Professional Documents

Culture Documents

Activity About Corporation

Uploaded by

Shaira Mae ObligaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Activity About Corporation

Uploaded by

Shaira Mae ObligaCopyright:

Available Formats

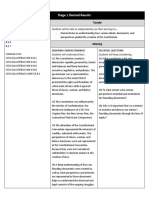

FUNDAMENTALS OF ACCOUNTANCY BUSINESS AND MANAGEMENT

Shaira Mae Obliga

BSA – 4th YEAR

1. Define corporation. What are the essential attributes of corporations?

A corporation is an entity recognized by law as possessing an existence separate and distinct from its

owners; that is, it is a separate legal entity. The essential attributes of corporation are: a. A corporation

is an artificial being with a personality separate and apart from its individual shareholders or members.

b. It is created by operation of law. c. It enjoys the right of succession. d. It has the powers, attributes

and properties expressly authorized by law or incident to its existence.

2. Identify five advantages of a corporation. Identify four disadvantages of a corporation.

Advantages:

The corporation has the legal capacity to act as a legal entity.

2. Shareholders have limited liability.

3. It has continuity of existence.

4. Shares of stock can be transferred without the consent of the other shareholders.

5. Its management is centralized in the board of directors.

Disadvantages:

A corporation is relatively complicated in formation and management.

2. There is a greater degree of government control and supervision.

3. It requires a relatively high cost of formation and operation.

4. It is subject to heavier taxation than other forms of business organizations.

5. Minority shareholders are subservient to the wishes of the majority.

3. Differentiate a stock from non stock corporation.

Stock corporation are corporations which have share capital divided into shares and are authorized to

distribute to the holders of such shares dividends or allotments of the surplus profits on the basis of the

shares held. While non stock corporation is one where no part of its income is distributable as dividends

to its members, trustees, or officers.

4. Identify the components of a corporation and briefly described each.

FUNDAMENTALS OF ACCOUNTANCY BUSINESS AND MANAGEMENT

• Corporators - corporators are entitled to enjoy all the benefits and rights which belong to any other

member of the corporation as such.

• Incorporators - are those stockholders or members mentioned in the Articles of Incorporation as

originally forming and composing the corporation, and who are signatories thereof.

• Shareholders - person, company, or institution that owns at least one share of a company's stock,

known as equity. Because shareholders essentially own the company, they reap the benefits of a

business's success.

• Member - member is a person who subscribed the memorandum of the company.

• Subscriber - is the name for someone who was a shareholder at the time of the company's

incorporation.

• Promoter - the one who decides an idea for setting up a particular business at a given place and carries

out a range of formalities required for the setting up of a business. A promoter may perhaps be an

individual, a firm, and an association of persons or a company.

• Underwriters - underwriters administer the public issuance and distribution of securities—in the form

of common or preferred stock—from a corporation or other issuing body in the equity markets. Perhaps

the most prominent role of an equity underwriter is in the IPO process.

• Independent director - acts as a guide, coach, and mentor to the Company. The role includes

improving corporate credibility and governance standards by working as a watchdog and help in

managing risk.

5. Identify the kinds of corporation as to nationality and purpose.

Stock Corporation – a corporation with capital stock divided into shares and authorized to distribute to

the holders of such shares, dividends or allotments the profits of the business based on equity of shares

Domestic Corporation (organized under Philippine laws)

100% Filipino-owned

60% Filipino-owned and 40% Foreign-owned

40.01% to 100% Foreign-owned (subject to certain provisions under Foreign Investments Act)

Foreign Corporation (organized under the laws of the corporation’s country of origin)

Branch Office

Representative Office

Regional Area Headquarters (RHQ)

Regional Operating Headquarters (ROHQ)

FUNDAMENTALS OF ACCOUNTANCY BUSINESS AND MANAGEMENT

Non-Stock Corporation – a corporation that neither generates profit nor issues shares of stock to its

members, and could have any of the following purposes:

Charitable;

Religious;

Educational;

Cultural;

Civic service; and

Other similar purposes, such as chambers or combinations trade, industry or agriculture

6. Differentiate a public from a private corporation.

There is a difference between public and private corporations. A private corporation is defined as a

smaller corporation where there is a limited number of shareholders that stock gets issued to, and the

stock isn't offered to the public. On the other hand, a public corporation has been authorized to sell

their stock to the public.

In a private corporation, the stocks are only held internally and won't be publicly traded. The founders,

group of investors, or management are usually the owners. The shareholders are often very involved in

the business and act as the directors and officers of the company. While in a public corporation, the

shares are traded through a stock exchange on the open market. The companies that have a large

amount of revenue and a bigger number of shareholders are often able to afford what it costs to go

public and be in compliance with the multiple regulations that are imposed on companies that are public

by securities laws and other types of governmental regulations.

7. What are the steps involved in the creation of a corporation?

1. Promotion

2. Incorporation

3. Formal organization and commencement of business operations.

8. What is an article of incorporation?

Articles of incorporation is a set of formal documents filed with a government body to legally document

the creation of a corporation. Section 14 provides that all corporations organized under this Code shall

file with the Securities and Exchange Commission articles of incorporation in any of the official languages

FUNDAMENTALS OF ACCOUNTANCY BUSINESS AND MANAGEMENT

duly signed and acknowledged by all of the incorporators, containing substantially the following matters

except as otherwise prescribed by this Code or special law.

9. What are some rights of a shareholder?

Common shareholders possess the right to share in the company's profitability and gains from its stock

price appreciation. Shareholders may also share in a company's profits by receiving cash or stock

payments from the company—called dividends. The most important rights that all common

shareholders possess include:

The right to share in the company's profitability, income, and assets

A degree of control and influence over company management selection

Preemptive rights to newly issued shares.

General meeting voting rights

10. Distinguish par value stock from no par value stock.

A par value for a stock is its per-share value assigned by the company that issues it and is often set at a

very low amount such as one cent. A no-par stock is issued without any designated minimum value.

Neither form has any relevance for the stock's actual value in the markets.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Commercial LAW: by Johnny LibertyDocument58 pagesCommercial LAW: by Johnny Libertycjjustice1100% (2)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Ugrd-Ncm6308 Bioethics Prelim To Final QuizDocument39 pagesUgrd-Ncm6308 Bioethics Prelim To Final QuizMarckyJmzer033 OgabangNo ratings yet

- Financial Distress (2008)Document24 pagesFinancial Distress (2008)Ira Putri100% (1)

- Billy's Farewell: Look! Through The Port Comes The Moonshine Astray! Billy BuddDocument9 pagesBilly's Farewell: Look! Through The Port Comes The Moonshine Astray! Billy BuddJoseph JaeKwon KimNo ratings yet

- TM-3534 AVEVA 12-1 - Diagrams AdministrationDocument108 pagesTM-3534 AVEVA 12-1 - Diagrams AdministrationWelingtonMoraesNo ratings yet

- Ricardo Pangan Final Exam Fabm - ShairamaeobligaDocument39 pagesRicardo Pangan Final Exam Fabm - ShairamaeobligaShaira Mae Obliga100% (1)

- نموذج استلام عهدة 136 - Custody Receipt Form TOOL & EQUIPMENTDocument1 pageنموذج استلام عهدة 136 - Custody Receipt Form TOOL & EQUIPMENTmctmcNo ratings yet

- TO Indian Government Accounts and Audit: (Fifth Edition)Document347 pagesTO Indian Government Accounts and Audit: (Fifth Edition)RananjaySinghNo ratings yet

- Crew Deal MemoDocument2 pagesCrew Deal MemoEz A FilmmakerNo ratings yet

- Republic Vs de GuzmanDocument2 pagesRepublic Vs de GuzmanAxel Gonzalez100% (1)

- Habaluyas Enterprises Vs JapsonDocument1 pageHabaluyas Enterprises Vs JapsonJL A H-DimaculanganNo ratings yet

- On Communication Between Teachers and Students During COVID-19 Pandemic. First ofDocument2 pagesOn Communication Between Teachers and Students During COVID-19 Pandemic. First ofShaira Mae ObligaNo ratings yet

- Business AnalysisDocument16 pagesBusiness AnalysisShaira Mae ObligaNo ratings yet

- Online Learning's Impact on Teacher-Student Communication During COVIDDocument53 pagesOnline Learning's Impact on Teacher-Student Communication During COVIDShaira Mae ObligaNo ratings yet

- Obliga, Shaira Mae-Quiz#7 Financial, Environmental and Consulting EngagementsDocument1 pageObliga, Shaira Mae-Quiz#7 Financial, Environmental and Consulting EngagementsShaira Mae ObligaNo ratings yet

- Obliga, Shaira MaeDocument3 pagesObliga, Shaira MaeShaira Mae ObligaNo ratings yet

- Answers in Fabm 1 and 2Document84 pagesAnswers in Fabm 1 and 2Shaira Mae ObligaNo ratings yet

- Business Excellence Model Activity-ObligaDocument3 pagesBusiness Excellence Model Activity-ObligaShaira Mae ObligaNo ratings yet

- Partnership Profit Sharing PlansDocument3 pagesPartnership Profit Sharing PlansShaira Mae ObligaNo ratings yet

- Mallari and Chua-Obliga, Shaira MaeDocument3 pagesMallari and Chua-Obliga, Shaira MaeShaira Mae Obliga100% (1)

- ExamDocument3 pagesExamShaira Mae ObligaNo ratings yet

- Authorization LetterDocument1 pageAuthorization LetterShaira Mae ObligaNo ratings yet

- Activity 03-21-22Document2 pagesActivity 03-21-22Shaira Mae ObligaNo ratings yet

- Mataguinas and Sorima-Obliga, Shaira MaeDocument2 pagesMataguinas and Sorima-Obliga, Shaira MaeShaira Mae ObligaNo ratings yet

- Likert ScaleDocument5 pagesLikert ScaleShaira Mae ObligaNo ratings yet

- Updated Title Page Obliga Ordoña ResearchDocument11 pagesUpdated Title Page Obliga Ordoña ResearchShaira Mae ObligaNo ratings yet

- Homemade Spreads, Jams by Sunny's GourmetDocument15 pagesHomemade Spreads, Jams by Sunny's GourmetafrilianiNo ratings yet

- No Deposit Bonus Terms and ConditionsDocument4 pagesNo Deposit Bonus Terms and ConditionsJaka TingNo ratings yet

- L/epublit Of: TBT BtlippintgDocument8 pagesL/epublit Of: TBT BtlippintgCesar ValeraNo ratings yet

- Hudson Meridian Defective and Leaky Construction 2015 2015 Ny Slip Op 30677 UDocument18 pagesHudson Meridian Defective and Leaky Construction 2015 2015 Ny Slip Op 30677 UJohn CarterNo ratings yet

- The First Epistle of Paul To The CorinthiansDocument14 pagesThe First Epistle of Paul To The Corinthiansmaxi_mikeNo ratings yet

- Forms TPT 5000a 10316 0Document1 pageForms TPT 5000a 10316 0timclbNo ratings yet

- Urethane Thinner A: Product DescriptionDocument1 pageUrethane Thinner A: Product DescriptionValeriyNo ratings yet

- Torts SyllabusDocument3 pagesTorts SyllabusRushmi NNo ratings yet

- Christianity in The 1st CenturyDocument23 pagesChristianity in The 1st CenturyMarvin John YpilNo ratings yet

- Back To Hong Kong and The PhilippinesDocument14 pagesBack To Hong Kong and The PhilippinesRobin James CheshireNo ratings yet

- Bocconi Financial Reporting and Analysis CourseworkDocument7 pagesBocconi Financial Reporting and Analysis CourseworkLuigi NocitaNo ratings yet

- Burden of Proof ConceptDocument2 pagesBurden of Proof ConceptnikhilNo ratings yet

- Performance Evaluation of RAK Ceramics & Standard Ceramics.Document24 pagesPerformance Evaluation of RAK Ceramics & Standard Ceramics.Emon HossainNo ratings yet

- Bean Game ActivityDocument4 pagesBean Game Activityapi-314402585No ratings yet

- Consent Letter Karnataka1Document2 pagesConsent Letter Karnataka1sayeed66No ratings yet

- Ubd Unit PlanDocument4 pagesUbd Unit Planapi-351329785No ratings yet

- Online Account Opening FormDocument4 pagesOnline Account Opening FormOm SinghNo ratings yet

- 论公民不服从(小姜老师整理)Document24 pages论公民不服从(小姜老师整理)James JiangNo ratings yet

- Idioms On CromeDocument2 pagesIdioms On CromeCida FeitosaNo ratings yet

- The Sabbath and The Mark of The BeastDocument7 pagesThe Sabbath and The Mark of The BeastRaphaelNo ratings yet

- Earn 5 Unlocks For Every 10 Resources You UploadDocument1 pageEarn 5 Unlocks For Every 10 Resources You UploadHuber Emiro Riascos GomezNo ratings yet