Professional Documents

Culture Documents

Intermediate Accounting 2 (Notes Payable) - Problem 3

Uploaded by

DM MontefalcoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Intermediate Accounting 2 (Notes Payable) - Problem 3

Uploaded by

DM MontefalcoCopyright:

Available Formats

PROBLEM 3: EXERCISES

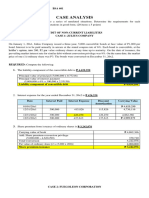

1.On January 1,20x1, Bark, Inc. issues a noninterest-bearing note of P2,000,000 in exchange for

equipment. The note is due on December 31,20x3. The effective interest rate is 16%.

Requirement: Provide all the entries during the term of the note.

2. On January 1,20x1, J&J Co. issues a noninterest-bearing note of P3,000,000 in exchange for

equipment. The note is due in three equal annual installments every December 31. The effective interest

rate is 18%.

Requirements:

a. Compute for current and noncurrent portions of the note payable on December 31,20x1.

b. Compute for the balance of discount on note payable on December 31,20x1 and determine how

this amount is allocated to the current and noncurrent portions of the note.

c. Provide all the entries during the term of the note payable.

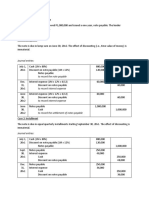

3. On January 1,20x1, Drive Co. paid cash of P200,000 and issued a noninterest-bearing note P2,000,000

in exchange for a vehicle. The note is due in four equal annual installments. The first installment is due

on January 1,20x1 and the succeeding installments are due every 1st of January. The prevailing rate of

interest for this type of note is 12%.

Requirements:

a. Prepare the journal entries.

b. How much is the interest expense in 20x2?

c. How much is the carrying amount of the note on Dec.31,20x1?

4. Help the inexperienced accountant of Ala-alipaw Co. reconstruct the information required in the

numbered blanks:

Face amount (1)

Discount on notes payable on initial recognition (2)

Effective interest rate (3)

Term of the note (in years) (4)

Date Payments Interest Expense Amortization Present Value

1/1/x1 1,119,272

12/31/x1 400,000 179,084 (5) 898,356

12/31/x2 400,000 (6) 256,263 (7)

12/31/x3 400,000 102,735 (8) 344,828

(9) 400,000 (10) 344,828 0

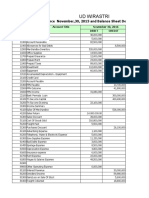

5. The current and noncurrent portions of Baa-baa Co.'s note payable at the end of the 1" year are

P213,534 and P507,016, respectively. The note is payable in four equal annual payments of P300,000

every December 31. Baa-baa Co. reported interest expense of P86,466 in the 2nd year. The note was

initially recognized at P911,205 on Jan. 1 of Year 1.

Requirement: Prepare a complete amortization table for the note.

You might also like

- Intermediate Accounting 2Document27 pagesIntermediate Accounting 2cpacpacpaNo ratings yet

- Intermediate Accounting 2 Second Grading Examination: Name: Date: Professor: Section: ScoreDocument25 pagesIntermediate Accounting 2 Second Grading Examination: Name: Date: Professor: Section: ScoreNah Hamza100% (1)

- Acctg 201 Midterm Quiz 3Document10 pagesAcctg 201 Midterm Quiz 3Minie KimNo ratings yet

- SBR Practice Questions 2019 - QDocument86 pagesSBR Practice Questions 2019 - QALEX TRANNo ratings yet

- Easy 1. Which Is The Correct Accounting For A Finance Lease in The AccountsDocument4 pagesEasy 1. Which Is The Correct Accounting For A Finance Lease in The AccountsQueen ValleNo ratings yet

- Lecturing C Meeting 01 - Paper F3 PDFDocument34 pagesLecturing C Meeting 01 - Paper F3 PDFchrislinNo ratings yet

- Notes Receivable: Long QuizDocument8 pagesNotes Receivable: Long Quizfinn mertensNo ratings yet

- CHAPTER 5 Notes Receivable PROBLEMSDocument14 pagesCHAPTER 5 Notes Receivable PROBLEMSJamaica Ata80% (5)

- Test Bank 1 - Ia 2Document18 pagesTest Bank 1 - Ia 2Xiena100% (2)

- Intermediate Accounting 2 First Grading ExaminationDocument12 pagesIntermediate Accounting 2 First Grading ExaminationJamie Rose AragonesNo ratings yet

- Intermediate Accounting 2Document18 pagesIntermediate Accounting 2cpacpacpaNo ratings yet

- Intermediate Accounting 2 First Grading ExaminationDocument18 pagesIntermediate Accounting 2 First Grading ExaminationJEFFERSON CUTE60% (15)

- REVIEWERDocument13 pagesREVIEWERCamille BagueNo ratings yet

- Quiz Chapter 5 Notes Receivable PDFDocument8 pagesQuiz Chapter 5 Notes Receivable PDFShantal kate LimNo ratings yet

- Chapter 6-Receivables 2Document4 pagesChapter 6-Receivables 2Emma Mariz Garcia100% (7)

- Quiz - Chapter 3 - Bonds Payable & Other Concepts - 2021Document2 pagesQuiz - Chapter 3 - Bonds Payable & Other Concepts - 2021Martin ManuelNo ratings yet

- 4 - Notes ReceivableDocument10 pages4 - Notes Receivablejoneth.duenasNo ratings yet

- Check - Chapter 10 - She Part 1Document4 pagesCheck - Chapter 10 - She Part 1ARNEL CALUBAGNo ratings yet

- 1ST Grading ExamDocument12 pages1ST Grading ExamJEFFERSON CUTENo ratings yet

- Dr. M.D. Chase Long Beach State University Advanced Accounting 525-46B Intercompany Leases-Illustrative Examples Page 1Document8 pagesDr. M.D. Chase Long Beach State University Advanced Accounting 525-46B Intercompany Leases-Illustrative Examples Page 1Zenni T XinNo ratings yet

- Notes Payable and Bonds Payable - Quiz - With Answers - For PostingDocument8 pagesNotes Payable and Bonds Payable - Quiz - With Answers - For PostingWinny PoeNo ratings yet

- Bab 14Document4 pagesBab 14tutykaykay67% (3)

- Accounting For Notes ReceivablesDocument4 pagesAccounting For Notes ReceivablesYeon TanNo ratings yet

- ReceivablesDocument4 pagesReceivablesKentaro Panergo NumasawaNo ratings yet

- Shareholders' Equity (Part 1) : Share Premium Retained EarningsDocument3 pagesShareholders' Equity (Part 1) : Share Premium Retained EarningsJamie Rose Aragones0% (3)

- Final Exam IntermediateDocument24 pagesFinal Exam IntermediateIrene Grace Edralin AdenaNo ratings yet

- Auditing Problem Final Exam With Answer Only, No SolutionDocument23 pagesAuditing Problem Final Exam With Answer Only, No SolutionRheu Reyes100% (1)

- Quiz - Chapter 32 - She Part 1 PrintingDocument3 pagesQuiz - Chapter 32 - She Part 1 PrintingAllen Kate50% (2)

- Lect 11c Depreciation-Disposals (Part 3)Document17 pagesLect 11c Depreciation-Disposals (Part 3)11Co sarahNo ratings yet

- ACC204 Prelim Exam No AnsDocument6 pagesACC204 Prelim Exam No AnsKathleen Marcial0% (2)

- Actg 4 Bonds Payable4Document2 pagesActg 4 Bonds Payable4RAMOS, Jann Julianne D.No ratings yet

- Chapter 13 HW SolutionsDocument23 pagesChapter 13 HW SolutionsSijo VMNo ratings yet

- 04 Quiz 1Document3 pages04 Quiz 1prettyboiy19No ratings yet

- Midterm Exam MWF Released To StudentsDocument3 pagesMidterm Exam MWF Released To StudentsAliah AutenticoNo ratings yet

- Accounting 1Document10 pagesAccounting 1Jay EbuenNo ratings yet

- FAR-05 Notes PayableDocument3 pagesFAR-05 Notes PayableMaxene Joi PigtainNo ratings yet

- ComprExam DDocument11 pagesComprExam DPrashant MakwanaNo ratings yet

- Reviewer For Mid Term ExamDocument12 pagesReviewer For Mid Term ExamJannelle SalacNo ratings yet

- Intermediate Acctg2 - Prelims StudentDocument7 pagesIntermediate Acctg2 - Prelims StudentLalaland AcadsNo ratings yet

- FAR Practical Exercises Notes Receivable and Loans ReceivableDocument2 pagesFAR Practical Exercises Notes Receivable and Loans ReceivableAB CloydNo ratings yet

- Accounting PoliciesDocument8 pagesAccounting PoliciesJandyeeNo ratings yet

- Abbie Merry VecinaBSA 6011Document7 pagesAbbie Merry VecinaBSA 6011elleeeewoodssssNo ratings yet

- CACC 520-781 Accounting For ManagementDocument7 pagesCACC 520-781 Accounting For ManagementEmadNo ratings yet

- Northern CPA Review Co. (NCPAR)Document12 pagesNorthern CPA Review Co. (NCPAR)Dieter LudwigNo ratings yet

- Department of Commerce, Bahauddin Zakariya University, Multan Instructions For The ExamDocument1 pageDepartment of Commerce, Bahauddin Zakariya University, Multan Instructions For The ExamTHIND TAXLAWNo ratings yet

- Reviewer For IA2Document13 pagesReviewer For IA2Cessy SecyNo ratings yet

- Financial Accounting P3Document4 pagesFinancial Accounting P3amiNo ratings yet

- Chapter 13 - Sh. Based PaymentsDocument4 pagesChapter 13 - Sh. Based PaymentsXiena75% (4)

- Adjustments For Preparation of Financial Statements (ACCA)Document9 pagesAdjustments For Preparation of Financial Statements (ACCA)team aspirantsNo ratings yet

- Quiz - Chapter 12 - Sh. Based Payments Part 1 - 2021Document4 pagesQuiz - Chapter 12 - Sh. Based Payments Part 1 - 2021Krezza Amor MabanNo ratings yet

- QuizDocument5 pagesQuizDanna VargasNo ratings yet

- 06 Task Performance 1Document4 pages06 Task Performance 1Bryan BristolNo ratings yet

- Accounts Payable and Notes PayableDocument3 pagesAccounts Payable and Notes PayablenjsrzaNo ratings yet

- Module - IA Chapter 6Document10 pagesModule - IA Chapter 6Kathleen EbuenNo ratings yet

- Using Economic Indicators to Improve Investment AnalysisFrom EverandUsing Economic Indicators to Improve Investment AnalysisRating: 3.5 out of 5 stars3.5/5 (1)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsFrom EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsNo ratings yet

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Private Debt: Yield, Safety and the Emergence of Alternative LendingFrom EverandPrivate Debt: Yield, Safety and the Emergence of Alternative LendingNo ratings yet

- Bonds ReviewerDocument7 pagesBonds ReviewerDM MontefalcoNo ratings yet

- IcbcDocument1 pageIcbcDM MontefalcoNo ratings yet

- Climate Change ScriptDocument3 pagesClimate Change ScriptDM MontefalcoNo ratings yet

- Assumption and LimitationDocument4 pagesAssumption and LimitationDM MontefalcoNo ratings yet

- Analysis of Walmart's Globalization StrategyDocument2 pagesAnalysis of Walmart's Globalization StrategyDM MontefalcoNo ratings yet

- Module 1 Ra DancesDocument30 pagesModule 1 Ra DancesDM MontefalcoNo ratings yet

- Module 4 (Rhythmic)Document18 pagesModule 4 (Rhythmic)DM MontefalcoNo ratings yet

- Problems - BPDocument11 pagesProblems - BPDM MontefalcoNo ratings yet

- Law NotesDocument5 pagesLaw NotesDM MontefalcoNo ratings yet

- Law On SalesDocument30 pagesLaw On SalesDM MontefalcoNo ratings yet

- Intermediate Accounting 2 (Notes Payable) - Problem 6Document2 pagesIntermediate Accounting 2 (Notes Payable) - Problem 6DM MontefalcoNo ratings yet

- Module 3 (Rhythmic)Document16 pagesModule 3 (Rhythmic)DM MontefalcoNo ratings yet

- ch3 Not EditedDocument14 pagesch3 Not EditedDM MontefalcoNo ratings yet

- Illustration 1 (Notes Payable)Document4 pagesIllustration 1 (Notes Payable)DM MontefalcoNo ratings yet

- RIZALDocument2 pagesRIZALDM MontefalcoNo ratings yet

- Psy 1-Understanding The Self Week # 4Document4 pagesPsy 1-Understanding The Self Week # 4DM MontefalcoNo ratings yet

- Intermediate Accounting 2 (Notes Payable) - Problem 2Document3 pagesIntermediate Accounting 2 (Notes Payable) - Problem 2DM MontefalcoNo ratings yet

- Reimers Finacct03 Sm04Document46 pagesReimers Finacct03 Sm04Maxime HinnekensNo ratings yet

- Principles of Macroeconomics 5E 5E Edition Ben Bernanke Et Al All ChapterDocument67 pagesPrinciples of Macroeconomics 5E 5E Edition Ben Bernanke Et Al All Chapterroscoe.carbonaro447100% (6)

- Fundamentals of Partnership: Dhiman ClaimsDocument7 pagesFundamentals of Partnership: Dhiman ClaimsAyareena GiriNo ratings yet

- Ec 1745 Fall 2008 Problem Set 1Document2 pagesEc 1745 Fall 2008 Problem Set 1tarun singhNo ratings yet

- 5010 Ohada Fin Reporting p2Document12 pages5010 Ohada Fin Reporting p2serge folegweNo ratings yet

- Balance-Sheet - PWC& Deloitte-Summary & AnalysisDocument7 pagesBalance-Sheet - PWC& Deloitte-Summary & AnalysisAjit AgarwalNo ratings yet

- Wachovia Securities DatabookDocument44 pagesWachovia Securities DatabookanshulsahibNo ratings yet

- CH 1Document17 pagesCH 1Jin CaiNo ratings yet

- Modul Pratama - JawabanDocument127 pagesModul Pratama - JawabanDity Rakhma QintariNo ratings yet

- Account Summary: Past Due Current Charges Total Amount DueDocument2 pagesAccount Summary: Past Due Current Charges Total Amount DueGuillermina HerreraNo ratings yet

- Public Finance & Taxation - Chapter 4, PT IVDocument24 pagesPublic Finance & Taxation - Chapter 4, PT IVbekelesolomon828No ratings yet

- Cash App - Statement 2020Document4 pagesCash App - Statement 2020ss ds67% (3)

- Guide To Crypto Markets - Q1 2024Document44 pagesGuide To Crypto Markets - Q1 2024Ad UtilNo ratings yet

- 1519 Loza, JesusDocument17 pages1519 Loza, JesusIsabella Kings100% (1)

- List of General & Commercial Banks in The Philippines: Philippine Banking SystemDocument3 pagesList of General & Commercial Banks in The Philippines: Philippine Banking SystemNoeme LansangNo ratings yet

- REPUBLIC ACT NO. 10883, July 17, 2016 An Act Providing For A New Anti-Carnapping Law of The PhilippinesDocument16 pagesREPUBLIC ACT NO. 10883, July 17, 2016 An Act Providing For A New Anti-Carnapping Law of The PhilippinesGabe BedanaNo ratings yet

- Sample Computation: 10% Bank FinDocument1 pageSample Computation: 10% Bank FinjonNo ratings yet

- FIN 542 International Financial Management: Mechanics of Foreign Exchange Exchange Rate Parity Text p98Document17 pagesFIN 542 International Financial Management: Mechanics of Foreign Exchange Exchange Rate Parity Text p98Anonymous rcCVWoM8bNo ratings yet

- Humidifier InvoiceDocument2 pagesHumidifier InvoicebhagatnairitaNo ratings yet

- FORM VI (See Rule 14 (2) )Document2 pagesFORM VI (See Rule 14 (2) )Venkataramana NippaniNo ratings yet

- Receivables Management: "Any Fool Can Lend Money, But It TakesDocument37 pagesReceivables Management: "Any Fool Can Lend Money, But It Takesjai262418No ratings yet

- Module 3Document79 pagesModule 3kakimog738No ratings yet

- Kotak Lifetime Income V13Document11 pagesKotak Lifetime Income V13skverma3108No ratings yet

- Assignment 1 BBFH308Document8 pagesAssignment 1 BBFH308Simba MashiriNo ratings yet

- Hybrid and Derivative SecuritiesDocument23 pagesHybrid and Derivative SecuritiesMd Rasel Uddin ACMANo ratings yet

- 5 Structured Products Forum 2007 Hong KongDocument11 pages5 Structured Products Forum 2007 Hong KongroversamNo ratings yet

- PRESENTATION On Merchant BankingDocument12 pagesPRESENTATION On Merchant Bankingsarthak1826No ratings yet

- Intermediate Accounting 17th Edition Kieso Test BankDocument56 pagesIntermediate Accounting 17th Edition Kieso Test Bankesperanzatrinhybziv100% (28)

- Bank Marketing 1Document69 pagesBank Marketing 1nirosha_398272247No ratings yet

- DFGTBTDocument316 pagesDFGTBTLexuz GatonNo ratings yet