Professional Documents

Culture Documents

Earnings Statement: Non-Negotiable

Uploaded by

Pepe DecaroOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Earnings Statement: Non-Negotiable

Uploaded by

Pepe DecaroCopyright:

Available Formats

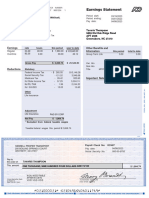

CO. FILE DEPT. CLOCK VCHR. NO.

020

CHA 001061 000300 0000120005 1 Earnings Statement

TLE NY LLC Period Beginning: 11/01/2021

86 PURCHASE STREET Period Ending: 11/15/2021

RYE, NY 10580 Pay Date: 11/19/2021

Taxable Marital Status: Single JOHN RYAN ROSA

Exemptions/Allowances: 57 STILLWATER AVE

APT 311

Federal: 0

NY: 0

STAMFORD, CT 06902

rate hours this period year to date

Regular 15 0000 80 00 1 200 00 2 400 00 YOUR COMPANY PHONE NUMBER IS 203-521-6709

Overtime 22 5000 26 27 591 08 22 089 01

Gross Pay $1 791 08 63 409 09 BASIS OF PAY: HOURLY

Statutory

Federal Income Tax -199 97 379 44

Social Security Tax -111 05 216 32

Medicare Tax -25 97 50 59

NY State Income Tax -81 70 157 73

NY SUI/SDI Tax -1 20 2 40

NY Paid Family Leave Ins -4 84 9 42

Net Pay $1 366 35

Checking 1 -1 366 35

Net Check $0 00

Your federal taxable wages this period are

$1 791 08

2000 A DP, LLC

TLE NY LLC Advice number: 00000120005

86 PURCHASE STREET Pay date: 11/19/2021

RYE NY 10580

Deposited to the account of account number transit ABA amount

JOHN RYAN ROSA xxxxx9799 xxxx xxxx $1 366 35

NON-NEGOTIABLE

You might also like

- 2020-05-22wyndham Hotels and ResortsDocument1 page2020-05-22wyndham Hotels and ResortsDiana MartinezNo ratings yet

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-NegotiableAyanna Sellers100% (5)

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-NegotiableAdam MartensNo ratings yet

- Celestine 5Document1 pageCelestine 5Nicole Caruther0% (1)

- Pay Stub Edmondson - 1Document1 pagePay Stub Edmondson - 1Mary AndresonNo ratings yet

- Pete's Salary For A Week PDFDocument1 pagePete's Salary For A Week PDFCarmen KuhneNo ratings yet

- Second PaystubDocument1 pageSecond Paystubjohnathan greyNo ratings yet

- Direct Deposit Advice This Is Not A CheckDocument1 pageDirect Deposit Advice This Is Not A CheckAlex RoofNo ratings yet

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-NegotiableKarma HoranNo ratings yet

- To 121520 Pay StubDocument1 pageTo 121520 Pay Stubsulaimon2023No ratings yet

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-NegotiableMikkyNo ratings yet

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-NegotiableLuis Alexander Soriano SanchezNo ratings yet

- DJ L Pay Stubs 2Document1 pageDJ L Pay Stubs 2jase0% (1)

- Nieves 1Document1 pageNieves 1carterNo ratings yet

- Tristan Borders Pay Stub 09.17Document1 pageTristan Borders Pay Stub 09.17Alex NeziNo ratings yet

- MZTooo 009416240000 R 0719 E2 DF39 B1621Document1 pageMZTooo 009416240000 R 0719 E2 DF39 B1621to become oneNo ratings yet

- Total Deduction This Perio: Earnings StatementDocument1 pageTotal Deduction This Perio: Earnings StatementPepe DecaroNo ratings yet

- 2 BXooo 006610620000 R 969253 A0 FFC521Document1 page2 BXooo 006610620000 R 969253 A0 FFC521Pily AguilarNo ratings yet

- Earnings Statement: Zalena K Mcclenic 11 Sixth ST Westbury, Ny 11590Document1 pageEarnings Statement: Zalena K Mcclenic 11 Sixth ST Westbury, Ny 11590mellishagrant11No ratings yet

- Check Ais-3Document1 pageCheck Ais-3JOHNNo ratings yet

- KPQooo 001266420000 R 07112758 C846621Document1 pageKPQooo 001266420000 R 07112758 C846621Jonathan GutierrezNo ratings yet

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-NegotiableYanet AlvarezNo ratings yet

- 08 - 05 - 2021 Foods Off Cycle 119644 Supplemental PDFDocument1 page08 - 05 - 2021 Foods Off Cycle 119644 Supplemental PDFVictoria ChevalierNo ratings yet

- 2020-06-09wyndham Hotels and Resorts 2Document1 page2020-06-09wyndham Hotels and Resorts 2Diana MartinezNo ratings yet

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-Negotiablesivajyothi1973No ratings yet

- Payroll ADPDepositDocument1 pagePayroll ADPDepositAJServicesNo ratings yet

- Ryan Pay Stub 2Document1 pageRyan Pay Stub 2Ryan Baker100% (1)

- SSPUSADVDocument1 pageSSPUSADVJamesNo ratings yet

- Statement For Nov 22, 2021Document1 pageStatement For Nov 22, 2021Alexia BeckwithNo ratings yet

- Earnings Statement: Zalena K Mcclenic 11 Sixth ST Westbury, Ny 11590Document1 pageEarnings Statement: Zalena K Mcclenic 11 Sixth ST Westbury, Ny 11590mellishagrant11No ratings yet

- KPQooo 000132800000 R 071 B1815 CA88621Document1 pageKPQooo 000132800000 R 071 B1815 CA88621freddieaddaeNo ratings yet

- Earnings Statement: D Lane Agency Inc. 3348 Peachtree RD NE Suite 700 Atlanta, GA 30326Document1 pageEarnings Statement: D Lane Agency Inc. 3348 Peachtree RD NE Suite 700 Atlanta, GA 30326Muhammad AdeelNo ratings yet

- Earnings Statement: Non NegotiableDocument3 pagesEarnings Statement: Non NegotiableKang KimNo ratings yet

- July Pay Stub - STEWART SANDRA LDocument1 pageJuly Pay Stub - STEWART SANDRA LjamesNo ratings yet

- Screenshot 2019-12-04 at 17.37.04Document1 pageScreenshot 2019-12-04 at 17.37.04Arthur LottieNo ratings yet

- 71 Gooo 007040320000 R 631 B4 BB0 AF3621Document1 page71 Gooo 007040320000 R 631 B4 BB0 AF3621JaCoby HutchinsonNo ratings yet

- Family Justice RulesDocument656 pagesFamily Justice RulesMinialaNo ratings yet

- Birth CertificateDocument2 pagesBirth CertificateLevi Kipkorir Kirui68% (121)

- Paystub Resilience Lab Medical PC 20231001 20231015Document1 pagePaystub Resilience Lab Medical PC 20231001 20231015samantha.vasquezNo ratings yet

- Contract Between Club and Amateur PlayerDocument3 pagesContract Between Club and Amateur Playeranil100% (1)

- Blackhawk School District Suing Norfolk Southern After East Palestine Train DerailmentDocument27 pagesBlackhawk School District Suing Norfolk Southern After East Palestine Train DerailmentWPXI StaffNo ratings yet

- PLX 8796 3U Server Intel Open-Compute-Specification - 190718Document54 pagesPLX 8796 3U Server Intel Open-Compute-Specification - 190718Misha KornevNo ratings yet

- Chapter 39 Corporate Formation and FinancingDocument12 pagesChapter 39 Corporate Formation and FinancingBao Thanh Nguyen LamNo ratings yet

- Mobil Engineering Procurement Construction Offshore Installation 20190606 PDFDocument2 pagesMobil Engineering Procurement Construction Offshore Installation 20190606 PDFWale OyeludeNo ratings yet

- Anti Smoking Ordinance FATIMADocument5 pagesAnti Smoking Ordinance FATIMAAnonymous Gj8FY0C3z33% (3)

- Rights Duties of Employees and Employers ReportDocument13 pagesRights Duties of Employees and Employers ReportPipork Bubbles100% (1)

- 10 Villa vs. Garcia Bosque DIGESTDocument1 page10 Villa vs. Garcia Bosque DIGESTTeresa CardinozaNo ratings yet

- Adamson University Faculty and Employees Union. v. Adamson UniversityDocument2 pagesAdamson University Faculty and Employees Union. v. Adamson UniversityMark Anthony ReyesNo ratings yet

- Pay Statement DataDocument1 pagePay Statement Datadwomohrobert939No ratings yet

- LTLooo 008100340000 R 26 A31580 FB1621Document1 pageLTLooo 008100340000 R 26 A31580 FB1621shayNo ratings yet

- 12 - 15 Pay StatementDocument1 page12 - 15 Pay StatementjordanmoonmanNo ratings yet

- J4 Xooo 008460700000 R 265 F9 DAA636621Document1 pageJ4 Xooo 008460700000 R 265 F9 DAA636621America PerfectoNo ratings yet

- 1st CheckDocument1 page1st CheckMoeez MaalikNo ratings yet

- Earnings Statement: Non NegotiableDocument1 pageEarnings Statement: Non NegotiableKang KimNo ratings yet

- B3Uooo002511540000r031517F4FB66621 01 - 19Document1 pageB3Uooo002511540000r031517F4FB66621 01 - 19markchristory07No ratings yet

- Colombia Check StubDocument1 pageColombia Check Stubwadealexus50No ratings yet

- 12:29 GW PaystubDocument1 page12:29 GW Paystubdonbabich8No ratings yet

- 69 Eooo 002030930000 R 26645 CF39 B1621Document1 page69 Eooo 002030930000 R 26645 CF39 B1621zcooper2011No ratings yet

- Statement 2022Document1 pageStatement 2022Alexander Barno AlexNo ratings yet

- Ap 3Document1 pageAp 3Moeez MaalikNo ratings yet

- Amazon 1Document1 pageAmazon 1kimikorollinsNo ratings yet

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-NegotiableKB’s CreationsNo ratings yet

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-NegotiableanandsoggyNo ratings yet

- ALBA PP 14 Paystub July 7 2017 PDFDocument1 pageALBA PP 14 Paystub July 7 2017 PDFayoubarade1No ratings yet

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-Negotiablemanuela sotoNo ratings yet

- Creighton PaystubDocument1 pageCreighton Paystubraheemtimo1No ratings yet

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-Negotiabledijaje865No ratings yet

- USAA Statement Template 2Document4 pagesUSAA Statement Template 2Adnan HussainNo ratings yet

- Tamara Shelton Paystub Apr 08 2024Document1 pageTamara Shelton Paystub Apr 08 2024ellamaekitchensNo ratings yet

- The Age of Exploration Unveiling New Horizons and Global ConnectionsDocument2 pagesThe Age of Exploration Unveiling New Horizons and Global ConnectionsPepe DecaroNo ratings yet

- Unveiling The Tapestry of Native Americans Unearthing Rich History, Culture, and ResilienceDocument2 pagesUnveiling The Tapestry of Native Americans Unearthing Rich History, Culture, and ResiliencePepe DecaroNo ratings yet

- Novo DocumentoDocument1 pageNovo DocumentoPepe DecaroNo ratings yet

- Cyber Bulliying Scenarios and Preventions: Scenaroi #1Document3 pagesCyber Bulliying Scenarios and Preventions: Scenaroi #1accounts 3 lifeNo ratings yet

- Assessment Cover Sheet: Student Must Fill This SectionDocument49 pagesAssessment Cover Sheet: Student Must Fill This SectionParash RijalNo ratings yet

- Peoplesoft Maintenance ManagementDocument954 pagesPeoplesoft Maintenance ManagementBamini PrakashNo ratings yet

- Travelling Allowance Bill For Tour: PART-A (To Be Filled Up by Government Servant)Document5 pagesTravelling Allowance Bill For Tour: PART-A (To Be Filled Up by Government Servant)samir kumarNo ratings yet

- World Credit WhitepaperDocument43 pagesWorld Credit Whitepaper:Lawiy-Zodok:Shamu:-El100% (2)

- How To Be A Canteen ConcessionaireDocument2 pagesHow To Be A Canteen ConcessionairePersonal MailNo ratings yet

- History Chapter 10Document8 pagesHistory Chapter 10siddesh mankarNo ratings yet

- 1the Basics - CourseraDocument4 pages1the Basics - CourseraRajKumarNo ratings yet

- Delete Blank Rows in Excel - Easy Excel TutorialDocument5 pagesDelete Blank Rows in Excel - Easy Excel TutorialJamalodeen MohammadNo ratings yet

- Infrastructure LawDocument23 pagesInfrastructure LawDileep ChowdaryNo ratings yet

- There Can Be No AssumptionDocument20 pagesThere Can Be No AssumptionNoah ButschNo ratings yet

- High-Performance Silicon-Gate CMOS: Semiconductor Technical DataDocument6 pagesHigh-Performance Silicon-Gate CMOS: Semiconductor Technical DataMuhammad Rizwan Haider DurraniNo ratings yet

- ERM - Experience From Japanese CompanyDocument38 pagesERM - Experience From Japanese CompanyNguyen Quoc HuyNo ratings yet

- Department of Backward Classes WelfareDocument1 pageDepartment of Backward Classes WelfareMahesh KoujalagiNo ratings yet

- The Payment of Bonus ACT, 1965Document20 pagesThe Payment of Bonus ACT, 1965anandi_meenaNo ratings yet

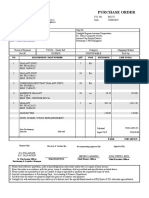

- Amended PO 002527Document1 pageAmended PO 002527patlina mae LacsonNo ratings yet

- United States v. Wyman Taylor, 129 F.3d 131, 10th Cir. (1997)Document5 pagesUnited States v. Wyman Taylor, 129 F.3d 131, 10th Cir. (1997)Scribd Government DocsNo ratings yet

- Lab Exam 1Document3 pagesLab Exam 1Miko F. RodriguezNo ratings yet

- Online Hate Speech Essay Competition Runner UpDocument12 pagesOnline Hate Speech Essay Competition Runner UpNuno CaetanoNo ratings yet