Professional Documents

Culture Documents

Certificate of Compensation Payment/Tax Withheld: (Present)

Certificate of Compensation Payment/Tax Withheld: (Present)

Uploaded by

Jeremiah DavidOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Certificate of Compensation Payment/Tax Withheld: (Present)

Certificate of Compensation Payment/Tax Withheld: (Present)

Uploaded by

Jeremiah DavidCopyright:

Available Formats

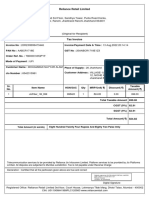

Republic of the Philippines

For BIR BCS/ Department of Finance

Use Only Item: Bureau of Internal Revenue

BIR Form No.

Certificate of Compensation

2316

January 2018 (ENCS)

Payment/Tax Withheld

For Compensation Payment With or Without Tax Withheld 2316 01/18ENCS

Fill in all applicable spaces. Mark all appropriate boxes with an "X".

1 For the Year 2 For the Period

(YYYY) 2 0 1 8 From (MM/DD) 0 1 0 1 To (MM/DD) 1 2 3 1

Part I - Employee Information Part IV-B Details of Compensation Income & Tax Withheld from Present Employer

3 TIN

722 - 300 - 580 - 0000 A. NON-TAXABLE/EXEMPT COMPENSATION INCOME Amount

4 Employee's Name (Last Name, First Name, Middle Name) 5 RDO Code 27 Basic Salary (including the exempt P250,000 & below)

or the Statutory Minimum Wage of the MWE

ARCEO, REGINA, CANLAS 21A

28 Holiday Pay (MWE)

6 Registered Address 6A ZIP Code

#230 DEL PILAR ST., DOLORES, 2010 29 Overtime Pay (MWE)

6B MABALACAT

Local Home Address CITY 6C ZIP Code

30 Night Shift Differential (MWE)

6D Foreign Address

31 Hazard Pay (MWE)

32 13th Month Pay and Other Benefits

7 Date of Birth (MM/DD/YYYY) 8 Contact Number (maximum of P90,000) 20,000

08 07 1997 09262665497 33 De Minimis Benefits

9 Statutory Minimum Wage rate per day 34 SSS, GSIS, PHIC & PAG-IBIG Contributions

and Union Dues (Employee share only) 17,640

10 Statutory Minimum Wage rate per month

35 Salaries and Other Forms of Compensation

Minimum Wage Earner (MWE) whose compensation is exempt from

11

withholding tax and not subject to income tax 36 Total Non-Taxable/Exempt Compensation

Part II - Employer Information (Present) Income (Sum of Items 27 to 35)

37,640

12 TIN

116 - 676 - 130 - 0000 B. TAXABLE COMPENSATION INCOME REGULAR

13 Employer's Name

37 Basic Salary 240,000

BORDON, FERNANDO, LAYUG

14 Registered Address 14A ZIP Code 38 Representation

DAU, MABALACAT CITY 2010 39 Transportation

15 Type of Employer

X Main Employer Secondary Employer

40 Cost of Living Allowance (COLA)

Part III - Employer Information (Previous)

16 TIN

- - - 41 Fixed Housing Allowance

17 Employer's Name 42 Others (specify)

42A

18 Registered Address 18A ZIP Code

42B

SUPPLEMENTARY

Part IVA - Summary

43 Commission

19 Gross Compensation Income from Present

Employer (Sum of Items 36 and 50) 257,640

44 Profit Sharing

20 Less: Total Non-Taxable/Exempt Compensation

Income from Present Employer (From Item 36) 37,640

45 Fees Including Director's Fees

21 Taxable Compensation Income from Present

Employer (Item 19 Less Item 20) (From Item 50) 240,000

46 Taxable 13th Month Benefits

22 Add: Taxable Compensation Income from

Previous Employer, if applicable

47 Hazard Pay

23 Gross Taxable Compensation Income

(Sum of Items 21 and 22) 240,000

48 Overtime Pay

24 Tax Due 0 49 Others (specify)

25 Amount of Taxes Withheld

25A Present Employer 0 49A

25B Previous Employer, if applicable 49B

26 Total Amount of Taxes Withheld as adjusted 50 Total Taxable Compensation Income

(Sum of Items 25A and 25B) 0 (Sum of Items 37 to 49B)

240,000

I/We declare, under the penalties of perjury that this certificate has been made in good faith, verified by me/us, and to the best of my/our knowledge and belief, is true and correct, pursuant

the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof. Further, I/we give my/our consent to the processing of my/our informati

as contemplated under the *Data Privacy Act of 2012 (R.A. No. 10173) for legitimate and lawful purposes.

51 FERNANDO L. BORDON Date Signed

Present Employer/Authorized Agent Signature over Printed Name

CONFORME:

52 REGINA C. ARCEO Date Signed

Employee Signature over Printed Name Amount paid, if CTC

CTC/Valid ID No. Place of

Date Issued

of Employee Issue

To be accomplished under substituted filing

I declare, under the penalties of perjury that the information herein stated are I declare, under the penalties of perjury that I am qualified under substituted filing of Income Tax Return

reported under BIR Form No. 1604-C which has been filed with the Bureau of (BIR Form No. 1700), since I received purely compensation income from only one employer in the Philippines

Internal Revenue. for the calendar year; that taxes have been correctly withheld by my employer (tax due equals tax withheld); that

the BIR Form No. 1604-C filed by my employer to the BIR shall constitute as my income tax return; and that BIR

Form No. 2316 shall serve the same purpose as if BIR Form No. 1700 has been filed pursuant to the provisions

53 FERNANDO L. BORDON of Revenue Regulations (RR) No. 3-2002, as amended.

Present Employer/Authorized Agent Signature over Printed Name

(Head of Accounting/Human Resource or Authorized Representative) 54 REGINA C. ARCEO

Employee Signature over Printed Name

*NOTE: The BIR Data Privacy is in the BIR website (www.bir.gov.ph)

You might also like

- Sale of Goods Act, 1930Document47 pagesSale of Goods Act, 1930CHARAK RAY100% (1)

- Form 48 DTR 1Document1 pageForm 48 DTR 1Rechell A. Dela Cruz100% (4)

- CS Form No. 32 Oath of Office 2018Document1 pageCS Form No. 32 Oath of Office 2018Princess Joy Morales100% (1)

- Garrett Dailey: Motion to Strike Portions of Appellant's Reply Brief - Mussallem v. Mussallem Santa Clara County Superior Court Judge Richard Berra - 6th District Court of Appeal San Jose - Administrative Presiding Judge Conrad L. RushingDocument12 pagesGarrett Dailey: Motion to Strike Portions of Appellant's Reply Brief - Mussallem v. Mussallem Santa Clara County Superior Court Judge Richard Berra - 6th District Court of Appeal San Jose - Administrative Presiding Judge Conrad L. RushingCalifornia Judicial Branch News Service - Investigative Reporting Source Material & Story IdeasNo ratings yet

- FICS Analysis ToolDocument14 pagesFICS Analysis ToolLen Cardona Bagunas100% (1)

- Bir Form 1902Document4 pagesBir Form 1902fatmaaleah100% (1)

- Principles of Natural JusticeDocument22 pagesPrinciples of Natural JusticeanamtaNo ratings yet

- Conciliation AgreementDocument3 pagesConciliation Agreementsijithskumar33% (3)

- BIODATADocument2 pagesBIODATAYel Roan67% (3)

- DTRDocument3 pagesDTRYhena Chan33% (3)

- Template Psipop 2017Document14 pagesTemplate Psipop 2017John Patrick Taguba Agustin67% (3)

- 201 File ChecklistDocument2 pages201 File ChecklistDeth David GorospeNo ratings yet

- 2316 Jan 2018 ENCS Final2Document1 page2316 Jan 2018 ENCS Final2Rafael DizonNo ratings yet

- Anecdotal Record: Department of EducationDocument1 pageAnecdotal Record: Department of EducationShenron InamoratoNo ratings yet

- Palaro 2009 Medical CertificateDocument1 pagePalaro 2009 Medical CertificateHari Ng Sablay100% (1)

- Landbank IAccess Enrollment FormDocument4 pagesLandbank IAccess Enrollment FormJohn Balagbis100% (1)

- Bir Form 1901Document4 pagesBir Form 1901Jayvee CayabyabNo ratings yet

- 201 Files ChecklistDocument1 page201 Files ChecklistChristopher Pontejo100% (1)

- Crucial ResourcesDocument10 pagesCrucial ResourcesDEBORAH MANABATNo ratings yet

- E25 - Lyn Joy v. Mendoza - D-VucadDocument1 pageE25 - Lyn Joy v. Mendoza - D-Vucadlyn joyNo ratings yet

- Step Increment Template For SecondaryDocument5 pagesStep Increment Template For SecondaryKarissaNo ratings yet

- CJ Sereno On Plagiarism Against Justice Del CastilloDocument50 pagesCJ Sereno On Plagiarism Against Justice Del CastilloSophiaKirs10100% (1)

- Prelim Exam in PolDocument9 pagesPrelim Exam in PolJen AniscoNo ratings yet

- Introduction Notes On LandDocument2 pagesIntroduction Notes On LandNikki Estores GonzalesNo ratings yet

- Med Cert DepedDocument1 pageMed Cert DepedMark Cañete PunongbayanNo ratings yet

- Change of StatusDocument4 pagesChange of Statuswaldimar brigoliNo ratings yet

- Assignment OrderDocument1 pageAssignment OrderLoueda May Z. CaradoNo ratings yet

- Authority To Travel: Innovative Teaching and Learning Strategies For Modern Pedagogy"Document2 pagesAuthority To Travel: Innovative Teaching and Learning Strategies For Modern Pedagogy"Lorena Bolanos BascoNo ratings yet

- For Agency Remittance AdviceDocument6 pagesFor Agency Remittance AdviceGreg Terrones Mueco50% (2)

- DTR in SoftDocument1 pageDTR in Softfatima naranjoNo ratings yet

- Yokohama Tire PhilsDocument2 pagesYokohama Tire PhilsBon Bons100% (1)

- 2316 Chairman Public School TeacherDocument1 page2316 Chairman Public School TeacherCASUNCAD, GANIE MAE T.No ratings yet

- E. CARINGAL-Certificate-of-ParticipationDocument1 pageE. CARINGAL-Certificate-of-ParticipationSfa Mabini Batangas100% (1)

- Answer Sheets 35 - 40 - 50 ItemsDocument4 pagesAnswer Sheets 35 - 40 - 50 ItemsNiña DyanNo ratings yet

- Accomplishment ReportDocument2 pagesAccomplishment Reportjanwill ocampo0% (1)

- 08202023cseppt Subprof PassersDocument6 pages08202023cseppt Subprof PassersTOPNOTCHER PhilippinesNo ratings yet

- DBM-CSC Form No. 1 Position Description Forms..Document99 pagesDBM-CSC Form No. 1 Position Description Forms..Ley Domingo Villafuerte Gonzales100% (6)

- Sample of Position Description FormDocument2 pagesSample of Position Description FormJen Linares100% (1)

- Human Resource Development PlanDocument20 pagesHuman Resource Development PlanAiza Rhea Santos100% (1)

- Daily Time RecordDocument2 pagesDaily Time RecordCarlo Fernando Padin0% (1)

- Locator SlipDocument1 pageLocator SlipErwin Bucasas67% (3)

- Justification of Non-Availability of CerDocument2 pagesJustification of Non-Availability of Ceranon_794869624100% (1)

- Form 58ADocument2 pagesForm 58ARhea B BorromeoNo ratings yet

- Bacao ES - Copy-of-BP - WP - 4 - FY-2022 - BoncodinFormula - AllDocument9 pagesBacao ES - Copy-of-BP - WP - 4 - FY-2022 - BoncodinFormula - AllMhalou Jocson EchanoNo ratings yet

- 1OATH OF OFFICE - NewformatDocument6 pages1OATH OF OFFICE - NewformatNasra AbdulganiNo ratings yet

- Application For Completion of Grades For Under GraduatesDocument1 pageApplication For Completion of Grades For Under GraduatesJoann Saballero Hamili100% (2)

- Department of Education: Expected Outputs and Assessment For LDM 2 TeachersDocument15 pagesDepartment of Education: Expected Outputs and Assessment For LDM 2 TeachersMarjorie IdianNo ratings yet

- Republic of The Philippines BC-CSC Form No. 1 (Position Description Form)Document3 pagesRepublic of The Philippines BC-CSC Form No. 1 (Position Description Form)Dale Marie Renomeron100% (1)

- Certification - Telephone BillDocument1 pageCertification - Telephone BillREGIONAL DIRECTOR SOUTHERN TAGALOG100% (1)

- Daily Time RecordDocument2 pagesDaily Time RecordLeonil Estaño83% (6)

- PER-QF-04 POSITION DESCRIPTION FORM - CSC Revised 2017 (Administrative Assistant II (Disbursing Officer II)Document2 pagesPER-QF-04 POSITION DESCRIPTION FORM - CSC Revised 2017 (Administrative Assistant II (Disbursing Officer II)Lordiel Faderagao100% (1)

- Format NOSA CY 2020Document5 pagesFormat NOSA CY 2020Jhaye LagascaNo ratings yet

- Locator Slip: Department of EducationDocument4 pagesLocator Slip: Department of EducationRaulJunioRamosNo ratings yet

- Certification: Department of EducationDocument2 pagesCertification: Department of EducationReyes C. Ervin100% (1)

- Adviser's Students' Record Management System (SMSHS-ARMS) Using Microsoft ExcelDocument6 pagesAdviser's Students' Record Management System (SMSHS-ARMS) Using Microsoft ExcelInternational Journal of Innovative Science and Research Technology100% (1)

- COE School Issued - Without Compensation Certification Custodio MaximarDocument1 pageCOE School Issued - Without Compensation Certification Custodio MaximarEfra SageNo ratings yet

- Certificate of Good Moral CharacterDocument2 pagesCertificate of Good Moral CharacterJohnny Fred Aboy LimbawanNo ratings yet

- Action Plan PfaDocument2 pagesAction Plan PfaManangbiday UdquinNo ratings yet

- Teachers Pass SlipDocument2 pagesTeachers Pass SlipSheila Bliss J. Goc-ongNo ratings yet

- CERT of No Time in and OutDocument8 pagesCERT of No Time in and OutSample BakeshopNo ratings yet

- Work Experience Sheet CS Form No. 212Document1 pageWork Experience Sheet CS Form No. 212Josephino Castillo50% (2)

- Bir Form 2316 BlankDocument296 pagesBir Form 2316 BlankRomeda ValeraNo ratings yet

- BIR GovernmentDocument15 pagesBIR GovernmentEdgar Miralles Inales ManriquezNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument2 pagesCertificate of Compensation Payment/Tax WithheldED'z SantosNo ratings yet

- BIR Form 2316Document1 pageBIR Form 2316Angelique MasupilNo ratings yet

- 2022 NleDocument24 pages2022 NleFrancis Anthony EspesorNo ratings yet

- New Bir 2316 Ebs Members DesoDocument5 pagesNew Bir 2316 Ebs Members DesoEMELYN COSTALESNo ratings yet

- 2316 EB Pollclerk EB Member and DESODocument1 page2316 EB Pollclerk EB Member and DESOyeiwjwjsNo ratings yet

- People of The Philippines, Plaintiff-Appellee, vs. Paulino Sevilleno Y Villanueva Alias TAMAYO, Accused-AppellantDocument5 pagesPeople of The Philippines, Plaintiff-Appellee, vs. Paulino Sevilleno Y Villanueva Alias TAMAYO, Accused-AppellanteenahNo ratings yet

- Ethicon v. Covidien - Appellate BriefsDocument188 pagesEthicon v. Covidien - Appellate BriefsSarah BursteinNo ratings yet

- BCP BB Claim - August 2022Document2 pagesBCP BB Claim - August 2022Nayyar AlamNo ratings yet

- Hs 799 ShortDocument1 pageHs 799 ShortLevi LittleNo ratings yet

- Lucero V COMELEC DigestDocument2 pagesLucero V COMELEC DigestDaniel FordanNo ratings yet

- Woodard V Diversified Adjustment Service, Inc. (DAS) FDCPA ComplaintDocument12 pagesWoodard V Diversified Adjustment Service, Inc. (DAS) FDCPA ComplaintghostgripNo ratings yet

- 12Document42 pages12Shoaib ShaikhNo ratings yet

- Torts Full Text June 30Document4 pagesTorts Full Text June 30ricalicious0928No ratings yet

- Eabgari of West Bengal State Excise Receives National AwardDocument4 pagesEabgari of West Bengal State Excise Receives National AwardeabgariNo ratings yet

- Impeachment Polling Biden 17 DistrictsDocument42 pagesImpeachment Polling Biden 17 DistrictsCami MondeauxNo ratings yet

- Danial Latifi & Anr Vs Union of India On 28 September, 2001Document13 pagesDanial Latifi & Anr Vs Union of India On 28 September, 2001ravi_dwayneNo ratings yet

- Chapter 4 RizalDocument9 pagesChapter 4 RizalVanessa ReatazaNo ratings yet

- Manila Polo Club Employees' Union v. Manila Polo ClubDocument14 pagesManila Polo Club Employees' Union v. Manila Polo ClubgoyrexNo ratings yet

- The Limits of Progressivism - Boundless US HistoryDocument11 pagesThe Limits of Progressivism - Boundless US HistoryRosa EternaNo ratings yet

- Republic of The Philippines vs. Judge Vicente A. HidalgoDocument12 pagesRepublic of The Philippines vs. Judge Vicente A. HidalgoErika Mariz Sicat CunananNo ratings yet

- Michigan v. Treasurer of Makati (CTA 2015) - Dividends Exempt From Local Business TaxDocument44 pagesMichigan v. Treasurer of Makati (CTA 2015) - Dividends Exempt From Local Business TaxBobby Olavides SebastianNo ratings yet

- Ellis Sandoz - The Roots of Liberty - Magna Carta, Ancient Constitution, and The Anglo-American TraditionDocument353 pagesEllis Sandoz - The Roots of Liberty - Magna Carta, Ancient Constitution, and The Anglo-American TraditionAlysson Nunes SantosNo ratings yet

- Case Digest cONSTITUTIONAL LAW IDocument26 pagesCase Digest cONSTITUTIONAL LAW ISERVICES SUBNo ratings yet

- Berkeley Law - Statement From The Dean's OfficeDocument2 pagesBerkeley Law - Statement From The Dean's OfficewildawhiteNo ratings yet

- Tongko Vs Manufactures Life InsuranceDocument2 pagesTongko Vs Manufactures Life InsuranceGelyn DiazNo ratings yet

- Quicknotes Tax MCQS Book 1 - Gen. Principles PDFDocument18 pagesQuicknotes Tax MCQS Book 1 - Gen. Principles PDFMethlyNo ratings yet

- Self Inspect Handbook Nisp 08Document30 pagesSelf Inspect Handbook Nisp 08DoxCak3No ratings yet