Professional Documents

Culture Documents

Recievables - Credit Management

Uploaded by

Drusti M SOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Recievables - Credit Management

Uploaded by

Drusti M SCopyright:

Available Formats

Advanced Financial Management – 20MBAFM306 2021

UNIT: 05

Receivable / Credit Management

Receivable: The term receivable is defined as “debt owed to the firm by customers

arising from sale of goods/services in the ordinary course of business”. When the firm

sells its products or services on credit, and it does not receive cash for it immediately, but

would be collected in near future. Till collection they form as current assets.

Objectives of Receivable Operation

Receivables arise out of credit extended to customers. Therefore, the objectives of

receivables management are as follows

1. Accounts receivables arise due to credit sales. Credit sales helps the firm to increase its

total sales because, the firm can sell the goods to parties who are not able to make payment

immediately.

2. Credit sales increase the profit of the firm. The profit of the firm is increased due to the

credit sales because,

The margin of profit can be increased due to credit sales because customers accept the

goods even at a little higher price if the goods are supplied on credit terms.

Credit sales becomes necessary to face competition from other firms in the industry,

when other firms are selling the goods on credit, to cope up with the competition a firm

has to resort credit sales.

Cost of maintaining Accounts Receivables

1. Cost of financing: maintaining accounts receivables results in locking-up of the funds of

a firm. The amount or cost of funds locked-up in receivables is called cost of financing.

2. Administrative cost: maintaining receivables involves keeping up of records of the

credit sales made to customers and payments received from them. The cost involves in this

job is called administrative cost.

3. Collection cost: there are certain expenses to be incurred for collecting the amount from

the debtors. Ex: cost of sending reminders, legal charges, and salaries to collecting staff.

4. Defaulting cost: when a firm has receivables, a part of them may become irrecoverable

or bad. The bad debts arising from the receivables are called defaulting cost.

Department of Management Studies, JNNCE, Shivamogga Page 1

Advanced Financial Management – 20MBAFM306 2021

Receivable Management emphasizes the following

1. Terms of payment

2. Credit policy variables

3. Credit evaluation

4. Credit granting decision

5. Control of accounts receivables

1. TERMS / MODES OF PAYMENT: the various terms used in the receivable management

include:

a. Cash Terms or cash mode: cash in advance or cash on delivery. Whenever a firm sells

goods or services on cash terms, the value of goods or services will be received either cash

in advance (before the goods are shifted) or on delivery.

b. Open Account: it is created when the goods are sold on credit; credit facility may include

discount on period. Open account means, after the sale and purchase agreement between

seller and buyers, the seller first shifts goods with invoice (bill), which consists of the credit

terms, credit period allowed, cash discount for early payment, and the period of cash

discount offer, quantity of goods with their total value and so on. The invoice generally

acknowledged by the buyer.

Cash discount is a type of discount for prompt payment before the credit period. Is the

discount allowed to buyer for the early payment? For example a seller has given 2/15,

net 45. It means that discount of 2 percent is allowed; if the payment is made on or

before 15 days, otherwise full payment is due by 45th day.

Credit period means the length of time extended by the supplier of raw materials, goods

or services. Credit period is the period allowed by seller to customer to pay economic

value of goods.

c. Bill of exchange: A bill of exchange represents an unconditional order issued by the

seller asking the buyer to pay the amount mentioned on it on demand at a certain future

date. This type of demand is made only when the seller does not have strong evidence of

the buyer’s obligation. In other words, if the seller wants a clear commitment from the

buyer, before he/she delivers the goods/seller can arrange a commercial draft. When the

buyer accepts a bill than it becomes a trade acceptance, which may hold till the maturity or

get it discounted.

Department of Management Studies, JNNCE, Shivamogga Page 2

Advanced Financial Management – 20MBAFM306 2021

The advantages of bills of exchange are (i) It represents negotiable instrument. (ii) It serves

as a written evidence of a definite obligation. (iii) It helps in reducing cost of finance to

some extent, since it can be discounted.

d. Letter of Credit: Letter of credit (L/C) is a formal document issued by a bank on behalf

of customer, stating the conditions under which the bank will honor the commitments of its

customer (buyer). Payment through the letter of credit arises whenever trade takes place

at international level, but now a day it has been used in domestic trade also. In other words,

whenever trade takes place in the absence of face-to-face unknown people, issue of letter of

credit (L/C) arises.

Functions of the letter of credit are, (i) It eliminates risk, since letter of credit issued by

good standing bank. (ii) It reduces uncertainty, as the seller knows the conditions that

should be fulfilled to receive payments. (iii) It provides safety to the buyer, who wants to

ensure that payment is made only in conformity with the conditions of the letter of credit.

e. Consignment: In consignment, business consigner (seller) sends goods to consignee

(agent of the seller). In this case goods are just shipped but not sold to the consignee. Since

the consigner retains the title of the goods till they are sold by the consignee to a third

party. In this consignment only sales proceeds are remitted to the consignor by the

consignee.

2. Credit Policy Variables

The major credit policy tools are:

1. Credit standards

2. Credit period

3. Collection efforts

4. Cash discount

1. Credit standards: What standard should be applied in accepting or rejecting the

customer?

Following are the options for extension of credit to customer. It can be:-

a. Option 1: Tight or restrictive policy

b. Option 2 : Liberal or non-restrictive policy

Option 1 (strict): firm may decide not to extend credit to any customer, however strong the

customer’s credit rating may be.

Department of Management Studies, JNNCE, Shivamogga Page 3

Advanced Financial Management – 20MBAFM306 2021

Or

Option 2 (liberal): firm may decide to grant credit to all customers, irrespective of their

credit rating.

Between these 2 extremes points, there are several possibilities.

Often, liberal credit standard push the sales by attracting more customers.

This policy, however may lead to higher chances of bad debt loss.

More investment is needed on receivables & also leads to higher collection charges.

Strict, credit standards have opposite effect,

It tends to reduce sales

Reduces bad debts

Less investment on debtors

Lower collection cost.

Credit standard model shows how liberal credit policy effects on residual income/profit

When we sell more, sales volume increases

Variable cost also increases

There is increase in contribution

Increase in sales leads to increase in bad-debts

Total investment on receivables also increases

Increase in investment, leads to increase in interest charges.(amount invested

from Short Term Loan)

Cost of capital assumed to be constant

Even then the company can make profit.

2. Credit period: It refers to length of time customers are allowed to pay their purchases. It

generally varies from 15 to 60 days. When firm does not extend any credit – then the credit

period will be zero. If a firm allows 30 days credit – its credit term is ‘net 30’.

Lengthening of credit period pushes-up sales not only to the existing customers but also

attracts new customers. This leads to more investment in debtors. As a result of higher

investment in debtors, it also leads to increase in bad-debts losses. Shortening of credit

period, tends to lower sales. Leads to less investment on debtors. Reduces bad-debt losses

Department of Management Studies, JNNCE, Shivamogga Page 4

Advanced Financial Management – 20MBAFM306 2021

3. Collection Policy / efforts: Is required for timely collection of receivables from the

customers, when they become due.

Collection policy consists of

Monitoring the state of receivables

Sending letters to customers, when due date is approaching

Electronic & telephonic advice to customers around the date

Threat of legal actions to overdue customers

Legal actions against overdue customers

Strict collection policy: decreases sales, shortens average collection period, reduces bad-

debts percentage & increases collection charges.

Liberal collection policy: push-up sales, lengthens the average collection period,

increases bad-debts percentage & decreases collection expenses.

4. Cash Discount: Firm generally offers cash discounts to induce customers to make

prompt payments. The percentage allowed & the period during which it is available is

reflected in the credit terms.

For ex: 2/10, net 30. Means that a discount of 2% is allowed if the payment is made by the

10th day, otherwise full payment should be made by the 30th day.

Liberalizing the cash discount policy:

Means higher percentage of discount is allowed or the discount period is lengthened. Such

an action – increases the sales [as discount is regarded as price reduction]. Reduction in

ACP [as customers pay promptly.Increases the profit].

3. Credit Evaluation of Customers

a. Credit information

i. financial statements

ii. bank references

iii. trade references

b. Credit investigation and analysis

i. analysis of credit file

ii. financial analysis

iii. analysis of business and management

Department of Management Studies, JNNCE, Shivamogga Page 5

Advanced Financial Management – 20MBAFM306 2021

ERRORS IN CREDIT EVALUATION

In assessing credit risks, two types of errors occur:

Type I error: A good customer is misclassified as a poor credit risk

Type II error: A bad customer is misclassified as a good credit risk

Credit analysis

It refers to the analyzing of the quality of the customer on individual basis. The credit

manager will analyze 3c’s i.e., character, capacity and condition of the person to whom the

credit is to be given. The credit analysis depends upon the experience of the financial or

credit manager to judge the extent and genuineness of the customer. This mainly involves

the analysis of the following relating to a customer:

Collection period

Default rate

Five Cs of Credit

Character : The willingness of the customer to honor his obligations

Capacity : The operating cash flows of the customer

Capital : The financial reserves of the customer

Collateral : The security offered by the customer

Conditions : The general economic conditions that affect the customer

Techniques of credit analysis

Numerical Credit Scoring

Discriminate analysis

Department of Management Studies, JNNCE, Shivamogga Page 6

Advanced Financial Management – 20MBAFM306 2021

NUMERICAL CREDIT SCORING

It tries to overcome the drawbacks of the traditional analysis which is more of subjective

and is difficult to draw the judgment based on the risk analysis. According to this

technique; credit worthiness or project rating index is calculated using following steps.

1) Identify the relevant factors useful for credit evaluation.

2) Assign weights to each factor, based on the relative importance of each factor.

3) Rate the customer based on various listed factors, using an appropriate rating scale.

4) Multiply the factor rating with the factor weight to get the factor score for each factor.

5) Add all the factor scores to determine the overall ‘project-rating index’.

6) Accept the customer if the rating index is more than desired value or Reject the

customer if the rating index is less than the desired value

DISCRIMINANT ANALYSIS

The credit rating under numerical analysis is somewhat based on ad-hoc and characterized

by subjectivity, the discriminate analysis overcome this drawback with a Z score. It

considers the financial ratio of its customers as the basic determination of credit

worthiness. The ratio includes current ratio and ROE.

Two variables differentiate good customer from the bad customer with a straight line.

+ signifies the good customers who are above the straight line. o signifies the bad

customers who are placed below the straight line.

Department of Management Studies, JNNCE, Shivamogga Page 7

Advanced Financial Management – 20MBAFM306 2021

4. Credit Granting Decision

5. Control of Receivables

• Receivables turnover – provides relationship between credit sales and debt of a firm.

• Average collection period – is a time taken by firm in collecting receivables cash from

the customer.

• Day’s sales outstanding – The ratio of receivables outstanding at the time to sales per

day.

Department of Management Studies, JNNCE, Shivamogga Page 8

Advanced Financial Management – 20MBAFM306 2021

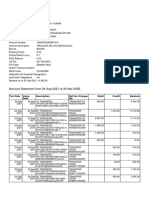

Ageing Schedule:

The ageing schedule of debtors is prepared based on the collection pattern. The total

debtors’ balances are classified according to their age i.e. the outstanding period for which

the amount is uncollected. The ageing schedule provides useful information for assessing

the company’s liquidity position, efficiency of credit control department, efficiency in

collection of receivables, comparison with previous ageing schedules etc. The age analysis

of debtors may be used to help and decide what action to take about older debts.

For better control on collection of receivables, ageing schedule is prepared and analyzed

for identifying the overdue amounts.

The age-wise distribution of accounts receivables at a given time is depicted in the ageing

schedule. For example, the ageing schedule at the end of various quarters may be as

follows:

Outstanding accounts receivable

A comparison of ageing schedules at periodic intervals helps to identify change in the

payment Behavior of customers.

Department of Management Studies, JNNCE, Shivamogga Page 9

Advanced Financial Management – 20MBAFM306 2021

The ageing schedule can be compared with the credit period extended by the company.

When the percentage of receivables belonging to higher age groups is above a stipulated

norm, action has to be initiated before they turn into bad debts. If the company’s credit

terms are say ‘net sixty days,’ then control needs to be exercised in the form of follow up

measures in respect of the bottom 20 percent accounts.

The average collection period and the ageing schedule have traditionally been popular

measures for monitoring receivables. However, they suffer from a limitation. They are

influenced by the sales pattern as well as the decreasing, average collection period and the

ageing schedule will differ from what they would be if sales are constant. This holds even

when the payment behaviour of customers remains unchanged. The reason is simple: a

greater portion of sales is billed currently. Similarly, decreasing sales lead to the same

results. The reason here is that a smaller portion of sales is billed currently. It can be well

explained with an example.

Collection Matrix

Collection matrix is a method of showing percentage of receivables collected during the

month of sales and subsequent months. It helps in studying the efficiency of collections

whether they are improving or deteriorating.

Department of Management Studies, JNNCE, Shivamogga Page 10

Advanced Financial Management – 20MBAFM306 2021

Factoring

Factor: A financial institution which render services relating to the management and

financing of debtors. Factor selects accounts receivables of their client. Factor takes

responsibility of collecting accounts receivables selected by it

What is factoring? What functions does it perform?

Factoring involves an outright sale of receivables of an organization to a financial

institution or private agency, called factor. A factor specializes in management of trade

credit. Factors collect receivables and also advance cash against receivables to solve the

client firms’ liquidity problem. For providing their services, they charge interest on

advance and commission for other services.

The factor performs the following functions:

1. Factors provide financial assistance by extending advance cash against book debts.

2. Sales ledger administration and credit management services to his clients, by

maintaining the ledger of customers of clients, taking all follow-up actions, etc.

3. Protection against default in payment by debtors, by initializing legal actions at an early

time.

4. Credit collection

5. He guards the interest of his client, by developing better strategy against possible

defaults by customers of his client; etc.

Costs of Receivables Management

The following are the main costs associate with accounts receivable management:

• Capital cost

• Collection cost

• Bad debt cost

Capital cost/opportunity cost:

Providing goods or services on credit involves block of firm’s funds. In other words the

increased level of accounts receivables is an investment in current assets (as

debtors/receivables). These blocked funds in receivables need to be financed, by

shareholders funds or from short-term borrowings. They involve some cost. If receivables

Department of Management Studies, JNNCE, Shivamogga Page 11

Advanced Financial Management – 20MBAFM306 2021

are financed by shareholders funds there involves opportunity cost to shareholders. If they

are financed by borrowed funds, it involves payments of interest, which is also a cost.

Collection cost:

Collection costs are those costs that are incurred in collecting the debts from the customers

to whom the credit sales have been granted. The collection costs may include, staff salaries,

records, stationery, postage that are related to maintenance credit department, and

expenses involved in collecting information about prospective customers, from specialized

agencies, for evaluation of prospective customer before going to grant credit.

Bad debt cost:

Sometimes customer may not pay their dues because of the inability to pay. Such costs are

referred as bad debts, and they have to be written off, because they cannot be collected.

These costs can be reduced to some extent if the firm properly evaluates customer before

granting credit, but complete avoidance is not possible.

Factors Influencing Receivables Investments

The level of investment in receivables is affected by the following factors:

– Volume of credit sales

– Credit policy of firm

– Seasonality of business

– Trade terms

– Collection policy

– Bill discounting

Volume of credit sales:

– Size of credit sale is the prime factor that affects the level of investment in receivables.

– Investment in receivable increase when the firm sells major portion of goods on credit

basis and vice versa. In other words increase in credit sales increase the level of receivables

and vice versa.

Department of Management Studies, JNNCE, Shivamogga Page 12

Advanced Financial Management – 20MBAFM306 2021

Credit policy of firm

– There are two types of credit policies such as lenient and stringent credit policy.

– A firm that is following lenient credit policy tends to sell on credit to customers very

liberally, which will increase the size of receivables, on the other hand, a firm that following

stringent credit policy will have low size of receivables, because, the firm is very selective

in providing of stringent credit.

– A firm providing stringent credit may be able to collect debts promptly this will keep the

level of receivables under control.

Seasonality of business

– A firm doing seasonal business has to provide credit sales in un-season.

– When the firm provides credit automatically the level of investment in receivables will

increase with the comparison of the level of receivables in the season; because in season

firm will sell goods on cash basis only.

– For example refrigerators, air cooling products will be sold on credit in the winter season

and on cash in summer season.

Trade terms

– It is the most important factor (variable) in determining the level of investment in

receivables.

– The important credit terms are credit period and cash discount.

– If credit period is more when compared to other companies / industry, then the

investment in receivables will be more.

– Cash discount reduces the investment in receivables because it encourages early

payments.

Collection policy

– Collection policy is needed because all customer do not pay the firm’s bills in time.

– A firm’s liberal collection policy will not be able to reduce investment in receivables, but

in future sales may be increased.

– On the other hand a firm that follows stringent collection policy will definitely reduce

receivables, but it may reduce future sales.

– Therefore the collection policy should aim at accelerating collections from slow payers

and reducing bad debt base.

Department of Management Studies, JNNCE, Shivamogga Page 13

Advanced Financial Management – 20MBAFM306 2021

Bill discounting and Endorsement

– Bills discounting and endorsing to the third party to him/her the firm has to pay will

reduce the size of investment in receivables.

– If the bills are dishonored on the due date, again the investment in receivable will

increase because, discounted bills or endorsed bills have to be paid by the firm.

Department of Management Studies, JNNCE, Shivamogga Page 14

You might also like

- Receivables Management NotesDocument25 pagesReceivables Management NotesBon Jovi0% (1)

- Chapter Four Receivables Management Nature and Importance of ReceivablesDocument10 pagesChapter Four Receivables Management Nature and Importance of ReceivablesBenol MekonnenNo ratings yet

- Unit 4 Receivable ManagementDocument7 pagesUnit 4 Receivable ManagementNeelabh67% (3)

- Chapter 3 Credit ManagementDocument37 pagesChapter 3 Credit ManagementTwinkle FernandesNo ratings yet

- Credit PolicyDocument84 pagesCredit PolicyDan John Karikottu100% (6)

- Receivable Management: 1.1. Introduction To The StudyDocument21 pagesReceivable Management: 1.1. Introduction To The StudyMythili Karthikeyan100% (1)

- Chapter 5Document15 pagesChapter 5Nicole LasiNo ratings yet

- Receivables Management SelfDocument36 pagesReceivables Management Selfnitik chakmaNo ratings yet

- FM II CH-4-1Document12 pagesFM II CH-4-1Fãhâd Õró ÂhmédNo ratings yet

- Credit ManagmentDocument17 pagesCredit ManagmentKetan SonawaneNo ratings yet

- Spontaneous FinancingDocument3 pagesSpontaneous Financingmohi80% (1)

- B) Receivables Management:-: IntroductionDocument13 pagesB) Receivables Management:-: Introductionshivani96620No ratings yet

- TOPIC 9 Chapter 19 Accounts Receivable and Inventory ManagementDocument17 pagesTOPIC 9 Chapter 19 Accounts Receivable and Inventory ManagementIrene KimNo ratings yet

- Receivable ManagementDocument12 pagesReceivable Managementpratik wableNo ratings yet

- Limitations of FactoringDocument12 pagesLimitations of Factoringkomalthorat50% (2)

- Credit Managers. Lesson 3Document40 pagesCredit Managers. Lesson 3Joseph PoNo ratings yet

- Accounts ReceivableDocument52 pagesAccounts Receivablemarget100% (3)

- Module 2-Receivables ManagementDocument36 pagesModule 2-Receivables Managementgaurav shettyNo ratings yet

- Credit & Receivables Ross Book SlidesDocument8 pagesCredit & Receivables Ross Book SlidesMohamed HamedNo ratings yet

- Sai Kiran Print PDFDocument53 pagesSai Kiran Print PDFThanuja BhaskarNo ratings yet

- Short Term FinancingDocument16 pagesShort Term FinancingDinesh RamrakhyaniNo ratings yet

- Montanez, Padua (Accounts Receivable Management - FM, Reporting)Document24 pagesMontanez, Padua (Accounts Receivable Management - FM, Reporting)Emilio Joshua PaduaNo ratings yet

- IInd Unit - Factoring and Venture CapitalDocument28 pagesIInd Unit - Factoring and Venture Capitalguna57617No ratings yet

- Account Receivables Management & Credit Policy: Presented byDocument37 pagesAccount Receivables Management & Credit Policy: Presented byKhalid Khan100% (1)

- Accounts Receivable ManagementDocument2 pagesAccounts Receivable ManagementVaishali GuptaNo ratings yet

- FACTORINGDocument6 pagesFACTORINGsadathnooriNo ratings yet

- Credit Management CHAPTER 1Document23 pagesCredit Management CHAPTER 1Tokib TowfiqNo ratings yet

- Receivable Management KanchanDocument12 pagesReceivable Management KanchanSanchita NaikNo ratings yet

- Introduction of Topic:: Short-Term FinancingDocument15 pagesIntroduction of Topic:: Short-Term Financingshaharyar9No ratings yet

- B4U2mcs 035Document15 pagesB4U2mcs 035Ts'epo MochekeleNo ratings yet

- FM112 Chapter III Receivables Inventory ManagementDocument19 pagesFM112 Chapter III Receivables Inventory ManagementThricia Mae IgnacioNo ratings yet

- FM112 Chapter III Receivables Inventory ManagementDocument19 pagesFM112 Chapter III Receivables Inventory ManagementThricia Mae IgnacioNo ratings yet

- What Is Factoring?Document6 pagesWhat Is Factoring?Nokia PokiaNo ratings yet

- Receivables Management: Chapter - 4Document7 pagesReceivables Management: Chapter - 4Hussen AbdulkadirNo ratings yet

- Receivables Management: Chapter - 4Document7 pagesReceivables Management: Chapter - 4Hussen AbdulkadirNo ratings yet

- Capter 4 FM IIDocument7 pagesCapter 4 FM IIbmulat87No ratings yet

- 1cm8numoo 989138Document52 pages1cm8numoo 989138javed1204khanNo ratings yet

- Different Types of Factoring: Financial Transaction Accounts Receivable Invoices Factor DiscountDocument4 pagesDifferent Types of Factoring: Financial Transaction Accounts Receivable Invoices Factor DiscountSunaina Kodkani100% (1)

- Project On Accounts ReceivableDocument61 pagesProject On Accounts ReceivableNilesh JhaNo ratings yet

- Factoring, Forfaiting & Bills DiscountingDocument3 pagesFactoring, Forfaiting & Bills DiscountingkrishnadaskotaNo ratings yet

- Factoring and IngDocument7 pagesFactoring and IngAnsh SardanaNo ratings yet

- Presented By: 1. Pravin Gavali 2. Vickram Singh MIT-MBA (Finance)Document24 pagesPresented By: 1. Pravin Gavali 2. Vickram Singh MIT-MBA (Finance)shrikant_gaikwad100No ratings yet

- Fa-I Chapter 7Document16 pagesFa-I Chapter 7Hussen AbdulkadirNo ratings yet

- Factoring ServicingDocument25 pagesFactoring ServicingTanya JaliNo ratings yet

- CHAPTER FOUR Receivable ManagementDocument16 pagesCHAPTER FOUR Receivable ManagementeferemNo ratings yet

- Debtors Financing-Factoring: Swayam Siddhi College of MGMT & ResearchDocument15 pagesDebtors Financing-Factoring: Swayam Siddhi College of MGMT & Researchpranjali shindeNo ratings yet

- Unit-II Sources of Business FinanceDocument33 pagesUnit-II Sources of Business FinancedaogafugNo ratings yet

- Assignment of Receivables ManagementDocument6 pagesAssignment of Receivables ManagementHarsh ChauhanNo ratings yet

- Management of Account RecivablesDocument16 pagesManagement of Account RecivablesSumit SamtaniNo ratings yet

- Receivable & Payable Management PDFDocument7 pagesReceivable & Payable Management PDFa0mittal7No ratings yet

- On WCFDocument11 pagesOn WCFMayank SinghalNo ratings yet

- Management of Receivable: ReceivablesDocument4 pagesManagement of Receivable: ReceivablesshahrukhziaNo ratings yet

- Lecture 09Document17 pagesLecture 09simraNo ratings yet

- Credit and Collection Chap1Document39 pagesCredit and Collection Chap1Nick Jagolino90% (10)

- Receivable ManagementDocument29 pagesReceivable Managementvini2710No ratings yet

- 304FIN AFM Unit 4.4 WCMGT Receivables MGTDocument30 pages304FIN AFM Unit 4.4 WCMGT Receivables MGTKaran KacheNo ratings yet

- The Art of Persuasion: Cold Calling Home Sellers for Owner Financing OpportunitiesFrom EverandThe Art of Persuasion: Cold Calling Home Sellers for Owner Financing OpportunitiesNo ratings yet

- Unlocking Financial Opportunities: A Comprehensive Guide on How to Establish Business CreditFrom EverandUnlocking Financial Opportunities: A Comprehensive Guide on How to Establish Business CreditNo ratings yet

- Credit Secrets: Learn the concepts of Credit Scores, How to Boost them and Take Advantages from Your Credit CardsFrom EverandCredit Secrets: Learn the concepts of Credit Scores, How to Boost them and Take Advantages from Your Credit CardsNo ratings yet

- Capital Structure DecisionDocument10 pagesCapital Structure DecisionDrusti M SNo ratings yet

- Advanced Financial Management - 20MBAFM306: Department of Management Studies, JNNCE, ShivamoggaDocument11 pagesAdvanced Financial Management - 20MBAFM306: Department of Management Studies, JNNCE, ShivamoggaDrusti M SNo ratings yet

- Advanced Financial Management - 20MBAFM306: Department of Management Studies, JNNCE, ShivamoggaDocument16 pagesAdvanced Financial Management - 20MBAFM306: Department of Management Studies, JNNCE, ShivamoggaDrusti M S100% (1)

- Advanced Financial Management - 20MBAFM306: Department of Management Studies, JNNCE, ShivamoggaDocument9 pagesAdvanced Financial Management - 20MBAFM306: Department of Management Studies, JNNCE, ShivamoggaDrusti M SNo ratings yet

- Tan Shuy v. MaulawinDocument1 pageTan Shuy v. MaulawinJennilyn Tugelida100% (1)

- Account Statement From 24 Sep 2021 To 24 Mar 2022Document41 pagesAccount Statement From 24 Sep 2021 To 24 Mar 2022ravindra kumarNo ratings yet

- Novation: A. B. Subrogation C. Delegacion D. ExpromissionDocument56 pagesNovation: A. B. Subrogation C. Delegacion D. ExpromissionJoyce LunaNo ratings yet

- Soal Sapac010Document7 pagesSoal Sapac010ulfanysmn67% (6)

- Summer Internship ProjectDocument21 pagesSummer Internship ProjectSonam GuptaNo ratings yet

- PD 957 PDFDocument4 pagesPD 957 PDFInnah MontalaNo ratings yet

- Section 5 Compensation ARTICLE 1278 - Concept of Compensation - Both Two Persons AreDocument10 pagesSection 5 Compensation ARTICLE 1278 - Concept of Compensation - Both Two Persons AreRhon Mhiel RomanoNo ratings yet

- EOU Audit ChecksDocument5 pagesEOU Audit Checksశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- Sap MM Role Matrix PDFDocument12 pagesSap MM Role Matrix PDFGuru PrasadNo ratings yet

- VendorDocument6 pagesVendorLoving TejuNo ratings yet

- Idoc F110 ProcessDocument12 pagesIdoc F110 ProcessReal PlayerNo ratings yet

- Customer Name Card Account No MR Chandrashekar K 4375 XXXX XXXX 6003Document5 pagesCustomer Name Card Account No MR Chandrashekar K 4375 XXXX XXXX 6003Chandrashekar KNo ratings yet

- Credit Card PaymentsDocument14 pagesCredit Card PaymentscanjiatpNo ratings yet

- Receipt For SOLOMON FOLASHAYO - Payment For UNDERGRADUATE FEESDocument1 pageReceipt For SOLOMON FOLASHAYO - Payment For UNDERGRADUATE FEESjesseamobi10No ratings yet

- Proforma Invoice: Flui-Tec Instruments & ControlsDocument1 pageProforma Invoice: Flui-Tec Instruments & ControlsShivaNo ratings yet

- Fundamentals of E-CommerceDocument7 pagesFundamentals of E-CommerceWendoor6696No ratings yet

- Final Field ReportDocument23 pagesFinal Field ReportVũ NinhNo ratings yet

- VisaNet Network Processing OverviewDocument16 pagesVisaNet Network Processing Overviewsalesuse2shopNo ratings yet

- Account Recivable PDFDocument70 pagesAccount Recivable PDFkhaledNo ratings yet

- IBet Features v2Document10 pagesIBet Features v2henny10No ratings yet

- Third Party Payments For A Particular or Multiple Invoices - Alternative PayeeDocument10 pagesThird Party Payments For A Particular or Multiple Invoices - Alternative PayeeBalanathan VirupasanNo ratings yet

- Diego v. DiegoDocument13 pagesDiego v. DiegoIvan LuzuriagaNo ratings yet

- Organizational and Duties of PWD OfficersDocument92 pagesOrganizational and Duties of PWD OfficersMuhammad RiazNo ratings yet

- SAP Dunning Process Training TutorialDocument11 pagesSAP Dunning Process Training TutorialERPDocs100% (2)

- OBLIGATION - Juridical Necessity To Give, To Do or Not To Do 4 Elements of ObligationDocument43 pagesOBLIGATION - Juridical Necessity To Give, To Do or Not To Do 4 Elements of ObligationMary Jane G. FACERONDANo ratings yet

- Nordea BankDocument6 pagesNordea Bankeureka.net24No ratings yet

- Aplus User Manual PDFDocument213 pagesAplus User Manual PDFTing TingNo ratings yet

- Citibank's EPay MinDocument2 pagesCitibank's EPay MinDevesh KumarNo ratings yet

- RTP Process ControlsDocument4 pagesRTP Process ControlsPankaj SinghNo ratings yet