provided by accounting is

financial in nature, a reasonable unit of measure is necessary to be able to do so.

In the Philippines we use the Philippine peso, this is as if peso has the same

purchasing power at any given time.

4. Going Concern. Financial information are generally presented on the assumption

that the entity is established not for a limited period of time, hence going concern

is the underlying concept behind the depreciation of an asset.

Basic Accounting Principles

1. Objectivity Principle. Accounting records are based on the most reliable data

from valid source documents which can be verified by other user of financial

information.

2. Historical Cost. This principle states that assets should be recorded at their

actual cost at acquisition date and not on the fair market value as at reporting

date.

3. Revenue Recognition Principle. Revenue/Income is to be recognized in the

accounting period when goods are delivered or services are rendered or

performed and not when cash or payment is received.

4. Expense Recognition Principle. Expenses should be recognized in the

accounting period in which goods and services are used up to produce revenue

and not when the entity pays for those goods and services.

5. Adequate Disclosure. Requires that all relevant information be disclosed in the

financial statements.

6. Materiality. The size and nature of the item are evaluated together to determine

it’s materiality in a particular circumstance.

7. Consistency Principle. Application of accounting method should be the same

from accounting period to another to achieve comparability of financial reports of

an enterprise.

(Refer to the textbook: Chapter 2- The Accounting Equation and the Double Entry System)

LSPU SELF-PACED LEARNING MODULE: FUNDAMENTALS OF ACCOUNTING 1 & 2

Prepared by: MA. ALYN S. KARAGDAG, CPA

Republic of the Philippines

Laguna State Polytechnic University

ISO 9001:2015 Certified

Province of Laguna

Level I Institutionally Accredited

Elements of Financial Statements

The accounting process or cycle will provide the accounting information about an entity’s

financial position at the end of the period and the entity’s financial performance during a

certain period.

Elements of Financial Statements

I.

Financial Position

A. Assets

B. Liability

C. Equity

II. Financial Performance

D. Income

E. Expense

Asset is a present economic resource controlled by the entity as a result of past events.

Liability is a present obligation of the entity to transfer an economic resource as a result

of past events.

Equity is the residual interest in the assets of the enterprise after deducting all its

liabilities

single or sole proprietorship, there is only one equity account

partnership, each partner has an owner’s equity

corporation, owners’ equity or stockholders equity consists of share capital of

stockholders/members, and retained earning

Income is increases in assets, or decreases in liabilities, that result in increase in equity,

other than those relating to the contributions from holders of equity claims.

Expenses are decreases in assets, or increases in liabilities, that result in decreases in

equity, other than those distributions to holders of equity claims.

Commonly used account titles

A. Assets

Current Assets

• As per revised Philippines Accounting Standards(PAS) No. 1, assets are current

when:

a. It expects to realize the assets, or intends to sell or consume it, in its

normal operating cycle;

b. It holds the asset primarily for the purpose of trading

c. It expects to realize the asset within twelve months after reporting

period; or

d. The asset is cash or cash equivalent unless the asset is restricted

from being exchanged or used to settle a liability for at least twelve

months after reporting period.

• Cash- it includes coins, currency, checks, money orders, bank deposits and bank

drafts.

• Cash Equivalents – as per PAS no.7, these are short-term, highly liquid investments

that are readily convertible to known amount of cash and which are subject to an

LSPU SELF-PACED LEARNING MODULE: FUNDAMENTALS OF ACCOUNTING 1 & 2

Prepared by: MA. ALYN S. KARAGDAG, CPA

Republic of the Philippines

Laguna State Polytechnic University

ISO 9001:2015 Certified

Province of Laguna

Level I Institutionally Accredited

insignificant risk of changes in value.

– Example: Marketable securities, time deposits

• Notes Receivable – is a written pledge that the customer will pay the business a fixed

amount of money on a certain date.

• Accounts Receivable – these are claims against customers arising from sale of

services or goods on credit.

•

• Inventories – as per PAS No. 2, these are assets which are

– Held for sale in the ordinary course of business;

– In the process of production for such sale;

– In the form of materials or supplies to be consumed in the production process

or in the rendering of services.

• Prepaid Expenses- these are expenses paid for by the business in advance.

– Example: Prepaid insurance, Prepaid rent, Prepaid taxes

Non-current assets

Property, Plant and Equipment- as per PAS no. 16, these are tangible assets that are

held by an enterprise for use in the production or supply of goods or services, or for

rental to others, or for administrative purposes and which are expected to be used

during more than one period.

Included are: land, building, machinery and equipment, furniture and fixtures, motor

vehicles and equipment.

Accumulated Depreciation – is a contra account that contains the sum of the

periodic depreciation charges.

Intangible Assets – per PAS No. 38, these are identifiable, nonmonetary assets

without physical substance held for use in the production or supply of goods or

services, for rental to others, or for administrative purposes.

Included are: goodwill, patents, copyrights, licenses, franchises, trademarks, brand

names, secret processes, subscription lists and non-competition agreements.

B. Liabilities

Current Liabilities

• As per revised Philippines Accounting Standards(PAS) No. 1, liabilities are

current when:

a. it expects to settle the liability in its normal operating cycle;

b. it holds the liability primarily for the purpose of trading

c. the liability is due to be settled within twelve months after the

reporting period; or

d. the entity does not have an unconditional right to defer settlement of

the liability for at least twelve months after the reporting period.

Accounts Payable – represents the reverse relationship of the accounts

receivable.

Notes Payable – a reverse of notes receivable. In this case the business entity is

the maker of the note; that is, the business entity is the party who promises to

pay.

Accrued Liabilities – contains the amount payable to others for unpaid expenses.

This includes salaries payable, rent payable, utilities payable, interest payable, and

taxes payable.

LSPU SELF-PACED LEARNING MODULE: FUNDAMENTALS OF ACCOUNTING 1 & 2

Prepared by: MA. ALYN S. KARAGDAG, CPA

Republic of the Philippines

Laguna State Polytechnic University

ISO 9001:2015 Certified

Province of Laguna

Level I Institutionally Accredited

Unearned Revenues – consists of payments receive before the providing the

service or before the delivery of goods to the customers.

Example: Rental advance and deposits received by the lessor;

Current Portion of Long-Term Debt – these are portions of mortgage notes,

bonds, and other long-term indebtedness which are to be paid within one year

from the balance sheet date.

Non-current Liabilities

• Mortgage Payable- this account contains long term debt of the business entity for

which the business has pledged certain assets as security to the creditor.

• Bonds Payable – long term debt obtain from lenders by issuing bonds. The bond

is a contract between the issuer and the lender specifying the terms of repayment

and the interest to be charged.

C. Owner’s Equity

Capital – this account is used to record the original and additional investment of

the business owner. It is increased by the amount of profit earned during the year

or is decreased by a loss.

Withdrawals – this account is used to record cash or other assets taken by the

owner from the business.

Income Summary – a temporary account used at the end of the accounting period

to close income and expenses.

D. Income

Service Income – revenues earned by performing services for a customer or

client.

Example: transport services; tutorial services; medical services;

Sales – revenues earned as a result of sales of merchandise.

Example: sale of lot by real estate companies; sale of motor vehicles; sale of

groceries by supermarket or sari-sari stores

E. Expenses

Cost of sales – or cost of goods sold, is the cost incurred to purchase or to produce

the products sold

Salaries and wages – expense incurred as a result of an employer-employee

relationship such as salaries, wages, 13th month pay, cost of living allowances and

other benefits.

Power, light and water – utilities expenses

Communication expense

Rent Expense

Supplies Expense

Insurance Expense

Depreciation Expense – portion of the cost of property, plant and

equipment(except land) allocated or charges as expense during the period.

Uncollectible Accounts Expense – the amount of receivables estimated to be

LSPU SELF-PACED LEARNING MODULE: FUNDAMENTALS OF ACCOUNTING 1 & 2

Prepared by: MA. ALYN S. KARAGDAG, CPA

Republic of the Philippines

Laguna State Polytechnic University

ISO 9001:2015 Certified

Province of Laguna

Level I Institutionally Accredited

doubtful of collection and charged as expense during the period.

Interest Expense – an expense related to the borrowed funds.

The Account

The account is the basic summary device of accounting.

Account is a detailed record of the increases, decreases and the balance of each element of

the financial statements. Each element of the financial statement has to have a

separate account.

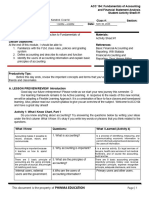

“T” account is the simplest form a account, it has three(3) parts the

1. account title

2. left side - debit side

3. right side – credit side

Account title

left side or right side or

debit side credit side

The Accounting Equation

- is the basic tool of accounting, the basic accounting model

Assets = Liabilities + Owner’s Equity

This equation states that assets must always equal liabilities and owner’s equity.

Debits and Credits – The Double-Entry System

Double-entry system is used in accounting, which means that every business transactions

must be recorded under this system.

Each transaction affects at least 2(two) accounts, there must be one or more accounts that

increases ( debited or credited) or decreases ( debited or credit). The increases or

decreases in each account is depend upon each type of account.

Dr and Cr is the abbreviation for debit ( from the latin debere) and credit ( from the latin

credere), respectively.

The rules of debit and credit

Increases in assets are recorded as debits, while decreases are recorded as credits.

Increases in liabilities and owner’s equity are recorded as credits, while decreases are

recorded as debits.

Increases in income increases owner’s equity hence recorded as credits.

Increases in expense decreases owner’s equity hence recorded as debits.

LSPU SELF-PACED LEARNING MODULE: FUNDAMENTALS OF ACCOUNTING 1 & 2

Prepared by: MA. ALYN S. KARAGDAG, CPA

Republic of the Philippines

Laguna State Polytechnic University

ISO 9001:2015 Certified

Province of Laguna

Level I Institutionally Accredited

The normal balance of an account refers to the side of account – debit or credit – where

increases are recorded

Engaging Activities

Discussion about the definition of accounting, its basic concepts and

fundamental principles.

Memorization and oral recitation of account titles and definition under each

element of the financial statements.

Lecture, discussion on the accounting equation and the basic rules for debit

and credit.

Recite the rule of debit and credit for assets, liabilities, owner’s equity,

income and expenses.

LSPU SELF-PACED LEARNING MODULE: FUNDAMENTALS OF ACCOUNTING 1 & 2

Prepared by: MA. ALYN S. KARAGDAG, CPA

Republic of the Philippines

Laguna State Polytechnic University

ISO 9001:2015 Certified

Province of Laguna

Level I Institutionally Accredited

Performance Tasks

PT 1

True of False

___________1. Accounting is a service activity whose function is to provide qualitative information, about

economic entities that is intended to be useful in making economic decisions.

___________2. The measurement phase of accounting is accomplished by recording phase.

___________3. For reporting purposes, the personal assets and debts of a business owner should be

combined with the assets and debts of the business.

___________4. Assets are usually valued under historical cost.

___________5. Objectivity principle requires relevant information to form part of financial statements for

decision-making purposes.

___________6. The periodicity concept involves dividing the life of a business entity into accounting

periods of equal length thus enabling the financial users to periodically evaluate the results

of business operations.

___________7. Objectivity principle states that an accounting transactions should be supported by

sufficient evidence to allow two or more qualified individuals to arrive at essentially similar

conclusion.

___________8. Going concern concept assumes that the business has an indefinite economic life.

___________9. A business transaction is the occurrence of an event or of a condition that must be

recorded.

__________10. Interpretation of financial data is achieved through the preparation of financial

statements.

PT 2

Multiple Choice

1) Which of the following is an appropriate definition of accounting?

a. A means of recording transactions and keeping records

b. Collection, organization, and communication of vast amounts of information

c. The interconnected network of subsystems necessary to operate a business

d. The measurement ,processing, and communication of financial information

about an identifiable economic entity

2) Accounting is a service activity. It's function is to provide

a. qualitative information

LSPU SELF-PACED LEARNING MODULE: FUNDAMENTALS OF ACCOUNTING 1 & 2

Prepared by: MA. ALYN S. KARAGDAG, CPA

Republic of the Philippines

Laguna State Polytechnic University

ISO 9001:2015 Certified

Province of Laguna

Level I Institutionally Accredited

b. quantitative and qualitative information

c. quantitative information

d. None of the above.

3) A business which prepares financial statements every year is following the __________concept.

a. periodicity

b. entity

c. going concern

d. stable monetary unit

4) The _________concept assumes that the business has an indefinite economic life

a. periodicity

b. entity

c. going concern

d. stable monetary unit

Which accounting concept should be considered if the owner of a business takes goods from

5) inventory for his personal use?

a. The substance over form concept

b. The accrual concept

c. The going concern concept

d. The business entity concept

Which accounting principle states that omitting or misstating this information could influence

6) users of the financial statements?

a. Materiality

b. Objectivity

c. Historical cost

Which of the following accounting principle means that similar items should receive a similar

7) accounting treatment?

a. Materiality

b. Objectivity

c. Historical cost

8) Assets are usually valued under which basis?

a. replacement cost

LSPU SELF-PACED LEARNING MODULE: FUNDAMENTALS OF ACCOUNTING 1 & 2

Prepared by: MA. ALYN S. KARAGDAG, CPA

Republic of the Philippines

Laguna State Polytechnic University

ISO 9001:2015 Certified

Province of Laguna

Level I Institutionally Accredited

b. Historical cost

c. net realizable value

d. fair market value

Which of the following accounting concepts states that an accounting transaction should be

supported by sufficient evidence to allow two or more qualified individuals to arrive at essentially

9) similar conclusion?

a. matching

b. objectivity

c. periodicity

d. stable monetary unit

10) Which of the following processes best defines accounting?

a. Measuring economic activities

b. Communicating results to interested parties

c. Preventing fraud

d. Both a and b

PT 3

True of False

___________1. Capital represents the owner’s investment, or equity in a business.

___________2. Liabilities represent amounts owed to creditors.

___________3. Accounts receivable is considered an asset.

___________4. The owner’s withdrawals account is listed with the other expenses of a

business.

___________5. Assets are things of value owned by a business entity.

___________6. An owner can invest cash or other assets of value in the business.

___________7. A withdrawal by the owner is recorded as a deduction from assets and

an increase in expense.

___________8. Accounts Payable is a current assets.

___________9. Capital investment is an income.

__________10. Prepaid rent is an expense.

Multiple Choice pp 3-29 to3-34

PT4

1. True or False pages 3-24 and 3-25

2. Problem #4 p 3-28

3. Problem #5 p 3-29

4. Problem #6, page 3-40, Effects of transactions

LSPU SELF-PACED LEARNING MODULE: FUNDAMENTALS OF ACCOUNTING 1 & 2

Prepared by: MA. ALYN S. KARAGDAG, CPA

Republic of the Philippines

Laguna State Polytechnic University

ISO 9001:2015 Certified

Province of Laguna

Level I Institutionally Accredited

5. Problem #8, page 3-42

6. Problem #12 page 3-46 (however, instead of recording recording transactions in a financial

worksheet, records the transactions in T- Accounts.

Understanding Directed Assess

Learning Resources

LSPU SELF-PACED LEARNING MODULE: FUNDAMENTALS OF ACCOUNTING 1 & 2

Prepared by: MA. ALYN S. KARAGDAG, CPA

Republic of the Philippines

Laguna State Polytechnic University

ISO 9001:2015 Certified

Province of Laguna

Level I Institutionally Accredited

Accounting Fundamentals by Ballada, Win and Ballada, Susan. 2020 Issue – 6th Edition

https://www.youtube.com/watch?v=1924ois6Vn4

https://www.youtube.com/watch?v=fPOcUtfGtxQ

https://www.youtube.com/watch?v=w6jOjZqPXD0

https://www.youtube.com/watch?v=5CUCojBKuBo

https://www.youtube.com/watch?v=n-lCd3TZA8M

https://www.youtube.com/watch?v=w6jOjZqPXD0

LSPU SELF-PACED LEARNING MODULE: FUNDAMENTALS OF ACCOUNTING 1 & 2

Prepared by: MA. ALYN S. KARAGDAG, CPA

You might also like

- Accounting Survival Guide: An Introduction to Accounting for BeginnersFrom EverandAccounting Survival Guide: An Introduction to Accounting for BeginnersNo ratings yet

- Senior High School Department: Quarter 3 - Module 1: Introduction To AccountingDocument9 pagesSenior High School Department: Quarter 3 - Module 1: Introduction To AccountingJaye RuantoNo ratings yet

- Unit Number/ Heading Learning OutcomesDocument22 pagesUnit Number/ Heading Learning OutcomesQuisha Palatan100% (1)

- Fundsbasic Acctg ModuleDocument21 pagesFundsbasic Acctg ModuleLeizyl de MesaNo ratings yet

- Week 1 Module 1 Chapter 1 Statement of Financial Position 2Document10 pagesWeek 1 Module 1 Chapter 1 Statement of Financial Position 2Joyce TanNo ratings yet

- Accounts Volume 1Document503 pagesAccounts Volume 1Utkarsh100% (1)

- Module Acctg1Document49 pagesModule Acctg1Belle TurredaNo ratings yet

- To Financial Accounting: Learning OutcomesDocument22 pagesTo Financial Accounting: Learning OutcomesBorhanNo ratings yet

- Module 1Document23 pagesModule 1Ma Leah TañezaNo ratings yet

- Nature and Scope of AccountingDocument19 pagesNature and Scope of AccountingSaffa IbrahimNo ratings yet

- Far Module Prelim Complete Chapter 1 To 5docx CompressDocument40 pagesFar Module Prelim Complete Chapter 1 To 5docx CompressKorra SamiNo ratings yet

- For CE Fundamentals of Accounting MODULE 1Document129 pagesFor CE Fundamentals of Accounting MODULE 1Sarahjane TerradoNo ratings yet

- Module 1 FArDocument6 pagesModule 1 FArfirestorm riveraNo ratings yet

- Subject Financial Accounting and Reporting Chapter/Unit Chapter 2/part 1 Lesson Title Accounting and Business Lesson ObjectivesDocument16 pagesSubject Financial Accounting and Reporting Chapter/Unit Chapter 2/part 1 Lesson Title Accounting and Business Lesson ObjectivesAzuma JunichiNo ratings yet

- Introduction To AccountingDocument12 pagesIntroduction To AccountingJACK FFNo ratings yet

- Module 1 - Accounting and BusinessDocument16 pagesModule 1 - Accounting and BusinessNiña Sharie Cardenas100% (1)

- MG 224 Financial AccountingDocument31 pagesMG 224 Financial AccountingMuhammad UsamaNo ratings yet

- Fabm1 - DLLDocument7 pagesFabm1 - DLLAmur Jessica FuentesNo ratings yet

- Conceptual Framework and Accounting StandardsDocument142 pagesConceptual Framework and Accounting StandardsAni TubeNo ratings yet

- FABM1 Lesson-1-Introduction-to-AccountingDocument4 pagesFABM1 Lesson-1-Introduction-to-AccountingPrincess Smaeranza Campos-DulayNo ratings yet

- Module 1Document23 pagesModule 1esparagozanichole01No ratings yet

- SAS#2-ACC104 With AnswerDocument5 pagesSAS#2-ACC104 With AnswerartificerrrrNo ratings yet

- Recorded in The Accounting Books. "Non-Accountable Events" Are Not Recorded in The Accounting BooksDocument52 pagesRecorded in The Accounting Books. "Non-Accountable Events" Are Not Recorded in The Accounting BooksAnnie RapanutNo ratings yet

- FMA - Non-Specific - MBA ZC415 COURSE HANDOUTDocument13 pagesFMA - Non-Specific - MBA ZC415 COURSE HANDOUTRavi KaviNo ratings yet

- SAS#1-ACC104 With AnwerDocument6 pagesSAS#1-ACC104 With AnwerartificerrrrNo ratings yet

- Fabm1 Module 1 Week 1Document8 pagesFabm1 Module 1 Week 1Alma A CernaNo ratings yet

- Fundamentals of Accounting: Prof. Marikriz M. Paulino, MBA Certified BookkeeperDocument22 pagesFundamentals of Accounting: Prof. Marikriz M. Paulino, MBA Certified BookkeeperCharina Jaramilla PesinoNo ratings yet

- Accounting For Managers Dmgt403 - e - BookDocument304 pagesAccounting For Managers Dmgt403 - e - BookParul Khanna100% (1)

- Module 1 - FAR 2Document33 pagesModule 1 - FAR 2Catherine CaleroNo ratings yet

- Fundamentals of Accounting 1Document70 pagesFundamentals of Accounting 1Xia AlliaNo ratings yet

- ABMFABM1 q3 Mod1 Introduction-to-Acctg.Document19 pagesABMFABM1 q3 Mod1 Introduction-to-Acctg.Eduardo john Doloso100% (1)

- CFAS Module Week 1-2Document11 pagesCFAS Module Week 1-2Yamit, Angel Marie A.No ratings yet

- MODULE 2 - BUSINESS ACCOUNTING RevisedDocument16 pagesMODULE 2 - BUSINESS ACCOUNTING RevisedArchill YapparconNo ratings yet

- Accounting 12 NotesDocument15 pagesAccounting 12 NotesDenine Dela Rosa OrdinalNo ratings yet

- LeaP-ABM-FABM1-Week 1 To 5Document4 pagesLeaP-ABM-FABM1-Week 1 To 5Paulo Amposta Carpio100% (1)

- Chapter 1Document19 pagesChapter 1SherwinA.JimenezNo ratings yet

- Maria Aimee V. Mancenido: Accounting-Auditing - HTMLDocument8 pagesMaria Aimee V. Mancenido: Accounting-Auditing - HTMLAirish Roperez EsplanaNo ratings yet

- Bookkeeping NC Iii - Module 1Document15 pagesBookkeeping NC Iii - Module 1Abigail AndradeNo ratings yet

- Mba Course HandoutDocument11 pagesMba Course HandoutSajid RehmanNo ratings yet

- Accounting Gr10 - September 4, 2021Document4 pagesAccounting Gr10 - September 4, 2021wandeerNo ratings yet

- Basic AccountingDocument84 pagesBasic AccountingMusthaqMohammedMadathil100% (1)

- Lesson 1 - PART 1 INTRODUCTION TO ACCOUNTINGDocument2 pagesLesson 1 - PART 1 INTRODUCTION TO ACCOUNTINGsweetzelNo ratings yet

- Bookkeeping and Accounting For Small Business: Ishmael Y. Reyes Aldon M. FranciaDocument35 pagesBookkeeping and Accounting For Small Business: Ishmael Y. Reyes Aldon M. FranciaTom Vargas0% (1)

- Module 3 - FarDocument19 pagesModule 3 - FarAzuma JunichiNo ratings yet

- DMGT403 Accounting For Managers PDFDocument305 pagesDMGT403 Accounting For Managers PDFpooja100% (1)

- Chapter 1 Introduction To AcctgDocument11 pagesChapter 1 Introduction To AcctgNUR ANIS SYAMIMI BINTI MUSTAFA / UPMNo ratings yet

- ACCT 1026 Lesson ONEDocument13 pagesACCT 1026 Lesson ONEAnnie RapanutNo ratings yet

- BAM 1 - Fundamentals of AccountingDocument33 pagesBAM 1 - Fundamentals of AccountingimheziiyyNo ratings yet

- Chapter 1Document7 pagesChapter 1Janah MirandaNo ratings yet

- @ Principles of Fundamentals Accounting IDocument506 pages@ Principles of Fundamentals Accounting IbashatigabuNo ratings yet

- Learning Outcomes No L01 L02 L03 L04 L05Document11 pagesLearning Outcomes No L01 L02 L03 L04 L05AbiNo ratings yet

- Acc 101 Basic Accounting IDocument70 pagesAcc 101 Basic Accounting Igarba shuaibuNo ratings yet

- Principle of Accounting 1 - Chapter 1Document34 pagesPrinciple of Accounting 1 - Chapter 1Mbu Javis Enow100% (2)

- Week 01 - 01 - Module 01 - Concepts and PrinciplesDocument11 pagesWeek 01 - 01 - Module 01 - Concepts and Principles지마리No ratings yet

- Fin ZC415Document11 pagesFin ZC415vigneshNo ratings yet

- Accounting Technicians Scheme (West Africa) : Basic Accounting Processes & Systems (BAPS)Document428 pagesAccounting Technicians Scheme (West Africa) : Basic Accounting Processes & Systems (BAPS)Ibrahim MuyeNo ratings yet

- Fabm Module1Document24 pagesFabm Module1lol u’re not harry stylesNo ratings yet

- Chapter 1 FARDocument10 pagesChapter 1 FARHehe Hehe50No ratings yet

- Revision Notes Chapter-1 Introduction To AccountingDocument8 pagesRevision Notes Chapter-1 Introduction To AccountingVaibhav ChauhanNo ratings yet

- Condition Monitoring of Steam Turbines by Performance AnalysisDocument25 pagesCondition Monitoring of Steam Turbines by Performance Analysisabuhurairaqazi100% (1)

- Photon Trading - Market Structure BasicsDocument11 pagesPhoton Trading - Market Structure Basicstula amar100% (2)

- Material Safety Data Sheet (According To 91/155 EC)Document4 pagesMaterial Safety Data Sheet (According To 91/155 EC)Jaymit PatelNo ratings yet

- Analysis of Material Nonlinear Problems Using Pseudo-Elastic Finite Element MethodDocument5 pagesAnalysis of Material Nonlinear Problems Using Pseudo-Elastic Finite Element MethodleksremeshNo ratings yet

- CDKR Web v0.2rcDocument3 pagesCDKR Web v0.2rcAGUSTIN SEVERINONo ratings yet

- A320 Basic Edition Flight TutorialDocument50 pagesA320 Basic Edition Flight TutorialOrlando CuestaNo ratings yet

- IPO Ordinance 2005Document13 pagesIPO Ordinance 2005Altaf SheikhNo ratings yet

- RENCANA KERJA Serious Inspeksi#3 Maret-April 2019Document2 pagesRENCANA KERJA Serious Inspeksi#3 Maret-April 2019Nur Ali SaidNo ratings yet

- Module 5 Data Collection Presentation and AnalysisDocument63 pagesModule 5 Data Collection Presentation and AnalysisAngel Vera CastardoNo ratings yet

- Topic 4: Mental AccountingDocument13 pagesTopic 4: Mental AccountingHimanshi AryaNo ratings yet

- Level 3 Repair: 8-1. Block DiagramDocument30 pagesLevel 3 Repair: 8-1. Block DiagramPaulo HenriqueNo ratings yet

- Personal Best B1+ Unit 1 Reading TestDocument2 pagesPersonal Best B1+ Unit 1 Reading TestFy FyNo ratings yet

- Evaluating Project Scheduling and Due Assignment Procedures An Experimental AnalysisDocument19 pagesEvaluating Project Scheduling and Due Assignment Procedures An Experimental AnalysisJunior Adan Enriquez CabezudoNo ratings yet

- 3412C EMCP II For PEEC Engines Electrical System: Ac Panel DC PanelDocument4 pages3412C EMCP II For PEEC Engines Electrical System: Ac Panel DC PanelFrancisco Wilson Bezerra FranciscoNo ratings yet

- Computer First Term Q1 Fill in The Blanks by Choosing The Correct Options (10x1 10)Document5 pagesComputer First Term Q1 Fill in The Blanks by Choosing The Correct Options (10x1 10)Tanya HemnaniNo ratings yet

- Pneumatic Fly Ash Conveying0 PDFDocument1 pagePneumatic Fly Ash Conveying0 PDFnjc6151No ratings yet

- MDOF (Multi Degre of FreedomDocument173 pagesMDOF (Multi Degre of FreedomRicky Ariyanto100% (1)

- Dike Calculation Sheet eDocument2 pagesDike Calculation Sheet eSaravanan Ganesan100% (1)

- MORIGINADocument7 pagesMORIGINAatishNo ratings yet

- Cabling and Connection System PDFDocument16 pagesCabling and Connection System PDFLyndryl ProvidoNo ratings yet

- Kaitlyn LabrecqueDocument15 pagesKaitlyn LabrecqueAmanda SimpsonNo ratings yet

- PCDocument4 pagesPCHrithik AryaNo ratings yet

- Aisladores 34.5 KV Marca Gamma PDFDocument8 pagesAisladores 34.5 KV Marca Gamma PDFRicardo MotiñoNo ratings yet

- Resume Jameel 22Document3 pagesResume Jameel 22sandeep sandyNo ratings yet

- Lending OperationsDocument54 pagesLending OperationsFaraz Ahmed FarooqiNo ratings yet

- Edita's Opertionalization StrategyDocument13 pagesEdita's Opertionalization StrategyMaryNo ratings yet

- SND Kod Dt2Document12 pagesSND Kod Dt2arturshenikNo ratings yet

- Properties of Moist AirDocument11 pagesProperties of Moist AirKarthik HarithNo ratings yet

- MSDS - Tuff-Krete HD - Part DDocument6 pagesMSDS - Tuff-Krete HD - Part DAl GuinitaranNo ratings yet

- Office Storage GuideDocument7 pagesOffice Storage Guidebob bobNo ratings yet