Professional Documents

Culture Documents

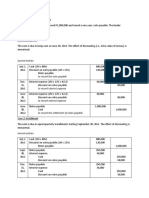

Intermediate Accounting 2 (Notes Payable) - Problem 2

Uploaded by

DM MontefalcoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Intermediate Accounting 2 (Notes Payable) - Problem 2

Uploaded by

DM MontefalcoCopyright:

Available Formats

PROBLEM 2: MULTIPLE CHOICE-THEORY

1. Which of the following statements is incorrect?

a. Notes payable are initially recognized at fair value minus transaction costs.

b. Discount on notes payable is treated as a contra-liability account rather than an asset account.

c. A short-term, non-trade note payable may nevertheless be discounted if it clearly contains a financing

component.

d. All interest-bearing notes need not be discounted.

2. The concept that best supports the discounting of notes to their present value is

a. time value of money.

b. matching.

c. accrual basis.

d. legal form over substance

3. Which of the following rates is used to compute for the interest expense on a note payable?

a. stated rate

b. nominal rate

c. effective interest rate

d. coupon rate

4. Railing Co. issued a 4-year, P600,000, noninterest bearing note that requires payment in lump sum at

maturity date. Railing determined that the effective interest rate on the note is 12%. Which of the

following statements is correct?

a. Railing Co. will most likely measure the note on initial recognition by multiplying the face amount of

the note by PV of 1 @12%, n=4.

b. Railing Co. will most likely measure the note on initial recognition by multiplying the face amount of

the note by PV of ordinary annuity of 1 @12%, n=4.

c. Railing Co. will most likely measure the note on initial recognition by multiplying the face amount of

the note by PV of an annuity due of 1 @12%, n=4.

d. Any of these as an accounting policy choice.

5. On October 1 of this year, a company issued a one-year note payable that bears a market rate of

interest. The face amount of the note and the entire amount of the interest are due on September 30 of

next year. At December 31 of this year, the entity should report on its statement of financial position

a. interest expense for the interest accruing this year.

b. interest payable equal to one-year's interest on the note.

c. no interest payable.

d. interest payable for the interest accruing this year.

6. Drops Co. issues a 3-year, P600,000, noninterest bearing note that requires three equal annual

payments at the end of each year. The effective interest rate on the note is 14%. How should Drops Co.

measure the note on initial recognition?

a. P600,000 x PV of ordinary annuity of 1 @14%, n=3

b. P600,000 x PV of 1 @14%, n=3

c. P200,000 x PV of ordinary annuity of 1 @14%, n=3

d. P200,000 x PV of an annuity due of 1 @14%, n=3

7. An entity issues a three-year, P1M noninterest-bearing note that matures in lump sum payment. The

effective interest rate is 12%. Which of the following is correct?

a. The measurement of the note on initial recognition is computed as P1M x PV of an ordinary annuity of

1 @12%, n-4.

b. No interest expense shall be recognized on the note because it is noninterest-bearing.

c. The amortized cost of the note increases each year.

d. The amortized cost of the note decreases each year.

8. An entity issues a three-year, P1M noninterest-bearing note that matures in three equal annual

payments due at the end of each year. The effective interest rate is 12%. Which of the following is

correct?

a. The measurement of the note on initial recognition is computed as P1M x PV of an ordinary annuity of

1 @12%, n=4.

b. No interest expense shall be recognized on the note because it is noninterest-bearing.

c. The amortized cost of the note increases each year.

d. The amortized cost of the note decreases each year.

9. A company issued two one-year notes in exchange for merchandise. One note has a face amount of

P6,000 and was interest-bearing at an annual rate of 18%. The other note has a face amount of P7,080

and was non-interest-bearing (its implied interest rate was 18%).

a. The total amount of cash ultimately to be paid will be more for the interest-bearing note.

b. Both notes will cause the same total interest to be recognized.

c. The amount of interest expense that should be recognized is higher for the interest-bearing note.

d. The amount that should be debited to the inventory account is higher for the noninterest-bearing

note

10. On March 1,20x1, Nickelodeon Co. issued a P6,000, 12% dated January 1,20x1 in exchange for an

outstanding note payable of P6,000. The principal and the 6 months interest of the note are due on July

1,20x1. On initial recognition, which of the following accounts increased?

a. Prepaid interest

b. Interest payable

c. Discount on note payable

d. Interest expense

You might also like

- 103 CompilationDocument12 pages103 CompilationLyn AbudaNo ratings yet

- 04b Receivables (Part 2)Document6 pages04b Receivables (Part 2)JEFFERSON CUTE100% (1)

- Time Value of Money and Valuation of Stocks and BondsDocument12 pagesTime Value of Money and Valuation of Stocks and BondsSteph TubuNo ratings yet

- Module 8 - ReviewerDocument8 pagesModule 8 - ReviewerFiona MiralpesNo ratings yet

- Final Term Examination. Intermediate AccountingDocument8 pagesFinal Term Examination. Intermediate AccountingOrtiz, Trisha Mae S.No ratings yet

- Notes and Loans Payable ExerciseDocument4 pagesNotes and Loans Payable ExerciseLovenia M. FerrerNo ratings yet

- Latsol Abc Ujian 2 InterDocument9 pagesLatsol Abc Ujian 2 InterABIMANTRANANo ratings yet

- Assignment 1Document7 pagesAssignment 1Camilo Andres MesaNo ratings yet

- Module 8 - TheoriesDocument3 pagesModule 8 - TheoriesFiona MiralpesNo ratings yet

- Actg 431 Quiz Week 4 Theory of Accounts (Part IV) Notes Payable QuizDocument4 pagesActg 431 Quiz Week 4 Theory of Accounts (Part IV) Notes Payable QuizMarilou Arcillas PanisalesNo ratings yet

- FARAP 4702 ReceivablesDocument8 pagesFARAP 4702 Receivablesliberace cabreraNo ratings yet

- ReiceivablesDocument27 pagesReiceivablesrivaceline100% (3)

- Acc QuizDocument3 pagesAcc QuizRey Joyce AbuelNo ratings yet

- QuestionsDocument4 pagesQuestionsAloha Bu-ucan0% (1)

- Notes ReceivablesDocument15 pagesNotes Receivableslana del reyNo ratings yet

- Farap 4502Document9 pagesFarap 4502Marya NvlzNo ratings yet

- FAR 6.2MC - Noncurrent Liabilities (Part 1) Notes and Loans PayableDocument4 pagesFAR 6.2MC - Noncurrent Liabilities (Part 1) Notes and Loans Payablekateangel ellesoNo ratings yet

- NOTES PAYABLE - TheoriesDocument2 pagesNOTES PAYABLE - TheoriesWassupNo ratings yet

- CHAPTER 5 Notes Receivable PROBLEMSDocument14 pagesCHAPTER 5 Notes Receivable PROBLEMSJamaica Ata80% (5)

- Accounting Part 1: TheoriesDocument6 pagesAccounting Part 1: Theoriesnd555No ratings yet

- Cae15 Chap16 TheoriesDocument21 pagesCae15 Chap16 TheoriesJomarNo ratings yet

- Chapter 3 Problems - Ia Part 2Document16 pagesChapter 3 Problems - Ia Part 2KathleenCusipagNo ratings yet

- 6Document2 pages6Carlo ParasNo ratings yet

- Pre Quali 2019Document9 pagesPre Quali 2019Haidie DiazNo ratings yet

- Ia Long Exam AprDocument16 pagesIa Long Exam AprChristy HabelNo ratings yet

- CHP 13 Testbank 2Document15 pagesCHP 13 Testbank 2judyNo ratings yet

- CHP 13 Testbank 2Document15 pagesCHP 13 Testbank 2judyNo ratings yet

- 2 - Receivables Theory of AccountsDocument6 pages2 - Receivables Theory of AccountsandreamrieNo ratings yet

- ch14 PDFDocument38 pagesch14 PDFerylpaez92% (12)

- Current Liab PDFDocument16 pagesCurrent Liab PDFYou're WelcomeNo ratings yet

- Current Liabilities (MARK)Document9 pagesCurrent Liabilities (MARK)Michael Olmedo NeneNo ratings yet

- Chapter 7 Self TestDocument7 pagesChapter 7 Self TestMichelleNo ratings yet

- Bonds Exercises With AnswersDocument10 pagesBonds Exercises With AnswersDenise Jane RoqueNo ratings yet

- QUIZ7 Audit of LiabilitiesDocument3 pagesQUIZ7 Audit of LiabilitiesCarmela GulapaNo ratings yet

- Answer Key - M1L2 PDFDocument4 pagesAnswer Key - M1L2 PDFEricka Mher IsletaNo ratings yet

- Reviewer - ReceivablesDocument5 pagesReviewer - ReceivablesMaria Kathreena Andrea AdevaNo ratings yet

- Chap 8 Effective Interest Method Fin Acct 2 - Barter Summary Team PDFDocument7 pagesChap 8 Effective Interest Method Fin Acct 2 - Barter Summary Team PDFKhimjoy Lim0% (1)

- Extra Exercises For PPMT - IPMTDocument1 pageExtra Exercises For PPMT - IPMTqpqpqpqpqpNo ratings yet

- SampleQuestions Finance 1Document9 pagesSampleQuestions Finance 1YiğitÖmerAltıntaşNo ratings yet

- ARest of Theories ParDocument92 pagesARest of Theories ParJireh Mae RiveraNo ratings yet

- Intermediate Accounting 1 Final ExaminationDocument9 pagesIntermediate Accounting 1 Final ExaminationPearlyn Villarin100% (1)

- TOApayables AnswersDocument14 pagesTOApayables AnswersEunice FulgencioNo ratings yet

- FIN QUIZ Answer KeyDocument6 pagesFIN QUIZ Answer KeyGrazielle DiazNo ratings yet

- AC 506 Midterm ExamDocument10 pagesAC 506 Midterm ExamJaniña NatividadNo ratings yet

- ExcerciseDocument1 pageExcerciseJacinto Doctolero Barruga IIINo ratings yet

- EXAM Intermediate Accounting 2Document8 pagesEXAM Intermediate Accounting 2Grace100% (1)

- 2Document14 pages2MARIANo ratings yet

- Notes and Loans ReceivableDocument10 pagesNotes and Loans ReceivableKent TumulakNo ratings yet

- Sample ProblemsDocument6 pagesSample ProblemsLyndon AsisNo ratings yet

- Far15 Long Term Liability 1Document9 pagesFar15 Long Term Liability 1Joana TatacNo ratings yet

- Aaccounting Chap 9Document12 pagesAaccounting Chap 9abed abedNo ratings yet

- Acelec 331 Summative1 Set ADocument5 pagesAcelec 331 Summative1 Set ALost AlienNo ratings yet

- Essay About HonestyDocument13 pagesEssay About HonestyRENZ ALFRED ASTRERONo ratings yet

- Accounts Receivable QuizzerDocument4 pagesAccounts Receivable Quizzerknorrpampapakang67% (3)

- Module 13 Present ValueDocument10 pagesModule 13 Present ValueChristine Elaine LamanNo ratings yet

- Ch.14 Current Liabilities: Exercise 14.01 True or FalseDocument5 pagesCh.14 Current Liabilities: Exercise 14.01 True or FalseFaishal Alghi FariNo ratings yet

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Analysis of Walmart's Globalization StrategyDocument2 pagesAnalysis of Walmart's Globalization StrategyDM MontefalcoNo ratings yet

- Bonds ReviewerDocument7 pagesBonds ReviewerDM MontefalcoNo ratings yet

- IcbcDocument1 pageIcbcDM MontefalcoNo ratings yet

- Assumption and LimitationDocument4 pagesAssumption and LimitationDM MontefalcoNo ratings yet

- Module 1 Ra DancesDocument30 pagesModule 1 Ra DancesDM MontefalcoNo ratings yet

- Climate Change ScriptDocument3 pagesClimate Change ScriptDM MontefalcoNo ratings yet

- ch3 Not EditedDocument14 pagesch3 Not EditedDM MontefalcoNo ratings yet

- Law On SalesDocument30 pagesLaw On SalesDM MontefalcoNo ratings yet

- Module 4 (Rhythmic)Document18 pagesModule 4 (Rhythmic)DM MontefalcoNo ratings yet

- Law NotesDocument5 pagesLaw NotesDM MontefalcoNo ratings yet

- Module 3 (Rhythmic)Document16 pagesModule 3 (Rhythmic)DM MontefalcoNo ratings yet

- Intermediate Accounting 2 (Notes Payable) - Problem 6Document2 pagesIntermediate Accounting 2 (Notes Payable) - Problem 6DM MontefalcoNo ratings yet

- RIZALDocument2 pagesRIZALDM MontefalcoNo ratings yet

- Problems - BPDocument11 pagesProblems - BPDM MontefalcoNo ratings yet

- Intermediate Accounting 2 (Notes Payable) - Problem 3Document2 pagesIntermediate Accounting 2 (Notes Payable) - Problem 3DM MontefalcoNo ratings yet

- BonusesDocument1 pageBonusesDM MontefalcoNo ratings yet

- Illustration 1 (Notes Payable)Document4 pagesIllustration 1 (Notes Payable)DM MontefalcoNo ratings yet

- Bonds Payable Problem 5 & 6Document3 pagesBonds Payable Problem 5 & 6DM MontefalcoNo ratings yet

- Bonds Payable Problem 1Document1 pageBonds Payable Problem 1DM MontefalcoNo ratings yet

- Bonds Payable Problem 2Document3 pagesBonds Payable Problem 2DM MontefalcoNo ratings yet

- Intermediate Accounting 2 (Notes Payable) - Problem 1Document1 pageIntermediate Accounting 2 (Notes Payable) - Problem 1DM MontefalcoNo ratings yet

- Psy 1-Understanding The Self Week # 4Document4 pagesPsy 1-Understanding The Self Week # 4DM MontefalcoNo ratings yet

- Intermediate Accounting 2 (Notes Payable) - Problem 4Document3 pagesIntermediate Accounting 2 (Notes Payable) - Problem 4DM MontefalcoNo ratings yet

- Chapter 3 InterestDocument76 pagesChapter 3 InterestShudipto PodderNo ratings yet

- Testbank KTLTCDocument54 pagesTestbank KTLTCPHƯƠNG ĐẶNG DƯƠNG XUÂNNo ratings yet

- Interest Rate Derivatives - A Complete Beginner's GuideDocument10 pagesInterest Rate Derivatives - A Complete Beginner's GuideACC200 MNo ratings yet

- Cpi - Practice ExercisesDocument4 pagesCpi - Practice ExercisesGia Hân100% (1)

- ACCA P4 Advanced Financial Management Mock Exam QuestionsDocument16 pagesACCA P4 Advanced Financial Management Mock Exam QuestionsSyedAliRazaKazmi100% (2)

- TemplateDocument117 pagesTemplateAshith Radishan RanasingheNo ratings yet

- You Are Given The Following Equation For The Real DemandDocument1 pageYou Are Given The Following Equation For The Real Demandtrilocksp SinghNo ratings yet

- Answer Key FPBDocument74 pagesAnswer Key FPBJoy Gutierrez100% (2)

- Solved Sandy Consumes Only Hamburgers H and Milkshakes M at BasketDocument1 pageSolved Sandy Consumes Only Hamburgers H and Milkshakes M at BasketM Bilal SaleemNo ratings yet

- ECO764A - Financial EconometricsDocument14 pagesECO764A - Financial Econometricsarya agarwalNo ratings yet

- International Arbitrage and Interest Rate ParityDocument16 pagesInternational Arbitrage and Interest Rate ParityFeriel El IlmiNo ratings yet

- Ch04 Tool KitDocument80 pagesCh04 Tool KitAdamNo ratings yet

- Type Yourids Please in ChatDocument6 pagesType Yourids Please in ChatSaqib AliNo ratings yet

- Nominal and Effective Interest RateDocument4 pagesNominal and Effective Interest RateLarry NocesNo ratings yet

- Intermediate Accounting Chapter 9-14Document10 pagesIntermediate Accounting Chapter 9-14thea tangalinNo ratings yet

- Test Bank Chapter 15 Investment BodieDocument42 pagesTest Bank Chapter 15 Investment BodieTami DoanNo ratings yet

- SQB 1017020Document290 pagesSQB 1017020Екатерина ПетроваNo ratings yet

- Basic Fixed Income MathematicsDocument44 pagesBasic Fixed Income MathematicsSCCEGNo ratings yet

- Investments Kapitel 5Document40 pagesInvestments Kapitel 57srq2nrhytNo ratings yet

- C4 Final Assignment v2Document43 pagesC4 Final Assignment v2Lan Chau100% (1)

- Sanchez, Gian Emmanuelle R. CE21S2 Compound Interest More Than One Period Per Year Group 2Document4 pagesSanchez, Gian Emmanuelle R. CE21S2 Compound Interest More Than One Period Per Year Group 2Gian SanchezNo ratings yet

- Financial Markets and Institutions Test Bank (021 030)Document10 pagesFinancial Markets and Institutions Test Bank (021 030)Thị Ba PhạmNo ratings yet

- Ch5 - Time Value of MoneyDocument52 pagesCh5 - Time Value of MoneyAneeqah EssaNo ratings yet

- Hedge Documentation - SampleDocument8 pagesHedge Documentation - SampleSanjeev KumarNo ratings yet

- CA Final Audit Important Questions Compiler PDFDocument309 pagesCA Final Audit Important Questions Compiler PDFNick VincikNo ratings yet

- Document Name Bond Math Version Number V1 Approved by Marisha Purohit Approval Date 03/05/2020 Creator Audience Students/Faculty/ManagementDocument20 pagesDocument Name Bond Math Version Number V1 Approved by Marisha Purohit Approval Date 03/05/2020 Creator Audience Students/Faculty/ManagementRavindra A. KamathNo ratings yet

- Week 1 - Lecture Note - With SolutionDocument33 pagesWeek 1 - Lecture Note - With SolutionChip choiNo ratings yet

- Lesson 11 - Introduction To Compound Interest - 2019-2020Document8 pagesLesson 11 - Introduction To Compound Interest - 2019-2020kelvinNo ratings yet

- Application of Concepts 5. Swaps: Fixed Rate Floating Rate Company X 8.0% Libor Company Y 8.8% LiborDocument8 pagesApplication of Concepts 5. Swaps: Fixed Rate Floating Rate Company X 8.0% Libor Company Y 8.8% LiborAgastya SoodNo ratings yet

- The Parity Conditions: World Economy - Interest Rate Parity 1Document9 pagesThe Parity Conditions: World Economy - Interest Rate Parity 1barlieNo ratings yet