Professional Documents

Culture Documents

1

Uploaded by

Jean Kathyrine ChiongCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1

Uploaded by

Jean Kathyrine ChiongCopyright:

Available Formats

1. Is the power to tax inherent in local government units?

a. No. The power is only exercisable by the national government.

b. No. The power is merely delegated by the mandate of the Constitution.

c. Yes. Local government units are able to exercise the power of local taxation.

d. Yes. Local government units have unbridled discretion in setting rates and objects of local

taxation.

2. The power to impose tax by the local government can only be exercised through:

a. A valid ordinance as enacted by the Sanggunian.

b. A valid proclamation as issued by the local chief executive (mayors, barangay captains, etc.)

c. A valid publication as done by the local secretary in three consecutive weeks.

d. A valid circular as issued by the local treasurer.

3. The following are the limitations to the practice of local taxation:

I. Inherent limitations

II. Constitutional limitations

III. Statutory or congressional limitations

a. I and II only

b. I and III only

c. II and III only

d. I, II and III

4. With respect to local taxes, which agency or office primarily issues advisory tax rulings?

a. Bangko Sentral ng Pilipinas

b. Office of the Local Treasurer

c. Bureau of Local Government Finance

d. Bureau of Internal Revenue

5. The opinions of the Bureau of Local Government Finance are:

a. Conclusive

b. Mandatory

c. Directory

d. Final

6. Statement 1: As a general rule, local government units cannot impose income taxes.

Statement 2: As a general rule, local government units cannot impose estate taxes.

a. Only Statement 1 is true

b. Only Statement 2 is true

c. Both statements are true

d. Both statements are not true

7. Local government units can levy income taxes on:

a. Businesses engaged in general retail and merchandise

b. Insurance and pre-need companies

c. Non-resident foreign corporations

d. Banks and other financial institutions

You might also like

- PROBLEM 1. (Estimating Goodwill - Direct Valuation) RequiredDocument2 pagesPROBLEM 1. (Estimating Goodwill - Direct Valuation) RequiredJean Kathyrine ChiongNo ratings yet

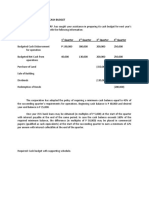

- Illustrative Problem On Cash Budget: ST ND RD THDocument3 pagesIllustrative Problem On Cash Budget: ST ND RD THJean Kathyrine ChiongNo ratings yet

- Goodwill P 200,000Document1 pageGoodwill P 200,000Jean Kathyrine ChiongNo ratings yet

- Consolidation WorksheetDocument1 pageConsolidation WorksheetJean Kathyrine ChiongNo ratings yet

- Discussion Problem No. 1 - (Estimating Goodwill - Direct Valuation)Document1 pageDiscussion Problem No. 1 - (Estimating Goodwill - Direct Valuation)Jean Kathyrine Chiong100% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5796)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)