Professional Documents

Culture Documents

Celestine 5

Uploaded by

Nicole CarutherCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Celestine 5

Uploaded by

Nicole CarutherCopyright:

Available Formats

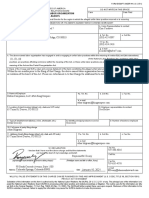

CO. FILE DEPT. CLOCK VCHR. NO.

120

F2S 204640 006000 1NHC 00000002011 1

Earnings Statement

Period Beginning: 05/01/2022

Period Ending: 05/14/2022

BOYDD CONTRACTOR SERVICES Pay Date: 05/20/2022

14014 US/183 STE #401

AUSTIN, TX 78717

Taxable Marital Status: Single

Exemptions/Allowances: SHANEICE CELESTINE

6710 Babcock Rd

Federal: 1 San Antonio, TX 78249

TX: 1

rate hours this period year to date

Regular

Overtime

Vacation

Sick PTO

Gross Pay $1,920.00 17,280.00

Statutory

Federal Income Tax

©2001, 1999, 1998 Automatic Data Processing, Inc.

Social Security Tax

Medicare Tax

TX State Income Tax

_

Net Pay $1,476.97

____ Your Federal taxable wages this period are $1,920.00

Your TX taxable wages this period are $1,920.00

TEAR HERE

▲

î 2000 A DP, LLC

Advice number: 00000002011

BOYDD CONTRACTOR SERVICES

14014 US/183 STE #401 Pay date:

AUSTIN, TX 78717

Deposited to the account of account number transit ABA amount

SHANEICE CELESTINE xxxxxx5524 xxxx xxxx

NON−NEGOTIABLE

THE ORIGINAL DOCUMENT HAS A REFLECTIVE WATERMARK ON THE BACK. HOLD AT AN ANGLE TO VIEW WHEN CHECKING THE ENDORSEMENT.

1

You might also like

- Methods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeFrom EverandMethods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeNo ratings yet

- View paystub details like earnings, taxes, deductionsDocument1 pageView paystub details like earnings, taxes, deductionsjohnathan greyNo ratings yet

- Wage Earnings StatementDocument1 pageWage Earnings StatementDiana MartinezNo ratings yet

- StatementDocument1 pageStatementWaifubot 2.1No ratings yet

- DJ L Pay Stubs 2Document1 pageDJ L Pay Stubs 2jase0% (1)

- Earnings Statement: Earnings Other Benefits and Information DepositsDocument1 pageEarnings Statement: Earnings Other Benefits and Information Depositshitta100% (1)

- Direct Deposit Advice This Is Not A CheckDocument1 pageDirect Deposit Advice This Is Not A CheckAlex RoofNo ratings yet

- Sample: Earnings StatementDocument1 pageSample: Earnings Statementashlei100% (1)

- Gil Rental Payroll - 105 - 022019Document1 pageGil Rental Payroll - 105 - 022019Steven LinNo ratings yet

- 2 BXooo 006610620000 R 969253 A0 FFC521Document1 page2 BXooo 006610620000 R 969253 A0 FFC521Pily AguilarNo ratings yet

- Adp Pay Stub Template 1Document1 pageAdp Pay Stub Template 1Candy ValentineNo ratings yet

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-NegotiableAdam MartensNo ratings yet

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-NegotiableAyanna Sellers100% (5)

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-NegotiableMorenita Pareles100% (1)

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-NegotiableMorenita ParelesNo ratings yet

- July PAY STUB 03Document1 pageJuly PAY STUB 03enudo SolomonNo ratings yet

- WI Employee Earnings Statement May 2021Document1 pageWI Employee Earnings Statement May 2021MikkyNo ratings yet

- Gina L Eggleton 22965 NE Albertson RD Gaston, OR 97119: Company: Check No. Group: Loc. Dept: Check Date: HoursDocument4 pagesGina L Eggleton 22965 NE Albertson RD Gaston, OR 97119: Company: Check No. Group: Loc. Dept: Check Date: HoursGigi EggletonNo ratings yet

- J6Hooo009310710000r0313131DE64F521 PDFDocument1 pageJ6Hooo009310710000r0313131DE64F521 PDFRoll KingsNo ratings yet

- SSPOFADVDocument1 pageSSPOFADVKaren OHareNo ratings yet

- Manuel Medel Paystubs PDFDocument7 pagesManuel Medel Paystubs PDFSantiago ManuelNo ratings yet

- Wells Fargo Bank StatementDocument4 pagesWells Fargo Bank StatementBanjiNo ratings yet

- View your Tesla pay statement onlineDocument1 pageView your Tesla pay statement onlinekelle brassartNo ratings yet

- JanuaryDocument6 pagesJanuaryHumayon MalekNo ratings yet

- TD Business Premier Checking: Account # 435-4366572Document1 pageTD Business Premier Checking: Account # 435-4366572hanhNo ratings yet

- Pay StubDocument1 pagePay StubLulu HuttonNo ratings yet

- Bank Statement JuneDocument4 pagesBank Statement JuneHugo Beltran100% (1)

- Account # 0306977871: Lifegreen CheckingDocument8 pagesAccount # 0306977871: Lifegreen CheckingAmanda ConryNo ratings yet

- WELS FARGO Bank - Statement - 123123Document7 pagesWELS FARGO Bank - Statement - 123123Alex Nezi50% (2)

- Your Business Advantage Fundamentals™ Banking: Account SummaryDocument6 pagesYour Business Advantage Fundamentals™ Banking: Account SummaryH.I.M Dr. Lawiy ZodokNo ratings yet

- METABANKDocument1 pageMETABANKdae ChoNo ratings yet

- This Study Resource Was: Fifth Third Business PlusDocument2 pagesThis Study Resource Was: Fifth Third Business PlusPatsy HilllNo ratings yet

- Bayshore Properties, Inc Lambros Riverwoods Complex 2018 Val Obj PDFDocument1 pageBayshore Properties, Inc Lambros Riverwoods Complex 2018 Val Obj PDFLinda FreibergerNo ratings yet

- Mar-2021, Apr-2021, May-2021, Jun-2021, Aug-2021Document4 pagesMar-2021, Apr-2021, May-2021, Jun-2021, Aug-2021James Franklin100% (3)

- ADP Pay Stub TemplateDocument1 pageADP Pay Stub Templateenudo Solomon67% (3)

- Chase bank statement summary for February 2022Document4 pagesChase bank statement summary for February 2022mondol miaNo ratings yet

- Pete's Salary For A Week PDFDocument1 pagePete's Salary For A Week PDFCarmen KuhneNo ratings yet

- #BWNLLSV #000000P0W3PTR1A1#000AMP90F Susan M Runkle 12956 Se 97Th Terrace RD Summerfield FL 34491-9441Document3 pages#BWNLLSV #000000P0W3PTR1A1#000AMP90F Susan M Runkle 12956 Se 97Th Terrace RD Summerfield FL 34491-9441John BeanNo ratings yet

- Job PRC Contracting Inc Attn: Job PRC Contracting Inc Payroll 10610 Union Hall ST Jamaica Ny 11433 ToDocument1 pageJob PRC Contracting Inc Attn: Job PRC Contracting Inc Payroll 10610 Union Hall ST Jamaica Ny 11433 ToDevon JohnsonNo ratings yet

- Chase Bank Feb 2023Document4 pagesChase Bank Feb 2023Muhammad Usman40% (5)

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-NegotiableYanet AlvarezNo ratings yet

- JPMCB Bank Statement FebDocument2 pagesJPMCB Bank Statement FebClinton ForgyNo ratings yet

- ListDocument6 pagesListalonsoNo ratings yet

- Higher Savings Rates and Checking Account StatementDocument1 pageHigher Savings Rates and Checking Account StatementJoachim Nosik100% (1)

- Chase Bank September 2021 Statement SummaryDocument4 pagesChase Bank September 2021 Statement SummaryAmina chahal0% (1)

- A DP Payroll With CheckDocument1 pageA DP Payroll With CheckFuvv FreeNo ratings yet

- Regions Bank Statement 2Document4 pagesRegions Bank Statement 2Emmy JC Asinaba100% (3)

- My Chase StatementDocument1 pageMy Chase Statementozzie patterson100% (1)

- Found Bank Statement FebDocument1 pageFound Bank Statement FebMagenNo ratings yet

- Bank Account StatementDocument11 pagesBank Account StatementJohn SmitNo ratings yet

- Chase Bank StatementDocument4 pagesChase Bank StatementJoe SFNo ratings yet

- Paystub 3Document1 pagePaystub 3J RequenaNo ratings yet

- Paystub - 2009 03 31Document1 pagePaystub - 2009 03 31jrodasc100% (1)

- Cheesecakefacory PDFDocument1 pageCheesecakefacory PDFTate YatesNo ratings yet

- Proof of renters insurance documentDocument1 pageProof of renters insurance documentQuintinaNo ratings yet

- Statements 9126Document6 pagesStatements 9126Liseth Ortiz50% (2)

- Bank of America StatementDocument12 pagesBank of America StatementAmin Sahil0% (1)

- TD Bank StatementDocument3 pagesTD Bank StatementdeepdokNo ratings yet

- Walmart Money Card Bank StatementDocument3 pagesWalmart Money Card Bank StatementPaige Steele100% (1)

- PayStatementData (5)Document1 pagePayStatementData (5)dwomohrobert939No ratings yet

- Foster PayDocument4 pagesFoster PayNicole CarutherNo ratings yet

- USA PATRIOT Act Customer Identification Program NoticeDocument23 pagesUSA PATRIOT Act Customer Identification Program NoticeNicole CarutherNo ratings yet

- Celestine 5Document1 pageCelestine 5Nicole Caruther0% (1)

- form-w2-Ramona-Crawford 2Document9 pagesform-w2-Ramona-Crawford 2Nicole CarutherNo ratings yet

- Please Docusign: Proposed OrderDocument29 pagesPlease Docusign: Proposed OrderNicole CarutherNo ratings yet

- CertificateDocument1 pageCertificateNicole CarutherNo ratings yet

- 8155 60 039 6143672 Account Number: Amount DueDocument6 pages8155 60 039 6143672 Account Number: Amount DueNicole Caruther100% (2)

- Keep your insurance cards handyDocument4 pagesKeep your insurance cards handyDawn Lamb UmikerNo ratings yet

- Shaneice Celestine: Work Experience Work ExperienceDocument1 pageShaneice Celestine: Work Experience Work ExperienceNicole CarutherNo ratings yet

- Shaneice Celestine: Work Experience Work ExperienceDocument1 pageShaneice Celestine: Work Experience Work ExperienceNicole CarutherNo ratings yet

- Fake Louis Vuitton Receipt Template WordDocument2 pagesFake Louis Vuitton Receipt Template WordNicole Caruther0% (2)

- Indegent PaperworkDocument2 pagesIndegent PaperworkLindsey BradfieldNo ratings yet

- The - Nation 04.april.2022Document66 pagesThe - Nation 04.april.2022Belu IonNo ratings yet

- The Law Pertaining To The State and Its Relationship With Its CitizensDocument52 pagesThe Law Pertaining To The State and Its Relationship With Its CitizensRedraine Reyes100% (1)

- Rescuing a minor from illegal custodyDocument4 pagesRescuing a minor from illegal custodyKritika ThakurNo ratings yet

- StrikeDocument10 pagesStrikefarzana faisalNo ratings yet

- Adcb Aura BankDocument1 pageAdcb Aura Bankabdhaadi.saqibNo ratings yet

- Robber's Cave ExperimentDocument2 pagesRobber's Cave Experimentzuzu_zuzu96No ratings yet

- Feminist Criticism ApproachDocument2 pagesFeminist Criticism ApproachKarl Wyndyll LambanNo ratings yet

- Award 38839Document13 pagesAward 38839RajakannanNo ratings yet

- Application For Judicial ReviewDocument8 pagesApplication For Judicial ReviewWilliam SilwimbaNo ratings yet

- Welcome To Your Chapter 4 ActivityDocument2 pagesWelcome To Your Chapter 4 ActivityAlexandriteNo ratings yet

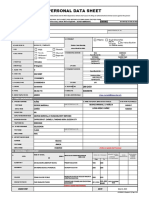

- Department of Social Welfare and Development-Administrative Officer IiDocument2 pagesDepartment of Social Welfare and Development-Administrative Officer Iipreciousabuso143No ratings yet

- (Revised) Scribe Declaration Anx IIDocument2 pages(Revised) Scribe Declaration Anx IIDeepesh kumarNo ratings yet

- King Soopers Unfair Labor Practices FilingDocument3 pagesKing Soopers Unfair Labor Practices FilingMichael_Roberts2019No ratings yet

- 092 Nha Vs EvangelistaDocument4 pages092 Nha Vs EvangelistaUE LawNo ratings yet

- Procurementof Consulting ServicesDocument37 pagesProcurementof Consulting ServicesRam Prasad AwasthiNo ratings yet

- NCR - MandaluyongDocument3 pagesNCR - MandaluyongireneNo ratings yet

- UntitledDocument107 pagesUntitledRajitha100% (1)

- Cs Form No. 212 PDS May 22 2023Document4 pagesCs Form No. 212 PDS May 22 2023Lemuel MarceloNo ratings yet

- Snuggie TM Cancellation PleadingsDocument19 pagesSnuggie TM Cancellation PleadingsDaniel BallardNo ratings yet

- Certificate 1Document1 pageCertificate 1dnsent.123No ratings yet

- CONTEX vs. CIRDocument3 pagesCONTEX vs. CIRAnneNo ratings yet

- FILAMER CHRISTIAN INSTITUTE v. IACDocument6 pagesFILAMER CHRISTIAN INSTITUTE v. IACmarkhan18No ratings yet

- Organized Crime: Gangs, Mules, Street-Level DealersDocument4 pagesOrganized Crime: Gangs, Mules, Street-Level DealersAudi KawiraNo ratings yet

- Request For Proposal FOR: Tasiast Mauritanie Limited S.ADocument16 pagesRequest For Proposal FOR: Tasiast Mauritanie Limited S.AFunda HandasNo ratings yet

- Florida Black CodesDocument16 pagesFlorida Black CodesWFTVNo ratings yet

- UntitledDocument81 pagesUntitledA Chat With AlexNo ratings yet

- Uy Tuazon v. World WiserDocument2 pagesUy Tuazon v. World WiserNeil Aubrey GamidoNo ratings yet

- Tra Confirmation Page 1601eq DecemberDocument1 pageTra Confirmation Page 1601eq Decembernaim indahiNo ratings yet

- Atty suspended, barred from notary role for unauthorized notarizationsDocument1 pageAtty suspended, barred from notary role for unauthorized notarizationsMagr EscaNo ratings yet

- Benjamin FranklinDocument16 pagesBenjamin FranklinBiblioteca ContaderoNo ratings yet