Professional Documents

Culture Documents

Discussion Problem No. 1 - (Estimating Goodwill - Direct Valuation)

Uploaded by

Jean Kathyrine Chiong100%(1)100% found this document useful (1 vote)

2K views1 pageaccounting

Original Title

Discussion Problem no

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentaccounting

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

100%(1)100% found this document useful (1 vote)

2K views1 pageDiscussion Problem No. 1 - (Estimating Goodwill - Direct Valuation)

Uploaded by

Jean Kathyrine Chiongaccounting

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

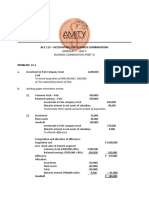

Discussion Problem no.

1 - (Estimating Goodwill - Direct Valuation)

Entity Y is contemplating on acquiring Entity X. Relevant information follows;

Entity X's average annual earnings in the past 5 years were P1,000,000

Entity X's net assets as at the current year-end have a fair value of P8,000,000

The industry average rate of return equity is 12%

The Probable duration on entity B's "Excess earnings" is 5 years.

Required:

1. Goodwill is equal to the average excess earnings capitalized at 25%. How much is the goodwill?

Average annual earnings P 1,000,000

Normal earnings on average net assets

(8,000,000 X 12%) (960,000)

Excess earnings P 40,000

Divide by: Capitalization rate 25%

Goodwill P 160,000

2. Goodwill is measured by capitalizing the average earnings at 12%. How much is the goodwill?

Average annual earnings P 1,000,000

Divide by: capitalization rate 12%

Estimated purchase price P 8,333,333

Fair value of net assets (8,000,000)

Goodwill P 333,333

You might also like

- Joint ArrangementDocument5 pagesJoint ArrangementEzrah Lukes100% (2)

- Audprob Answer 1Document1 pageAudprob Answer 1venice cambryNo ratings yet

- Acctg For Business Combination - Second Lesson PDFDocument21 pagesAcctg For Business Combination - Second Lesson PDFDebbie Grace Latiban Linaza100% (3)

- Digos Company Financial StatementsDocument2 pagesDigos Company Financial Statementsannewilson100% (1)

- Activity For Finals TermDocument6 pagesActivity For Finals TermRhegee Irene RosarioNo ratings yet

- OrDocument10 pagesOrasdf100% (1)

- HB - Forex Midterm 2021Document5 pagesHB - Forex Midterm 2021Allyssa Kassandra LucesNo ratings yet

- Practice Problems 1Document1 pagePractice Problems 1Ma Angelica Balatucan0% (1)

- Audit of Cash Basis, Single Entry and Correction of Errors (Q)Document4 pagesAudit of Cash Basis, Single Entry and Correction of Errors (Q)Lesley Pascual Cortez100% (1)

- Preweek Drill2Document7 pagesPreweek Drill2Grave KnightNo ratings yet

- CH 8 LiabilitiesDocument10 pagesCH 8 LiabilitiesKrizia Oliva100% (1)

- Valle Quiz AbcDocument6 pagesValle Quiz Abclorie anne valle100% (2)

- Chapter 9 - Shareholders' Equity ReviewDocument12 pagesChapter 9 - Shareholders' Equity ReviewLouie De La Torre50% (4)

- Accounting For Special Transaction C8 Prob 5Document2 pagesAccounting For Special Transaction C8 Prob 5skilled legilimenceNo ratings yet

- 8a. Responsibility and Segment Accounting CRDocument20 pages8a. Responsibility and Segment Accounting CRAngelica Gaspay EstalillaNo ratings yet

- Acc 113 - Accounting For Business CombinationsDocument8 pagesAcc 113 - Accounting For Business CombinationsAlthea CagakitNo ratings yet

- Use The Following Information For The Next Seven Questions:: Activity 2.4Document2 pagesUse The Following Information For The Next Seven Questions:: Activity 2.4Tine Vasiana Duerme0% (1)

- 162 005Document1 page162 005Angelli LamiqueNo ratings yet

- Grace-AST Module 6Document2 pagesGrace-AST Module 6Devine Grace A. MaghinayNo ratings yet

- Home Office and Branch Accounting PDFDocument3 pagesHome Office and Branch Accounting PDFJisselle Marie Custodio0% (1)

- Chapter 21 - The Effects of Changes in Forex RatesDocument52 pagesChapter 21 - The Effects of Changes in Forex RatesPutmehudgJasd100% (1)

- Multiple Responses - Module 2Document3 pagesMultiple Responses - Module 2Jere Mae MarananNo ratings yet

- Chapter 7Document18 pagesChapter 7Yenelyn Apistar CambarijanNo ratings yet

- Brilliant Cosmetics 2017 financial statement adjustmentsDocument3 pagesBrilliant Cosmetics 2017 financial statement adjustmentsVilma Tayum100% (1)

- ACCBCOMB - Oct 10Document13 pagesACCBCOMB - Oct 10kimkim100% (1)

- ABC Chapter 5 Accounting For Business Combinations by Millan 2020Document25 pagesABC Chapter 5 Accounting For Business Combinations by Millan 2020Nayoung LeeNo ratings yet

- Grace-AST Module 10Document5 pagesGrace-AST Module 10Devine Grace A. MaghinayNo ratings yet

- Print ExamDocument14 pagesPrint ExamkristinamanalangNo ratings yet

- Grace Corp Audited FSDocument17 pagesGrace Corp Audited FSArchie Guevarra90% (10)

- Corporate Liquidation DisDocument4 pagesCorporate Liquidation DisRenelyn DavidNo ratings yet

- Arroyo - HW in Advacc 2 C14 Business CombinationsDocument4 pagesArroyo - HW in Advacc 2 C14 Business CombinationsAnjj Arroyo100% (1)

- Buscomsubsequent EventDocument4 pagesBuscomsubsequent EventJomar Villena67% (3)

- COMPRE PROB - LIABILITIES Wit Ans KeyDocument152 pagesCOMPRE PROB - LIABILITIES Wit Ans Keyjae100% (2)

- Accounting for Construction ContractsDocument7 pagesAccounting for Construction Contractsgenevieve sicatNo ratings yet

- PDF Valle Quiz ABC CompressDocument6 pagesPDF Valle Quiz ABC CompressPotie RhymeszNo ratings yet

- Problems On Audit of Shareholders EquityDocument26 pagesProblems On Audit of Shareholders EquityNhel AlvaroNo ratings yet

- VELUNTA - Ass. in ASTDocument4 pagesVELUNTA - Ass. in ASTLiberty VeluntaNo ratings yet

- Assets Carrying Amounts Fair Values Cash 10,000 10,000 Receivables, Net 400,000 280,000 Inventory LiabilitiesDocument2 pagesAssets Carrying Amounts Fair Values Cash 10,000 10,000 Receivables, Net 400,000 280,000 Inventory LiabilitiesTine Vasiana DuermeNo ratings yet

- Consolidation Exercises With AsnwerDocument47 pagesConsolidation Exercises With Asnwerjessica amorosoNo ratings yet

- YowDocument35 pagesYowJane Michelle Eman100% (1)

- Joint operation profit and cash received calculationDocument1 pageJoint operation profit and cash received calculationelsana philip100% (1)

- Chapter 5 - Teacher's Manual - Afar Part 1Document15 pagesChapter 5 - Teacher's Manual - Afar Part 1Mayeth BotinNo ratings yet

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument5 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionErwin Labayog MedinaNo ratings yet

- Intermediate Accounting 3 Quiz 1 Print ExamDocument12 pagesIntermediate Accounting 3 Quiz 1 Print ExamVerlyn ElfaNo ratings yet

- Sample ProblemsDocument3 pagesSample ProblemsGracias100% (1)

- Government Accounting: 16 Each Ky Jer Pau Cza Mabuu Paste Na KyDocument22 pagesGovernment Accounting: 16 Each Ky Jer Pau Cza Mabuu Paste Na KySharjaaahNo ratings yet

- Pre 12 QuizDocument9 pagesPre 12 QuizCJ GranadaNo ratings yet

- Audit Risk Model and MaterialityDocument14 pagesAudit Risk Model and Materialityedrick LouiseNo ratings yet

- PROBLEM 1. (Estimating Goodwill - Direct Valuation) RequiredDocument2 pagesPROBLEM 1. (Estimating Goodwill - Direct Valuation) RequiredJean Kathyrine ChiongNo ratings yet

- Unit 5: Assessment ExercisesDocument3 pagesUnit 5: Assessment ExercisesJaved MushtaqNo ratings yet

- Measure Goodwill Indirect ValuationDocument1 pageMeasure Goodwill Indirect ValuationJean Kathyrine ChiongNo ratings yet

- Special Accounting Topics For Business CombinationDocument4 pagesSpecial Accounting Topics For Business CombinationMixx MineNo ratings yet

- Activity Chapter 3: (A) Average Annual Earnings 2,600,000Document2 pagesActivity Chapter 3: (A) Average Annual Earnings 2,600,000Randelle James FiestaNo ratings yet

- Managerial Accounting CalculationsDocument4 pagesManagerial Accounting CalculationsJudy1928No ratings yet

- INTANGIBLE-ASSETSDocument5 pagesINTANGIBLE-ASSETSDarlianne Klyne BayerNo ratings yet

- Accounting For Business Combination Chapter 3 - Part 1Document1 pageAccounting For Business Combination Chapter 3 - Part 1Janella Umieh De UngriaNo ratings yet

- CPALE FAR STATEMENT OF FINANCIAL POSITIONDocument12 pagesCPALE FAR STATEMENT OF FINANCIAL POSITIONEnrique Hills RiveraNo ratings yet

- Segment Reporting, Decentralization and The Balanced ScorecardDocument20 pagesSegment Reporting, Decentralization and The Balanced ScorecardSneha SureshNo ratings yet

- Solved Problems: OlutionDocument5 pagesSolved Problems: OlutionSavoir PenNo ratings yet

- Business Application Lesson ObjectivesDocument7 pagesBusiness Application Lesson ObjectivesRinna Lynn FraniNo ratings yet

- Measure Goodwill Indirect ValuationDocument1 pageMeasure Goodwill Indirect ValuationJean Kathyrine ChiongNo ratings yet

- 4Document1 page4Jean Kathyrine ChiongNo ratings yet

- 3Document2 pages3Jean Kathyrine ChiongNo ratings yet

- Measure Goodwill Indirect ValuationDocument1 pageMeasure Goodwill Indirect ValuationJean Kathyrine ChiongNo ratings yet

- 1Document1 page1Jean Kathyrine ChiongNo ratings yet

- Prepare The Unadjusted Trial BalanceDocument1 pagePrepare The Unadjusted Trial BalanceJean Kathyrine ChiongNo ratings yet

- ABC GroupDocument2 pagesABC GroupJean Kathyrine ChiongNo ratings yet

- Computation of GoodwillDocument2 pagesComputation of GoodwillJean Kathyrine ChiongNo ratings yet

- 1Document1 page1Jean Kathyrine ChiongNo ratings yet

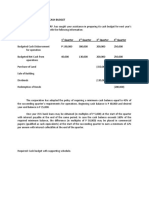

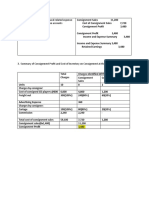

- Illustrative Problem On Cash Budget: ST ND RD THDocument3 pagesIllustrative Problem On Cash Budget: ST ND RD THJean Kathyrine ChiongNo ratings yet

- Consolidation WorksheetDocument1 pageConsolidation WorksheetJean Kathyrine ChiongNo ratings yet

- PROBLEM 1. (Estimating Goodwill - Direct Valuation) RequiredDocument2 pagesPROBLEM 1. (Estimating Goodwill - Direct Valuation) RequiredJean Kathyrine ChiongNo ratings yet

- To Record Cost of Goods Sold and Related Expense and Close Income and Expense AccountsDocument1 pageTo Record Cost of Goods Sold and Related Expense and Close Income and Expense AccountsJean Kathyrine ChiongNo ratings yet

- Problem 2Document2 pagesProblem 2Jean Kathyrine ChiongNo ratings yet

- 2Document2 pages2Jean Kathyrine ChiongNo ratings yet

- Problem 3Document2 pagesProblem 3Jean Kathyrine ChiongNo ratings yet

- ABC Corp. XYZ Corp. Book Value Fair Value Book Value Fair ValueDocument2 pagesABC Corp. XYZ Corp. Book Value Fair Value Book Value Fair ValueJean Kathyrine ChiongNo ratings yet

- Problem 1Document1 pageProblem 1Jean Kathyrine ChiongNo ratings yet

- Problem 2Document1 pageProblem 2Jean Kathyrine ChiongNo ratings yet

- NOTESDocument1 pageNOTESJean Kathyrine ChiongNo ratings yet

- TRANSACTIONSDocument2 pagesTRANSACTIONSJean Kathyrine ChiongNo ratings yet

- Measure Goodwill Indirect ValuationDocument1 pageMeasure Goodwill Indirect ValuationJean Kathyrine ChiongNo ratings yet

- Problem 1Document1 pageProblem 1Jean Kathyrine ChiongNo ratings yet

- NOTES1Document1 pageNOTES1Jean Kathyrine ChiongNo ratings yet

- RequiredDocument1 pageRequiredJean Kathyrine ChiongNo ratings yet