Professional Documents

Culture Documents

Basics of Accounts

Uploaded by

shruthiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Basics of Accounts

Uploaded by

shruthiCopyright:

Available Formats

Uf44/199773

By: CA Vipul Vora VPA 09420251647

BASICS OF ACCOUNTING

Accounting Concepts:

1. Entity Concept: For accounting purpose the "business" is treated as a separate entity

from the proprietor. This is concept helps in keeping in private afairs of the proprietor away

from the business affairs. Thus, if a proprietor invests Rs. 1,00,000 /- in the business, it is

deemed that the proprietor has given Rs. 1,00,000/-as loan to the business.

2. Dual Aspect Concept: This is the basic concept of accounting. As per this concept, every

business transaction has a dual effect. For example, if Sandeep starts business with cash

of Rs. 1,00,000 /- there are two aspects of the transaction: "Asset Account" and "Capital

ACcOunt The business gets asset (cash) of Rs. 1,00,000 /- and on the other hand the

business owes Rs.1,00,000/-to Sandeep as her capital. This can be expressed in the form

of an equation as follows:

Capital (Equity) Cash (Asset)

Rs. 1,00,000/- Rs. 1,00,000/-

If the business increases the assets by purchase of building Rs.50,000 on credit and

borrowing Rs. 30,000/-, the equation would be

Equities (Liabilities) Assets

Capital (+) Creditor (+) Loan Cash (+) Building

Rs. 1,00,000 (+) 50,000 (+) 30,000 Rs. 1,30,000 (+) 50,000

Thus, at any point of time the total assets are equal to total liabilities.

3. Going Concern Concept (Continuity of Activity): It is assumed that the business

concern will continue for a fairly long time, unless and until it has

entered in to a state of

liquidation. It's as per this assumption, that the accountant does not take into account the

sale value of assets while valuing them.

Similarly, depreciation on assets is provided on

the basis of expected lives of the assets rather than

on their market value. Since the

concern is to be kept continuously alive for a

long period of time, financial and accounting

policies are directed towards maintaining such continuity activity.

of

4. Periodicity Concept: Accounts are prepared for a fixed period i.e. for a

etc. Only the transactions entered in a year, for a quarter

of that period. particular period can be recorded in the accounts

5. Cost Concept: All the assets are recorded at cost and not at the market value. An

exception to this is the stock of the business.

at cost or net According to AS -2, Closing Stock is valued

realizable value whichever is less.

CA-Foundation | Accounting Basics of Accounts Page 1

By: CA Vipul Vora VPA 07447799773

420251647

when it is realized. The wn

6. Realization Concept: Income is accounted only

to receive from customer zed"

means either cash is received or a legal obligation n

held.

7. Accrual Concept: Accrual concept means folloWing the mercantile system of accounti

It means that all the income which is earned

and all the expenses which are incuro

the last date of the accounting period is accounted for, irrespective oT whether it received

or paid respectively.

8. Matching Principle: It means that in case any income is credited to P&L AVc, then all the

corresponding expenses which have been incurred for earning that income should he

debited to P&L AlC. Similarly if any expense is debited to P&L AC, then the corresponding

income should be credited to P&L A/c.

9. Money Measurement Concept: Only those transactions can be recorded in accounts

which have a monetary implication.

Accounting Conventions:

1. Conservatism/ Prudence Convention: An accountant needs to be conservative i.e.

all expensesor losses should be provided for; if there is any possibility of its

OcCurrence. But income would be only provided for if the accountant is certain of its

earning

2. Materiality Convention: All material items (i.e. important items) should be properly

disclosed in the financial statements.

3. Disclosure Convention: Every information which is

disclosure of true and fair view of the final accounts should important

for the proper

be disclosed.

4. Consistency Convention: Same

followed

accounting policies and principles should be

consistently every year. The policies may be changed incase of

for the betterment of the

or

organization. legal binding

Fundamental Accounting Assumptions:

There are three fundamental accounting assumptions:

1. Accrual Concept.

2. Going Concern Concept.

3 Consistency Convention.

Classification of Accounts

The ledger accounts may be classified as under:

1. Personal Accounts.

2. Impersonal Accounts.

a) Real or Property Accounts.

b) Nominal or Fictitious Accounts.

VPA 07447799773

By: CA Vipul Vora VPA 09420251647

Thus, Accounts may be of three kinds:

Personal Accounts

i) Real Accounts

ii) Nominal Accounts

etc. These

of individuals, firms, companies,

sOnal Accounts: These are the accounts For recording transactions,

these

cOunts may be of creditors, debtors, bankers' etc.

accounts are treated as "Personal Accounts".

These

which relate to otherthan persons.

personal Accounts: These are the accounts

are again divided into further two types, viz:

or possessions of

a) Real Accounts: These are the accounts of properties, assets

the businessman.

the businessman. These accounts represent the belongings of

or asset. Real

A separate account is maintained for each class of the property

Accounts may assume the following:

I. Tangible Real Accounts: These accounts consists of assets and properties

which can be seen, touched, felt, measured, purchased and sold (i.e perceived

by senses)

I. Intangible Real Accounts: These accounts consists of assets and properties

which cannot be seen, touched, felt but they are capable of measurement in

terms of money. Eg: Goodwill

b) Nominal Accounts: These are accounts of expense or losses and gains or

incomes. These accounts are called fictitious accounts as they do not represent

any tangible asset. A separate account is maintained for each head of expense or

loss or gain or income. For example, interest account, commission account,

discount account.

Accounting Rules:

Debit the receiver

Personal Account

Credit the giver.

Real Account Debit what comes in

Credit what goes out.

Nominal Account Debit the expenses & losses

Credit the incomes &gains.

SIGNIFICANCE OF DEBIT AND CREDIT

Debit in personal account

I. fthe account is new, debit implies that the person whose account is being debited has

become debtor of the business.

I. If the account is already there and the person whose account is being debited as

already a debtor of the business, the new debit implies that the due from that person

has increased.

. If the account of the person who is a creditor of the business is debited, the debit

implies that the amount due to that person has decreased by the amount of debit.

CA-Foundation | Accounting Basics of Accounts Page 3

By: CA Vipul Vora VPA 07447799773

09420251647

Credit in personal account

the person wnose account is being credited

I f the account is new, credit implies that

has become creditor of the business.

credited it will mean that the amount which

. If the account of a creditor of a business is

the amount of the fresh credit.

IS due to that person has increased by that the amount for which the

I1. Credit in the account of a debtor of the business signifies

debtor was liable to the business has diminished by the amount of the credit entry.

Debit in real accounts

A debit in real account means that either the value of the asset whose account is being debited

has increased or the business has acquired more of that asset.

Credit in real accounts

A credit in the real accounts implies that either the value of the asset whose accounts is being

credited has decreased or the business has disposed off part or the whole of the asset.

Debit in nominal accounts

A debit in nominal accounts signifies that there has been an expense or loss of the amount of

the debit or some income or profit has diminished by the amount of the debit.

Credit in nominal accounts

A credit in nominal accounts implies that there has been an income or a profit of the amount.

It can be summarized as follows:

Transaction Debit/ Credit

Increase in asset Debit

Decrease in Asset Credit

Increase in income Credit

Decrease in income Debit

Increase in expense Debit

Decrease in expense Credit

Increase in liability Credit

Decrease in liability Debit

ACCOUNTING CYCLE

The process of accounting cycle consists of the following steps:

I. Analysis of transactions.

II. Journalizing the transactions.

I. Ledger Posting.

V. Balancing of each ledger account.

V. Preparation of a Trial Balance.

VI. Recording of adjustment

VII. Posting of adjustment entries

VIlI. Recording of closing entries

IX. Preparation of financial statements.

CA-Foundation | Accounting Basics of Accounts

Page 14

By: CA Vipul Vora VPA 07447799773

VPA 0942025164

TYPES OF DISCOUNT

Cash Discount

indn allowance to the debtor in order to recover the debts eartier. It is allowed in order to

a octhe debtor to make the payment immediately or within a stipulated period. Obviously

thedscount is allowed when payment is received and a cash discount is received when

the

payment is made early.

Trade Discount

A Irade discount is an allowance made by the whole seller to the retailer in order to enable

the retailer to sell at list prices and to earn a reasonable margin of profit. It is provided wnen

the purchase is made in bulk

quantity.

For Example:

Goods worth Rs.1,00,000 sold to Sanket less 10% trade discount.

Inthistransaction. Sanket has to pay only Rs. 90,000 (Rs. 1,00,000 less Rs. 10,000 T.D.) as

he is allowed a 10% trade discount. But trade discount does not

appear in the books of account

as this amountisalready deducted in the invoice. Therefore, whether trade discount is allowed

or received, it will not appear in the books of accounts.

Capital and Revenue Items

The main purpose of accounting is to ascertain the true results of the business in terms of

profit and loss during a particular accounting period. The profit or loss of a business can be

ascertained by matching business revenues against the cost of the same period. Therefore, a

clear understanding between capital and revenue (expenditures and receipts) is necessary for

the correct ascertainment of profit or loss. It may be noted that revenue items are included

only in income statement or profit or loss account and capital items form part of balance sheet

figures. Let us examine the features of capital and revenue items in the accounting parlance.

Capital and Revenue Expenditures

Before the preparation of final accounts, it is essential to understand clearly the distinction

between the capital and revenue expenditures. Capital expenditure is that expenditure which

results in acquisition of an asset or which resuts in an increase in the earning capacity of

a business. Another test of a capital expenditure is that the benefit of such expenditure lasts

for a long period of time. Obvious examples of capital expenditures are land, buildings,

machinery., furniture, patents, etc.

Expenditure which does not result increase in capacity or in reduction of day to day expenses

is not capital expenditure, unless there is a tangible asset to show for it. All sums spent up to

the point an asset ready for use should also be treated as capital expenditure.

Expenses whose benefit expires within the year of expenditure and which are incurred to

maintain the earning capacity of existing assets are termed as revenue expenditure. Amounts

paidfor wages, salary, carriage of goods, repairs, rent and interest, etc., are items of revenue

expenditure.

CA-Foundation | Accounting Basics of Accounts Page 5

By: CA Vipul Vora VPA

PA O447799773

094202516

The following are the points of distinction between capital expenditure and revenie

expenditure:

) Capital expenditure is incurred in acquiring or improving permanent assets which are not

meant for resale. But revenue expenditure is a routine expenditure incurred in the normal

course of business.

(i) Capital expenditure seeks to improve the earning capacity of the business whereas

revenue expenditure purposes to maintain the earning capacity of the business.

(iit) Capital expenditure is normally a non-recurring outlay but revenue expenditure is usually

a recurring item.

(iv) Capital expenditure produces benefits over several years. Hence only a small part is

charged to income statement as depreciation and the rest appears in the balance sheet

But revenue expenditure is consumed within an accounting year and the entire amount is

charged to the (current year's) income statement. Hence it does not appear in the Balance

Sheet. Deferred revenue expenditure is however an exception to this rule.

Deferred Revenue Expenditure

There are certain expenses which may be in the nature of revenue but their benefit may not

be consumed in the year in which such expenditure has incurred; rather the benefit may

extend over a number of years. All such expenditures are basically the nature of revenue

expenditure, e.g. heavy advertising expenditure incurred introducing a new line or developing

a new market. Charges of these expenses are deferred because such expenses benefit more

than one accounting period. Moreover profits a particular year should not be unduly

affected. The matching principle demands this. The basis of charge should usually be

proportionate to the benefit consumed/reaped.

Thus, deferred revenue expenditure is revenue in character but

() the benefit of which is not exhausted in the same year, or

(i) is applicable either wholly or in part of the future years, or

(ii) is accidental with heavy amount and it is not prudent to charge against the profit of one

year.

Comparison between Capital Expenditure and Deferred Revenue Expenditure

The main feature of capital expenditure is that results in a benefit

which will accrue to

the business enterprise for a long time, say 10 or 15

years. Deferred revenue

expenditure also results in a benefit which will accrue in future period but

3 to 5 years. generally for

The capital expenditure

or the

resulting asset

is usually

capable of being reconverted

into cash though may be at a loss. This is not possible in the

case of deferred

expenditure. revenue

CA-Foundation | Accounting Basics of Accounts

Page 6

VPA 07447799773

By: CA Vipul Vora VPA 09420251647

OBJECTIVES OF ACCOUNTING

he objectives of accounting are as follows:

.Systematic recording oftransaction

2. Ascertainment of results of above recorded transaction

3. ascertainment of the financial position of the business

4. Providing information to the users for rational decision-making

5. To know the

solvency position

FUNCTIONS OF ACcOUNTING

The main functions of accounting are as follows:

1. Measurement

2. Forecasting

3. Decision-making

4. Comparison & Evaluation

5. Control

6. Government Regulation and Taxation

SUB-FIELDS OF ACcOUNTING

The various sub-fields of accounting are:

1. Financial Accounting

2. Management Accounting

3. Cost Accounting

4. Social Responsibility Accounting

5. Human Resource Accounting

USERS OF ACCOUNTING INFORMATION

Following are the various users of accounting information:

1. Invertors

Employees

Lenders

Suppliers

5. Customers

6. Gov rnment and their agencies

7. Public

FUNDAMENTAL ACcOUNTING ASSUMPTIONS

There are three fundamental accounting assumptions:

() Going Concern

(i) Consistency

in) Accrual

FINANCIAL STATEMENTS

Thefollowing are the important qualitative characteristics of the financial statements:

1. Understandability

2. Relevance

3. Reliability

4. Comparability

CA-Foundation | Accounting Basics of Accounts Page 11

By: CA Vipul Vora VPA

VPA 07447799773

094202516

5. Materiality

. Faithful Representation

7. Substance Over Form

8. Neutrality

9. Prudence

10. Ful, fair and adequate disclosure

11. Completeness

LIST OF ACCOUNTING STANDARDS

STANDARD

SI. No. of the TITLE OF THE ACCOUNTING

No Accounting

Standards (AS) Disclosure of Accounting Policiees

AS 1

2. AS 2 (Revised) Valuation ofInventories

3. AS 3 (Revised) Cash flow Statement

4. AS 4 (Revised) Contingencies and Events Occurring after the Balance Sheet Date

5. AS 5 (Revised) Net Profit or Loss for the Period, Prior Period Items and Changes in

Accounting Policies

. AS 6 Abolished

. AS 7 (Revised) Accounting for Construction Contracts

8. AS 9 Revenue Recognition

9.

9. AS 10 (Revised)|Property, Plant and Equipment

10. AS 11 (Revised) The Effects of Changes in Foreign Exchanges Rates

11. AS 12 Accounting for Government Grants

12. AS 13 Accounting for Investments

13. AS 14 Accounting for Amalgamations

14. AS 15 (Revised) Employee Benefits

15. AS 16 Borrowing Costs

16. AS 17 Segment Reporting

17. AS 18 Related Partly Disclosure

18. AS 19 Leases

19. AS 20 Earnings Per Share

20. AS 21 Consolidated Financial Statement

CA-Foundation | Accounting Basics of Accounts

Page | 12

By: CA Vipul Vora VPA 07447799773

09420251647

21. AS 22 Accounting for Taxes on Income

Consolidated Financial

22. AS 23 Accounting for Investments in Associates in

Statements

23. AS 24 Discontinuing Operations

24. AS 25 Interim Financial Reporting

25. AS 26 Intangible Assets

26. AS 27 Financial Reporting of Interests in Joint Ventures

27. AS 28 Impairment of Assets

28. AS 29 Provisions, Contingent Liabilities& Contingent Assets.

You might also like

- 61a8953c7b94b - Account English NotesDocument23 pages61a8953c7b94b - Account English NotesAnuska ThapaNo ratings yet

- Digital Assignment-2: Yogesh. A 19BCC0028Document8 pagesDigital Assignment-2: Yogesh. A 19BCC0028Ash KetchumNo ratings yet

- Financial Reporting & Analysis Study MaterialDocument127 pagesFinancial Reporting & Analysis Study Materialxaseyay235No ratings yet

- Accounting Notes Module - 1Document16 pagesAccounting Notes Module - 1Bheemeswar ReddyNo ratings yet

- Accountingppt 140927013707 Phpapp02 PDFDocument25 pagesAccountingppt 140927013707 Phpapp02 PDFANKITNo ratings yet

- AccountingDocument22 pagesAccountingawdadadNo ratings yet

- Accounting ConceptsDocument8 pagesAccounting ConceptsBajra VinayaNo ratings yet

- Business AccountingDocument25 pagesBusiness AccountingYash PatawariNo ratings yet

- Concepts ConventionsDocument5 pagesConcepts Conventionssinghriya2513No ratings yet

- Accounts Notes 1Document7 pagesAccounts Notes 1Dynmc ThugzNo ratings yet

- Basics of Business AccountingDocument34 pagesBasics of Business AccountingMadhusmita MishraNo ratings yet

- Accounting Concepts and ConventionsDocument2 pagesAccounting Concepts and ConventionsWelcome 1995No ratings yet

- Unit-1:-Introduction of Financial Management Accounting, Book Keeping & RecordingDocument5 pagesUnit-1:-Introduction of Financial Management Accounting, Book Keeping & RecordingShradha KapseNo ratings yet

- Book Keeping Form OneDocument97 pagesBook Keeping Form OneChizani MnyifunaNo ratings yet

- Accounting ConceptsDocument2 pagesAccounting Conceptssoumyasundar720No ratings yet

- Accounting and Financial ManagementDocument3 pagesAccounting and Financial ManagementDhara PatelNo ratings yet

- Accounting Concepts and ConventionsDocument40 pagesAccounting Concepts and ConventionsAmrita TatiaNo ratings yet

- CPT Accounts ThoeryDocument6 pagesCPT Accounts ThoeryanandvkakuNo ratings yet

- Concepts: Introduction To Financial AccountingDocument30 pagesConcepts: Introduction To Financial Accountingbmurali37No ratings yet

- Topic OneDocument21 pagesTopic Onesammie celeNo ratings yet

- Accounts TheoryDocument73 pagesAccounts Theoryaneupane465No ratings yet

- Concepts & Conventions in AccountingDocument5 pagesConcepts & Conventions in Accountingpratz dhakateNo ratings yet

- BasicConceptofManagerialAccounting Unit 1Document9 pagesBasicConceptofManagerialAccounting Unit 1sourabhdangarhNo ratings yet

- AFM Question Bank For 16MBA13 SchemeDocument10 pagesAFM Question Bank For 16MBA13 SchemeChandan Dn Gowda100% (1)

- Accounting Concepts: 1. The Business Entity ConceptDocument2 pagesAccounting Concepts: 1. The Business Entity Conceptnikita bajpaiNo ratings yet

- Accounting PrinciplesDocument4 pagesAccounting PrinciplesManjulaNo ratings yet

- Module-1: Accounting Concepts and ConventionsDocument14 pagesModule-1: Accounting Concepts and ConventionsSai kiran VeeravalliNo ratings yet

- Accounting Concepts and ConventionsDocument7 pagesAccounting Concepts and ConventionsPraveenKumarPraviNo ratings yet

- Unit 1 TAPDocument19 pagesUnit 1 TAPchethanraaz_66574068No ratings yet

- GAAPDocument14 pagesGAAPMr SuTtUNo ratings yet

- Accounting Concepts and ConventionsDocument4 pagesAccounting Concepts and ConventionsPrincess RubyNo ratings yet

- 2.basic Accounting Concepts and ConventionsDocument10 pages2.basic Accounting Concepts and ConventionsLakshmanrao NayiniNo ratings yet

- Company Outsiders: Resources TodayDocument20 pagesCompany Outsiders: Resources TodaySarbani Mishra0% (1)

- Unit - Ii Introduction To Financial AccountingDocument37 pagesUnit - Ii Introduction To Financial AccountingdownloaderNo ratings yet

- Afm 2Document3 pagesAfm 2helpevery7No ratings yet

- Accounting Concepts F5Document7 pagesAccounting Concepts F5Tinevimbo NdlovuNo ratings yet

- Accountancy: Accounting Is The Language of The BusinessDocument41 pagesAccountancy: Accounting Is The Language of The BusinessAnand Mishra100% (1)

- Balance Sheet BasicsDocument24 pagesBalance Sheet Basicsnavya sreeNo ratings yet

- Financial and Management AccountingDocument9 pagesFinancial and Management AccountingyogipendliNo ratings yet

- Syllabus: Subject - Financial AccountingDocument74 pagesSyllabus: Subject - Financial AccountingAnitha RNo ratings yet

- Financial Accounting Notes B.com 1st SemDocument64 pagesFinancial Accounting Notes B.com 1st SemJeevesh Roy0% (1)

- The Original Attachment: BasicsDocument32 pagesThe Original Attachment: BasicsVijayGogulaNo ratings yet

- Accounting NotesDocument71 pagesAccounting Noteswaseem ahsanNo ratings yet

- Accounting ConceptsDocument4 pagesAccounting ConceptsAjmal KhanNo ratings yet

- BCOM 1 Financial Accounting 1Document63 pagesBCOM 1 Financial Accounting 1karthikeyan01No ratings yet

- MBA Financial AccountingDocument57 pagesMBA Financial AccountingNaresh Guduru100% (1)

- Accounting Concepts and Priciples: Fundamentals of Accountancy, Business and Management 1Document10 pagesAccounting Concepts and Priciples: Fundamentals of Accountancy, Business and Management 1Marilyn Nelmida TamayoNo ratings yet

- Accounting Concept Refers To The Basic Assumptions and Rules andDocument4 pagesAccounting Concept Refers To The Basic Assumptions and Rules andManisha SharmaNo ratings yet

- Chapter 3 Analyzing Transactions To Start A BusinessDocument3 pagesChapter 3 Analyzing Transactions To Start A BusinessPaw VerdilloNo ratings yet

- Basics of Accounting Theory: AppendixDocument6 pagesBasics of Accounting Theory: AppendixRushelle Vergara MosepNo ratings yet

- Principle of Accounting Notes CompleteDocument34 pagesPrinciple of Accounting Notes Completemuzammilamiri2No ratings yet

- Agri Rahulic: Accounting Concepts and Conventions of AccountingDocument3 pagesAgri Rahulic: Accounting Concepts and Conventions of AccountingAgricultural RahulicNo ratings yet

- Financial Accounting-Short Answers Revision NotesDocument26 pagesFinancial Accounting-Short Answers Revision Notesfathimathabasum100% (7)

- Accounting Concepts and ConventionsDocument17 pagesAccounting Concepts and ConventionsKathuria AmanNo ratings yet

- Accounting Concepts and ConventionsDocument13 pagesAccounting Concepts and Conventionssunsign100% (1)

- Assignment (Fundamentals of Book - Keeping & Accounting)Document25 pagesAssignment (Fundamentals of Book - Keeping & Accounting)api-370836989% (9)

- AccountingDocument5 pagesAccountingCma Pushparaj KulkarniNo ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- Mid Term Question Paper - Corporate Governanace and Ethics-Sem IV Batch 2020-2022 PDFDocument3 pagesMid Term Question Paper - Corporate Governanace and Ethics-Sem IV Batch 2020-2022 PDFshruthiNo ratings yet

- Conflict and Negotiation - Question Paper Set 1-Semester 4 - Batch 2020-22Document2 pagesConflict and Negotiation - Question Paper Set 1-Semester 4 - Batch 2020-22shruthiNo ratings yet

- Correlation and Data DistributionDocument21 pagesCorrelation and Data DistributionshruthiNo ratings yet

- Unit 1 BSDocument30 pagesUnit 1 BSshruthiNo ratings yet

- Entrep Module 1 Q1Document14 pagesEntrep Module 1 Q1MacyNo ratings yet

- StashFin IntroDocument12 pagesStashFin IntroMohit Garg100% (1)

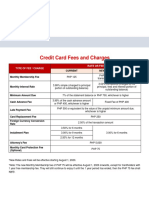

- Credit Card Fees and Charges: Type of Fee / Charge Rate or FeeDocument1 pageCredit Card Fees and Charges: Type of Fee / Charge Rate or FeeKram Yer EtentepmocNo ratings yet

- Bill Gates - Business at The Speed of ThoughtDocument64 pagesBill Gates - Business at The Speed of Thoughtадміністратор Wake Up SchoolNo ratings yet

- Amc Case StudyDocument2 pagesAmc Case StudyAishwarya SundararajNo ratings yet

- 2023 Budget Ordinance First ReadingDocument3 pages2023 Budget Ordinance First ReadinginforumdocsNo ratings yet

- Quarter 3 Summative Test 1Document4 pagesQuarter 3 Summative Test 1Maria CongNo ratings yet

- Balance of Payment: DR - Pinki ShahDocument12 pagesBalance of Payment: DR - Pinki ShahRain StarNo ratings yet

- Strategic Management Concepts Competitiveness and Globalization Hitt 11th Edition Solutions Manual Full DownloadDocument11 pagesStrategic Management Concepts Competitiveness and Globalization Hitt 11th Edition Solutions Manual Full Downloaddonnaparkermepfikcndx100% (36)

- Careem's Owner HandbookDocument103 pagesCareem's Owner HandbookgateebNo ratings yet

- JD 60 13Document13 pagesJD 60 13nlrbdocsNo ratings yet

- 6QQMN331 Sample Essay 2Document28 pages6QQMN331 Sample Essay 2dance.yards0vNo ratings yet

- SJB ProfileDocument4 pagesSJB ProfileSourajit PattanaikNo ratings yet

- PART 1 An Overview of Strategic Retail Management 21: Chapter 1 An Introduction To Retailing 22Document1 pagePART 1 An Overview of Strategic Retail Management 21: Chapter 1 An Introduction To Retailing 22AlesmanNo ratings yet

- Faq Transitional Issues Companies Act 2016 - Technical 2 2 2017 PDFDocument14 pagesFaq Transitional Issues Companies Act 2016 - Technical 2 2 2017 PDFazilaNo ratings yet

- Break-Even Level of Output BUSINESS STUDIES IGCSEDocument3 pagesBreak-Even Level of Output BUSINESS STUDIES IGCSEHriday KotechaNo ratings yet

- ACS 1000 Preventive MaintenanceDocument2 pagesACS 1000 Preventive Maintenanceazultenue780% (1)

- Define PERT and CPM in Project Management and Its Importance and PROS and Cons of Pert and CPM in Project ManagementDocument4 pagesDefine PERT and CPM in Project Management and Its Importance and PROS and Cons of Pert and CPM in Project Managementbaskar rajuNo ratings yet

- Intermediate Accounting 2 (Notes Payable) - Problem 2Document3 pagesIntermediate Accounting 2 (Notes Payable) - Problem 2DM MontefalcoNo ratings yet

- Deed of Sale of Motor VehicleDocument1 pageDeed of Sale of Motor VehicleJoemar CalunaNo ratings yet

- Marketing Strategies of Cornetto, WallsDocument13 pagesMarketing Strategies of Cornetto, Wallsmaham aziz100% (1)

- 2nd RMA For 30 RADIOsDocument4 pages2nd RMA For 30 RADIOsmohamedNo ratings yet

- Brand DecisionsDocument38 pagesBrand Decisionssonalidhanokar9784100% (2)

- Customer Information Sheet (CRL-FM-ADMN-049) - r1Document1 pageCustomer Information Sheet (CRL-FM-ADMN-049) - r1alvin salmingoNo ratings yet

- A Project Report On Group InsuranceDocument64 pagesA Project Report On Group Insurancesharinair1393% (15)

- Cadweld Multi: An Evolution in Exothermic WeldingDocument2 pagesCadweld Multi: An Evolution in Exothermic Weldingakshaf10No ratings yet

- Tata Technologies IPO PDF 201123Document1 pageTata Technologies IPO PDF 201123Hitesh PhulwaniNo ratings yet

- Example RA Working at Height Risk AssessmentDocument6 pagesExample RA Working at Height Risk AssessmentYossef K FawzyNo ratings yet

- Supplying The Fashion Product-Assessment 1-Range Plan ReportDocument31 pagesSupplying The Fashion Product-Assessment 1-Range Plan Reportapi-292074531No ratings yet

- 426 Exam 2 Questions AnswersDocument25 pages426 Exam 2 Questions AnswersIlya StadnikNo ratings yet